I first heard about Wellington based financial planning firm FoxPlan a few years ago when a couple of their advisers tried to add me on LinkedIn. I ignored them, like with most strangers trying to add me, but fast forward to this year I came across a FoxPlan workshop on event website Eventbrite. I decided to register to see what FoxPlan were all about, and for this event I brought four of my friends along with me – not the most conventional place for a social gathering!

It was going to be a long evening, with the workshop running from 5pm to 8pm in their Courtenay Place office. It was hosted by FoxPlan founders John and Sally Killick, along with Financial Adviser Dieter. In this article I’ll cover what I learnt in this workshop along with my thoughts.

This article is not endorsed or sponsored by FoxPlan or their advisers, is my personal interpretation of the workshop’s content, and is not to be considered as investment advice.

1. Key takeaways from the workshop

An ABC of Financial Literacy

Before the workshop I was emailed a soft copy of a handy book ‘An ABC of Financial Literacy’, written by John Killick. It’s a very nice guide covering 26 different concepts relating to finance and investment. Check out the book here (PDF) if you’re keen to have a look.

A. The power of planning

The first theme discussed in the workshop was planning.

The first step of planning is to talk about your goals (and not about products). Set measurable goals such as “I want to fund my children’s education” or “I want to create multi-generational wealth”. Only then can you talk about which specific products (i.e. banking, investments, insurance) can help you reach those goals.

A common goal is to retire with enough money to sustain your current (or better) lifestyle. The speaker blasted through some spreadsheets and calculations used to determine how much money you need to save per month to reach your retirement goal. The process they used roughly looked like:

- Calculate expenses – Take your age, your projected expenses in retirement, and factor in inflation, to work out how much money you need per year of retirement

- NZ Super – Subtract the income you’ll get from NZ Superannuation, to work out how much capital you need (given NZ Super won’t cover all expenses)

- Existing investments – Subtract the capital you might be able to drawdown from your KiwiSaver and other existing investments

- Shortfall/surplus – The result is your shortfall/surplus. If you have a shortfall you’ll need to contribute more money towards retirement in order to meet your goal. If you have a surplus, you’re already saving more than enough.

The single biggest regret of most clients is “I wish I had started saving earlier”. Here are some example calculations of how much someone needs to save per month to reach $1,000,000 by retirement. It certainly demonstrates that starting saving sooner makes it easier.

- At age 30 – $500 per month

- Age 35 – $790 per month

- Age 40 – $1,050 per month

- Age 45 – $1,690 per month

- Age 50 – $2,880 per month

When you reach retirement, you will likely go through different phases – the GoGo phase (65-75), SlowGo phase (75-85), and the NoGo phase (85-95). Your spending is likely to slow as you move through these phases, therefore you don’t have to factor in inflation in your retirement years. And if you do run short of money, you can “eat your house”, by using a reverse mortgage to drawdown equity from your house.

B. The magic of equities

The second theme discussed in the workshop was equities (shares).

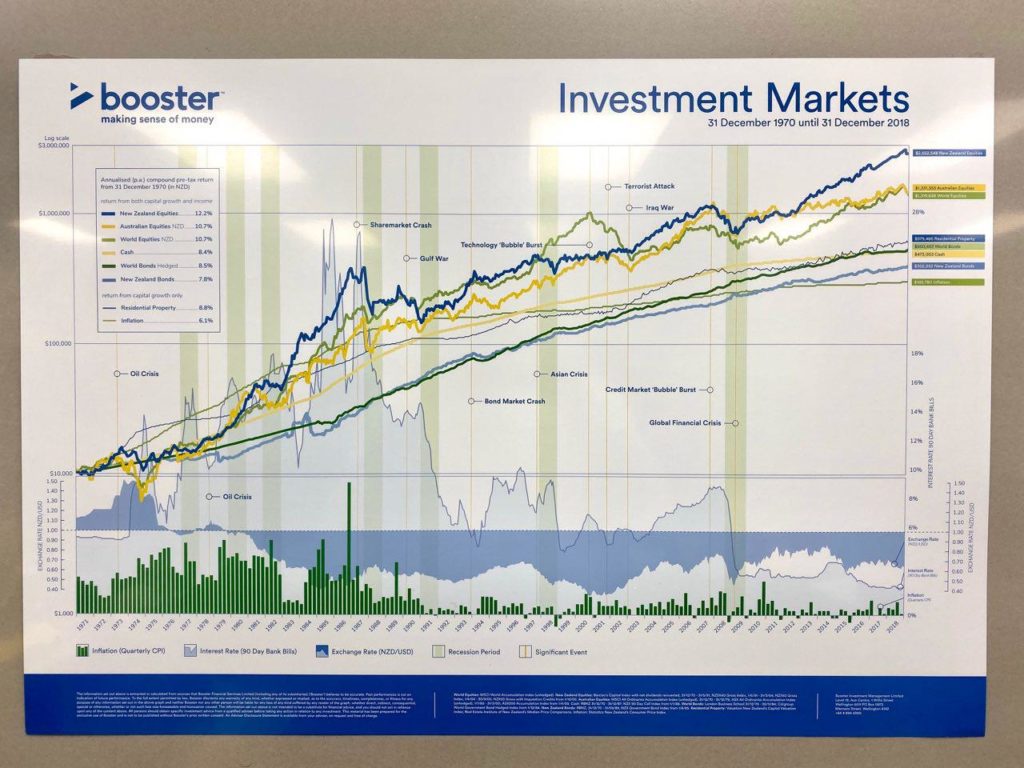

There are four main asset classes (equities, property, bonds, cash). Here are their average returns per year from 1971-2018, and how much money you’d have in 2019, if you had invested $10,000 in each asset class in 1971:

| Asset | Avg. Return | $10,000 invested |

| World Equities | 10.7% | $1,319,638 |

| Property | 8.8% | $579,486 |

| World bonds | 8.5% | $500,453 |

| Cash | 8.4% | $473,003 |

Equities are the best performing asset class (and NZ equities are even better at a 12.2% average return), while property really needs leverage for it to outperform. Therefore, you should not be afraid to put as much of your portfolio as you can into equities.

Unfortunately equities are perceived as high risk and most people still stick to bonds and cash. To manage the risk, shouldn’t we increase our exposure to bonds as we grow older (e.g. have <your age>% of your portfolio in bonds)? No! the speaker is 70 and is still mostly invested in equities! There are some strategies you can use to manage the risk:

Bucket approach – Keep some money (e.g. 2-3 years of living expenses) outside of equities in separate ‘buckets’, so you can cover your upcoming living costs without having to sell your shares during a downturn.

Diversify – Diversification can reduce volatility and risk. Remember to invest in multiple companies, in international and emerging markets (as NZ makes up less than 0.5% of global markets), and both large and small cap companies.

Understand Volatility – Sharemarkets are volatile. Volatility is just a market reaction, not a loss. Always stay the course and never sell your shares during volatile times. Instead take the opportunity to buy more shares while they’re ‘on sale’.

Have Faith – During bear markets (the market falling for a sustained period of time), the world does not end, but just appears to be. The media adds fuel to the fire by spreading news of doom and gloom because bad news sells (or gets more clicks). Have faith – of the 13 bear markets since 1946, the average length was just 15 months (with an average decline of 32%). The below statement is a nice way to put it:

The advance is permanent; the declines are temporary

2. Did they try to sell anything?

Given FoxPlan are a financial planning firm, they heavily promoted the value of having a financial adviser – they call your relationship with their advisers a 30 year partnership. It is similar to how the best in the world, such as elite athletes, all pay for a coach. They savaged DIY investors, saying they always underperform and always make bad decisions (Ouch. As a DIYer myself, that hurts to hear). An adviser is there to stop you from being too conservative, give you a positive perspective when markets are tumbling, and maximise your good decisions.

They perhaps tried a little too hard on their sales pitch though, as it often felt like they were rambling on about things, rather than providing concrete information on a particular point. It was quite distracting, and made it hard to follow the workshop and pick up any substantial learning points. I understand it’s a free workshop, but there needs to be a good balance between promoting your business, and giving valuable insights to the audience (like with the Craigs workshop I attended last month).

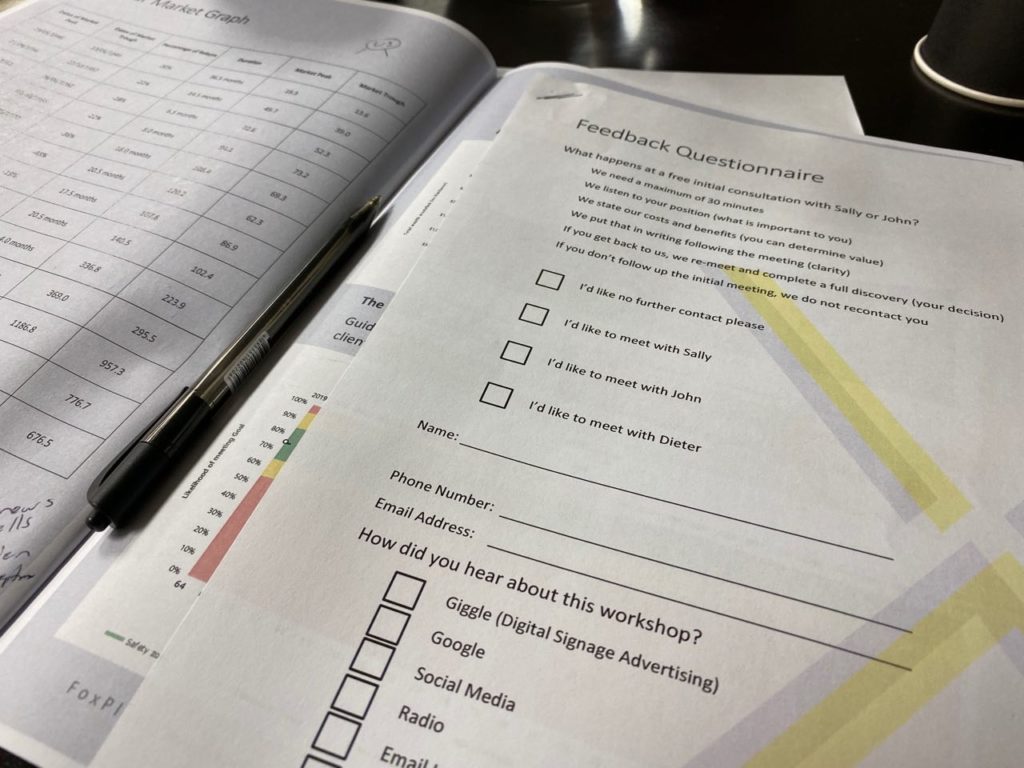

Lastly, they asked us to fill in a Feedback Questionnaire at the end, in which we could opt in to have a free initial consultation with either John, Sally, or Dieter. None of my friends opted in (but I believe the couple sitting beside me were keen to meet Sally).

3. Was there any free food?

Halfway through the workshop we all paused for a break. Pizza from Tommy Millions was served! I picked up a slice of their pepperoni and a slice of their margherita pizza, and it was the best pizza I’ve had in a long time! Both slices had light, crispy bases, and perfectly flavoured toppings.

There were a couple of awesome giveaways during the workshop. One of my friends won the aforementioned ‘ABC of Financial Literacy‘ book as a hard copy. Another friend won a $200 New World voucher at end – I believe she is going to share the love by buying lollies for us, but I am still waiting for these!

She also won the following document, which she’s since offloaded to me, and we both have no idea what to do with it. It’s a data collection booklet to complete with one of their advisers, in order to develop a personalised financial plan. But neither of us want to, or need to use a financial adviser…

Lastly at the conclusion of the event, beers, ginger beers, wines, and nibbles were provided. We were well looked after 🙂

4. My thoughts on the workshop

I struggled to pick out the key points of this workshop. The presentation lacked cohesion – moving quickly through some topics, rambling on too much about others, and there was way too much jumping back and forth between different unrelated points. My friends say they’re waiting for this blog post as they also struggled to understand the content!

However, their aggressive approach to investing in equities was somewhat refreshing. Finally, people who have the balls to encourage sticking most of your portfolio in equities, even when you’re 70! Out the window goes the traditional rule of sticking <your age>% of your portfolio into bonds! To me this was a great reminder that shares are the best performing asset class, and we should really be less fearful and conservative in our portfolios.

Lastly, do you need a financial adviser? It is up to you to decide. I myself am going to remain a stubborn DIY investor. I enjoy managing my own finances and investments, and services like InvestNow and Sharesies have made the NZ investing scene so much easier for DIYers. But there is no doubt that advisers provide value, giving you advice tailored to your unique personal circumstances, or coaching you through your financial life (including telling you not to panic sell your equities when the markets crash).

If you’re looking for an adviser, FoxPlan is not the only option. I’d suggest checking out Mary Holm’s page about financial advisers, where she has a list of fee-only advisers (as opposed to commission based advisers who get paid when they sell a particular product to their client). My fellow bloggers Nick Carr and Sonnie Bailey are advisers on this list, so check them out!

My overall rating of the event: 2.5/5 stars

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.