The options for investing your KiwiSaver money are always growing. Today there’s at least 36 different schemes and hundreds of funds to choose from. These include schemes offered by the big banks, active fund managers, passive fund managers, and newer options from platforms like InvestNow and Kernel. In this article we break down the options to help you make an informed decision on what scheme and fund to invest in.

Background info:

Before reading this article check out the below if you want more detail on what KiwiSaver is and how KiwiSaver funds work:

– KiwiSaver 101 – How does KiwiSaver fit into your investment portfolio?

This article covers:

1. Traditional KiwiSaver schemes

2. Customisable KiwiSaver schemes

3. Our favourite KiwiSaver funds

1. Traditional KiwiSaver schemes

A lot of KiwiSaver schemes take a traditional 3-sizes-fits-all approach, offering “Growth“, “Balanced“, and “Conservative” type funds. They all contain a mix of NZ and international shares and bonds, resulting in a well-diversified fund investing across different asset classes, geographies, and industries. The key difference between the three types of fund are the proportion of growth assets (like shares and property) and income assets (like bonds and cash) they contain:

- Growth funds contain mostly growth assets so have higher potential returns, but higher volatility. Therefore they tend to better suit longer-term investors.

- Conservative funds contain mostly income assets so have lower potential returns, but lower volatility. Therefore they tend to better suit shorter-term investors.

- Balanced funds fall in between these two categories, with a roughly even split between growth and income assets.

Some providers offer other types of funds like “Aggressive” and “Moderate” – These just have a slightly different mix of growth and income assets. For example, Aggressive funds invest almost entirely in growth assets, and Moderate funds fall in between Balanced and Conservative funds (containing more growth assets than Conservative funds, but less than Balanced funds).

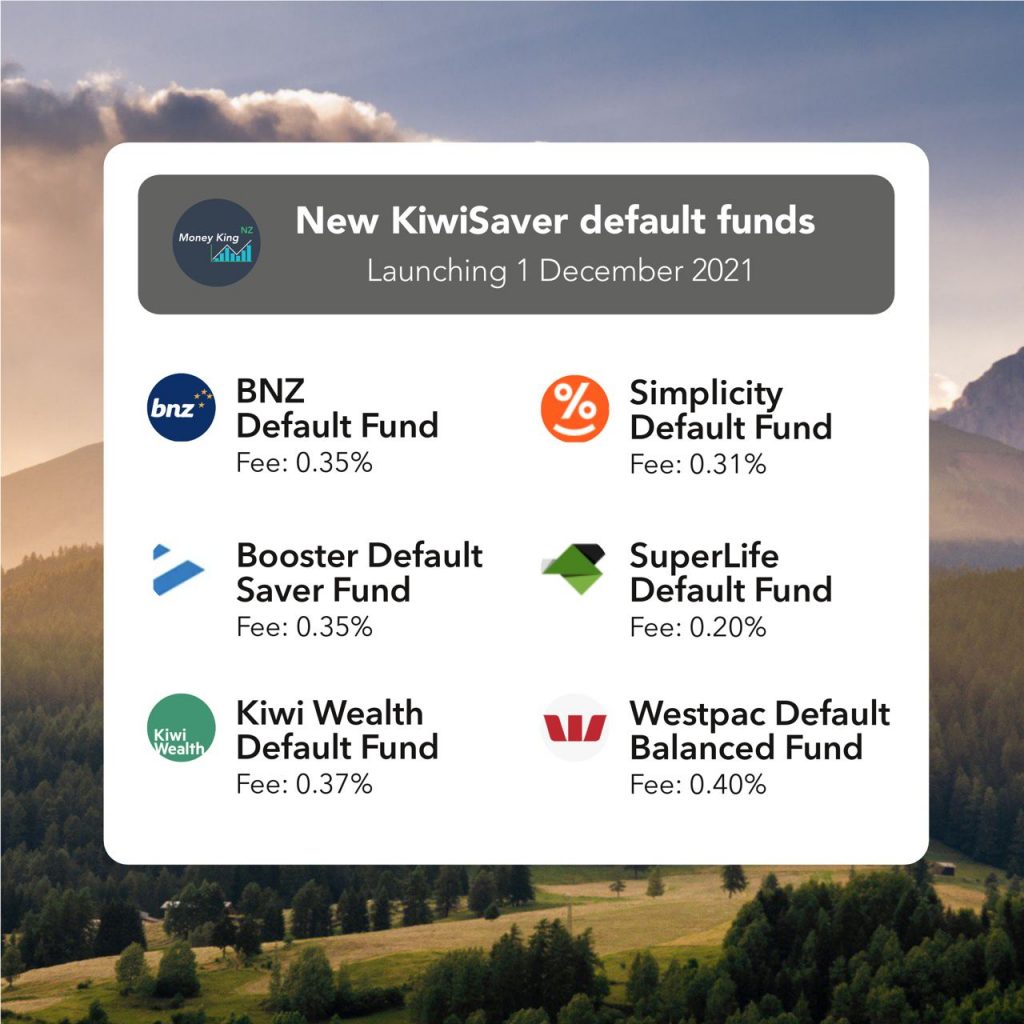

Default funds

If you sign up for KiwiSaver as a new member and don’t pick your own fund, you’ll automatically be put into one of six Default funds. They’re all Balanced funds, investing in a roughly even split between growth and income assets.

The below table summarises each default fund’s annual management fee, percentage of the fund allocated to Growth and Income assets, and the minimum suggested investment timeframe (e.g. a minimum suggested investment timeframe of 6 years means the fund manager recommends you shouldn’t invest in that fund unless you’re investing for 6 years or longer):

| Fund | Fee | Growth assets | Income assets | Minimum timeframe |

| BNZ Default | 0.35% | 60% | 40% | 7 years |

| Booster Default Saver | 0.35% | 55% | 45% | 5 years |

| Kiwi Wealth Default | 0.37% | 60% | 40% | 5 years |

| Simplicity Default | 0.31% | 56% | 44% | 6 years |

| SuperLife Default | 0.20% | 54% | 46% | 8 years |

| Westpac Default | 0.40% | 50% | 50% | 6 years |

You don’t have to be a new KiwiSaver member to join a default fund – they’re open for anyone to invest in. Default funds have some of the lowest KiwiSaver fund fees and are closely scrutinised by the authorities, so they’re well worth considering if you’re after a Balanced type fund.

Further Reading:

– KiwiSaver fund check in – How do the new default funds affect you?

Bank KiwiSaver schemes

The big banks all offer their own KiwiSaver schemes. They’re pretty good at leveraging the fact that they’re well known brands that New Zealanders trust with their money, taking a combined market share of 61.5% in the KiwiSaver space!

ANZ

ANZ is the world’s largest KiwiSaver provider with over 20% market share. They offer 6 fund options:

| Fund | Fee | Growth assets | Income assets | Minimum timeframe |

| Growth | 1.09% | 80% | 20% | 7 years |

| Balanced Growth | 1.04% | 65% | 35% | 6 years |

| Balanced | 0.99% | 50% | 50% | 5 years |

| Conservative Balanced | 0.79% | 35% | 65% | 5 years |

| Conservative | 0.65% | 20% | 80% | 4 years |

| Cash | 0.27% | 0% | 100% | none |

ANZ also has a Lifetimes option which automatically places you into a fund depending on your age:

| Age | Fund |

| 0 – 35 | Growth |

| 36 – 45 | Balanced Growth |

| 46 – 55 | Balanced |

| 56 – 60 | Conservative Balanced |

| 61 – 64 | Conservative |

| 65+ | Cash |

ANZ also manages the OneAnswer KiwiSaver scheme who offers the same six funds as ANZ, as well as seven funds that invest in a single asset class:

- NZ Fixed Interest

- International Fixed Interest

- Australasian Property

- International Property

- Australasian Share

- International Share

- Sustainable International Share

ASB

ASB is the 2nd largest KiwiSaver provider with around 16% market share. They offer 6 funds:

| Fund | Fee | Growth assets | Income assets | Minimum timeframe |

| Growth | 0.70% | 80% | 20% | 11 years |

| Balanced | 0.65% | 60% | 40% | 6 years |

| Moderate | 0.60% | 40% | 60% | 3 years |

| Conservative | 0.40% | 20% | 80% | 2 years |

| NZ Cash | 0.35% | 0% | 100% | none |

| Positive Impact | 1.00% | 60% | 40% | 11 years |

BNZ

BNZ’s KiwiSaver scheme has the lowest fees of all the banks. They’re the 8th largest KiwiSaver provider, offering 6 non-default funds:

| Fund | Fee | Growth assets | Income assets | Minimum timeframe |

| Growth | 0.45% | 80% | 20% | 10 years |

| Balanced | 0.45% | 60% | 40% | 7 years |

| Moderate | 0.45% | 40% | 60% | 5 years |

| Conservative | 0.45% | 20% | 80% | 3 years |

| First Home Buyer | 0.45% | 15% | 85% | 3 years |

| Cash | 0.30% | 0% | 100% | none |

They have an interestingly named First Home Buyer Fund, but there’s nothing special about it apart from having a slightly different asset allocation to the Conservative Fund. It has a 60% allocation to cash and a 25% allocation to bonds, versus the Conservative Fund’s 25% cash and 55% bond allocation. This should make the FHB Fund less volatile.

Kiwi Wealth

Kiwi Wealth (sibling company of Kiwibank) offers 5 non-default funds (the “Default Conservative” Fund used to be a default fund prior to 1 Dec 2021). They’re the 5th largest KiwiSaver provider.

| Fund | Fee* | Growth assets | Income assets | Minimum timeframe |

| Growth | 1.10% | 80% | 20% | 10 years |

| Balanced | 1.02% | 55% | 45% | 5 years |

| Conservative | 0.87% | 30% | 70% | 3 years |

| Default Conservative | 0.52% | 20% | 80% | 1 year |

| Cash | 0.45% | 0% | 100% | none |

*The minimum annual fee for Kiwi Wealth’s funds is $40

Westpac

Westpac is the 3rd largest KiwiSaver provider with around 10% market share. They offer 6 non-default funds:

| Fund | Fee | Growth Assets | Income Assets | Minimum timeframe |

| Growth | 0.55% | 80% | 20% | 10 years |

| Balanced | 0.50% | 60% | 40% | 7 years |

| Moderate | 0.40% | 40% | 60% | 5 years |

| Conservative | 0.40% | 25% | 75% | 3 years |

| Defensive Conservative | 0.40% | 20% | 80% | 3 years |

| Cash | 0.25% | 0% | 100% | none |

Further Reading:

– ASB, BNZ YouWealth, Kiwi Wealth review – Are managed funds with your bank worth it?

Active fund managers

These are specialist fund managers who offer actively managed funds – They have fund managers researching and selecting assets to invest in, attempting to beat the performance of the market.

Milford

Milford is one of the oldest and best performing KiwiSaver providers, with 7th largest market share. Their Growth and Balanced funds have been the top performing over the last 10 years, earning them a good reputation in the KiwiSaver industry.

| Fund | Fee | Growth assets | Income assets | Minimum timeframe |

| Aggressive | 1.15%* | 95% | 5% | 10 years |

| Active Growth | 1.25%* | 78% | 22% | 7 years |

| Balanced | 1.07%* | 61% | 39% | 5 years |

| Moderate | 1.06%* | 40% | 60% | 4 years |

| Conservative | 0.95% | 18% | 82% | 3 years |

| Cash | 0.20% | 0% | 100% | none |

*this figure includes the estimated performance fees that this fund charges.

Further Reading:

– Milford review – Better than index funds?

JUNO

JUNO is a newish KiwiSaver scheme, famous for their outstanding past performance and relatively low fees.

| Fund | Fee | Growth assets | Income assets | Minimum timeframe |

| Growth | n/a | 80% | 20% | 10 years |

| Balanced | n/a | 60% | 40% | 5 years |

| Conservative | n/a | 25% | 75% | 3 years |

They have a subscription type fee structure where you pay a monthly membership fee based on your account balance, rather than traditional percentage based fees. This can work out pretty well in some cases – for example the fee on a $10,000 balance equates to 0.60%.

| Balances | Monthly fee |

| Under $5,000 | $2.50 |

| $5,000 to $14,999 | $5 |

| $15,000 to $24,999 | $8 |

| $25,000 to $49,999 | $20 |

| $50,000 to $74,999 | $40 |

| $75,000 to $99,999 | $60 |

| $100,000 to $199,999 | $90 |

| $200,000 and above | $90 + $30 for every additional $100k invested |

But JUNO’s horrendous performance in the past year (one of the worst performing providers in 2021), coupled with a recent fee increase has taken the shine off the scheme. Despite a poor 2021, their Growth Fund has still been the top performing Growth KiwiSaver over the last 3 years. Only time will tell whether they can bring their past levels of performance back.

Booster

Booster is the 10th largest KiwiSaver scheme and they offer quite a large number of funds. Some of them are quite unique in the strategies they use, for example:

- Geared Growth Fund – Uses gearing (i.e. leverage or using borrowed money) to get additional exposure to shares. Their target gearing ratio is 35%, so for every $1 you invest in the fund you could be getting up to $1.35 worth of exposure to shares. It’s an ultra-aggressive fund that could deliver higher returns, but at the expense of higher volatility.

- Shielded Growth Fund – Uses options contracts to reduce the impact of significant market dips on the fund.

- Capital Guaranteed Fund – Booster provides a guarantee that the fund’s unit price on 31 March won’t be lower than its unit price on 31 March of the previous year. In the case of a decline in unit price, Booster will add additional assets to the fund to make up for the loss.

Booster also offers a range of Socially Responsible (SR) funds, which exclude investment into companies involved with things like tobacco, alcohol, and gambling.

| Fund | Fee* | Growth assets | Income assets | Minimum timeframe |

| Geared Growth | 1.74% | 99% | 1% | 15 years |

| SR Geared Growth | 1.80% | 99% | 1% | 15 years |

| High Growth | 1.34% | 99% | 1% | 10 years |

| SR High Growth | 1.35% | 98% | 2% | 10 years |

| Shielded Growth | 1.36% | 99% | 1% | 7 years |

| Growth | 1.29% | 80% | 20% | 7 years |

| SR Growth | 1.32% | 75% | 25% | 7 years |

| Balanced | 1.22% | 60% | 40% | 5 years |

| SR Balanced | 1.29% | 55% | 45% | 5 years |

| Moderate | 1.11% | 40% | 60% | 4 years |

| SR Moderate | 1.14% | 35% | 65% | 4 years |

| Capital Guaranteed | 0.91% | 10% | 90% | 2 years |

| Enhanced Cash | 0.75% | 0% | 100% | none |

*Booster also charges a $36 annual membership fee for balances over $500.

Another interesting aspect of Booster’s KiwiSaver scheme is that they offer free accidental death insurance if you’re investing in one of their non-default funds.

Fisher Funds

Fisher Funds is a well known fund manager who operates two separate KiwiSaver schemes. Together they take 4th place in KiwiSaver market share rankings. Apart from that there’s not much else special about them. Their past performance has been good, but nothing outstanding.

The classic Fisher Funds scheme has 3 funds:

| Fund | Fee | Growth assets | Income assets | Minimum timeframe |

| Growth | 1.03%* | 81% | 19% | 5 years |

| Balanced Strategy | 0.99%* | 59.6% | 40.4% | 4 years |

| Conservative | 0.93% | 27.5% | 72.5% | 2 years |

*this figure includes the estimated performance fees that this fund charges.

The Fisher Funds TWO scheme was formed back in 2013 after Fisher Funds acquired the Tower KiwiSaver scheme. They offer 5 funds:

| Fund | Fee | Growth assets | Income assets | Minimum timeframe |

| Equity | 1.15% | 100% | 0% | 7 years |

| Growth | 1.04% | 81% | 19% | 5 years |

| Balanced | 0.94% | 60% | 40% | 4 years |

| Conservative | 0.92% | 27.5% | 72.5% | 2 years |

| Preservation | 0.61% | 0% | 100% | none |

Both funds offer “GlidePath”, an option where you’re automatically invested into a mix of funds depending on your age:

- Fisher Funds GlidePath – Those up to age 46 are fully invested in the Growth Fund. After that you’ll get a gradually increasing allocation to the Conservative Fund until age 86, at which point you’ll be fully invested in the Conservative Fund.

- Fisher Funds TWO GlidePath – Those up to age 27 are fully invested in the Equity Fund. From age 28 you’ll start getting an allocation to the more conservative funds, gradually increasing your exposure to income assets.

In October 2021 Fisher Funds acquired AON’s KiwiSaver scheme. Perhaps we’ll see a Fisher Funds THREE scheme sometime in the future?

Nikko AM

Nikko AM offers 3 traditional diversified KiwiSaver funds, plus 5 single asset class options, making them a little more customisable than other providers. Of particular note is the ARK Disruptive Innovation Fund. It’s based on Cathie Wood’s ARK Innovation ETF, an actively managed fund investing in a portfolio of 35 innovative (and somewhat speculative) companies. The fund is famous for its spectacular performance in 2020, before crashing back down to earth in 2021:

| Fund | Fee* | Growth assets | Income assets | Minimum timeframe |

| Growth | 1.09%^ | 88% | 12% | 5 years |

| Balanced | 0.94%^ | 70% | 30% | 3 years |

| Conservative | 0.71% | 32.5% | 67.5% | 2 years |

| SRI Equity | 0.95% | 100% | 0% | 5 years |

| Global Shares | 1.15% | 100% | 0% | 5 years |

| ARK Disruptive Innovation | 1.25% | 100% | 0% | 7 years |

| NZ Corporate Bond | 0.80% | 0% | 100% | 2 years |

| NZ Cash | 0.45% | 0% | 100% | 3 months |

*Nikko AM also charges a $30 annual membership fee.

^this figure includes the estimated performance fees that this fund charges.

Pathfinder

Pathfinder offers a KiwiSaver scheme focussed on ethical investing. They’re probably one of the more stringent managers in excluding investment into areas of concern like fossil fuels, weapons, and animal cruelty. They also have a couple of interesting investments in their portfolio with stakes in Sharesies and Easy Crypto.

| Fund | Fee* | Growth assets | Income assets | Minimum timeframe |

| Growth | 1.29% | 74.9% | 25.1% | 10 years |

| Balanced | 1.14% | 56% | 44% | 5 years |

| Conservative | 0.84% | 16.4% | 83.6% | 3 years |

*Pathfinder also charges an annual membership fee of $27 for balances over $1,000

Other schemes

There are plenty of other actively managed KiwiSaver schemes which we haven’t covered above. These include:

- Amanah

- AMP

- AON

- Aurora

- BCF

- Christian KiwiSaver

- Generate

- LifeStages

- MAS

- Maritime

- Mercer

- NZDF

- NZ Funds

- QuayStreet

- Select

- Summer

- SuperEasy

Passive fund managers

Passive fund managers invest in an index, attempting to match the performance of the market, rather than researching and picking individual assets to invest in. Because they don’t have to employ analysts and investment managers, passively managed funds tend to have cheaper fees.

Simplicity

You could say that Simplicity was a major player in kickstarting a movement towards low-cost, passively managed KiwiSaver funds. They’re one of the fastest growing KiwiSaver schemes, currently placed 11th in terms of market share. They offer 3 funds:

| Fund | Fee | Growth assets | Income assets | Minimum timeframe |

| Growth | 0.31% | 78% | 22% | 9 years |

| Balanced | 0.31% | 56% | 44% | 6 years |

| Conservative | 0.31% | 22% | 78% | 3 years |

Despite appearances, Simplicity’s funds aren’t fully passive. Each of their funds have small allocations to non-traditional assets like mortgage lending, build-to-rent housing, and private equity. In addition, it’s argued that their funds are sub-optimally constructed resulting in a tax leakage issue where their investors pay more tax than they need to. But Simplicity are still a popular option due to their low fees, ethical exclusions from their funds, and their donation of 15% of management fees to charity.

Further Reading:

– Simplicity vs JUNO vs BNZ – Battle of the low cost KiwiSaver funds

2. Customisable KiwiSaver schemes

Most of the five KiwiSaver schemes we’ll cover below also offer traditional fund options. But they also offer the option to highly customise your KiwiSaver portfolio by allowing you to select your own mix of individual funds/asset classes or even individual companies.

InvestNow

Traditional fund options

InvestNow KiwiSaver offers the Foundation Series funds, which are low-cost, mostly passively managed funds, designed to compete head-on with Simplicity’s funds:

The Foundation Series funds have a slightly higher headline management fee than Simplcity, but are arguably “cheaper” as they’re built in a more tax-efficient manner. Plus not everyone is a fan of Simplicity’s ventures into build-to-rent housing, mortgage lending, and private equity – The Foundation Series funds resolve that by investing purely into traditional share and bond investments without Simplicity’s distractions. See the below article for a full comparison between the two competitors:

Further Reading:

– InvestNow Foundation Series vs Simplicity funds – Tax leakage an issue?

Customisable fund options

InvestNow’s KiwiSaver scheme is really unique. Outside of their Foundation Series funds you can build a custom KiwiSaver portfolio using funds from different managers. For example, you could split your KiwiSaver between the Foundation Series Growth Fund and Milford Growth Fund. Investors can choose from a total of 36 funds from 14 different fund managers:

- Antipodes – 1 international shares fund

- Castle Point – 2 funds

- Fisher Funds – 2 funds (Growth and Conservative)

- Foundation Series – 2 funds

- Harbour – 4 funds

- Hunter – 1 international bond fund

- Macquarie – 8 funds, including their 4 index funds

- Milford – 3 funds (Active Growth, Balanced, Conservative)

- Mint – 3 funds

- Pathfinder – 1 fund (Ethical Growth)

- Russell – 4 funds

- Salt – 2 funds

- SuperLife – 1 fund (Growth)

- Te Ahumairangi – 1 international shares fund

Overall it’s a powerful scheme, with different asset classes, passive index funds, and actively managed funds all represented within their 36 options.

A quarter of those invested in the Foundation Series Growth Fund also invest in the Milford Active Growth Fund, suggesting many InvestNow KiwiSaver Scheme members want to mix index/passive and active investing styles.

InvestNow

SuperLife

Traditional fund options

SuperLife offers 5 traditional fund options, ranging from High Growth to Income. They’re built mostly by investing in Smartshares‘ range of ETFs.

| Fund | Fee* | Growth assets | Income assets | Minimum timeframe |

| High Growth | 0.63% | 99% | 1% | 10 years |

| Growth | 0.61% | 80% | 20% | 9 years |

| Balanced | 0.60% | 60% | 40% | 8 years |

| Conservative | 0.57% | 30% | 70% | 6 years |

| Income | 0.56% | 0% | 100% | 5 years |

*SuperLife also charges an annual membership fee of $30

Age Steps option

The Age Steps product automatically allocates you to a fund depending on your age – with younger investors having more exposure to growth assets, and an increasing allocation towards income assets as you move through the age brackets.

| Fund | Fee* | Growth assets | Income assets |

| Age 20 | 0.63% | 96% | 4% |

| Age 30 | 0.62% | 80% | 20% |

| Age 40 | 0.62% | 80% | 20% |

| Age 50 | 0.61% | 75% | 25% |

| Age 60 | 0.60% | 57.5% | 42.5% |

| Age 70 | 0.58% | 40% | 60% |

| Age 80 | 0.56% | 10% | 90% |

Age Steps is similar to ANZ’s Lifetimes option, and Fisher Fund’s Glidepath option. They’re great for people who aren’t sure what fund to invest in and for those who don’t want to manually rebalance their funds as they get older and closer to retirement. However, these options are one-size-fits-all in nature as they invest with the assumption that you’re aiming to use your KiwiSaver for retirement at age 65. Their investment allocations likely wouldn’t suit those using KiwiSaver for buying their first home or those with different investment needs.

Further Reading:

– Target date funds: Simple, but are they effective? (Your Money Blueprint)

Customisable fund options

SuperLife’s scheme also allows you to build a custom KiwiSaver portfolio out of 42 funds. Most of these invest in Smartshares’ ETFs and include NZ, global, regional, sector, and thematic funds.

| Asset class | # of funds |

| NZ shares | 6 |

| Global shares | 4 |

| Regional shares | 13 |

| Sector funds | 5 |

| Bonds & Cash | 7 |

| Diversified | 7 |

Further Reading:

– Smartshares & SuperLife review – The smart way to invest in shares?

Kernel

Traditional fund option

Kernel is the world’s newest KiwiSaver provider, who plan to open their scheme to new investors in May 2022. They offer one traditional fund option – the High Growth Fund which invests in NZ and International shares, as well as a small allocation to REITs and infrastructure.

| Fund | Fee | Growth assets | Income assets | Minimum timeframe |

| High Growth | 0.25% | 98% | 2% | 5 years |

Being an aggressive fund with almost 100% allocation to growth assets, the High Growth Fund is only suitable to long-term investors with a high risk tolerance. But Kernel plans to add conservative options in the future.

Customisable fund options

Investors can also build a custom KiwiSaver portfolio from any of Kernel’s 13 index funds:

- The High Growth Fund

- 3 NZ funds (NZ 20, NZ Small & Mid Cap Opportunities, NZ 50 ESG Tilted)

- 2 Global funds (Global 100, Global Dividend Aristocrats)

- 1 Regional fund (S&P 500)

- 3 Sector funds (NZ Commercial Property, Global Infrastructure, Global Green Property)

- 3 Thematic funds (Moonshots Innovation, Electric Vehicle Innovation, Global Clean Energy)

They have a good mix of funds – broad market ones like NZ 50 ESG Tilted and Global 100, as well as interesting sector/thematic ones like Global Infrastructure and Moonshots Innovation.

Further Reading:

– Kernel review – High quality index funds

kōura

Digital advice option

The issue kōura KiwiSaver attempts to address is that over half of New Zealanders are in the wrong type of KiwiSaver fund. In response kōura offers a unique digital advice tool, where investors get asked some questions about their personal and financial circumstances. The tool will then spit out a custom built portfolio based on the answers. The aim is to get investors into the right asset allocation without having to deal with a financial adviser.

kōura builds their portfolios using a mix of the following 9 passively managed funds. This includes the first dedicated KiwiSaver fund to invest in cryptocurrency:

| Fund | Fee* |

| NZ Equities | 0.63% |

| US Equities | 0.63% |

| Rest of World Equities | 0.63% |

| Emerging Markets Equities | 0.63% |

| Fixed Interest | 0.63% |

| Cash | 0.63% |

| Carbon Neutral Cryptocurrency | 1.10% |

| Clean Energy | 1.10% |

| NZ Property | 1.10% |

*kōura also charges a $30 annual membership fee.

Customisable fund option

You can also build your own custom portfolio out of kōura’s 9 funds. The only restriction is that there’s a maximum percentage you can allocate your money towards certain funds:

- Most core funds – 100%

- Emerging Markets Equities Fund – 50%

- Specialty Funds (Carbon Neutral Cryptocurrency, Clean Energy, NZ Property) -10%

Further Reading:

– Kōura review – Crypto meets KiwiSaver

Craigs

Customisable fund options

Craigs KiwiSaver is the most powerful scheme in terms of customisation, allowing you to select from 260 different investment options, including individual shares, ETFs, and unlisted funds. You could theoretically invest your entire KiwiSaver into one company like Fisher and Paykel Healthcare, or a single asset like gold (via a gold ETF).

| Category | # of options |

| NZX listed shares | 56 |

| ASX listed shares | 44 |

| International shares | 39 |

| NZ funds | 47 |

| Australian funds | 7 |

| International funds | 63 |

| Cash | 4 |

For the privilege of being able to select your own individual assets for your KiwiSaver portfolio, you’ll pay the following fees:

- Admin/membership fees of up to $45 per year

- Management fees of up to 1.25% p.a. of the amount you’ve invested

- Brokerage fees of up to 1.25% to buy or sell any listed investments

- Underlying fund management fees for any funds you choose to invest in

So while the fees are on the high side, Craigs KiwiSaver is a premium product and also comes with the option get investment advice and market research from an adviser.

Further Reading:

– Build your own KiwiSaver – InvestNow vs SuperLife vs Craigs

Other schemes

KiwiWRAP is similar to Craigs in that it allows you to self-select individual companies and funds. However, they’re only available through a financial adviser and requires a hefty minimum investment of $50,000.

3. Our favourite KiwiSaver schemes

As you’ve gathered throughout this article, there’s plenty of KiwiSaver options to choose from. So here we’ve selected our 5 favourites.

These aren’t recommendations to invest in any of these schemes, but rather what we’d personally consider choosing from based on our investing needs and preferences. The best scheme for you may differ, and will depend on your own personal circumstances.

InvestNow

InvestNow KiwiSaver has an excellent tax efficient traditional fund option with their two Foundation Series Funds. Plus their customisable fund option features 14 different fund managers, and goes a long way in addressing KiwiSaver’s limitation of not being able to invest with more than one provider. All of this comes with reasonable fund management fees, and no added membership fees.

Kernel

Kernel’s KiwiSaver scheme is brand new and hasn’t even launched to the public at the time of writing, but it’s one we’d personally seriously consider. Their management fees starting from 0.25% are among the lowest in the market, and gets you access to their suite of well-built index funds. Many of their funds are unique, and make Kernel’s scheme highly customisable – investors can add funds investing in areas like infrastructure and electric vehicles to their portfolios.

Milford

While we prefer low fee index funds, Milford has been around for a while and has a great track record with most of their funds beating the market over the last several years – even when you take into account their higher fees. They have a broad selection of traditional funds, ranging from aggressive to cash. They’re one of the very few active fund managers we’d personally trust with our money.

Simplicity

There’s lots we don’t like about Simplicity’s funds. They’re tax inefficient, and dabble in initiatives (like mortgage lending and build-to-rent housing) that detract from our preference of having our money invested in a simple, passive manner. However, their fees are cheap and they offer an easy to understand range of funds, making Simplicity a go-to favourite for investors. As a bonus, they’re transparent, clearly listing all their funds’ holdings on their website, and have ethical exclusions around investment into the nastiest industries.

BNZ

InvestNow’s Foundation Series and Kernel completely lack conservative fund options, while Simplicity lacks a true short-term option (given the absence of a cash option). BNZ fills the gap with their competitively priced Conservative, First Home Buyer, and Cash funds. And while more expensive than Simplicity and Foundation Series, BNZ’s Growth and Balanced funds are cheapest out of the banks, and are tax efficient.

What should you choose?

The most important thing to choose is the right type of fund (e.g. Growth, Balanced, or Conservative), rather than the right provider. For example, deciding between Milford and Fisher Funds won’t make much difference if you’re not investing in the right mix of growth and income assets in the first place. The type of fund you should pick will depend on your investment goals, time horizon, and risk tolerance – Very generally longer-term investors with a high risk tolerance may find Growth funds most suitable, while short-term investors may find Conservative funds most suitable. Check out the below article for more info on the factors you should consider in selecting a fund type:

Further Reading:

– How to invest $1k/$10k/$100k in New Zealand

One you’ve determined the right type of fund to invest in, you can then choose a scheme/provider that offers that type of fund. Things you might want to consider are:

- Fees – Are they value for money? Consider a provider’s fund management fees, membership fees, and tax efficiency.

- Ethical considerations – Do their funds’ investments align with your ethical views?

- Customisation – Are you happy with sticking your money into a traditional fund, or do you want the flexibility to customise your KiwiSaver portfolio?

- Investment strategy – Do you like a particular provider’s active investment strategy? Or perhaps you prefer to invest in low-fee index funds?

- Performance – Does the provider have a good track record with performance? Though keep in mind past performance doesn’t guarantee future results.

Conclusion

We’ve covered a lot of KiwiSaver schemes in this article, and you could fit them into five broad categories:

- Default funds – Funds you’ll get allocated to if you enrol in KiwiSaver but don’t select your own fund. They’re good Balanced fund options with low fees.

- Bank KiwiSaver schemes – Offered by the big banks. Trustworthy places to invest your money, but generally don’t have the best fees and performance.

- Active fund managers – Offered by specialist active fund managers. Tend to have higher fees, but some have a track record of great performance and some offer very unique funds.

- Passive fund managers – These invest mainly in index funds, and as a result tend to have lower fees.

- Customisable KiwiSaver schemes – These provide a high level of customisation for your KiwiSaver portfolio, including the ability to select different individual funds/asset classes.

But the most important aspect of picking a KiwiSaver fund is to invest in the right mix of growth assets versus income assets, which will depend on your investment goals, time horizon, and risk tolerance. This mix will determine whether a Growth, Balanced, Conservative, or other type of fund will suit you best. Once you’ve determined what type of fund you need, you can then decide on what provider to go with based on your personal preferences.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.