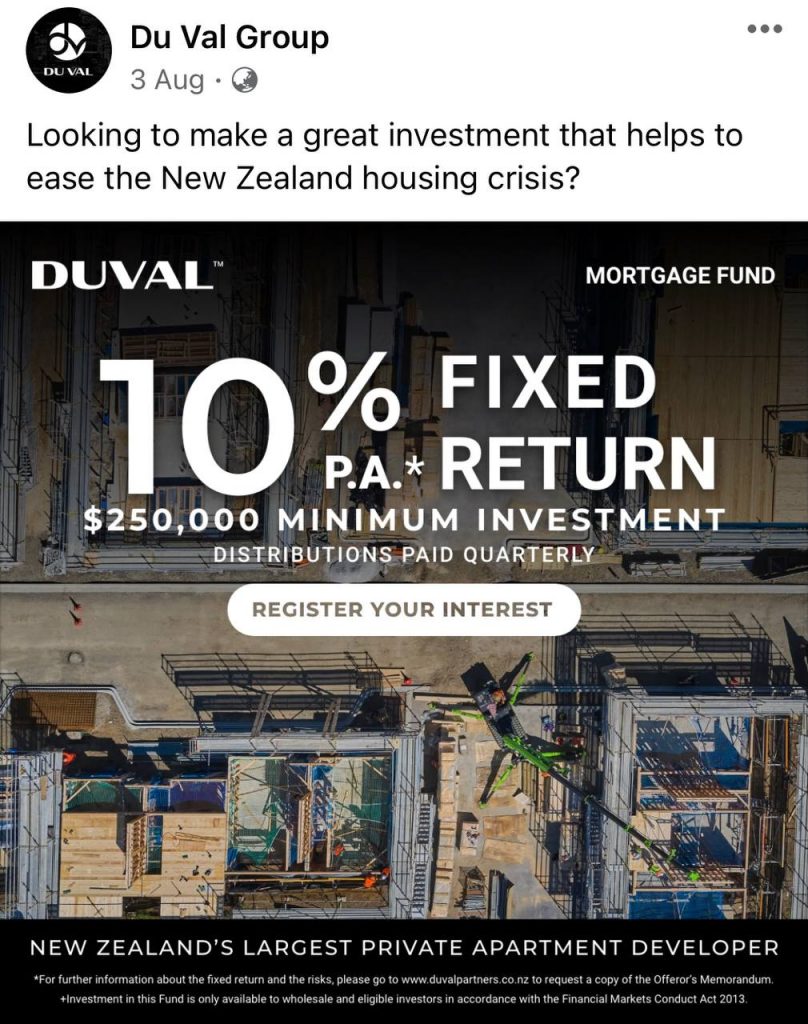

If you use Facebook or Instagram you might have seen some ads promoting a 10% return for investing with property developers like Du Val Group and Williams Corporation. This rate of return is significantly higher than what you can earn by sticking your money in a bank savings account or term deposit, and is even comparable with the long-term average return you can get from shares.

So is it worth investing with these housing developers? And what’s the catch with such a high return – is it a scam? Read on to find out.

This article covers:

1. What’s on offer?

2. How does the investment work?

3. What are the risks?

1. What’s on offer?

There are number of property developers who are promoting investment opportunities through Facebook and Instagram, which they claim will help fund the development of new townhouses and apartments and ease the housing crisis. As well as helping to solve one of our nation’s biggest issues, these investments come with a juicy 10% per annum return. Sounds good right?

The first thing to know about these investments is that unfortunately a high percentage of people reading this won’t qualify to invest in these products. These investments require you to be a wholesale investor, AND have at least $100,000 to invest.

What is a wholesale investor?

– Someone who is investing at least $750,000 into a financial product.

– Someone whose primary business is investing in financial products.

– Someone who is a large investor (has a net worth over $5 million).

– Eligible investors. These are people who have sufficient knowledge and experience in dealing with financial products to adequately assess the merits and information needs for an investment opportunity. They must have their expertise certified by a lawyer, accountant, or financial adviser.

A friend of mine who’s eligible to invest approached Du Val Group and Williams Corporation expressing interest in taking on one of their investments. Here’s an overview of the investment opportunities he was offered:

Du Val Group

Du Val Group is a South Auckland based developer of townhouses and apartments, who also operate a number of related businesses like property management. They offer the following investment fund:

- Du Val Mortgage Fund – Open to wholesale investors only. Minimum investment $250,000 for eligible investors, and $750,000 for other wholesale investors.

Williams Corporation

Williams Corporation is a developer of affordable housing in Christchurch, Wellington, and Auckland. They offer three investment funds:

- Williams Corporation Capital – Open to wholesale investors only. Minimum investment $750,000.

- Williams Corporation Capital Partnership – Open to wholesale investors only. Minimum investment $100,000.

- Williams Corporation First Mortgage Investments – Open to wholesale investors only. Minimum investment $750,000.

The difference between the three funds mainly relates to how they are structured, but they all intend to deliver the same 10% return to investors.

2. How does the investment work?

Use of funds

Property developers like Du Val Group and Williams Corporation need a lot of capital to operate. In general a townhouse development project would involve:

- Finding and buying suitable land for the project.

- Designing the housing development and obtaining the relevant council consents (resource consent, building consent).

- Preparing the land for construction, including the removal of any existing buildings.

- Construction and fit out of the units.

- Connecting the development to utilities like water, electricity, and internet.

- Marketing and selling the properties to buyers (or to renters if it’s a build to rent development).

That’s a lot of money going out over a project period of 1.5 to 2 years to pay for a massive range of costs – especially when some projects can comprise over a hundred units. And during this time a developer makes almost no income from the project as they get paid by a purchaser on settlement of the property, which only occurs after the property has been completed (after the title and Code Compliance Certificate is issued).

Developers usually don’t have enough of their own capital to cover all of a project’s costs (particularly with Du Val Group and Williams Corporation who have a large amount of work going on at once), so they need to borrow money to pay for the project’s outgoings like land, architects, consenting, materials, and tradespeople. Banks typically won’t lend out the entire costs of a development project (as this is considered to be too high risk), so developers must turn to alternative sources of funding to get projects over the line.

Du Val Group and Williams Corporation do this by setting up a financing arm for their business which operates as a standalone company. The financing arm then raises money from investors by offering investment into their funds. The financing arm then funds the developer’s projects, in the form of a loan to each project. The funding sources for a large project could look something like:

- 30% funded with the developer’s own equity

- 50% funded with a loan from a primary lender such as a bank

- 20% funded with a loan from the developer’s financing arm (i.e. investors’ money)

Each project pays interest back to the developer’s financing arm, which is then distributed out to investors on a regular basis. Despite a project having to pay a high interest rate for the financing arm loan (so that they can afford to pass on a high return to investors), the weighted average financing costs for a development project is relatively low as bank interest rates are lower. Lastly, on the settlement of a project the loan is paid back to the financing arm, which frees up this money to finance new projects or pay back to investors.

Returns

Du Val Group and Williams Corporation’s funds are fixed income investments that work a bit like bonds. They all offer a fixed 10% annual return paid quarterly (so each payment would equate to a 2.5% return). This return is before tax.

Getting your money out

For Du Val Group’s fund, investors are able to submit a request to withdraw their money at any time. However, a request to withdraw an investment can be rejected for whatever reason e.g. if your money is tied up in development projects. Du Val Group also require 60 days notice for exiting an investment.

If you have held an investment for over 12 months, Du Val Group also allows you to transfer your investment to another wholesale investor, or sell your investment on Du Val’s secondary market (this would incur a 0.5% fee). Lastly, if any of Du Val Group’s businesses list on a sharemarket, any investments in the fund can be converted into shares of that listed business.

For Williams Corporation, all their funds have a 12 month minimum investment period. After this period investors can request to withdraw their money at any time. This request can be rejected if there isn’t enough unallocated funds to pay out the investor – in this case Williams Corporation will endeavour to pay out the investor within 6 months by pairing a withdrawal request to the settlement of a project. If over 33% of the money invested in each fund wants to be withdrawn at once, then the withdrawal timeframe can be stretched out to 12 months.

Williams Corporation investors can also withdraw their investment to pay for the deposit or settlement on a Williams Corporation property.

3. What are the risks?

Project risks

The main risk of investing in Du Val Group and Williams Corporation’s funds is that one or more of their development projects cannot repay the loans from the developers’ financing arms. This could affect the financing arm’s capability to pay back investors the full amount of their investment. There are many risks that projects face that can impact their ability to repay their debts:

- Construction timeline risks – Construction can take longer than expected for many reasons such as defects or unforeseen issues. COVID-19 lockdowns can also delay projects as construction must halt.

- Environmental – Unexpected issues with the development site such as hazardous materials on the land could also cause delays or require rework to the plans.

- Market risks – The developer might not be able to sell or rent out the properties at the desired price if there’s less demand for the properties than expected.

- Materials and labour risk – Building materials and labour could end up costing more than budgeted, or there could be difficulty in sourcing the right parts and tradespeople.

- Legal/regulatory risks – Consents, approvals, and titles could take longer than anticipated to obtain.

Delays can be especially troublesome for projects as they push out the settlement of properties, preventing cash flowing in to pay back loans. Delays also increase costs as they result in projects paying more in interest. If a project becomes financially constrained due to delays and/or higher than expected costs things start to get interesting.

Fortunately there are a number of layers of protection that must be used up before a project’s financial constraints affect investors’ money. For example, if a project faced a big overrun in costs:

- One of the first things impacted would the profit that the project makes (higher costs = less profit).

- If the cost overrun is so great that the project becomes unprofitable, the developer’s equity would be next in line to take a hit.

- If that equity is eaten up then investors would be next in line to be impacted. They would be looking at the prospect of the project not being able to pay back some or all of the loan.

However, one really bad project wouldn’t result in investors losing all their money. The financing arm lends investors’ funds out to multiple projects, therefore spreading the risk out among multiple developments.

How about more severe circumstances where the developer went bust and couldn’t complete a project? The lending the financing arm provides to each project is secured against the project’s property and any purchase contracts to buy the project’s units. In this case it’s possible the project’s land along with the purchase contracts could be sold to another developer, and the sale proceeds used to pay back the loan. However, there is no guarantee that the sale of these assets would be sufficient to pay back the entire loan. And in the case where a primary lender such as a bank co-funded the project, the bank would be first in line to have their loan paid back from the sale proceeds.

Product risks

There are a few other risks relating to the investment funds:

- Interest rate risk – The return on this investment is fixed at 10%. If interest rates rise, this return could become less attractive relative to other investment opportunities.

- Liquidity risk – There is no guarantee that you can get your money out when you want to. The funds have the right to decline withdrawal requests, and this is more likely to happen if too much investor money is tied up in projects or if too many investors want to withdraw their money at once. In this case you would likely have to wait until a project settles before any withdrawals can happen.

- Conversion risk – If any of Du Val Group’s businesses lists on a sharemarket, any investment in Du Val’s fund can be converted into shares of that listed business. This could result in you holding a significantly different investment product than the one you originally entered into.

Conclusion

These investments are relatively high risk, and in fact the FMA have recently warned Du Val about misrepresenting the risk of their fund. A 10% return on your investment is excellent during today’s low interest rate environment, but comes with a greater likelihood that some or all of your money won’t be paid back to you (compared to if you stick the money in the bank or with a reputable bond issuer). While there are a few layers of security associated with each project, the risk that developers take on is still high, and the bubbly housing market and building boom won’t last forever. It’s very possible that a seemingly stable and profitable operating environment can change to a difficult one.

These investments are also complex and are wholesale only for a good reason. You are essentially playing the role of a financier assessing whether or not to lend your money out to a business. You need to do your own due diligence, and as a wholesale only opportunity, the rules around what information needs to be disclosed about the investment are less stringent compared to retail opportunities. The onus is firmly on the investor to seek out and evaluate enough information to be able to weigh up the risks and potential returns of the investment.

But high risk and complexity doesn’t automatically make investing with Du Val Group and Williams Corporation a bad investment. Nor are these investments scams, with genuine business models surrounding these funds. But personally (as a long-term investor) I would prefer to stick with traditional investments such as funds and shares:

- Firstly, there is much less paperwork involved – you can even buy shares in a company without interacting with another human and/or while you’re sitting on the toilet.

- Secondly, it is easier to do due diligence on funds and publicly listed shares given information on these is easily accessible online.

- Lastly, although they are different asset classes, and they might not provide a consistent 10% income every year (you can expect shares to have low or negative returns in some years), the average return on shares over the long-term should be right up there with Du Val and Williams’ investment products.

However, those with shorter investing timeframes or with a requirement for income might find these funds more attractive than I do. In fact these investments could perhaps generate enough income to fund a modest lifestyle. But be sure to do your own due diligence.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Great Article. Worth noting however that both DuVal & Williams Corp have hundreds of millions of debt arranged through second tier lenders/brokers (Reesby & Co for DuVal & NZMS for Williams Corp). This mezzanine debt comes at a substantial cost (typically 12-20%) and puts the projects at greater risk of failure.

Given the current environment with a decrease in end values of circa 15% increased build costs of circa 15% and increasing finance costs I would be very nervous about investing in this space.

Thanks. Yes it is a very difficult time for property developers right now. Plus the returns of 10% p.a. have not risen in line with the current environment.