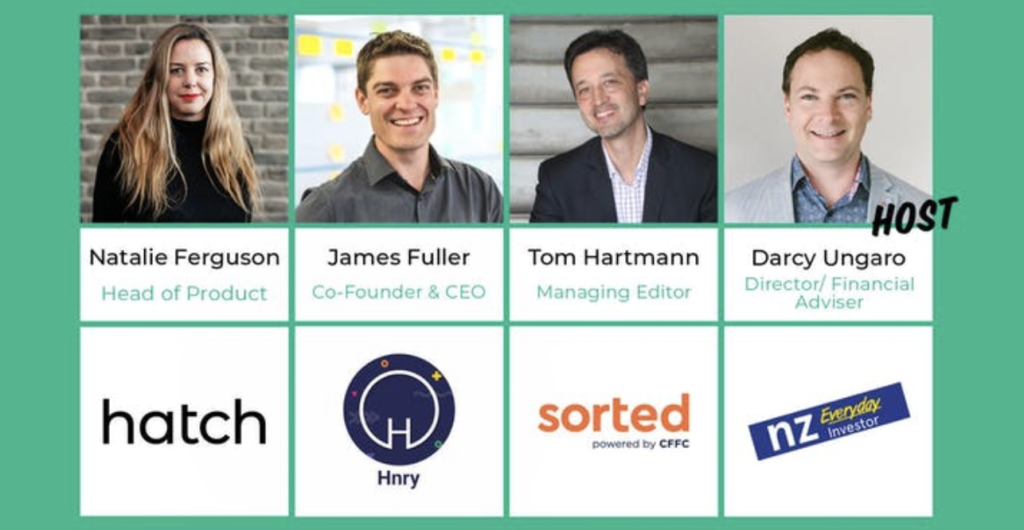

I’ve recently begun listening to investing and finance related podcasts, one of them being NZ Everyday Investor, hosted by Darcy Ungaro. Last week Darcy facilitated a panel event in Wellington to discuss “financial empowerment and investing as a contractor”, featuring a smart group of panelists:

- Natalie Ferguson – Head of Product, Hatch

- James Fuller – Co-Founder & CEO, Hnry

- Tom Hartmann – Managing Editor, Commission for Financial Capability

Whether you consider yourself a Contractor, Self-Employed, or an Independent Earners, this community makes up 15-20% of the New Zealand workforce. I have always been curious about contracting, having worked alongside them since the early days of my career. I wondered how could investing for contractors differ from investing for employees?

Given my curiosity, my friend and I registered for the event via Eventbrite, and we went off to the Urban Hub offices on Lambton Quay for an evening of learning and free food! In this article I’ll cover what I learnt at this panel event along with some of my thoughts.

This article is not endorsed or sponsored by the panelists or the organisations they represent, is my personal interpretation of the event’s content, and is not to be considered as investment advice.

1. Key takeaways from the panel

Before the event

Before the event I did some of my own research about how contracting differed from being an employee. While contractors have the potential to earn a higher hourly rate than employees, there are a few general differences that contractors need to watch out for:

- Employees are likely to be employed on a permanent basis. Contractors are employed on a temporary or per hour basis, which could result in irregular income.

- Employees get paid annual leave, sick leave and so on. Contractors don’t get leave, so don’t earn anything if they’re sick or on holiday.

- Employees get KiwiSaver contributions automatically deducted from their pay, as well as employer contributions. Contractors don’t get either, and must make voluntary contributions if they wish to participate in KiwiSaver.

- Employees have their taxes automatically deducted for them as soon as they get paid, through PAYE tax. Contractors must deal with things like tax, ACC levies, and GST themselves, or hire an accountant to do so.

Panel discussion

Back to the panel. There was no particular structure to the discussion, instead it was driven by a mixture of questions from Darcy, and questions that were submitted by the audience in real-time, using a cool web app called Slido.

Now for the key takeaways of the discussion!

Have a safety net

Everyone should have an emergency fund (of at least $1,000), especially contractors as they are more likely to face periods without work. An audience member asked where they could put such funds to earn a good return, but also maintain liquidity.

The answer is to have the money in an online savings account – maybe even in a different bank to reduce your visibility of the money and the temptation to spend it! This answer will probably disappoint many people given the returns in savings accounts are so low. But I totally agree with this answer. The role of your emergency money is to protect you in an emergency, not to generate high returns for you – so don’t be greedy with this money!

Further Reading:

– The best bank accounts and credit cards for managing your everyday finances

KiwiSaver for contractors?

Contractors have fewer incentives when it comes to KiwiSaver, the main one being the lack of employer contributions. The only incentive for contractors is the annual $521 government contribution, where you earn 50 cents for every dollar (up to $1,043) you voluntarily contribute to KiwiSaver. However, there are proposals to increase the government contribution to $2,000, which means you’d get $2 for every $1 you contribute.

So should contractors invest in KiwiSaver or outside of KiwiSaver, especially once they have maxed out their government contributions? Why not both!? KiwiSaver is essentially a managed fund with restrictions – your money is locked and this could either be a good or bad thing for you. If KiwiSaver’s restrictions suit your investment goals (e.g. you are investing for retirement at 65), then it’s ok to use KiwiSaver. Otherwise there are plenty of non-KiwiSaver options.

Whatever your goals or preferences, I personally think it’s worth voluntarily contributing the minimum (approximately $21 per week) in order to get the $521 government contribution. This equates to a 50% return on your contributions!

How should you go about investing?

Just start now! Many people put off starting to invest, as they get hooked up on doing too much research, or get hooked on emotional barriers (such as the fear of losing money). But the benefits of starting now, rather than later are:

- You’ll learn a lot, just by doing.

- Your risk is low when you’re starting out by investing small amounts of money. If you stuff up and lose $50 or $100, consider this a cheap education!

- By gaining experience in investing, you’ll know what you’re doing later on, once you’ve built up larger amounts of money to invest.

- You’ll build good habits, such as investing regularly.

How can you invest? You could use Hatch to buy shares (18% of Hatch users are Independent Earners). Pick companies you know well, and companies where you can back their long term vision. If you don’t want to pick individual companies, Hatch offers hundred of ETFs, many of them with low management fees around 0.1% – 0.2%. Also don’t be afraid of dips in the sharemarket – consider them as your shares going on sale, and an opportunity to buy more!

Remember that shares are not the only asset class you can invest in. Sorted has a nice tool called the Investor Kickstarter, which provides a starting point to work out the mix of assets you should be investing in to suit your goals.

Dealing with lumpy income

An issue for contractors is how do you build regular habits when your income is irregular? A solution is to deal with your income in percentage terms. Allocate a certain percentage of your income for expenses, a percentage for your safety net, and a percentage for investments. That way as your income increases or decreases, the actual dollar amount you’re investing will automatically rise or fall.

Hnry has an “allocations” feature which can do this automatically for contractors – by sending a set percentage of your income off to different places, immediately as that income is received. Hnry charges 1% of your income (up to a maximum of $2,000), and that gives you access to all of their services.

Dealing with tax

Contractors have to put aside money for tax, as tax isn’t always automatically deducted from their income (unlike an employee with PAYE). Someone in the audience asked if there’s any way you can take advantage of this money.

The answer is don’t spend it, the money isn’t yours! It isn’t worth the risk and return to invest it either. You will soon have to pay this money to the IRD so just keep it aside in a bank account.

Resources about investing

What resources can you use to learn more about personal finance and investing? Try various sources. Find the ones you like and don’t be afraid to subscribe to the ones that resonate with you! It’s best to go for independent resources – ones that don’t try to sell you a particular product or service.

Some resources mentioned were Ruth from The Happy Saver, Darcy’s NZ Everyday Investor Podcast, the Cooking the Books podcast, and Sorted. There was no mention of Money King NZ. I guess I am not famous enough yet 🙁

Recording of the event

If you want to see the whole panel discussion, check out the recording of the event below:

2. Did they try to sell anything?

Given the event was sponsored by Hatch and Hnry, it is understandable that they want to use the event to increase their exposure, particularly to the contractor community. Apart from Hnry stickers and Hatch cards placed around the venue, there was no forceful selling of their products.

However, the panelists would persistently refer to their own product when answering questions. E.g. Natalie spoke about Hatch as being the solution for contractors to invest in shares and ETFs. While it didn’t distract from the discussion too much, my super minor gripe is that it would have been a more rounded discussion if alternative services were acknowledged – as Hatch is definitely not the only way for contractors to invest their money.

Further Reading:

– Shopping for ETFs – Sharesies vs Hatch

3. Was there any free food?

This might have been one of the most organised investing events that I’ve been to! Upon arriving we were greeted by a member of the Hatch team, had our names checked off the attendees list, were given a name tag, two free drink vouchers, and were immediately directed to the food and drinks!

On offer was a good selection of pizza from Hell, beer, wine, and orange juice. There was about half an hour of eating, drinking, and talking before the panel discussion begun, ensuring we were all well fed and watered.

4. My thoughts on the event

I have always thought wrongly that contractors are super well off, having worked with many that easily earned over $100 per hour. Therefore I thought they don’t need advice on how to invest and so on. But now I realise the contractor community has their own unique challenges when it comes to money, such as dealing wth downtime, tax, and the lack of KiwiSaver benefits. There has been a big push for inclusivity in investing recently (for example, getting more smaller investors and more women investing), and it’s great to see that the independent earner community hasn’t been forgotten!

Given the nature of the event (a panel discussion), the content of the event wasn’t substantial compared to a workshop or seminar type event. I would have liked them to dive deeper into the investing side of things, but I guess investing still works largely the same whether you’re self-employed, or an employee. It’s mainly KiwiSaver and the way that contractors have to manage their finances that differs. But overall it was still a fun discussion, with tasty pizza and beers.

My overall rating of the event: 4/5 stars

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.