Index funds that invest in international shares are a fantastic way to diversify your investment portfolio overseas, particularly as our home NZ market makes up less than 0.5% of the world. International Share Index Funds make investing overseas easy, as they often take care of the tedious things for you, such as currency exchange, custodial arrangements, brokerage, tax, and negotiating foreign markets you’re unfamiliar with.

So what are all the options, and which one should you invest in? And is it better to go hedged or unhedged, with a PIE or FIF, and with or without emerging markets? These are some of the differences that will be explored in this article.

Index Fund shootout articles:

– Smartshares vs Macquarie vs Kernel vs Harbour – NZ Share Index Fund shootout

– Smartshares vs Vanguard vs Macquarie vs Kernel – International Share Index Fund shootout (this article)

– Smartshares & Kernel – Thematic Index Fund shootout

– Smartshares vs SuperLife vs Macquarie vs Simplicity – Bond index fund shootout

– Smartshares vs Macquarie vs Milford vs Nikko AM – Cash fund shootout

This article covers:

1. What’s on offer?

2. Through which channels can you invest in these funds?

3. What are the fees?

4. Index Design and Past Performance

5. Other considerations

Update (20 Jun 2021) – Add coverage of new Smartshares and Kernel funds

Update (4 Apr 2022) – AMP’s funds have been renamed to Macquarie

Update (11 Apr 2022) – Kernel have updated their fees and added a new S&P 500 fund

1. What’s on offer?

Smartshares, Vanguard, Macquarie, and Kernel all issue, low cost, passively managed funds that invest in international shares. This section will look at the different options from each issuer.

A. Smartshares

Smartshares is an ETF Issuer owned by NZX, and offer the following International Share Index Funds:

- Total World ETF (TWF) – Invests in over 8,000 companies globally from developed and emerging markets

- Total World ETF (NZD Hedged) (TWH) – Same as TWF, but is hedged to the New Zealand Dollar

- Global Equities ESG ETF (ESG) – Invests in over 2,500 companies globally from developed markets. Excludes companies involved in controversial areas such as Nuclear Weapons, Civilian Firearms, and Thermal Coal

- US 500 ETF (USF) – Invests in the 500 largest listed companies in the United States

- Europe ETF (EUF) – Invests in over 1,300 companies from developed countries in Europe

- Asia Pacific ETF (APA) – Invests in over 2,300 companies from developed countries in the Asia Pacific region (e.g. Japan, Hong Kong, Australia, Singapore, NZ)

- Emerging Markets ETF (EMF) – Invests in over 5,000 companies from emerging markets countries (e.g. China, India, Brazil)

- Emerging Markets ESG ETF (EMG) – Invests in over 1,500 companies from emerging markets (e.g. China, India, Brazil). Also includes South Korea as an emerging market. Excludes companies involved in controversial areas such as Nuclear Weapons, Civilian Firearms, and Thermal Coal

That’s a lot of companies those funds invest in! To do so, Smartshares doesn’t invest in all these companies directly, but instead they invest in Vanguard and iShares ETFs to get indirect exposure to all these companies and countries.

Smartshares also have a few other international funds such as US Large Growth, US Small Cap, and Japan Equities ESG, but these won’t be covered in this article due to their relatively narrow focus.

B. Vanguard

Vanguard is a fund manager, most famous for their ETFs, with over $5 billion in funds under management. They have two funds that are popular with New Zealand investors:

- International Shares Select Exclusions Index – Invests in over 1,500 companies globally from developed countries, excluding Australia

- International Shares Select Exclusions Index (NZD Hedged) – Invests in the exact same companies as above. This fund is fully hedged to the New Zealand Dollar (more on this in section 5)

C. Macquarie

Macquarie offers one International Share Index Fund:

- All Country Global Shares Index Fund – Invests in over 2,500 companies globally from developed and emerging markets

D. Kernel

Kernel is a relatively new entrant to the international share index fund space, having just launched their global funds in July 2020, and an S&P 500 Fund in April 2022:

- S&P Global 100 – Invests in 100 large-cap companies from developed countries around the world

- S&P Global Dividend Aristocrats – Invests in 89 large-cap companies from developed countries which have a track record of paying high dividends over the long-term

- S&P 500 – Invests in the 500 largest listed companies in the United States. Currency hedged to the NZ Dollar.

Funds by category

I have categorised these 13 funds into three categories, based on what they’re invested in:

Global

Global funds invest in companies from around the whole world, so are probably the best funds to invest in for their wide geographical diversification. These funds can be further split into two categories, depending on whether they invest in emerging markets or not:

Developed countries + Emerging markets

- Smartshares Total World ETF

- Smartshares Total World ETF (NZD Hedged)

- Macquarie All Country Global Shares Index Fund

Developed countries only

- Smartshares Global Equities ESG ETF

- Vanguard International Shares Select Exclusions Index Fund

- Vanguard International Shares Select Exclusions Index Fund (NZD Hedged)

- Kernel S&P Global 100 Fund

Regional

Regional funds only invest in a single region (or country in the case of the US 500 ETF). They are not an essential part of an investment portfolio if you’re already invested in a global fund, unless you want increased exposure to a particular region – for example, the Smartshares Total World ETF is already 55% invested in the United States, so you do not also need the US 500 ETF in your portfolio.

- Smartshares US 500 ETF

- Kernel S&P 500 Fund

- Smartshares Europe ETF

- Smartshares Asia Pacific ETF

- Smartshares Emerging Markets ETF

- Smartshares Emerging Markets ESG ETF

Dividend

Dividend funds invest in the market’s highest dividend paying companies, so are good if you’re investing to generate income.

- Kernel S&P Global Dividend Aristocrats Fund

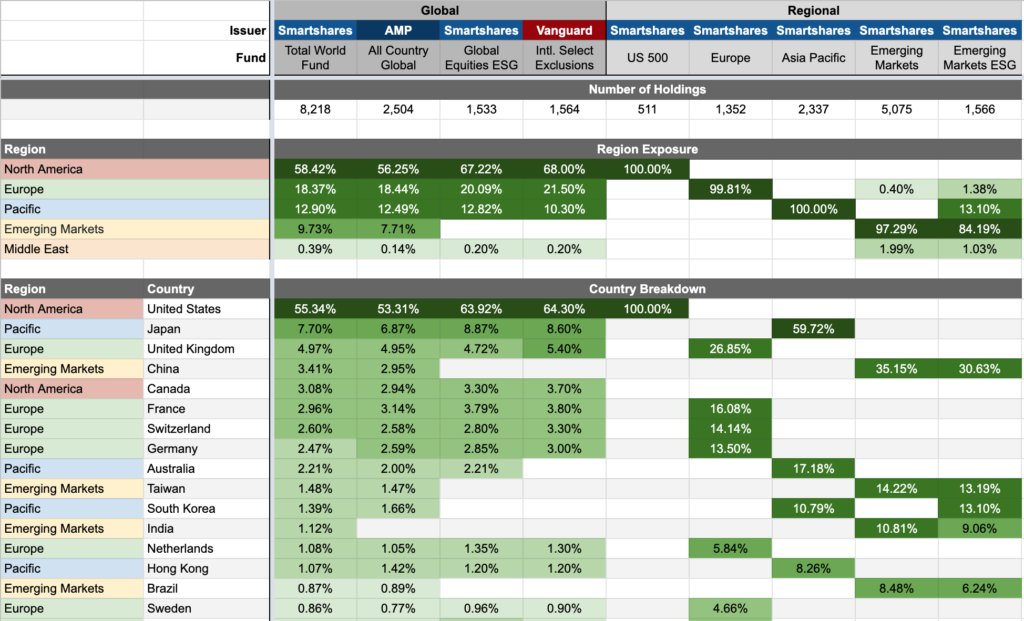

What are the specific countries that each fund invests in?

For more information on the specific region and country exposures of each fund, check out this spreadsheet (opens in Google Sheets).

2. Through which channels can you invest in these funds?

There are multiple ways you can invest in International Share Index Funds – the main ones being direct from the manager/issuer of the fund, through a fund platform, or through a broker. Here’s a quick look at the options:

A. Smartshares

Smartshares’ funds are the most widely available, being offered through four different channels:

Direct

You can buy Smartshares’ funds directly from Smartshares. They require a minimum initial investment of $500, and subsequent investments require $250 for one-off investments, or $50 for regular monthly investments. There are a couple of major limitations when investing direct through Smartshares:

- There’s no facility to sell your investment – you’d need to use a broker like ASB Securities or Direct Broking to do so.

- Investments orders are only processed only once a month, on the 20th of the month.

Fund Platforms

Fund Platform Sharesies enables you to buy and sell Smartshares’ International Share ETFs with a minimum investment of just 1 cent!

Keen to start building your investment portfolio with Sharesies? Sign up with this link, and you’ll get a bonus $5 in your account to invest!

InvestNow also offers buying and selling of Smartshares funds, starting at $50 if you invest through a Regular Investment Plan, or $250 for one-off investments.

Brokers

Smartshares’ funds are Exchange Traded Funds (ETFs), listed on the NZ sharemarket, so you can use a broker like ASB Securities or Jarden Direct to buy and sell these ETFs. This requires you to buy a minimum of 100 units for an initial investment into a fund.

SuperLife

SuperLife doesn’t offer the actual Smartshares funds, instead offering funds that invest exclusively into Smartshares’ funds (minimum investment $1). For example, the SuperLife Total World Fund invests exclusively into the Smartshares Total World ETF. The two ESG funds (Global Equities ESG, Emerging Markets ESG) are not available as SuperLife funds.

B. Vanguard

The two Vanguard funds are wholesale funds, designed for the likes of KiwiSaver providers to use in their funds. As a result, the minimum investment into these funds is $500,000 AUD. Fortunately there are some solutions to get around this:

Fund Platforms

InvestNow offers the two Vanguard funds at a minimum of $50 if you invest through a Regular Investment Plan, or $250 for one-off investments. Now that’s much more affordable than $500k!

Other services

InvestNow is the only realistic option for ordinary investors to purchase the two Vanguard funds, given the high minimum investment requirement. However, Vanguard has other funds available on international markets:

- Over 60 funds available on the US market, accessible via Hatch

- Over 26 funds available on the Australian market, accessible via ASB Securities or Direct Broking

There are many implications and considerations when using these options to access Vanguard funds, which I won’t cover in this article. You can check out my article Shopping for ETFs – Sharesies vs Hatch for more details.

C. Macquarie

Fund Platforms

Both InvestNow and Sharesies offer the Macquarie All Country Global Shares Index Fund.

D. Kernel

Direct

Kernel’s funds can only be bought direct from Kernel themselves, through their own online platform. The minimum investment is $1.

3. What are the fees?

There are two types of fees you’ll pay when investing in these International Share Index Funds:

- Fund Management Fee – A fee charged as a percentage of the amount you have invested in a fund

- Channel Fee – A fee depending on what channel you use to invest in these funds, such as an account fee, or brokerage fee

A. Smartshares

Fund Management Fees

Smartshares’ Fund Management Fees range from 0.34% to 0.59% per year. However, the fees are completely different when investing through SuperLife, ranging from 0.44% to 0.63% per year:

| Fund | Regular Fee | SuperLife Fee |

| Total World | 0.40% | 0.48% |

| Total World (NZD Hedged) | 0.46% | 0.48% |

| Global Equities ESG | 0.54% | n/a |

| US 500 | 0.34% | 0.44% |

| Europe | 0.55% | 0.49% |

| Asia Pacific | 0.55% | 0.49% |

| Emerging Markets | 0.59% | 0.63% |

| Emerging Markets ESG | 0.59% | n/a |

Channel Fees

- Direct through Smartshares – A $30 Establishment fee applies if you’re investing directly through Smartshares for the first time.

- InvestNow – No other fees apply.

- Sharesies – A brokerage fee of 0.5% on orders up to $3,000, then 0.1% on any amounts above $3,000 applies to buying or selling any Smartshares ETFs.

- Brokers – Brokerage fees (starting at $15) apply every time you buy or sell.

- SuperLife – An account fee of $12 per year applies.

In addition, spreads are charged whenever you buy or sell units in Smartshares’ funds. This is a small fee to cover the transaction costs of the fund, and is normally $0.005 per unit you buy or sell.

B. Vanguard

Fund Management Fees

Vanguard’s fund management fees are the cheapest among the funds compared in this article:

| Fund | Fee |

| International Shares Select Exclusions | 0.20% |

| International Shares Select Exclusions (NZD Hedged) | 0.26% |

Channel Fees

Vanguard charges a 0.07% spread when buying or selling units in the International Shares Select Exclusions fund, and a 0.12% spread when buying or selling units in the International Shares Select Exclusions (NZD Hedged) fund.

C. Macquarie

Fund Management Fees

Macquarie’s All Country fund charges a very reasonable fund management fee:

| Fund | Fee |

| All Country Global Shares Index Fund | 0.42% |

Channel Fees

Macquarie charges a 0.07% spread when buying or selling units in the above fund.

D. Kernel

Fund Management Fees

The management fee for Kernel’s global funds is a reasonable 0.25%.

| Fund | Fee |

| Kernel S&P Global 100 | 0.25% |

| Kernel S&P Global Dividend Aristocrats | 0.25% |

| Kernel S&P 500 | 0.25% |

Channel Fees

For balances over $25,000 Kernel charges a membership fee of $5 per month ($60 per year).

4. Index Design and Past Performance

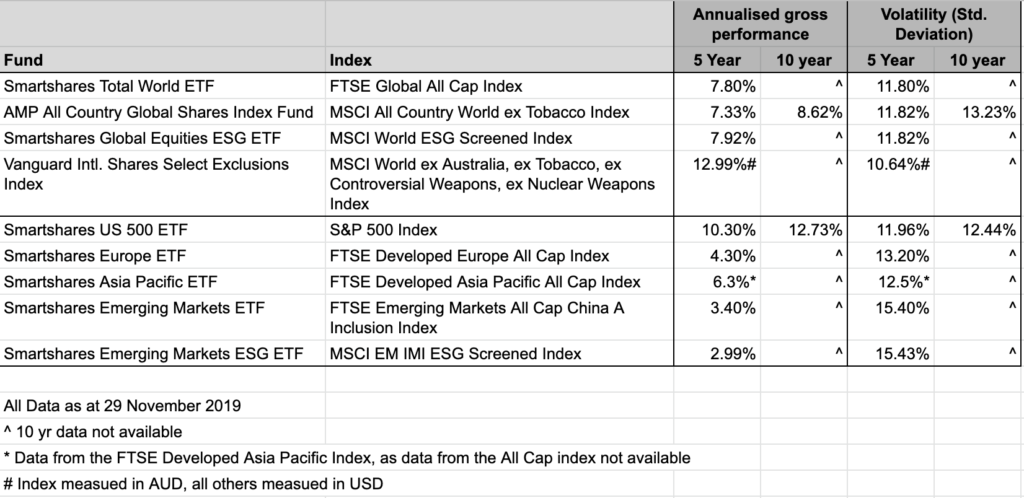

Index Funds track (invest in) an index. An index is a collection of companies (and their weightings), along with a set of rules to decide which companies are in the index. So what indexes do our International Share Index Funds follow, and what has their performance and volatility been like? See table below:

A couple of interesting points:

- Global indexes have performed better, and have been less volatile than most regional indexes in recent years, thanks to a strong US market. This shows the value of geographical diversification, as not all regions will perform well in a given period of time.

- The MSCI World ex Australia index outperformed all other indexes, because this index is measured in Australian Dollars. Its strong performance has been helped by the AUD steadily declining against the USD over the past 5 years.

Going forward each fund should follow the performance of their respective indexes closely, but remember this is past performance data, and is not a guarantee of how future performance will be. Other factors will affect each funds’ return such as currency hedging, fees, and tax.

Emerging Markets

As mentioned in section 1, some global funds invest in emerging markets, and some don’t. So is it better to have exposure to countries like China, India, Brazil, and South Africa? Emerging markets tend to be more volatile, and their recent performance has been poor. I personally still like emerging markets as I think they have more potential for growth compared to developed markets, but I wouldn’t consider them essential in your portfolio. You could always also invest in a standalone emerging markets fund if you want exposure to this region.

Small-Cap Companies

Most indexes invest only in large and mid-cap companies (i.e. larger size companies). However, Smartshares Total World, Europe, Asia Pacific, Emerging Markets, and Emerging Markets ESG funds also invest in small-cap companies. Like emerging markets, small-cap companies have been more volatile and have underperformed in recent times (7.2% vs 7.9% return for large-cap companies over the last 5 years). Again, I don’t consider them essential, however they may have higher growth potential as some scale up into larger companies.

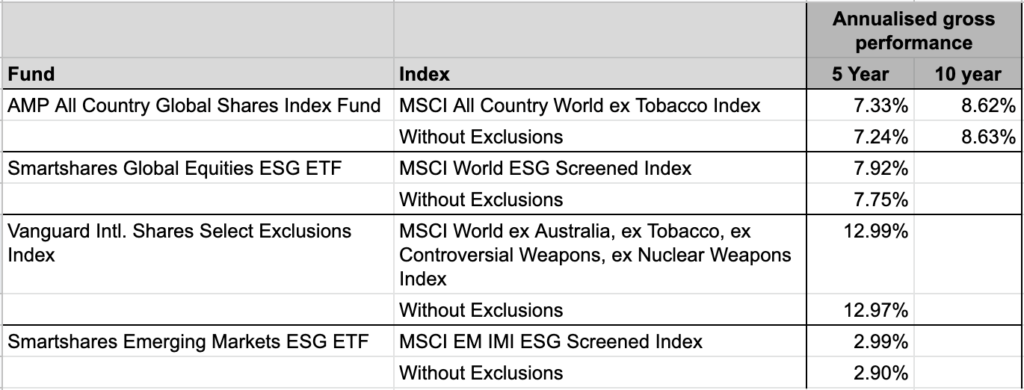

Ethical investing

The following funds exclude companies that have involvement in the following industries:

- Smartshares ESG funds (Global Equities ESG ETF, Emerging Markets ESG ETF) – Excludes 102 and 119 companies respectively in Controversial Weapons, Nuclear Weapons, Civilian Firearms, Tobacco, Thermal Coal, Oil Sands

- Vanguard International Shares Select Exclusions – Excludes 11 companies in Tobacco, Controversial Weapons, Nuclear Weapons

- Macquarie All Country Global Shares Index – Excludes 24 companies in Tobacco

How have these exclusions affected performance? Excluding controversial industries has either improved or barely affected performance over the last 5 years. The below table shows how each fund’s index would have performed if they didn’t have any exclusions:

5. Other considerations

There are some other important considerations when deciding which International Share Index Fund to invest in. These are complex topics (particularly tax), so I may write a future article to cover these in more depth.

Tax

The Vanguard funds are Australian domiciled funds. They are considered Foreign Investment Funds (FIFs) in which special tax rules apply:

- If you have under $50,000 invested in FIFs – Distributions (dividends) are taxable at your marginal tax rate

- If you have $50,000 or more invested – Your tax liability is calculated using either the FDR method or CV method, then taxed at your marginal tax rate

You will need to include any tax you owe on the fund in a tax return. See my article on tax for more info on this.

All other funds are NZ domiciled PIE funds. Each fund’s FIF tax liability is calculated by the fund manager (using the FDR method) and then attributed to the fund’s investors. You do not have to include this tax in your tax return.

- The Smartshares ETFs (excluding SuperLife) are Listed PIEs so are taxed at a fixed rate of 28%.

- Macquarie and SuperLife funds are Multi-Rate PIEs (MRPs), so are taxed at your Prescribed Investor Rate (PIR).

Further reading:

– Tax on foreign investments – How do FIF and Estate Taxes work?

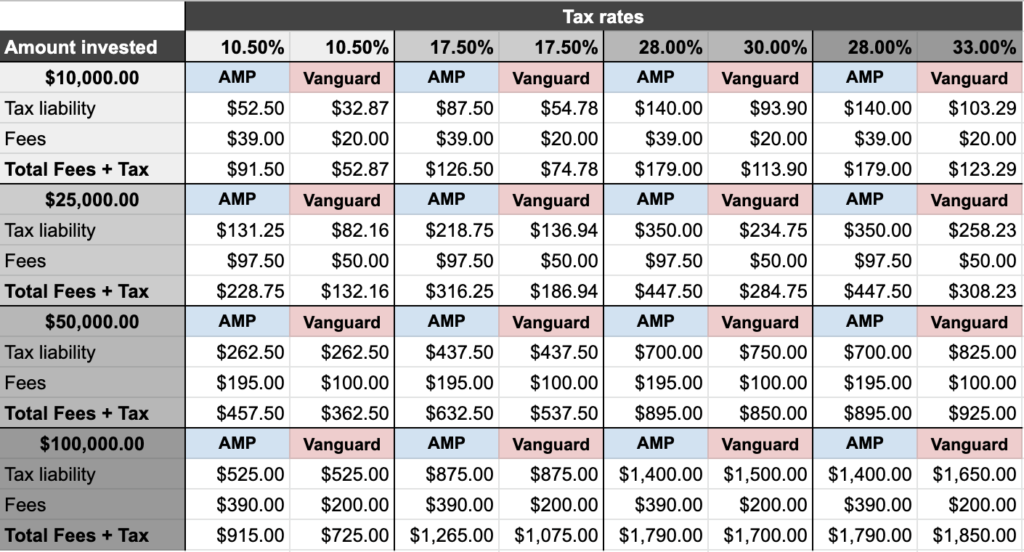

Tax Comparison

PIE or FIF – What’s better? Taxation on PIE funds is much less complex, and may be lower if you’re on the top tax bracket, as you only have to pay 28% tax on PIEs (as opposed to 33% on FIFs). But there are at least a few cases where investing in the Vanguard FIFs may be more tax efficient:

- You have less than 50k invested – In this case you are only taxed on your distributions (currently ~3.13%). This will result in a lower tax liability as long as distributions remain below 5% (the rate used to calculate your tax under the FDR method).

- Your marginal tax rate is 30% – This may result in your Vanguard fund’s tax liability being higher than that of an equivalent PIE fund, but is likely to be offset by the lower fees.

- Your marginal tax rate is less than 30% – Your Vanguard fund tax liability may be the same than that of an equivalent PIE fund, but the lower fees of Vanguard’s funds will result in your overall costs being lower.

- You return is very low or negative – In which case you can choose to calculate your tax liability using the CV method, which should result in lower tax than using the FDR method.

- You’re adding a significant amount of money to your fund – As FIF tax under the FDR method is calculated on the market value of your fund at the beginning of the tax year, any new investment you make may not be taxable until the next tax year.

Here is a quick fee + tax comparison between the Macquarie All Country fund and Vanguard FIFs, which confirms that you’re normally better off with Vanguard, unless you have over $50,000 invested AND are on the highest marginal tax rate.

Currency Hedging

Investing internationally adds another layer of volatility to your investment due to fluctuations in currency exchange rates. For example, even if the price of your shares stay the same, the value of your investment would still rise and fall as the NZ Dollar goes up and down. Fund managers may use varying levels of currency hedging to dampen these fluctuations:

- Smartshares Total World ETF (NZD Hedged) – Fully hedged to the NZD

- Vanguard International Shares Select Exclusions (NZD Hedged) – Fully hedged to the NZD

- Macquarie All Country Global Shares Index – 69% hedged to the NZD

- Kernel S&P 500 – 100% hedged to the NZD

- All other funds – No currency hedging

So should you go Hedged or Unhedged? I don’t think there’s a right or wrong answer here, however, my preference would be to go for the unhedged fund:

- Hedging is more expensive – for example, Smartshares and Vanguard’s NZD hedged equivalents both charge an extra 0.06% in management fees.

- Currency fluctuations should even out over the long-term – Given shares are a long-term investment, there is less need to hedge a share fund, since any short-term fluctuations can be ignored. However, hedging is more appropriate for shorter-term investments such as bonds.

Distributions (dividends)

All funds intend (although do not guarantee) to pay distributions at the following frequencies:

- Smartshares – Half yearly, except for the two ESG funds and SuperLife – No distributions

- Vanguard – Quarterly

- Macquarie – Half yearly

- Kernel – Quarterly

All distributions can be automatically reinvested into the fund (except when using Sharesies), or taken as a cash payment.

Conclusion

There is no doubt that index funds are an attractive way to diversify your investment portfolio internationally. They give you exposure to thousands of companies in one fund, so you can avoid having to pick individual shares in countries you’re unfamiliar with. However, there are certainy more considerations to make when investing internationally such a tax, and currency hedging.

My opinion that a global one is the way to go, for their broad geographical exposure. For this the unhedged Vanguard fund available through InvestNow is very hard to beat with its very low fee, and diversification into over 1,500 companies worldwide. Otherwise the Smartshares Total World ETF is a good alternative, being a PIE fund (simplifying your tax obligations), and giving you exposure to emerging markets – It is currently my fund of choice.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.