As a New Zealander, there’s many reasons why you might want to invest in Australian companies. Firstly, a number of NZ companies like Xero list on the Australian sharemarket (the ASX), but not the NZX. Secondly, you’re probably already familiar or interested in many of the companies over there such as NAB (parent of BNZ Bank), AfterPay, or Woolworths. Or maybe you just want to diversify away from NZ’s tiny sharemarket. Whatever your reason, here’s a guide to how to invest in Australian shares for Kiwis living in New Zealand.

This article covers:

1. Investing through funds

2. Investing in individual companies

3. Limitations of investing in individual companies in Australia

Update (14 June 2021) – Added the Smartshares S&P/ASX 200 ETF and Sharesies as options for investing in Australian shares

1. Investing through funds

Investing via funds is an easy way to get exposure to Australian shares. You’ll get diversification across a number of Australian companies in one go, you won’t have to research companies in a less familiar market, and you’ll avoid having to deal with tax and foreign exchange complications yourself. Here are the options:

Smartshares

Smartshares offers four index funds that invest in the Australian sharemarket (fees in brackets):

- S&P/ASX 200 (0.30%) – Invests in the 200 largest companies on the ASX

- Australian Top 20 (0.60%) – Invests in the 20 largest companies on the ASX

- Australian Mid Cap (0.75%) – Invests in the 51st to 100th largest companies on the ASX

- Australian Dividend (0.54%) – Invests in the 50 highest dividend paying companies found within the ASX 300

In addition, they offer the following sector specific funds:

- Australian Financials (0.54%) – Invests in financial sector companies found within the ASX 200

- Australian Resources (0.54%) – Invests in resources sector companies found within the ASX 200

- Australian Property (0.54%) – Invests in Real Estate Investment Trusts (REITs) found within the ASX 200

These funds can be purchased from InvestNow, Sharesies, direct from Smartshares, an NZX broker, or SuperLife.

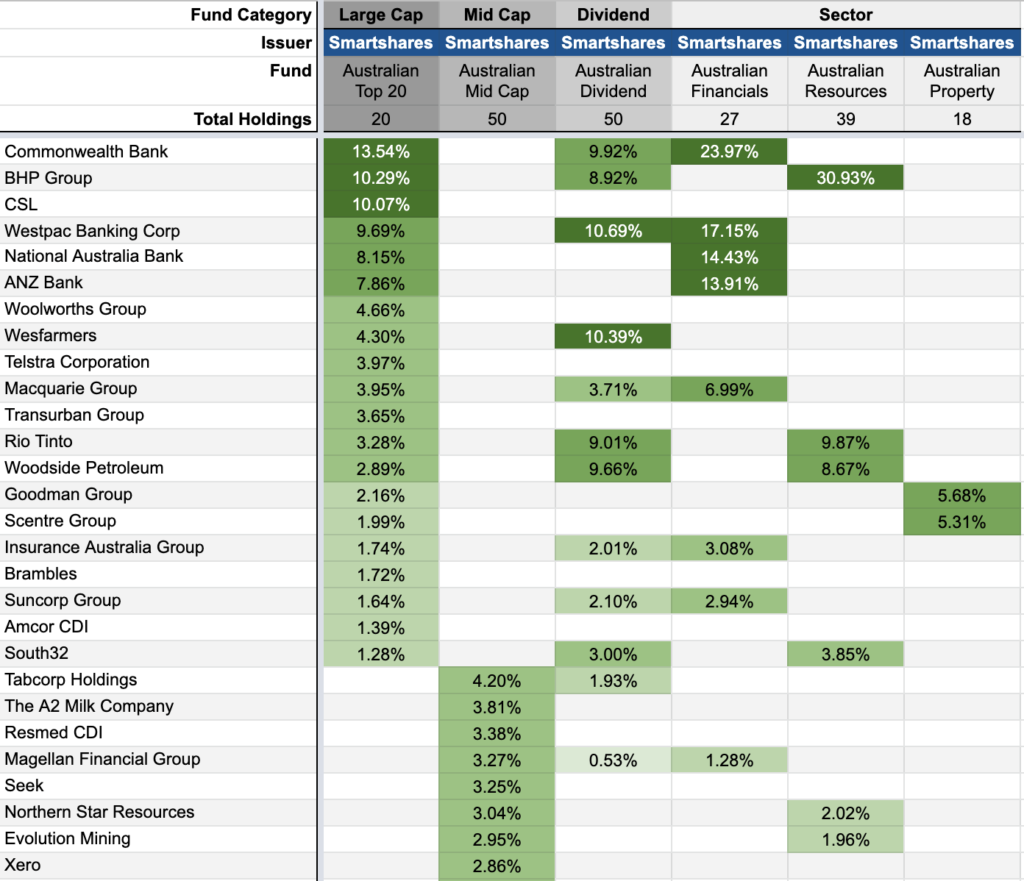

Unfortunately, with the exception of the S&P/ASX 200 ETF, none of the Smartshares Australian index funds are particularly appealing. The offering is quite fragmented, with each fund covering very narrow segments of the Australian sharemarket. In addition, some funds can have heavy exposures to certain industries – for example, the Australian Top 20 fund is 46.57% invested in the financials sector.

Want to know what specific companies each of the six Smartshares Australian index funds invest in? Check out this spreadsheet for the details!

Other funds

Outside of Smartshares, InvestNow offers a good number of funds that invest in Australian shares. Examples are (with fees in brackets):

- APN AREIT PIE Fund (1.12%)

- Devon Australian Fund (1.66%)

- Fisher Funds Australian Growth Fund (1.83%)

- Milford Australian Absolute Growth Fund (1.19%)

- Pie Funds Australasian Dividend Fund (2.59%)

They also have a selection of Trans-Tasman funds that invest in both New Zealand and Australian shares. Examples are:

- AMP Capital Australasian Property Index Fund (0.42%)

- Devon Dividend Yield Fund (1.01%)

- Fisher Funds Trans-Tasman Equity Trust (1.75%)

- Milford Trans-Tasman Equity Fund (1.05%)

- Mint Australasian Equity Fund (1.45%)

You can see how to find out what companies each of these funds invests in using the link below:

Further Reading:

– Beyond the top 10 – How to see everything your fund is invested in

Unfortunately, these funds all have an undesirable feature – high fees! All these funds charge fees in excess of 1.00%.

2. Investing in individual companies

Funds won’t cut it for everyone who wants to invest in Australia. Firstly, the above fund offerings are limited, and tend to have either narrow market coverage, or high fees. Secondly, there are heaps of investors who want the control of selecting individual companies to invest in. This is where brokers come in, enabling you to invest in individual companies on the ASX.

Sharesies

Sharesies launched their ASX offering in April 2021, giving Kiwis low-cost access to individual shares on the Australian market for the first time.

Their transactions fees are 0.5% on orders up to $3,000, and $15 + 0.1% of the value exceeding $3,000 for orders over $3,000.

Keen to start building your investment portfolio with Sharesies? Sign up with this link, and you’ll get a bonus $5 in your account to invest!

Further Reading:

– Sharesies review – Still a good investment platform in late 2021?

ASB Securities/Jarden Direct

ASB Securities and Jarden Direct are two of your local broking options that gets you access to the ASX. ASB Securities is probably more convenient, as ASX trading is enabled by default when you set up an account with them. With Jarden Direct, you need to fill in a separate application form to get started on ASX trading.

You must pay brokerage fees each time you buy or sell shares through ASB Securities and Jarden Direct. These fees are:

| ASB Securities | 0.30% Minimum charge $30 AUD |

| Jarden Direct | Greater of $29 AUD or 0.30% for orders up to $30,000 $29 + 0.30% of the value exceeding $30,000 for orders over $30,000 |

The brokerage fees are roughly in line with what they charge for trades on the NZX. However, they are still relatively high and are not ideal for people wanting to invest small amounts.

Australian banks

If you have an existing Australian bank account with one of the big 4 banks (perhaps from living in Australia in the past), it may be possible to open a brokerage account with that bank:

- Commonwealth Bank – CommSec

- NAB – nabtrade

- Westpac – Westpac Share Trading

- ANZ – ANZ Share Investing

Their brokerage fees are cheaper than ASB Securities and Jarden Direct, starting at $14.95 AUD for nabtrade, and $19.95 AUD for the other firms.

3. Limitations of investing in individual companies in Australia

The limitations to investing in Australian shares are not dissimilar to the limitations of investing in other foreign countries. Here’s what you need to consider before investing:

Foreign Exchange

When you buy shares on the ASX, you must exchange your New Zealand Dollars into Australian Dollars. For Sharesies, they charge a 0.4% fee for FX transactions from NZD to AUD, and AUD back to NZD.

Both ASB Securities and Jarden Direct charge a Foreign Exchange margin – a somewhat hidden fee. To illustrate this margin, the NZD-AUD exchange rate at the time of writing (31 January 2020) was 0.9655. This is also known as the mid-market exchange rate. Let’s see what happens when you exchange $10,000 NZD to AUD:

- Mid-market rate – Exchanging $10,000 NZD to AUD at the mid market rate of 0.9655 would give you $9,655 AUD

- ASB Securities – ASB’s NZD-AUD rate is 0.9526, lower than the mid-market rate. This would give you $9,526 AUD. That means there’s a hidden cost or margin of $129 AUD or ~1.3%.

- Jarden Direct – Jarden Direct’s NZD-AUD rate is 0.9577, which would get you $9,577 AUD. That’s a hidden cost or margin of $78 AUD or ~0.8%.

The margins also apply for bringing AUD back to NZD e.g. in the case of selling your shares. Let’s take a quick look at what happens when you exchange $10,000 AUD back to NZD:

- Mid-market rate – Exchanging at the mid-market rate of 1.0354 would get you $10,354 NZD.

- Jarden Direct – Exchanging at Jarden Direct’s rate of 1.0256 would get you $10,256 NZD. That’s a margin of $98 NZD.

If using an Australian broker like CommSec or Nabtrade, you could use TransferWise to get your NZD over to your Australian bank account.

Currency fluctuations

The value of your shares will fluctuate as the exchange rate between NZD and AUD fluctuates. For example, an increase in the NZD-AUD exchange rate will result in your shares decreasing in value (in NZD terms).

Ownership of shares

When buying ASX shares through Sharesies, your shares are held in the name of a custodian.

Further Reading:

– What happens to your money if InvestNow or Sharesies go bust?

When using the other brokers mentioned above, you hold your Australian shares in your name. They offer CHESS sponsorship which means you own your Australian shares under your Holder Identification Number (HIN). Your HIN is associated with your broker, but you can easily transfer your HIN, along with your holdings to another broker.

Dividends

If you use Sharesies to buy ASX shares, you will receive any dividends as cash in your Sharesies wallet. There is no option to participate in a Dividend Reinvestment Plan.

If you use a broker that allows you to hold your shares under your own name, you may need to consider the logistics of how you will receive dividend payments from your investments. The first thing you should do after buying shares in an Australian company is to register for an account at the company’s share registry (most likely either Link, Computershare, or Boardroom) and ensure your dividend payment method is right for you. Here are the potential options:

- NZ Bank Account – Many Australian companies allow you to pay their dividends as NZD into a New Zealand bank account.

- Dividend Reinvestment Plan – Some companies allow you to reinvest your dividends into more shares in the company, instead of receiving a cash dividend, as part of the company’s Dividend Reinvestment Plan.

- AUD Bank Account – You could have your dividend paid out into an Australian bank account, perhaps by opening a Foreign Currency Account with ASB.

Tax

NZ companies have imputation credits attached to their dividends, which reduces the amount of tax we pay on these dividends. Similarly, many Australian companies have Franking credits attached to their dividends. New Zealand investors cannot use these Franking credits to reduce their tax payable on Australian dividends, making the ASX a relatively unattractive market for dividend investing.

However, it’s not all bad. Australian companies that pay out Franking credits are typically exempt from the Foreign Investment Fund (FIF) tax rules which would usually apply to overseas investments. In this case, only the dividends from these companies are taxable. You can check whether an Australian company is exempt from the FIF tax rules here.

Further Reading:

– What taxes do you need to pay on your investments in New Zealand? (FIFs)

Conclusion

While previously unattractive, the options for Kiwis to invest in Australian shares has improved greatly in recent months. We’ve had the launch of the Smartshares S&P/ASX 200 ETF, as well as Sharesies’ ASX offering which offers a low cost alternative to ASB Securities and Jarden Direct.

So should you invest in Aussie shares given these new options? Not necessarily. You can also get exposure to Australian shares as part of a global shares index fund, or potentially as part of your KiwiSaver fund. And like New Zealand, Australia is just a tiny part of the global financial markets – therefore I wouldn’t consider Australian funds or shares an essential component of your investment portfolio.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Has much of significance changed in the Australian Investment options ex NZ since this article was written?

Nope, we last updated the article a year ago adding Sharesies and the AUS ETF to the mix, but no substantial updates since then. That could change when Superhero and BetaShares launch their products in NZ.