Cluster bombs, land mines, and controversial weapons. Having your hard earned KiwiSaver money being invested in these industries is probably the last thing you want. This is where ethical investing comes in – to make your money not just work harder, but more responsibly as well.

Ethical investing is not an easy topic and has a tendency to be a divisive issue – everyone has different views, and not everyone cares. So what is ethical investing, what are the options, and what are the limitations of ethical investing? And does ethical investing actually make an impact on the world?

This article covers:

1. What is Ethical investing?

2. What are the Ethical KiwiSaver options?

3. What are some Ethical non-KiwiSaver investments?

4. Are there any limitations of Ethical investing?

5. Does Ethical investing have an impact?

Update (29 June 2021) – Kernel now has sustainable funds. Mindful Money now covers non-KiwiSaver funds.

1. What is Ethical investing?

According to the 2019 NZ Responsible Investment Survey, 83% of people expect their investments to be invested ethically. You may have also heard of terms like Socially Responsible investing (SRI), ESG investing, Sustainable investing, and so on – I will put all these concepts under the same ‘ethical investing umbrella’ for this article. So ethical investing is something most people want, but what does it actually mean?

Avoiding ‘bad’ companies

The first and most common aspect of ethical investing is also known as ‘Negative Screening’ – avoiding investing in (‘screening out’) undesirable companies. Examples are:

- Avoiding bad industries such as weapons manufacturing, tobacco, and gambling.

- Avoiding bad behaviours such as those who violate human rights, or perform animal testing.

- Avoiding investments that are not consistent with the values of a particular religion.

Selecting ‘good’ companies

The other aspect to ethical investing, also known as ‘Positive Screening’, is choosing ‘good’ or ‘ethical’ companies to invest in. A common approach to this is to look for companies who demonstrate positive ‘ESG‘ (Environmental, Social, Governance) factors:

- Environmental – Considers impact on the environment, such as emissions and use of green technologies.

- Social – Considers impact on society, such as treatment of employees, suppliers, and consumers.

- Governance – Considers corporate governance issues, such as diversity of the board of directors and the relationship with shareholders.

Aligning investments with personal values

To sum it up, I would say that ethical investing is about aligning your investments with your personal values, and having your investments reflect how you want the world to look like. Ethical investing aims to make you money, and allows you to feel good about it at the same time!

2. What are the Ethical KiwiSaver options?

KiwiSaver funds are often in the spotlight when it comes to ethical investing, especially given it’s the most prevalent investment scheme in New Zealand with 3 million members. In recent years providers have come under fire for investing in companies involved in cluster bombs, land mines, nuclear weapons, and fossil fuels.

KiwiSaver money being invested in undesirable industries continues to be an issue today:

$4.2billion of KiwiSaver funds is being invested in companies that the vast majority of New Zealanders want to avoid, including $1.4bn in companies that test products on animals and $1.2bn in fossil fuels

Barry Coates, Founder & CEO, Mindful Money

There is a strong demand for ethical KiwiSaver options, so what are your options? Here are just a few examples:

Ethical Funds

These funds explicitly market themselves as ‘ethical’ or ‘socially responsible’.

Simplicity – They are one of the fastest growing KiwiSaver providers for a good reason, charging low fees and claiming to be ethical at the same time. They also donate 15% of management fees to charity.

CareSaver – Issued by Pathfinder, the CareSaver scheme made the news for stating that they wouldn’t invest in any NZ companies who didn’t have a female director. They have a strict exclusions policy, but also actively seek out companies that make a positive difference. They donate 20% of management fees to charity.

SuperLife – SuperLife’s Ethica fund is one of the oldest ethical funds, having launched all the way back in 2008!

Religious Funds

These funds approach ethical investing by investing in assets that comply with a specific religion’s values.

Amanah – Aims to be a Shari’ah compliant fund (conforms to Islamic values), avoiding companies with high debt, and those involved with things considered ‘Haram’ (sinful) like alcohol, money lending, pork, and adult entertainment.

Christian KiwiSaver – Invests based on Christian values, and is not open to the general public. You must express a Christian faith or be an employee of a Christian Mission or Ministry to join the scheme.

Funds with exclusions

Many other KiwiSaver funds have some sort of responsible investing or exclusions policy, so may also meet your criteria of being ‘ethical’, even when they don’t explicitly market themselves as ethical. Here are just a few examples of these funds:

JUNO – Doesn’t claim to be an ethical KiwiSaver scheme, but excludes a number of controversial industries, and considers ESG factors in their investment decisions.

Milford – Similar to JUNO in that they exclude controversial industries, and consider ESG factors.

Craigs KiwiSaver – This is a really unique KiwiSaver scheme that allows you to pick exactly what companies make up your KiwiSaver fund. This enables you to fully customise your fund to be as ethical or unethical as you like, based on how you feel about specific companies.

How do I check if my KiwiSaver fund is ethical?

Your fund manager – Look through a fund manager’s website for an ethical/responsible investment policy, or look in their Documents section for their Statement of Investment Policy and Objectives (SIPO).

Mindful Money – This is an independent website dedicated to providing transparency on where all KiwiSaver funds are invested in:

Mindful Money is a new charity that is taking ethical investment into the mainstream. Mindful Money shows investors where their KiwiSaver funds are invested (eg. in weapons, fossil fuels, gambling etc) and helps them choose an ethical fund that aligns with their values.

Barry Coates, Founder & CEO, Mindful Money

More on Mindful Money later on.

3. What are some Ethical non-KiwiSaver investments?

NZ domiciled ethical funds

Here are some examples of NZ domiciled ethical funds:

Smartshares – Released five international shares ‘ESG’ ETFs in June 2019. Screens out companies involved in industries like thermal coal mining, tobacco, and controversial weapons (available on InvestNow and Sharesies).

Kernel – Released three new sustainable index funds in June 2021. These are a green property fund, clean energy fund, and a NZ 50 ESG Tilted fund (which invests in the NZX 50 index, but weights companies according to sustainability factors).

Pathfinder – They have a number of ethical investment products, and claim to have NZ’s first Vegan-friendly fund with their Global Water Fund (available on InvestNow and Sharesies).

International ethical funds

There is no shortage of ethical funds in available in overseas markets, like the US. Here are some interesting examples (all available on Hatch):

iShares Global Clean Energy ETF (ICLN) – Invests in companies in the renewable energy sector.

Impact Shares Minority Empowerment ETF (NACP) – Invests in US companies that have strong racial and ethnic diversity policies in place.

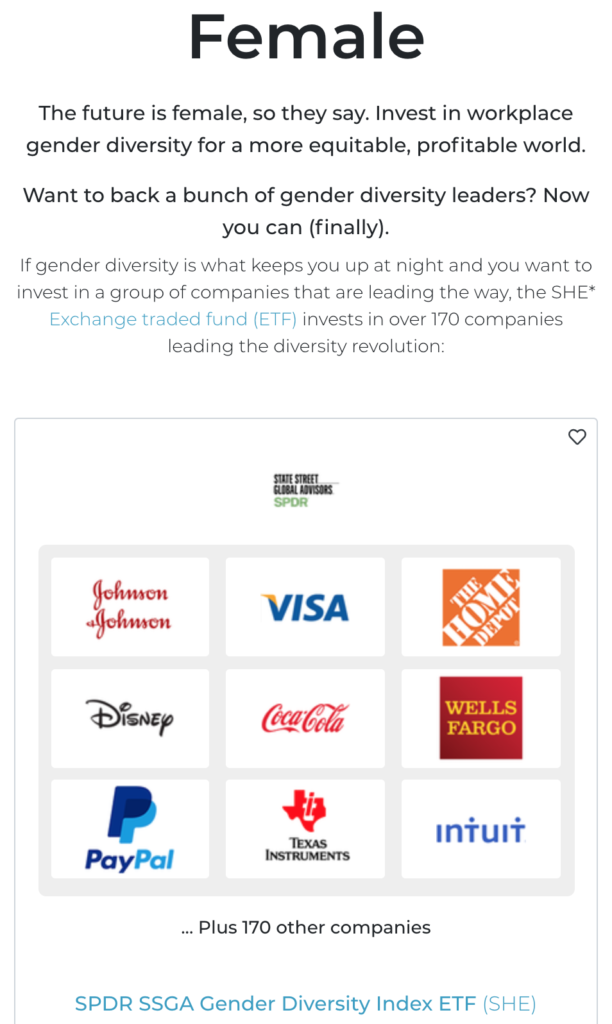

SPDR Gender Diversity Index ETF (SHE) – Invests in US companies that demonstrate a good level of gender diversity in their senior leadership.

How do I check if my fund is ethical?

Your fund manager – Look through a fund manager’s website for an ethical/responsible investment policy, or look in their Documents section for their SIPO.

Mindful Money – They also cover non-KiwiSaver funds in analysing where your fund is invested.

Smart Investor – Allows you to search for a fund and download a spreadsheet of that fund’s entire holdings, which you can inspect yourself to see if they invest in any undesirable companies. Also works for KiwiSaver funds.

Individual companies

It is not easy for investors to determine how ethical a fund is, given they can contains hundreds or even thousands of companies, sometimes in indirect investments. Not many people have the time to evaluate the ethics of such a large number companies – so investing in individual companies could be the solution!

Shares – Instead of having a fund manager choose which companies are ethical or not, you can always choose them yourself! Investing in individual shares gives you ultimate control to investing in companies that match your values. This is not limited to shares listed on the sharemarket – Equity Crowdfunding can be a good way to support emerging companies that you consider ethical.

Green bonds – Ethical investing is not limited to shares. Some bond issues can be considered ethical as well, particularly Green Bonds. These bonds can only be used for environmentally friendly or sustainable purposes, for example, Contact Energy’s green bonds used to finance their renewable energy assets.

4. Are there any limitations of Ethical investing?

One size does not fit all

Everyone has a different view on what’s ethical and what isn’t. Therefore there’s no such thing as an ethical fund that can please every investor and align with every investor’s values. JUNO’s view on ethical investing sums it up nicely:

We don’t claim to be ‘ethical’. ‘Ethics’ are defined as personal beliefs and it’s very unlikely we could invest in line with all of our members’ ethics.

JUNO KiwiSaver Scheme

As an example, Simplicity excludes SkyCity from their funds (for gambling). For some people this exclusion does not go far enough – the likes of Air New Zealand could also be considered an undesirable company because of the emissions they produce. Restaurant Brands could be considered unethical because KFC is unhealthy. You could probably find an argument for any company to be considered ‘unethical’ if you tried!

A2 Milk is another interesting example – not everyone wants to be invested in the dairy industry for a variety of reasons. While CareSaver actively excludes the company, funds like Simplicity Growth and AMP Ethical Leaders NZ Shares has A2 Milk among their top investments!

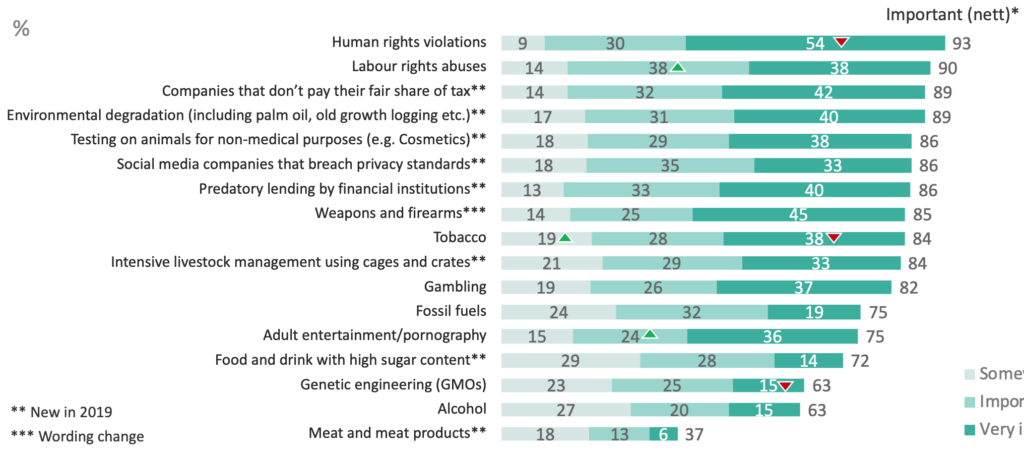

On the other hand, a fund’s exclusions policy can be seen as too strict. For example, is Simplicity’s exclusion of alcohol taking things too far? Let’s look at the stats from the NZ Responsible Investment Survey – while almost all (93%) think human rights violations is an important issue to avoid, alcohol is a less controversial issue, with only 63% wanting to avoid alcohol in their investments. Interestingly, CareSaver does not exclude alcohol from their investments!

The implication of this is that investors should carefully consider a fund’s exclusions and inclusions to see whether a fund actually aligns with their values.

Greenwashing

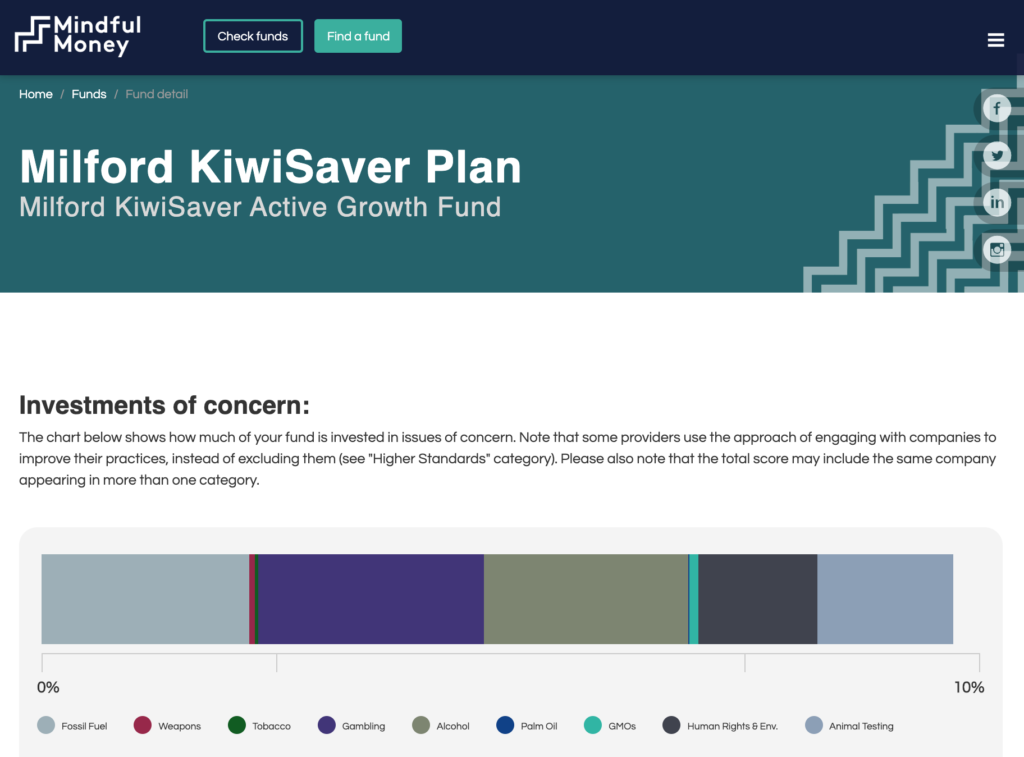

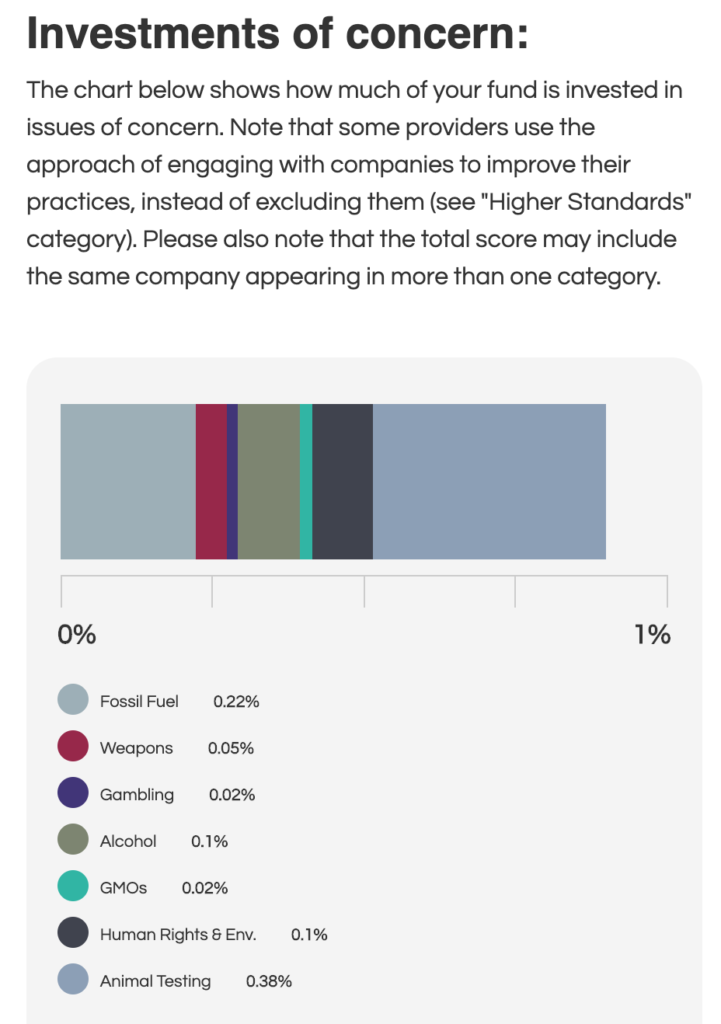

Many funds market themselves as Ethical, but what does that really mean? After all, It is just a claim by the fund manager that they invest in a responsible manner, but their actual investments do not always match the claims. This is where I feel a site like Mindful Money comes in handy, as they independently evaluate a fund’s holdings and whether they actually avoid investing in ‘areas of concern’.

The public are confused by claims of ethical, responsible, green, sustainable investment, without clear standards. Mindful Money is able to show them the companies in their portfolio, across ten categories that surveys show New Zealanders want to avoid.

Mindful Money includes brings the light of scrutiny to misleading claims and greenwashing. The public are able to see not only direct portfolio investments but also companies held in indirect funds. This is the first time that a full portfolio view has been made available to investors.

Barry Coates, Founder & CEO, Mindful Money

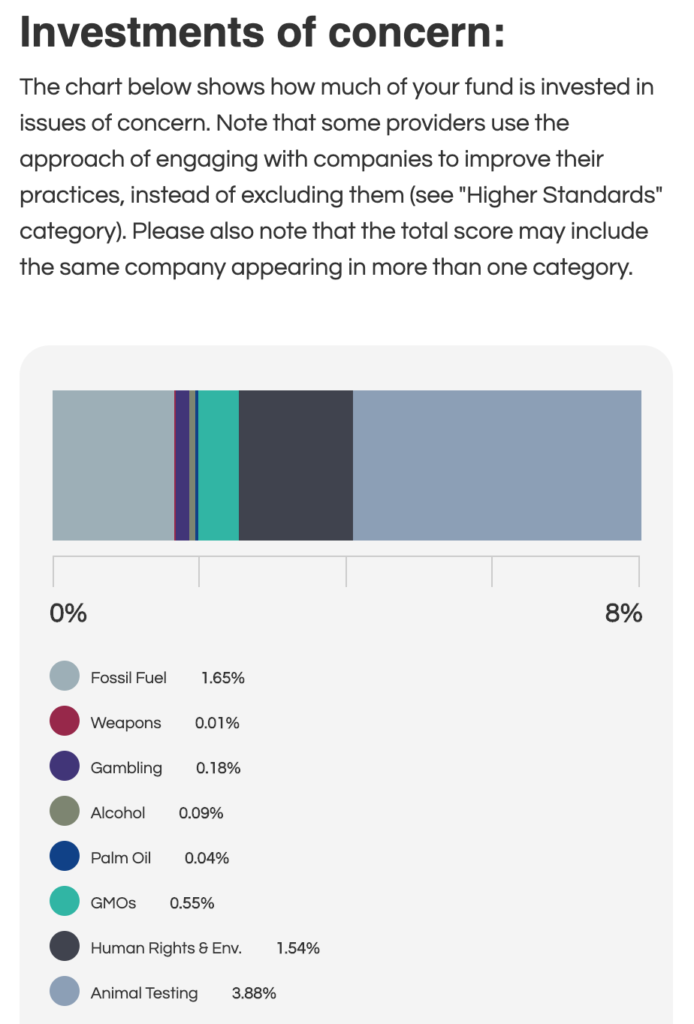

I put Mindful Money to a quick test, and the results were interesting. I first checked my KiwiSaver fund, the JUNO Growth Fund. At first I was slightly horrified to see the fund invested in areas of concern, but note that their exposure to those areas is less than 1%:

I then checked Simplicity’s Growth fund, which had a much higher 8% invested in areas of concern! It is fascinating to see a fund that markets themselves as ethical has more invested in the likes of fossil fuels and animal testing, compared to a fund that doesn’t claim to be ethical!

I am not accusing Simplicity of greenwashing here. In fact they are yet to fully implement their ethical investment policies, particularly for their Australian investments, as they are waiting for Vanguard to provide an ethical Australian fund.

But this still goes to show that investors need to dig deeper beyond a fund manager’s claims, to see if they actually meet your expectations of what an ethical fund should be. You can check your own KiwiSaver fund using Mindful Money’s fund check tool.

Performance

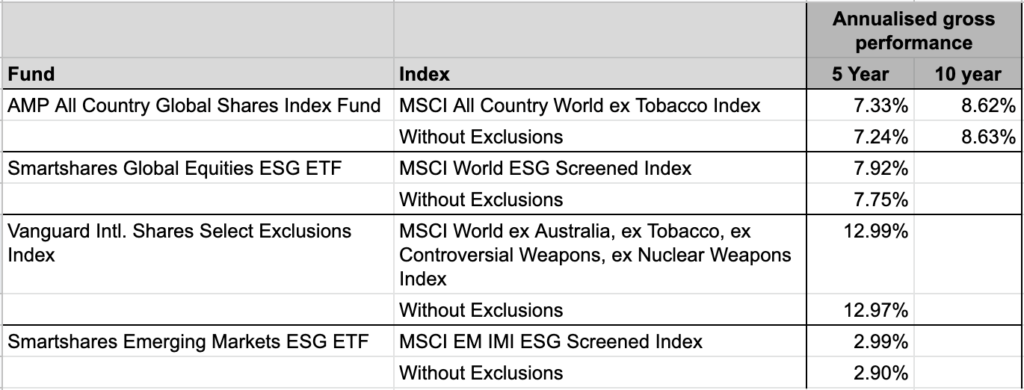

Do ethical investments perform worse than regular investments? Probably not. I don’t like to get hooked up on performance (as it’s backward-looking information), but studies I’ve seen suggest that ethical funds perform just as well or better than regular funds. And here’s a table showing that a number of global share funds perform slightly better thanks to their exclusion of unethical industries:

And there are reasons to suggest that ethical companies will continue to perform well into the future. Ethical companies may be at a lower risk to fines and reputational damage, have more satisfied employees and customers, and perhaps will have a longer lifespan as the world transitions away from undesirable industries.

Fees

Do ethical investments attract higher fees? Yes and no. While there are some ethical funds that have above average fees, there are plenty of options who’s fees are amongst the lowest. Here’s a quick comparison using data from Sorted’s KiwiSaver Fund Finder:

- Above average fees – Caresaver Growth (1.41%), Amanah Growth (2.25%)

- Average KiwiSaver growth fund fee – 1.34%

- Below average fees – Simplicity Growth (0.48%), SuperLife Ethica (0.87%)

5. Does Ethical investing have an impact?

How does ethical investing support ‘good’ companies?

So how does ethical investing actually benefit a ‘good’ company? I’m sorry to say that it doesn’t directly benefit the companies you invest in. When you buy shares in a company or fund, your money just goes to the seller of the shares, rather than the company itself (unless you’re participating in a capital raise).

The indirect benefit comes from supporting that ‘good’ company’s share price. A strong share price should attract positive attention from potential investors, and make it easier for companies to raise capital. The problem is, as a retail investor you are barely making a difference to a company’s share price.

It’s not all bad

At least with ethical investing you get the benefit of your portfolio not making money from ‘bad companies’. You can feel good while making money, show you care about certain issues, and you don’t have sacrifice performance or pay higher fees to do so. And hopefully the increased prevalence of ethical investing will encourage wider changes such as motivating ‘bad companies’, fund managers, and lawmakers to improve ESG practices, or policies. Positive change takes time!

And while ethical investing might not quite make the impact you desire, remember you can still make a difference as a consumer. You could buy products from companies that share your values, minimise household waste, or use public transport to make a greater impact on the world than you would by putting a few hundred dollars into an ethical investment fund.

Conclusion

Ethical investing is about aligning your investments with your personal values, whether it be wanting to avoid companies that are involved in controversial weapons, or wanting to support companies that promote gender diversity. There are many options to invest ethically, and you don’t have to sacrifice performance or pay higher fees to do so.

There are a couple of really important things to keep in mind when thinking about ethical investments. Firstly everyone’s values are different – not all ethical funds are created equal, and not all fund managers’ claims of responsible investing are going to align with your expectations. Secondly, your impact as an ethical investor is extremely limited – We also need to be better consumers to make a real difference to the world.

Thank you to Barry Coates for answering my questions about Mindful Money, and providing some input into this article.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.