Watch out InvestNow, there’s some new competition in town! Flint Wealth is a new investment platform which just launched in January 2022, and brings many similarities to the incredibly popular InvestNow service – offering dozens of funds from several fund managers, without any account or transaction fees. Could this new fund supermarket be a better option than the incumbent?

This article covers:

1. What’s on offer

2. Fees

3. Other considerations

4. Flint Wealth vs InvestNow

5. Flint Wealth vs direct investment with fund managers

Update (27 Jun 2022) – Flint have reduced their minimum investment from $250 to $50

1. What’s on offer

Flint Wealth is a fund platform where you can buy and sell 98 funds from 12 different fund managers. These fund managers include:

- Castle Point – 3 funds

- Clarity – 8 funds

- Devon – 6 funds

- Fisher Funds – 7 funds

- Harbour – 14 funds

- Hunter – 1 fund

- Milford – 11 funds

- Mint – 4 funds

- Nikko AM – 3 funds

- Pathfinder – 2 funds

- SuperLife – 38 funds

- Tahito – 1 fund

The funds on offer cover a wide range of asset classes:

- Cash – Funds that invest in bank deposits and short-term loans to corporations. For example, the Milford Cash Fund.

- NZ Fixed Interest – Funds that invest in NZ bonds. For example, the SuperLife NZ Government Bond Fund.

- International Fixed Interest – Funds that invest in international bonds. For example, the Hunter Global Fixed Interest Fund.

- Australasian Equities – Funds that invest in NZ and/or Australian shares. For example, the Devon Trans-Tasman Fund.

- International Equities – Funds that invest in international shares. For example, the Fisher Funds International Growth Fund.

- Listed Property – Funds that invest in Real Estate Investment Trusts (REITs). For example, the Harbour Real Estate Investment Fund.

- Diversified – Funds that invest across multiple asset classes. For example, the SuperLife Growth Fund, which invests in a mix of NZ shares, international shares, and bonds.

The funds represent a mix of active and passive management styles:

- Active – Funds that actively research and pick which assets to invest in, aiming to beat the market. This includes funds managed by Milford, Fisher Funds, and Pathfinder.

- Passive – Funds that track a market index, aiming to match the return of the market (with the view that it’s very hard to outperform the market over the long-term). Most SuperLife funds fall into this category, as well as a couple of Harbour funds.

This table summarises the number of funds on offer across the different asset classes and management styles:

| Passive | Active | Total | |

| Cash | 0 | 2 | 2 |

| NZ Fixed Interest | 1 | 7 | 8 |

| International Fixed Interest | 2 | 4 | 6 |

| Australasian Equities | 13 | 20 | 33 |

| International Equities | 12 | 9 | 21 |

| Listed Property | 3 | 2 | 5 |

| Diversified | 4 | 19 | 23 |

| Total | 35 | 63 | 98 |

Overall Flint’s offering is very comprehensive, and would likely be enough to cover most people’s investing needs. You can check out a list of all of Flint’s funds on this spreadsheet.

2. Fees

Fees for using the platform

Flint doesn’t charge investors any fees for using the platform – there’s no brokerage, transaction, membership, or foreign exchange fees. There’s no catch to this – instead Flint makes money by earning commission from the fund managers who list their funds on the platform.

It’s a win-win arrangement, with fund managers being able to reach new customers through the platform, and investors having fewer fees to pay. In addition, one of Flint’s owners is fund manager Harbour (with the other two owners being Trustees Executors and Research IP), so the platform provides a way for them to distribute their own funds out to investors.

Management fees

While the platform doesn’t charge any fees, you’ll still need to pay the fees charged by the manager of the funds you invest in:

- Fund management fees – All funds on Flint charge a percentage based management fee. These range from 0.20% to 4.37% p.a. though passively managed funds charge less with most of their fees being under 0.50%. These fees are reflected as a tiny deduction in the value of your fund everyday. For example, if your fund’s management fee is 1%, the value of your fund would drop by 0.00274% (1% divided by 365) on a daily basis to reflect this fee.

- Performance fees – A few actively managed funds charge performance fees if they perform better than a certain benchmark set by the fund.

- Spreads – Many funds apply spreads whenever you buy or sell units in the fund. These are reflected in the price you buy or sell your fund at. For example, if a fund’s buy spread is 0.10%, you’ll buy units in the fund at a 0.10% premium to the current unit price. If a fund’s sell spread is 0.10%, you’ll sell units in the fund at a 0.10% discount to the current unit price. Spreads apply to cover the transaction costs of entering or exiting a fund, so that investors already invested in the fund don’t bear the costs of that trading activity. You can find the spreads for Flint’s funds in each fund’s Product Disclosure Statement.

3. Other considerations

Minimum investment

Flint has a minimum investment of $50 per purchase.

Account types

Currently only individual accounts are available, but Flint are working on adding joint accounts. Trust and Company accounts are also in the pipeline.

Auto-invest

Currently there’s no auto-invest functionality available, but this is something they’re working on.

Order execution

Orders to buy or sell units in a fund are executed daily, with most transactions settled within a couple of business days.

Distributions

Any distributions (dividends) a fund pays is paid out as cash to your Flint account. There’s currently no option to automatically reinvest these.

Tax

Currently all funds listed on Flint are Multi-Rate PIEs, where your fund’s taxable income is taxed at your Prescribed Investor Rate (PIR). Taxes on your funds are calculated and charged either:

- Annually on 31 March, in which case your tax liability for each fund is automatically paid by selling off units from each of your funds. Or,

- Whenever you sell units in your funds, in which case your tax liability is automatically deducted from your sale proceeds.

Custody of investments

Any investments you buy through Flint are held in custody with Trustees Executors. Your funds are held separately to the Flint platform, so if they were to go bust they can’t use them to cover their expenses or pay back their debts. Your funds aren’t directly registered in your name, but you’re still the beneficial owner of them, and you still get the full benefit of any gains and distributions they make.

User interface

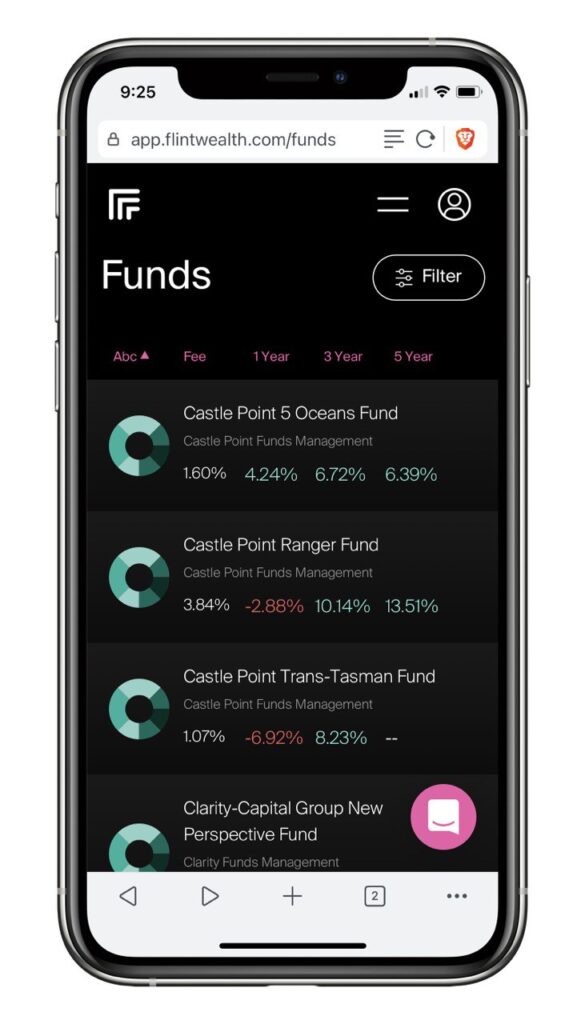

The Flint platform is built as a progressive web app which makes it desktop and mobile friendly. Navigating around the platform is quick and easy.

Fund research & data

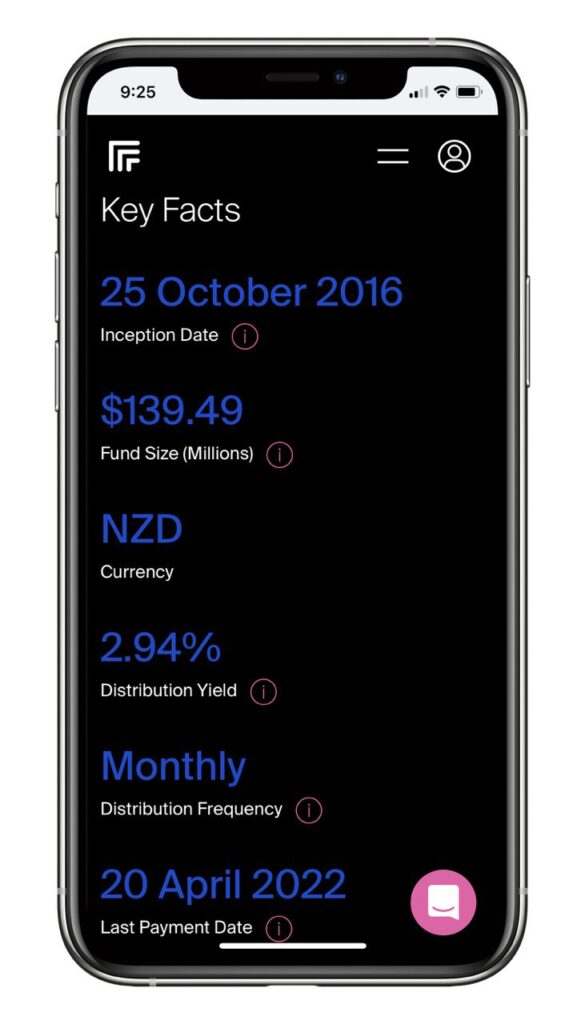

Another selling point of Flint is having easy access to fund data. Key facts about each fund like fees, yield, and past performance can be found easily by clicking into each fund.

Flint also has freely downloadable research PDFs for each fund, outlining the fund’s performance, strategies, and objectives. However, this research doesn’t provide too much materially new information over what’s already available in each fund’s Product Disclosure Statement or Fund Update documents.

Lastly, Flint has a partnership with RIAA (Responsible Investment Association Australasia), where the platform shows whether a fund has been RIAA certified:

The Responsible Investment Association Australasia (RIAA) Certification Symbol signifies that a fund has implemented an investment style and process that systematically takes into account environmental, social, governance or ethical considerations, and this investment process reliability has been verified by an external party.

Product roadmap

Being a brand new platform it’s likely that Flint will be actively improving their platform over the coming months. Apart from new auto-invest and joint account functionality mentioned above, Flint have told us they’ve got new funds and new partnerships in the works, and are continuously releasing enhancements to the platform every fortnight.

4. Flint Wealth vs InvestNow

On the surface Flint is incredibly similar to InvestNow. They both offer a huge range of funds from a variety of New Zealand fund managers, don’t charge any account or transaction fees, and have a fairly low minimum investment of $50. So let’s take a detailed look into how they compare.

Similarities and differences in fund offering

Index funds

InvestNow’s and Flint’s index fund offering is largely different:

- Smartshares – While InvestNow offers Smartshares’ range of index funds, Flint has the almost identical range of SuperLife funds. More on the differences between Smartshares and SuperLife later on.

- Harbour – Both platforms offer Harbour’s two NZ shares index funds.

- Other index funds – Index funds offered by Foundation Series, Macquarie, and Vanguard can only be found on InvestNow.

Overall InvestNow’s range of index funds is slightly more comprehensive.

Further Reading:

– Smartshares & SuperLife review – The smart way to invest in shares?

Actively managed funds

InvestNow has a much wider range with plenty of fund managers that Flint doesn’t have onboard like ANZ, Russell, and Pie Funds. InvestNow also has a couple of unique funds like Vault’s Bitcoin Fund, and Squirrel’s Monthly Income fund which invests in to peer-to-peer loans.

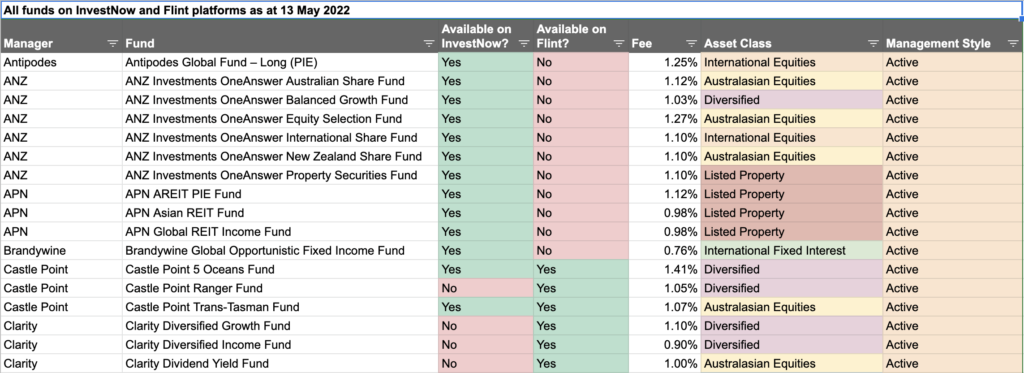

In addition, almost all of Flint’s actively managed funds are also available on InvestNow. The exceptions are the following which are only available on Flint:

- Castle Point Ranger Fund

- Clarity’s 8 funds

- Devon Diversified Income Fund

- Devon Sustainability Fund

- Harbour Enhanced Cash Fund

So overall InvestNow is the clear winner when it comes to the variety of actively managed funds on offer.

Further Reading:

– Vault International Bitcoin Fund review – The best way to own Bitcoin?

– Squirrel Monthly Income Fund review – P2P Lending made easy as PIE

Comparison spreadsheet

To help you compare the fund offerings between the two platforms, we’ve put together a spreadsheet containing a full list of funds on Flint and InvestNow (as at 13 May 2022). This sheet can be found here.

Smartshares vs SuperLife

The popular range of Smartshares‘ ETFs is not available on Flint, but they offer an almost identical alternative in the form of SuperLife‘s funds. These funds mostly mirror Smartshares’ offering – For example, the SuperLife US 500 Fund invests entirely into the Smartshares US 500 ETF, giving both funds exposure to the same underlying assets. However, there’s a few key differences between Smartshares’ ETFs and SuperLife’s equivalents which we’ll cover below:

Range of funds

There’s a few differences in the range of funds on offer:

- Thematic and ESG funds – SuperLife doesn’t have Smartshares’ thematic funds (which invest into Automation & Robotics, and Healthcare Innovation related companies). Nor does SuperLife offer an equivalent to Smartshares’ ESG funds (which exclude investment into contentious industries like tobacco and weapons).

- Diversified funds – SuperLife has a few unique funds that Smartshares doesn’t have, most notably the diversified (High Growth, Growth, Balanced, Conservative, and Income) funds. These are handy pre-built funds which combine multiple asset classes (including NZ and international shares, bonds, and cash) into one fund, saving you from picking funds and building a diversified portfolio yourself.

- NGB and TWH – InvestNow doesn’t offer Smartshares’ NZ Government Bonds (NGB) and Total World NZD Hedged (TWH) ETFs. However these funds are available through Flint in SuperLife form.

Management fees

SuperLife’s fund management fees are slightly different to their Smartshares equivalents:

Smartshares’ “Core Series” ETFs are more expensive in SuperLife form. For example:

| Smartshares fee | SuperLife fee | |

| S&P/NZX 50 (NZG) | 0.20% | 0.49% |

| US 500 (USF) | 0.34% | 0.44% |

However, many of Smartshares’ non-core funds are slightly cheaper in SuperLife form. For example:

| Smartshares fee | SuperLife fee | |

| Europe (EUF) | 0.55% | 0.49% |

| Australian Mid Cap (MZY) | 0.75% | 0.49% |

Fractional units

InvestNow doesn’t allow you to buy fractional units in Smartshares’ ETFs, which results in a couple of quirks relating to buying Smartshares’ funds:

- Firstly, they deduct the value of two units from your order. Let’s say you have an order to buy $50 of a Smartshares ETF whose unit price is $12. Your order will be deducted by $24 ($12 x 2), resulting in an order value of $26. This deduction occurs to prevent you from spending more than the $50 you originally ordered, in the case the unit price of the ETF increases between the time you placed the order and the time the order is executed.

- Secondly, following on from the above example, your $26 order is only enough to buy 2 whole units of the above Smartshares ETF – $24 going towards the two units at $12 each, and $2 as “change”. Overall your $50 order has resulted in just $24 being invested, and $26 left as cash in your account!

The above quirks mean you’ll always be left with uninvested cash after investing in Smartshares ETFs though InvestNow. This is a common bugbear for InvestNow customers, but using Flint would resolve this issue as SuperLife allows buying partial units.

Tax

Smartshares’ ETFs are Listed PIEs, taxed at flat rate of 28%. SuperLife’s funds are Multi-Rate PIEs, taxed at your Prescribed Investor Rate (PIR) which could be 10.5%, 17.5%, or 28%.

This flat tax rate can be another bugbear for Smartshares investors, particularly kids who would typically be on a lower PIR than 28%, and would have to wait until the end of each tax year to claim back any excess tax paid. SuperLife provides an alternative to get around this limitation by applying an investor’s correct PIR upfront.

Other differences

Here’s a few other differences between Flint and InvestNow:

- Auto-invest – InvestNow customers have the ability to make automatic regular investment contributions. There’s no such option on Flint.

- User interface – InvestNow’s user interface is dated and isn’t mobile friendly. Flint’s UI is much better.

- Distribution reinvestment – On InvestNow you can choose to have your funds’ distributions automatically reinvested or paid out in cash. On Flint, currently the only option is to have distributions paid out in cash.

- Fund data and research – Flint surfaces a lot of key facts about their funds that can often be hard to find such as the fund’s distribution frequency and yield. On the other hand, InvestNow shows relatively little data on each of their funds.

- Term deposits – InvestNow also offers term deposits, while Flint doesn’t.

Check out our article below for a full review on InvestNow:

Further Reading:

– InvestNow review – The most efficient way to invest?

5. Flint Wealth vs direct investment with fund managers

Lastly, let’s take a brief look at how investing through Flint differs from investing in their funds directly through a fund manager.

Flint vs SuperLife

SuperLife charges a $12 per year membership fee when investing directly through them. You’ll save that $12 fee when investing in their funds via Flint. However, you’ll lose a few features that are unique to the SuperLife platform:

- A lower minimum investment of just $1 (versus $50 on Flint).

- Age Steps, an investment option which automatically determines your fund allocation based on your age.

- Automatic rebalancing of your funds.

Flint vs other fund managers

Most other fund managers listed on Flint have quite high minimum investment requirements if investing through them directly. For example:

- Milford requires a minimum investment of $1,000 when investing directly through them.

- Devon’s minimum is $10,000.

- Harbour’s minimum is $100,000!

Flint brings these minimum investment requirements down to just $50, plus adds the benefit of being able to invest with multiple fund managers without having to sign up with each of them individually.

Conclusion

While InvestNow is a firm favourite among many Kiwi investors, we think Flint is a solid alternative. They’ve got some of InvestNow’s best features such as no account or transaction fees, and despite being brand new, they already have plenty of quality fund managers listed on their platform.

One key aspect investors may like about Flint is that they offer SuperLife’s funds over Smartshares’ ETFs. SuperLife gives you the same investment exposure as Smartshares’ funds but solves a few issues some investors have with them such as the cash drag from having to buy full units, and the flat 28% tax. Although this can come at the expense of having to pay the higher management fees associated with SuperLife’s funds.

But if you’re not concerned about the above or are already happy with InvestNow, there’s not yet a major compelling reason to move your investments over to Flint. While Flint’s UI is superior, InvestNow currently has more variety in their fund offering and more mature set of features like auto-invest and distribution reinvestment. However, Flint Wealth is just a baby in the world of investment platforms and they’re yet to realise their full potential in terms of features and products. They’re a promising competitor and we’re very excited to see how they develop over the coming months.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Good rundown 👍

You may want to have a closer look at the research provided on Flint…it’s significantly more than the PDS and Fund Update. E.g qualitative research opinion.

Don’t you work for the research provider Andy?

Thanks Andy. We just feel that the research doesn’t provide much materially new information from a retail investor point of view. We could be wrong though – some may find the reports useful.

Great comparison.

A suggestion – perhaps you could add an extra column or two in the spreadsheet to show the fund fees for Flint vs InvestNow? I haven’t compared them all but as of today (11 Dec 2022) the SmartShares US Large Growth fee management fee is 0.46% with Flint and 0.51% with InvestNow. But the US 500 is cheaper with InvestNow with 0.34% versus 0.44% with Flint. Might be swings and roundabouts if people are holding multiple funds but for the odd person who specifically is wanting to invest into just one or two the fee difference could be a reason.

Hi Francis, thanks for reading.

The management fee for a given fund is the same regardless of whether you invest through InvestNow or Flint. The differences you mention are because InvestNow offers Smartshares’ funds, while Flint offers SuperLife’s funds. Quite similar products, but there are a number of tax and fee differences between them. We cover both Smartshares and SuperLife funds in the spreadsheet, but we’ll look into making a new spreadsheet which makes it easier to compare the funds.

Would be cool to see how InvestNow and Flint stack up in 2024, not that Flint offers auto invest and has more funds to choose from.

Agreed! Update Moneyking 😉

We have tried both recently and decided on flint. I wish flint had more funds and TDs or high interest savings. Flint now does have auto invest. Invest now needs to wake up with their site. They’ve been telling people they are updating it for years. Good point about Superlife overcoming the irritations of the smarshares funds.

UPDATE: Flint Wealth is closing (app.flintwealth.com). Sell your investments out of the platform by Friday July 25, 2024. It looks like the platform was not successful enough for the buyer of the over-arching company.