In this article we’re getting back to the basics of investing, covering what shares are, the basics of funds, as well as a few other key investing concepts. We’ll also throw in a few pizza related analogies along the way to help explain it all. If you’re new to investing or just need a refresher, this article is for you!

This article covers:

1. Shares

2. Other asset classes

3. Funds

4. Other concepts

1. Shares

What are shares?

Shares represent a unit of ownership in a company. When you buy shares in a company, you become a part owner of that company. Imagine a company as a pizza. That pizza is cut up into lots of slices (each slice representing a “share” of the pizza). When you buy a slice, you own part of that pizza.

There’s lots of different companies out there that you can buy shares in (Air New Zealand, Apple, Nike, and Contact Energy to name a few), just like there’s lots of flavours of pizza – meat lovers, Hawaiian, supreme, dessert pizzas, and so on.

How can you make money from shares?

Firstly you can make money from capital gains. This involves selling your shares at a higher price than what you paid for them. For example, if you buy some shares at a price of $10 then they later increase in price to $11, you’ll make a gain of $1 per share if you sell them. Shares tend to go up in price if a company grows and becomes more profitable, as people will be willing to pay a higher price for that company’s shares.

Imagine there’s only 1 Hawaiian pizza in the world, and you bought a slice of it. If Hawaiian pizza became more popular, it would likely go up in price, as people would be willing to pay a higher price to get their hands on a slice.

You can also make money from dividends. This is when a company distributes a portion of their profits out to their shareholders, usually 2 or 4 times a year. It’s like earning a bit of income every few months just for owning certain flavours of pizza. However, companies that pay higher dividends aren’t necessarily better investments. Some companies pay lower dividends (or no dividends at all), instead reinvesting their profits to further grow the business (which means higher potential for capital gains).

How can you lose money from shares?

A company you invest in isn’t guaranteed to do well. If a company performs poorly, their share price will usually fall, as companies are generally worth less if their ability to grow and make a profit goes down. If you sell your shares at a lower price than what you bought them at, you’ll make a capital loss. Imagine Hawaiian pizza went down in popularity – your slice of Hawaiian pizza would probably go down in price as fewer people would be willing to buy that flavour.

This is why diversification (investing in many different companies) is important. If one company you’ve invested in performs badly, you won’t lose all your money as it’ll be spread across other companies. Same if you had to cater for an office pizza party – you’d probably buy a few flavours of pizza as betting on just one flavour is risky!

However, diversification doesn’t remove all the risks of investing in shares. The entire sharemarket as a whole can be volatile. Geopolitical issues (like wars), pandemics, and sometimes no particular reason at all can cause widespread decreases in company share prices. Imagine people started preferring to eat pasta, leading to pizza becoming a less popular type of food – In that case it’s likely that all pizzas would go down in price, regardless of the flavour.

Because of this volatility, investing in shares doesn’t deliver good results every year. In some years they can perform well, but in other years they could go down in value. That’s why shares are usually considered a long-term investment as it can take a number of years to recover from any volatility and deliver positive results. It’s like putting a pizza in the oven – It takes time and patience to fully cook, and it would be unreasonable to expect results just a few seconds after putting it in.

Where can you buy shares?

A sharemarket is a place where companies list their shares and make them available for trading. Examples of sharemarkets are the NZX (the NZ sharemarket), ASX (Aussie sharemarket), NYSE, and Nasdaq (two of the largest US sharemarkets). Keeping with our pizza analogies, you could think of it a marketplace which has a menu with lots of different flavours of pizza, and where slices of those pizzas can be bought or sold.

Everyday people can’t participate in the sharemarket. Instead you need a broker to buy and sell shares on the sharemarket on your behalf. This could be Sharesies or Hatch for example. You pay a brokerage fee (and foreign exchange fees if buying overseas shares) in return for their service. Think of brokers as delivery drivers who delivers your pizza to you after you’ve bought it from the marketplace.

Further Reading:

– Shares 101 – How to buy shares, which companies to pick, and more

2. Other asset classes

Shares aren’t the only thing that people can invest in. Just like how pizza isn’t the only thing you can buy at a pizza outlet (they also offer things like garlic bread, chicken wings, and soda), there are many more asset classes you can invest in like cash, bonds, peer-to-peer lending, and cryptocurrency.

- Cash, bonds, and peer-to-peer lending all involve lending your money out to a bank, government, or other organisation and getting paid interest in return. While they generally don’t have the ability to deliver capital gains, they’re a lot more stable than shares.

- Cryptocurrencies are digital currencies or assets. People hold onto them in the hope they go up in price, or lend them out to earn interest. They’re much more volatile and risky than shares.

Further Reading:

– Bonus Saver vs Notice Saver vs Term Deposit – Which savings product is right for you?

– Bonds 101 – 5 things to know about investing in bonds

– 5 things to know about investing in Peer to Peer Lending

– Cryptocurrency 101 – Is it investing or gambling?

What should you invest in?

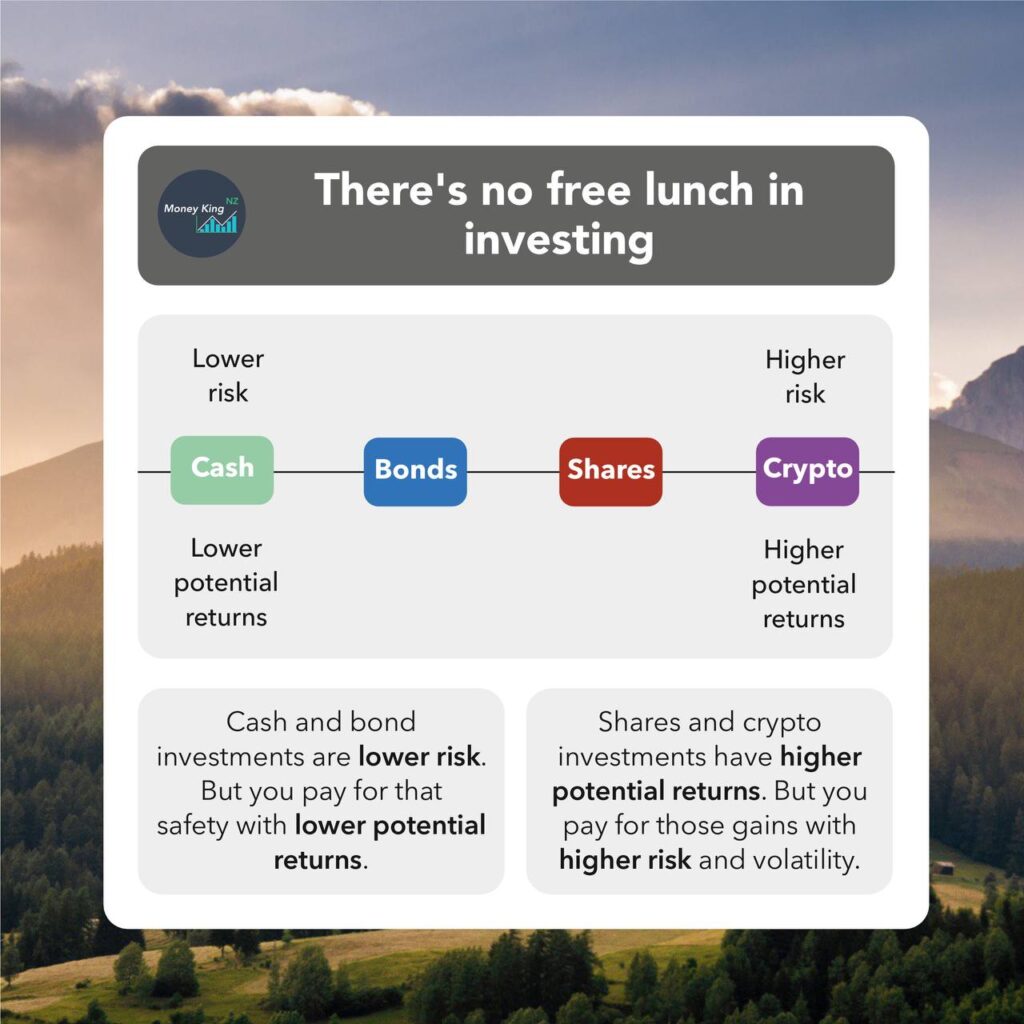

There’s no one-size-fits-all answer as to what you should invest in. But generally:

- Longer-term investors may find more “aggressive” assets like shares better suited to them. While these assets have higher potential returns, a long-term investment timeframe is needed to ride out the volatility in these investments.

- Shorter-term investors may find more “conservative” assets like cash and bonds better suited to them. While these assets have lower potential returns, they’re much less volatile so will help protect your money from going down in value.

Overall what you should invest in comes down to your personal circumstances such as your investment goals, time horizon, and risk tolerance. Similarly, the food you buy at a pizza shop depends on personal tastes and needs. For example, a pizza won’t help much if you’re thirsty, while a bottle of soda won’t be much use if you’re hungry!

Further Reading:

– How to invest $1k/$10k/$100k in New Zealand

3. Funds

What is a fund?

A fund is an investment which contains the shares of many companies. Funds are run by fund managers who are responsible for selecting which companies their funds invest in. You pay the fund manager a management fee in return for their service. Think of a fund as a pizza box which contains many slices of pizza, each a different flavour chosen by the manager of that box. The key benefits of investing in a fund are:

- You get diversification because your money is invested towards a variety of companies, instead of just one.

- You don’t have to do much research on what companies to invest in, as your fund manager selects what companies to invest in for you.

Funds don’t always just contain shares. Some funds contain only bonds or cash. It’s like having a pizza box full of just garlic bread. Other funds contain a mix of asset classes – For example, Simplicity’s Growth Fund contains a mix of shares, bonds, and cash. It’s like a variety box of pizza, garlic bread, and chicken wings!

Actively managed funds vs Index funds

Funds can be actively managed or index funds. This refers to how a fund manager selects which assets to invest in.

Actively managed funds have fund managers and analysts researching and picking which companies to invest in. Their aim is to outperform the market i.e. pick companies they think will do better than the average. Examples of actively managed funds are those offered by Milford or Fisher Funds.

Index funds invest in an entire market or segment of the market. For example, a NZX 50 index fund invests in the 50 largest companies on the NZ sharemarket, broadly representing the whole NZ sharemarket. Also known as passively managed funds, their aim is to match the return of the market with the belief that it’s incredibly hard for actively managed funds to consistently beat the market average over the long-term. Index funds also tend to have lower fees as they don’t have to employ people to research and pick companies. Examples of index funds are those offered by Kernel and most Smartshares funds.

You could think of an active fund manager as someone who tries to pick the best flavours of pizza. While an index fund manager just picks all the flavours!

ETFs vs Unlisted funds

Funds can be ETFs or unlisted funds. This refers to where you can buy and sell a fund.

ETFs stands for Exchange Traded Funds – they can be bought and sold on the sharemarket. Examples are Smartshares‘ funds which are listed and can be traded on the NZX. Imagine ETFs as pizza boxes that can be bought and sold in a marketplace alongside other assets like shares. ETFs and index funds aren’t the same thing – Most ETFs are index funds, but some are actively managed.

Unlisted funds are funds that aren’t listed on a sharemarket. Instead you have to buy and sell that fund through the manager of that fund, or on a fund platform like InvestNow. Imagine unlisted funds as pizza boxes you have to go direct to the manufacturer to buy and sell. While this may seem less accessible than an ETF, many unlisted funds have low minimum investment requirements and they don’t charge brokerage fees for buying and selling the fund. Like ETFs, some unlisted funds are index funds and some are actively managed.

Further Reading:

– Funds 101 – What’s the difference between an Index Fund, ETF, and more?

KiwiSaver funds

KiwiSaver funds are just a special type of fund that have restrictions on when you can withdraw money from them – the main reasons for withdrawal being when you reach age 65 or buy your first home. Apart from that, KiwiSaver funds work the same as regular funds, investing in a variety of shares, bonds, and cash. It’s like having a pizza box that’s locked and can’t be open until a certain time.

KiwiSaver funds aren’t as flexible as regular funds because of their withdrawal restrictions, but this could be a good thing as you can’t dip into it when you’re tempted to spend the money inside. They’re also worth having to harvest the benefits of the KiwiSaver scheme such as employer and government contributions – where your boss and the government put money into your KiwiSaver fund alongside your own money.

Further Reading:

– KiwiSaver 101 – How does KiwiSaver fit into your investment portfolio?

4. Other concepts

Emergency fund

If you choose to invest in shares it’s important to have some sort of emergency fund. This is money that’s usually kept in a bank savings account, that can be used to pay for any unexpected expenses such as your car breaking down, dental treatment, vet visits, or putting food on the table if you lose your job. By having an emergency fund, you’ll be able to pay for these unexpected expenses without having to disturb your long-term investments or get into debt. Think of it as having a box of chicken wings on the side, so you don’t have to dip into your pizza if you get hungry.

Dollar cost averaging

Dollar cost averaging is a popular strategy for entering into an investment. It involves investing the same dollar amount of money into an asset (like a share or fund) on a regular basis (for example investing $100 into a fund every week). Dollar cost averaging comes with a couple of key benefits:

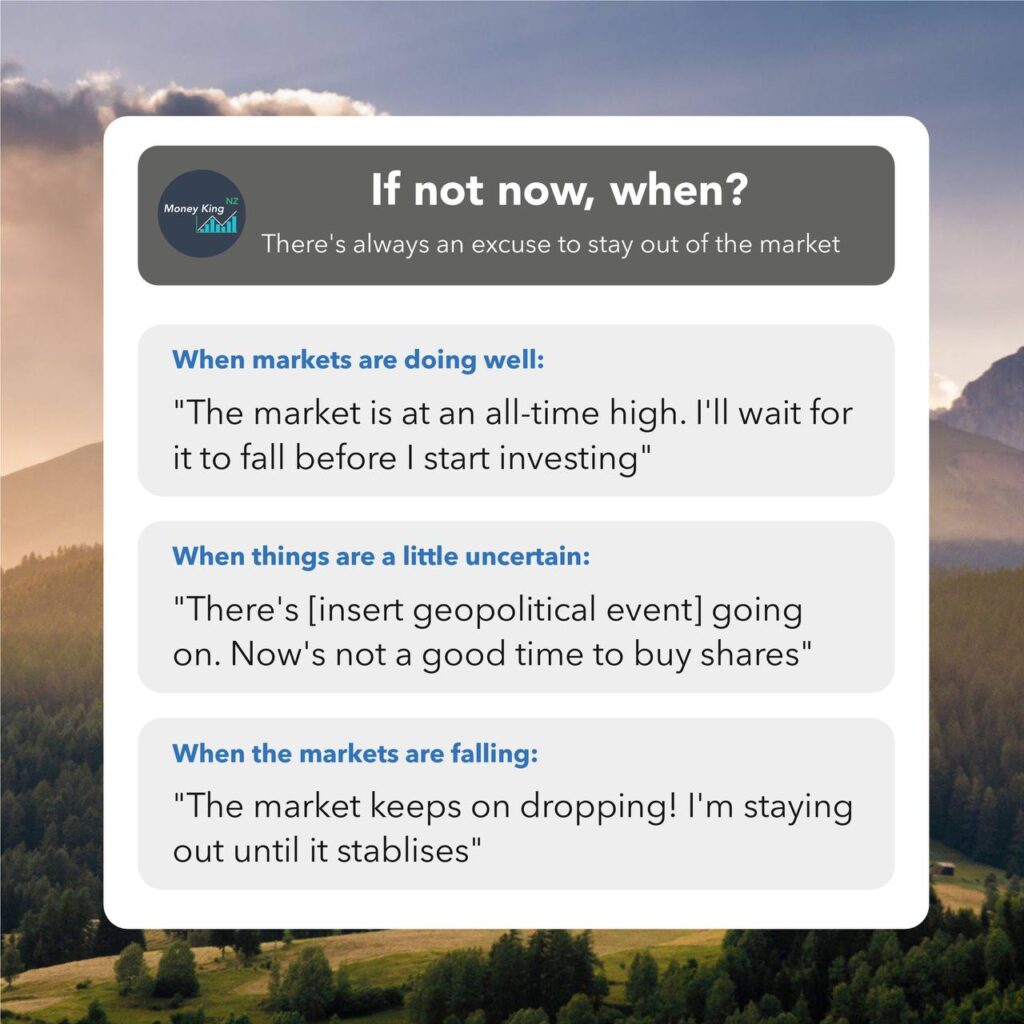

- It reduces risk. Say you have $12,000 to invest in shares. Investing all of that money at once could be risky as the value of those shares could drop straight after you make your investment. Drip feeding that money in (e.g. by investing $1,000 per month over a year) would reduce that risk of putting all your money in at a bad time.

- It takes some of the emotion out of investing as you invest on a regular timetable, regardless of whether the market is performing well or poorly. This removes the guesswork in trying to “time the market” (attempting to find the “perfect” time to enter the market).

Compounding

You’ve probably already heard of the term compound interest. This refers to the ability to earn interest on your interest. For example, say you invested $100 in a savings account and after 1 year you had earned $5 in interest. The following year you would earn interest on your initial $100 as well as the $5 of interest you just made. Compounding is attractive to investors as it allows you to make money off your profits in addition to your own money – this can greatly increase your earnings, especially over the long-term.

While shares don’t pay interest, share investors can still benefit from compounding. For example, dividends you earn from your shares can be reinvested to buy more shares, resulting in you earning more and more dividends over time (compounding dividends). What about companies that don’t pay dividends? These companies tend to reinvest their profits to further grow the company, which could result in the company making even more profits (compounding returns), hopefully leading to an increase in that company’s share price.

Ethical investing

Ethical investing involves shaping your investments to align with your ethical views. This could involve:

- Negative screening – Avoiding certain companies based on the industry they’re in (e.g. gambling or fossil fuels) or because of their poor Environmental, Social, or Governance (ESG) practices. It’s like avoiding certain flavours or ingredients on a pizza. For example, many think pineapple on a pizza is a sin and will avoid it at all costs.

- Positive screening – Selecting companies based on their positive ESG practices e.g. companies that have a positive impact on the environment or society. It’s like looking for pizzas that have ingredients with certain characteristics (e.g. using free-range meat).

Ethical investing will mean different things to different people – it ultimately comes down to personal taste. For example, while pineapple on a pizza is controversial some people are fans of it!

Further Reading:

– Clean and Green? 5 things to know about Ethical investing

Conclusion

Investing can be simpler than you think. At its core it involves picking a diversified portfolio of shares, and holding them for the long-term so you can compound your earnings and ride out any volatility in the markets. And if you’re not sure what shares to pick, funds are a great option to offload that responsibility to a professional fund manager. If you’re investing for the short-term or don’t have the stomach for volatility, then more conservative assets like cash or bonds may be more suitable for you.

For those wanting to dive deeper into the world of investing, we have over 100 articles on our site covering everything from in-depth guides to specific concepts to reviews of funds and investment platforms. So feel free to check the rest of the Money King NZ site out!

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

good job

Thanks!