KiwiSaver is a savings scheme set up by the New Zealand Government. It’s aimed at helping New Zealanders save for retirement, although it can be used to help fund the purchase of your first home.

With money in the scheme being contributed from yourself, your employer, the government, and the investment returns from your KiwiSaver fund, the KiwiSaver scheme is a fantastic tool to invest and grow your money. Here are 3 tips to ensure you’re getting the most out of your KiwiSaver fund.

Further Reading:

– KiwiSaver 101 – How does KiwiSaver fit into your investment portfolio?

How does KiwiSaver work?

Firstly, how does KiwiSaver work? Assuming you’re an employee between the ages of 18 and 64, as a member of KiwiSaver:

- You (the employee) contribute at least 3% of your wages or salary into your KiwiSaver account. This automatically comes out of your pay each payday.

- Your employer contributes 3% of your pay into your KiwiSaver account.

- The government contributes 50 cents for every $1 you contribute to your KiwiSaver account. The government contributes a maximum of $521.43 per year.

If you’re self-employed or not working, you can still make your own voluntary contributions to KiwiSaver, and the government will still pay you the government contribution.

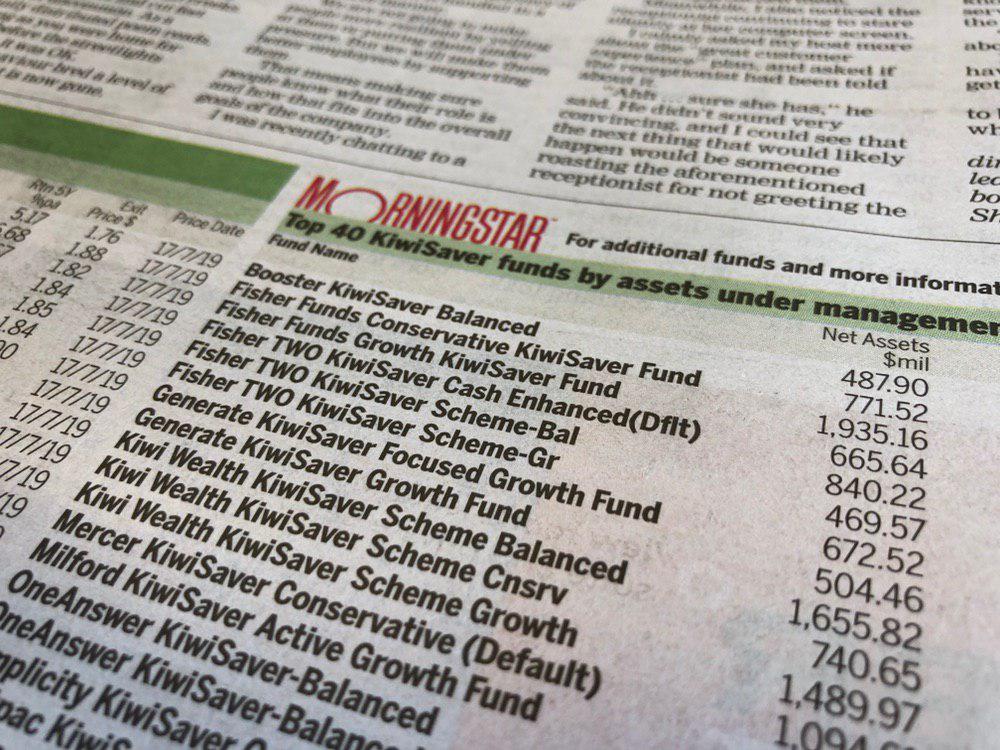

The money in your KiwiSaver account is then invested in a fund (which invests in various assets like bank deposits, bonds, and shares), with an aim to grow your money. These funds are managed by a fund manager (which you can select) like ANZ, Simplicity, or JUNO – not by the Government.

Tip 1 – Select the right type of KiwiSaver fund

The type of fund most suitable for you depends on how many years you have to invest – that would be how many years until you’re 65 (given KiwiSaver is a retirement savings scheme), or how many years until you buy your first home if you intend to use KiwiSaver for that purpose. Use the below table as a very rough starting point for thinking about what type of fund you should be in:

| Years to invest | Fund type |

| 0 ~ 5 | Conservative (mostly invested in cash and bonds) |

| 5 ~ 10 | Balanced (evenly split between bonds/shares) |

| ~ 10+ | Growth (mostly invested in shares) |

Why is the type of fund you select so important? Let’s say you’re 30 years old, so you have 35 years until retirement. Assuming you start with $0 in your KiwiSaver account, and your contributions total $5,000 per year, at 65 years old your KiwiSaver account would be worth the following for each fund type:

- Conservative: $308,985 (assuming an average return of 3% per year)

- Balanced: $473,372 (assuming a 5% return per year)

- Growth: $750,439 (assuming a 7% return per year)

That’s a massive difference! An unfortunate feature of KiwiSaver is that when you join the scheme, and you don’t select a fund for your KiwiSaver money to be invested in, your money will go into a “default fund”. These “default funds” are conservative, and given KiwiSaver is mainly a long-term retirement scheme, many people could potentially lose $441,454 just by being too lazy to move out of their default fund into a growth fund.

Conversely someone close to buying their first home probably shouldn’t go for a growth fund. As these funds are invested mostly in shares, they can drop significantly in value over the short-term – which means you could be withdrawing your KiwiSaver money at a time your investment has gone down in value (long-term investors won’t face this same problem, as they can wait several years for the investment value to recover).

So make sure you’re enrolled in the type of fund most suitable for you, particularly if you’re in a default fund. To do this you can talk to your KiwiSaver fund provider about switching the type of fund you’re invested in. And as always, everyone’s situation is unique so you may also want to consult with a financial advisor to determine the best investment option for you.

Tip 2 – Ensure you get the $521 government contribution

The KiwiSaver government contribution is some of the easiest money you’ll ever make. Put $1042.86 into your KiwiSaver each year (between 1 July and 30 June), and you’ll earn an additional $521.43*. That’s a guaranteed 50% return, which is pretty hard to find anywhere else.

*You must have been a KiwiSaver member for a full year to 30 June to receive the full $521.43 government contribution. If you join KiwiSaver part way through the year, your government contribution will be pro-rated to the time you’ve been a member. For example, if you join KiwiSaver on 1 January you will be eligible for half the government contribution ($260.71).

Employees – if you earn $34,762 or more a year, you’re all sorted. Contributing just the minimum 3% of your pay equates to just over $1042.86, so you’ll get the maximum government contribution of $521.43 per year. If you’re an employee earning less than $34,762 per year, you can also make voluntary contributions to reach the magic number of $1042.86.

If you’re self-employed or not working – you can still make voluntary contributions into KiwiSaver. You’d need to contribute $20.06 per week to reach the $1042.86 each year in order to earn the maximum government contribution.

If you can’t afford to contribute $1042 year, it’s still worth it to contribute what you can. You’ll still receive 50 cents in government contributions for every $1 you put in. There is no minimum amount you need to put in to be eligible for government contributions, so even if you manage to put in just $10, you’ll still receive $5.

Tip 3 – Lower your fees

Unfortunately the KiwiSaver providers that manage our funds for us tend to charge A LOT of fees. The average fee for a KiwiSaver Growth fund is 1.32%. Using Sorted.org’s KiwiSaver fee calculator, a 35-year-old could expect to pay over $42,000 in fees until age 65, in an average-fee fund like Milford’s Growth fund.

Many people will argue that fees aren’t that important – your returns after fees are more important. I agree that overall returns are crucial – but the problem is that future returns aren’t guaranteed, while fees are. In other words, a high-fee provider that has produced high returns in the past is not guaranteed to produce their high returns in the future, but they’ll still continue to charge their high fees.

The solution is to go for a low-fee provider like Simplicity, JUNO, BNZ, or Superlife. By paying low fees year after year, you could save tens of thousand of dollars. The same 35-year-old above would only pay $9,740 in fees by going with Simplicity’s low-fee growth fund.

Further Reading:

– Simplicity vs JUNO vs BNZ – Battle of the low cost KiwiSaver funds

Bonus Tip – Think again about increasing your contribution rate

Employees enrolled in KiwiSaver can choose to contribute either 3, 4, 6, 8, or 10% of their wages or salary into their KiwiSaver account. You might think it’s sensible to increase your contributions over the minimum 3% in order to save more money for retirement. But for most full-time employees I would suggest thinking again before contributing more than the minimum. There are a few reasons why:

- Contributing more than $1042.86 per year does not earn you any additional government contributions, because they are capped at $521.43 per year.

- You do not get any tax advantages for contributing more

- Your money is pretty much locked up in your KiwiSaver account until you’re 65 or when you buy your first home. And there is no guarantee that future governments will continue allowing withdrawals for buying a home, or keep the age of withdrawal at 65.

KiwiSaver funds are just ordinary investment funds with restrictions

An easy alternative to increasing your contribution rate would be to put aside more of your pay and invest it into a non-KiwiSaver investment. For example, instead of increasing your contributions from 3% to 6%, put an extra 3% of your pay towards a non-KiwiSaver fund. With these funds, you’ll have the flexibility to withdraw this money earlier than with KiwiSaver e.g. if you want to retire and use that money before the age of 65.

There are probably 3 main exceptions to this tip:

- Your employer is generous and offers to match your KiwiSaver contributions at a rate higher than 3% e.g. if you elect to contribute 6%, your employer matches this with a 6% employer contribution.

- You earn less than $34,762 per year, and want to increase your contribution rate to help get the full $521 government contribution.

- You are happy with a KiwiSaver fund’s restrictions on withdrawals, as you don’t think you’re disciplined enough to save a larger amount of money. In this case increasing your KiwiSaver contributions will help lock more of your money away from the temptation of spending it.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.