With the abundance of holidays this month, April 2022 has seen relatively little news coming out of the investment industry. However, there’s still a number of things to cover in this month’s “What’s been happening in the markets” article including some big announcements out of Kernel, a new company coming to the NZX, and a new savings product from Heartland Bank.

This article covers:

1. Market movements

2. Big announcements from Kernel

3. More product updates

1. Market movements

The NZX 50 is down 0.04% over the last month, and is down 8.59% Year-to-date. A number of large NZX companies have done well this month such as Spark (+7.66%), Infratil (+4.02%), and EBOS Group (+5.00%), offsetting the poor performance of Fisher and Paykel (-9.66%), a2 Milk (-15.32%), and Meridian Energy (-5.01%).

Following a largely positive month in March, April 2022 was a rough one for the US market, with the S&P 500 down 6.29% over the last month, and down 10.05% YTD. There were a number of interesting events to go along with the volatility, such as earnings reporting season well underway (with this season’s big loser being Netflix, down 47.29% for the month), and Elon Musk looking to buy out Twitter (or perhaps looking to back out of the deal?).

Let’s take a look at how the Aussie markets are doing. The ASX 200 is down 0.77% over the last month, and is down just 0.51% YTD. Pretty resilient thanks to the heavy weighting towards banks and mining companies who are doing well in an environment of rising interest rates and commodity prices.

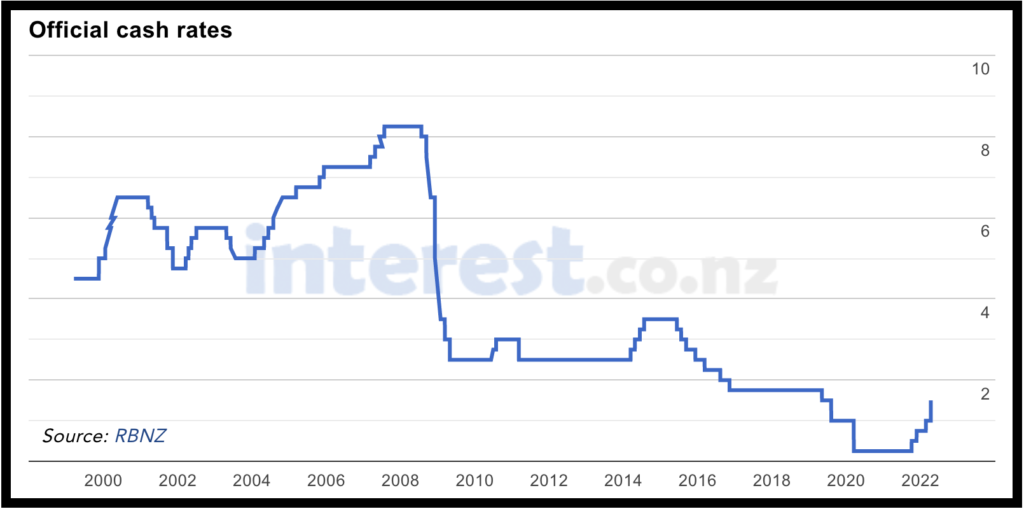

As always it’s hard to pinpoint a single reason for the weakness in the markets. Though one factor that’s definitely having an impact is rising interest rates. Locally the Reserve Bank of NZ raised the OCR this month from 1% to 1.5% largely in response to inflation, so rates are well and truly on their way up (though still low compared to what we’ve seen historically). YouTuber The Plain Bagel put out a good video explaining how rising interest rates might impact your investments here: What Rising Rates ACTUALLY Mean For Your Investments

We’re sure you’re all tired of seeing the market constantly flat or in the red. But it’s a good time to remind yourself that investing is a long-term venture rather than a get rich quick scheme – It’s entirely normal to see long periods of weakness where you’ll see little to no results. And remember this market weakness isn’t necessarily a bad thing, but rather an opportunity to accumulate shares or units in funds at cheaper prices!

2. Big announcements from Kernel

Index fund manager Kernel announced some substantial changes to their platform earlier this month, so we’ll spend some time in this article covering what’s new.

New Products

A. New funds

Firstly, Kernel launched 2 new funds, bringing their total number of funds to 13. The new funds are:

Kernel High Growth Fund – A diversified bundle of 5 Kernel funds:

- NZ 20 Fund (23.5%)

- NZ Mid & Small Cap Opportunities Fund (5.9%)

- Global 100 Fund (58.6%)

- Global Infrastructure Fund (5%)

- Global Green Property Fund (5%)

- Cash (2%)

The High Growth Fund replaces the “bundles” Kernel previously offered and is a handy option to set and forget your investment without having to do the hard work of selecting individual funds yourself.

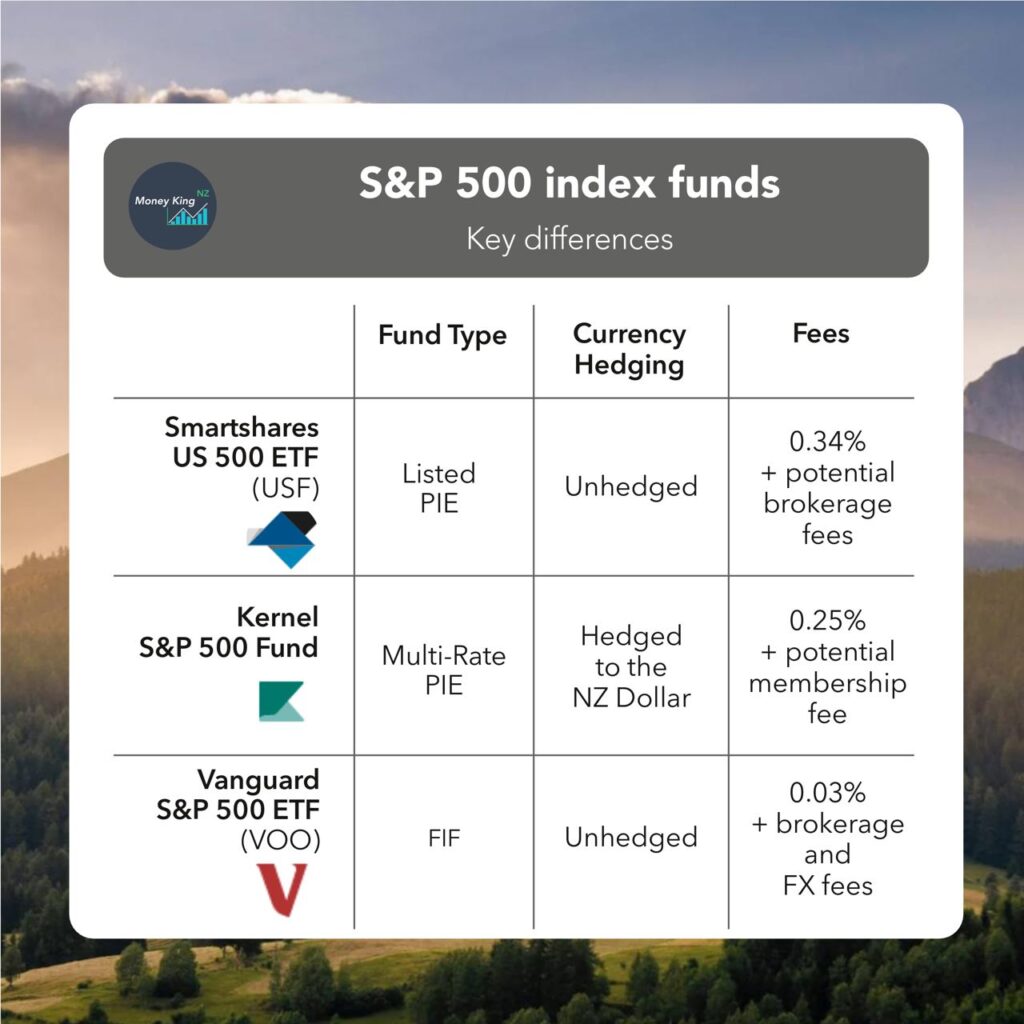

Kernel S&P 500 Fund – Invests in the S&P 500 index, representing the 500 largest companies listed in the United States. Unlike the Smartshares US 500 ETF, Kernel’s fund is currency hedged to the New Zealand Dollar so will be protected from exchange rate fluctuations between the NZ and US Dollar. This hedging could work for or against you, depending on how the exchange rates move.

It’s an odd choice of fund to add to their offering given the overlap with the Global 100 Fund. Kernel even suggests in a blog post that Global 100 is a great substitute for the S&P 500, given its relatively close correlation, and wider geographical exposure. But understandably the S&P 500 is a highly demanded product, and Kernel’s currency hedged option provides a point of difference to other S&P 500 funds.

B. Kernel KiwiSaver

Secondly, Kernel announced a KiwiSaver scheme, allowing you to put your KiwiSaver money into their new High Growth Fund, or a custom mix of any of their 13 funds. Kernel’s KiwiSaver plan provides a competitive alternative to other low-cost passive KiwiSaver options such as InvestNow and SuperLife, and should also please Simplicity members who are looking for a more aggressive investment (given Simplciity’s Growth Fund has a ~22% allocation to bonds and cash). Though keep in mind all of Kernel’s funds invest in shares, so their KiwiSaver scheme won’t be suitable for those needing their money in the short-term or those with a low risk tolerance. Kernel’s KiwiSaver Plan will be available to the public in the coming weeks.

C. Kernel Save

Thirdly, Kernel officially announced their Save product. This is a notice saver type account which pays 1.90% interest and requires 34 day’s notice to withdraw your money. This is nothing special as you can already go to Heartland Bank to get the same account and interest rate, but it might be handy for some Kernel customers to have their long-term investments and short-term savings all in one place. Kernel Save will be available to the public in the coming weeks.

Fee changes

Kernel have also made some big changes to their fee structure:

- Management fee cuts – The fees for Kernel’s core funds have been cut to 0.25% (from 0.39%). The fees for their thematic funds have been cut to 0.45% (from 0.55%). For the NZ 50 ESG Tilted Fund, the management fee remains at 0.25%.

- No more rebates – Kernel previously gave customers investing over $25,000 through the platform a 0.10% p.a. management fee rebate. This rebate no longer applies.

- Account fee changes – Kernel previously charged a $3 per month account fee for customers investing $1,000 or more. This fee has now increased to $5 per month and now kicks in if you invest $25,000 or more. This fee doesn’t apply to Kernel’s KiwiSaver offering.

Let’s take a look at the impact these changes will have on investors:

- Those investing under $25,000 – You’ll be better off. The management fee cuts and the elimination of account fees for smaller investors makes Kernel an even more compelling option for you.

- Those investing $25,000 to $60,000 – You’ll be worse off, as the increase in account fees is greater than the reduction in management fees.

- Those investing over $60,000 – You may be better off, as the lower management fees start to offset the increased account fee.

The exceptions to this are if you’re investing in the:

- NZ 50 ESG Tilted Fund – Worse off for larger investors as the removal of the rebate results in an effective fee increase from 0.15% to 0.25%.

- Thematic funds – The removal of the rebate effectively means larger investors are paying the same 0.45% fee as before.

So overall the fee changes isn’t all good news. The interesting part is that Kernel have replaced an incentive to invest over $25k (to get the fee rebate) with a penalty (in the form of account fees kicking in). We’ve heard from a few disappointed investors who’ve either reduced their Kernel investments to under $25k or have been put off the platform altogether in response to the changes.

The sweet spot for Kernel seems to be $1-$24999 after that there is a massive fee increase. I have just reduced my funds to drop below this fee increase threshold.

I’ve also withdrawn funds to reduce my balance below the $25k mark… The incentive for saving hard and investing more has been removed. As a larger long term investor I’m disappointed with these fee ‘reductions’.

It’s a little confusing, so under $25,000 I’ll pay .25% then my fee doubles to .49% at 25,000?!? I’m not sure that makes sense. Larger customers are already paying more $$ in fees!

Looking ahead

This month’s announcements from Kernel are mostly positive, and they say there’s more products yet to come. These include more conservative fund options as well as an on-call savings option (which doesn’t require a notice period to get your money out). In the meantime you can check out our updated Kernel review below:

Further Reading:

– Kernel review – High quality index funds

3. More product updates

Here’s some updates on a few other investment products.

New Heartland Notice Saver

Heartland Bank recently launched a 90 Day Notice Saver account, adding to their 32 Day Notice Saver offering. Those wanting to withdraw from this savings account will need to wait a while – it takes 90 days to get your money out! It could be a good option for those willing to sacrifice flexibility to earn a higher interest rate, with the account currently paying an interest rate of 2.50% (versus 1.90% for their 32 Day account).

For comparison Kiwibank also offers a 90 Day Notice Saver account paying 2.15% interest.

In related news, Heartland increased the interest rate for their Direct Call Account (which doesn’t require any notice period to withdraw your funds) this month from 1.05% to 1.50%.

Further Reading:

– Bonus Saver vs Notice Saver vs Term Deposit – Which savings product is right for you?

Is Opoly back?

We first covered the apparent demise of property crowdfunding platform Opoly back in January, but it seems they’ve risen from the ashes. This month Opoly made a few social media posts suggesting that they’re preparing some new property crowdfunding offers, giving investors the opportunity to invest in real estate with as little as $100. We eagerly await to see how their new offers go – with the sentiment around the property market softening in recent months, perhaps it’ll be even more challenging getting investors onboard this time round.

More and more people are looking into fractional ownership.

Opoly (via Facebook)

New listings going live soon!!

Further Reading:

– What happened to Property Crowdfunding in New Zealand?

The launch of Sugar Wallet

Sugar Wallet is an investment platform which you may have seen mentioned on the news or in our January news article. While the platform is brand new (officially coming out of beta, and launching on the iPhone App Store earlier this week), their product offering isn’t – they simply give investors access to Simplicity‘s existing Growth, Balanced, and Conservative funds.

So is it worth using? Probably not. Sugar Wallet slaps on a $3 per month account fee if you invest over $250 with them, while Simplicity doesn’t charge such a fee. So if you want to invest in Simplicity’s funds, you might as well do so directly via Simplicity rather than let Sugar Wallet clip the ticket. Feel free to check out our full review below:

Further Reading:

– Sugar Wallet review – Clipping the ticket?

Ampol coming to the NZX

We covered in last month’s news article that Z Energy (ZEL) will be acquired by Australian fuel company Ampol, and as a result we’ll lose Z as a listing on the NZX – in fact Z Energy’s last day of trading on the NZX was Thursday 28 April. However, we’ll be compensated in the form of Ampol listing their shares on the NZX in the near future (currently Ampol is only listed on the ASX).

It’s not the most exciting news for the NZ sharemarket, essentially swapping one fuel company for another. But at least the listing of Ampol will make it easier for New Zealanders to get exposure to Z’s new parent company, saving you from having to convert your money to Australian Dollars to invest.

In related news, Z Energy’s departure from the NZX leaves the NZX 50 index short of 1 constituent. The Warehouse Group (WHS) will come into the index to fill that vacant spot.

Conclusion

Thanks for dropping by on our site and reading our April 2022 news article. We hope you had an enjoyable month and made the most of the holidays – we sure did with a couple of awesome camping trips in Whangarei and Raglan. But with the weather getting cold it’s time to put the tent away until Summer comes around.

Lastly, we put out four popular articles this month so be sure to check them out if you haven’t already:

In case you missed them – April 2022’s articles:

– 12 common investing myths and misconceptions busted

– The ultimate guide to index funds in New Zealand

– The ultimate guide to KiwiSaver funds and schemes

– The ultimate guide to investment platforms in New Zealand

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Thanks for the article. I had never heard about Sugar Wallet and now might check it out to learn more. I am surprised and intrigued they are on-selling Simplicity Funds. InvestNow tried that a while back and Simplicity pulled out because they were not interested in having other people own the relationship with their members.

We’re intrigued by that aspect too! Thanks for bringing it up. We have a Sugar Wallet review in the works, and will approach them for further comment on their relationship with Simplicity. Perhaps Simplicity is more willing to work with Sugar Wallet as they don’t undercut them on fees. While they weren’t happy with InvestNow, given InvestNow provided a way to get around the $30 p.a. membership fee Simplicity charged at that time.