Sharesies and Hatch are New Zealand’s friendly faces of investing, and are both fantastic services that have brought ETF investing much closer to everyday Kiwis. ETFs (Exchange Traded Funds) are incredibly popular options to have in your investment portfolio, giving investors instant diversification in a wide rage of companies, with low fees, and ease of buying and selling. As a quick overview:

- Sharesies is a service that allows you to buy ETFs listed on the New Zealand market.

- Hatch is a service that allows you to buy ETFs listed on the United States markets.

In this article, I want to uncover the pros and cons of creating an ETF portfolio with each service. Is it better to buy local ETFs with Sharesies or go shopping for overseas ETFs with Hatch?

Other articles you should check out:

– Buying shares in the USA – Sharesies vs Hatch vs Stake. A comparison between Sharesies and Hatch for buying US shares.

– Smartshares US 500 (USF) vs Vanguard S&P 500 (VOO) – Which ETF is better? A comparison between investing in Smartshares vs Vanguard ETFs.

– Sharesies review – Still a good investment platform in late 2021?

– Hatch review – Hard to recommend

Update (8 October 2019) – Hatch no longer charges an account inactivity fee

1. What’s on offer?

Sharesies

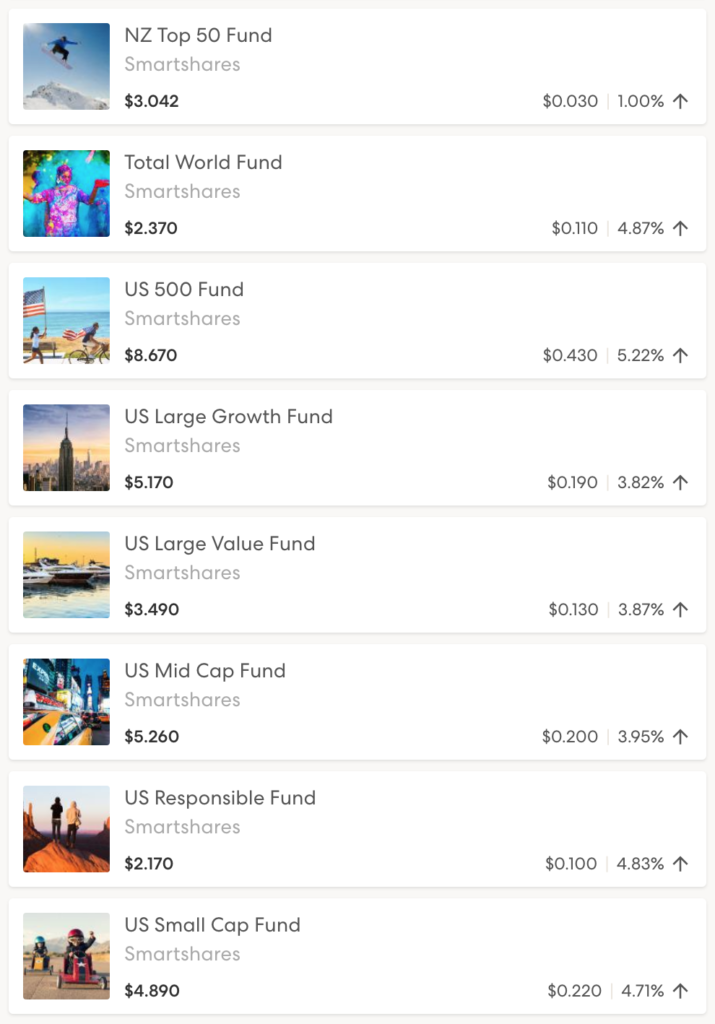

Sharesies is a Wellington based, pineapple loving company, with around 60,000 investors. They offer 32 ETFs on their platform, all of which are issued by Smartshares and include:

- Australasian share ETFs – e.g. NZ Top 50, Australian Top 20, NZ Dividend

- International share ETFs – e.g. US 500, Emerging Markets, Europe

- Sector specific ETFs – e.g. Australian Resources, Automation & Robotics

- Cash and fixed interest ETFs – e.g. NZ Bond, NZ Cash, Global Bond

All ETFs on Sharesies are NZ domiciled – i.e. based in NZ, listed on the NZ sharemarket, and traded using NZ Dollars.

Sharesies also offers the ability to buy and sell individual companies listed on the NZX, as well as some non-ETF funds offered by managers such as AMP and Pathfinder. However, these products won’t be covered in this article.

Hatch

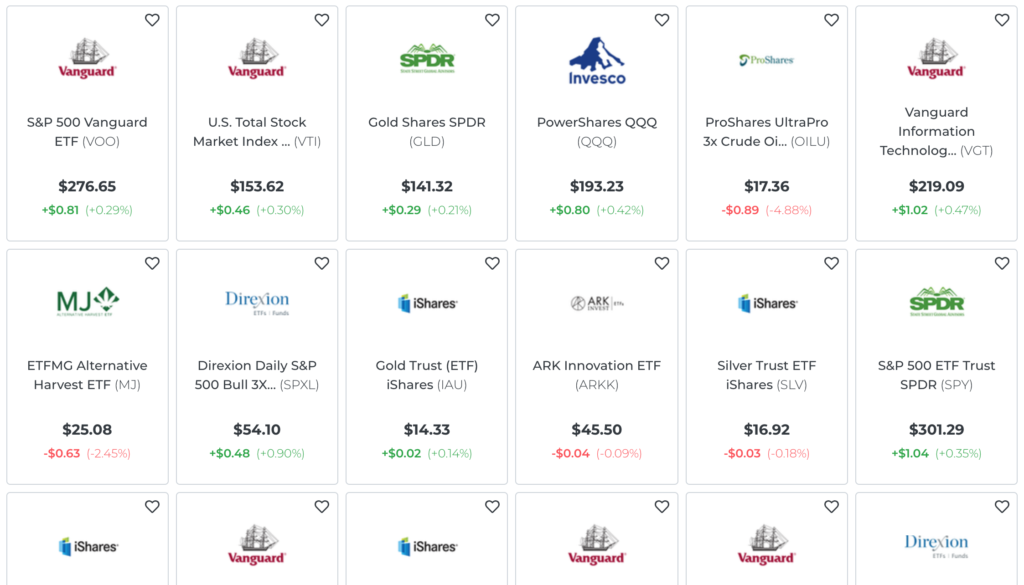

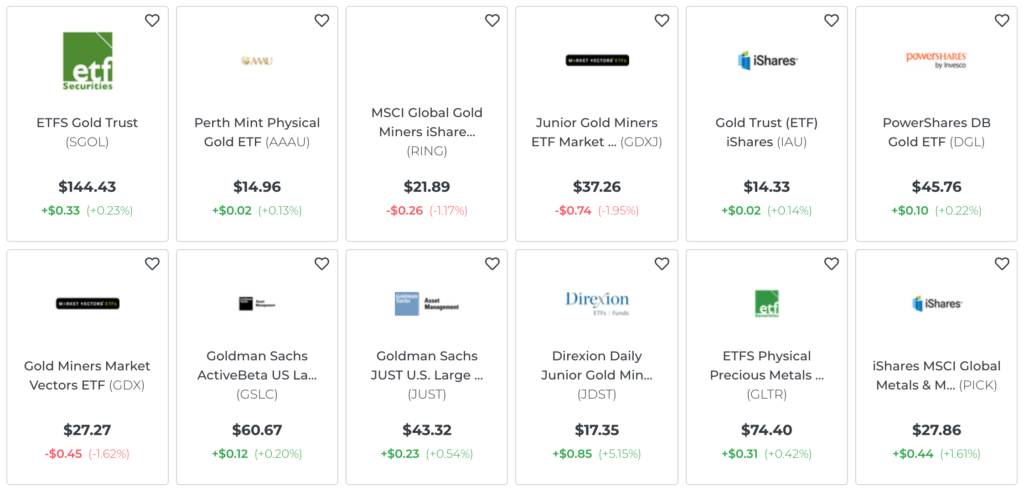

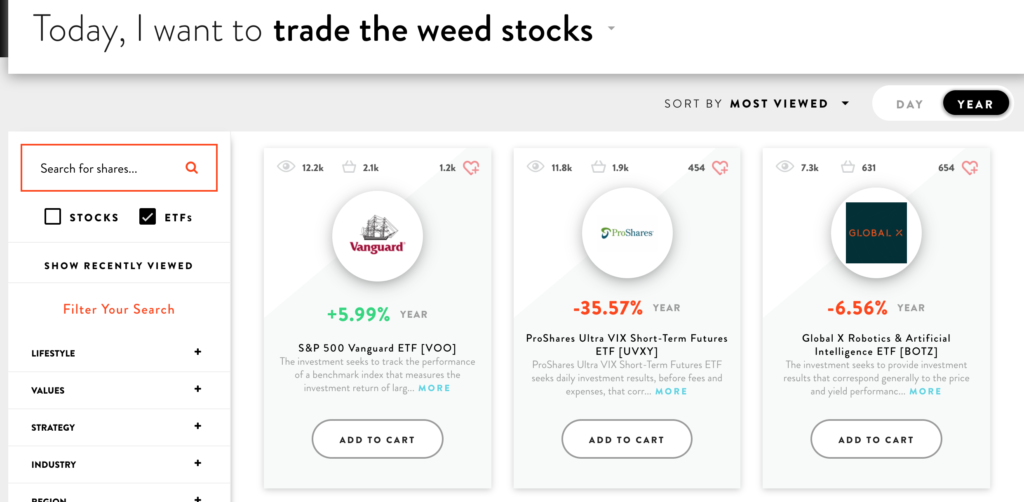

Hatch is another Wellington based service owned by KiwiWealth, and they’ve recently reached over 10,000 investors. Hatch gives Kiwis easy access to the United States sharemarket, and with this access comes the opportunity to invest in 754 different US domiciled ETFs!!!

Some of the ETF issuers are (click each one to go to their websites):

- iShares – Issued by BlackRock, they are the world’s largest ETF issuer, with over 200 of their ETFs available on Hatch

- Vanguard – The world’s 2nd largest ETF issuer, but perhaps the most famous, Vanguard offer over 60 ETFs on Hatch

- SPDR – Issued by State Street Global Advisors, they are the 3rd largest issuer of ETFS, with over 50 available on Hatch

- Global X – They are not a big ETF issuer, but they offer more niche, thematic ETFs such as those investing in Robotics and AI, and Internet of Things

Not all US ETFs are available on Hatch. In total there are over 1,500 ETFs trading in the US, so if you’re after a smaller ETF you might be out of luck. Although 754 ETFs is already plenty of choice, and you are bound to find something on Hatch that meets your investment needs.

Hatch also allows you to invest in individual companies on the US sharemarket, but this won’t be covered in this article.

Minimum investment

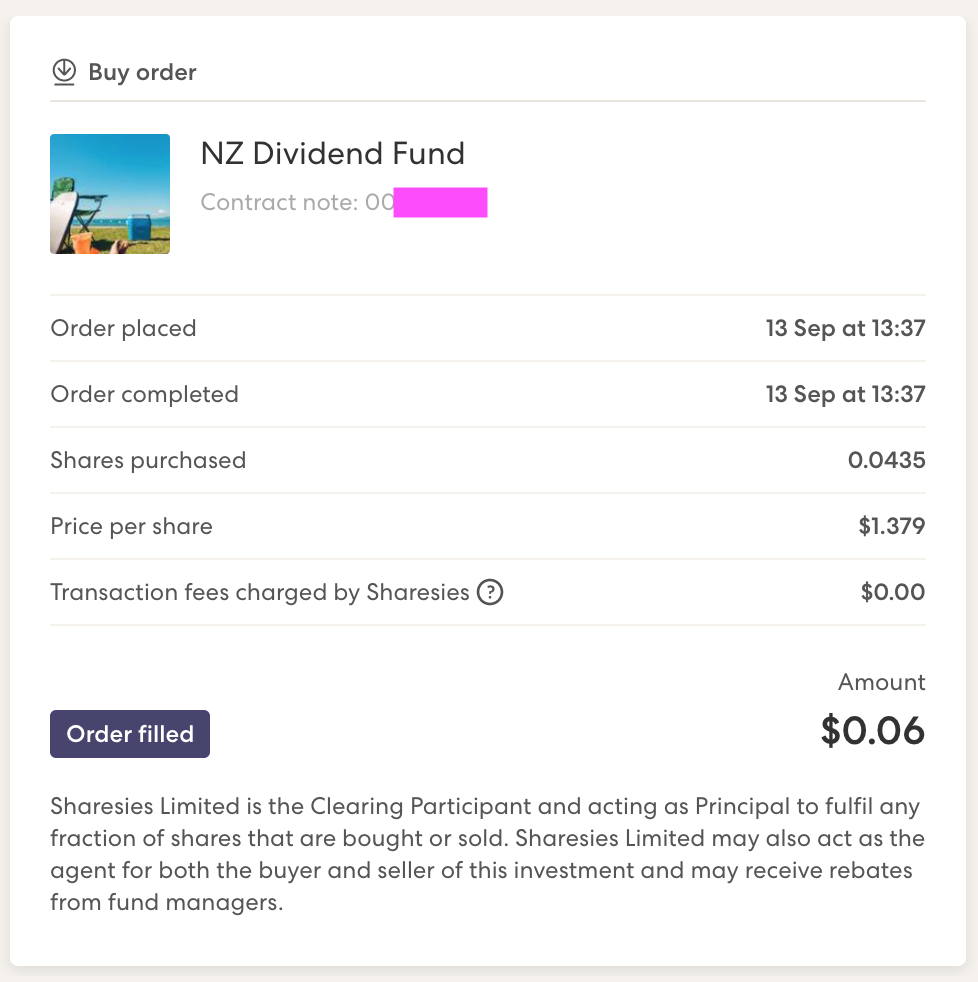

One of Sharesies’ best features is that there’s no minimum investment amount – you could make an investment of one cent if you wanted to! Hatch also has no minimum investment amount, but given their brokerage fees start from $3 USD, you probably wouldn’t want to make an investment of one cent…

Both services are able to achieve such a low minimum investment amount by offering fractional shares. This means even if you only have $50 to invest, but a share in the ETF you want to buy costs $100, you can still buy 0.5 shares of that ETF.

2. Building an ETF portfolio

Before we compare fees, I want to build an example ETF portfolio on both Sharesies and Hatch, so that you can see what a portfolio on each platform might look like.

I’ll be basing this example portfolio off the 3-Fund Portfolio concept I first introduced in the article Building an investment portfolio – Simplicity vs InvestNow. The concept is about building a very simple, but still diversified investment portfolio that typically contains three asset classes:

- International shares

- Bonds

- Domestic shares

Sharesies

Our Sharesies 3-Fund ETF portfolio will be made up of three Smartshares ETFs, with exposure to global shares, global bonds, and local NZ shares:

| ETF | Weighting |

| Smartshares Total World ETF | 60% |

| Smartshares Global Aggregate Bond ETF | 20% |

| Smartshares NZ Top 50 ETF | 20% |

Hatch

Two Vanguard ETFs will make up 80% of our Hatch 3-Fund ETF portfolio – The Total World Stock ETF, and Total World Bond ETF. Interestingly Total World Stock is the ETF that Smartshares invests in to make up 100% of their Total World ETF!

The iShares MSCI NZ ETF will make up the remaining 20% of our Hatch portfolio. It is a bit strange to buy a New Zealand ETF from a foreign market (it would be like going to the States to by a Kiwi steak and cheese pie), but we’ll roll with it for the sake of this comparison.

| ETF | Weighting |

| Vanguard Total World Stock ETF | 60% |

| Vanguard Total World Bond ETF | 20% |

| iShares MSCI New Zealand ETF | 20% |

We will be using our Sharesies 3-Fund ETF portfolio, and our Hatch 3-Fund ETF portfolio as a basis for our fee comparison below.

3. Fees

Sharesies and Hatch have very different fee structures:

Sharesies

Account fee – Sharesies charges an ongoing account fee based on the value of your portfolio, starting from $1.50 per month when you have a balance of over $50:

This is a little expensive in my opinion, particularly for smaller balances. For example, a $1,000 portfolio would attract account fees of $18 per year, which equates to 1.8%!

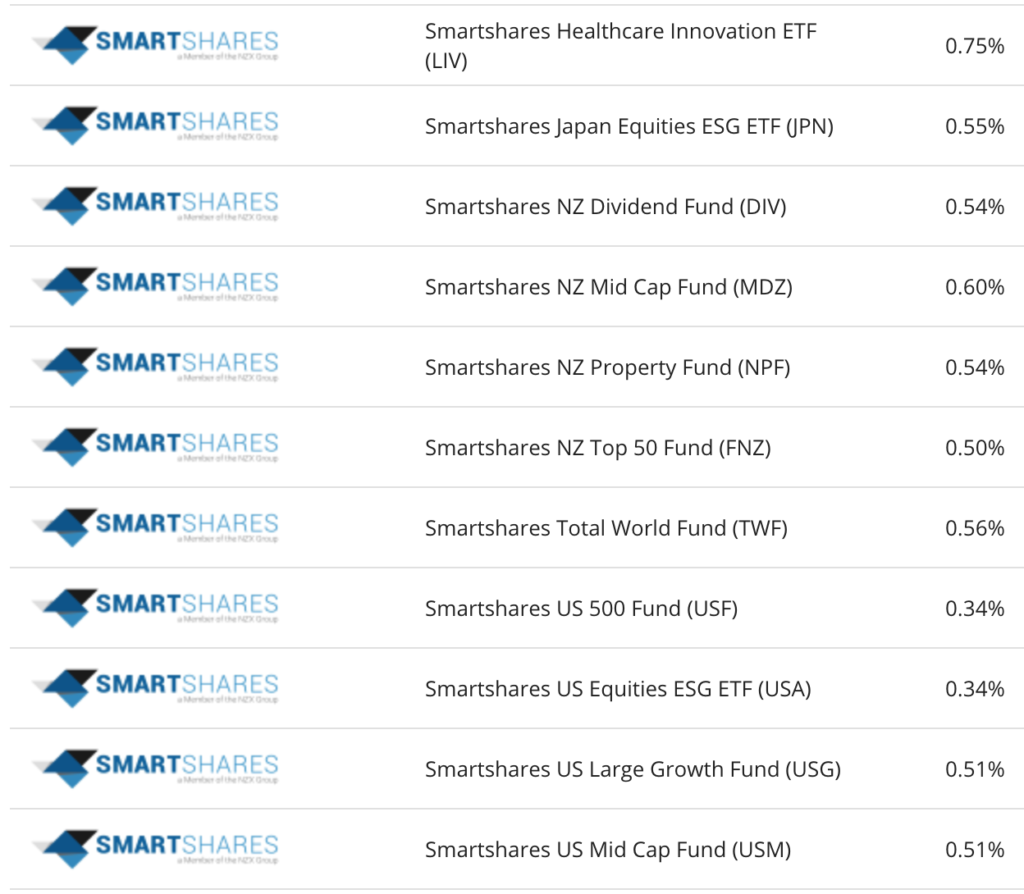

Fund management fees – Smartshares ETFs charge a fund management fee of between 0.30% and 0.75%. For the ETFs in our Sharesies 3-Fund portfolio, their management fees are:

- Smartshares Total World ETF – 0.56%

- Smartshares Global Aggregate Bond ETF – 0.30%

- Smartshares NZ Top 50 ETF – 0.50%

This gives us a weighted average fee for our Sharesies 3-Fund ETF portfolio of 0.50%.

Full details on Sharesies’ fees can be found on their Help Centre.

Hatch

Foreign exchange (FX) fees – To invest using Hatch, you must first deposit New Zealand dollars and convert it to US dollars. A 50 basis points (bps) fee is applied to this conversion which is calculated with the equation:

- Exchange Rate – (Exchange Rate * 0.005)

For example, if the NZD-USD exchange rate is 0.638, Hatch will change your NZD to USD at a rate of 0.6348.

Brokerage – Hatch charges brokerage fees each time you buy or sell an ETF on their platform:

- $3 USD to buy/sell a fraction of one share

- $0.02 USD per share to buy/sell one or more full shares, with a minimum charge of $8 USD

The implication of this is that you need to invest large amounts at a time (ideally several hundred dollars) to make the brokerage worthwhile.

Fund management fees – The management fees for the ETFs in our Hatch 3-Fund portfolio are:

- Vanguard Total World Stock ETF – 0.09% (so cheap!)

- Vanguard Total World Bond ETF – 0.09% (so cheap!)

- iShares MSCI New Zealand ETF – 0.47%

The US domiciled Vanguard ETFs are incredibly cheap compared to the Smartshares equivalents! Not so much for the iShares NZ ETF, given this is a more niche fund. However, the weighted average fee for our Hatch 3-Fund ETF portfolio is still a very low 0.17%.

Tax related fees – When you make your first deposit, Hatch charges a one-off $1.50 USD fee to complete your US tax forms. They subsequently charge $0.50 USD each year to complete your US tax return.

Account fees – There is no ongoing account fee for Hatch.

Full details on Hatch’s fees can be found on their site.

What’s up with the big difference in management fees?

Do you ever feel that shopping in New Zealand is expensive compared with shopping overseas? It’s a downside of living in NZ – with high shipping costs, tax, and low volumes making locally sold goods more expensive. We can alternatively look to buy things from overseas sources, but once you factor in shipping costs, currency conversion, and shipping times, it might not be much better than buying locally.

Sadly it’s the same story for our locally domiciled ETFs. Their higher fees reflect the cost of “importing” the ETF, such as brokerage and FX. Lower volume also plays a part – more money invested is better as a fund’s costs can be split among more investors. Again, we can look at buying cheaper overseas domiciled ETFs as an alternative, but have to factor in the additional fees.

4. Fee Comparison

So how would the fees of Sharesies and Hatch apply to our 3-Fund ETF portfolios we created in section 2 of this article? Which one is cheaper? Unfortunately it’s hard to say, as it depends on a lot of variables such as how many years you’ll be investing, how many regular contributions you make, and the amount of money you invest.

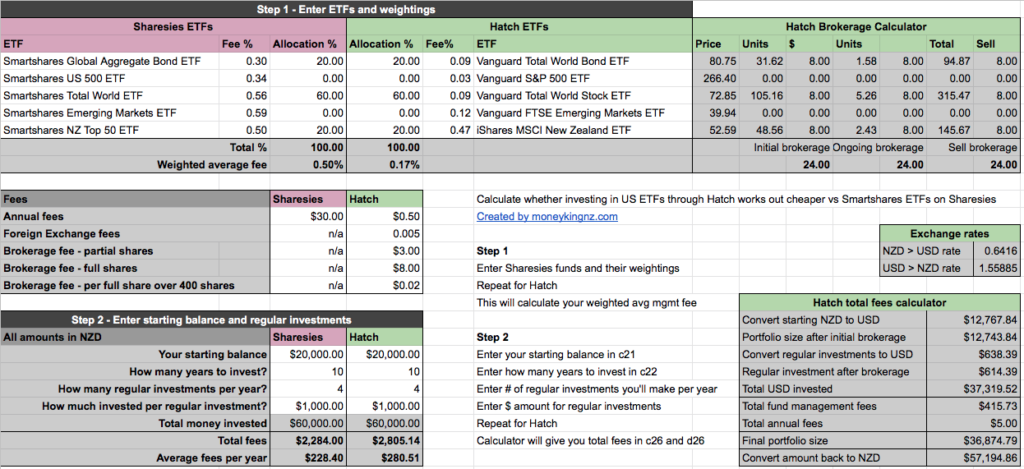

Fortunately I’ve built a spreadsheet to calculate the fees based on these variables. It takes into account any account fees, fund management fees, brokerage, tax fees, and foreign exchange fees. It can also factor in regular contributions to your portfolio.

It’s a VERY rough calculation (in particular it doesn’t factor in any capital growth or dividends), but should give you a ballpark idea of the level of fees you can expect with each service, under different scenarios.

Let’s run through some scenarios and see which service comes out cheaper for each one:

A. Alice from Auckland

Alice has $10,000 to invest for 5 years in our 3-fund ETF portfolios. She plans on adding $1,000 to her portfolio once every year. Here’s the fees she’d pay with each service:

– Sharesies: $460

– Hatch: $517

Sharesies is a little cheaper for Alice. Given her short investment timeframe of 5 years, the brokerage and FX costs of Hatch have negated the cheaper fund management fees that come with the US ETFs.

B. Bruce from Blenheim

Bruce is identical to Alice, but has an investment timeframe of 10 years instead of 5. His fees are:

– Sharesies: $1,044

– Hatch: $900

Now Hatch is cheaper, as Bruce has more time for the lower fund management fees of the US ETFs to offset Hatch’s brokerage and FX costs.

C. Cathy from Christchurch

Cathy is like Bruce and wants to invest in the same 3-Fund portfolio for 10 years, starting with $10,000. However, she’s a much more diligent saver and wants to add a regular $1000 a month to her portfolio. Her fees are:

– Sharesies: $3,772

– Hatch: $6,994

Sharesies is much cheaper for Cathy! With Hatch, the brokerage fees incurred from making regular contributions would really hurt her.

D. Dorothy from Dunedin

Dorothy is identical to Cathy, however, she invests $3,000 every three months (instead of $1,000 every month). Her fees are:

– Sharesies: $3,772

– Hatch: $4,023

Hatch’s fees are lower for Dorothy than for Cathy, thanks to her less frequent contributions lowering brokerage costs. However, Sharesies is still cheaper for her.

E. Elizabeth from Edgecumbe

Elizabeth is relatively well-off and contributes $6,000 every three months into our 3-Fund ETF portfolio over 10 years. Her fees are:

– Sharesies: $6,748

– Hatch: $6,231

Now Hatch is cheaper for for Elizabeth. Given she’s investing a larger amount, the cheaper management fees really start to kick in and offset Hatch’s brokerage costs.

In general, Sharesies tends to be cheaper for people who intend to make frequent contributions to their investments, or those with smaller investment amounts, thanks to having no brokerage costs. However, Hatch tends to be cheaper for those investing larger amounts, less frequently, and for enough years for the lower management fees to offset the brokerage and foreign exchange costs.

Want to do your own fee comparison between Sharesies and Hatch? You can take a copy of the spreadsheet I used to do the calculations here (must have a Google account to copy it)

5. Other considerations

Fees aren’t the only thing that matters. There are many other pros and cons to consider when deciding between Sharesies and Hatch.

Sharesies

User Experience – Both platforms are easy to use and have great mobile friendly interfaces. However, I’d say Hatch requires a lot more effort to use – you’re dealing directly with the US market so have to convert your currency to USD, perform trades in USD, and track everything in USD.

With Sharesies you only have to deal with NZD. Once you’ve logged in and made a deposit into the platform, it takes just 7 mouse clicks and 2 keyboard inputs to go from your investor dashboard to having an ETF bought and in your portfolio. It certainly takes a lot less thinking and effort.

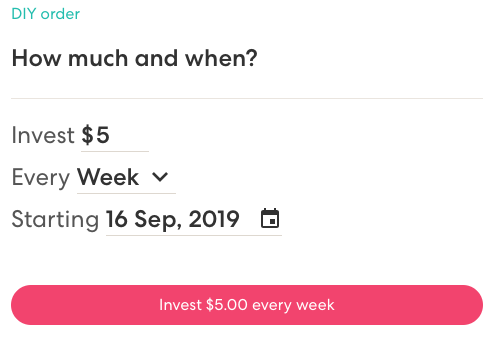

Automated investing – If 7 clicks to make an investment is still too much for you, you can automate your investing on Sharesies by setting up Auto-invest. This allows you to automatically invest $5 or more into the funds you want on a regular basis. Automated investing is coming to Hatch soon.

Tax – Generally you don’t have to do anything regarding tax when investing in Smartshares ETFs on Sharesies (check Sharesies’ tax documentation here). But with Hatch, your investment is considered as an overseas investment – you will need to pay tax on any dividends earned, and if you have over $50,000 invested overseas you need to apply the FIF tax rules (check Hatch’s tax article here). It is not that hard to fulfil these tax requirements, but obviously not as convenient as going down the Sharesies + Smartshares route.

Hatch

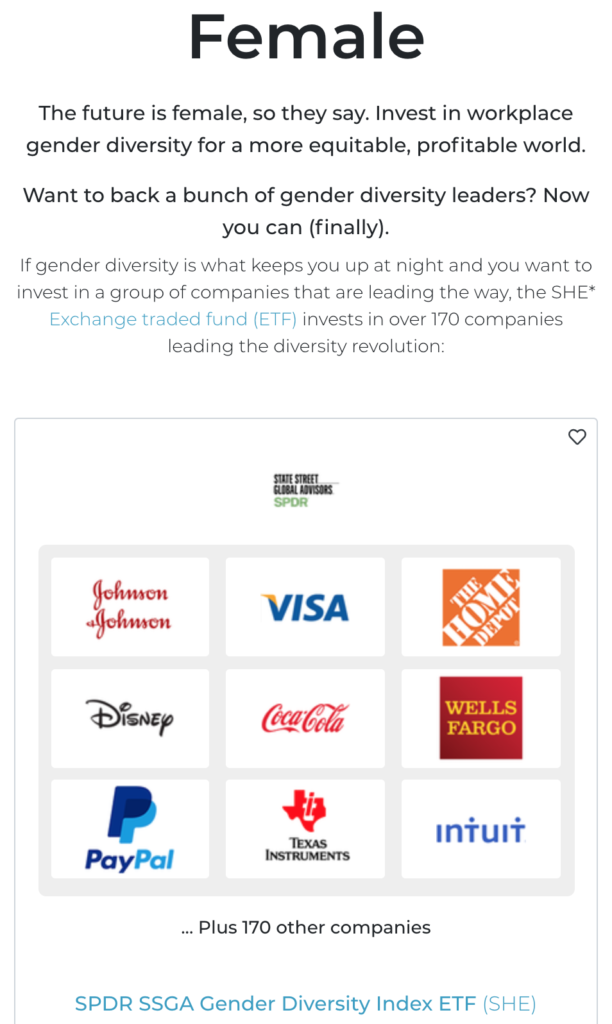

More choice – Hatch offers over 750 ETFs versus Sharesies’ 32 ETFs. It’s like being a kid in a candy shop – the choices and possibilities for building your investment portfolio seem endless. Here’s a few examples of some cool and interesting ETFs on Hatch:

| Theme | ETFs |

| Tech specific | Invesco Solar Energy ETF Global X Lithium & Battery Tech ETF |

| Sector specific | iShares US Insurance ETF Guggenheim China Technology ETF |

| Values related | SPDR Gender Diversity Index ETF Impact Shares Minority Empowerment ETF |

| Precious metals | iShares Gold Trust iShares Silver Trust ETF |

| Country specific | iShares Taiwan ETF iShares Italy ETF |

But is more choice better? It’s often harder to make a decision when you have overwhelming choice, compared to when options are scarce. Plus do you really need the niche ETFs that you can get on Hatch, when something like the Smartshares Total World ETF (investing in over 8,000 companies) provides sufficient diversification for most people?

Competing services

Sharesies and Hatch are the most popular, but are not the only services to offer ETFs to Kiwis. So I want to round out the article by giving a couple of competing services a quick mention.

InvestNow

InvestNow is pretty similar to Sharesies, being a platform that lets you invest in a selection of Smartshares ETFs, and heaps more funds from other providers. It’s my platform of choice, as they don’t charge any account fees, but their downside is the higher minimum investment amount of $50, and inferior user interface.

Stake

Stake is the Australian equivalent of Hatch, also allowing you to buy shares and ETFs on the US market. Their major advantage is that they charge zero brokerage fees! The downside is that Kiwi investors face an onerous process to deposit and withdraw funds with Stake (unless you have an Aussie bank account):

- To deposit money – you must make a manual international money transfer from NZD to Stake’s USD account using a service like TransferWise. Stake charges a $20 USD fee for each deposit made this way.

- To withdraw money – you must first use Stake to exchange your USD to Australian Dollars (incurring Stake’s FX fee). Then you need to get Stake to arrange an international money transfer to have that AUD converted to NZD and paid to your NZ bank account.

Conclusion

Sharesies and Hatch have dramatically lowered the barriers to investing in ETFs. So when creating an investment portfolio with ETFs, should you shop locally with Sharesies, or go look overseas with Hatch?

Sharesies gives you ultimate flexibility in being able to invest whatever amount of money, however often you want, without being hurt by brokerage fees. You could make an investment of ten cents everyday if you wanted to. I would say Sharesies better suits a wider audience – it’s perfect for beginners or people wanting to gradually build up a portfolio by regularly investing their spare change.

Hatch’s HUGE selection of ETFs and their low management fees make you think “WOW”. But to make the most of this you need to invest a lot of money, less frequently, and for a long period of time – in order to offset the brokerage and FX costs. I feel like Hatch would be better for more experienced investors who have larger amounts to invest, and who would embrace the extra choice rather than be overwhelmed by it.

I personally don’t use either, but my choice between the two would be Sharesies – it’s simple and offers sufficient ETFs for my investment needs. I have tried investing in the US market before, but found myself disliking the effort required to convert currency, and track everything in USD. However, I would still consider using Hatch if I wanted to invest in individual US companies.

Keen to start building your investment portfolio with Sharesies? Sign up with this link, and you’ll get a bonus $5 in your account to invest!

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Thank you so much for your blog, I am learning so much!

I have some money invested in VOO via Hatch. At the moment I am depositing about NZ$500-1000 into it each month (total of about NZ$20k at the moment). I am not sure if I can keep up this amount of deposits every month, but I am investing for the future so have at least 10 more years of just building up my portfolio.

Recently I have woken up to the many many many funds and ETFs available via different platforms I could be using. I think the FIF tax side of things are a bit beyond me atm, and am considering joining Sharesies or Investnow to invest in the S&P500 instead.

Am I better to sell what I have in Hatch and buy the VOO equivalent again on another platform? Or keep what I have in Hatch and invest in something else on a different platform to diversify and avoid FIF tax (ie. Keep below $50k)? I am stuck in analysis paralysis coupled with lack of sleep from having a baby recently. Would love your thoughts!

Hey there. There isn’t usually a right or wrong answer when it comes to keeping your investments or moving them. It usually doesn’t cost extra to have your investments split across multiple platforms, though it can be a bit more messy to manage if your funds are held in multiple places. It isn’t really something worth getting stuck over.

But if you really wanted to get into the details around tax efficiency, you could consider what structure is taxed the least for your personal situation. For example, could you keep less than $50k in Hatch to take advantage of the de minimis exemption, then invest the rest in a PIE? Or would you be better off with your entire investments in a PIE? Unfortunately there is no definitive answer here given it highly depends on your personal situation and is something we touch on in this article: https://moneykingnz.com/whats-the-best-sp-500-index-fund-in-2022/

Overall the differences between the various S&P 500 options are minor in the grand scheme of things. A more important aspect of building a portfolio is to keep on putting money into a sensible index fund, rather than getting caught up in analysis paralysis around finding the absolute perfect fund. Hope that helps, and hope you can get some good sleep soon.