What I’ve been investing in is a monthly series covering what investments I’ve made during the month, and any investing related news that I’ve found interesting. In February 2020, global markets have been very turbulent as the Coronavirus disrupts economies around the world. There is definitely a lot happening in investing right now!

The below is not financial advice, nor a recommendation to invest in the following. Please do your own research before making any investment decisions.

What I’ve been investing in

Oceania Healthcare

Oceania Healthcare is an aged care operator who are a bit smaller than the likes of Summerset and Ryman. I first invested in the company in late 2018 at $1.08 per share.

Their latest financial results were reasonable, and I felt their share price had been lagging in relation to its peers like Arvida and Summerset. Therefore I added more Oceania shares to my portfolio at a price of $1.19 per share. Unfortunately the price has dropped even further since my purchase.

Retirement Income Group

Retirement Income Group (RIG) is New Zealand’s only annuity provider. Annuities aren’t a popular financial product in New Zealand – but they essentially combine an investment fund with insurance:

- Investment returns from the fund (and capital if necessary) are drawn down to pay out a retiree a regular fortnightly income.

- If the investment fund is depleted, the insurance kicks in and continues to pay out a regular income to the retiree for the remainder of their life.

I think there is potential for the annuity market to grow, as a growing number of people seek certainty in having enough income for the rest of their retirement. It certainly fits in well with the ageing population theme I have going in my investment portfolio!

RIG has seen pleasing growth over the last few years and are associated with the likes of Simplicity, insuring their Guaranteed Income KiwiSaver fund. They’re also looking at listing on the NZX in the next couple of years.

This month they raised capital in a new Equity Crowdfunding campaign so I decided to invest in the minimum amount of shares on offer which was 1,064 shares at $2.35 a share.

Zeffer Cider

Zeffer Cider is a Hawkes Bay based company who manufactures cider. I first invested in them through an Equity Crowdfunding campaign on Snowball Effect at $1.40. This month Zeffer issued new shares (also at $1.40 per share), raising more capital to give them more capacity to work with their new distributor, Lion.

It is a little disappointing that the value of their shares hasn’t appreciated in the last couple of years. But I was happy to invest a few hundred dollars, as I’m a fan of their product, and trust that their new partnership will be positive for the business.

Transurban

Transurban is an Australian listed company, managing toll roads in Melbourne, Sydney, Brisbane, and North America. I’ve had an eye on this company for a while, and took advantage of the market downturn to buy shares in Transurban late on Friday afternoon.

Market volatility

Global sharemarkets have taken a big dive recently as investors begin to digest news about the impact and spread of COVID-19. I have not sold any investments, nor have I changed my investment strategy as a result of this. I invest in shares and index funds with the intention of holding them for life. This event is just temporary and will pass, and assuming I have bought good quality assets, their prices should recover over time.

Perhaps more concerning is what’s happening locally. People are rushing to the supermarkets to hoard supplies, resulting in long queues and depleted stock. I don’t think this reactionary behaviour is particularly productive. We should already have a few days worth of food and water on hand to be prepared for a natural disaster, and all this hoarding just creates fear and disruption for ordinary shoppers trying to feed themselves and their families. I will be living my life normally until advised otherwise by the authorities.

Investing news

Harmoney winds down its P2P Lending platform

From 1 April, retail investors (everyday people like myself) won’t be able to lend money through Harmoney anymore. Harmoney will cease to become a P2P Lending Platform, and instead entirely fund their loans through institutional investors (like banks).

Harmoney’s decision is not surprising. They make less fee income from retail investors, yet it probably costs a lot more to have them onboard in terms of support, IT platform maintenance, admin, and regulatory requirements. Given retail investors only fund ~20% of loans, it is not surprising that Harmoney wants to consolidate their sources of lending.

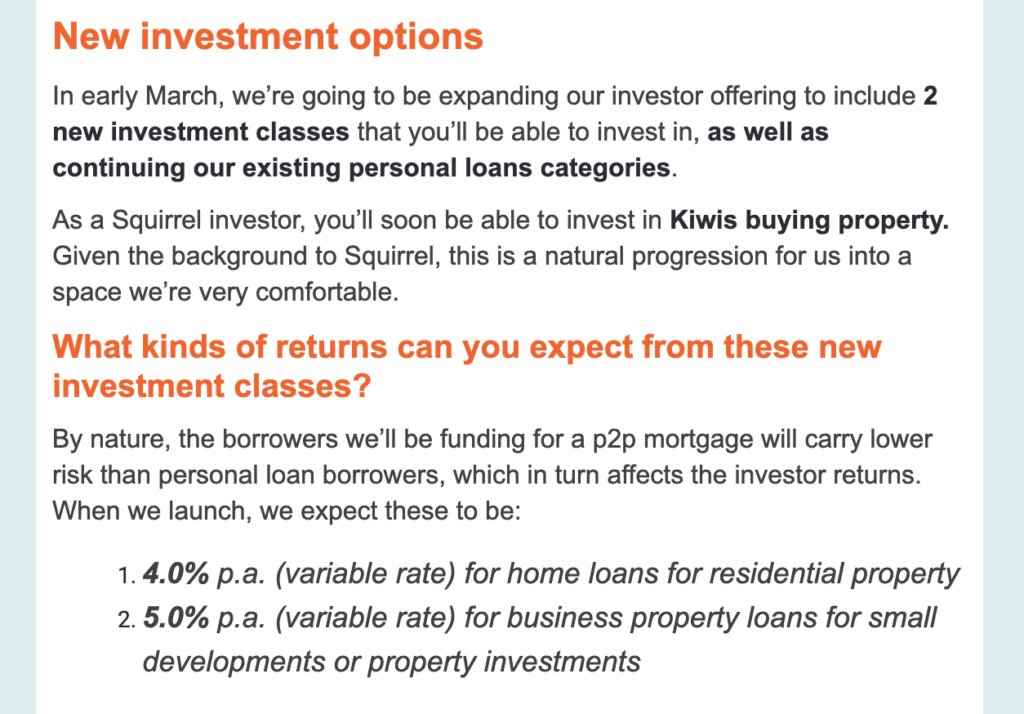

Squirrel expands its P2P Lending platform

Following Harmoney’s exit, Squirrel has announced the expansion of their P2P Lending platform. The big news is that they will now allow retail investors to lend their money to two new investment classes:

- Residential home loans – at a rate of around 4%

- Business property loans – at a rate of around 5%

Squirrel will also remove the bidding system they currently use to allocate investors to loans, and replace this with a first in, first served method, where investors will be matched to loans with interest rates between 6-7.5%. See this video for more details on the new offering.

New Smartshares ETFs coming

In an Investment News NZ article, Smartshares revealed that they will introduce some new low fee ETFs in April. From the article it looks like we’ll be getting:

- New Zealand – A fund covering the NZX 50, without the 5% cap on the weight of each company.

- Australia – A fund covering the ASX 200 index.

- Global – A currency hedged version of one of Smartshares’ global share funds. Currently none of their international share funds are hedged.

Smartshares are also hoping to lower their fund management fees across their whole range. I’m looking forward to having the new funds and fees officially announced.

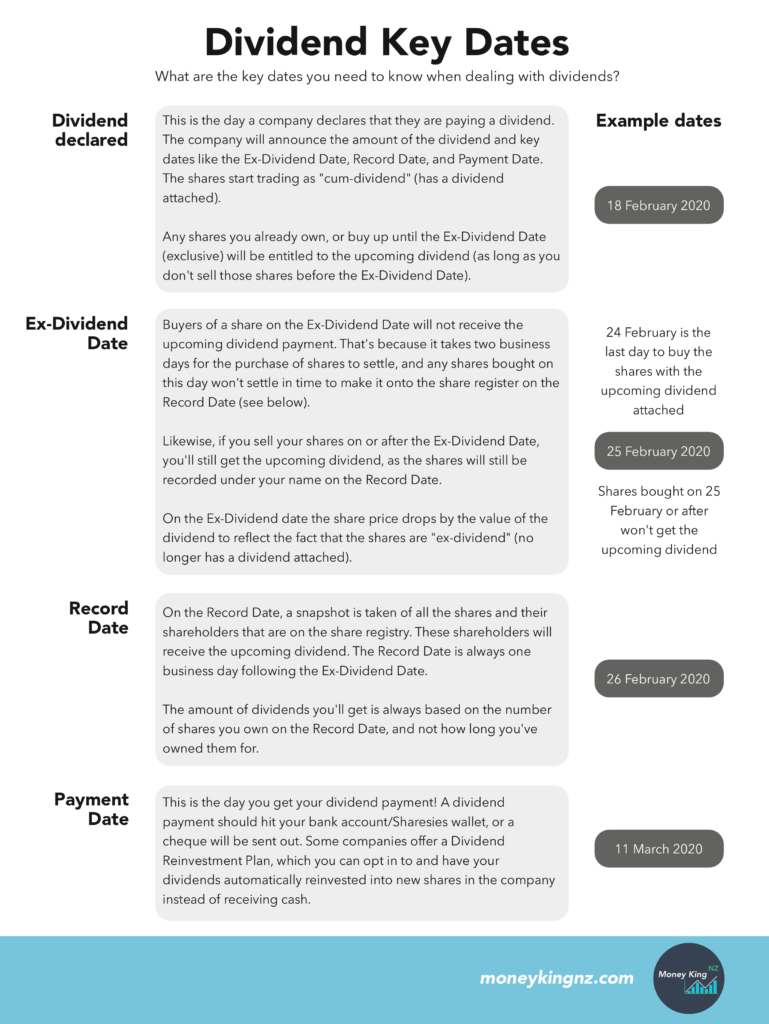

Dividend key dates

We’re in peak dividend season, so as a friendly reminder, here’s the key dividend dates you need to know about:

Money King NZ news

Another month packed full of articles on Money King NZ!

February 2020’s articles:

– How to invest in Australian shares from New Zealand

– Due diligence on shares – How I evaluate companies before investing

– Property vs Shares – The pros and cons of buying residential property

– Rights issues, share buybacks, and acquisitions – 5 things to know about corporate actions

This month Money King NZ was also featured in:

Passive Income NZ – Contributor to a great discussion on whether investing in rental properties were a sure thing, and how they compared to investing in index funds. Read the article on Passive Income NZ.

Finder – Named as a “Personal finance expert you need to know about” in their article 12 personal finance experts you need to know about in New Zealand. The only anonymous expert haha.

Last month’s What I’ve been investing in article:

– What I’ve been investing in – January 2020

Thanks for all your support!

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.