Building an investment portfolio is something many of us want to do to grow our wealth, and these days there are many options New Zealanders can use to do so. In this article I’m going to take a closer look at Simplicity and InvestNow – both very popular services we can use to invest, but are actually work quite differently. As a quick recap:

- Simplicity – a Fund Manager. They manage the fund you invest in, taking your money and investing it into assets like shares and bonds.

- InvestNow – a Fund Platform. A service that offers you a variety of different funds to invest in, like a “fund supermarket”.

Here I want to look at building an investment portfolio using both Simplicity and InvestNow, and in doing so, uncover the pros and cons of each service as well as their fees.

See article InvestNow Foundation Series vs Simplicity funds – Tax leakage an issue? for a comprehensive comparison between Simplicity and InvestNow’s diversified funds.

Update (21 August 2021) – Reflect the latest funds and fees

Update (1 December 2021) – Simplicity no longer charges a $20 annual membership fee.

Portfolio Objectives

Before I begin the comparison, here’s the objectives for the portfolio we want to build:

- Simple – Keep things easy by building a basic investment portfolio using funds that contain bonds and shares. No picking shares in individual companies or buying things like cryptocurrency here.

- Diversified – To reduce the risk of investing. We want a portfolio that covers a wide area geographically (to spread our risk across different countries), as well as different asset classes.

- Low Cost – To maximise our returns, the portfolio should have low fees.

1. What’s on offer?

Simplicity

Simplicity is a fund manager who offer three “Diversified” funds. These funds contain a mix of asset classes like bonds and shares:

- Growth Fund – contains mostly shares, higher risk, and best for longer term investing

- Balanced Fund – contains similar levels of shares and bonds, medium risk, and best for medium-long term investing

- Conservative Fund – contains mostly bonds, lower risk, and best for medium-shorter term investing

Simplicity also offer NZ Share and NZ Bond funds, but I won’t be looking at these in this article. The are not diversified enough, only investing in our small NZ market, and you can already get enough exposure to NZ shares and bonds through Simplicity’s Diversified funds.

Simplicity are best known for their popular KiwiSaver scheme! Check out my comparison between Simplicity, JUNO, and BNZ KiwiSaver schemes here.

InvestNow

InvestNow is a fund platform that offers over 100 funds. Most of them contain a single asset class – either cash, bonds, shares, property, or even commodities. There are several diversified funds offered on the platform, but they are on the expensive side when it comes to fees.

Therefore to build an investment portfolio on InvestNow, it’s best to take a DIY (do-it-yourself) approach. Firstly, by picking the funds we want to invest in, and secondly, determining the weighting of each fund – the percentage of our money we want to allocate to each fund.

Fun fact: InvestNow were able to offer Simplicity’s funds on their platform for a very short period of time due to a “mix-up”. Simplicity quickly had their funds removed from the platform after this was discovered. A shame for all Kiwi investors.

2. Portfolio comparison

Time to take a deeper look at what assets could make up our portfolio when using Simplicity and InvestNow.

Simplicity

Simplicity’s Diversified funds target investing in the following asset classes, with only each asset’s weighting differing between the three funds:

| Growth | Balanced | Conservative | |

| Cash | 2% | 2% | 2% |

| NZ Bonds | 7.5% | 16.5% | 36% |

| Global Bonds | 12.5% | 25.5% | 40% |

| NZ Shares | ~21.5% | ~15.5% | ~7% |

| Australian Shares | ~8% | ~5.5% | ~2.5% |

| Global shares | 48.5% | 35% | 12.5% |

These funds contain shares and bonds from NZ and Australia, as well as all around the world, so are diverse enough for us to achieve our objective of a simple, diversified, and cheap investment portfolio with just one fund! Easy as!

InvestNow

With over 100 funds on the platform, investors using InvestNow have to decide for themselves which ones to invest in. There are a many approaches we could take to select funds for a portfolio, and I want to explore two of them:

Replica Portfolio

The first approach I want to explore is to build an InvestNow portfolio that replicates Simplicity’s Diversified funds (this will also allow us to make a fairer comparison between the two services). We just have to pick funds in InvestNow that align with each asset class that Simplicity invests in:

- Cash – This can be ignored as it only makes up 2% in each fund – the cash used for liquidity purposes (allowing people to withdraw money from the fund), rather than investment purposes.

- NZ Bonds – Sadly there’s no cheap, standout NZ Bond Fund on InvestNow. I will just go for one of the cheapest ones available, the Smartshares NZ Bond ETF.

- Global Bonds – I’ll use the Smartshares Global Aggregate Bond ETF to get our global bond exposure.

- NZ Shares – I’ll use the Smartshares S&P/NZX 50 ETF to get our NZ share exposure.

- Australian Shares – I’ll use the Smartshares S&P/ASX 200 ETF for Aussie exposure.

- Global shares – I considered using InvestNow’s cheap Vanguard International Shares Index funds to get our global shares exposure, but it’s a Foreign Investment Fund, and taxed differently. I want to remove tax as a variable in this comparison, so will go for the Smartshares Total World ETF in this replica portfolio.

The result is what I will call our Replica Growth, Balanced, and Conservative portfolios:

| Replica Growth | Replica Balanced | Replica Conservative | |

| Smartshares NZ Bond | 10% | 15% | 35% |

| Smartshares Global Bond | 10% | 30% | 40% |

| Smartshares NZX 50 | 20% | 20% | 10% |

| Smartshares ASX 200 | 10% | 0% | 0% |

| Smartshares Total World | 50% | 35% | 15% |

I have rounded out the weightings to be at least 10% (to make it easier to work around InvestNow’s minimum investment amount of $50). I have left out Australian shares for Balanced and Conservative Replicas as their weightings fall under 10% (and we won’t be missing out on much, given Aussie makes up only 1-2% of the global market).

That was a bit of work to create the Replica portfolios! It took five InvestNow funds just to replicate one Simplicity fund!

3-Fund Portfolio

The second portfolio building approach I want to look at is the 3-Fund Portfolio, and is much simpler. The 3-Fund portfolio is a popular investing strategy, with the idea of keeping your portfolio minimalistic and easy to maintain, while still being very diversified.

The three asset classes that typically make up a 3-Fund Portfolio are Bonds, Domestic Shares, and International Shares. We can build the following 3-Fund portfolio, with weightings that approximately follow our above growth funds:

| Bonds – Smartshares Global Bond | 20% |

| NZ shares – Smartshares NZX 50 | 20% |

| Global shares – Smartshares Total World | 60% |

There are many possible variations to the above. You could increase your weighting towards bonds for a more conservative portfolio, or even drop bonds altogether for 2-Fund Portfolio. The main requirement is to keep it simple.

3. Fees

Fees apply to both Simplicity and InvestNow. I’ve done some math to see which one works out cheaper.

Simplicity

Simplicity charges the following for all their Diversified funds:

- 0.31% Fund Management Fee

InvestNow

InvestNow does not charge a membership or account fee, but there are still fund management fees that vary between each fund. Below are the management fees for the funds contained in our Replica and 3-Fund portfolios.

- Smartshares NZ Bond – 0.54%

- Smartshares Global Bond – 0.30%

- Smartshares NZX 50 – 0.20%

- Smartshares ASX 200 – 0.30%

- Smartshares Total World – 0.40%

Fee Comparison

Let’s look at the overall fees that would apply under each of the portfolios we built, and see how they compare to Simplicity:

Replica Portfolio

For our InvestNow Replica Growth and Replica Balanced portfolios, the weighted average fee is 0.35%. This means Simplicity’s Fund Management Fee is cheaper by 0.04%. The Replica Conservative portfolio has a weighted average fee of 0.39%, making Simplicity cheaper by 0.08%.

As a variation, If we ignore the tax implications, and go for the Vanguard International Shares Index Fund, instead of the Smartshares Total World ETF for our global shares exposure, our Replica Growth portfolio would be even cheaper with a weighted average fee of 0.25%. In this case InvestNow would always work out cheaper than Simplicity!

3-Fund Portfolio

Our 3-Fund portfolio has a weighted average fee of 0.34%, making it 0.03% more expensive than Simplicity.

Do you want to do your own comparison between Simplicity and your personal InvestNow portfolio? You can take a copy of the spreadsheet I used to do the calculations here (must have a Google account to copy it)

4. Other considerations

There are many other pros and cons to consider when deciding between Simplicity and InvestNow.

Simplicity

- Less work – Building a portfolio with Simplicity is a lot easier and requires less work. We can achieve a diversified investment portfolio with just one fund, as opposed to 3-5 with InvestNow.

- Rebalancing – Over time our funds in InvestNow will grow at different rates, and we have to perform rebalancing to get them back to our target weightings. E.g. If the Smartshares Total World ETF grows to 60% of our Replica Growth portfolio, we need to sell some units (or buy units in other funds) to get its weighting back to our 50% target. Simplicity’s funds automatically perform this rebalancing for us.

- Responsible Investing – Simplicity has a stricter Responsible Investing Policy. While none of the funds in our replica portfolios exclude any sectors, Simplicity’s funds exclude investing in tobacco, fossil fuels, gambling, alcohol, adult entertainment related companies and more.

- Kids – Simplicity waives the $20 Membership for under 18s – for kids, this makes their funds work out cheaper than our InvestNow Replica and 3-Fund portfolios.

InvestNow

- Minimum Investment – Simplicity requires a $1,000 minimum to invest in their funds. With InvestNow you only need $50 per fund to get started.

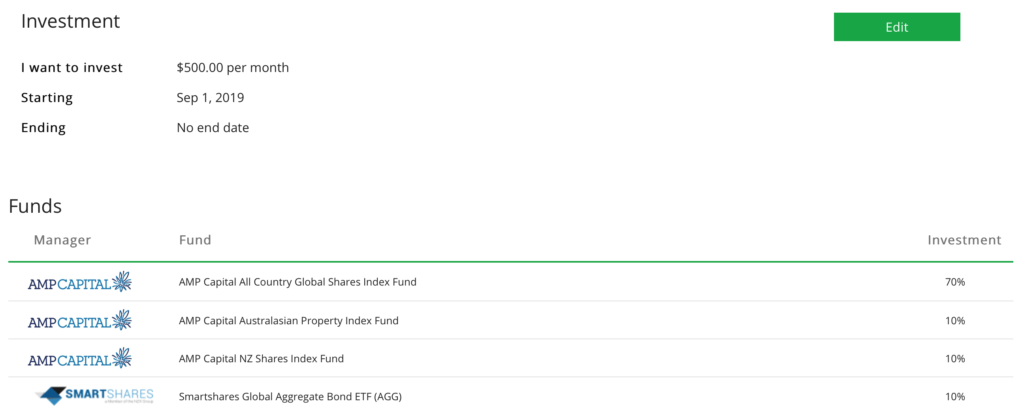

- Regular Investment Plans – You can use InvestNow’s Regular Investment Plan feature to make it significantly easier to set up a portfolio containing multiple funds. You just need to set how much money you want to invest on a regular basis, set the weighting of each fund you want to invest in, deposit money, and InvestNow will do the rest.

- Spreads – Some funds on InvestNow charge a spread when you buy or sell a fund. This is effectively a one-off a fee that varies by fund (but typically around 0.1%) to cover the transaction costs relating to buying and selling. Simplicity’s funds do not charge spreads – instead the transaction costs are borne by investors already invested in the fund, so having no spreads does not automatically make Simplicity cheaper.

- Tax – Although we’ve tried to minimise tax differences by avoiding the Vanguard fund, there is still a minor tax difference with the Smartshares ETFs that we used in our InvestNow portfolios. These are listed PIEs, so are always taxed at 28% – those on lower tax rates must claim back any additional tax paid. More info on this Reddit post.

- Specialised Funds – InvestNow offers funds that invest in areas that Simplicity’s funds don’t have much exposure to – such as Healthcare, Robotics & AI, Emerging Markets, and Commercial Property.

- DIY Weightings – You can adjust which asset classes you want to invest in and their weightings yourself, giving you ultimate control over your portfolio. With Simplicity you are stuck with their prescribed asset classes and weightings.

Conclusion

When it comes to building an investment portfolio, I don’t feel there’s a clear winner between Simplicity and InvestNow. With both services we are able to achieve our objectives of a simple, diversified, low fee portfolio very well. I guess this is similar to the “hire a pro vs DIY” debate?

Simplicity, the “hire a pro” option is more expensive at lower balances, but allows you to achieve a diversified investment portfolio by just putting your money into one fund. But a weak point is the high $1,000 minimum investment. Overall, they are best if having a hands-off portfolio is important you.

InvestNow, the “DIY” option is cheaper at smaller balances, but requires more work and thought from the investor to figure out what and how much of each fund to invest in. InvestNow’s strengths are the low minimum investment of $50, and the flexibility to build a portfolio just how you want. They are best if having more control, and being able to invest lower amounts is important to you.

I personally use InvestNow to build my investment portfolio. I don’t have enough money invested for Simplicity to work out cheaper for me, and don’t like Simplicity’s heavy weighting towards NZ and Australia in their funds – I already have enough exposure to these countries through my other investments. Using InvestNow means I can build and control my portfolio exactly how I want it 🙂

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

A very fair analysis as I am invested in both. But it clearly refers to the single investor. Entities such as Trusts, or investments for minors, are a separate matter. I find Investnow much easier to deal with. I know of other managers who have lost major accounts because of their bureaucratic and over zealous approach to rules only they adhere to.

Would love an update to this with current offerings

Hi, yes I’d like to know if this has changed recently as there seems to be a bigger gap between fees now?