March 2022 has been a roller coaster ride in the markets – has it bottomed out yet? In this month’s news article we provide a brief update on market conditions, explore the implications of Air NZ’s capital raise and Telsa’s share split, and cover what’s happening with savings interest rates.

This article covers:

1. Has the market bottomed out?

2. Air NZ capital raise, Tesla share split, and Z takeover

3. Savings accounts & Interest rate rises

4. It’s tax time

5. New owner for AMP funds

1. Has the market bottomed out?

The NZX 50 was flat for the past month (up to 30 March), though this still represents a solid recovery from the rough start we had in the market in the first half of the month.

The NZX 50’s relatively weak performance in the latter part of the month is largely due to a big drop in Fisher and Paykel Healthcare’s share price. FPH shares, which makes up about 12% of the NZX 50, has fallen ~10% this month after announcing they’re expecting to earn lower revenues for the 2022 financial year.

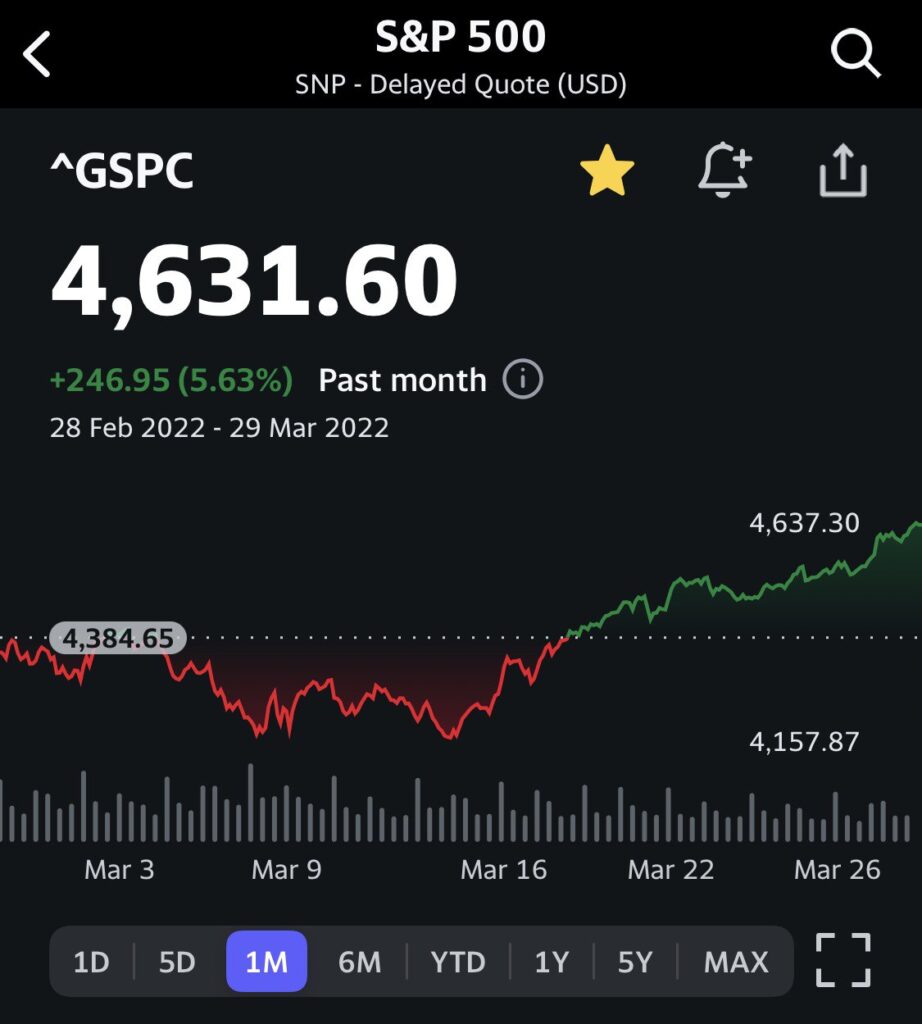

In the United States, the S&P 500 has performed better, up 5.63% over the past month after struggling in the first half of March. Definitely a month of two halves.

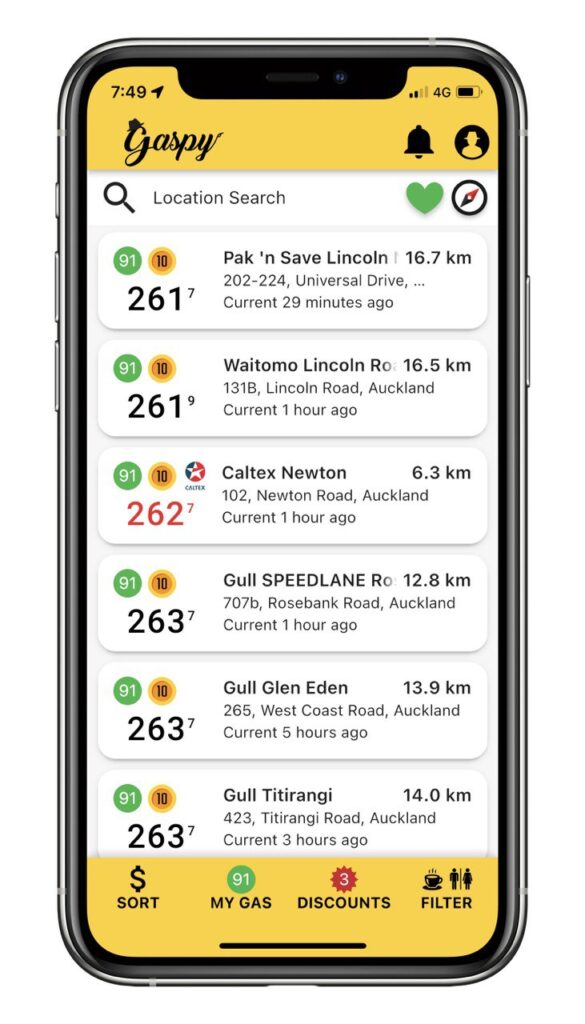

Oil prices have continued to rise, causing an explosion in petrol prices at the pumps. Though this has now eased off slightly after the government announced a temporary reduction in fuel taxes.

To help deal with the increasing cost of fuel, we’ve been using the Gaspy app to find the cheapest stations in our area, as here in Auckland prices can vary quite significantly from suburb to suburb. We’ve also seen people take advantage of Z’s Sharetank app where you can pre-purchase fuel, locking in today’s price. This is great if fuel prices go up, but you could end up paying more if prices go down.

Out of the woods?

With the latter half of March being quite positive for the markets, is the worst of the recent market volatility behind us? Hopefully the recent upswing has provided some relief if you were feeling a bit worried about your portfolio. But unfortunately no one knows what’s going to happen next. The war is still ongoing, so it won’t be a surprise to see more volatility come from that and other events.

Investing in shares will always be a roller coaster ride so we’re advocates for choosing investments based on your time horizon and risk tolerance. That means not getting too overconfident on shares, and selecting more conservative investments if you’re investing for the short-term or have a low risk tolerance.

Further Reading:

– How to invest $1k/$10k/$100k in New Zealand

2. Air NZ capital raise, Tesla share split, and Z takeover

A few companies are in the process of undertaking capital raises, share splits, and takeovers. These are all corporate actions which can confuse some investors, so let’s take a look at what’s happening in each case and what the implications are for investors:

Air New Zealand capital raise

A capital raise means that a company is selling new shares to investors in order to raise money to use for things like growing the business, paying for everyday operating expenses, or to pay off debt. Air New Zealand is looking to do a capital raise in the coming weeks in the form of a rights issue where existing shareholders of the company will get the chance to buy 2 new shares for every 1 share they already hold. The price for any shares bought through the rights issue will be $0.53, a significant discount to the $1.37 share price Air NZ was trading at before the issue was announced.

Participation in a capital raise is optional – you don’t have to invest more money into the company if you don’t want to. But if you don’t participate your shareholding will be diluted. That means you’ll end up owning a smaller portion of the company, because a capital raise introduces more shares to the company. Take a pizza sliced into 8 for example – if you had 1 slice, you’d own an eighth of the pizza. If that pizza were to have two extra slices added onto it, your single slice would now only be a tenth of the pizza. Some people won’t be bothered by this – a small shareholder owning 0.0034% of Air NZ might not care if they now own 0.002% of the company.

How will the share price be affected? Given the dilution shareholders face, capital raises typically result in downward pressure on a company’s share price. However, capital raises can sometimes increase the share price when done for a compelling reason (like to fund business growth). But in Air NZ’s case the capital raise will be mainly used to keep the airline afloat (after the damage caused by the pandemic), rather than to grow the business, therefore it’s likely for the raise to cut Air NZ’s share price.

So if you’re an Air NZ shareholder should you participate in the raise? Unfortunately we can’t give advice on what you should do. But we’d think about it as a question of whether Air NZ is a good business to invest your money in, rather than a question of whether $0.53 is a good price/discount. Lastly, if you choose not to participate, you can sell your rights to other investors on the NZX. And if you do participate, you can buy more rights if you wish to.

Tesla share split

A few companies like Tesla and Amazon are proposing to perform a share/stock split. What does this mean? We still don’t know the detail’s of Tesla’s share split but we can use Amazon as an example, who are proposing a 1 for 20 share split. When this occurs (expected to be in June), every share of AMZN you own will become 20 shares of AMZN. In addition, the company’s share price will reduce by 20 times to reflect the split. Let’s say you hold 1 Amazon share – how will this play out?

- Before the split you have 1 AMZN share worth ~$3,400 USD

- After the split you’ll have 20 AMZN shares worth ~$170 USD each, which totals up to be ~$3,400 USD.

So share splits don’t give you free money or a higher proportion of ownership in a company, nor do they change the fundamental value of a company. It’s like cutting 1 slice of pizza up into 20. You’ll end up with 19 more slices than what you started with, but you’ll still have the same amount of pizza!

However, recent share splits have interestingly caused company share prices to rise – Tesla shares jumped 8% on the day the split was announced. Why might this be? It’s probably because there’s a very common misconception that share splits are beneficial to shareholders because you get a higher quantity shares, or because it makes the share price become “cheaper”. In reality share splits provide no real benefit to shareholders.

Z Energy takeover

Z Energy (who also own Caltex) is getting taken over by Aussie fuel company Ampol. This means if you’re a Z shareholder, Ampol will buy your shares off you at a price of $3.76. Then Z Energy will no longer be listed on the NZX. This is due to happen in May, assuming the deal gets all the relevant regulatory approvals.

Are takeovers a good thing? It sure is if the price the acquirer (Ampol) is paying ($3.76) is higher than the price you originally paid for those shares – That would allow you to bank a profit when those shares are sold. But there are also a few cons to your company getting taken over:

- You think the company is worth more – You might not be happy if you feel the company is worth more than the $3.76 Ampol is paying.

- You make a loss – In the past Z Energy was trading at prices in excess of $8! Shareholders who bought at significantly higher prices would have to take a substantial capital loss when this deal goes through.

- You have to exit your investment earlier than anticipated – You might have been intending to invest in the company for the long-term, but the takeover of your shares will force you to find a new investment to deploy your money.

Further Reading:

– Rights issues, share buybacks, and acquisitions – 5 things to know about Corporate Actions

3. Savings accounts & Interest rate rises

Savings accounts aren’t going to make you rich, but they’re still an important tool in an investors toolbox. They’re ideal for keeping money you need in the short-term, protecting it from the volatility of sharemarket.

Interest rates increasing

The good news for those using savings accounts and similar investments is that interest rates have been on the rise recently, driven by the Reserve Bank of New Zealand increasing the Official Cash Rate (OCR) to try dampen down inflation. Late in February the Reserve Bank raised the OCR by 25 basis points from 0.75% to 1.00%. Here’s some examples of some savings rate increases as a result:

- Heartland Bank’s Direct Call account raised its rates from 0.85% to 1.05% this month. Just a few months ago it was at its lowest point paying just 0.50% interest .

- The average 1 year term deposit rate is almost at 2.50%, up from below 0.90% a year ago

- A couple of Squirrel’s peer-to-peer lending loan classes have also had an interest rate boost this month. The rates on their home loan and construction loan classes have increased by 0.25% and are now paying 4.50% and 5.50% respectively.

With more OCR increases to come, we can expect these savings rates to increase further – ANZ’s economists forecast the OCR to reach 3.00% by the end of the year! However this will also increase mortgage rates and may dampen down the return of shares as companies face higher interest rates to borrow money, and as dividend paying companies become less attractive relative to savings accounts.

Further Reading:

– Bonus Saver vs Notice Saver vs Term Deposit – Which savings product is right for you?

– Peer to Peer Lending review – Squirrel

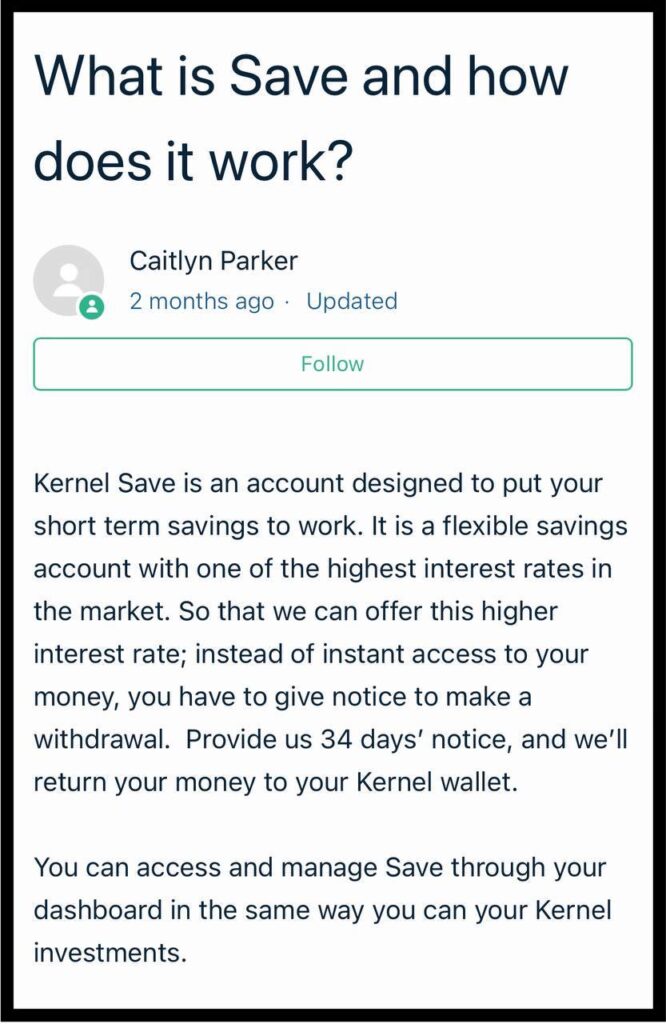

Kernel Save

In related news, index fund manager Kernel is testing out Kernel Save, a new product on their platform which works exactly the same as a notice saver account. This savings account is currently paying 1.40% interest and requires 34 days’ notice to get your money out.

It’s likely Kernel is partnering up with Heartland Bank to provide this account as Heartland’s own notice saver account is also offering a rate of 1.40%. Other notice saver products include Westpac’s Notice Saver (0.80% interest requiring 32 day’s notice), Kiwibank’s Notice Saver (0.85% for 32 day’s notice & 1.75% for 90 day’s notice), and Rabobank’s NoticeSaver (1.55% for 60 day’s notice).

So Kernel Save isn’t anything groundbreaking, but maybe useful for those with multiple goals. For example, those with long-term investment goals as well as short-term savings goals would be able to use the Kernel platform for both of these objectives.

Further Reading:

– What’s the best short-term investment?

– Kernel review – High quality index funds

4. It’s tax time

The end of March marks the end of the tax year, which means there’s a bit of interest in what you need to do in relation to taxes on your investments.

The below isn’t tax advice and may apply differently to you depending on your personal circumstances. If in doubt, talk to a tax professional.

The good news is that many of you won’t have to do anything. The following investments have their tax paid upfront so there is usually nothing further you need to pay:

- Dividends on NZ shares have taxed deducted at a Resident Withholding Tax (RWT) rate of 33%.

- Interest on NZ bonds, bank accounts, and peer-to-peer lending have taxed deducted at your RWT rate.

- Listed PIEs (like Smartshares’ ETFs) have taxed deducted at a flat Prescribed Investor Rate of 28%.

If you over or underpay your tax on the above investments throughout the year (e.g. due to using the wrong RWT rate), you may be eligible for a tax refund or bill to correct that over or underpayment.

Unlisted PIE funds (like Kernel, Simplicity, Milford, and almost all KiwiSaver funds) haven’t had any tax deducted throughout the year, so there’s some tax to pay at the end of year. Your fund manager will calculate this for you and automatically sell off some of your units to pay for this tax. In some cases (like with InvestNow or Kernel) your platform may give you the opportunity to deposit extra cash to cover your tax liability without having to sell off some of your units.

You’ll need to take some action if you’ve earned more than $200 in untaxed income. This could be income from overseas investments (FIFs), cryptocurrency, or things like rental property or self-employment which you haven’t paid tax on yet. In this case you’ll need to declare this income to the IRD on the IR3 – Individual Income Tax Return which is due on 7 July. If you’ve made less than $200 in untaxed income, then this doesn’t have to be declared to the IRD. See our articles below for more details on how your investments are taxed:

Further Reading:

– What taxes do you need to pay on your investments in New Zealand?

– Tax on foreign investments – How do FIF and Estate Taxes work?

Sharesies & Hatch tax quirks

In researching one of our recent articles we came across a couple of quirks of Sharesies and Hatch, which could result in suboptimal tax treatment on overseas investments (FIFs). We posted about these quirks on Reddit, and it generated a bit of discussion so we’ve reposted them below. These quirks don’t necessarily make these platforms bad ones, and tax shouldn’t usually be the primary consideration when choosing an investment platform, but it’s good to be aware of them:

Quirk 1 – Sharesies

Under the de minimis exemption (if you’ve invested less than $50,000 overseas) you only have to pay tax on your dividends. However, if your dividends (plus any other untaxed income like rental income) are less than $200 for the year you don’t have to declare this to the IRD – in that case you don’t have to pay tax on those dividends.

The quirk with Sharesies is that they automatically deduct tax from your foreign dividends, regardless of your tax position. Therefore you get taxed on your foreign dividends even if you’re below that $200 threshold. In addition, Sharesies deducts tax from your dividends upfront, reducing the amount of cash you have available to reinvest. Whereas normally this tax is paid in arrears after your tax returns are done.

Quirk 2 – Hatch

Hatch keeps your USD cash holdings in DARXX, a money market fund. DARXX is considered to be a FIF which results in a quirk where you could lose your ability to apply the de minimis exemption.

Let’s say you bought $40,000 NZD worth of Tesla shares – normally you’d be exempt from FIF given the cost of your FIFs are under $50,000. Now let’s say Tesla pumped and you now have $80,000 – still exempt as your cost is still $40,000. But if you sold those shares through Hatch, those $80k of sale proceeds would be swept into DARXX (at a cost of $80k) resulting in you having to apply the full FIF rules (potentially resulting in a significantly higher tax bill).

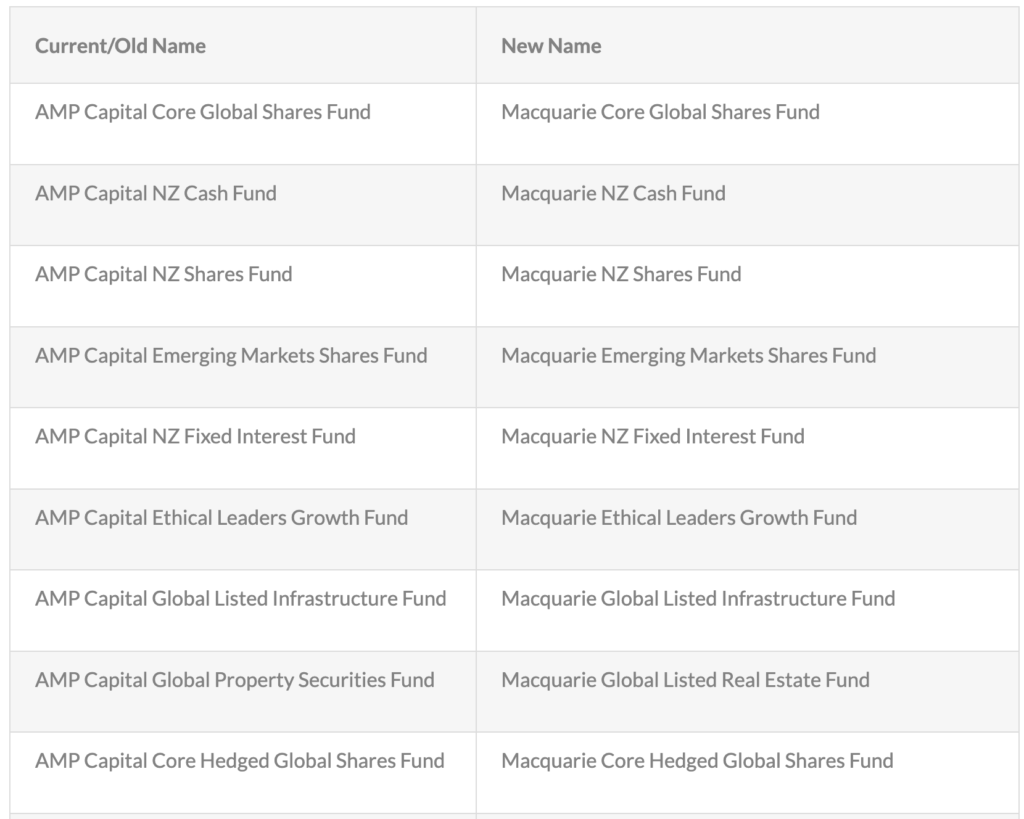

5. New owner for AMP funds

On the 26th of March AMP Capital’s NZ fund management business was sold to Macquarie Asset Management, an Australia-based investment management firm. As part of this change, AMP’s funds will be renamed and rebranded to Macquarie funds from 1 April. At this stage there’s no other changes to their funds – things like fees, investment strategy, and asset allocation are remaining the same.

Conclusion

Thanks for dropping by on our site and reading our March 2022 news article. We don’t run this site to make money, but rather to share our knowledge and passion for investing, so hope you learnt something from it. If you like our content we’d appreciate it if you shared it with friends or family, and if you don’t like our content we’re currently trialling a comments section on all of our articles, so feel free to post your thoughts there 🙂

In case you missed them – March 2022’s articles:

– Ask Money King NZ – Your investing questions answered

– Stake review – Is there a catch to their $0 brokerage fee?

– Tax on foreign investments – How do FIF and Estate Taxes work?

– Easy Crypto review – The best on-ramp to the world of cryptocurrency?

– Basic investing concepts explained – With pizza analogies!

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.