Index funds that invest in New Zealand shares are a fantastic investment to choose when beginning to invest, or for existing investors to use in their portfolios. They are easy to access and provide instant diversification in our familiar home market, with reasonable fees, and potentially come with tax advantages.

The hard part is deciding which NZ Share Index Fund to invest in – for example, What’s the difference between the Smartshares NZ Top 50 ETF, and NZ Mid Cap ETF?? To make things even harder, there are sometimes multiple ways to buy the same fund – for example, the Smartshares NZ Top 50 ETF can be bought from Smartshares directly, as well as InvestNow, Sharesies, ASB Securities, and SuperLife.

This article will take a look at the various NZ Share Index fund options, the different channels you can buy these funds through, their fees, and other considerations. Which one should you invest in?

Index Fund shootout articles:

– Smartshares vs Macquarie vs Kernel vs Harbour – NZ Share Index Fund shootout (this article)

– Smartshares vs Vanguard vs Macquarie – International Share Index Fund shootout

– Smartshares & Kernel – Thematic Index Fund shootout

– Smartshares vs SuperLife vs Macquarie vs Simplicity – Bond index fund shootout

– Smartshares vs Macquarie vs Milford vs Nikko AM – Cash fund shootout

This article covers:

1. What’s on offer?

2. Through which channels can you invest in these funds?

3. What are the fees?

4. Fee comparison

5. Other considerations

Update (20 June 2021) – Added new Smartshares, Kernel, and Harbour funds to coverage.

Update (1 December 2021) – Simplicity no longer charges a $20 annual membership fee.

Update (4 Apr 2022) – AMP’s funds have been renamed to Macquarie

Update (11 Apr 2022) – Kernel have updated their fees

1. What’s on offer?

Smartshares, Macquarie, Kernel, Harbour, and Simplicity all issue, low cost, passively managed funds that invest in shares found on the New Zealand Sharemarket, the NZX. Let’s take a look at the options from each issuer, and the differences between all of them:

A. Smartshares

Smartshares is the biggest and most established player here. They’re an ETF Issuer owned by NZX, and offer five NZ Share Index Funds:

- S&P/NZX 50 ETF (NZG) – Invests in the 50 largest companies on the NZX

- NZ Top 10 ETF (TNZ) – Invests in the 10 largest companies on the NZX

- NZ Top 50 ETF (FNZ) – Invests in the 50 largest companies on the NZX, with each company only allowed to make up a maximum of ~5% of the fund’s value

- NZ Mid Cap ETF (MDZ) – Invests in the 10th to 50th largest companies on the NZX, excluding Westpac and ANZ Banks

- NZ Dividend ETF (DIV) – Invests in the 25 highest paying dividend companies out of the NZ Top 50

- NZ Property ETF (NPF) – Invests in the 8 Real Estate Investment Trusts (REITs) listed on the NZX

B. Macquarie

Investment fund manager Macquarie offers two NZ index funds:

- NZ Shares Index Fund – Invests in the 50 largest companies on the NZX

- Australasian Property Index Fund – Invests in REITs listed on the NZX and ASX (Australia sharemarket)

C. Kernel

Kernel Wealth is a relatively new player, having launched in late 2019. They offer four NZ index funds:

- NZ 20 – Invests in the 20 largest companies on the NZX

- NZ Small & Mid Cap Opportunities – Invests in 23 of the smallest companies out of the NZX Top 50, plus 16 even smaller companies outside of the Top 50. Designed to complement the NZ 20 Fund, as together they give you exposure to most of the NZ sharemarket.

- NZ Commercial Property – Invests in the 8 REITs listed on the NZX

- NZ 50 ESG Tilted – Invests in the 50 largest companies on the NZX, excluding those operating in controversial industries, and with favourable weighting towards more sustainable companies.

D. Harbour

Harbour Asset Management, normally an active fund manager, offers just one NZ index fund:

- NZ Index Shares Fund – Invests in the 50 largest companies on the NZX, with each company only allowed to make up a maximum of ~5% of the fund’s value

E. Simplicity

Simplicity offers a standalone NZ share fund, based on the Morningstar New Zealand index (rather than the NZX 50). However this is not strictly an index fund as they exclude a number of index companies like SKYCITY and Genesis Energy from the fund due to ethical reasons.

- NZ Share Fund – Invests in 37 companies listed on the NZX.

Funds by category

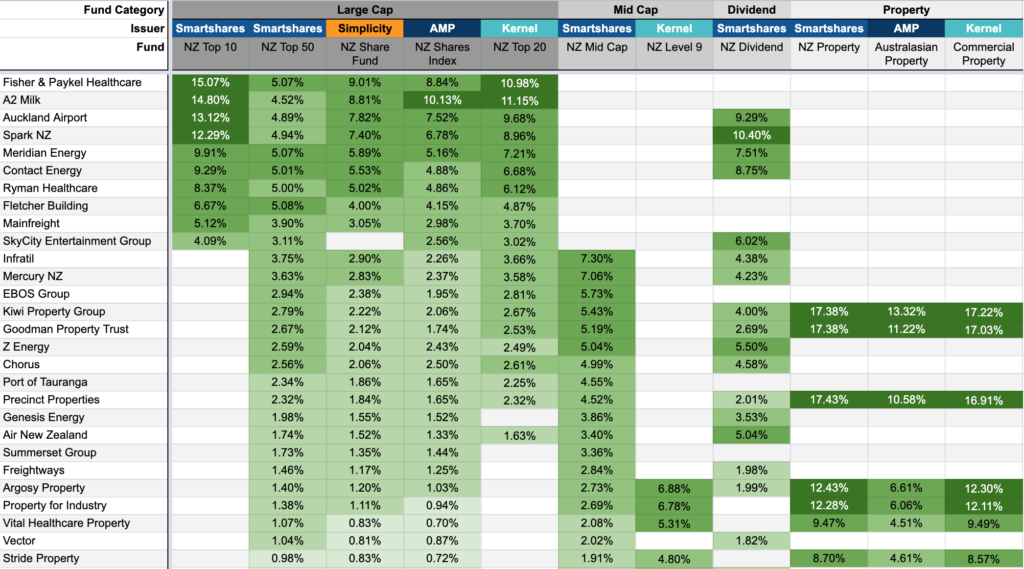

I have categorised these 13 funds into four categories, based on what they’re invested in. There are still differences between the funds in the same category, but all give you roughly the same type of investment exposure.

NZ Large Cap

The funds invest in the largest companies in the NZ market, and are what most people should invest in due to their broad market coverage and diversification (the funds below in bold cover the ‘Top 50’ companies in NZ). However, I’m not sure the Smartshares Top 10 ETF is worth investing in, as the coverage is way too narrow, investing in only 10 companies.

- Smartshares NZ Top 10 ETF

- Kernel NZ 20 Fund

- Smartshares S&P NZX 50 ETF

- Smartshares NZ Top 50 ETF

- Macquarie NZ Shares Index Fund

- Harbour NZ Index Shares Fund

- Kernel NZ 50 ESG Tilted Fund

- Simplicity NZ Share Fund

What’s the difference between the Smartshares NZ Top 50 ETF, the Smartshares S&P/NZX 50 ETF, the Macquarie NZ Shares Index Fund, and the Harbour NZ Index Shares Fund?

All four of these funds are similar in that they invest in the 50 largest companies on the NZX. Their differences are in how the companies are weighted:

The Smartshares S&P/NZX 50 ETF and the Macquarie NZ Shares Index Fund are Capitalisation weighted – The proportion of the fund a company makes up is according to the company’s size. For example, Fisher & Paykel Healthcare makes up over 14% of each fund, while smaller company SKY TV makes up only 0.20% of each fund.

The Smartshares NZ Top 50 ETF and the Harbour NZ Index Shares Fund are Capitalisation weighted with 5% limit – The proportion of the fund each company makes up is still based on the company’s size, but each company can only make up a maximum of 5% of the fund. This means there is a slightly higher weighting towards smaller companies.

The article Smartshares NZ Top 50 vs S&P/NZX 50 by The Happy Saver provides further reading on this topic

NZ Mid Cap

Mid Cap funds don’t invest in the market’s largest companies, giving you more exposure to the smaller companies on the market, than you would get by investing in a Large Cap fund. Kernel’s NZ Small & Mid Cap Opportunities Fund even invests in 16 companies outside of the NZ Top 50, such as Hallenstein Glassons, Napier Port, and Serko.

- Smartshares NZ Mid Cap ETF

- Kernel NZ Small & Mid Cap Opportunities Fund

NZ Dividend

Dividend funds invest in the market’s highest dividend paying companies, so are good if you’re investing to generate income. For example, the current yield of the NZ Dividend ETF is 5%, compared to 3.66% for the NZ Top 50 ETF. There is only one option in this category.

- Smartshares NZ Dividend ETF

NZ Property

Property funds only invest in Real Estate Investment Trusts (REITs). REITs are companies that invest in commercial property (e.g. offices, shopping malls, and industrial buildings). Property funds are not an essential part of an investment portfolio (unless you want increased exposure to commercial property), as you already get exposure to REITs in the Large Cap, Mid Cap, and Dividend funds.

- Smartshares NZ Property ETF

- Macquarie Australasian Property Index Fund

- Kernel NZ Commercial Property

What are the specific companies that each fund invests in?

For more information on the specific holdings and their weightings of each fund, check out this spreadsheet (opens in Google Sheets).

2. Through which channels can you invest in these funds?

There are multiple ways you can invest in the NZ Share Index Funds – the main ones being direct from the manager/issuer of the fund, through a fund platform, or through a broker. Let’s take a look at the options for each fund issuer:

A. Smartshares

Smartshares’ funds are the most widely available, being offered through four different channels:

Direct

You can buy Smartshares’ funds directly from Smartshares. They require a minimum initial investment of $500, and subsequent investments require $250 for one-off investments, or $50 for regular monthly investments.

A limitation of investing direct through Smartshares is that they don’t provide any facility to sell/withdraw your investment. You would need to use a broker like ASB Securities or Jarden Direct to sell your investment – this will be covered in more detail in section 5 of this article.

Another limitation is that investments made direct through Smartshares are only processed only once a month. When you make an investment order, your money is direct debited from your bank account on the 20th of the month, and the units of your investment are allocated to you on the 3rd of the following month. This process is a bit old school, especially as all other channels process your investment orders within a couple of days, rather than on a set day every month.

Fund Platforms

The InvestNow platform gives investor access to Smartshares funds, starting at $50 if you invest through a Regular Investment Plan, or $250 for one-off investments. Unlike investing directly through Smartshares, InvestNow allows you to sell your investment through their platform.

Sharesies also offers buying and selling of Smartshares’ NZ Share Index funds with a low minimum investment of just 1 cent!

Keen to start building your investment portfolio with Sharesies? Sign up with this link, and you’ll get a bonus $5 in your account to invest!

Brokers

Smartshares’ funds are Exchange Traded Funds (ETFs). This means the funds are listed and traded on the sharemarket, just like shares of an ordinary company. You can use a broker like ASB Securities or Jarden Direct to buy and sell these ETFs through the NZ sharemarket. This requires you to buy a minimum of 100 units for an initial investment into a fund – currently about $300 for the NZ Top 50 ETF.

SuperLife

SuperLife doesn’t offer the actual Smartshares funds, instead offering funds that invest exclusively into Smartshares’ funds (which you can invest in with as little as $1). For example, the SuperLife NZ Top 50 Fund invests exclusively into the Smartshares NZ Top 50 ETF. It’s a fund within a fund!

There are a couple of major implications to having this ‘fund within a fund’ structure. Firstly, SuperLife charges different fees to Smartshares (see section 3). Secondly, SuperLife structures their funds as Multi-Rate PIEs, rather than Listed PIEs which has some tax implications (see section 5).

B. Macquarie

Fund Platforms

InvestNow offers the Macquarie NZ Index Funds, also starting at $50 if you invest through a Regular Investment Plan, or $250 for one-off investments.

C. Kernel

Direct

Kernel’s funds can only be bought direct from Kernel themselves, through their own online platform. The minimum investment is $1.

D. Harbour

Direct

It’s possible to invest directly through Harbour, however their minimum investment amount is $100,000.

Fund Platforms

The more accessible way to access Harbour’s funds is through InvestNow, who offer the Harbour NZ Index Shares Fund.

E. Simplicity

Direct

The only way to invest in this fund is directly through Simplicity, whose minimum investment amount is $1,000.

3. What are the fees?

There are two types of fees you’ll pay when investing in these NZ Share Index Funds:

- Fund Management Fee – A fee charged as a percentage of the amount you have invested in a fund

- Channel Fees – Fees depending on what channel you use to invest in these funds such as an account fee, or brokerage fee

A. Smartshares

Fund Management Fees

Smartshares’ Fund Management Fees range from 0.20% to 0.60% per year, except when investing through SuperLife where the fees are all 0.49% per year.

| Fund | Regular Fee | SuperLife Fee |

| S&P/NZX 50 ETF | 0.20% | 0.49% |

| NZ Top 10 | 0.60% | 0.49% |

| NZ Top 50 | 0.50% | 0.49% |

| NZ Mid Cap | 0.60% | 0.49% |

| NZ Dividend | 0.54% | 0.49% |

| NZ Property | 0.54% | 0.49% |

Channel Fees

- Direct through Smartshares – A $30 Establishment fee applies if you’re investing directly through Smartshares for the first time.

- InvestNow – No other fees apply, apart from the above Fund Management Fees.

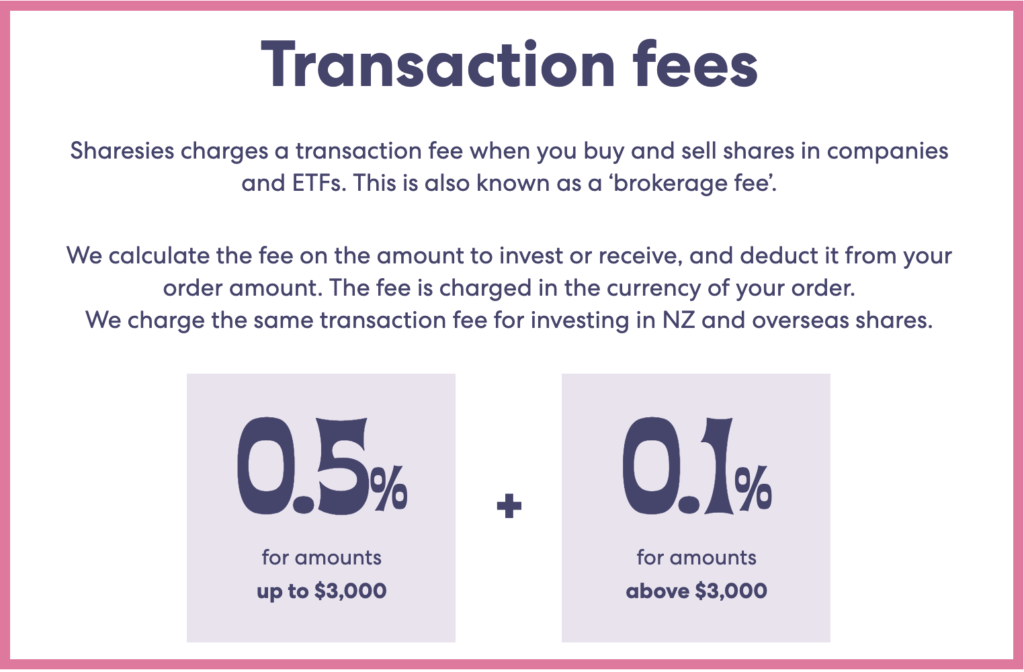

- Sharesies – A brokerage fee of 0.5% on orders up to $3,000, then 0.1% on any amounts above $3,000 applies to buying or selling any Smartshares ETFs.

- Brokers – Brokers charge brokerage fees every time you buy and sell shares. This fee can be quite expensive, starting at $15, so investing in Smartshares funds through brokers is probably not an ideal strategy for investing at a small scale.

- SuperLife – An account fee of $12 per year applies.

Further Reading:

– Sharesies’ new fee structure – How will the changes affect you?

In addition, spreads are charged whenever you buy or sell units in Smartshares’ funds. This is a small fee to cover the transaction costs of the fund and depends on market conditions.

Buy or sell spreads are intended to cover the transaction costs of buying or selling the underlying assets of a fund, so that these costs are not borne by other investors in the fund

InvestNow – Buy/Sell Spreads

B. Macquarie

Fund Management Fees

Macquarie’s management fees are:

| Fund | Fee |

| NZ Shares Index Fund | 0.36% |

| Australasian Property Index Fund | 0.82% |

Channel Fees

Macquarie charges a 0.27% spread when buying or selling units in their funds. Otherwise no other account fees apply.

C. Kernel

Fund Management Fees

The management fees for Kernel’s NZ funds are a reasonable 0.25%.

| Fund | Fee |

| NZ 20 | 0.25% |

| NZ Small & Mid Cap Opportunities | 0.25% |

| NZ Commercial Property | 0.25% |

| NZ 50 ESG Tilted | 0.25% |

Channel Fees

For balances over $25,000 Kernel charges a membership fee of $5 per month ($60 per year).

D. Harbour

Fund Management Fees

The management fee for the Harbour NZ Index Shares fund is 0.20%.

E. Simplicity

Fund Management Fees

The management fee for the NZ Share Fund is 0.10%.

4. Fee comparison

What is the cheapest fund and channel combination for each category of fund?

NZ Large Cap

If you’re investing less than $50, Kernel is the overall cheapest option given it’s the only option apart from Sharesies who charge brokerage fees. After that either the Smartshares S&P/NZX 50 ETF or Harbour NZ Index Shares Fund (through InvestNow) are the cheapest options with their low 0.20% management fees. At a balance of $1,000, Simplicity’s NZ Share Fund becomes available, with its low 0.10% fee.

| Amount invested | Cheapest fund |

| $1 – $49 | Kernel NZ 50 ESG Tilted/NZ 20 (direct) |

| $50 – $999 | Smartshares S&P/NZX 50 (via InvestNow) |

| $1,000 and above | Simplicity NZ Share (direct) |

NZ Mid Cap

Kernel’s NZ Small & Mid Cap Opportunities fund is the cheapest for all balances.

| Amount invested | Cheapest fund |

| $1 and above | Kernel NZ Small & Mid Cap Opportunities (direct) |

NZ Dividend

There is only one fund in the NZ Dividend category, and the cheapest channel to get it through depends on how much you’re investing.

| Amount invested | Cheapest fund |

| $1 – $49 | Smartshares NZ Dividend ETF (via Sharesies) |

| $50 – $23,999 | Smartshares NZ Dividend ETF (via InvestNow) |

| $24,000 and above | Smartshares NZ Dividend ETF (via SuperLife) |

NZ Property

Kernel’s NZ Commercial Property fund is the way to go:

| Amount invested | Cheapest fund |

| $1 and above | Kernel NZ Commercial Property (direct) |

5. Other considerations

There are many other pros and cons to consider when deciding which NZ Share Index Fund to invest in, and which channel to buy it through:

Index Performance

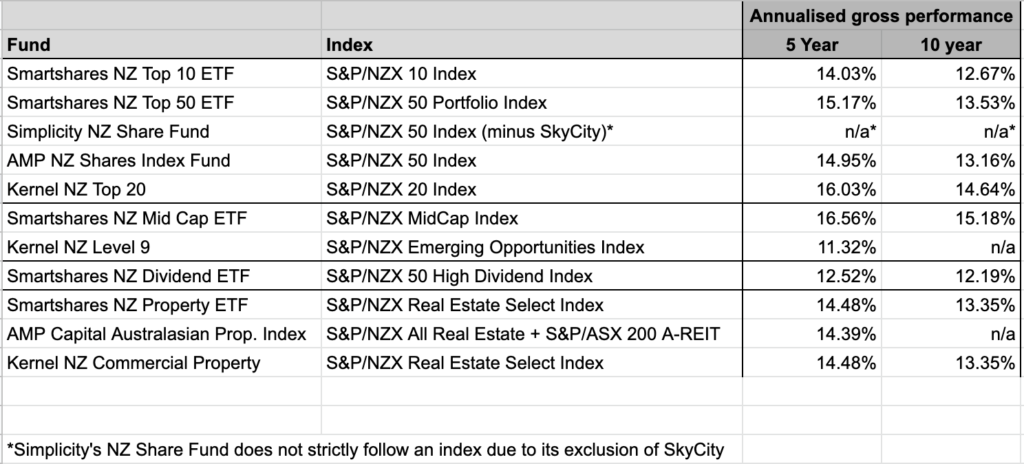

Index Funds track (invest in) an index. An index is a collection of companies (and their weightings), along with a set of rules to decide which companies are in the index. With these rules, index funds are passively managed (and have lower fees!), as opposed to actively managed funds who have fund managers picking which shares to invest in. So what indexes do our NZ Share Index Funds follow, and what has their performance been like (as at 10 November 2019)? See table below:

A few interesting points:

- The NZX 50 Portfolio Index outperformed the NZX 50 Index by 0.37% per year over 10 years, thanks to only allowing each company to make up a maximum of 5% of the index.

- Kernel worked with S&P to design totally new indexes for their funds. For example, one reason the NZX 20 Index was created was because the top 20 consistently outperformed the top 50 over the last 10 years, by 1.48% per year.

- The new Emerging Opportunities Index, tracked by Kernel’s Level 9 Fund has underperformed in recent years, but does provide a unique diversification into 16 companies outside the Top 50, which no other index fund invests in.

- The NZX MidCap Index, has been the best performer over the last 10 years, outperforming the Top 50 by 2.02% per year.

Going forward each fund should follow the performance of their respective indexes closely (minus fees and tax), but remember this is past performance data, and is not a guarantee of how future performance will be.

Distributions (dividends)

The NZ Share Index Funds intend to pay distributions at the following frequency:

- Smartshares – Half yearly, except SuperLife – No distributions

- Macquarie – Half yearly

- Kernel – Quarterly

- Harbour – Half yearly

- Simplicity – No distributions

All distributions can be automatically reinvested into the fund (except when using Sharesies), or taken as a cash payment.

Tax

All Smartshares ETFs are Listed PIEs so are taxed at a fixed rate of 28%. All other funds (including SuperLife) are Multi-Rate PIEs (MRPs), so are taxed at your Prescribed Investor Rate (PIR). MRPs might be more suitable for those with a PIR lower than 28%.

Ownership of your investment

Investing direct through a fund provider/issuer (Smartshares, Simplicity, Macquarie, Kernel, Simplicity), or through a broker, means your investment will be held under your own name. In the case of Smartshares, your investment will be held under your CSN (Common Shareholder Number).

If investing through InvestNow or Sharesies, your investment will be held in the name of a Custodian. If using SuperLife, your investment in the underlying Smartshares ETFs are held in SuperLife’s name. See my article What happens to your money if InvestNow or Sharesies go bust? for more info.

Selling Smartshares

If you’ve bought some funds direct from Smartshares, they don’t offer a facility to sell your investment – so what are your options for getting your money out?

- Use a broker like ASB Securities or Direct Broking to sell your shares. There is more detail in this The Smart and Lazy blog post or this Happy Saver blog post. The Smart and Lazy suggests opening a brokerage account ASAP (it’s free to do so), so that you’re ready to sell your investment at anytime.

- Make an off-market transfer of your shares to InvestNow. Then sell your shares via InvestNow. This involves more work than going through a broker, but you won’t need to pay brokerage costs using this method. You cannot do this with the NZ Top 10 ETF as this fund is not available on InvestNow.

Conclusion

It is pretty hard to choose which NZ Share Index Fund to invest in given there is so much choice. My opinion is that a NZ Large Cap fund, such as a ‘Top 50’ fund, is the way to go as these funds provide the broadest coverage of NZ market.

The InvestNow channel is a great all round option, especially for investing smaller amounts. They offer both Smartshares and Macquarie funds, as well as international funds, making it easier to build a diversified portfolio under one roof. The Smartshares S&P/NZX 50 ETF is probably the best option here.

Kernel is a strong provider. They have very competitive fees and they’re providing something new by investing in companies outside the NZ Top 50, as well as an ESG tilted option. I enjoyed the NZ Everyday Investor Podcast episode featuring Kernel’s founder, Dean Anderson, where they discussed plans to expand their offerings.

Lastly, do you need to invest in a Mid Cap, Dividend, or Property fund if you’ve already invested in a ‘Top 50’ fund? Probably not, as they don’t provide much further diversification, given the ‘Top 50’ funds contain the same companies – there is a lot of overlap between the funds. It is probably better to buy international funds to diversify your portfolio geographically.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.