Just as we’re all in the process of winding down for the year and preparing to go on holiday, Sharesies announced some massive changes to their pricing structure. In this article we break down the fee changes and see whether they have a positive or negative impact on you.

This article covers:

1. What are the fee changes?

2. Why are the fees changing?

3. How will the fees impact me?

4. How do the new fees stack up with other platforms?

5. How are other investors dealing with the changes?

1. What are the fee changes?

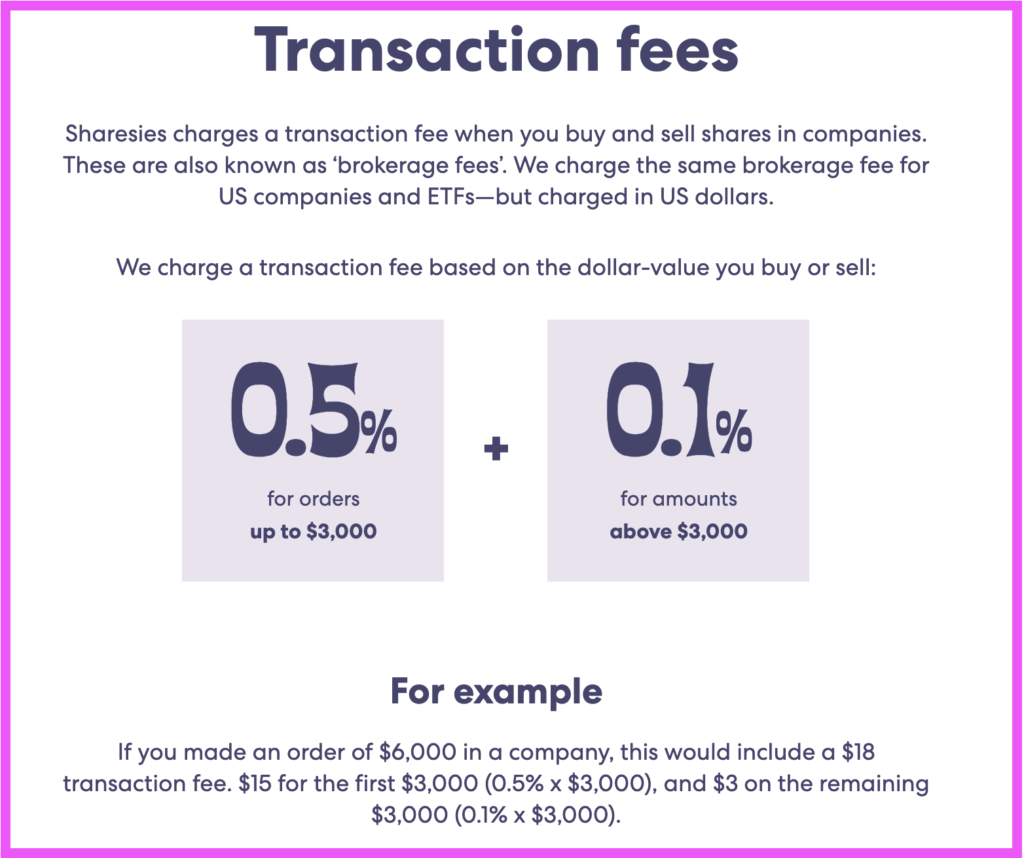

Transaction fees

Current fees (up to 30 January 2023)

Sharesies charges a percentage based transaction fee every time you buy or sell shares. This is currently 0.5% for orders up to $3,000, plus 0.1% for any amount over $3,000.

New fees (from 31 January 2023)

From 31 January 2023, the base transaction fee is increasing to 1.9%. However, the following transaction fee caps will apply:

- $25 NZD for NZ shares

- $15 AUD for Australian shares. The cap is $6 AUD for Australia based investors.

- $5 USD for US shares

That means no matter how much you invest into NZ shares, you won’t pay more than $25 NZD per order.

Unlisted managed funds (such as those offered by Milford, Pie Funds, or Pathfinder) do not incur a transaction fee.

Monthly plans

Current fees (up to 30 January 2023)

N/A. Sharesies doesn’t currently offer any monthly plans.

New fees (from 31 January 2023)

Sharesies’ new plans give you the option to pay a fixed dollar amount each month. In return you get your transaction fees covered up to a certain limit:

| Plan | What you’ll get each month |

| $3 plan | Transaction fees covered on up to $500 NZD of individual trades, plus Transaction fees covered on up to $1,000 NZD of auto-invest orders |

| $7 plan | Transaction fees covered on up to $1,000 NZD of individual trades, plus Transaction fees covered on up to $3,000 NZD of auto-invest orders |

| $15 plan | Transaction fees covered on up to $5,000 NZD of individual trades, plus Transaction fees covered on up to $10,000 NZD of auto-invest orders, plus NZX market depth subscription (usually $10 per month) |

| $1 kids plan | Transaction fees covered on up to $500 NZD of individual trades, plus Transaction fees covered on up to $1,000 NZD of auto-invest orders |

So let’s say you opted-in to the $3 monthly plan. By paying that $3, you’d be able to make up to $1,000 of investments though auto-invest without incurring any extra transaction fees. In addition you could make up to $500 in one-off buy/sell trades without incurring extra transaction fees. However, if you wanted to invest more beyond those limits, you’d be charged the regular 1.9% fee unless you upgrade to a higher tier plan.

Note that the plans don’t cover any additional costs like foreign exchange fees.

Monthly plans aren’t available for Australia based investors.

Other fees

A couple of other key fees are also changing:

- Foreign exchange fees – Charged when changing currency between NZD, AUD, and USD. Increasing from 0.4% to 0.5%.

- Transferring NZX shares out – Charged when transferring NZX listed shares out from Sharesies’ custody to your own CSN. Increasing from $5 to $15 per transfer.

- Account closure fee – There is normally no fee to close your Sharesies account. However, there’s a new $15 fee if Sharesies closes your account due to being non-compliant (e.g. for inappropriate activity or not meeting AML/CFT obligations).

A full breakdown of Sharesies’ fees can be found on their website here.

2. Why are the fees changing?

Sharesies haven’t provided a clear reason as to why they’re changing their fees, but the likely reason is that they’re burning through too much cash (with estimated losses of $3.8 million per month). Over 2020 and 2021, they’ve rapidly grown their business, hiring lots of staff and expanding their product offering. However, in 2022 the market downturn has hurt them, with investing activity dropping off a cliff. It probably isn’t sustainable to keep running the business with their current pricing model, hence the introduction of higher transaction fees and monthly plans in an attempt to get more consistent revenue.

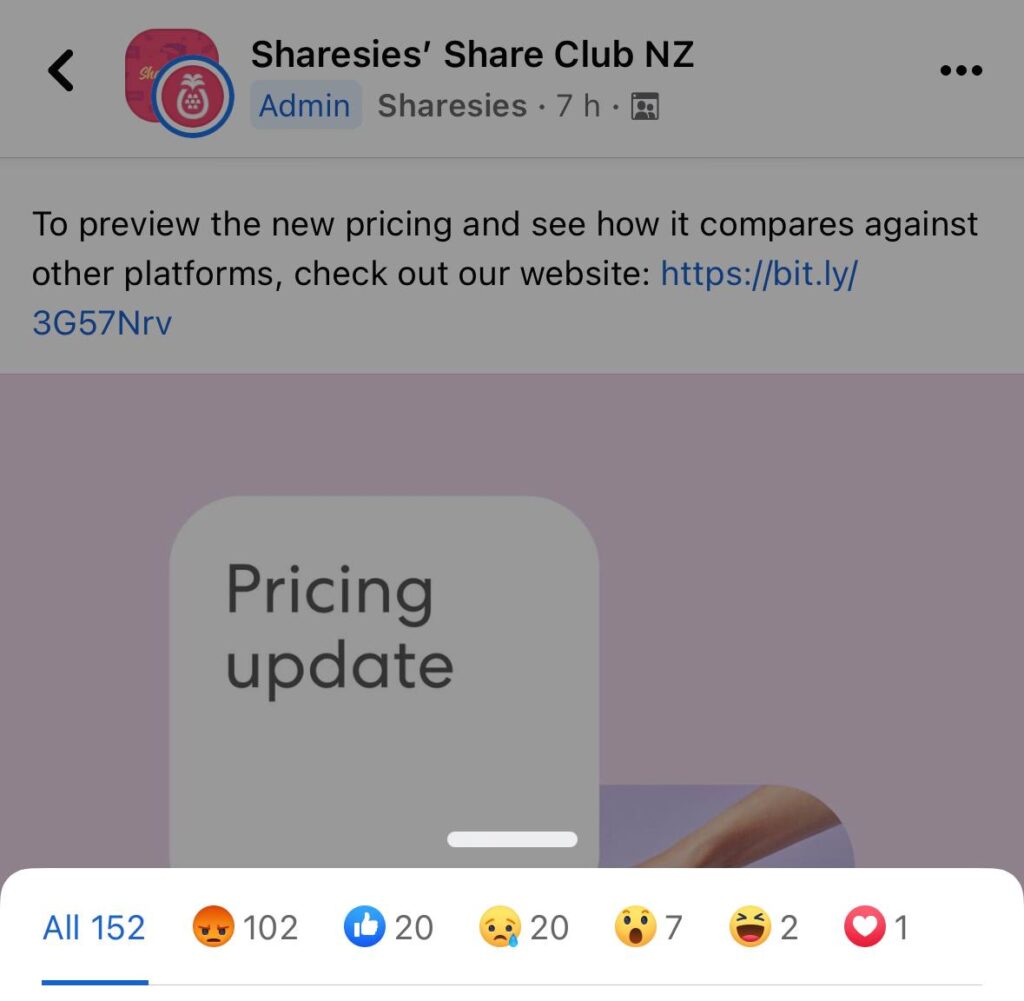

Sharesies is a business, and we respect their right to tweak their pricing model. However, we can’t help but think that the timing of the announcement is a bit sneaky. Being so close to Christmas, perhaps Sharesies are hoping that their customers are too distracted with other things to fully digest or notice the changes. But looking at all the grumpy face reactions on Facebook, it’s clear that the announcement hasn’t gone down well among their community.

The fee changes come into effect less than 2 years since they last tweaked their fees. Back in April 2021, Sharesies removed their monthly subscription fees, but added transaction fees onto Smartshares ETFs. You can read more about the April 2021 fee changes below:

Further Reading:

– Sharesies’ new fee structure – How will the changes affect you?

3. How will the fees impact me?

Casual investors

Those making occasional investments into Sharesies will be hurt the most by the changes. Someone who chucks say $100 into some shares once in a while will face an increase in transaction fees from 0.5% to 1.9% – significantly worse off. Not only does this represent your fees almost quadrupling, it means less of your money going towards buying shares and earning a return. A 1.9% fee is very chunky and means your investments have to go up by almost 4% just to break even (1.9% to buy + 1.9% to sell)! That’s very stink!

The exception is if you invested a very large amount of money per transaction, you may be better off under the new fee structure thanks to the caps:

- If investing $13,000 NZD or more at a time into NZ shares, you’ll be better off than the old fee structure thanks to the $25 transaction fee cap.

- If investing ~$3,000 AUD or more at a time into Aussie shares, you’ll be better off thanks to the $15 transaction fee cap.

- If investing ~$1,000 USD or more at a time into US shares, you’ll be better off thanks to the $5 transaction fee cap.

Regular investors

Those investing through Sharesies on a regular basis may find it better to opt-in to a monthly plan.

Monthly plan vs regular transaction fee

First let’s compare how their monthly plans compare with the regular 1.9% transaction fee:

- $3 plan – Works out cheaper if you invest $158 per month or more.

- $7 plan – Works out cheaper if you invest $369 per month or more.

- $15 plan – Works out cheaper if you invest $789 per month or more.

So if you’re committed to investing at least $158 per month through Sharesies, it’s better to opt-in to a monthly plan, as you’ll save over the regular 1.9% transaction fee.

Monthly plan vs old fee structure

Next let’s compare how their monthly plans compare with the old fee structure:

The $3 plan buys you:

- $500 in individual trades – Trading the maximum amount of $500 results in an effective fee of 0.6%, which is more expensive than their old fee structure.

- $1,000 in auto-invest trades – Trading the maximum amount of $1,000 results in an effective fee of 0.3%, which is cheaper than their old fee structure. However, if you invested less than $600 p/m, the plan would work out more expensive than the old fee structure.

- $1,500 in trades if you max out both portions of the plan – Trading the maximum amount of $1,500 results in an effective fee of 0.2%, which is cheaper than their old fee structure.

The $7 plan buys you:

- $1,000 in individual trades – Trading the maximum amount of $1,000 results in an effective fee of 0.7%, which is more expensive than their old fee structure.

- $3,000 in auto-invest trades – Trading the maximum amount of $3,000 results in an effective fee of 0.23%, which is cheaper than their old fee structure. However, if you invested less than $1,400 p/m, the plan would work out more expensive than the old fee structure.

- $4,000 in trades if you max out both portions of the plan – Trading the maximum amount of $4,000 results in an effective fee of 0.18%, which is cheaper than their old fee structure.

The $15 plan buys you:

- $5,000 in individual trades – Trading the maximum amount of $5,000 results in an effective fee of 0.3%, which is cheaper than their old fee structure. However, if you invested less than $3,000 p/m, the plan would work out more expensive than the old fee structure.

- $10,000 in auto-invest trades – Trading the maximum amount of $10,000 results in an effective fee of 0.15%, which is cheaper than their old fee structure.

- $15,000 in trades if you max out both portions of the plan – Trading the maximum amount of $15,000 results in an effective fee of 0.1%, which is cheaper than their old fee structure.

Overall if you invest $600 or more per month through auto-invest, chances are these new plans will make investing in Sharesies cheaper for you. However, other factors like the increase in foreign exchange fees may change the equation a bit depending on what you’re investing in. The changes are still a little disappointing as not everyone is able to invest $600 per month!

And the $7 and $15 plans are less useful as they require you to invest thousands of dollars each month to be worthwhile. That’s unless you’re already paying $10 per month for NZX market depth – in that case you could add $5 per month to buy into the $15 plan (which includes market depth) and get up to $15,000 worth of trades.

If this is all a bit confusing, we don’t blame you! We think the way Sharesies has implemented their plans is somewhat clunky:

- One-off orders and auto-invest orders are split out as separate components/limits of each plan. Therefore you’d have to split your monthly investing across auto-invest orders and manual one-off orders to make the most of your plan.

- Auto-invest has its limitations, for example, can’t be used to sell your shares. For those selling off their portfolios, you’re forced to use the one-off orders portion of a plan or pay the 1.9% regular transaction fee.

- You’re required to manually opt-in to a plan. It would be better if Sharesies automatically activated a plan if you had invested a certain amount each month. That would ensure investors always paid the minimum amount of fees.

But we do have to acknowledge that those who are investing regularly may be better off under these plans. Plus they may be a handy way to encourage people to invest regularly using auto-invest.

Kids accounts

Kids who are investing casually will also be hurt by the transaction fee going up from 0.5% to 1.9%.

However, Sharesies have introduced a $1 per month kids plan, which is worth it over the regular transaction fee if you’re investing $53 or more per month. The $1 kids plan buys you:

- $500 in individual trades – Trading the maximum amount of $500 results in an effective fee of 0.2%, which is cheaper than their old fee structure. However, if you invested less than $200 p/m, the plan would work out more expensive than the old fee structure.

- $1,000 in auto-invest trades – Trading the maximum amount of $1,000 results in an effective fee of 0.1%, which is cheaper than their old fee structure.

- $1,500 in trades if you max out both portions of the plan – Trading the maximum amount of $1,500 results in an effective fee of 0.07%, which is cheaper than their old fee structure.

So this is a good thing for kids, as long as you’re consistently investing $200 or more per month. Though not all families are in a position to invest this amount of money each month.

4. How do the new fees stack up with other platforms?

Understandably, a lot of Sharesies customers won’t be fans of the fee changes, especially when a lot of their user base are smaller, casual investors. So let’s do a quick comparison between Sharesies’ fees and their competitors.

NZX shares

There aren’t too many other options for investing NZ shares, with the main alternatives being:

Here’s a comparison table showing the transaction fees for various order sizes:

| $5 | $100 | $500 | $1,000 | $5,000 | |

| Sharesies (old fee) | $0.025 | $0.50 | $2.50 | $5 | $17 |

| Sharesies (new fee) | $0.095 | $1.90 | $9.50 | $19 | $25 |

| Sharesies (plan) | $3 | $3 | $3 | $3-$7 | $15 |

| ASB Securities | $15 | $15 | $15 | $15 | $30 |

| Jarden Direct | $29.90 | $29.90 | $29.90 | $29.90 | $29.90 |

Unfortunately, these options are still more expensive than Sharesies in most cases, given their fees typically start from ~$30 per order. The exception is if you’re buying/selling $1,000 or less in NZX shares through ASB Securities. In this case the fee is $15 per order, making them cheaper than Sharesies if you’re investing between $789 and $1,000. Perhaps this would be a good time for Hatch to launch their NZX offering?

Though the good news is that it’s possible to transfer your NZX shares out of Sharesies to your CSN (Common Shareholder Number). This would then allow you to trade your shares through these competing brokers. The fee is $5 per transfer until 31 January 2023 when the fee will increase to $15.

Further Reading:

– Buying shares on the NZX – Sharesies vs ASB Securities and Jarden Direct

NZ ETFs

Sharesies’ fees for investing into Smartshares ETFs has always been more expensive than competing options. Their latest fee changes may provide a further push for you to consider switching to an option that doesn’t charge transaction fees for buying Smartshares ETFs:

- InvestNow

- Investing directly via Smartshares

Here’s a comparison table showing the transaction fees for various order sizes:

| $5 | $100 | $500 | $1,000 | $5,000 | |

| Sharesies (old fee) | $0.025 | $0.50 | $2.50 | $5 | $17 |

| Sharesies (new fee) | $0.095 | $1.90 | $9.50 | $19 | $25 |

| Sharesies (plan) | $3 | $3 | $3 | $3-$7 | $15 |

| InvestNow | $0 | $0 | $0 | $0 | $0 |

| Smartshares | $0 | $0 | $0 | $0 | $0 |

Further Reading:

– Smartshares & SuperLife review – The smart way to invest in shares?

ASX shares and ETFs

Those looking for alternatives for investing in the ASX have the following to consider:

- ASB Securities – Always more expensive than Sharesies given their fees start from ~$15 AUD

- Jarden Direct – Always more expensive than Sharesies given their fees start from ~$29 AUD

- Interactive Brokers – Charges a 0.08% brokerage fee (minimum charge $6 AUD) + a 0.002% foreign exchange fee (minimum charge $2 USD). Works out cheaper than Sharesies if investing ~$375 AUD/~$412 NZD or more at a time.

- Tiger Brokers – Charges a 0.025% brokerage fee (minimum charge $2.50 AUD) + a $3.99 AUD platform fee + a 0.35% foreign exchange fee. Works out cheaper than Sharesies if investing ~$317 AUD/~$348 NZD or more at a time.

Here’s a comparison table showing the transaction fees + foreign exchange fees for various order sizes:

| $5 | $100 | $500 | $1,000 | $5,000 | |

| Sharesies (old fee) | $0.045 | $0.90 | $4.49 | $8.98 | $33.02 |

| Sharesies (new fee) | $0.12 | $2.39 | $11.95 | $20 | $40 |

| Sharesies (plan) | $2.76 | $3.23 | $5.23 | $11.37 | $38.65 |

| ASB Securities | $15.05 | $16.00 | $20.00 | $25.00 | $80.00 |

| Jarden Direct | $29.05 | $30.00 | $34.00 | $39.00 | $79.00 |

| Interactive Brokers | $8.80 | $8.80 | $8.80 | $8.80 | $8.80 |

| Tiger Brokers | $6.51 | $6.84 | $8.24 | $9.99 | $23.99 |

US shares and ETFs

The options for investing in US shares is a lot more competitive. The main competitors here are:

- Hatch – Charges a flat $3 USD brokerage fee + a 0.5% foreign exchange fee. Works out cheaper than Sharesies if investing ~$158 USD/~$243 NZD or more at a time.

- Stake – Charges no brokerage fees (increasing to $3 USD per transaction on 4 March 2023) + 1.0% in foreign exchange fees (with a minimum of $2 USD). Works out cheaper than Sharesies if investing ~$215 USD/~$331 NZD or more at a time (based on their new fees).

- Interactive Brokers – Charges a $0.005 per share brokerage fee (minimum charge $1) + a 0.002% foreign exchange fee (minimum charge $2). Works out cheaper than Sharesies if investing ~$125 USD/~$192 NZD or more at a time.

- Tiger Brokers – Charges a $0.0099 per share brokerage fee (minimum charge $1.99) + a 0.35% foreign exchange fee. Works out cheaper than Sharesies if investing ~$98 USD/~$151 NZD or more at a time.

Here’s a comparison table showing the transaction fees + foreign exchange fees for various order sizes:

| $5 | $100 | $500 | $1,000 | $5,000 | |

| Sharesies (old fee) | $0.045 | $0.90 | $4.49 | $8.98 | $33.02 |

| Sharesies (new fee) | $0.12 | $2.39 | $7.50 | $10 | $30.00 |

| Sharesies (plan) | $1.98 | $2.45 | $4.45 | $9.55 | $34.75 |

| Hatch | $3.03 | $3.50 | $5.50 | $8.00 | $28.00 |

| Stake | $5.00 | $5.00 | $8.00 | $13.00 | $53.00 |

| Interactive Brokers | $3.00 | $3.00 | $3.00 | $3.00 | $3.00 |

| Tiger Brokers | $2.00 | $2.34 | $3.74 | $5.49 | $19.49 |

So Sharesies is still the cheapest for investing small amounts of money at a time, and in some cases can work out even better if you opt-in to a monthly plan. It really depends on how often and how much you invest.

But those investing larger amounts may find the competing platforms to be more compelling. Unfortunately if you’re looking to switch your US share investments from Sharesies to one of these other platforms, you can’t transfer them across. You’d need to sell your holdings through Sharesies, then buy them back though your new platform.

Further Reading:

– Hatch review – Hard to recommend

– Stake review – Is there a catch to their $0 brokerage fee?

– Interactive Brokers & Tiger Brokers review – Better than Sharesies & Hatch?

Managed funds

There are no fee changes to Sharesies’ managed funds offering, which continue to be exempt from any transaction fees. However, those looking to switch from NZ/AU/US shares to managed fund investments in order to avoid the fee increase, might be disappointed to find that Sharesies’ managed funds offering is quite small. The following platforms arguably have more compelling offerings (and in most cases do not charge transaction fees either), so may be worth looking into:

Further Reading:

– InvestNow review – The most efficient way to invest?

– Flint Wealth review – A superior InvestNow clone?

– Kernel review – High quality index funds

– Simplicity review – Could there be better fund options out there?

5. How are other investors dealing with the changes?

We did a quick poll on our Instagram account on 31 January 2023 asking what our followers were doing in response to the new fees and here were the results:

- I plan to invest more with Sharesies – 6%

- I’ll be investing the same amount as before – 31%

- I’ve reduced or paused investing with Sharesies – 42%

- I’ve shifted my money to another platform – 21%

With the fees changes affecting different people in different ways, it’s no surprise there was a mixture of responses. There’s still plenty of people remaining loyal to Sharesies with 37% of respondents either planning to keep investing the same amount, or even investing more. However, a big chunk of people (42%) are either reducing or pausing their investing – most likely many people in this category are still digesting the changes and figuring out what to do next. And finally we had 21% of respondents shifting to other platforms like InvestNow, Kernel, Hatch, and Interactive Brokers.

Conclusion

The transaction fee increase from 0.5% to 1.9% will come as a nasty shock to many Sharesies customers. The almost quadrupling of fees will be ugly for those investing on a casual basis. However, it’s not all bad news – Sharesies’ monthly plans will be a win for some investors who invest regularly. As long as you’re committed to $600 a month through auto-invest, you can jump on a plan and end up better off under the new pricing structure. Though keep in mind that’s before taking into account the small increase in foreign exchange fees from 0.4% to 0.5%.

We appreciate that Sharesies are rewarding larger more regular investors, and that they’re moving to a hopefully more sustainable pricing model. But overall the implementation of these pricing changes is clunky and confusing. And worst of all the new fees hurt casual investors, and those who can’t afford to invest at least a few hundred dollars per month. There aren’t too many alternative platforms for small investors to switch to either. While larger investors could benefit from switching to the likes of Hatch or Interactive Brokers, the flat fee structures these platforms have means they’re not viable for investing a few dollars at a time. So small investors will either have to change their behaviour such as:

- Save up a few hundred dollars before investing that money (either by temporarily subscribing to a Sharesies plan or through another platform), or

- Sacrifice the ability to invest in individual companies and just stick with managed funds through the likes of InvestNow or Kernel (who don’t ping you with transaction or FX fees), or

- Just accept Sharesies’ increased fees (though keep in mind 1.9% is a very high fee and means your assets will have to deliver an after-tax return of ~3.8% just to break even).

These options are far from perfect. Sharesies prides themselves on giving everyday investors equitable access to the sharemarket, even if they just have $5 to invest. Unfortunately these changes go against helping small investors get ahead in building an investment portfolio.

What do you think? Feel free to let us know in the comments below. And if this article was helpful, please consider sharing it with any friends or family who also use Sharesies.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

I definitely need to think this over a bit, but I’m probably going to end up selling my Vanguard Australian Fund investment with them and moving it to S&P 500 with Hatch instead.

Good article thanks. This definitely helps in making a decision what to do i.e. either stick with Sharesies or dump then completely. Such a shame they dumped this on the investors in the week before Christmas and the previous 0.5% up to 3k (and 0.1% over 3k) for buying or selling was simple and easy to understand for the NZ market at least. They’ve turned it into a mess that now has me doing my sums to potentially (probably) leave the platform. An own goal if I ever saw one.

Agree, we’re fans of simple and easy to understand fee structures, but the new one is a bit of a dog’s breakfast. We’re with you on the crappy timing as well haha

Think it was very convenient for Sharesies to leave out interactive brokers from theor comparison table, as IBKR are actually quite a bit cheaper than them for a lot of trade amounts

This was disappointing news to wake up to and you’ve articulated my feelings perfectly; I hadn’t realised why it annoyed me so much but you’re right – Sneaky timing for the change. Fully understand that they’re a business in a tricky economy but just sucks that they’re going against their own brand of trying to uplift low-income earners (like me).

Definitely has convinced me to bail on Sharesies and keep focusing on index funds via Kernel!

We all just want a break at this time of year don’t we!

We suspect you’re not alone and many more people will shift focus to funds from platforms like Kernel and InvestNow…

Yup I’ve set up a Kernel account and will use them moving forward. I’ll just leave my holdings on sharesies and withdraw any dividends. It was the Christmas announcement of a fee change that annoyed me as well.

Merry Christmas haha

Seems like a few people are moving to Kernel?

It is disappointing to see that the people who can afford more are the ones that will see the benefits of the monthly plans. Those of us who were consistently investing small amounts will feel the difference for sure.

Absolutely. With such a high fee, small investors would need their investments to increase by almost 4% just to break even!

Sharesies don’t care about us. Just here to take advantage of the everyday Kiwi!

On the face of it, it is a PR Disaster, and my first reaction was to think about looking for other account providers. However when I calmed down and thought more about the subscription options then its not as bad as first thought. A PR Disaster, but perhaps not quite a disaster in reality… but then isn’t perception, reality?

You’re very right, the changes aren’t as bad as they appear on the surface. But they communicated them poorly and at a bad time.

In the end it’s the actions of investors that really matter. It’s easy to put up an angry face reaction or comment on Facebook, but in reality we wonder how many people will actually switch platforms as a result?

Judging from the comments I’m reading on their Facebook groups – plenty.

As I posted on your own page yesterday, Sharesies built it’s platform on the premise that it was to support low income people, with minimal disposal income to invest. That was how they advertised it, and how they “sold” it to us. We (people who meet the above criteria) supported the platform and helped it grow into what it is today. Without us, Sharesies would never have gotten off the ground.

I understand that they are losing money. I get that. But this was a dirty way to fix that problem in my opinion. A small fee increase would have been acceptable. I would have been happy with up to a 50% increase. But not 280%. That is simply greedy and shows that Sharesies does not understand their customer base at all. Timing sucks too, and will not have done them any favours in terms of their pending KiwiSaver launch. Most current investors will now not be interested in even considering that, as they have lost trust in Sharesies. Once you lose the trust of your customers, it is damned near impossible to earn it back.

I am hoping they will take all the comments onboard, realise that they stuffed up, and come back with an apology and a revised plan. Right now it feels that they have done a complete about-face, and are now focussing on attracting/keeping the larger investors (as that is where the money is for them), at the expense of the small investors who helped them build the platform in the first place.

I have already seen posts from people who have sold everything and closed their accounts. People who have cancelled their auto-investments, people who are seriously looking at switching platforms, people who have decided to quit Sharesies and go with managed funds only. Some of these people will pay a price for doing that, if they don’t fully understand the processes and consequences. People like me, who have a little more knowledge, have two choices as I see it. We either suck it up and carry on as usual, or we change our investing strategy from weekly/fortnightly/monthly DCA via Sharesies – to accumulating larger amounts to make fewer more significant investments via other platforms such as ASB Securities. I have yet to decide which way to go.

I have used IBKR for international stocks for sometime and Sharesies for NZX/ASX, kiwisaver is S&P500 with Kernel (the best plan in the country imo). Now I am seriously considering whether to keep my split auto invest between sharesies and IBKR or go all into IBKR, the tax advantage of owning NZ stocks being the only benefit of using sharesies. Doing around 600 in auto invest on the $3 plan would work out ok but any sells will be too expensive.

To me it looks like they are expecting that savy investors will use the plans and the other will just pay up without knowing, poor form if you ask me.

2% on buy and sell sides basically remove any chance to beat the market so may as well just buy ETFs through investnow of Kernel

That’s a good point we hadn’t really thought of. The plans only really work if you’re accumulating, given auto-invest doesn’t work if you’re selling. You’d have to make use of the one-off orders portion of the plan which is less cost effective.

Good article thanks helps in making a decision on what to do. As a causal investor of no more than 100-200 a month this is not good news for me. Is there any hint of when Hatch will look at NZX offering? I’d sign up today if they had it.

No idea, but September 2023 is a date we’ve seen thrown around. Not sure if their fee structure will be any better either as they’re merging with Jarden Direct for their NZX offering.

Great article, much appreciated. I had been pondering all of this.

What irks me most is the timing of this and the extreme short notice, not leaving much time to process and make a decision.

I will be selling out of Sharesies and altering my investment style to larger and less frequent investing through ASB.

I was also interested in the Sharesies kiwisaver in the future, but will no longer consider this as an option.

Seems like they’ve jeopardised their KiwiSaver launch with this move!

Great article as always. Good comments above. I think Carren sums it up best for my circumstances. Currently I invest a small amount fortnightly across our 3 family accounts so will get pinged by new fees. Will take Christmas to look at investments, strategy and platform!

Thanks for reading and Merry Christmas!

I am very disappointed in Sharesies. The fee hikes are an apparent cash grab to take advantage of small investors. The 280% fee increase will erode investors wealth in contrast to Sharesies supposed mission statement. The changes will disproportionately affect those the least well off in New Zealand. Customers will now be asked to pay a super-premium price for a very basic product.

The 280% increase in brokerage fee increases from 0.5% to 1.9 % will significantly increase the costs for small everyday investors and erode the wealth of small everyday investors. Compounded over the long term the supposedly small fee increase will cost Sharesies customers thousands of dollars of wealth potential. In contrast to other platforms Sharesies is considerably more expensive than Stake and Interactive Brokers.

Sharesies offers a very basic platform. Buying and selling of shares across NZ, US and AUS markets is the only feature available on the platform. Other platforms provide financial analysis and research, access to a greater range of markets, options trading, leverage, short securities and the ability to earn interest off idle money in your trading account. Eg Stake Black offers analysis and research while Interactive Brokers offer access to over 150 markets, 33 countries and 26 currencies. Interactive Brokers also allow investors to earn interest on their idle cash whereas Sharesies keeps interest for themselves.

The proposed fees and tiered plans will make investing significantly less accessible and more complicated for small everyday investors. Fee increases will disproportionately fall on small and middle-income earners. It is almost certain investing will not be a realistic opportunity for a lot of small everyday investors who can only afford small amounts to invest. Brokerage fees will represent a significantly higher proportion of invested capital. A lot of investors will be priced out from being able to build wealth as they will now need to see a 3.8% increase on their investments just to break even.

Sharesies is used by small everyday investors who want an easy and non-complicated way of getting ahead. Most of us find the world of investing complex and difficult to navigate. A lot of us don’t have thousands of dollars to invest and don’t have the option to invest regularly. Many of us haven’t grown up around an environment where money and investing were talked about. We don’t have endless time to research and calculate and compare complex fee structures across different platforms.

While Sharesies say that their purpose is to enable everyday investors towards financial empowerment, it would be easy to see how some people would see the new changes to be predatory. The fact these changes will be taking place during a recession is exceptionally predatory as investors will be unable to withdraw their investments prior to the end of January without incurring a significant cost. The changes will disproportionately fall on low-income earners. The new tiered monthly fee structure is not easy to understand cost wise. Announcement right before Christmas was likely to have been done so that the fee increases would go under the radar.

Very well said 😀

It definitely does affect small investors the most – especially when these investors don’t really have any viable alternative platform to switch to. That is unless you sacrifice the ability to invest in individual companies and stick with funds through InvestNow or Kernel.

Investnow looks the best for me for index funds and Interactive brokers for US stocks.

What about the Share Funds through Simplicity? In terms of kids accounts where I invest less than the $200 per month would I be better to pull out the money already invested and put that into a simplicity growth fund (there is more than $1000)? And then add regular weekly amounts to that? Thanks so much for the informative article.

Hi Kate, Simplicity is another option but comes with a couple of potential downsides right now. They have fewer fund options, and they’re missing an aggressive fund option – The Growth fund contains 20% bonds so many investors consider that a drag against overall returns over the long-term. Their funds are also tax inefficient (though this issue should be resolved soon). Feel free to check out our Simplicity review here: https://moneykingnz.com/simplicity-review-could-there-be-better-fund-options-out-there/

Nicely put. Another major issue I see is the lack of stability this creates. It’s only been two years since the last fee structure change. That doesn’t give a lot of confidence that there won’t be another one in the near (in investing terms) future. The whole reason for investing is to accumulate wealth so it has to be sold at some point. When that point arrives I now have no confidence that Sharesies is the place to be selling it, who knows what version of fee structure they will be on then. I’m out.

Good point – lack of stability is an issue. It really irks us too when investment platforms are constantly changing their products and fees (we’ll happily accept lower fees though haha). Especially as we’re in a major market downturn, the last thing you want is to cause more confusion and substantial change amongst investors.

New Zealand drove some good US brokers out. If we still had Td Ameritrade/schwab, we could have ZERO fees. How silly!! Little too late now.

I am glad I recently found Kernel Wealth for my S&P 500 index fund investing (I used to use the Smartshares S&P 500 fund through Shareies) as I don’t have to worry about transactions fees anymore and now this price change by Shareies confirms I made the right move.

I have also recently started playing around in Stake because again there is no transaction fees so once your money is in Stake you can actually buy and sell as many times as you want without incurring a transaction fee.

Yeah, Stake has high FX fees, but could be a handy option if you’re regularly trading in and out of investments.

I believe stake recently changed their pricing, so there will be a $3 transaction fee on trades, similar to Hatch.

Selling out of sharesies. I need the flexibility

Yeah very disappointing change indeed, especially given Sharesies’ whole mantra of empowering everyday low level investors! This seems to really just benefit the mid-high end regular investors.

Thanks for the summary btw MoneyKing and for being so quick on the ball with this – yours was the best review of the pricing change out there that I could find, and thanks for sharing it widely.

Thanks so much Jase!

Agree Jase. Great effort from MoneyKing to jump on it so quick. We are lucky to have people like MoneyKing doing the review and sharing it widely.

I have been investing $25 dollars a week for my daughter and another $25 per week on my name, created a DIY order few years back. Is the monthly plan going to be cheaper? It will cost me more I reckon. Am thinking to reduce the weekly order to $19 dollars and stay under the $1000 dollar limit. Thoughts please? Many thanks in advance.

Let’s assume you’re investing around $110 per month for your daughter. Under the old fees that’d cost $0.55, under the new fees that’d cost $2.09. With the kids plan you pay $1 per month, but that’s still more expensive than the old fees.

For your own investing, a plan would cost $3 per month – that’s way more expensive that the $0.55 you’d pay under the old fees and $2.09 you’d pay under the new fees. So looks like a plan isn’t worth it for yourself.

Not sure what you mean by staying under the $1,000 limit? As the amounts you’re investing each month are well below $1,000?

Thanks heaps for your response.

Agree, the old fees are way cheaper than the new fees. It’s a shame that they started doing this especially during holiday season, cheeky.

I got confused with the $1000 limit. I was thinking the limit is $1000 per annum, duh!

I have been investing in 9 different Kid’s accounts for my grandchildren with around $40 per month in auto invest trades. I have now deleted my auto invest orders but am unsure what to do with the money left in their accounts (ranging from $600 – 8,500). Should I wait for the transaction fees to go down next week and then sell off in $500 increments to get the better transaction fee until accounts are drained and invest somewhere else? Or do I just leave the money where it is (with auto invest turned off) and pay the $1 per month fee? Thanks so much for your great article.

Hi Sue, that’s awesome you’re investing for your grandkids every month. We can’t give you specific advice on what to do but could perhaps clarify a few things to help you make a decision. Given you’re investing $40 p/m, the monthly fee of $1 equates to 2.5% of your investment amount. In that case you’re better off not subscribing to the plan and paying the ordinary 1.9% fee. So it really comes down to whether you want to stay with Sharesies or not – is 1.9% good value, or is there a better value platform out there?

Thanks so much for coming back to me so quickly!

If I move away from Sharesies though…would I be best to leave the money already invested there and start fresh somewhere else … with their sharesies accounts moving across to them when they are 18. Or am I able to transfer them across (they are mainly invested in the USF Smarshares USF 500 ETF) to Smartshares from Sharesies for a $5 fee? Unsure if I’m correct on this transfer fee?

Presumably this would be cheaper then selling them and reinvesting in a new platform (especially as they are NZX listed USD and NZX funds that they are invested in).

Hi Sue, it won’t make a massive difference whether you keep that money with Sharesies vs moving it to another platform, given it doesn’t cost any extra fees to simply hold your investments on Sharesies. So it’s a question of whether you want to keep all your investments in one place, or happy to keep it spread across multiple platforms.

But if you do wish to transfer Smartshares ETFs out of Sharesies, the fee is now $15. So it’ll work out cheaper than incurring the 1.9% transaction fee if you’re transferring out $789 or more at once.

Sue, I am in a somewhat similar situation as you. I recommend, sticking with Sharesies, there is no other platform which is cheaper than Sharesies given you are investing $40 per month. Also, don’t opt for their monthly plan as you are only investing $40 per month, the ordinarly fee is cheaper than the plan in your case. Selling and reinvesting in a new platform is painful. Have you investigated InvestNow? Its a really good platform as well, only catch is that you cannot invest small amounts like you are doing with Sharesies.

The old saying applies once more ” THE RICH GET RICHER “

I have a modest amount in Sharesies (~$5,000) that I’m thinking of withdrawing entirely. It is spread across two companies & an ETF.

Could I subscribe to the $15 monthly fee (for a solitary month) to withdraw it all for $15 (+ a little more maybe) rather than incurring the 1.9% fee across the three investments? I estimate two sales would incur the $25 capped fee the third around $6 so I’m thinking $56 in fees.

Cheers, Mike

Hi Mike, yes you could temporarily subscribe to the $15 plan and that would cover any transaction fees for selling up to $5k NZD worth of investments. Seems like that’d work out much cheaper than the $56 you calculated.

Thanks Mike, much appreciated.