“Don’t invest more than you can afford to lose.” “Buy the dip!” “The S&P 500 is a good investment for beginners.” These are some of the well-intentioned tips that are constantly thrown around in investing communities. However, we don’t think these tips are quite correct. In this article we’ll be busting these and 9 other common investing myths and misconceptions – many of which could leave you worse off!

Our myths and misconceptions articles:

– 12 common investing myths and misconceptions busted (this article)

– 12 more investing myths and misconceptions busted

– 12 KiwiSaver myths and misconceptions busted

– 12 tax myths and misconceptions busted

1. Don’t invest more than you can afford to lose

This phrase is thrown around quite a lot to discourage people from investing money that isn’t “play money”. It’s probably appropriate advice for speculative investments like meme stocks and most cryptocurrencies, where there’s a reasonable likelihood of losing your entire investment.

But this advice isn’t correct for investing in general. It implies investing is gambling, akin to betting on the horses. It suggests that money you can’t afford to lose should be kept in the relative safety of a savings account (where it’ll get eroded away by inflation) or invested in property as the only way to grow your wealth.

We personally don’t follow that advice and have over 70% of our net worth (representing a few $100k) invested in shares. We definitely couldn’t afford to lose that, yet we’ve still chosen to commit that money into the markets. We use sound investment strategies to ensure we’re not gambling it away:

- Invest in quality – Always invest in shares because they’re good businesses, not because you think the price will go up. Popularity and hype may drive up share prices in the short-term, but quality is the ultimate driver of where that company’s share price will end up in the long-term.

- Diversify – Invest your money in many companies, across different industries and countries. If one of your companies goes bust, you won’t lose all your money, as it’s highly unlikely for all companies in a well-diversified portfolio to disappear at the same time.

- Invest for the long-term – Investing long-term will give you sufficient time for your investments to recover if they suffer from a downturn.

So instead of only “investing what you can afford to lose”, a better approach may be to “invest what you can afford to go without” (i.e. money you don’t need in the short-term).

Further Reading:

– I don’t believe the phrase “don’t put money in the share market that you can’t afford to lose” (The Happy Saver)

2. Invest in an S&P 500 index fund. It delivers a 10% return every year

We see this suggestion commonly given out to new investors who aren’t sure where to start with investing. It’s easy to see why this is the case:

- It’s well known – The S&P 500 is the world’s most famous sharemarket index. Investment content creators are constantly talking about it, and even Warren Buffet is a proponent of S&P 500 index funds.

- It’s easy to understand – The S&P 500 contains the 500 largest companies listed in the United States. It’s packed full of companies investors can relate to and understand like Apple, Tesla, and Walmart.

- It’s diversified – The 500 companies contained within a S&P 500 index funds provides plenty of diversification. Several industry sectors are represented in the fund including IT, healthcare, and consumer goods.

- It’s had a track record of strong returns – Its average return (back to the index’s inception in 1957) is 10.67% per year, despite going through events like the Global Financial Crisis and COVID-19. It’s been a great way to grow wealth over the long-term.

While investing in a S&P 500 index fund is far from the worst suggestion, there’s a few issues with this advice:

- It ignores volatility – Its 10.67% return is just an average, rather than a consistently flat 10.67% return every year. In some years the index has returned much more than 10%, but in other years returns have been negative. Think of investing in the S&P 500 as going on a roller coaster, rather than a smooth elevator ride. So while a S&P 500 index fund may be ok for long-term investors (who can tolerate the ups and downs), it’s unlikely to be good investment for short-term investors or those with a low risk tolerance.

- It’s concentrated on one country – The S&P 500 is said to have good geographical diversification as ~30% of its revenues are derived from outside the US. However we’d argue against this, as by investing in the index you’re only investing in companies listed in one country. It ignores the fact that there’s many good companies to be found outside of the US.

- Past performance doesn’t = future performance – There’s no guarantee the US market will continue to perform so strongly into the future. Perhaps other markets will do better than the US over the next few decades.

Further Reading:

– S&P 500 vs S&P Global 100: Which Should I Invest In? (Kernel)

– What do NZX 50, S&P 500, and Total World index funds actually invest in?

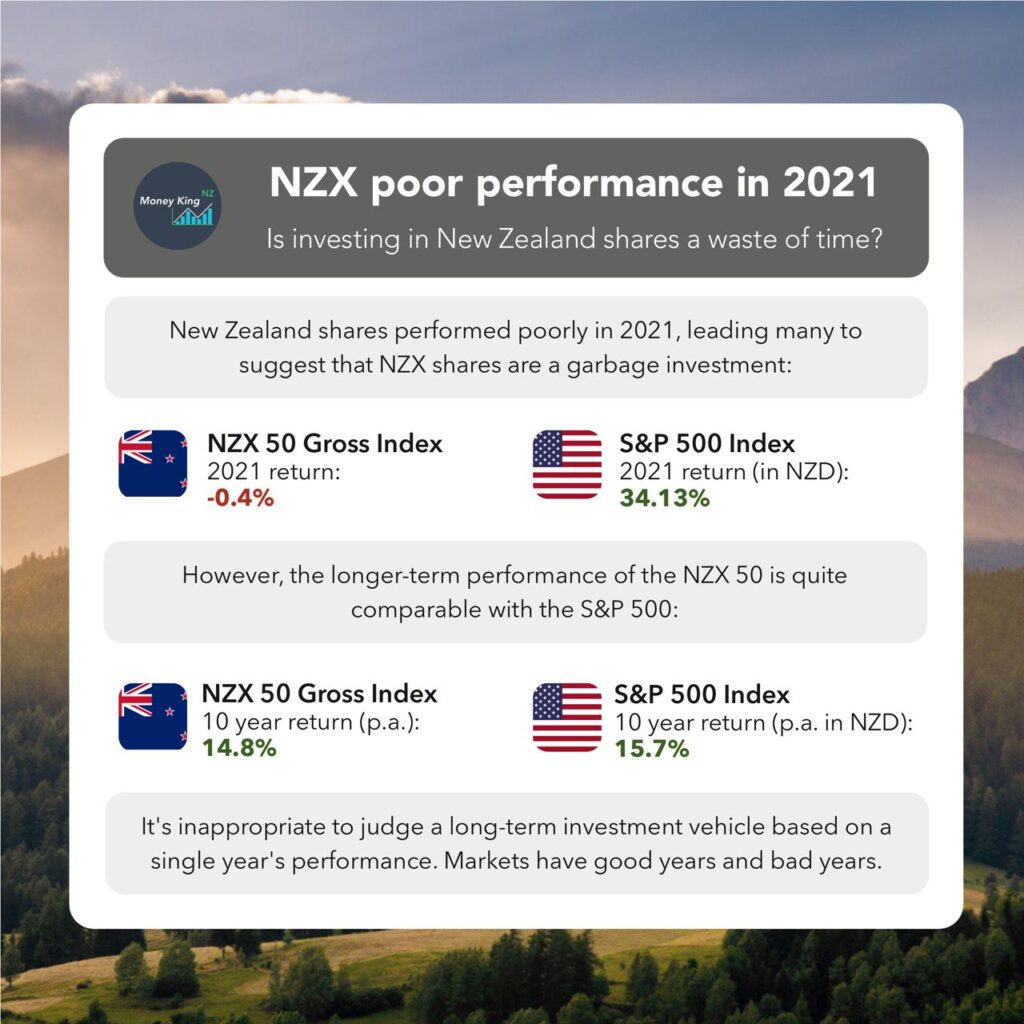

3. NZ shares are a waste of time

There’s a perception that New Zealand shares aren’t worth investing in likely because of the following reasons:

- The NZX has performed poorly recently – In 2021 the NZX 50 fell by 0.4%, while the S&P 500 rose by 34.13%.

- The NZX doesn’t have any good companies – There’s much fewer investment opportunities on the NZX. The fact that some local companies like Xero and Allbirds are listed on overseas markets doesn’t help.

But we disagree on the above and believe NZ shares are well worth considering as part of a diversified investment portfolio:

- Solid long-term performance – It’s inappropriate to judge a long-term investment vehicle based on 2021’s performance. It’s like teaching a teenager how to drive, and judging their performance after just one lesson. One year’s results aren’t indicative of how these markets will perform over the long-term. In fact, over the last 10 years the NZX 50 has delivered an average return of 14.8% per year versus 15.7% for the S&P 500 – a figure likely to be closer once you factor in the extra fees associated with investing in the US.

- Strong companies – It’s true that the NZX has fewer investment opportunities – but it’s unreasonable to expect a small country like NZ to have as many companies as the US or Australia. And of the companies we do have on the NZX, many have performed well recently. Examples that have beaten the S&P 500’s 34% return in 2021 are EBOS (47.5%), Heartland (60%), and Mainfreight (36.6%).

- Tax advantages – NZ shares pay imputation credits with their dividends, and aren’t taxed under the FIF regime. That gives NZ shares a big head start – international shares have to outperform NZ shares by ~1% every year just to make up for their tax disadvantages.

4. When your shares go down, buy the dip!

This advice is often dished out when the markets fall, and it’s actually a reasonable suggestion. It’s great taking advantage of dips in the market to buy into your investments at a discounted price. But there’s a couple of potential issues with buying the dip:

- An investment being cheap doesn’t automatically make it a good one. Putting more money into an investment just because it went down may be a case of throwing good money after bad. Instead, buy into a company because you want to own it, not because it’s on sale.

- This advice may encourage timing the market, perhaps by keeping some spare cash on the sidelines. In reality, the markets are pretty much impossible to time perfectly. Investors are generally better off fully committing their money into the market instead of keeping some as “dry powder” to deploy when their investments drop. This makes the advice of “buying the dip” redundant.

Further Reading:

– Does timing the market = better returns?

5. “Cheaper” shares are better

There’s a somewhat common perception that “cheaper” shares are better than “expensive” shares. For example, given a choice between:

- Company A with a price of $10

- Company B with a price of $100

Some may see Company A as a better investment, as the lower price would allow you to buy more units and perhaps offer a greater potential for return. However, it is the percentage gain of an investment, not number of units or price, that determines your returns.

Example

Zara invests $1,000 in Company A and $1,000 in Company B. This gives her:

– 100 shares in Company A

– 10 shares in Company B

Both companies’ share prices go up by 10%, so now Company A has a price of $11 per share, and Company B has a price of $110 per share. Zara’s investments are now worth:

– Company A: 100 shares x $11 = $1,100

– Company B: 10 shares x $110 = $1,100

Despite the lower share price of Company A enabling Zara to buy a larger quantity of shares compared with Company B, it is the percentage return that matters rather than the number of shares that she owns.

In addition, share prices are simply a made up number. For example, let’s say Company C is worth $100 million and wants to sell their shares on the sharemarket. They could do one of the following:

- Split the company up into 100 million pieces, in which case Company C would be worth $1 per share.

- Split the company up into 1 million pieces, in which case Company C would be worth $100 per share

Regardless of whether the company is split up into “cheap” $1 shares or “expensive” $100 shares, Company C is still worth $100 million and still has the same growth potential. So share prices alone are irrelevant in determining if a company is a good or bad investment.

Further Reading:

– Prices don’t matter! 4 things to know about share prices

6. It’s good to diversify your money across lots of funds

Diversification is an important aspect of investing, ensuring that your eggs aren’t all in the same basket. Some investors go about diversifying their portfolios by investing in lots and lots of funds – we’ve personally been there before, investing in a whopping 17 funds on InvestNow. But having lots of funds is often a sign of not knowing what you’re investing in, rather than a sign of being well diversified.

Having too many funds can lead to undesired results – not just because of the complexity, but because it could lead to less diversification! That’s because many funds overlap with each other and invest in a similar set of companies – in those cases, adding an additional fund to your portfolio might end up concentrating your portfolio towards a certain company/sector/country. For example:

- Investing in the Smartshares S&P/NZX 50 ETF gives you exposure to 50 of the largest companies listed in NZ. Adding the Smartshares NZ Property ETF to your portfolio doesn’t give you exposure to any new companies, as all companies in that fund can already be found in the NZX 50 fund. It only concentrates your portfolio towards the real estate sector.

- Investing in the Smartshares Total World ETF gives you exposure to over 9,000 companies across 48 countries. Adding the Smartshares US 500 ETF to your portfolio doesn’t add further diversification, given the Total World ETF already has a 60% exposure towards US shares. It only has the effect of concentrating your portfolio towards the US.

Funds are already diversified by nature and in most cases a single fund can go a long way to achieving a well-diversified portfolio. For example, a NZX 50 fund may seem simple, but contains 50 unique companies – It’s almost like having 50 individual holdings in your portfolio. So while there’s no “right” or “wrong” number of funds to invest in, a small handful is likely all you need.

Further Reading:

– More funds = less diversification? Are you investing in too many funds?

7. You don’t lose if you don’t sell

When your investments go down and are sitting in the red, conventional advice is to not panic as you haven’t actually lost money. This is true – if you don’t sell your losing investment, you won’t turn your “paper losses” into real losses.

Example

Johnny bought 1 share in Tesla for $1,100. Later on the price of Tesla went down to $900.

– If Johnny sold his Tesla share, he’d realise a loss of $200

– If Johnny doesn’t sell his Tesla share, he’d still own 1 Tesla share. The price of his investment could still go back up, or it could go down further. Gains or losses don’t count until Johnny actually sells his Tesla share.

Keeping calm and not selling your losing investments is pretty good advice. Dips and downturns are a normal part of investing, so having paper losses on your assets isn’t necessarily anything to worry about. However, there can be a couple of issues with holding onto your losing positions:

- It assumes that the price will recover – This is likely true if you’re investing in a quality company or fund. But in some cases a drop in an investment’s price may be permanent, perhaps due to a change in the company’s fundamentals or because the investment was highly overvalued. By not selling you may just be delaying the inevitability of realising your loss.

- It ignores opportunity cost – Keeping money tied up in a bad investment can still cost you, as that means less money available to put into a potentially better investment.

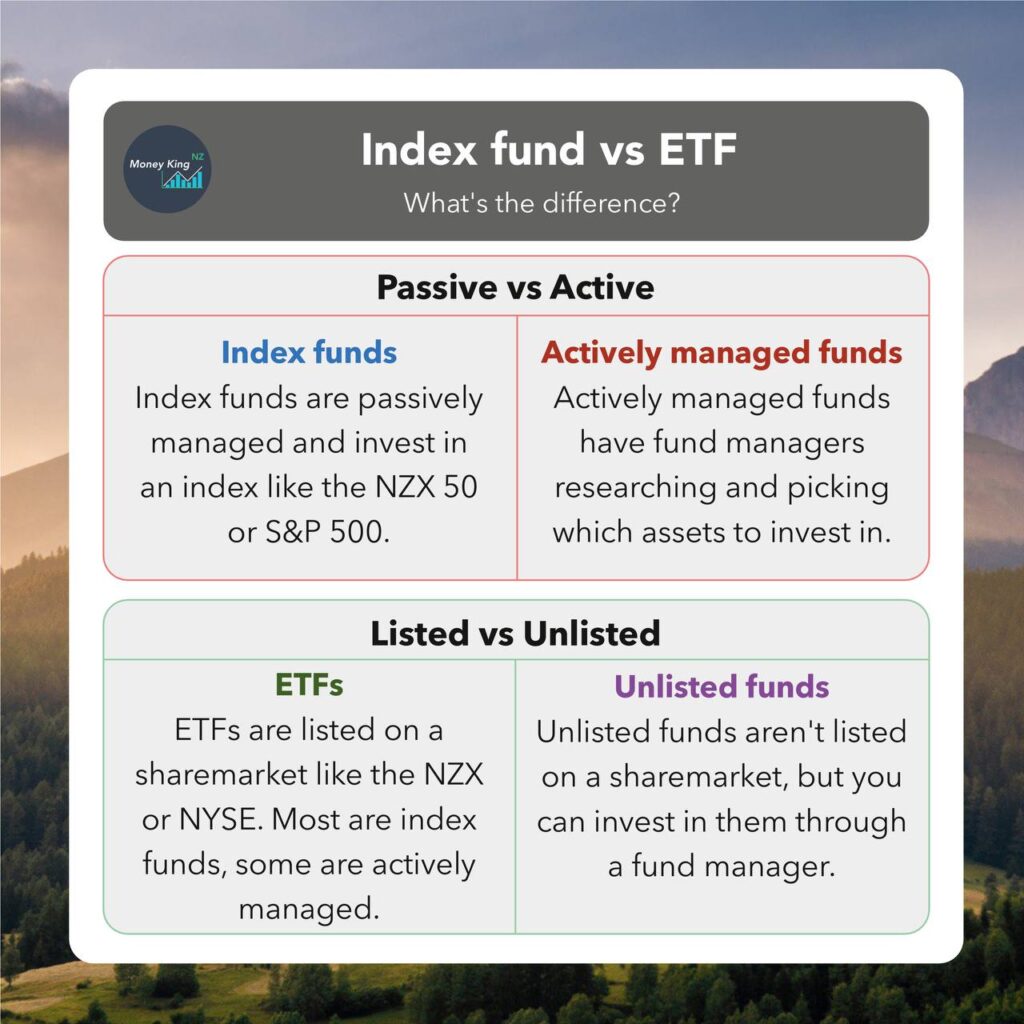

8. Index funds and ETFs are the same thing

There’s always heaps of confusion around this one! The truth is that the terms index fund and ETF refer to two different things.

The term index fund refers to how a fund manager chooses which companies to invest in. Index funds passively invest in an index (like the NZX 50 or S&P 500), while actively managed funds have fund managers researching and picking companies to invest in. Imagine the sharemarket being a crate of apples – actively managed funds try to pick the best apples, while index funds just buy the entire crate! Examples of index funds are Kernel funds and most Smartshares funds. Examples of actively managed funds are Milford’s and Juno’s funds.

The term Exchange Traded Fund (ETF) refers to where you can buy and sell that fund. ETFs are funds that are listed on a sharemarket like the NZX or NYSE, while unlisted funds aren’t listed on a sharemarket (so you’ll have to buy and sell that fund direct with the fund manager). Most ETFs are index funds (for example, the Smartshares US 500 ETF is an index fund which is listed on the NZ sharemarket), but some ETFs are actively managed (for example, the ARK Innovation ETF). Unlisted funds can also be index funds or actively managed funds – for example, Kernel’s index funds are unlisted, while Milford’s actively managed funds are also unlisted.

Further Reading:

– Funds 101 – What’s the difference between an Index Fund, ETF, and more?

9. Sharesies is expensive, Hatch is better

There’s sometimes a perception out there that certain investing platforms are better than others. However, no investing platform is perfect or the definitive best – the best platform for one person may not be the best for you. There’s many factors that affect what platform you should use, but a few key ones are:

- What you want to invest in – Different platforms often offer different investments. For example, InvestNow is no good if you want to pick shares in individual companies, and Stake is no good if you want to invest in NZX listed shares.

- Amount you’re investing – This can have a huge impact on the fees you pay. Say you wanted to invest $100 per month into US shares, either through Sharesies or Hatch. On Sharesies this transaction would cost ~$0.63 USD per month, and on Hatch this would cost ~$3.35 USD per month. So while Hatch has more features (which you might not even use), you’d pay a massive premium for that. The below table provides a simple comparison between Sharesies and Hatch for investing $100 p/m over 10 years into a US company:

| Sharesies | Hatch | |

| Amount invested per month (NZD) | $100 | $100 |

| Fees per month (USD) | $0.63 | $3.35 |

| Amount invested p/m after fees (USD) | $69.37 | $66.65 |

| Investment value after 10 years (USD, assuming 8% return) | $12,059 | $11,586 |

| Fees for selling (USD) | $72.20 | $60.92 |

| Amount withdrawn after fees (NZD) | $17,124 | $16,464 |

- Custody arrangements – There’s also a somewhat common misconception that Hatch is better than Sharesies, because Sharesies holds your shares in their custody (meaning you don’t own the shares), while Hatch allows you to hold your shares under your own name. This is far from being 100% true. Both platforms hold your investments under custody, though you remain the beneficial owner of those investments. The main difference in their custody arrangements is that Sharesies doesn’t allow you to transfer your foreign shares out to another broker, while Hatch does. Otherwise there’s no substantial difference in the safety of how each platform holds your shares.

Further Reading:

– InvestNow review – The most efficient way to invest?

– Buying shares in the USA – Sharesies vs Hatch vs Stake

10. Sustainable/ESG funds are ethical

Ethical investing is an increasingly hot topic as investors seek to align their investments with their ethical views. In order to invest ethically, you might choose some kind of sustainable/ESG/ethical fund:

- At minimum these funds use “negative screening” to exclude investment into undesirable industries such as weapons and tobacco.

- Some fund managers go further and utilise “positive screening” to choose investments that have positive ESG (Environmental/Social/Governance) characteristics.

The problem is that utilising negative and positive screening and labelling a fund as sustainable/ESG/ethical doesn’t necessarily make that fund ethical. Everyone draws a different line between what companies are and aren’t ethical, so it’s impossible for a fund to meet every investor’s ethical expectations. For example:

- Simplicity – Claims their funds are ethical and excludes investment into industries such as tobacco, weapons, gambling, and alcohol. However their funds invest in Nestle and Meta which are companies many consider to be unethical.

- Pathfinder – A fund manager who specialises in ethical investing. Some of their funds invest in cryptocurrency retailer Easy Crypto, an investment you could argue is unethical due to the power consumption of cryptocurrency.

- Kernel – Offers sustainability focussed funds like the the NZ 50 ESG Tilted fund. While this fund excludes certain investments (like Skycity for gambling and Z Energy for fossil fuels), it could be argued that other companies in the fund are unethical e.g. a2 Milk for dairy products, Genesis Energy for coal use, and Restaurant Brands for fast food.

None of these are bad funds, but demonstrates that true ethical investing requires investors to look beyond the label of a fund. Resources like Mindful Money can help investors research funds based on their ethics.

Further Reading:

– Clean and Green? 5 things to know about Ethical investing

11. The market is going down, time to switch to a Conservative fund

When the markets become volatile, people often change their investments or investing behaviours in response. Examples of this are switching from a Growth to Conservative fund in anticipation or in response to a market downturn, or reducing contributions to your investments.

Market volatility is usually the worst reason to change your investing behaviour, as it often involves an element of trying to time the market. For example, switching from a Growth to a Conservative fund will minimise further losses, but this may mean you miss out on the gains when the market recovers (unless you perfectly timed the market in switching back to a Growth fund).

A better approach would be to set up your investments from the very start to handle any market conditions that come by:

- Have an emergency fund – So you won’t be forced to sell out of your investments to pay for any unexpected expenses that may pop up.

- Buy investments that suit your time horizon – e.g. bank deposits for short-term investing to protect your money from the volatility of the markets, and shares for long-term investing so you have time to recover from market downturns.

- Buy investments that suit your risk tolerance – e.g. not overcommitting to volatile assets like shares or crypto if you know a downturn will cause you stress and sleepless nights.

- Be diversified – So your portfolio won’t be adversely affected if one investment goes bad.

With a well set-up portfolio you won’t have to react or panic when market volatility inevitability hits. The best time to change your investments is when your personal circumstances change (like when your investing goals change), not when you’re forced into it by volatility.

12. Air NZ is backed by the government – you can’t go wrong with this investment

A lot of people use the fact that Air New Zealand is backed by the government as their rationale for investing in the company. This is indeed a positive point about the company – with 51% Crown ownership, and the vital passenger and freight connectivity the airline provides, it’s unlikely the government will let the company go bust.

Unfortunately government backing doesn’t necessarily make Air NZ a good investment. While it could save your shares from going to zero, it doesn’t guarantee the share price will go up, nor does it guarantee the company will pay a dividend. It’s still a business like any other company listed on the market, facing opportunities and risks. While the company should do well if they can bounce back from the pandemic, there’s no guarantee they’ll do so – things like high fuel prices and soft passenger demand can hamper their recovery.

Conclusion

The investing tips given out in communities like Facebook Groups and Reddit are always well-intentioned, but Money King NZ doesn’t always agree with the popular view. These forums are usually great for discussing and learning about investing, but these common misconceptions demonstrate the risks of asking for investment advice from strangers on the internet. It could literally pay to challenge the conventional advice around investing, do your own research, and talk to a financial adviser if you’re in doubt.

Are there any myths and misconceptions we missed? Or any points in the article you disagree with? Let us know in the comments below, or check out our article 12 more investing myths and misconceptions busted.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Really enjoyed this article!

Cheers, thanks for reading!

NZ Super” is basically a LifeTime Annuity and inflation adjusted , so can a retiree factor the NZ Super income as a ‘Bond proxy’ in a retirement portfolio? eg. $24,201.46 / 0.03 x1 = $806,715.00 worth of Bonds at 3%. Cheers

You could think about it that way. But NZ Super isn’t guaranteed – the eligibility criteria and amount could all change by the time you retire. We’re 30+ years away from retirement age, so personally don’t factor in Super income with the assumption it won’t exist in its current universal form by then.

Haven’t thought of it that way, which kind of makes sense. But as Money King NZ said, it is not guaranteed. I like to take it as a safety net rather that a sure thing, so planning as it doesn’t exist, but it may be there if things don’t go according to plan.

Well written and sensible article.

Thank you!

Thank you for a well written and useful article :))

Thanks for reading!

Thanks, passed this on to my kids 18 and 16 to read as covers all the bases for them, great read!

Thanks Kate 😀