Recently we came across a couple of YouTube videos from a New Zealand personal finance channel called Financial Knowledge (FK). In these videos FK makes several arguments against investing in KiwiSaver, suggesting that after watching his videos you might consider reducing your contributions or dropping them altogether. So should you follow FK’s suggestions, or are they complete rubbish? In this article, we’ll look at some of the claims FK makes about the KiwiSaver scheme and provide our own perspectives on each one.

FK’s videos that this article is in response to:

– Why I Quit KiwiSaver – Should You?

– Complete Guide To KiwiSaver – What You Didn’t Know!

1. KiwiSaver won’t help you buy a house

One of the main reasons to have KiwiSaver is to help you get your first home. But with the average house price constantly going up, is it actually going to help you achieve that goal?

Financial Knowledge

Saving up to buy a house is a major motivator for someone to join KiwiSaver, but FK questions the ability for the scheme to actually help in this regard. KiwiSaver certainly isn’t a silver bullet in putting together a house deposit. For example, someone on a $70,000 salary contributing 3% into the scheme for 10 years will come out with around $56,500 (assuming a 7% annual return) – That’s unlikely to be enough for a deposit in the main centres.

But we have to be reasonable here – KiwiSaver is an investment account, not a magical money multiplier. It’s not a shortcut where you can just plonk away a few percent of your salary each payday and come out with a house deposit on the other side. It exists to complement your journey towards a house deposit, which will often require your own planning and savings outside of the scheme.

And as for the issue of house prices increasing over time, making it more and more difficult to put together a deposit, you’ll face the same issue even if you invest outside of KiwiSaver. Non-KiwiSaver investments aren’t any better in helping you towards your home ownership dream, given they aren’t magical money multipliers either. In fact, only investing outside of KiwiSaver may leave you worse off as you’ll be leaving the scheme’s financial incentives on the table. These are:

- Government contributions – The government will contribute $0.50 to your KiwiSaver (up to $521.43 per year) for every $1 you make in employee or voluntary contributions. Over 10 years that could equate to $5,214 plus any investment gains you make off that.

- Employer contributions – Many employers will match your employee contributions at a minimum rate of 3%. Over 10 years, on a $70,000 salary that could equate to $14,700 plus any investment gains you make off that.

Wouldn’t it be better to have this money to put towards your house deposit, than to not have them at all?

First Home Grant

The only way that you’ll qualify for a First Home Grant is if you’re living in a very rural part of the country.

Financial Knowledge

The First Home Grant is another incentive of contributing to KiwiSaver, as it could give you up to $10,000 towards buying your first home. But FK argues that it’s pretty much impossible to get the grant.

The biggest problem with this is, that there’s a massive discrepancy in the average house price in the area, and what the maximum threshold is to actually qualify for one of these grants

Financial Knowledge

That’s because the grant’s house price caps fall well below the average house price in most regions. For example:

- In Auckland – To qualify for the grant, the house you’re buying needs to be under $875,000. However, the average house price in Auckland is $1.2 million.

- In Christchurch – To qualify for the grant, the house you’re buying needs to be under $550,000 for an existing home or $750,000 for a new home. However, the average house price in Christchurch is $800,000.

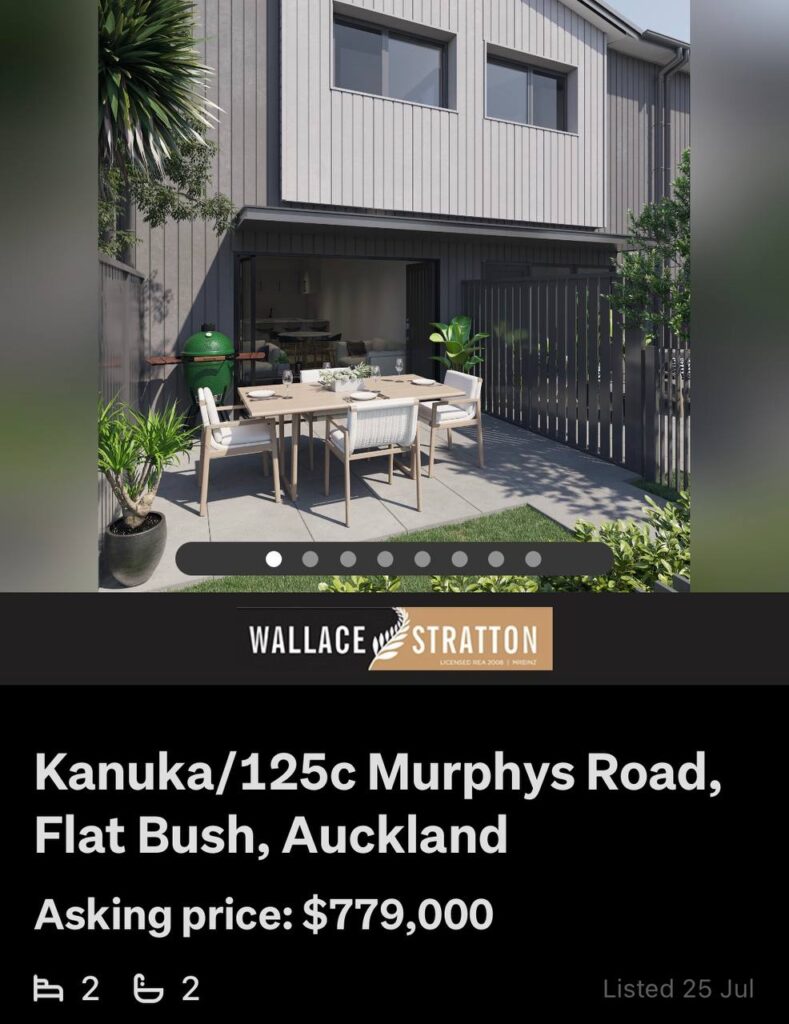

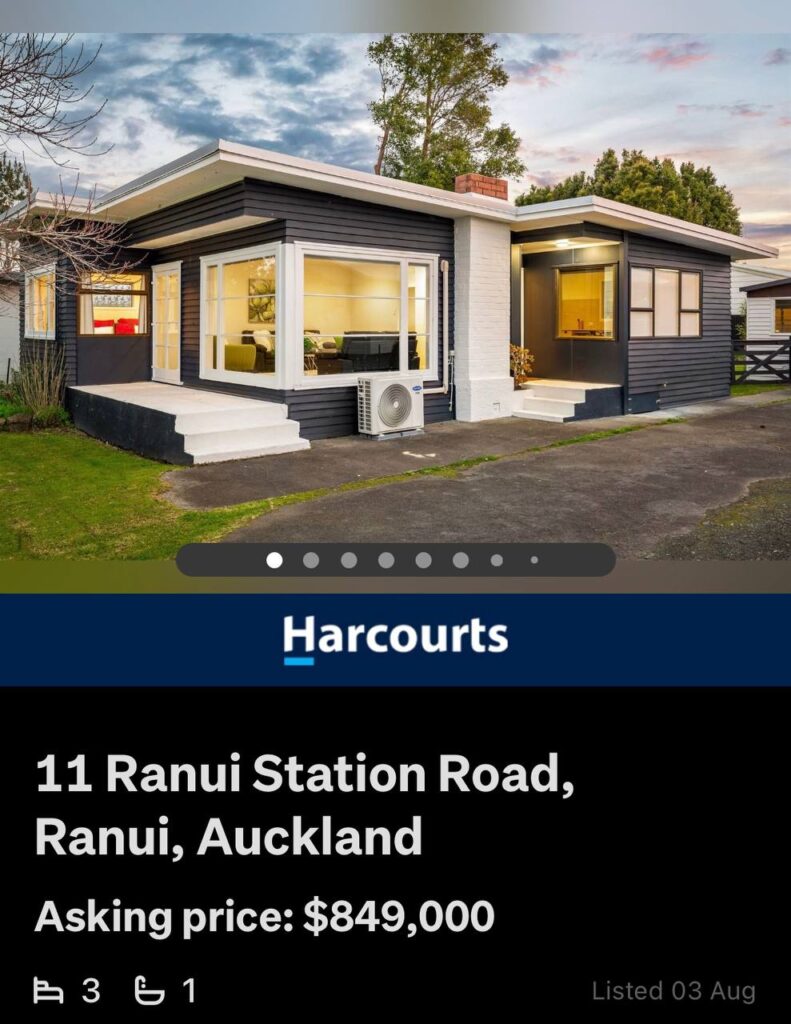

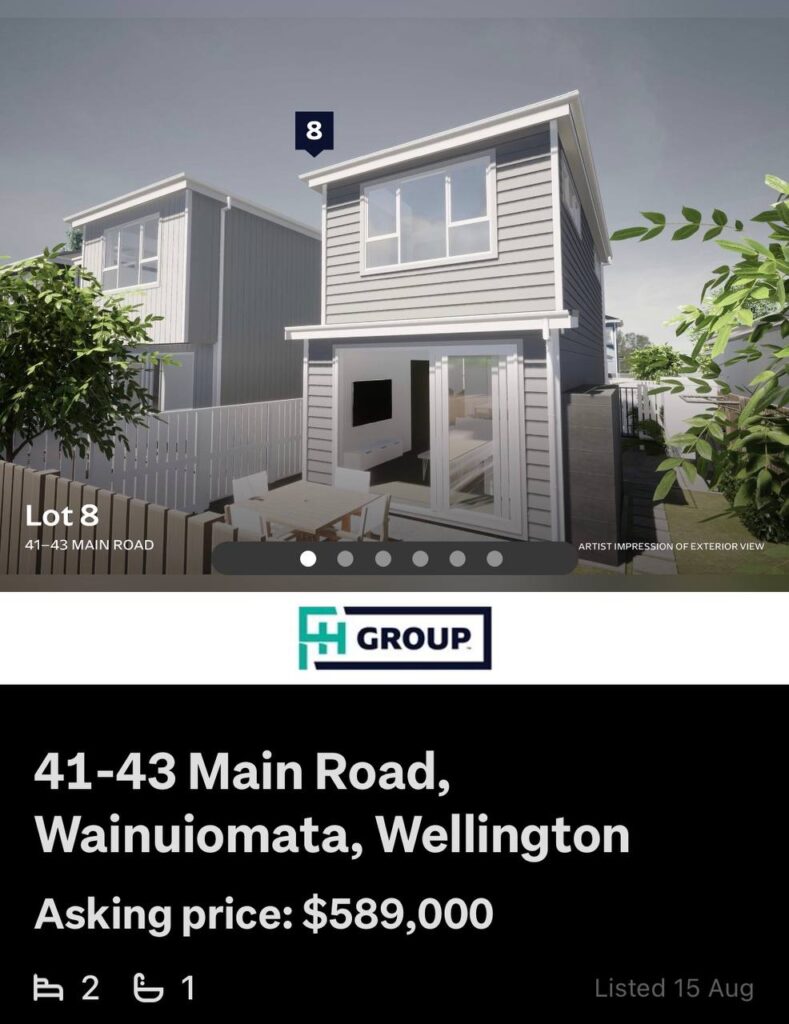

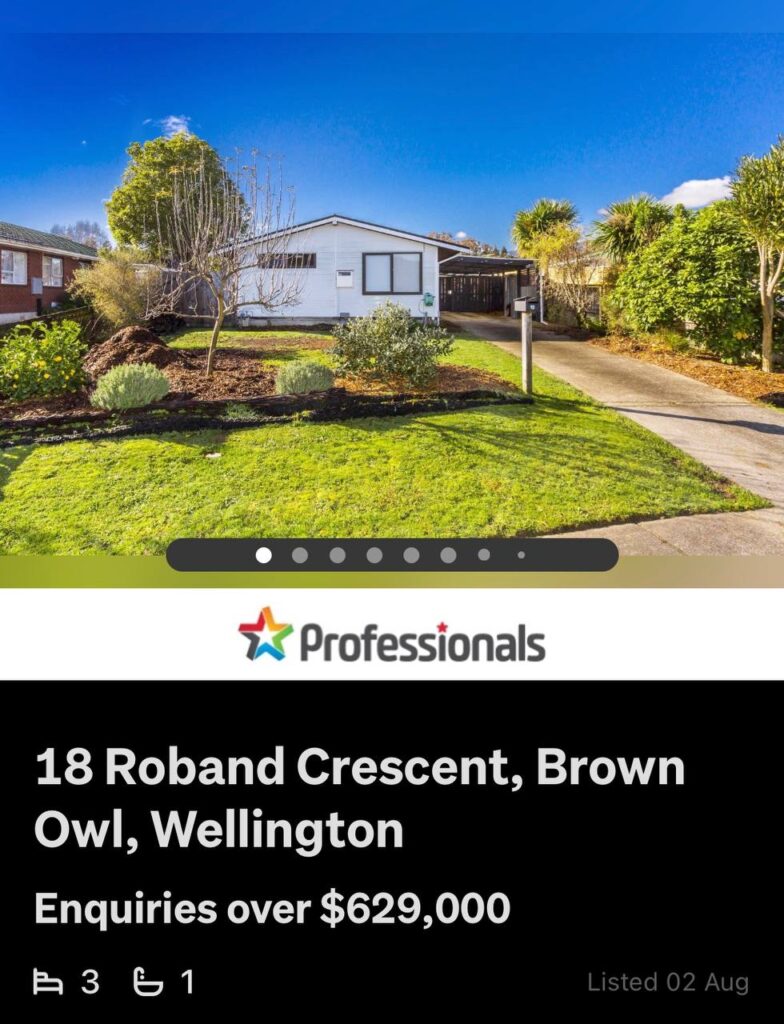

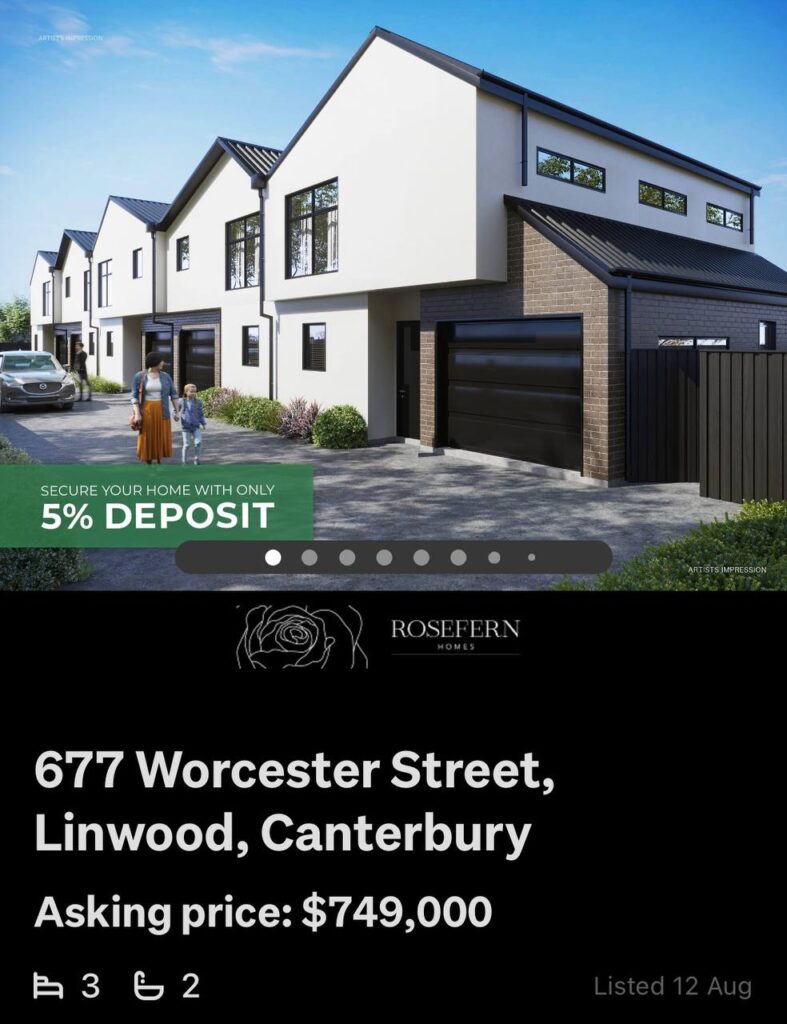

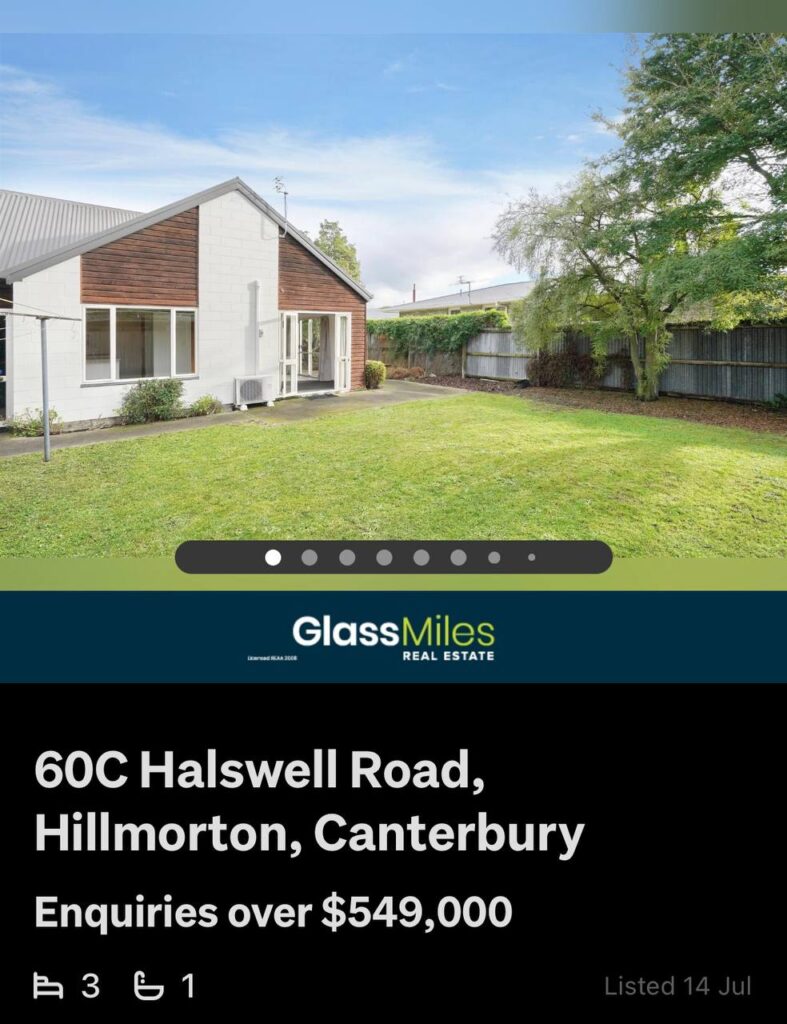

So if you’re buying an average priced house, then FK is right in saying that the grant is near impossible to get. But most first home buyers wouldn’t be buying an average priced home anyway – they’d likely be looking at a much cheaper entry-level home. And there are plenty of those that do fall under the caps:

So while your options are limited if you’re trying to get the grant, you certainly don’t have to be buying a house in Kaikohe to qualify for it.

Further Reading:

– Can’t afford a house? 5 ways to help you get on the ladder

2. KiwiSaver isn’t effective in helping you save for retirement either

The average balance for someone using KiwiSaver is only $29,000, so that really isn’t going to be enough for retirement.

Financial Knowledge

FK suggests that KiwiSaver won’t help people save for retirement either, as the average balance for members in the scheme is just $29,000. Sure, that won’t go far in giving you a comfortable retirement, but $29,000 is just the average balance at one point in time, and FK’s statement assumes that people won’t be making any further contributions to their KiwiSaver funds in the lead up to their retirement.

In reality, the KiwiSaver scheme is relatively new at just 15 years old, and most members are over a decade away from retirement (71.5% of members are aged 50 or under). We are sure to see the average KiwiSaver balance increase over time, as these people continue to contribute to their balances and earn investment returns.

Take a 30-year-old for example, who earns $70,000 p.a. and has 35 years left for their KiwiSaver balance to grow. If they started with the average balance of $29,000 and contributed the minimum 3% into a Growth Fund, they’ll end up with $655,326 (not adjusted for inflation) at age 65, according to the Sorted KiwiSaver Calculator. Now that is significantly more than $29,000!

If you look at what the national average is for a return from people’s KiwiSaver schemes, it’s just 3.2%. So if most people are only making an average of 3%, then you’ll likely be losing money to inflation.

Financial Knowledge

FK goes on to suggest that the average return of a KiwiSaver fund is so low, that you’ll fail to beat inflation by investing in the scheme. But keep in mind, the return of 3.2% that FK uses in his argument is just an average, which includes the returns of cash and conservative funds. Plenty of people will be making more than that through the likes of Balanced and Growth funds. In fact 42% of KiwiSaver money is invested in Growth funds making it by far the most popular type of fund.

The returns from a Growth fund will likely be enough to beat inflation over the long-term (which has averaged around ~2% per year). So even if we adjust our above $655,326 for inflation, we’d still have a balance for $329,182 for retirement. According to Sorted’s Retirement Calculator that would provide us with $303 per week, which combined with $463 from NZ Super would be enough for a single person to live a “no-frills” lifestyle in a main centre, and have $115 per week to spare. So KiwiSaver certainly can be effective in helping you prepare for retirement.

3. Cash funds are a waste of time

I wouldn’t really recommend this fund type because the KiwiSaver scheme is designed to give you long-term growth on your investments.

Financial Knowledge

FK recommends against investing in a Cash fund, as KiwiSaver is designed for long-term investment, and Cash funds have the worst long-term returns. Yes, the objectives the scheme helps you save for (buying a first home and retirement) are usually major, long-term goals. But in reality, many people in KiwiSaver have their money invested in the scheme for the short-term. For example, someone intending to use their KiwiSaver to buy a house in a couple of year’s time would not be considered a long-term investor.

Our view is that Cash funds are an important tool for someone looking to withdraw their KiwiSaver money in the very short-term (e.g. 1-2 years). Cash funds certainly do have the lowest potential returns, but they’re not designed to make you money. Instead they turn your KiwiSaver into a pseudo savings account, in order to keep your house deposit or retirement nest egg away from the volatility of the share and bond markets – something we’ve seen a lot of this year.

Cash fund vs other fund types – Average 1 year performance to 30 June 2022:

– Cash: 0.7%

– Conservative: -6.9%

– Balanced: -8.7%

– Growth: -10.6%

– Aggressive: -11.7%

Further Reading:

– What’s the best short-term investment?

4. Growth funds are the best

This is most definitely going to be the best KiwiSaver fund for you.

Financial Knowledge

Growth funds are the most popular type of fund across providers, but it is misleading (and probably illegal) to say they will “most definitely going to be the best KiwiSaver fund for you”. There is no such thing as a definitive best when it comes to KiwiSaver fund types. Different people have different financial goals and circumstances, so what’s best for one person may not be the best for another.

For example, Growth funds might suit a 30-year-old with a reasonable risk tolerance who’s investing for retirement. However, another 30-year-old who’s expecting to buy a house next year may find a Cash fund to be best, as it will protect their house deposit from the potential downside of being in the markets.

Growth funds give you the best returns because they have the highest risk investments within them, which are shares of individual companies.

Financial Knowledge

FK also claims that Growth funds will give you the best returns over the long-term. This is not true either. While Growth Funds (which invest in ~80% shares and ~20% bonds and cash) will likely outperform Cash, Conservative, and Balanced funds, there are Aggressive funds which invest 90%+ in shares, offering even higher potential returns. More on these funds later on.

Further Reading:

– What’s the best low cost Growth/Aggressive KiwiSaver fund?

5. KiwiSaver funds only pick very safe companies

It’s important to keep in mind that the types of companies that a KiwiSaver scheme will put their money into do have to be safe for their investors… They don’t have massive drops in their value, and they are overall a very safe and consistent investment.

Financial Knowledge

FK says that KiwiSaver funds only invest in “very safe” companies that don’t have massive drops in their value, perhaps providing the allusion that the funds are low risk investments. But this is quite a strange statement to make. There’s no requirement for KiwiSaver funds to stick to safe, stable companies. For example, here’s a few KiwiSaver holdings which have been hit hard in the past year:

- ANZ Growth Fund – a2 Milk (-20%), eBay (-36%)

- Milford Active Growth Fund – Fisher & Paykel Healthcare (-39%), My Food Bag (-47%)

- Juno Growth Fund – Alibaba (-42%), Netflix (-56%)

- NZ Funds Growth Fund – Invests a small amount into cryptocurrency, which typically isn’t an asset class you’d consider “safe”.

- Passively managed KiwiSaver funds – These have limited say on the actual companies they’re investing in, as they have to buy whatever companies are in the indices they track, regardless of whether they’re “safe” or “risky”.

Fund managers reduce the risk of a KiwiSaver fund primarily through diversification, rather than through company selection. They typically invest in hundreds of assets spread across different industries and geographies, therefore it’s almost impossible for your fund to go to zero, unless all companies in the fund go bust at the same time. That probably won’t happen unless something apocalyptic happens.

But we still feel that FK may be misrepresenting and understating the risks of KiwiSaver. No matter how diversified a fund is, you can’t diversify your way out of market crashes and corrections, so it’s inevitable your fund will face many large downturns over your investing career.

To get an idea of how severely a KiwiSaver fund could be hit by a downturn, you could look the Nikko AM ARK Disruptive Innovation Fund, which plummeted by 70% from February 2021 to June 2022! Although that’s just an outlier and the average Growth and Aggressive fund is only down by 10.6% and 11.7% respectively over the last year, a 10.6% loss could still represent a big chunk of your house deposit, or could still be enough to make investors have sleepless nights.

Implications of the risks

So because there are risks involved with investing in KiwiSaver, does that mean you should avoid the scheme? No, because non-KiwiSaver investments are also subject to the same risks. For example, investing in the Simplicity Growth Fund through KiwiSaver is no risker than investing in the same fund outside of KiwiSaver.

But what this risk means is that you shouldn’t automatically go for an Aggressive fund for example, just because they have the highest returns. You need to take into account other factors in choosing a fund such as:

- Investment timeframe – How long before you need to withdraw the money? Those investing long-term should be ok to go with a Growth or Aggressive fund, as they have enough time up their sleeves for their fund to recover from a market downturn. But those needing the money in the short-term may want to stick with the likes of Conservative or Cash funds (as we discussed above), to protect their money from the volatility of the markets.

- Risk appetite – How well can you tolerate losses in the value of your investments? Those with a high risk appetite may be ok investing in an Aggressive fund. But those less willing to see fluctuations in the value of their KiwiSaver may want to consider a Growth or even Balanced fund, which will be less volatile.

Further Reading:

– The ultimate guide to KiwiSaver funds and schemes

6. You’d be better off investing in an index fund like the S&P 500

The S&P 500 will far outperform any KiwiSaver provider at over $7 million over 45 years – and this is comparing it to the most profitable KiwiSaver scheme

Financial Knowledge

FK argues that the returns of KiwiSaver funds are inferior, suggesting a much better alternative in the form of an S&P 500 index fund. He provides the following example of someone investing $1,000 per month from age 20 to 65. Over 45 years of investing, here’s what he claims you’d have in each fund:

- ASB Growth Fund – $1.38 million

- ANZ Growth Fund – $1.59 million

- S&P 500 – $8.6 million

What!!!? With such a massive gulf between these KiwiSaver Growth funds and the S&P 500, why would you even bother with KiwiSaver!?

But there are so many things wrong with this comparison. Firstly, the comparison assumes the following returns for each fund:

- ASB Growth Fund – ~3.8%

- ANZ Growth Fund – ~4.3%

- S&P 500 – 10%

We have no idea where the numbers for the ASB and ANZ Growth Funds came from, but FK has significantly understated their performance. Since inception both funds have delivered an annual return of over 6%, and in the last 10 years both funds have returned over 9% p.a. Much higher than what FK has used in his calculations.

Secondly, FK says there’s no management fees to invest in an S&P 500 fund.

There’s also no management fee for this [S&P 500] ETF

Financial Knowledge

This is also untrue. Not only do S&P 500 funds charge a management fee, you may also incur account fees, brokerage fees, and foreign exchange fees in the course of investing in the index. That would bring your annual 10% return of the S&P 500 closer to ~9.5%, and that’s before the impact of tax.

Thirdly, FK is comparing apples to oranges. In this case, he’s comparing a broad market index fund invested 100% into shares with a Growth fund invested 80% shares and 20% into cash and bonds. So of course the broad market index fund will outperform the Growth fund over the long-term, as it doesn’t have the performance drag of cash and bonds. Wouldn’t a better comparison be between the S&P 500 and a more aggressive KiwiSaver fund?

In addition, FK has missed the fact that you don’t need to go outside of KiwiSaver to access the S&P 500 index. You can easily invest your KiwiSaver in the S&P 500 via the following providers:

- SuperLife – Offers the SuperLife US 500 Fund, which is essentially a KiwiSaver version of the Smartshares US 500 ETF.

- Kernel – Offers the Kernel S&P 500 Fund, which is currency hedged to the NZ Dollar.

The returns of the above S&P 500 KiwiSaver funds are no better or worse than investing in the index outside of KiwiSaver. They track the exact same underlying index and invest in the same companies. And as for fees, while the KiwiSaver version of SuperLife’s US 500 Fund is a little more expensive than their non-KiwiSaver equivalent, Kernel’s KiwiSaver fees are even cheaper than their non-KiwiSaver fees.

Further Reading:

– What’s the best S&P 500 index fund in 2022?

Other indices

You’re relying on 500 of the biggest companies in the world to make you profit which is very much a winning strategy

Financial Knowledge

While FK focuses on the S&P 500 as his investment of choice, it’s understandably not for everyone. Firstly, as we mentioned above, investing in a fund containing 100% shares won’t suit every investor. Not everyone can tolerate the volatility and downturns of the sharemarket (like the S&P 500 bear markets shown below) so may find an allocation to bonds (e.g. by investing in a Growth or Balanced fund) to be helpful.

Recent S&P 500 bear markets

– Oct 2007 to Mar 2009: -56.8%

– Feb 2020 to Mar 2020: -33.9%

– Jan 2022 to Jun 2022: -23.6%

Secondly, while investing in the S&P 500 has indeed been a winning strategy in recent times, the index only contains companies listed in one country, the United States. That might not be geographically diversified enough for some. Therefore, many might prefer other index funds (like global ones), with the understanding that US companies won’t necessarily continue to outperform other regions into the future. That’s no problem for KiwiSaver investors, as there’s plenty of other KiwiSaver index funds to choose from with providers such as:

- Kernel – Offers 13 index funds, including the High Growth Fund which invests in a mix of NZ and global shares.

- InvestNow – Offers a small selection of 7 index funds.

- SuperLife – Offers a huge range of index funds which largely replicate Smartshares’ ETFs.

Or if that’s not enough, there’s a couple more interesting choices:

- kōura – Uses a robo-adviser to build a personalised KiwiSaver portfolio for you, using their suite of index funds. Includes the option to allocate up to 10% of your KiwiSaver towards Bitcoin.

- Craigs – Allows you to self-select a KiwiSaver portfolio out of over 200 investment options including individual companies and ETFs.

So while KiwiSaver isn’t as flexible as other investments, you certainly don’t have to settle for a boring Growth fund with your bank when it comes to picking where to invest your KiwiSaver money!

Further Reading:

– Kernel review – High quality index funds

– Smartshares & SuperLife review – The smart way to invest in shares?

– Kōura review – Crypto meets KiwiSaver

– Build your own KiwiSaver – InvestNow vs SuperLife vs Craigs

7. Non-KiwiSaver funds require you to put in less money to get the same result

You’re actually having to put in less money as well, because you’re not topping it up with 3% of your weekly income, and there’s no employer contributions as well

Financial Knowledge

FK suggests that investing outside of KiwiSaver is more attractive, because it doesn’t require you to contribute 3% of your pay. Therefore you don’t have to put in as much money, to get the same result as investing inside of KiwiSaver. Now this might be the most misleading statement from a personal finance content creator we’ve ever seen! Take the story of Jenna and Aaron for example:

Jenna

Jenna is 30 years old and earns a salary of $70,000. She contributes to KiwiSaver at a rate of 3%.

After tax, ACC, and KiwiSaver contributions, Jenna’s take home pay is $52,858 per year.

Each year Jenna gets $4,091 invested into her KiwiSaver. This is made up of:

– $2,100 in contributions from her own salary

– $1,470 in contributions from her employer

– $521 in contributions from the government

After investing that $4,091per year into KiwiSaver, Jenna is still left with her entire $52,858 thanks to the employer and government contributions.

Aaron

Aaron is also 30 years old and also earns a salary of $70,000. He doesn’t contribute to KiwiSaver but still invests elsewhere.

After tax, and ACC, Aaron’s take home pay is $54,958 per year. That’s $2,100 more than Jenna as he’s not getting KiwiSaver contributions deducted from his pay.

Aaron also decides to invest $4,091 per year to match Jenna, but chooses to do so in a non-KiwiSaver Fund. He has to get that money from his own take home pay.

After investing that $4,091 per year outside of KiwiSaver, Aaron is left with just $50,867. He is $1,991 worse off compared to Jenna because he needs to put in more of his own money.

So FK’s statement here is totally incorrect. Our non-KiwiSaver member earning $70,000, actually has to put in $1,991 more of their own money each year to have the same amount invested as a KiwiSaver member, because they don’t get the benefit of employer and government contributions.

Further Reading:

– KiwiSaver 101 – How does KiwiSaver fit into your investment portfolio?

8. People only contribute to KiwiSaver because they don’t know an alternative

The majority of people will contribute towards a KiwiSaver scheme because they don’t know an effective alternative, and it’s all they really know in terms of getting ready for retirement

Financial Knowledge

This is another statement by FK that couldn’t be further from the truth! KiwiSaver definitely isn’t just an investment scheme for the financially ignorant. Many people actively choose to invest in KiwiSaver because they feel it’s worthwhile contributing to, not because they don’t know how to invest elsewhere. Our polls on social media show that the vast majority of people have a favourable view towards investing in the scheme:

Social media poll results

We asked our followers on Instagram and Twitter “Is investing in KiwiSaver worth it?” and got 200 responses:

– Yes: 165 respondents (82.5%)

– No: 11 respondents (5.5%)

– Not sure: 24 respondents (12%)

The main drivers for actively contributing to the scheme are the financial incentives, which are highly compelling given the ROI (return on investment) on offer:

- Government contributions – Essentially a 50% after-tax ROI on every dollar you contribute up to $1042.86 each year.

- Employer contributions – Essentially a 100% before-tax ROI on every dollar you contribute, assuming you’re not on a total remuneration package.

Where else can you easily find such high risk-free returns? People also enjoy the non-financial benefits of the scheme, like the fact that it’s a set-and-forget way to make regular contributions towards your first home or retirement.

However, we do have to acknowledge that KiwiSaver is far from perfect. It only allows you to withdraw from it in very limited circumstances, so you couldn’t use it for things like education, starting a business, or travel. Therefore under 18s may want to stay out of KiwiSaver, as they don’t get the above financial incentives in return for having their money locked up. Instead under 18s may want to consider investing in non-KiwiSaver investments where there’s no restrictions on withdrawing the money.

Otherwise remember that KiwiSaver isn’t an either-or thing – If you’re contributing to the scheme, there’s nothing stopping you from you investing outside of it as well. Many people approach it by investing the minimum just to harvest the financial incentives, then invest the rest of their savings in non-KiwiSaver investments that can be withdrawn at any time. So even for financially knowledgeable people, there’s some strong financial and non-financial reasons to have KiwiSaver as at least a small part of your portfolio.

Further Reading:

– 12 KiwiSaver myths and misconceptions busted

Conclusion

Everyone is entitled to their own opinion, and it’s not uncommon to see content creators make mistakes and have divergent views to your own. But after watching his two KiwiSaver videos, we feel that Financial Knowledge is not a reputable content creator. His various statements on KiwiSaver are so misleading, and despite his good intentions, he’s done more harm than good in helping everyday New Zealanders form a balanced view on the scheme. His older content is also of concern, even suggesting using Bitcoin and crypto lending to save for a house deposit, and touting SafeMoon (essentially a scam cryptocurrency) as an investment at one point.

But back to the original question, should you be reducing your KiwiSaver contributions or dropping them altogether? Perhaps you should if you’re under 18, or if you’re contributing more than the minimum needed to extract the financial incentives from the scheme. However, dropping your contributions in response to any of FK’s misconceptions is a bad idea.

In most cases we think that KiwiSaver is absolutely worth it to contribute at least the minimum. The returns will be just as good as investing in the same fund outside of KiwiSaver, plus you’ll benefit financially from employer and government contributions – both of which will have a positive impact towards your first home purchase or retirement. It’s like having your cake and eat it too!

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Hey MoneyKing NZ, thanks for posting this. Will have a look at the videos to actually see by myself, but based on what you mention here there is a lot of misleading information there.

I think it’s a missed opportunity as there is not a lot of content on Youtube focussing on NZ (that I’m aware of at least) with good information. I prefer to read rather than watch, but still it would provide access to other people that might prefer that way.

By the way, I have a small suggestion. One of the links to the Youtube videos (the second) open within the same browser tab instead of in a new one. Maybe as an editing task before publishing the article, make sure all 3rd party links open in new windows. You definitely want to keep your site open.

And thanks for posting all the content you put on your site. All of them have something worth reading, keep the good work! I for one will try and comment often (first time here) as long as I have something interesting to say, and I would definitely recommend more people doing the same, usually in this kind of articles the comment section is as interesting and the content itself.

Thanks!

Hi Juan, thanks for the suggestion. We do try to have external links open in a new window but must have missed that one. And thanks for reading and posting your comment – really appreciate it!

I’d say Kiwisaver is a safe spot for the risk-averse culture we have. Very nice post!

Where is the data(chart) about the S&P500 index for the past 5 years? The return before taxes and fees is still above what KiwiSaver offers, even with the Govt contributions and employer by a larger percentage. ~68%

Just a small adjustment to reflect the real figures based on here https://www.qv.co.nz/price-index/

The Avg house price in Auckland is $1.5M not $1.2M

The Avg house price in Christchurch is ~$770k

Thanks mate. Check out section 6 of the article where we explain why the S&P 500 doesn’t necessarily offer a better return than KiwiSaver – because you can put your entire KiwiSaver into an S&P 500 index fund if you wanted to.

Great content as always! What do you think about Kiwisaver as an investment strategy for someone located overseas who is not sure if they will settle long term in NZ . Obviously this takes aways the employer contribution benefit and potential for house deposit (if buying overseas). By the way I understand any response is not financial advice, but given we have so many kiwis overseas I thought you might have some general thoughts. Cheers!

Cheers Billy. There are usually no financial incentives for someone based overseas to be contributing to KiwiSaver. So depending on which country you’re based in, you might want to consider using a local investment platform as that’ll also save you foreign exchange costs in moving money to NZ. If you do decide to settle in NZ, it should be easy enough to move that money back and restart your KiwiSaver contributions.

wow that’s terrifying. Pretty concerning when people (well intentioned or not) are creating such misleading and inaccurate content. Financial literacy is such a gap in NZ, and while I think it is slowly (SLOOOOWWWWLLLYYY) closing, people like this can only do damage. I am torn between watching the videos to make up my own mind, and not giving the YouTube algorithm any more reason to suggest this to anyone else through views/comments etc.

In a nutshell, this:

“If you’re contributing to the scheme, there’s nothing stopping you from you investing outside of it as well. Many people approach it by investing the minimum just to harvest the financial incentives, then invest the rest of their savings in non-KiwiSaver investments that can be withdrawn at any time”

Exactly my approach, but you need a thorough understanding of the whys and why nots that it sounds like this creator is doing nothing to provide! Thanks for the article.

Thanks Mikey. You are right, there are already so many KiwiSaver myths and misconceptions out there and this creator doesn’t help at all. It probably won’t hurt too much if you viewed the videos, in fact we would encourage our readers to look at different perspectives before making up their minds 🙂

Very interesting article as I have been considering putting funds into Kiwisaver for a grandchild. Well explained and clear. Thank you.

Thank you!

Personally KiwiSaver drops constantly saving is better option the return is uncertain on KiwiSaver

Depends whether you’re using KiwiSaver for the long term or not. If you’re willing to bear the uncertain returns, a Growth/High Growth KiwiSaver fund should deliver much better results over the long term versus saving. For the short term saving is still great for its certainty. You can invest in savings products through KiwiSaver as well via the many Cash funds available.