Smartshares S&P/NZX 50 (NZG), Smartshares NZ Top 50 (FNZ), Macquarie NZ Shares Index, Harbour NZ Index Shares, Harbour Sustainable NZ Shares, Kernel NZ 20, Kernel NZ 50 ESG Tilted, and Simplicity NZ Share. These are all index funds which contain a broad selection of NZ companies, allowing you to easily invest in our local sharemarket. With so many options, which one is the best? In this article we’ll take a detailed look at each fund including what they invest in and their fees to help you make a decision on which one to pick.

This article covers:

1. What’s on offer?

2. Fees

3. Fund composition

4. Other considerations

1. What’s on offer?

New Zealand shares index funds allow you to invest in the NZ sharemarket in one go, by containing a broad selection of companies listed on our domestic market. They contain companies spread across many industries, including well known names such as Contact Energy, Spark, Fletcher Building, and Air New Zealand.

These funds make it easy to invest locally, saving you from having to research and pick individual companies to invest in. And being index funds, these benefits come with low management fees. Overall, NZ shares index funds are commonly used as a core building block in a long-term investment portfolio, sitting alongside the likes of global shares index funds. So let’s take a look at our fund options below:

Smartshares S&P/NZX 50 (NZG)

Smartshares’ core NZ fund offering is the S&P/NZX 50 ETF which tracks the S&P/NZX 50 Index. This fund contains 50 of the largest companies listed on the NZ sharemarket. You can invest in this fund direct via Smartshares (minimum investment $500), through InvestNow (minimum investment $50), or via an NZX broker like Sharesies (minimum investment $0.01).

The S&P/NZX 50 ETF is also offered by Smartshares’ sibling fund manager SuperLife. The SuperLife version of this fund has the same underlying investments, but have slight differences around fees and tax which we’ll cover later the in article. The SuperLife fund is available direct from SuperLife (minimum investment $1), or through Flint (minimum investment $50).

Smartshares NZ Top 50 (FNZ)

Smartshares also offers the NZ Top 50 ETF which tracks the slightly different S&P/NZX 50 Portfolio Index. This fund also contains 50 of the largest companies listed on the NZ sharemarket, however has a maximum weighting of 5% towards a single company. More on this difference later in the article.

The NZ Top 50 ETF is available direct via Smartshares, InvestNow, or through an NZX broker like Sharesies. It’s also available in SuperLife version, which can be purchased direct via SuperLife or through Flint.

Further reading:

– Smartshares & SuperLife review – The smart way to invest in shares?

Macquarie NZ Shares Index

Macquarie offers the NZ Shares Index Fund. Like the Smartshares S&P/NZX 50 ETF, this fund tracks the S&P/NZX 50 index. It’s available through the InvestNow platform (minimum investment $50).

Harbour NZ Index Shares

Harbour offers the NZ Index Shares Fund. Like the Smartshares NZ Top 50 ETF, this fund tracks the S&P/NZX 50 Portfolio index. It’s available through the InvestNow or Flint platforms (minimum investment $50).

Harbour Sustainable NZ Shares

Harbour also offers the Sustainable NZ Shares Fund which isn’t strictly an index fund, but is based on the S&P/NZX 50 Portfolio Index with the following modifications:

- Has a few ethical exclusions e.g. Sky City, Air New Zealand, Genesis Energy.

- Has minor re-weightings of companies based on their ESG/sustainability scores. Companies considered to be sustainable may make up a slightly larger proportion of the fund, while less sustainable companies may make up a slightly smaller proportion of the fund.

The fund is available through InvestNow and Flint (minimum investment $50).

Kernel NZ 20

Kernel’s core NZ index fund offering is the NZ 20 Fund which tracks the S&P/NZX 20 Index. The fund invests in the 20 largest companies listed on the NZ sharemarket. You can invest in this fund directly via Kernel (minimum investment $1).

Kernel NZ 50 ESG Tilted

Kernel also offers the NZ 50 ESG Tilted Fund which tracks the S&P/NZX 50 Portfolio ESG Tilted Index. This is similar to the other NZX 50 funds, but with a couple of key differences:

- Has a small number of ethical exclusions e.g. Sky City for its involvement in gambling.

- Re-weights companies based on their ESG/sustainability scores. Companies considered to be more sustainable make up a larger proportion of the fund, while less sustainable companies make up a smaller proportion of the fund.

You can invest in this fund directly via Kernel (minimum investment $1).

Further reading:

– Kernel review – High quality index funds

Simplicity NZ Share

Simplicity offers the NZ Share Fund which isn’t strictly an index fund, but is based on the Morningstar NZ Index and modified to exclude certain companies for ethical reasons. Overall the fund invests in 40 companies listed on the NZ sharemarket.

You can invest in this fund directly via Simplicity where the minimum investment is $1,000 making it a less accessible option. In addition Simplicity doesn’t offer any international share funds to complement their NZ fund, which means you may have to sign up for another platform to diversify your portfolio overseas (their closest international option is the Growth Fund which has ~50% international shares, but this also contains ~20% NZ shares, meaning it overlaps with the NZ Share Fund).

Summary

Here’s an overview of the different NZ shares index funds on offer:

| Fund | Index tracked | Constituents |

| Smartshares S&P/NZX 50 | S&P/NZX 50 | 50 |

| Smartshares NZ Top 50 | S&P/NZX 50 Portfolio | 50 |

| Macquarie NZ Shares Index | S&P/NZX 50 | 50 |

| Harbour NZ Index Shares | S&P/NZX 50 Portfolio | 50 |

| Harbour Sustainable NZ Shares | S&P/NZX 50 Portfolio (with modifications) | 45 |

| Kernel NZ 20 | S&P/NZX 20 | 20 |

| Kernel NZ 50 ESG Tilted | S&P NZX 50 Portfolio ESG Tilted Index | 48 |

| Simplicity NZ Share | Morningstar New Zealand Index (with modifications) | 40 |

2. Fees

Management fees

All funds charge a management fee which is an ongoing fee charged as a percentage of the amount you have invested in a fund, and reflected as a tiny deduction in your fund’s unit price:

| Fund | Fee |

| Smartshares S&P/NZX 50 | 0.20% |

| SuperLife S&P/NZX 50 | 0.49% |

| Smartshares NZ Top 50 | 0.50% |

| SuperLife NZ Top 50 | 0.49% |

| Macquarie NZ Shares Index | 0.36% |

| Harbour NZ Index Shares | 0.20% |

| Harbour Sustainable NZ Shares | 0.25% |

| Kernel NZ 20 | 0.25% |

| Kernel NZ 50 ESG Tilted | 0.25% |

| Simplicity NZ Share | 0.10% |

Other fees

Transaction fees

If you buy/sell Smartshares’ ETFs through Sharesies or another NZX broker, then a brokerage/transaction fee will apply. For example, Sharesies charges a 0.5% transaction fee on orders up to $3,000, then 0.1% on any amounts above $3,000. There’s no transaction fees for investing in Smartshares’ ETFs direct via Smartshares, via InvestNow, or through SuperLife or Flint. Nor do any other funds covered in this article have transaction fees.

Spreads

Spreads apply whenever you buy or sell units in some funds. This is a small fee to cover the transaction costs of the fund, and work by applying a premium or discount to the fund’s unit price. For example, if a fund’s buy spread is 0.27% you’ll buy units in the fund at a 0.27% premium to the current unit price, and if a fund’s sell spread is 0.27% you’ll sell units in the fund at a 0.27% discount to the current unit price.

| Fund | Buy spread | Sell spread |

| Smartshares S&P/NZX 50 | Varies | Varies |

| Smartshares NZ Top 50 | Varies | Varies |

| Macquarie NZ Shares Index | 0.27% | 0.27% |

Spreads for Smartshares’ funds vary depending on market conditions. Spreads don’t apply to SuperLife or any other funds covered in this article.

Account fees

Some investment platforms charge account fees on top of the other fees:

- Smartshares – A one-off $30 set-up fee applies if you’re investing directly via Smartshares.

- SuperLife – An ongoing account fee of $12 per year applies if you’re investing directly through SuperLife.

- Kernel – An ongoing account fee of $5 per month applies if you’re investing over $25,000 through Kernel. This can increase their effective fees by quite a bit, from a headline management fee of 0.25% to 0.49% if you’re investing $25,000, or 0.35% if you’re investing $100,000.

3. Fund composition

All eight funds are quite similar, so you certainly don’t need to invest in more than one. But there’s a few small aspects that set these funds apart, so here’s a more detailed look at them:

S&P/NZX 50 vs S&P/NZX 50 Portfolio

Two funds track the main S&P/NZX 50 Index:

- Smartshares S&P/NZX 50 ETF

- Macquarie NZ Shares Index Fund

Two others funds track the S&P/NZX 50 Portfolio Index:

- Smartshares NZ Top 50 ETF

- Harbour NZ Index Shares Fund

For the main S&P/NZX 50 index, the larger the company, the higher weighting it has in the index. For example, the index has a 11.29% weighting towards Fisher and Paykel Healthcare (FPH), the largest company on the NZX. In other words, for every $100 you invested in the index, $11.29 would be allocated to FPH.

The Portfolio index works similarly, but there’s a maximum weighting of 5% towards a single company. So large companies like FPH, Auckland Airport, and Spark who take up a big proportion of the main index, take up a smaller proportion of the Portfolio index. For example, for every $100 you invest in Portfolio index, just $4.42 would be allocated to FPH.

The below table shows the weighting differences of the 10 largest holdings in the Smartshares S&P/NZX 50 ETF compared with the Smartshares NZ Top 50 ETF. Note that some companies’ weightings in the Portfolio Index can drift slightly over the 5% cap due to market movements, but these are trimmed back when the index is rebalanced every quarter.

| Company | Smartshares S&P/NZX 50 | Smartshares NZ Top 50 |

| Fisher & Paykel Healthcare | 11.29% | 4.42% |

| Auckland Airport | 7.60% | 5.48% |

| Spark | 6.88% | 4.71% |

| Mainfreight | 5.76% | 5.26% |

| EBOS Group | 5.22% | 5.35% |

| Contact Energy | 5.10% | 4.87% |

| Meridian Energy | 4.91% | 4.76% |

| Infratil | 4.80% | 4.90% |

| Fletcher Building | 4.15% | 4.93% |

| a2 Milk | 3.37% | 4.21% |

| Total weighting of top 10 holdings | 59.06% | 48.89% |

There’s no definitive best between the two indices. While the 5% cap of the Portfolio index prevents large companies from dominating the fund, and increases exposure to smaller companies, that might not be a good thing if the larger companies perform better. The Portfolio index has outperformed the main index in recent times (delivering an annual return of 13.08% p.a vs 12.20% p.a. over the last 10 years), but going forward who knows? We don’t have a crystal ball to tell which will perform better into the future.

Further reading:

– What do NZX 50, S&P 500, and Total World index funds actually invest in?

Is 20 companies enough?

Kernel’s NZ 20 Fund only contains 20 companies which doesn’t seem like a lot compared with an NZX 50 fund. However, this should still be enough in terms of diversification:

- The NZX 20 index already represents a large chunk of the broader NZX 50 index, with its 20 constituents making up ~80% of the NZX 50. That essentially means the 30 smaller companies of the NZX 50 adds relatively little diversification, making up only ~20% of the NZX 50.

- Both the NZX 50 and NZX 20 have a remarkably similar sector composition, despite the difference in the number of constituents:

| Sector | S&P/NZX 50 | S&P/NZX 20 |

| Healthcare | 23.5% | 26.3% |

| Industrials | 22.1% | 24.6% |

| Utilities | 21.2% | 22.9% |

| Communication Services | 11.5% | 13.6% |

| Real Estate | 9.4% | 6.0% |

| Consumer Staples | 4.7% | 4.1% |

| Consumer Discretionary | 3.3% | 2.5% |

| Financials | 2.4% | 0.0% |

| Information Technology | 1.9% | 0.0% |

- The NZ sharemarket isn’t that big, and the 50 companies of the NZX 50 represents quite a large proportion of the total number of companies listed on the NZX. The NZX 20 represents a smaller group of just 20 companies, and this means poor performing companies can be dropped out of the index more quickly. This shows in past performance with the NZX 20 delivering a 13.02% p.a. return vs 12.20% p.a. for the NZX 50 over the last 10 years.

- The fund isn’t designed to be the only one in your portfolio, but rather to go alongside other funds such as Kernel’s NZ Small & Mid Cap Opportunities Fund or Global 100 Fund. Adding a global fund to your portfolio will provide a greater diversification benefit, than choosing the NZX 50 over the NZX 20.

Further reading:

– Should I Invest in the NZ 50 Fund or NZ 20 Fund? (Kernel blog)

Ethical exclusions

Some funds exclude companies involved with certain industries. These are:

- Harbour Sustainable NZ Shares – Large carbon emitters, alcohol, gambling, munitions, adult entertainment, nuclear armaments, firearms, tobacco and recreational cannabis, child labour, and companies with human and animal right violations.

- Kernel NZ 50 ESG Tilted – The Energy sector, Casinos & Gaming sub-industry, as well as companies involved in thermal coal, tobacco, and controversial weapons, in addition to companies not in compliance with the UNGC.

- Simplicity NZ Share – Fossil fuel exploration and extraction, alcohol, tobacco, gambling, military weapons, civilian firearms, nuclear power, and adult entertainment.

But not all the above industries are represented in their respective indices (for example, there’s no nuclear weapon, recreational cannabis, or adult entertainment companies in NZ to exclude). So the list of companies excluded from these funds is actually quite small. These are:

- Harbour Sustainable NZ Shares – Sky City Entertainment, Genesis Energy, Air New Zealand, Fonterra. Also excluded Z Energy prior to its delisting from the NZX.

- Kernel NZ 50 ESG Tilted – Sky City Entertainment. Also excluded Z Energy prior to its delisting from the NZX.

- Simplicity NZ Share – Sky City Entertainment, Genesis Energy.

ESG tilting

Further to making ethical exclusions, the Kernel NZ 50 ESG Fund (and to some extent, the Harbour Sustainable NZ Shares Fund) re-weight companies based on how sustainable they are. This is done by calculating an ESG score for each company (which looks at things like company’s governance practices, fossil fuel exposure, and workplace diversity), then adjusting each company’s weighting up or down according to their score. For example:

- Meridian Energy – Makes up 4.76% of the NZ Top 50 ETF, but is weighted up to 9.55% in the ESG Tilted Fund.

- Infratil – Makes up 4.90% of the NZ Top 50 ETF, but is weighted down to 0.96% in the ESG Tilted Fund.

| Company | Smartshares NZ Top 50 | Kernel NZ 50 ESG Tilted | Difference |

| Auckland Airport | 5.48% | 10.79% | +5.31 |

| EBOS Group | 5.35% | 4.94% | -0.41 |

| Mainfreight | 5.26% | 3.43% | -1.83 |

| Fletcher Building | 4.93% | 5.37% | +0.44 |

| Infratil | 4.90% | 0.96% | -3.94 |

| Contact Energy | 4.87% | 8.67% | +3.80 |

| Meridian Energy | 4.76% | 9.55% | +4.79 |

| Spark | 4.71% | 2.60% | -2.11 |

| Fisher & Paykel Healthcare | 4.42% | 7.09% | +2.67 |

| a2 Milk | 4.21% | 3.41% | -0.80 |

Interestingly the return of the ESG Tilted index is 8.47% p.a. over the last 5 years, which beats the 8.05% p.a. return of the Portfolio index, though that isn’t indicative of future returns.

Simplicity’s holdings

Simplicity’s NZ Share Fund is based on a completely different index to all the other funds, and they’re pretty coy about how the fund is actually constructed. They’re relatively vague when it comes to describing specifically what their fund invests in:

The NZ Share Fund invests in companies and property trusts listed on the New Zealand stock exchange (NZX).

Due to their lack of transparency, you’d have to dig a bit deeper to find that the fund is based on the Morningstar NZ index. Here’s some key facts about the index:

- It comprises roughly 40 of the largest companies listed on the NZX. This represents all NZX 50 companies except for ANZ, Westpac, Scales, SKY TV, NZX, Vista Group, Eroad, Sanford, Fonterra, and Tourism Holdings.

- It also contains Briscoe Group, which sits outside the main NZX 50 index.

- The index also contains Sky City and Genesis, but Simplicity excludes them from their fund for ethical reasons.

4. Other considerations

Are NZ shares worth it?

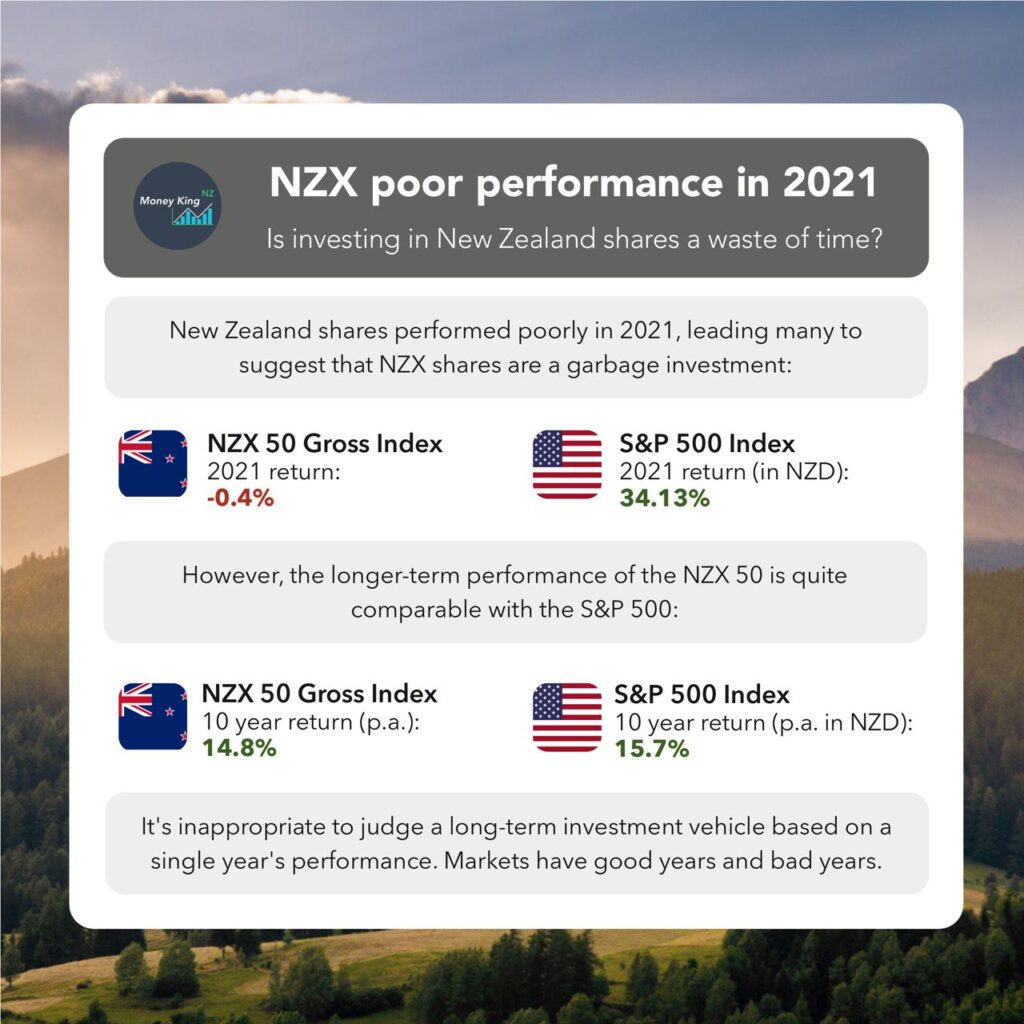

There’s a perception that New Zealand shares aren’t worth investing in likely because of the following reasons:

- The NZ sharemarket has performed poorly recently – For example, in 2021 the NZX 50 fell by 0.4%, while the S&P 500 rose by 34.13%.

- The NZ sharemarket doesn’t have any good companies – There’s much fewer investment opportunities on the NZX. The fact that some local companies like Xero and Allbirds are listed on overseas markets doesn’t help.

But we disagree on the above and believe NZ shares are well worth considering as at least a small part of a diversified investment portfolio. Firstly, it’s inappropriate to judge a long-term investment vehicle based on one year’s performance, as short-term results aren’t indicative of how these markets will perform over the long-term. In fact, over the last 10 years the NZX 50 has delivered a strong average return of 14.8% per year versus 15.7% for the S&P 500 – a figure likely to be closer once you factor in the extra fees associated with investing in the US.

Secondly, NZ shares have some attractive tax advantages. Many NZX listed companies pay imputation credits with their dividends, and aren’t taxed under the FIF regime. That gives NZ shares a big head start – international shares have to outperform NZ shares by ~1% every year just to make up for their tax disadvantages.

Lastly, it’s true that the NZX has fewer investment opportunities – but it’s unreasonable to expect a small country like NZ to have as many companies as the US or Australia. And of the companies we do have on the NZX, many have performed well recently. Examples that have beaten the S&P 500’s 34% return in 2021 are EBOS (47.5%), Heartland (60%), and Mainfreight (36.6%).

Tax

All of these funds generate income throughout the year (i.e. dividends from the companies each fund invests in), which the fund has to pay tax on. This tax is passed onto investors in the fund. The following rates apply:

- Smartshares (excluding SuperLife) – These are Listed PIEs so are taxed at a fixed rate of 28% (though if you’re on a lower rate you can claim back any excess tax paid on your tax return, to offset the tax payable on your other income).

- All other funds – These are Multi-Rate PIEs (MRPs), so are taxed at your Prescribed Investor Rate (PIR), which should either be 10.5%, 17.5%, or 28%.

Fractional units

It isn’t possible to buy fractional units in Smartshares’ ETFs (unless you invest via Sharesies). This can result in some quirks where you’re left with uninvested cash after putting in an investment order to buy these ETFs, especially when using the InvestNow platform (this quirk is described in more detail in this article). All other funds support fractional units, so don’t have the same issue.

Distributions

Some funds intend (although do not guarantee) to pay distributions at the following frequencies, which can be automatically reinvested into the fund (except when using Sharesies or Flint), or taken as a cash payment:

- Smartshares – 6 monthly

- Macquarie – 6 monthly

- Harbour – 6 monthly

- Kernel – Quarterly

SuperLife and Simplicity funds don’t pay distributions. Any dividends the funds receive are reflected as an increase in the funds’ unit price, rather than paid out to investors.

KiwiSaver

Some of these funds are available to be selected as part of a KiwiSaver scheme:

- SuperLife S&P/NZX 50, SuperLife NZ Top 50 – SuperLife KiwiSaver

- Macquarie NZ Shares Index – InvestNow KiwiSaver

- Kernel NZ 20, Kernel NZ 50 ESG Tilted – Kernel KiwiSaver

Further reading:

– The ultimate guide to KiwiSaver funds and schemes

Past performance

Lastly, here’s a summary of how different indices have performed over recent years. Note that past performance isn’t indicative of future results.

| Index | 3 years (p.a.) | 5 years (p.a.) | 10 years (p.a) |

| S&P/NZX 50 | 0.91% | 7.16% | 12.20% |

| S&P/NZX 50 Portfolio | 2.25% | 8.05% | 13.08% |

| S&P/NZX 20 | 1.56% | 8.48% | 13.02% |

| S&P/NZX 50 Portfolio ESG Tilted | 2.11% | 8.47% | n/a |

| Morningstar NZ | 1.27% | 7.93% | 13.07% |

Also keep in mind that these are index level returns, and the funds would have delivered a slightly lower returns due to management fees, taxes, cash drag, and tracking differences.

Conclusion

Of our eight global shares index funds, all are quite similar so there’s no need to invest in more than one (otherwise they’ll overlap/duplicate each other). It’s really just minor differences that set them apart. Here’s our overall thoughts about each option:

- Smartshares S&P/NZX 50 – The classic NZX 50 index fund. Comes with low fees (unless you’re buying via SuperLife) and is easy to access. Though the flat tax rate of 28% could be a downside.

- Smartshares NZ Top 50 – Tracks the slightly different Portfolio index, but a little expensive when it comes to fees. You might as well invest in the cheaper Harbour alternative.

- Macquarie NZ Shares Index – Also fairly expensive, with both relatively high management fees and spreads. Could still be a good option for members of InvestNow’s KiwiSaver scheme.

- Harbour NZ Index Shares – Probably a better option compared to the Smartshares NZ Top 50, as it tracks the same index, but with significantly lower fees.

- Harbour Sustainable NZ Shares – A handy alternative if you’re interested in its ethical exclusions of the likes of Sky City, Genesis, and Air New Zealand.

- Kernel NZ 20 – Arguably tracks a better index than the NZX 50 based funds. It’s a strong option, especially if you’re already investing through Kernel’s ecosystem.

- Kernel NZ 50 ESG Tilted – The fund’s sustainability tilting makes the fund a stronger sustainable option compared with Harbour’s offering in our opinion, and an interesting alternative to the normal NZX 50 funds.

- Simplicity NZ Share – The winner when it comes to fees, tracking a fairly similar index to the NZX 50. However, the high minimum investment and having to open an account with Simplicity to access the fund may be inconvenient.

Like with most things in investing there’s no definitive best, and your personal preferences will also have a big influence which one you should invest in. We think all funds are solid options, though the Smartshares NZ Top 50 and Macquarie options are a little weaker. So if you’re struggling to deicide, you’ll usually be better off just picking one and investing in it rather than letting analysis paralysis hold you back.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Perfect timing, just as I’ve been trying to decide which NZ fund to invest in for the last few days. Thanks for another great article

Thank you Sean

Thanks for doing all the mahi on this one Money King! I’ve already sent it on to a couple of people who were asking a similar question. Thank you for all your hard work. Ruth

Thanks Ruth. Glad we could help the Happy Saver community as well

Awesome stuff man! Nicely explains, feels like you are not bias towards any of them and just sharing your opinion.