Back when I first started investing, buying shares in US listed companies was awfully expensive. You had to invest at least tens of thousands to make the fees (which were probably upwards of $100) worthwhile. More recently services like Hatch, Stake, and Sharesies have opened a whole new world to Kiwi investors offering US shares with much more reasonable fees. And soon we’ll also get easy access to ASX listed shares though Sharesies.

I jumped onboard almost immediately, excitedly investing in US companies like Facebook and Apple. I had also started a small portfolio of ASX companies through Australian broker NABTrade. But after less than a year I had decided to sell off all my international shares. In this article, I’ll cover the reasons why I made the decision to do so, sticking to New Zealand domiciled investments.

Reasons why I don’t invest in overseas shares

1. Foreign Currency

Before buying shares in US or Australian markets you first need to exchange your New Zealand Dollars to US or Australian Dollars. The foreign exchange (FX) fee for this is reasonable, starting at 0.4% (on Sharesies). But add that amount to your brokerage and the fees start stack up. The fees stack up even further when you want to sell your US or Australian shares and change your foreign currency back to NZD, incurring another set of FX fees.

In addition, currency fluctuations can add another layer of risk to your investments. A rising NZD reduces the value of your overseas shares. This might not be an issue for long term investors like myself, but it’s definitely a factor shorter term traders should keep an eye on.

2. Tax

In my opinion, the handling of tax on international investments is much more inconvenient compared to NZ domiciled investments. In my case (this could differ from person to person), whenever I received a dividend I had to:

- Calculate the New Zealand Dollar equivalent of the dividend amount. Then multiply that amount by my tax rate.

- Subtract the amount of foreign withholding tax I’ve already paid to work out how much tax I still owe to the IRD.

- Record this amount and keep money aside for inclusion in my tax return at the end of the year.

Compare this to NZ domiciled investments which calculate and pay tax on your behalf automatically. On top of that international shares do not carry the benefit of imputation credits (Aussie Franking credits can’t be claimed by Kiwi investors), nor are they available in a PIE structure.

Some platforms help you with the tax on international shares, but this feature isn’t universal across all services. And there is software available to automate your tax such as Sharesight, but it’s a bit expensive relative to my modest sized portfolio. Overall buying international shares feels like so much more hassle, only to be treated unfavourably in terms of tax.

Further reading:

– Tax on foreign investments – How do FIF and Estate Taxes work?

3. Unfamiliar markets

While investing in international markets presents greater opportunity, I also think it comes with greater risk. Not all opportunities are good ones – when you have to select from a pool of investments many times larger than the NZ market, it’s hard to know where to start beyond the well-known companies or whatever the current meme stocks are.

In addition, I lack sufficient knowledge of overseas markets and economies to conduct adequate due diligence on potential investment opportunities. When you buy shares, you are buying a business – and I wouldn’t buy a business without having a solid understanding of it and the environment it operates in.

I am more comfortable investing in local companies, where my stronger knowledge of the local economy, geography, demographics, and so on enable me to make a better assessment of a company’s merits.

4. Time zone difference

Given the time zone difference, US markets are open when most New Zealanders are sleeping. With other commitments such as work in the morning, and unwillingness to wake up in the middle of the night to make trades, there is only a very small window for me to buy and sell shares on the US markets.

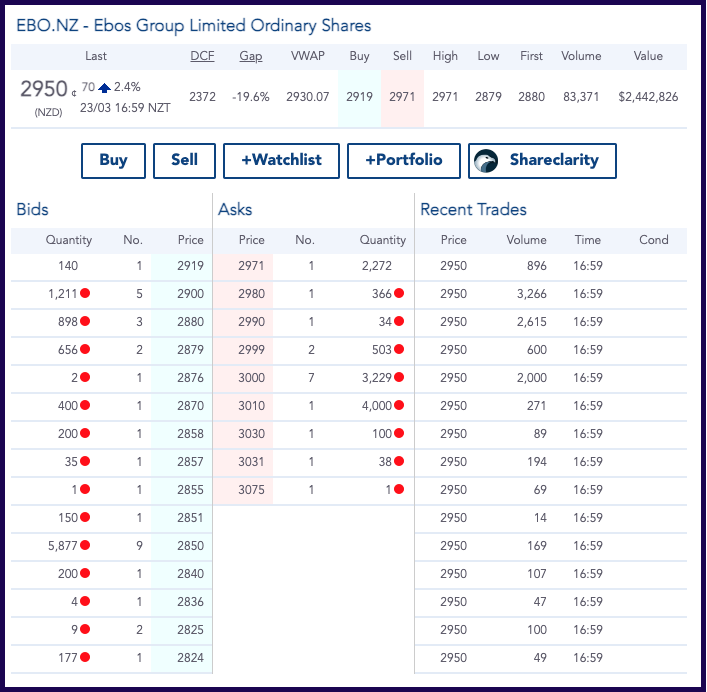

This one is a minor reason – Like many other people I could simply place an order before I go to bed and wake up to see the outcome. But being used to seeing live market prices and market depth with my NZX shares, it’s hard to give up that level of visibility of the market, and knowing exactly what price I’m buying my shares at.

5. Returns

One motivator for investing in overseas markets is to access a wider pool of companies that could outperform the market and increase your portfolio’s returns. Individual companies like Tesla have performed spectacularly over recent years, while certain meme stocks have presented opportunity for massive short term gains. However, there are a few issues with this approach:

- First you have to pick companies which will perform well in the future. This is hard, but not impossible. Researching potential investments well will certainly help.

- If you do manage to pick companies that outperform the market, well done. But chances are these companies won’t boost your portfolio’s returns by much. You’ve probably diversified your portfolio into multiple companies, so an outperforming company’s returns will get diluted by the other companies in your portfolio – some of which may have underperformed the market.

- If your entire portfolio still outperforms the market, chances are it won’t outperform the market consistently into the future. Past performance is not a guarantee of future performance. A portfolio that’s incredibly successful over one year will not necessarily perform as well year after year into the future.

There is nothing wrong with picking individual companies from the US or Australia with the aim of doing better than the market. But I recognise that the chances of me being successful with this approach over the long term are slim. So I prefer not to go through the inconveniences of buying and holding international shares, just for the slight chance of outperforming the market.

The alternative

Instead of buying US and ASX shares, I get exposure to foreign markets by investing in NZ domiciled index funds which contain international shares. My personal choice is to invest in Smartshares‘ range of ETFs. Smartshares offers over 20 index funds that invest in overseas shares and bonds.

My favourite is TWF – the Smartshares Total World ETF which has a reasonable management fee of 0.4%. TWF invests in over 8,000 companies from around 40 countries across both developed and emerging markets. About half of the fund is invested in the US (being the world’s largest market), with smaller weightings towards the UK, Japan, China, and so on.

Currency risk can be mitigated with TWH – an identical fund to TWF, except hedged to the New Zealand Dollar. This means FX movements don’t really affect the value of this fund, although the fees are a little bit higher at 0.46%. I personally stick to TWF, with the view that currency fluctuations will be negligible once you average them out over the long term.

I also like Kernel, now that they’ve introduced a few international funds. Their Global 100 fund is a solid option to get overseas exposure, and they also have a couple of unique thematic funds such as an electric vehicle fund.

All of the above options should give your portfolio more than enough diversification into international shares. The fees are expensive compared to overseas index funds, but given they are NZ domiciled investments, they save you from having to exchange currency, or navigate the complex tax rules. I don’t have the ability to choose individual companies through these funds, but I prefer not to given my unfamiliarity with overseas markets.

Conclusion

Hatch, Stake, and Sharesies’ US shares offering is excellent for many investors. They have greatly reduced the fees and investment amount needed to invest in the US (and soon the ASX), and most importantly, they’ve given kiwi investors more choice. There are so many more great companies out there when compared to our domestic market.

I don’t view these platforms negatively, however this amount of choice isn’t suitable for me or my style of investing. US and ASX shares have only ended up increasing the complexity of my portfolio, resulting in higher fees, more tax, and higher risk. Is it worth having this extra complexity just for the chance to get a few percent more in returns per year? Maybe you’ll do well and outperform the market enough to make it worthwhile, but are you able to do that consistently over the long term?

My foray into international shares resulted in so much more effort for inferior returns compared to what I could have got by sticking to local investments. Keeping my portfolio simple means less time spent managing my investments and more time to do other things. And thanks to index funds like the Smartshares Total World ETF, I can still diversify my portfolio globally with little effort.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.