Index funds are an investment we often write about here on Money King NZ, and are also what we primarily use in our personal investment portfolios. They’re an understandably popular way to invest – they have low fees, can provide diversification across different companies and industry sectors, and save us from having to research and pick individual stocks. NZX 50, S&P 500, and Total World index funds are some of the most commonly talked about, providing Kiwi investors with broad exposure to domestic and international shares.

While index funds are an incredibly easy way to invest, it’s not always clear to investors what these funds actually invest in and how they work. So this article is here to help, covering the basics of how index funds operate, and what companies and industries are inside the popular NZX 50, S&P 500, and Total World funds.

This article covers:

1. The S&P/NZX 50 Index

2. The S&P 500 Index

3. The FTSE Global All Cap Index

Update (4 Apr 2022) – AMP’s funds have been renamed to Macquarie

1. The S&P/NZX 50 Index

The index

An index measures the performance of a slice of a financial market. They were originally developed for journalistic purposes to provide a simple summary of what had happened in the sharemarket on a given day, instead of having to report the individual performance of each company!

The S&P/NZX 50 index is the main index used to gauge the performance of New Zealand shares, measuring the performance of the 50 largest companies listed on the NZ sharemarket. While there’s many more than 50 companies listed on the NZX, the index is still seen to provide a reliable indicator of how the market is doing, given it represents ~90% of the size of the NZ sharemarket.

You can’t invest in an index directly – an index like the S&P/NZX 50 is just data rather than a financial asset. However, you can invest in an index through an index fund. These funds invest according to an index, aiming to track that index (or in other words, match the performance of that index). Index funds that track the S&P/NZX 50 Index include the:

Constituents

So how do index funds match the performance of an index? They do so by investing in all of the constituents of that index (i.e. the companies contained within that index). As the name suggests, the S&P/NZX 50 Index has 50 constituents including Mainfreight, SKYCITY, a2 Milk, and Air New Zealand:

Therefore the performance of index funds like the Smartshares S&P/NZX 50 ETF is directly influenced by the collective performance of these 50 companies. For example, if the price of the 50 companies in the index go up, the value of the fund will also rise.

Selecting constituents for an index like the S&P/NZX 50 is a bit more complicated than simply picking the 50 largest NZX listed companies. Indices have specific methodologies (rules and criteria) for determining what companies are eligible for inclusion in an index. For example, indices will often filter out companies deemed to be too illiquid (i.e. companies that don’t have much trading activity on the sharemarket). We won’t get into the details, but the full methodology for the S&P/NZX 50 Index can be found here.

Weightings

How do index funds know how many shares of each constituent company to buy? TO do this they look at the weighting of each constituent. Weighting simply refers to what proportion of an index fund is invested in a given constituent. For example, The S&P/NZX 50 Index has a ~14% weighting towards Fisher and Paykel Healthcare. Therefore for every $100 you invested in a S&P/NZX 50 index fund, ~$14 would be invested in Fisher and Paykel Healthcare shares.

The S&P/NZX 50 Index is weighted by market cap (the total value of a company’s shares). Larger companies have larger weightings and make up a larger proportion of the index, while smaller companies make up a smaller proportion. Therefore large companies like Fisher & Paykel Healthcare, Auckland Airport, and Spark have a greater influence on the index’s performance compared with small companies like SKY TV and Napier Port.

Other indices may use other methodologies to determine the weightings of each constituent. For example, in an equal-weighted index each constituent has the same weighting regardless of their size.

The weightings of most market cap weighted indices are float-adjusted which essentially means a company’s weighting is adjusted down for any shares that are unable to be traded by the public. These could be shares that are held by the company’s founders, directors, governments, or any other insiders. For example, Restaurant Brands has a market cap of ~$1.8 billion which is big enough to make them a mid-sized company on the S&P/NZX 50 index. However, given most of the company’s shares are owned by Mexican company Finaccess Capital (whose shares are not in circulation on the sharemarket), Restaurant Brand’s weighting has been adjusted down significantly, making them one of the smallest companies in the index.

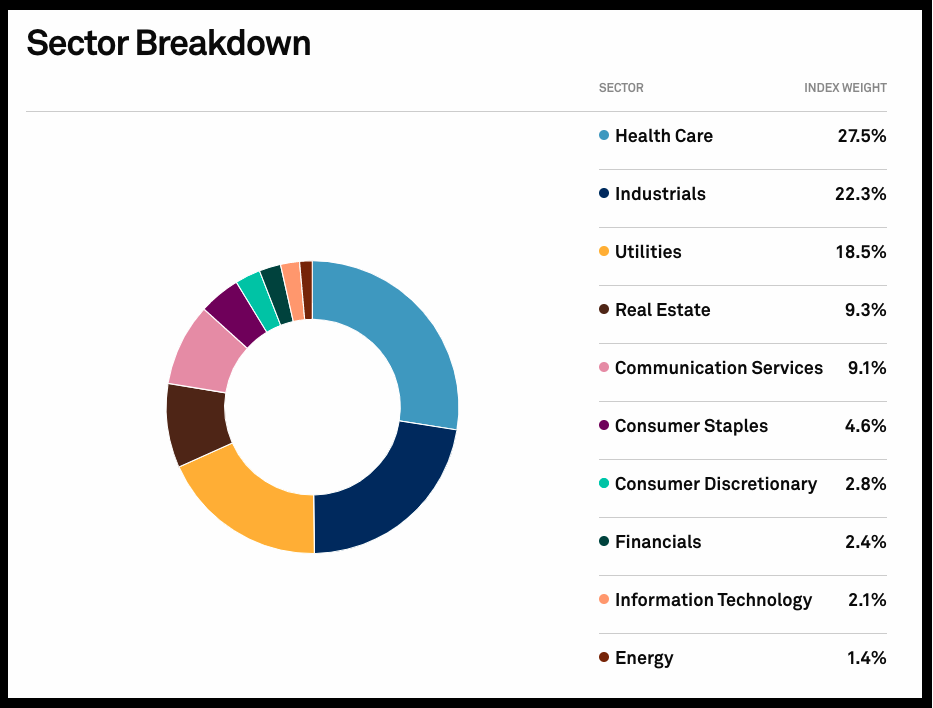

Once you take into account the weightings of each constituent we can see what industry sectors the S&P/NZX 50 index is exposed to. The largest sector exposures are Healthcare (e.g. Fisher and Paykel Healthcare, Summerset Holdings), Industrials (e.g. Auckland Airport, Mainfreight), and Utilities (e.g. Meridian Energy, Contact Energy). The index also has a sizeable 9.3% allocation towards Real Estate companies – therefore investors don’t need to invest in a standalone property fund to get exposure to that sector.

Rebalancing

The constituents of an index don’t last forever – companies inside the index may no longer meet the criteria for inclusion in an index, for example, if they perform poorly causing their market cap to shrink. And at the same time companies outside an index may emerge and come into contention for inclusion, for example, if a smaller company performs well and grows its market cap.

Companies within the index can also change, requiring adjustments to their weightings. For example, a company might raise capital and issue new shares which affects their market cap, which in turn affects their weighting on an index.

Therefore indices undergo maintenance on a regular basis through rebalancing, where the constituent companies of an index are reviewed, and replaced or re-weighted if necessary. The S&P/NZX 50 Index is rebalanced quarterly in March, June, September, and December.

Lastly, outside of the normal rebalancing schedule companies can get added and deleted from the index at any time. For example, if a company goes bust or delists from the NZX (e.g. due to being acquired by another company), the index will remove that company as a constituent and replace it with another company.

What is S&P?

S&P Dow Jones Indices is an index provider who are responsible for designing and running indices including determining the constituents and weightings of the index, and ongoing rebalancing. Index fund managers like Smartshares, AMP, and Kernel buy a license from S&P to use their indices for their funds. Other big index providers include FTSE and MSCI.

Other NZX indices

While the S&P/NZX 50 is the flagship index for the NZ sharemarket, there are many more indices covering the NZX. Most of them represent different slices of the S&P/NZX 50 index:

- S&P/NZX 50 Portfolio Index – Almost identical to S&P/NZX 50 Index, containing the 50 largest companies listed on the NZX. However, the Portfolio index has a maximum weighting of 5% towards a single constituent. Tracked by the Smartshares NZ Top 50 ETF and Harbour NZ Index Shares Fund.

- S&P/NZX 50 Portfolio ESG Tilted Index – Same as the above, but weights constituents with a sustainability twist. Companies considered to have good ESG (Environmental, Social, Governance) practices have their weightings adjusted upwards, while companies with poor ESG scores have their weightings adjusted down. The index also excludes companies operating in contentious industries such as SKYCITY (gambling) and Z Energy (fossil fuels). Tracked by the Kernel NZ 50 ESG Tilted Fund.

- S&P/NZX 10 Index – Contains the 10 largest companies listed on the NZX. Tracked by the Smartshares NZ Top 10 ETF.

- S&P/NZX Mid Cap Index – Contains the same constituents as the S&P/NZX 50, excluding companies in the S&P/NZX 10 index (i.e. the 10 largest companies) and any foreign based companies like Westpac and ANZ. Tracked by the Smartshares NZ Mid Cap Index.

- S&P/NZX 20 Index – Contains the 20 largest companies listed on the NZX. Has a maximum weighting of 15% towards a single constituent. Tracked by the Kernel NZ 20 Fund.

- S&P/NZX Emerging Opportunities Index – Contains companies outside of the S&P/NZX 20 Index who have a market cap of between $100 million and $1 billion. It’s the only index here to contain companies outside of the S&P/NZX 50 like Hallenstein Glasson, Turners, and My Food Bag. Tracked by the Kernel NZ Small & Mid Cap Opportunities Fund.

- S&P/NZX 50 High Dividend Index – Contains the 25 highest dividend yielding companies in the S&P/NZX 50. Tracked by the Smartshares NZ Dividend ETF.

- S&P/NZX Real Estate Select Index – Contains the 8 major REITs (Real Estate Investment Trusts) listed on the NZX. Tracked by the Smartshares NZ Property ETF and the Kernel NZ Commercial Property Fund.

Further Reading:

– What’s the best NZ shares index fund in 2022?

– More funds = less diversification? Are you investing in too many funds?

2. The S&P 500 Index

The index

The S&P 500 Index is perhaps the most famous one in the world, measuring the performance of the 500 largest companies listed in the US, and representing about 80% of the US sharemarket. Index funds that track the S&P 500 include the:

Index funds tracking the S&P 500 are popular among both beginner and expert investors (like Warren Buffet) as they provide easy access to recognisable companies from the world’s largest sharemarket, diversification across many companies and industries, and have delivered consistently strong returns over the long-term despite the many ups and downs.

Further Reading:

– Smartshares US 500 (USF) vs Vanguard S&P 500 (VOO) – Which ETF is better?

Constituents

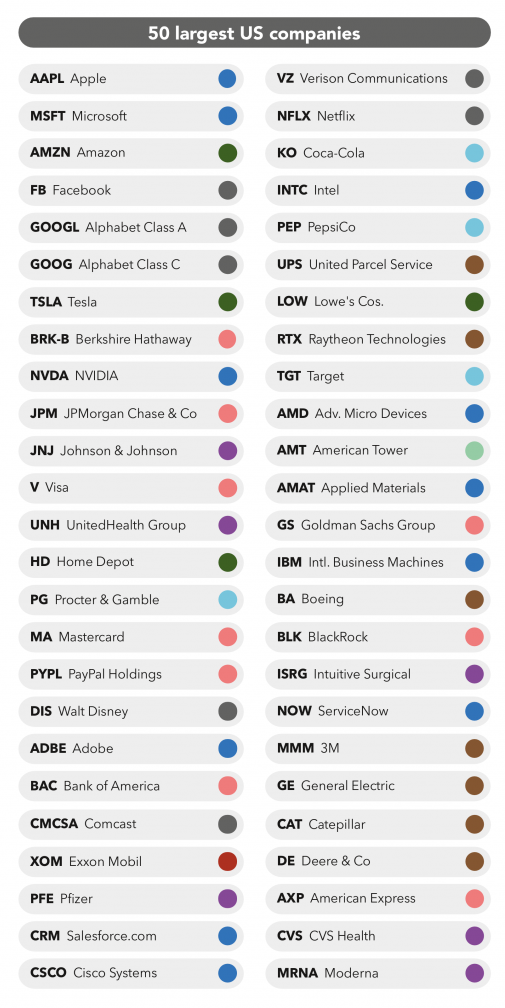

The S&P 500 Index is packed full of big names such as Amazon, Meta (Facebook), and Tesla. we won’t list out every single constituent here, but if you want to see the whole list you can do so by checking out the entire holdings of the Vanguard S&P 500 ETF.

The index has a quirk where it contains 505 constituents. This is because five companies in the index have two classes of stock. For example, Alphabet has Class A and Class C stock listed on the market. These are counted as two constituents, but only take up one slot in the 500 companies allowed in the index.

Weightings

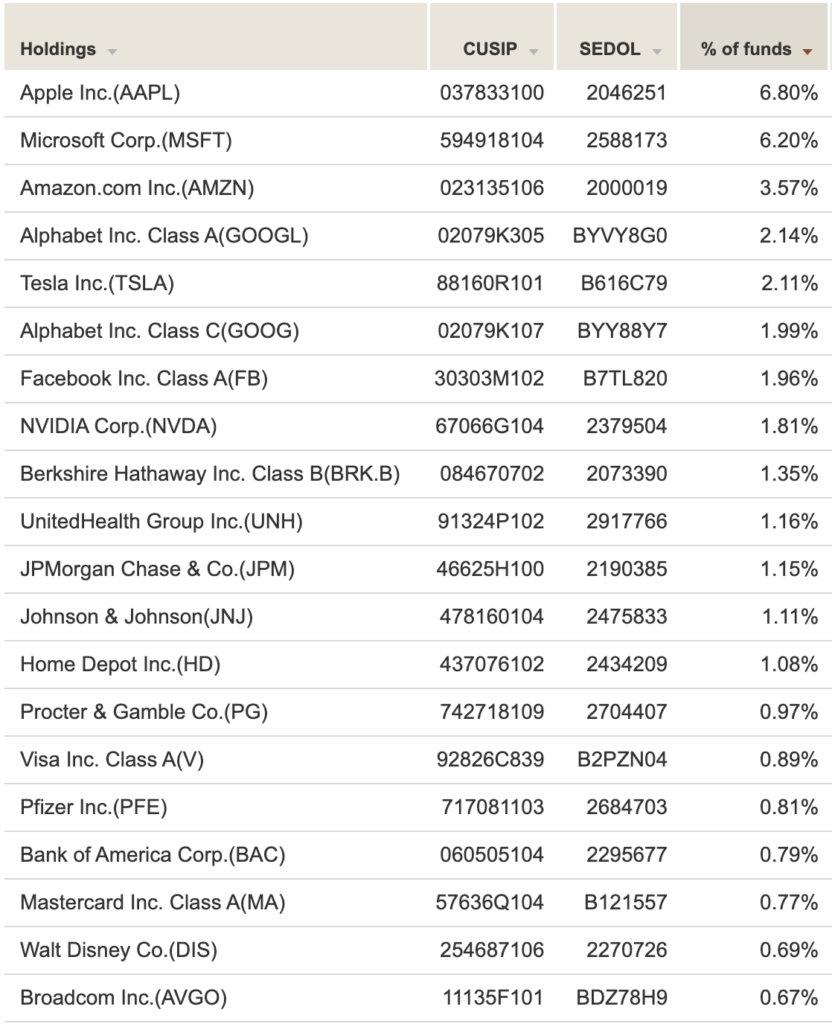

With market caps well over $1 trillion each, big tech companies like Apple, Microsoft, and Amazon have by far the largest weightings in the S&P 500 index – and will therefore have the largest influence on the ups and downs of the index:

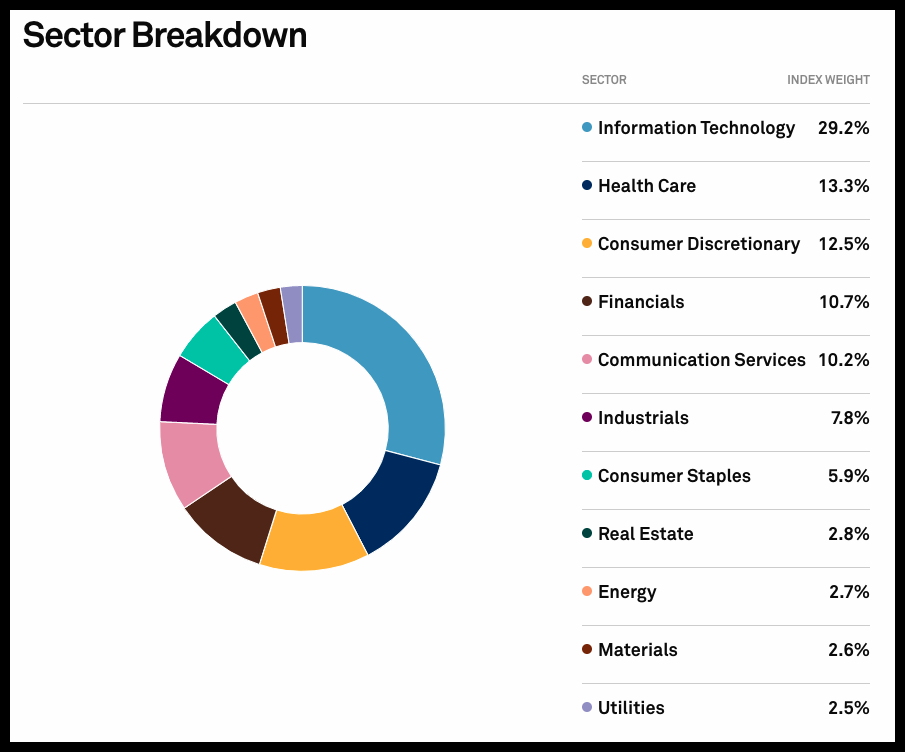

As for what sectors are represented in the S&P 500, the index is unsurprisingly tech-heavy. But it still provides plenty of diversification across sectors:

Rebalancing

The S&P 500 index is rebalanced quarterly inMarch, June, September, and December.

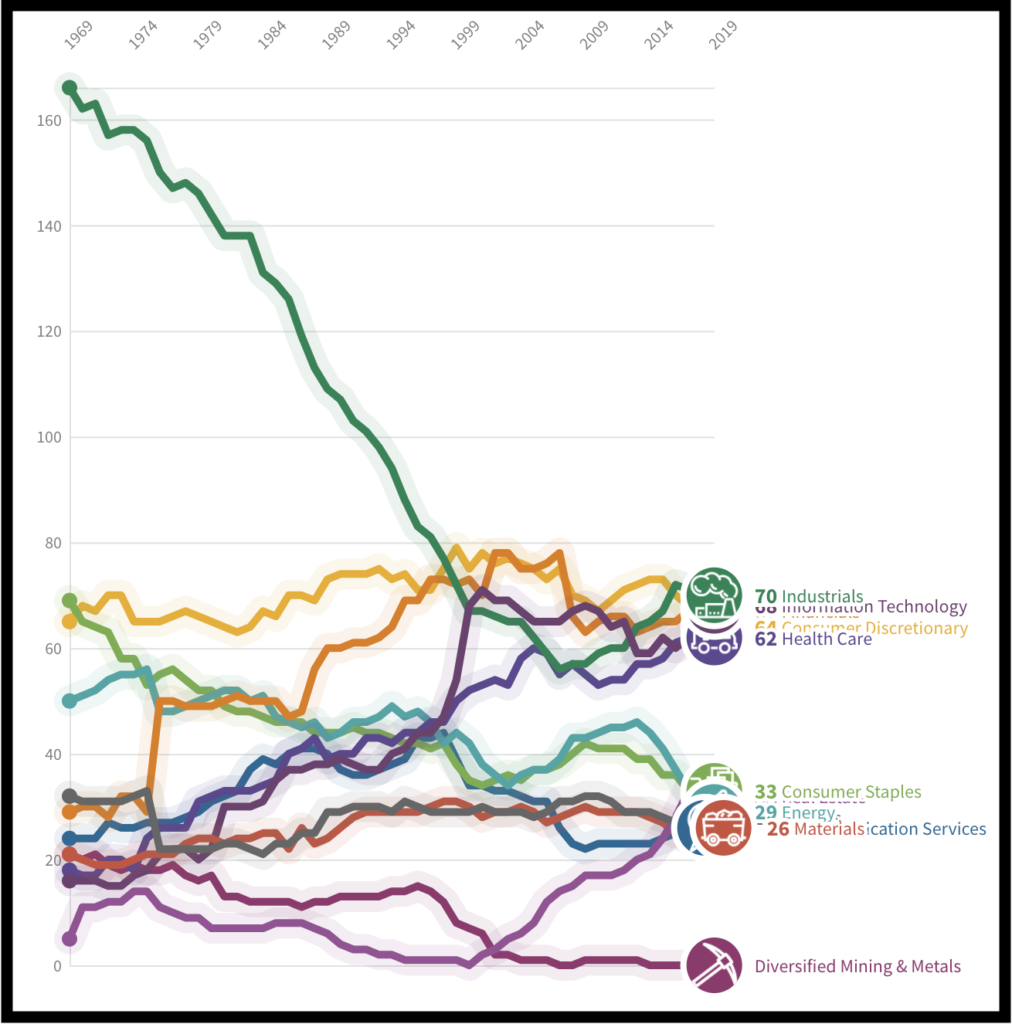

The index was founded in 1957, so with its long history we can see how rebalancing has affected the index. The below chart from a handy blog post from QAD shows a sharp decline in the number of Industrials sector companies in the index over the decades, with increased representation from companies in sectors like IT and Healthcare:

This is useful in demonstrating one of the most important features of index funds in that they regularly and automatically have poorly performing companies cleaned out, letting relatively newer companies like Amazon and Tesla come in (whereas picking your own stocks and actively managed funds require a lot more effort to determine when to sell out of a company). In fact, the average lifespan of a company to be on the S&P 500 is just 16-17 years, with rebalancing working to help keep the constituents on the index relevant to the world we live in.

Other US indices

There’s tons more US indices, but here’s just a few that are tracked by NZ domiciled index funds:

- MSCI USA ESG Screened Index – This index is based on the MSCI USA Index which contains 628 large and mid-cap companies listed in the US. The ESG Screened index excludes companies in the USA Index which are involved in industries such as controversial, civilian and nuclear weapons, tobacco, and thermal coal. After screening these companies out, the ESG Screened index contains 593 constituents. Tracked by the Smartshares US Equities ESG ETF.

- CRSP US Large Cap Growth Index – Contains ~270 US listed large-cap companies which are considered to be growth stocks. These are companies that are seen to have higher potential for growth such as Apple, Tesla, and NVIDIA. Tracked by the Smartshares US Large Growth ETF.

- CRSP US Large Cap Value Index – Contains ~350 US listed large-cap companies which are considered to be value stocks. These are companies that typically have lower growth prospects, but are seen to be trading at a lower price than what they’re actually worth such as Berkshire Hathaway, Johnson & Johnson, and Pfizer. Tracked by the Smartshares US Large Value ETF.

3. The FTSE Global All Cap Index

Index

The S&P 500 Index arguably provides a reasonable level of global diversification, despite only containing US listed companies. That’s because the index’s constituents derive ~30% of their revenues from outside the US, giving it some global economic exposure. However, the S&P 500 ignores all the companies listed in other parts of the world like Europe and Asia.

That’s where the FTSE Global All Cap Index comes in, providing a greater level of geographic diversification by investing in companies from both developed and emerging markets from all around the world.Index funds that track the FTSE Global All Cap Index include the:

Constituents

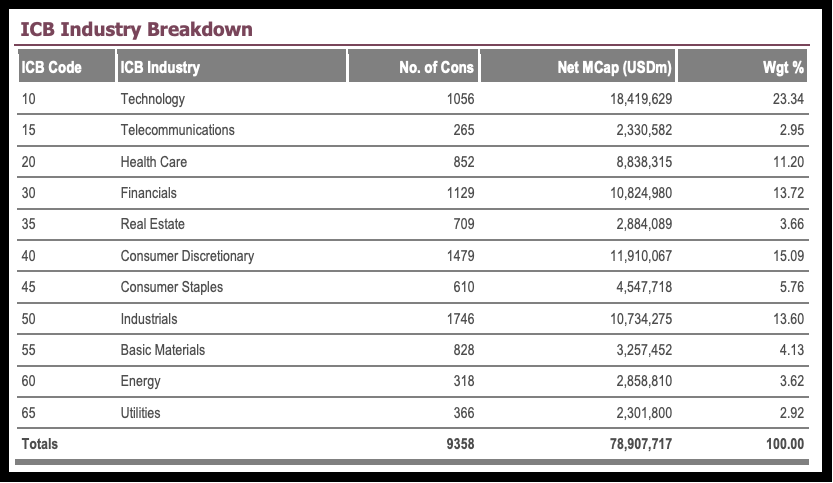

The constituent list for this index is extensive with over 9358 companies from 49 countries. This includes S&P 500 companies like Apple, Tesla, and Visa, but diversifying beyond the US gives exposure to companies like Alibaba, Samsung Electronics, and Unilever.

In addition, while indices like the S&P 500 focus on large-cap companies, the FTSE Global All Cap Index also contains small-cap companies. For example, the index contains over 1,800 constituents from the US, going well beyond the 505 contained in the S&P 500.

Weightings

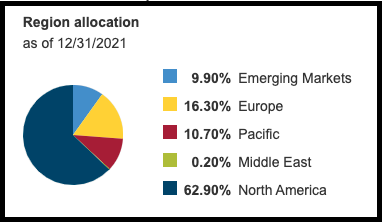

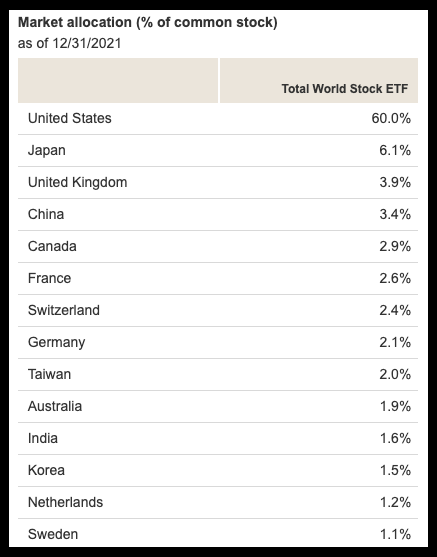

TheFTSE Global All Cap Index provides significantly more global diversification than the S&P 500, with sizeable weightings towards companies listed in Europe, Asia Pacific, and Emerging Markets (like China, India, and Brazil):

Despite investing in so many regions and countries, the FTSE Global All Cap Index still includes a heavy 60% weighting towards the US. Therefore if you’re investing in a fund that tracks this index, there’s no need to also invest in a S&P 500 fund to get exposure to the US market (unless you have good reason to double down on US shares).

Like the S&P 500, theFTSEGlobal All Cap Index has a heavy weighting towards tech companies:

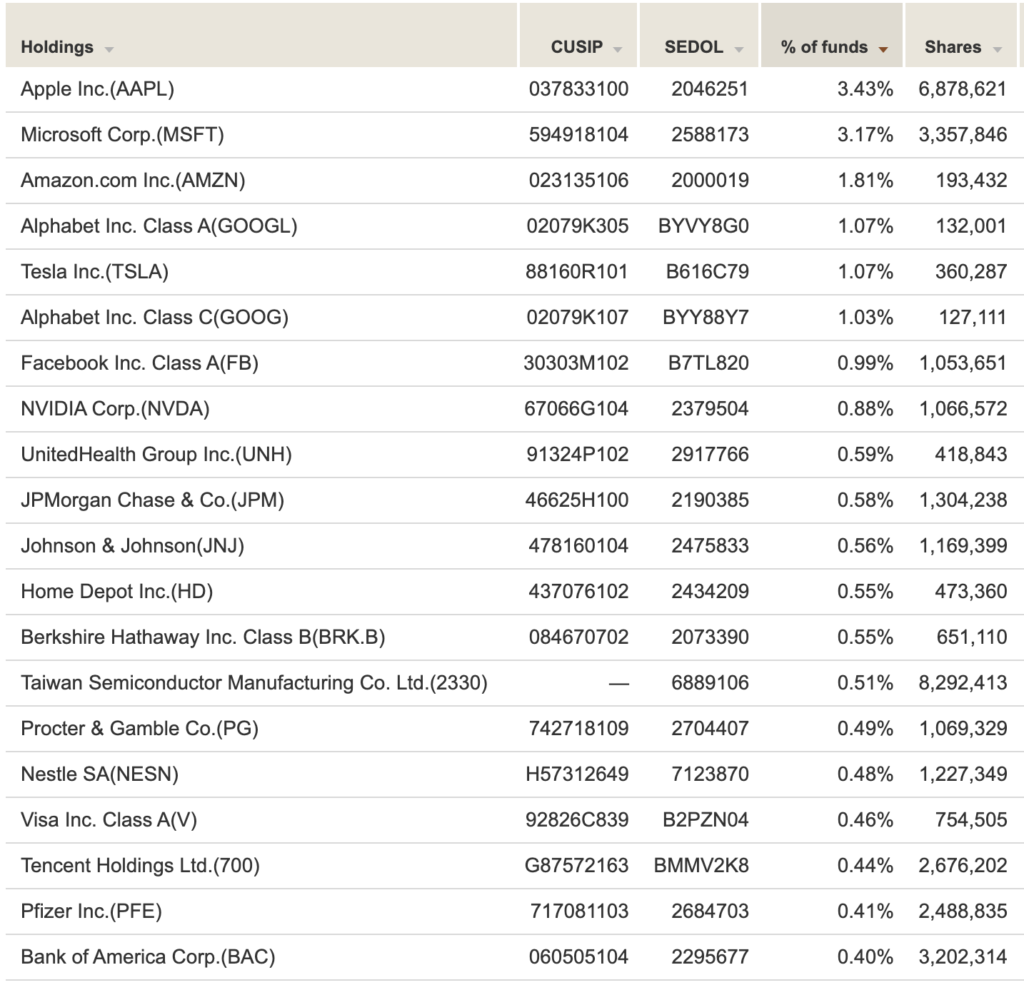

Also similar to the S&P 500 index, the tech giants have the largest weightings in the FTSEGlobal All Cap Index. In fact the largest companies in the index are almost identical to the S&P 500 (given the huge size of so many US companies), except for a few international companies sprinkled in like Taiwan Semiconductor Manufacturing Co, Nestle, and Tencent Holdings.

Rebalancing

The FTSE Global All Cap Index is rebalanced semi-annually in March and September.

Other global indices

There’s heaps more global share indices, but here’s just a few that are tracked by NZ domiciled index funds:

- MSCI All Country World ex Tobacco Index – Contains companies from both developed and emerging markets. With a focus on larger companies, the index has fewer constituents (~2,900) compared with the FTSE Global All Cap Index. Tracked by the Macquarie All Country Global Shares Index Fund.

- S&P Global 100 Ex-Controversial Weapons Index – Contains 100 large, global companies from around the world. Has a roughly 70% allocation towards the US, with the remaining 30% weighting towards companies from Europe and Asia Pacific. Tracked by the Kernel Global 100 Fund.

- S&P Developed Ex-Korea Dividend Aristocrats Quality Income Index – A more specialised index containing 90 companies from around the world which have consistently maintained and/or increased their dividends for at least the last 10 years. The index is weighted by dividend yield, and has a roughly 55% allocation towards the US. Tracked by the Kernel S&P Global Dividend Aristocrats Fund.

- MSCI World Ex Australia Custom ESG Leaders Index – Contains about 675 companies that have positive ESG practices. These include companies listed in 22 developed markets including a ~70% weighting towards the US. Tracked by the Smartshares Global Equities ESG ETF.

Further Reading:

– What’s the best global shares index fund in 2022?

Conclusion

Index funds are essentially funds that make investments based on rules that determine what companies to invest in and their weightings. As a result they:

- Save investors from having to research and select individual companies, given buying an index fund means you’re investing in a whole slice of a market (like the 50 largest companies in NZ) in one go.

- Have low fees, because index fund managers don’t have to employ people to analyse and pick companies for their funds. They simply invest according to the constituents and weightings of an index.

- Tend to deliver better performance than actively picking companies, as it’s extremely hard to consistently beat the market over the long-term. Even the majority of professional fund managers fail to do so.

Hopefully this article has given you a better understanding of what some of NZ’s most popular index funds like the Smartshares S&P/NZX 50 ETF and Smartshares US 500 ETF invest in and how they work. They’re pretty powerful products, but if they don’t suit you there are millions more indices out there, so there’s sure to be an index fund that meets your investing needs and preferences.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.