“Investing will make you rich!” “Buy low, sell high!” “A recession is coming – now’s not a good time to invest!” Following on from our original investing myths and misconceptions article, we’ll be busting these and 9 more well-intentioned investing tips that are commonly thrown around, but we don’t think are quite correct.

Our myths and misconceptions articles:

– 12 common investing myths and misconceptions busted

– 12 more investing myths and misconceptions busted (this article)

– 12 KiwiSaver myths and misconceptions busted

– 12 tax myths and misconceptions busted

1. Investing will make you rich

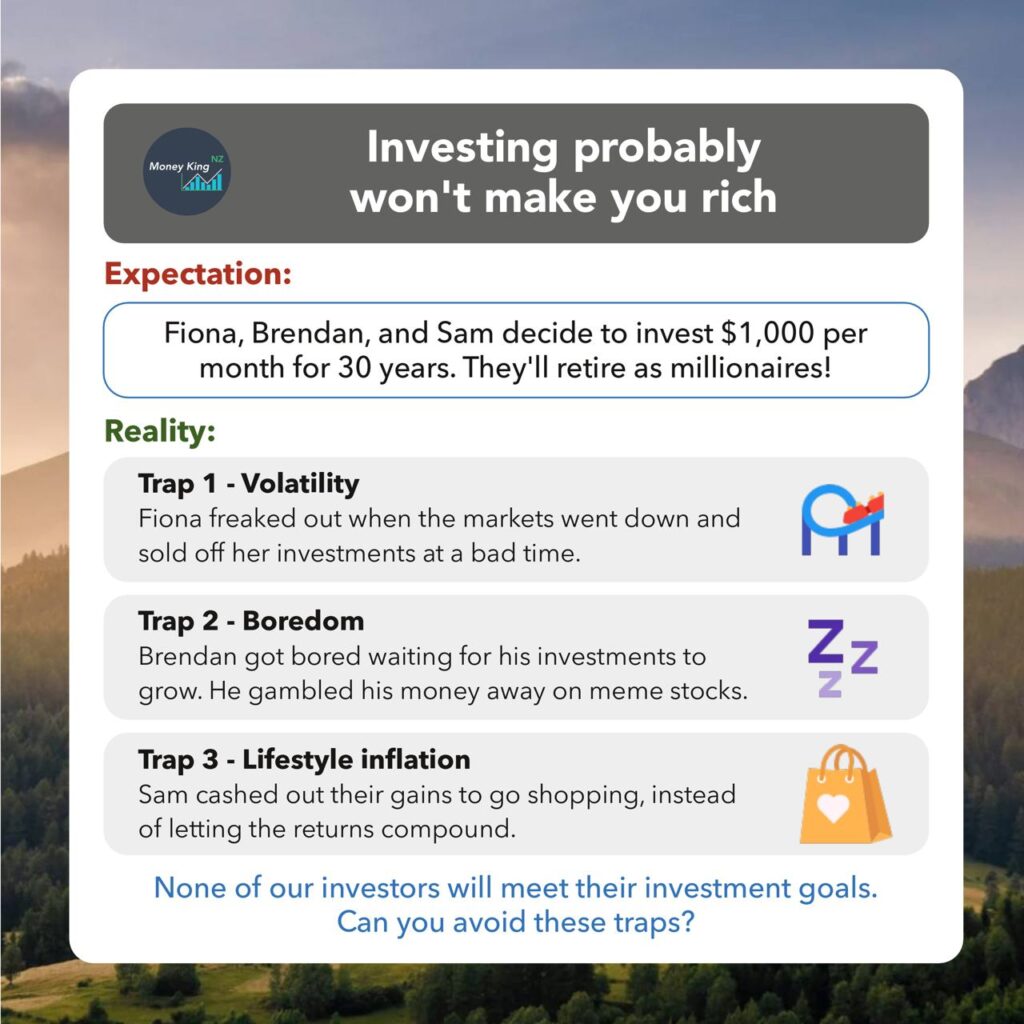

You might have seen posts from other content creators that make it seem like investing is an easy way to get rich. They’ll say something along the lines of “invest $1,000 a month into an index fund, and you’ll retire as a millionaire”. Theoretically investing can indeed be that easy, but it assumes you have perfect investing behaviours. In reality investing is a lot more difficult, and there’s many traps that could derail your journey to grow your wealth. For example:

- Volatility – Market fluctuations and downturns can lead to panic selling or trying to time the market, when investors are usually better off consistently drip feeding money in and riding out the crashes.

- Boredom – It can take years before you see any meaningful results with your investments. The resulting boredom can lead to constant tweaking of your portfolio and gambling your money away on the hottest stock, fund, or coin in an attempt to accelerate your progress – Essentially taking on more risk and incurring extra brokerage fees, when it’s usually best to simply and patiently buy and hold.

- Lifestyle inflation – People often see investing as a means to earn extra income and fund their lifestyles. They don’t reinvest their profits, so don’t benefit from compounding returns. Capital gains and dividends alone won’t make you rich, but rather it’s the compounding of your returns over several years and decades that really helps your wealth take off.

So there’s a lot more to investing than just picking an investment to drop money into. The behavioural aspect of being an investor is just as important, and will likely make just as much of an impact on your investing outcomes as selecting the right assets to invest in.

2. A recession is coming – Now’s not a good time to invest in shares

There’s a lot of economic uncertainty at the moment, and it’s looking increasingly likely we’ll be facing a recession in the coming months (if we aren’t already in one). This has led to many people avoid investing with the fear that the worst economic and market conditions are yet to come. But we think recession fears are a poor reason to stay out of the sharemarket:

- Recessions are impossible to time – People often tell themselves that they’ll get back into the sharemarket when the economy is in better shape. But in reality it’s impossible to know when’s the right time to get back in. Markets are forward looking and tend to hit the bottom and recover well before the economy actually does. If you wait for good economic times to come before investing, you’ll likely be too late to get the best discounts in the sharemarket.

The value of the market doesn’t reflect the exact current economy, rather it’s PREDICTING what is coming up soon. When the recession looms, the market drops. But when the recession gets here, the market begins rising, predicting the recovery.

Jeremy Schneider

- We don’t know the impact of the next recession – Nor do we know the impact it’ll have on the sharemarket. Perhaps the impact won’t be as severe as anticipated, as the current sharemarket downturn may have already priced in some recession risk.

- Recessions are unavoidable – Even if you managed to sidestep the next recession, they’ll always be another one around the corner. It’s inevitable you’ll encounter a few recessions in your lifetime, so if you wanted to completely avoid them, you’d have to avoid investing altogether!

So instead of trying to sidestep the next recession, we prefer to gradually drip feed money into our investments regardless of the economic outlook. This allows you to get at least some exposure to shares if they bounce back up from here, without having to commit all your money into the market at once in case they go down further.

Further Reading:

– 2020 Recession? How to prepare your investment portfolio

3. Buy low, sell high is a good investment strategy

Investing advice doesn’t get any simpler than buy low, sell high. Buy an asset while it’s “low” + sell it at a higher price than what you paid for it = profit! While we think this advice is appropriate for traders, there’s a few issues with applying it to investors:

- It implies you should regularly trade – There’s nothing wrong with making money from trading in and out of stocks. But the best investors tend to buy and hold quality assets for several years or decades, letting their returns compound. Plus their capital gains will be less likely to be subject to tax.

- Timing the market is unrealistic – Buy low, sell high is harder than it sounds. How do you know a stock is “low” and won’t go down further? How do you know a stock is “high” and won’t go up even higher?

- It may encourage speculation – You may end up speculating on what stock is going to go up, rather than investing in companies you’d genuinely want to own. A company that’s gone down in price doesn’t necessarily mean it’s a quality investment, nor does a company that’s gone up in price necessarily make it an investment you should sell.

- Emotions get in the way – When the markets are low, people tend to feel fearful and are reluctant to buy into investments. And when the markets are high, people tend to get greedy and FOMO into the market. This leads to many investors doing the exact opposite of buy low, sell high, by buying high and selling low.

We think a better strategy is to invest early and often. Investing early gives you more time to ride out the volatility of the markets and for your returns to compound. Investing often (e.g. by dollar cost averaging) takes timing and emotion out of the equation by investing regardless of whether you feel the market is “low” or “high”.

4. Savings accounts and term deposits are a waste of time

Most bank term deposits are currently paying interest at a rate of around 3%. And with the latest inflation numbers coming in at around 7%, it may seem like keeping your money in the bank is a waste of time as the returns fail to keep up with it. But we don’t think this is necessarily a bad thing because:

- Shares aren’t suitable if you need money in the short-term – Say you’re saving for a holiday in a year’s time, so you might be tempted to invest in shares to earn a higher potential return in the meantime. However, you’ll pay for these higher potential returns with higher volatility. You might end up facing a market downturn and having to sell off your shares at a loss to fund your holiday. Shares work better for investors who have long investment timeframes as they have time to ride out these downturns.

- You don’t always have to beat inflation – An inflation rate of 7% doesn’t mean your money has gone down in value by 7%. Instead it means prices of goods and services nationwide have increased by an average of 7% (measured by a basket of things like food, utilities, transport, and healthcare). Your personal inflation rate won’t necessarily be 7%, as the things you spend your money on will likely differ from the national average. We think inflation is a bad benchmark to target when making investment decisions.

So we believe that savings accounts and term deposits are still important tools for investors. They won’t make you rich, but you get stability in return, ensuring that the money you need in the short-term is shielded from the ups and downs of the sharemarket.

Further Reading:

– What’s the best short-term investment?

– Why your income may not need to match inflation (Your Money Blueprint)

5. Sharesies has a good user interface

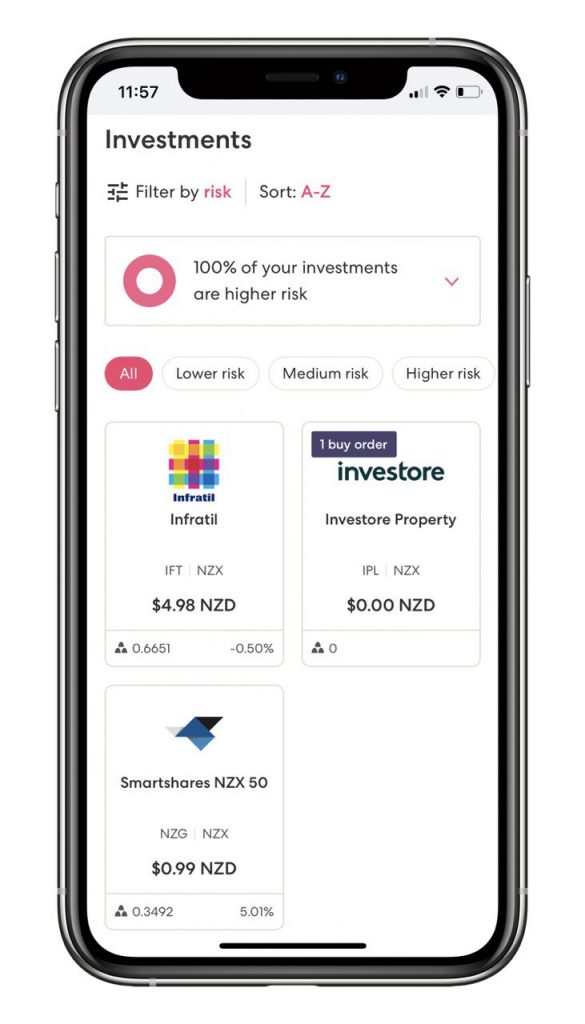

Sharesies is known to be a user friendly investment platform, and they even offer native mobile apps for iOS and Android devices. It’s great that they’re making investing more accessible, but this friendliness comes with a potentially huge downside. It could lead to the excessive checking of your portfolio, which can then lead to undesirable actions like the panic selling or constant tweaking your investments.

Take the COVID-19 lockdown announcements in recent years as an example – They all resulted in the panic buying of groceries and toilet paper, something our brains push us to do to feel we have a sense of control and that we’re taking action to protect ourselves in an uncertain situation. Similar behaviour can be seen when people see volatility in their investment portfolios. Such volatility often leads to panic selling or other bad investment decisions, in an attempt to take control in a tumultuous market.

Checking your portfolio regularly only amplifies how the volatility feels. For example, someone who checks their portfolio everyday has an almost 50% chance of seeing their investments down for the day. By checking it monthly there’s an almost 40% chance you’ll see a negative return. However, someone checking their portfolio annually only has a 25% chance of seeing a negative return, and after 5 years there’s only a 10% chance. Perhaps a lot of panic selling could be avoided by checking your portfolio less often, to cut out the noise of the markets and smooth out the volatility.

So while there’s nothing wrong with having a nice UI and app, keep in mind they won’t make you a better investor, nor enhance your returns. We feel that these are more of a marketing tool, encouraging people to engage and trade more, so that platforms can collect more brokerage revenue. They push the exact opposite of what investors should be doing!

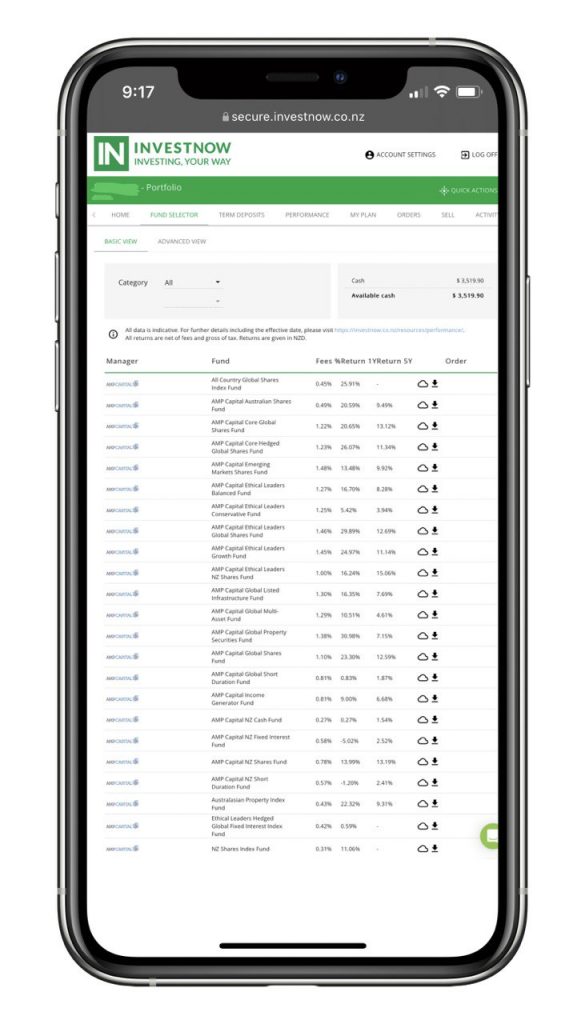

On the other hand, it’s often said that InvestNow has a bad UI. Improvements to the UI would definitely be welcome, but it’s not a dealbreaker in our view! It still gets the job done, and is a platform designed for set and forget investors who don’t need to check their portfolios everyday.

6. Earning money from dividends is a good thing

Most people like earning dividends – it’s passive income coming into your bank account (or reinvested into more shares) on a regular basis. But there can be a few issues with putting a heavy emphasis on them:

Your total returns may be lower – Dividends aren’t free money – they’re paid out of a company’s earnings. That means a dividend paying company has less money to reinvest into the company, which usually means less potential for the company to grow further and deliver capital gains. Ignoring capital gains can result in a lower overall return. Take the S&P/NZX 50 High Dividend Index for example (which contains the 25 highest dividend paying companies on the NZX), which has delivered a 11.08% p.a. return over the last 10 years. This has underperformed the main S&P/NZX 50 index which has delivered a 12.43% p.a. return over the same period.

Your portfolio might become under diversified – By focussing on dividends, you might end up picking companies in sectors that tend to pay higher dividends like real estate, financials, and utilities. You may be missing out on potentially higher growth sectors like technology and healthcare.

It may encourage the selection of poor quality companies – People often invest in companies based on its dividend yield, frequency (e.g. monthly), or timing of dividend payments (e.g. in August). But a company’s dividend yield is backwards looking (based on past dividend payments) and isn’t a guarantee of future payouts, while high yields are often indicative of a company with limited or negative growth prospects. Similarly, picking companies based on dividend frequency or timing is a bad strategy, as these factors don’t say anything about the dividend’s sustainability or quality of the company.

Your portfolio may be less tax efficient – Depending on the exact composition of your portfolio, a focus on dividends may result in it being taxed less efficiently. Dividends are taxed most of the time, while capital gains usually aren’t.

So while dividend paying companies are an important part of a well diversified portfolio, they probably shouldn’t be your only focus. Instead your potential total returns (dividends + capital gains) are a more important metric.

Further Reading:

– Dealing with Dividends – 5 things to know about them

7. If you had invested in the S&P 500, you would’ve made a 26.89% return in 2021

It’s true that the S&P 500 delivered a 26.89% return in 2021. But the problem with this statement is that you can’t actually invest in an index like the S&P 500 or NZX 50. An index is just a bunch of data, rather than an investment product – you could think of it simply as a spreadsheet which contains a list of companies.

However, you can invest in a fund that tracks an index (i.e an index fund). Take the S&P 500 index for example – you can’t buy the S&P 500, but you can buy a fund which contains the 500 companies within the index. This difference may seem like a minor technicality, but there’s quite a few major implications to this:

- Index funds have to pay tax, while indices don’t.

- Index funds charge management fees, while indices don’t.

- Index funds hold a tiny bit of cash (which may be a drag on performance), while indices don’t.

- Index funds incur costs to buy/sell the assets within the fund.

- Investors often have to pay brokerage, spreads, and foreign exchange fees to buy or sell index funds.

Therefore it’s impossible for index funds to deliver the same returns as the index. An S&P 500 index fund would not have given you that same 26.89% return as the index did in 2021, but rather it would’ve delivered a net return that’s a couple of percentage points lower. We still think index funds are great products (that we personally use) and most of these issues still persist with other products like actively managed funds. But just make sure you factor these costs in if you’re trying to make projections on how much your portfolio will be worth in the future.

Further Reading:

– What do NZX 50, S&P 500, and Total World index funds actually invest in?

8. My investment will compound more if I invest everything in one fund

Compounding is an important concept in investing. Compound interest refers to the ability to earn interest on your interest, allowing you to make money off your profits in addition to your own money. While shares don’t pay interest, share investors can still benefit from compounding. For example, dividends can be reinvested to buy more shares, resulting in compounding dividends. And companies that don’t pay dividends tend to reinvest their profits to further grow the company, which could result in the company making even more profits (compounding returns). This compounding effect can greatly increase your earnings, especially over the long-term.

There’s a misconception that you’ll earn more interest/returns and get a greater compounding effect if you invested everything in one bank account or fund, than if you were to split your money across multiple accounts/funds. This isn’t correct – Returns and any subsequent compounding are the same regardless of the number of funds you’ve invested in. Take the following scenarios for example:

- Scenario 1 – $10,000 invested in 1 fund

- Scenario 2 – $10,000 evenly split across 2 funds

If each fund made a return of 5% per year and we compounded the returns, here’s how much money we’d end up with in each scenario:

| Scenario 1 (1 fund) | Scenario 2 (2 funds) | |

| Year 0 | $10,000 | $5,000 + $5,000 = $10,000 |

| Year 1 | $10,500 | $5,250 + $5,250 = $10,500 |

| Year 2 | $11,025 | $5,512.50 + $5,512.50 = $11,025 |

| Year 3 | $11,576.25 | $5,788.125 + $5,788.125 = $11,576.25 |

In either scenario, after 3 years we’ve ended up with the same total dollar amount of $11,576.25.

9. Now’s a good time to buy inflation hedging assets

Inflation is currently sky high, and many investors are interested in picking up investments that can take advantage or hedge against that like infrastructure companies or even gold. But we think this is an example of placing a short-term bet on the markets or chasing the flavour of the day. Examples of such trends are:

- Energy related assets in recent months, as oil prices have skyrocketed

- The NFT craze in 2021

- Meme stocks and coins like GameStop and Dogecoin in 2021

- Work from home stocks in 2020, as the world shut down in response to COVID-19

- Internet stocks in 2000

There’s nothing wrong with picking assets you think will do well, but chasing what’s trendy can be dangerous:

- There’s no guarantee that what’s trending will outperform the market, especially if you get in at the later stages of a trend playing out.

- The trend will end. Just like economies have always recovered from recessions, inflation will eventually cool down sooner or later. The flavour of the day will often become tomorrow’s losers. Take Zoom for example whose share price increased by over 400% in 2020 (as people started to work from home due to the pandemic), but has dropped by more than half since then as the world started to return to normal.

We think a better approach is to have an “all-weather portfolio” – A portfolio which you can confidently hold long-term through good and bad times, and periods of high or low inflation, instead of constantly trying to guess which direction the wind is going to blow. An all-weather portfolio should be well diversified and aligned to your goals and risk tolerance. For us this is broad market index funds with a few sector and thematic funds thrown into the mix. That way we don’t have to constantly tweak our investments in response to news headlines.

10. If you don’t know what shares to pick, a good place to start is to look at companies you already use

Knowing where to start with investing is challenging, thanks to the overwhelming number of companies and funds you can possibly invest in. So a tip that’s commonly dished out (including from platforms like Hatch) is to start with companies you’re already familiar with.

A good place to start is with the products, services, and brands that you’re already spending your money on

Hatch

This is reasonable, well intentioned advice. It’s better than investing in a company you don’t understand, and it makes investing more engaging. Not only can you be a customer of Apple or Netflix, but you can be a shareholder of those businesses too! However, just because you know a company, doesn’t necessarily make it a good investment. You being a customer of a company doesn’t say anything about its quality, growth prospects, or financials.

In addition, you may be limiting your investable universe to only companies and industries you know. Financial markets are incredibly vast with thousands of companies across hundreds of industries, and sticking to what you know could result in concentrating your portfolio towards certain sectors (for example, a portfolio concentrated towards technology, without any exposure to healthcare).

Therefore we believe that if you don’t know where to invest, then it’s better start with a fund. Let the professionals pick which companies to invest in for you, or use an index fund to invest in an entire segment of the market at once. And if you really want to invest in particular companies you like, you can always take a core-satellite approach to building a portfolio. This involves investing the majority of your money in relatively boring broad market funds, and adding small investments into more interesting investments like individual companies to keep your portfolio exciting without adding too much risk.

Further Reading:

– 6 ways to build a long-term investment portfolio in New Zealand

11. Share splits are a good thing

Over the past couple of years, a bunch of companies like Amazon, Alphabet, and Tesla have announced share splits. These all attracted a lot of hype, for example, Tesla shares jumped 8% on the day a potential share split was announced.

However, share splits do nothing to change the fundamental value of a company, nor do they give you free money. Take Amazon for example, who did a 1 for 20 share split this month. When this happened every share of AMZN you owned became 20 shares of AMZN. In addition, the company’s share price reduced by 20 times to reflect the split. Let’s say you held 1 Amazon share – how did this play out?

- Before the split you had 1 AMZN share worth ~$2,500 USD

- After the split you now have 20 AMZN shares worth ~$125 USD each, which totals up to be ~$2,500 USD

It’s like changing a $100 note for twenty $5 notes – In either case you have $100. Or it’s like cutting 1 slice of pizza up into 20 – You’ll end up with 19 more slices than what you started with, but you’ll still have the same amount of pizza!

Some may argue that share splits increase liquidity and accessibility of a company’s shares. But this doesn’t have any real implications for most retail investors, who can already buy fractional shares through most popular investing platforms. Instead all share splits really do is trick people into thinking the shares are more attractive as they become “cheaper” and allow you to buy a higher quantity. Therefore we believe it’s a bad idea to make investment decisions based on share splits.

Further Reading:

– Rights issues, share buybacks, and acquisitions – 5 things to know about Corporate Actions

– Do Stock Splits ACTUALLY Boost Returns? What the Numbers Say (The Plain Bagel)

12. It’s too expensive to get professional financial advice

It’s somewhat true that professional financial advice is inaccessible. Many require you to have lots of money to invest (e.g. $100,000+), and others charge thousands of dollars in fees. However, there’s a few options which are both accessible and have relatively low fees (or are even free). But they do come with downsides such as having limited investment options. Examples are:

- BetterSaver – Provides free advice on what KiwiSaver fund best suits you. They make money by earning commission from the KiwiSaver funds they recommend to their customers. Their downside is that they’re limited to providing advice on only 7 KiwiSaver schemes (all actively managed).

- Craigs mySTART – Provides portfolio construction advice, with a low minimum investment of $100. Their downsides are limited investment options (a selection of around 200 shares and funds), and higher brokerage and management fees compared with DIY investment platforms.

- ANZ – Offers free investment advice. Their downside is that they can only offer ANZ’s investment products (e.g. ANZ KiwiSaver and investment funds).

To get around these downsides you might consider using a fee-only adviser. These advisers aren’t paid a commission so aren’t tied to recommending you specific products. Instead they charge you a one-off fee for their advice. You can find a list of these advisers on MoneyHub. With fees starting from around $2,000, these advisers aren’t cheap.

But we think it might be more expensive not to seek professional advice. Navigating the various asset classes and investment products isn’t easy, let alone constructing a portfolio that suits your goals and personal circumstances. So despite the inaccessibility, we think using a financial advice service is worth considering alongside a DIY approach. There’s nothing wrong with learning investing yourself (that’s what this site is here for!), but getting advice will give you a massive head start over DIY investors. We’ll admit that we personally would’ve been better off using an adviser in our early days of investing instead of aimlessly throwing our money into different assets.

Further Reading:

– What I learnt – The Great FMA Debate: DIY Investing

Conclusion

That’s all for our second instalment of investing myths and misconceptions busted. Hope you took away something useful from it, and be sure to check out our first myths and misconceptions article if you haven’t already.

Are there any myths and misconceptions we missed? Or any points in the article you disagree with? Let us know in the comments below!

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Thanks always enjoy your clear information

Cheers Sandra 😊

Thanks Sandra!