Imagine you were starting your investment journey from scratch. Say you had paid off any high interest debt, built an emergency fund, set up your KiwiSaver, and now you want to invest long-term – perhaps for retirement, for your kids, or just to build wealth in general. And say you wanted to keep your investments as simple as possible, either because you’re a beginner and/or you want to take a hands-off approach? Not everyone wants to deal with analysing financial statements, tax and so on! How would you go about investing in this situation?

In this article we’ll cover step-by-step how we’d personally go about creating an incredibly simple long-term investment portfolio, and cover the detail and reasoning behind each step. We’ll show that long-term investing can be easier than you think!

The steps and funds described in this article do not constitute financial advice and should only be used as a starting point for your own research. Always consider your personal financial circumstances or consult with a financial adviser before making any investment decisions.

This article covers:

1. Pick what to invest in

2. Set up a regular investing plan

3. Maintain your portfolio

4. Stay on course

1. Pick what to invest in

It’s hard to know where to start when choosing what to invest in. But one concept most investors are familiar with is diversification – It’s important to invest across different companies, industries, geographies, so you don’t have all your eggs in one basket in case one goes bad. But did you know you can build a diversified investment portfolio by investing in just one fund? There’s a number of funds out there that invest in a variety of assets across different industry sectors including:

- NZ shares – This might include companies like Fisher & Paykel Healthcare, Auckland Airport, Meridian Energy, and Spark.

- International shares – This includes the US, UK, Australia, Japan, France, and beyond, and might include companies like Apple, Microsoft, Nike, and Walmart.

- Bonds – These represent loans to governments and corporations, both in NZ and around the world.

These funds are commonly known as “diversified” or “multi-sector” funds, and chances are your KiwiSaver fund also invests in this way. By investing in a single diversified fund, you don’t have to um and ah over what international shares fund to choose, and what percentage of your portfolio you should have invested in NZ shares. Nor do you have to pick individual companies, saving you from having to analyse financial statements and learn what a P/E ratio is. Perfect for our incredibly simple portfolio!

We’d also aim to invest our money into a low fee fund. Some people like to pick funds based on past performance over low fees, but we’d argue this is a poor strategy as past returns often don’t translate into future results. Today’s best funds can easy be tomorrow’s losers, but fees are the one constant that eat away at your returns.

Funds we’d pick

Below are a couple of funds that meet our above criteria, having low fees and being highly diversified across assets, geographies and industries (with each fund investing in hundreds of different assets).

Any of the below funds can also be used as your KiwiSaver fund. See our below article for more details:

– What’s the best low cost Growth/Aggressive KiwiSaver fund?

Foundation Series Growth Fund

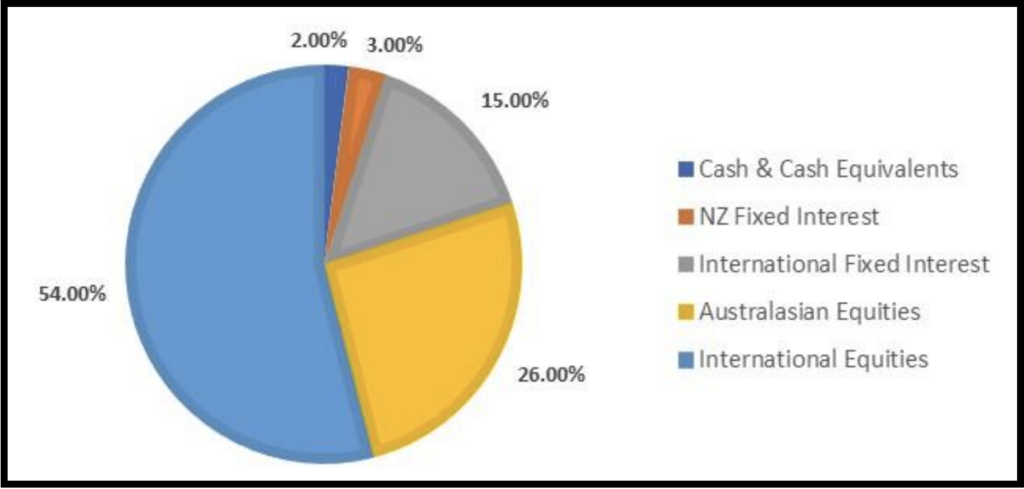

The Foundation Series Growth Fund is a diversified fund investing in:

- Around 26% NZ shares (so for every $100 you invest into the fund, about $26 gets invested into NZ shares)

- Around 54% international shares

- Around 5% NZ bonds and cash

- Around 15% international bonds

The fund charges a management fee of 0.37% p.a. which is an ongoing fee charged as a percentage of the amount you have invested in a fund. This equates to 37 cents per year for every $100 invested. The fund also charges a spread, which is kind of like a transaction fee. This is 0.10% when buying the fund and 0.11% when selling the fund.

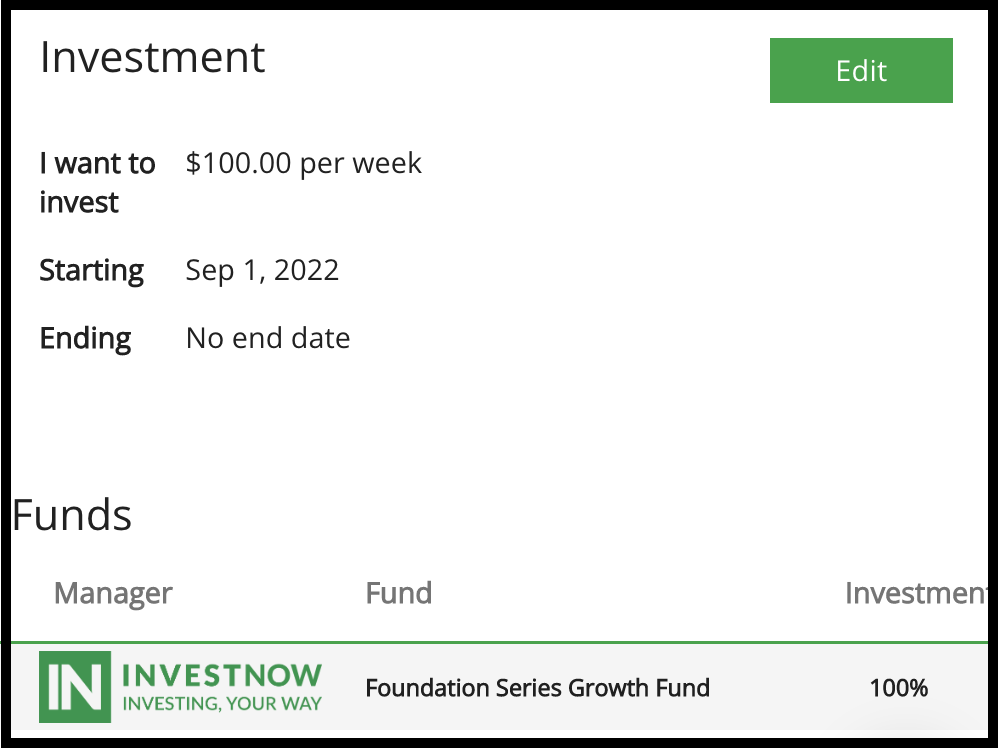

We can invest in this fund through InvestNow where the minimum investment is $250 for a one-off investment or $50 if we set up a Regular Investment Plan (more on this later).

Further Reading:

– InvestNow review – The most efficient way to invest?

Kernel High Growth Fund

The Kernel High Growth Fund is a diversified fund investing in:

- Around 30% NZ shares

- Around 60% international shares

- Around 5% international infrastructure related companies

- Around 5% international real estate companies

A key difference between this fund and the Foundation Series Growth Fund is that the High Growth Fund doesn’t invest in bonds, in favour of having a higher allocation towards shares. As a result this fund has the potential to deliver higher returns, but will be more volatile – i.e. the value of the fund will likely fluctuate up and down more.

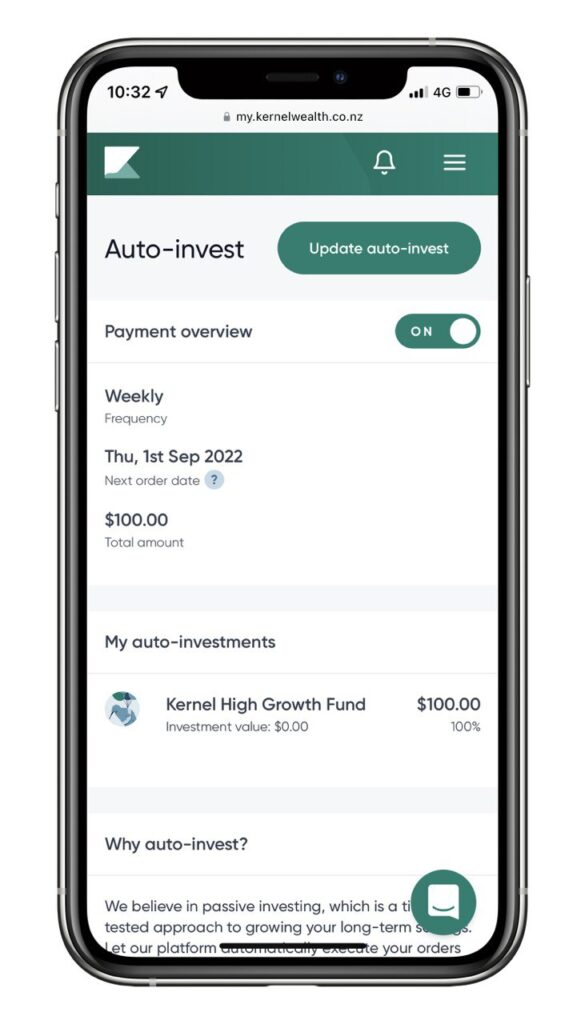

The High Growth Fund has a management fee of 0.25% p.a., plus a $5 per month account fee applies if we have $25,000 or more invested with Kernel. We can invest in this fund through Kernel where the minimum investment is just $1.

Further Reading:

– Kernel review – High quality index funds

Why we wouldn’t pick the S&P 500 or Simplicity Growth Fund

There’s other fund options we could use for our incredibly simple portfolio, for instance an S&P 500 index fund or the Simplicity Growth Fund, which are also very simple and popular investment products. But here’s why we personally wouldn’t use them:

- S&P 500 index funds – These funds only invest in companies listed in one country, the United States. We don’t think this is diversified enough to be the sole fund in our portfolio. It misses out on companies in countries like the UK, Japan, France, and Australia, and there’s no guarantee that US companies will perform better than these countries. The S&P 500 also doesn’t contain any NZ companies, which come with tax advantages for Kiwi investors.

- Simplicity Growth Fund – This fund is quite similar to the Foundation Series Growth Fund, having low fees of 0.31%, and investing in a mix of local and international shares and bonds. However, the fund is constructed in a way that isn’t tax efficient, which eats into our returns. In addition, their minimum investment is $1,000 making it less accessible than the other options.

These are still good options, but we don’t believe they’re the best for what we’re trying to achieve. In the end the best fund for you comes down to your personal preferences, and you could easily swap out our Foundation Series or Kernel fund for another fund of your choice. The two articles below may help if you want to dig into the S&P 500 or Simplicity options further:

Further Reading:

– What’s the best S&P 500 index fund in 2022?

– InvestNow Foundation Series vs Simplicity funds – Tax leakage an issue?

How do you make money from these investments?

When we invest in one of these funds, we’ll be buying units in the fund. For example, if we invested $100 into the Kernel High Growth Fund at a unit price of $5, we’ll get 20 units in the fund. Each unit represents the value of the assets inside a fund. So how do we make money by investing in those units?

- Capital gains – As the companies in each fund grow in value, the value of our units will also increase.

- Distributions – Companies and bonds in each fund pay dividends and interest. A fund may pay these out to investors on a regular basis. More on this later.

But as with any investment there’s also risks. The value of shares and bonds can also go down in the short-term, reducing our funds’ unit prices. If we sold our units at a lower price then what we bought them at, we’d walk away from our investment with a loss. Therefore these funds are best suited to long-term investors who don’t mind seeing volatility in their fund and have several years up their sleeves to allow their fund to grow and recover from any dips. Other investors may find other types of investments like Balanced, Conservative, or Cash funds more suitable.

Further Reading:

– Funds 101 – What’s the difference between an Index Fund, ETF, and more?

– What’s the best short-term investment?

2. Set up a regular investment plan

Lots of new investors feel uncertain about when’s a good time to start investing. Many get emotions involved in their decision making, perhaps by not starting to invest at all when they feel negative about the shape of the economy and sharemarket.

The market keeps on going down, and there’s a recession around the corner. I’m not investing until things stabilise!

Others try to time the market, waiting for the perfect time to put their money in.

The markets are at all time highs! I’ll wait for the market to cool down before investing.

But investing based on emotion often results in disaster, by buying high when the markets are doing great, then selling at a loss when a market crash unexpectedly hits. And timing the market and predicting the future movements of it is impossible. If we waited for the perfect time to start investing, we’d never find it! So we believe that any time is a good time to start an investment portfolio. One day we’ll look back and wish we’d started earlier!

And with the investment platforms we’ve chosen having such low minimum investments, there’s little barrier to investing and we can get started regardless of whether we had $100 or $100,000.

Further Reading:

– Does timing the market = better returns?

Regular investing

If anytime is a good time to invest, then how can we manage the uncertainty of the markets? One solution is to slowly drip feed our money into our chosen fund, instead of committing all of our money at once. Many use a strategy called Dollar Cost Averaging (DCA), which involves investing the same dollar amount on a regular basis, regardless of how high or low our fund is. For example, if we had $10,000 to invest, we might choose to invest $1,000 every week over 10 weeks instead of all of it at once. Or perhaps we might choose to build up our portfolio by investing $100 every week on an ongoing basis.

By investing on a consistent timetable, we take emotion and timing out of the equation. There’s no need to worry about whether we’ve invested at a good or bad time, or whether now’s a time to invest more or less money. And by not committing all our money into our investments at once, we have some protection against investing when the markets are at a peak – Because if markets drop after our initial investment, we still have money on the sidelines waiting to be drip fed into our fund.

Putting your investments on auto-pilot

Many platforms have auto-invest functionality, which combined with automatic payments from your bank account, helps put our dollar cost averaging strategy in place and allows us to build up our investment portfolio without having to lift a finger. This works as follows:

- Set up automatic payment from our bank account to our investment platform e.g. $100 every week

- Set up an auto-invest plan on our investment platform

- Our automatic payment sends money to our investment platform at our chosen frequency

- Our auto-invest plan automatically invests that money into our chosen fund.

InvestNow – Their Regular Investment Plan allows us to invest either weekly, fortnightly, monthly, quarterly, or six-monthly. Using a Regular Investment Plan also reduces InvestNow’s minimum investment from $250 to $50.

Kernel – Their auto-invest function allows us to invest either weekly, fortnightly, or monthly.

The frequency we choose to invest doesn’t matter. Whether we invest weekly, fortnightly, or monthly, this won’t make a substantial difference to our results. It’s the consistency that matters. However, a common strategy is to line up your auto-invest plan with whatever frequency you get paid, so that you can effortlessly contribute to your investment every payday.

3. Maintain your portfolio

In this step we take a look at what’s needed to maintain our portfolio on an ongoing basis.

Tax

Tax is something we’ll have to pay on our investments on an ongoing basis (not just when we sell or withdraw). Very few enjoy the intricacies of tax, but by selecting the Foundation Series and Kernel funds for our incredibly simple portfolio, we’ve greatly simplified things when it comes to sharing our investment income with the IRD. Both funds are structured as multi-rate PIEs, which calculate and keep track of the tax we owe for us. We only need to pay tax:

- When we sell any units – Any tax we owe will be deducted from the sale proceeds of our units.

- At the end of the tax year (31 March) – In early April InvestNow and Kernel will send us an email detailing how much tax we owe. We can either deposit more cash into the platform to pay the tax, otherwise the platform will automatically sell off some of our units to cover the bill.

Easy. There’s no need to get out the calculator or declare our investment income on our tax returns. And there’s no need for us to understand the complex FIF tax rules associated with overseas based investments.

Further Reading:

– What taxes do you need to pay on your investments in New Zealand?

Distributions

Many of the assets that each fund invests in produces a stream of income:

- Shares – Many companies pay dividends on a regular basis, which represents a portion of their profits.

- Bonds – These pay out interest on a regular basis.

Some funds pay out this dividend and interest income to investors in the form of distributions. Kernel’s High Growth Fund intends to pay distributions quarterly. Other funds don’t pay distributions, including the Foundation Series Growth Fund and the KiwiSaver version of Kernel’s High Growth Fund. In these cases the dividends and interest these funds earn are reflected as an increase in the fund’s unit price, and are reinvested into buying more shares and bonds.

For funds that pay distributions, you might see them as a nice little passive income stream, and it might be tempting to withdraw them and go shopping. But we’re fans of reinvesting them into buying more units of our fund. This will help your returns compound, as we’ll earn even more distributions plus benefit from the capital growth of the extra units we bought. Fortunately, Kernel helps with this by allow us to set our distributions to auto-reinvest whenever they get paid, so we don’t even have to think about it.

Other considerations

There’s not much else needed to maintain our incredibly simple investment portfolio, but it’s worth keeping an eye on the following:

- Changes in income – This could change the amount we have to invest. For example, a pay increase could be an opportunity to increase our regular investments, rather than used to inflate our lifestyles.

- Investing goals – An investment portfolio should always be aligned with one’s investing goals. If our reasons for investing change (say we wanted to spend our money rather than invest long-term), then we may also have to change our investments to suit.

- Taking profits – There’s no need to take profits or rebalance our portfolio on a regular basis (for our funds, the fund manager takes care of the latter). It’s best to keep our money invested and compounding over the long-term. However, as we get closer to needing the money, we’d look at switching to more conservative investments to help protect our money from the volatility of the sharemarkets.

Further Reading:

– Portfolio WOF and service – How to maintain your investments

4. Stay on course

Long-term investing isn’t always as easy as selecting a fund and contributing to it regularly. There’s also the behavioural side of investing to consider. So here’s some important strategies we’d follow to stay on course and help ensure the success of our incredibly simple portfolio.

Strategies for staying on course

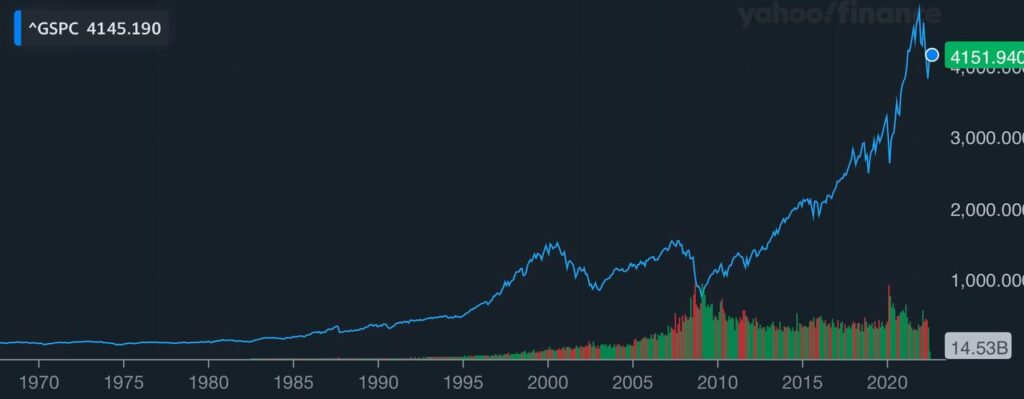

Let time do all the work

Throughout the course of our investing career, we can expect to see downturns in the value of our investment, sometimes by a lot. This can be scary, but don’t freak out! Market dips are normal, and they’re temporary in nature. There’s no need to take action based on them – tweaking or panic selling your investments in response can lead to realising the losses you’ve made. It’s the long-term result that matters – If we hold on tight and give our investments time, the value of it will eventually recover and continue to grow. Why is that?

- Firstly, companies are always innovating and growing. Businesses will adapt to any challenges the world will face, whether it be a pandemic, high inflation, or climate change.

- Secondly, we’re diversified across many companies. Even if one company in our fund goes bust, we still have investments in many other companies so we won’t lose all our money – it’s highly unlikely that all the companies in our fund like Apple, Microsoft, Auckland Airport, and Spark will go bust all at the same time!

There has never been a downturn that the markets haven’t recovered from. They’ve survived economic crises, wars, and pandemics. All that’s required from us investors is time.

Keep contributing

A common mistake we see is people reducing or pausing their investment contributions when the value of their funds start falling. However, market downturns are a great time to continue investing. When the value of our funds go down, our units get cheaper so it’s like they’re on sale. Every dollar we contribute will go further in buying up more units.

Another mistake we see during downturns is people wanting to sell their investments, with the intention of buying them back later after the downturn has ended. This involves timing the market twice – firstly trying to sell at the peak, then subsequently buying back at the bottom.

We might get our market timing right once or twice, but that could be giving us a false sense of confidence – Timing the market perfectly over the long-term is near impossible. There’s no indicator to tell us when the market has peaked, nor is the perfect time to buy back in announced in advance. So the best strategy is to just keep contributing and remembering to let time do the work.

Do other stuff

Getting our investment journey underway can be exciting and it can be tempting to check our portfolio every day to see how it’s going. But this isn’t the best investing habit. Seeing our portfolio constantly jump up and down can lead to knee-jerk reactions, and making impulsive tweaks which can derail our investing journey.

Checking our investments often won’t make us a better investor, and it won’t make our portfolio perform better. And given we’re investing long-term for 10, 20, or 30 years, why does it matter what our investments are worth today? Leaving our investments alone will make a massive difference as we’re less likely to see the volatility in our portfolio, and therefore less likely to have those knee-jerk reactions like panic selling. So perhaps it’s not a bad thing that InvestNow has an ugly UI, and that Kernel doesn’t have a flashy mobile app, making it harder to log in to them.

Another bad habit is getting sucked into the news. There’s always bad stuff happening in politics or the economy that could be damaging to the sharemarket. Plus there’s so many doomsdayers out there who’re adamant that the economy is going to melt down, and that the sharemarket is going to crash. Bad news gets more clicks, but it’s hardly encouraging for investors. So the best strategy is to just ignore all the headlines and predictions, and stop worrying about things we can’t control. Go and do other stuff like cooking a meal, hiking up a mountain, or playing with cats – anything other than immersing ourselves too deeply into the investment world.

Avoid what’s hot

Unfortunately our incredibly simple portfolio won’t make us rich overnight, and in fact we might not see any results for several months or years – investing in shares is not like a bank account where you earn a constant amount of interest month after month. Although this is normal, there’ll be times where we feel our portfolio is incredibly boring. We might get FOMO on occasion as more interesting investment opportunities pass by. For example, in recent years you might have seen a lot of hype around GameStop or AMC shares, or meme cryptocurrencies like Dogecoin and Shiba Inu, and it’s tempting to jump in and get a piece of the action.

But chasing what’s trendy, and constantly tweaking your investment strategy is often a recipe for bad results. We might get lucky and make some quick gains, but trends won’t last forever and trying to build meaningful wealth off them long-term isn’t sustainable. Sure we might eke out an extra 1-2% in performance, but it’s highly unlikely we’ll maintain that outperformance over our entire investing career – even professional fund managers tend to fail in beating the market over the long-term!

Our incredibly simple investment portfolio is a serous wealth building tool, not a casino. It’s ok to branch out to scratch your itch for investing in the latest hot stocks, but we’d be keeping them as satellite investments which we’d only allocate a small amount of money to. And keep in mind these satellites add risk and complexity to our portfolio. Boring is a good thing when it comes to investing.

Trust your fund manager

With our incredibly simple portfolio, we’ve put a lot of our wealth and faith into a single fund, managed by a single fund manager. Is this sustainable over the long-term?

In terms of the safety of the fund manager, both Foundation Series and Kernel offerings are regulated by the Financial Markets Authority, and they both have independent supervisors to ensure each manager is acting for the benefit of their investors. In addition, the funds’ assets get held by an independent custodian, so in the unlikely event they go bust, your money is safe.

In terms of the sustainability of our funds, remember they’re diversified across hundreds of different companies. And both of our funds are regularly rebalanced to provide an up-to-date reflection of the markets. If one company in a fund were to go bust, then a new company would enter the fund to replace it. There’s no need for ongoing research, nor do you have to add extra funds to your portfolio to spread your money around a little bit more.

So we have no problem with the long-term sustainability of our portfolio. All that’s left for us to worry about is the behavioural side of investing which we’ve covered above.

Further Reading:

– What happens to your money if InvestNow or Sharesies go bust?

Conclusion

In this article we’ve covered how we’d create an incredibly simple long-term investment portfolio from scratch, and the reasons for each step. Our portfolio is incredibly simple because:

- We’ve chosen to invest in a single widely diversified index fund (the Foundation Series Growth Fund or Kernel High Growth Fund), saving us from having to pick lots of different funds or individual stocks. Plus our ongoing fees will be low.

- We’re contributing to the fund regularly and consistently, so we don’t have to worry about when’s a good time to invest. Plus auto-invest functionality allows us to set-and-forget our contributions.

- Our portfolio is low maintenance, so requires minimal time, effort, and stress to maintain and deal with tax, plus any distributions are automatically reinvested to compound.

- We have sound investing behaviours in place to stay on course with our investments, and help ensure our portfolio delivers the result we want.

In addition, our incredibly simple portfolio is accessible to anyone. It works exactly the same regardless of whether you have $100, $10,000, or even $100k to invest.

This is how we’d personally do it anyway. Everyone’s financial goals, circumstance, preferences are different, and that might mean having a different approach or using different funds. For example, you may want more customisation and control, or to be more hands on with your investing – and there’s nothing wrong with that. Let us know in the comments if you’d do anything differently, or check out the below article for more ways you might approach building a portfolio.

Further Reading:

– 6 ways to build a long-term investment portfolio in New Zealand

But hopefully this article shows that there’s no need to complicate things when it comes to building wealth over the long-term. Investing can indeed be incredibly simple.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Great article thanks – and good to know that we are on the right track. One question however – we already have funds invested with another provider (in our case Sharesies) but are keen to transfer to one of the options recommended above. By selling the shares to release the funds so we can shift funds, are we potentially realising any losses of the market downturn, or is this mitigated as long as we promptly reinvest in the new fund to minimise the risk of short term fluctuations?

Thanks in advance

Hi Chris, thanks for reading. You technically will realise losses on your current fund, but that’s balanced out by being able to buy into your new fund at a lower price, given it’s similarly affected by the downturn. Also keep in mind brokerage fees/spreads plus time taken to transfer money across platforms, but those should be small factors in the grand scheme of things. So as long as your new fund suits you better than your old one, any time is a good time to switch.

Thanks for the info! I’m curious about the tax setup you mentioned for the Simplicity Growth Fund. I looked at both Kernel High Growth and Simplicity Growth and ended up with Simplicity. As far as I can tell, they both appear to be PIEs? In terms of rate, it seems Simplicity Growth has lower fees for amounts between $25,000–$100,000.

Did I overlook something in the rates or the tax details? I’m new to this so it’s quite likely!

Hi Daniel, you are right in saying that they’re both PIEs and that Simplicity’s headline fees are cheaper than Kernel’s in many instances. The tax issue with Simplicity is that their funds are currently poorly structured, which results in a tax inefficiency estimated to cost investors around 0.15% per year. We wrote about that issue in more detail here: https://moneykingnz.com/investnow-foundation-series-vs-simplicity-funds-tax-leakage-an-issue/#4

However, Simplicity have stated they’re currently looking at patching up that issue, so hopefully the tax situation will improve in a few months’ time.

Very interesting — thanks!

Thank you! So clear for a newbie like me. I am trying to raise my financial IQ but now I have so much information that I don’t know where to start (so I haven’t). I have about 13k from an inheritance (8k of which is offsetting my high mortgage). I’m feeling so financially vulnerable, but am also comfortable with risk. I earn about 65k gross and I need to feather my nest for a bright future (I’m late 40’s). I have just started Kiwisaver but want something extra too. What is the advantage of investing via Investnow Foundation Series Growth Fund (and who picks those companies) versus investing in the same fund through Milford please? Also if I move my KS to Milford as well then why not just have another investment that matches the choices they make for my KS?

Hi there, the main difference between Foundation Series and Milford is that Foundation Series is mostly passively managed, while Milford’s funds are actively managed. You can read about the differences here: https://moneykingnz.com/ask-money-king-nz-spring-2022/#3

So the main advantage of Foundation Series being mostly passively managed is their fees which are significantly lower than Milford’s. The fund will also deliver a similar return as the market, whereas actively managed funds tend to underperform the market over the long-term (though Milford has been one of the better performers).

As for whether your non-KiwiSaver investments should match your KiwiSaver investments, there’s really no right or wrong answer here. Some are happy sticking everything with the same provider, other prefer to spread things around. Nothing wrong with either approach!

Hi,

The hyperlink under the InvestNow section goes to an Admin post link and not the correct one;

Further Reading:

– InvestNow review – The most efficient way to invest?

Should go to

https://moneykingnz.com/investnow-review-the-most-efficient-way-to-invest/

That’s been fixed now, thanks!

Hey how different would the advice be around Simplicity etc now after their changes?

Much better products now, having fixed the tax efficiency issue. The main potential problem with their funds is their exposure to build-to-rent housing and mortgage lending which are quite divisive investments and arguably goes our principle of keeping it incredibly simple.

Great Article. thanks so much.

I am planning to get into passive managed funds with combination of lump-sum ($100k) & regular investment about $2000 each month.

Happy with dollar cost average approach when it comes to regular contribution but in terms of $100k initial investment, would it be better to wait till NZD strengthens a little bit as it’s pretty weak at this stage.

your help is much appreciated

We’re not fans of trying to time the market. It involves too much emotion and guesswork, to try and work out when to invest that $100k. For example, what if the NZD strengthens – how do you know if it’s the right time to invest and that the NZD won’t get even stronger? What if the NZD gets weaker?

So if you are really worried about currency, it may be better to dollar cost average that $100k into the market. Say by investing $10,000 per week over 10 weeks, or $5,000 per week over 20 weeks. Then you don’t have to worry so much about whether you’ve entered the market at a bad time.

Another thing to be aware of is that many funds will be at least partially currency hedged. So the strength of the NZD may not make as much of a difference to your fund as you think.

Great article, thank you. Given it’s a couple of years old now, would these 2 funds still be your top choices??