Should I move from Sharesies to another platform? Will you switch to Foundation Series’ funds? Should I invest $50k as a lump sum or spread out my investment? These were some of the questions we answered in our 5th Ask Money King NZ Q&A held with our Instagram followers.

The answers in this article have been provided without any knowledge or consideration of the personal circumstances of the person who asked the question. This content should not be taken as financial advice.

In case you missed it – Our previous Q&A article:

– Ask Money King NZ (Summer 2022) – Best way to come up with a house deposit?

1. I’m currently investing in TWF and the NZX 50, anything else I should consider?

With thousands of investment options to choose from, it’s easy to feel like you need to invest in lots of them, or feel like you’re missing something. You could consider adding satellite investments like thematic funds or individual shares, but they’re far from necessary, and aren’t guaranteed to deliver better results. Also if you have shorter term goals or a lower risk tolerance, then you might consider investing in more conservative assets like bonds or cash, as shares don’t tend to work as well here.

But chances are a simple portfolio (like what you have) is already enough. If you’re investing for the long-term and have the risk tolerance to invest 100% in shares, then those investments already give you a well diversified portfolio spread across NZ and globally. Counterintuitively, adding more funds can actually reduce the diversification of your portfolio. For example, adding a S&P 500 fund won’t give you any further diversification because your TWF fund already contains US shares. The S&P 500 would only concentrate your portfolio towards the US.

2. Global 100 vs S&P 500?

We wrote an article discussing S&P 500 vs global funds just last week – check it out below! But here’s a few key points about the two types of funds:

Both funds are well diversified investing across lots of different companies that operate in various industry sectors. However, some common concerns around the Global 100 are:

- Is 500 companies better than 100? 500 companies is often perceived to be way more diversified than 100 companies. But keep in mind more companies doesn’t always equal significantly more diversification, given the diminishing diversification benefits of adding more and more companies to a fund. These funds are market cap weighted (with larger companies making up the majority of each fund), therefore the 101st to 500th companies in the S&P 500 (which make up ~32% of the index) have a relatively small influence on its diversification and performance compared to the 100 largest companies (which make up ~68% of the index).

- Too much tech? Some people are concerned that the Global 100 is too concentrated towards tech, with big tech related companies (Apple, Microsoft, Amazon, and Alphabet) making up 36% of the fund. These companies only make up 18% of the S&P 500. However, if you look at the industry breakdowns for each fund, they’re actually quite similar – for example, IT companies make up 28.9% of the Global 100 and 27.13% of the S&P 500 (note that Amazon and Alphabet aren’t actually categorised in the IT sector). So while there is a greater concentration towards certain companies in the Global 100, it doesn’t come at the expense of poor industry diversification.

Another consideration is geographical diversification. The S&P 500 only invests in companies listed in the United States. Whereas the Global 100 goes beyond the US and also invests into other countries like Japan, France, and the UK. Some people argue that the globally diversified revenues of S&P 500 companies (where ~30-40% of revenues of S&P 500 companies come from overseas) removes the need to invest in these other countries. But we consider this to be a poor argument. For example, the FTSE 100 (an index representing the 100 largest companies listed on the London Stock Exchange) earns 75-80% of its revenues from outside the United Kingdom. Yet few people would consider the FTSE an adequately geographically diversified index.

Regarding performance, the Global 100 has outperformed the S&P 500 over recent years. But those are just past performance figures – We have no idea which one will perform better in the future.

| S&P 500 | Global 100 | |

| 1 year (31/01/22 to 31/01/23) | -10.77% | -8.91% |

| 5 years (31/01/18 to 31/01/23) | 7.99% | 9.53% |

Further Reading:

– S&P 500 vs Global index funds – What’s better?

– S&P 500 vs S&P Global 100: Which Should I Invest In? (Kernel blog)

3. Should I move from Sharesies if I’m a small investor (<$200/month)?

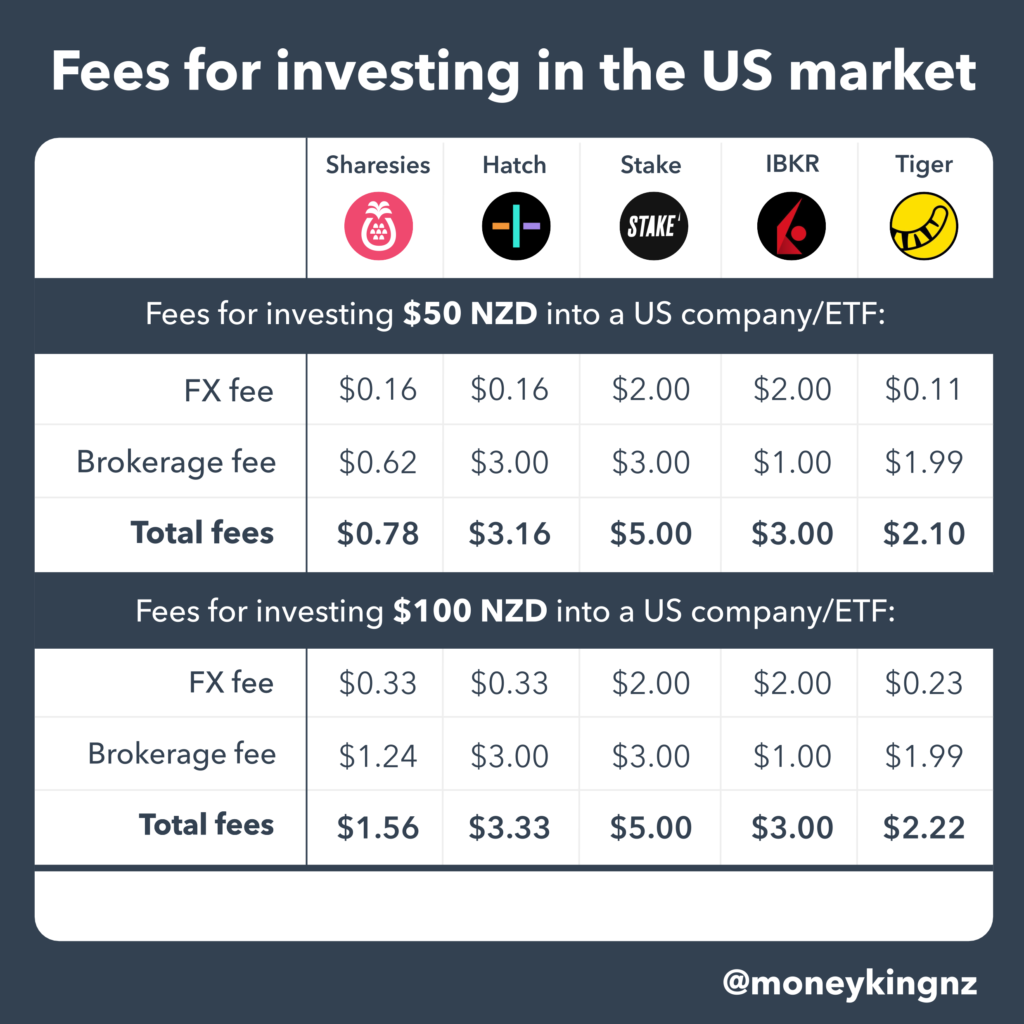

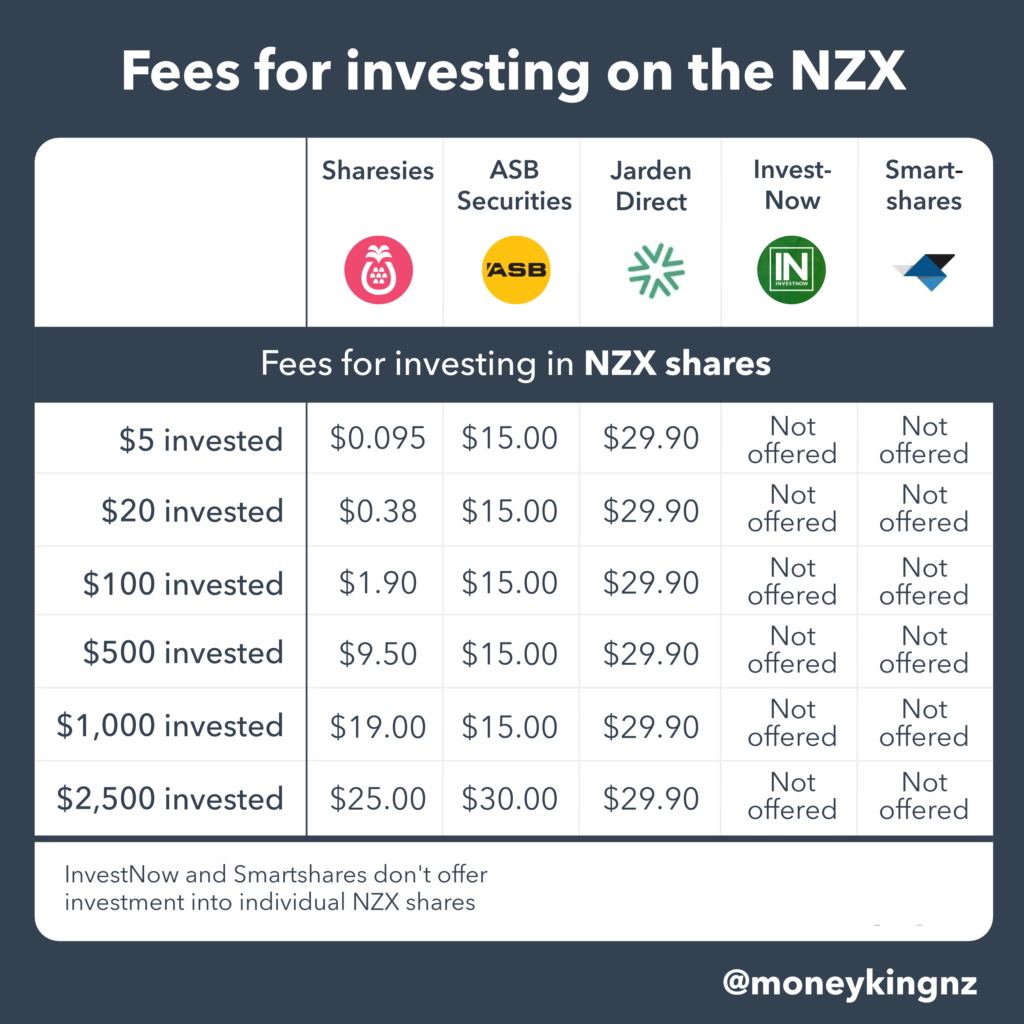

Maybe! It partially depends on what assets you’re investing in. If you’re wanting to invest in individual shares, Sharesies is expensive with their 1.9% brokerage fee (and their plans don’t help much if you’re investing small amounts each month). But they’re still one of the cheapest options for investing small amounts. That’s because other brokers tend to have flat fees which punish smaller investors. Check out some of our fee comparisons below:

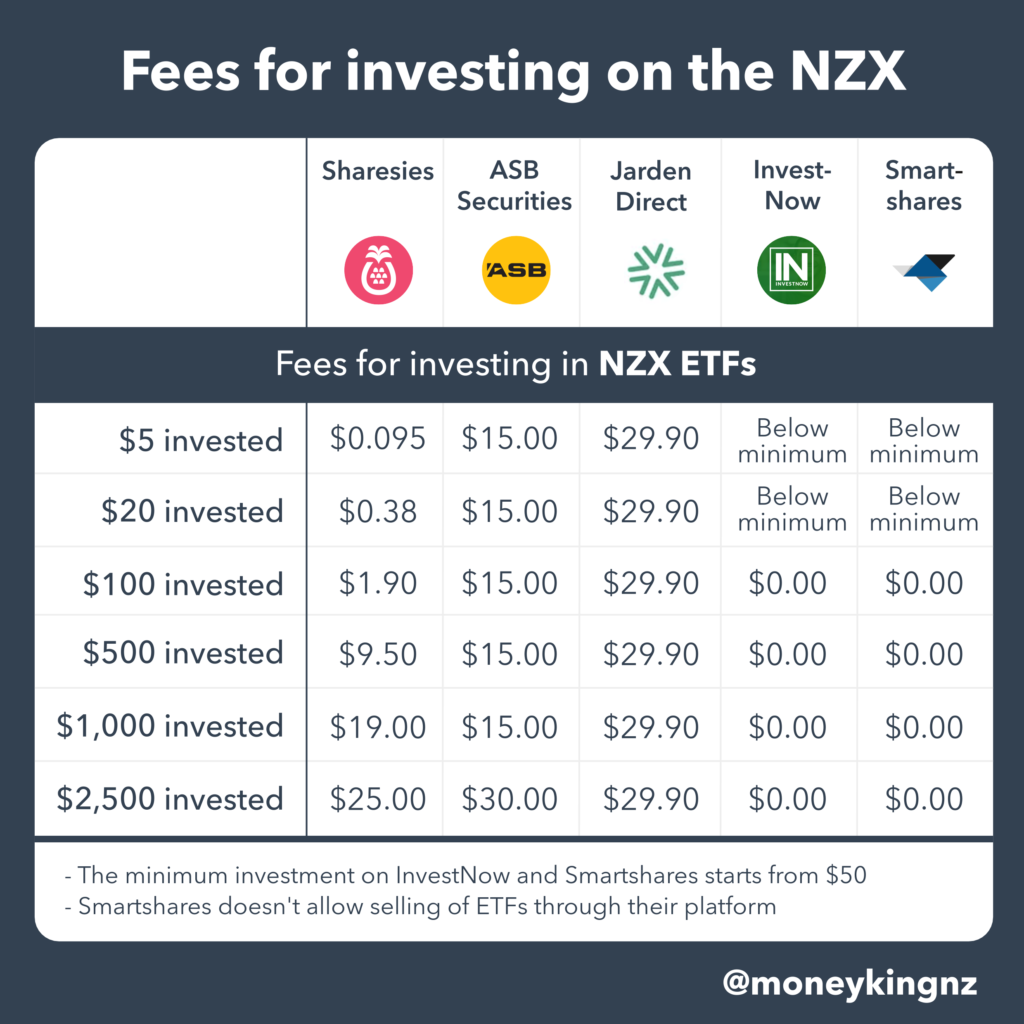

If you’re investing in funds, other options could be more cost effective and worth exploring. The likes of InvestNow, Kernel, and Flint all have a wide range of funds, have no transaction fees, and have small minimum investment requirements. The below table provides a fee comparison for investing into Smartshares’ ETFs:

But fees aren’t everything. There’s no point using the absolute cheapest platform if you don’t like it and it puts you off investing. So if you’re already happy with Sharesies and their fees, then that’s no problem either.

Further Reading:

– Sharesies’ January 2023 fee changes – Are they good or bad?

4. Dividend or growth stocks?

Both! We consider both dividend and growth companies to be important parts of a diversified share portfolio. And if you’re like us and invest primarily into broad market index funds, you’d naturally end up with a portfolio spread across companies with those different characteristics.

But the answer really depends on your personal circumstances. If we were forced to choose only one, we’d go for growth companies as we’re investing long term, have no need to generate cash flow from our investments right now, and have a high risk tolerance. Though our answer might be different if our circumstances were different, for example if we were relying on our portfolio to pay for our everyday bills.

5. Is it better to live off dividends or by selling bits and pieces of growth stocks?

The advantage with living off capital from growth stocks is that capital gains are sometimes taxed more favourably than dividends, they have higher potential returns over the long-term, and don’t tie you to a dividend payment schedule.

The advantage with living off dividends is that they pop into your account automatically, don’t incur brokerage fees, and dividend paying companies tend to be more stable and reliable than growth companies. It’s probably the less complicated way to live off a portfolio of shares.

But at the end of the day, what really matters isn’t the method as to how your portfolio earns a return, but rather the ability for your portfolio to support your desired lifestyle while remaining diversified and aligning with your risk tolerance. And chances are that could involve relying on both dividends and capital.

Further Reading:

– Investing for passive income – The danger with dividends

6. Good exchanges for stock picking (for a NZ tax resident)?

Not sure if you’re asking about investment platforms or actual stock exchanges, so let’s look at both!

Exchanges

If you’re looking at things from a tax residency perspective, investing in the NZX is most tax efficient for NZ tax residents. Capital gains are often tax free, while dividends can have minimal tax thanks to imputation credits. Plus there’s the advantage of not having to pay foreign exchange fees to invest domestically. Investing in the ASX is also relatively tax efficient as a lot of ASX shares are exempt from the FIF regime.

But the NZX and ASX are really small markets relative to the rest of the world, so it’s usually also worth broadening your stock picking into international markets even though they might not be as tax efficient. In other words, while tax is an important consideration, it shouldn’t be the primary basis of deciding what to invest in. The quality of the companies you pick matters too!

Platforms

For platforms the one you should use depends on what market you’re looking to trade in. For example:

- NZX – Sharesies, ASB, Jarden Direct

- ASX – Sharesies, ASB, Jarden, Tiger, IBKR

- US – Sharesies, Hatch, Stake, Tiger, IBKR

- Other markets – Tiger or IBKR

You can compare things like pricing structure and features they offer to determine the best one for you.

Further Reading:

– Hatch review – Hard to recommend

– Interactive Brokers & Tiger Brokers review – Better than Sharesies & Hatch?

– Sharesies review – Still a good investment platform in 2023?

As for tax, there’s not really any significant tax benefits associated with a particular platform, given it’s primarily the underlying asset you invest in that determines the tax you pay, rather than the platform you use. However, you may want to consider the following tax quirks:

- Local platforms like Sharesies and Hatch can have features to help you with your NZ tax liabilities, while foreign platforms like IBKR leave you largely on your own when it comes to tax.

- Hatch holds your US dollar cash in a money market fund, and as a result that cash gets taxed under the FIF regime.

- Sharesies automatically pays tax on your foreign dividends for you, even when you’re not required to declare those dividends as income (e.g. if you earn less than $200 in foreign dividends and other undeclared income during the tax year, then you normally don’t have to declare those dividends).

Further Reading:

– Tax on foreign investments – How do FIF and Estate Taxes work?

7. Will you switch strategies from Kernel to Foundation Series at all?

This question refers to Foundation Series’ two ultra low fee Total World and US 500 funds. For us the Foundation Series Total World Fund is a compelling alternative to our Kernel Global 100 investment (we wouldn’t consider the US 500, as it only invests in US companies so isn’t globally diversified enough for us). It has lower management fees (0.07% vs 0.25%) and no account fees, although there is a 0.5% transaction fee which applies every time you buy or sell units in the fund.

Some investors might also like the greater level of diversification the Total World Fund provides, given it invests in over 9,000 companies from over 40 countries, while Kernel’s fund is limited to 100 companies in 10 countries.

Further Reading:

– InvestNow Foundation Series review – What’s the catch with their 0.03% fee?

But we don’t intend to switch over. Even though the management fees are way lower, when taking the transaction fee and tax inefficiency of the Foundation Series fund into account, Kernel’s fund still works out really well. We did a comparison in the below article which showed that someone investing $100k over 10 years would only be $220 better off in the Foundation Series fund!

Further Reading:

– What’s the best global shares index fund in 2022?

So it’s not worth it for us to switch over just to save a few hundred dollars, especially when:

- We’re lazy.

- The Kernel platform is easier to use than InvestNow.

- We’d rate Kernel as being more likely than InvestNow to innovate and lower fees. There’s more room to cut fees from 0.25% than there is from 0.07%.

- We’d prefer focussing our efforts on investing as much as we can into a good, stable portfolio of funds (even though they might not be the absolute best), rather than constantly chopping and changing our investments.

8. Any strategies for getting a good exchange rate while investing in US stocks?

Not really. Just like share prices, exchange rates are unpredictable and out of our control. So you could try simply ignoring them. Exchange rates shouldn’t matter too much when investing over the long-term, as any adverse currency movements should be outstripped by the increase in the value of your shares. In other words, it’s probably not worth trying to time the market to get a better rate.

But another thing you could do is keep dollar cost averaging into your US investments. Most people are already familiar with using DCA to smooth out the volatility in share prices by investing regularly regardless of whether the market is up or down, so why not apply the same concept to exchange rates?

Lastly, another thing you could consider is investing in a currency hedged fund. These would almost entirely eliminate the impact of exchange rates on your overseas investments.

Further Reading:

– Hedged vs Unhedged funds – What’s better?

9. What are the pros and cons of investing in a Kernel’s High Growth Fund vs a custom portfolio of Kernel’s funds?

The main pro of the High Growth Fund is that it’s an incredibly simple way to invest long-term. It essentially invests in a pre-made mix of Kernel’s funds, giving you excellent diversification across NZ and global shares while saving you from the headache of having to choose specific funds yourself. The High Growth Fund Invests in:

- NZ 20 (23.5%)

- NZ Mid & Small Cap Opportunities (5.9%)

- Global 100 (58.6%)

- Global Infrastructure (5%)

- Global Green Property (5%)

- Cash (2%)

While the fund will suit many investors, it’s not a one-size-fits-all product. That’s where a custom mix can be advantageous. For example, the High Growth Fund’s ~30% allocation to NZ shares is too much for us, as we already have heaps of other NZ investments. Therefore we have a genuine need to choose a custom mix with less NZ exposure. It increases complexity of our portfolio, but it’s worth it for us to better align our investments with our needs and preferences.

Further Reading:

– What’s inside Money King NZ’s investment portfolio (2023)?

10. With a custom mix of Kernel’s funds, do you have to manually rebalance the allocations over time?

With a custom mix of index funds, your actual asset allocation will drift away from your target asset allocation over time. For example, if you had a portfolio of 80% global shares and 20% NZ shares, over time the NZ shares part of your portfolio would drift above 20% if they outperformed global shares.

In that case you might want to consider rebalancing to bring the NZ shares portion of your portfolio back down to 20% – and yes, that would be a manual task. Or you could leave them as is, if you’re happy with the higher NZ exposure and being overweight in NZ shares wasn’t detrimental to your investing goal – you might view rebalancing two funds in the same asset class (e.g. shares) to be less important than rebalancing two funds in different asset classes (e.g. a share fund and a bond fund).

Rebalancing isn’t an issue with pre-built funds like Kernel’s High Growth Funds, as the fund manager rebalances those funds to their target asset allocations for you.

11. What’s the best approach to invest $50k of savings into index funds? All at once or across 1 year?

Investing the lump sum is statistically the better option. Given sharemarkets go up 📈 most (about 70%) of the time, there’s a strong case in favour of putting all of your money to work immediately.

BUT there’s always the risk that your funds will go down shortly after you make a lump sum investment. Few people would be able to stomach seeing their entire $50k investment going down to say $40k 📉. That’s where dollar cost averaging comes in. By drip feeding your money in over a period of time you can mitigate the risk of putting in all your money at a bad time.

So there’s no perfect answer. One strategy wins mathematically, the other wins psychologically. It’s a good idea to consider your own risk tolerance and preferences when choosing one.

Further Reading:

– Does timing the market = better returns?

12. Is investing in term deposits with InvestNow riskier than dealing directly with the bank?

This was a good question that a reader asked us in the comments section of another article.

The main risk of term deposits is the bank going bust or getting into some financial strife, which would result in them not being able to pay back some or all of your deposit. That risk is identical regardless of whether you go through InvestNow or direct, given you’re holding the same underlying product with the same bank.

You might also be concerned about the counterparty risk associated with adding InvestNow as the middleman of your term deposit. However, InvestNow doesn’t even touch your money in the first place, but rather they just exist to facilitate your deposit with the bank. Simply put, they couldn’t take your money and run away with it, nor would you lose your money if InvestNow shut down. So we wouldn’t consider this a material risk.

So InvestNow is a legitimate place to use for term deposits, and sometimes they offer rates that are higher than going direct through the bank. The downsides is that they lack options such as being able to get interest paid on a regular basis (e.g. monthly or quarterly), and lack PIE term deposits.

13. Do you work in FinTech/Finance?

Not gonna say exactly where/what role, but yes 🤑

14. Keep up the good work Money King NZ. Love following your website for financial info

Thanks so much! Appreciate your support!

That’s all for our Autumn 2023 Q&A. Our next one will be in 3 months’ time, so keep an eye out on our Instagram for that. Going forward we’re thinking of providing the ability to ask questions anonymously – we think there might be some questions out there that people feel are “too dumb to ask”, so want to help provide the means for people to get those types of question out there. Let us know in the comments if you have any thoughts about how we could run these Q&As. Thanks!

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Currently looking at what to DCA into for the long term. I saw you mentioned that you were going to stay with Kernel.

The foundation series total world looks promising for me. I was thinking if you were to move to the foundation series, would you go 100% into the Foundation Series Total World or allocate some to NZ stocks? Trying to work out the sweet spot for tax benefits, fees etc… I had a thought of going 80% Total World Fund and 20% NZ20 on Kernel but feel like a bit of guess work from my behalf.

We personally still would keep an allocation to NZ shares – not only for tax benefits, but somewhat for patriotic reasons too.

There’s probably no definitive sweet spot. While most diversified funds have around 25-30% NZ shares, one size doesn’t fit all and your allocation depends on personal preferences, investment goals and so on. For example, we’ve personally gone for a 20% allocation to NZ – given we have so much other NZ investments, a 30% allocation seemed too high.

I would like to highlight an area of Sharesies recent pricing changes that in my opinion is a problem. They highlight that the maximum commission for a NZ share order is $25 for anything $10,000 or over, however they dont provide the ability to edit orders (only cancel) which means if our orders are only partially completed and the stock price moves our commission in completing the order if we chase the share price is going to be significantly over $25. eg place a $10,000 order, get partially filled for $1,000, share prices moves higher, you cancel the order and pay a higher price for the balance we will get charged $44 commission ($19 for the first $1,000 +$25 for the remaining). This only increases the more times we have to cancel an order and pay a higher price to complete our order. This would be solved by allowing us to edit the price on the remaining balance (like other brokers do) so that it remains one transaction rather than multiple transactions.

Oh, thanks for highlighting that. It sounds like a really bad investor experience, and perhaps a sneaky way for Sharesies to make more money. Hopefully they allow the ability to edit the limit price, but we wouldn’t count on them to fix that anytime soon.