Bonds are a major asset class but are often overshadowed by shares, despite the global bond market being just as big (if not bigger) in size. Most investment platforms focus on shares rather than bonds (we have Sharesies but not Bondsies!), and there is not much discussion on fixed interest investments in online investment communities.

Thankfully there are a few low cost index funds options that give investors a convenient way to add bonds to their portfolio. This article will take a look at the bond index fund options in New Zealand, the different channels you can buy these funds through, and their fees. How might these funds fit into your portfolio?

Index Fund shootout articles:

– Smartshares vs Macquarie vs Kernel vs Harbour – NZ Share Index Fund shootout

– Smartshares vs Vanguard vs Macquarie vs Kernel – International Share Index Fund shootout

– Smartshares & Kernel – Thematic Index Fund shootout

– Smartshares, SuperLife, Macquarie & Simplicity – Bond index fund shootout (this article)

– Smartshares vs Macquarie vs Milford vs Nikko AM – Cash fund shootout

This article covers:

1. What’s on offer?

2. How can you invest in these funds, and what are the fees?

3. The role of bond funds in your portfolio

4. International Bond Funds

Update (1 Dec 2021) – Simplicity no longer charges a $20 annual membership fee.

Update (4 Apr 2022) – AMP’s funds have been renamed to Macquarie

1. What’s on offer?

What are bond funds?

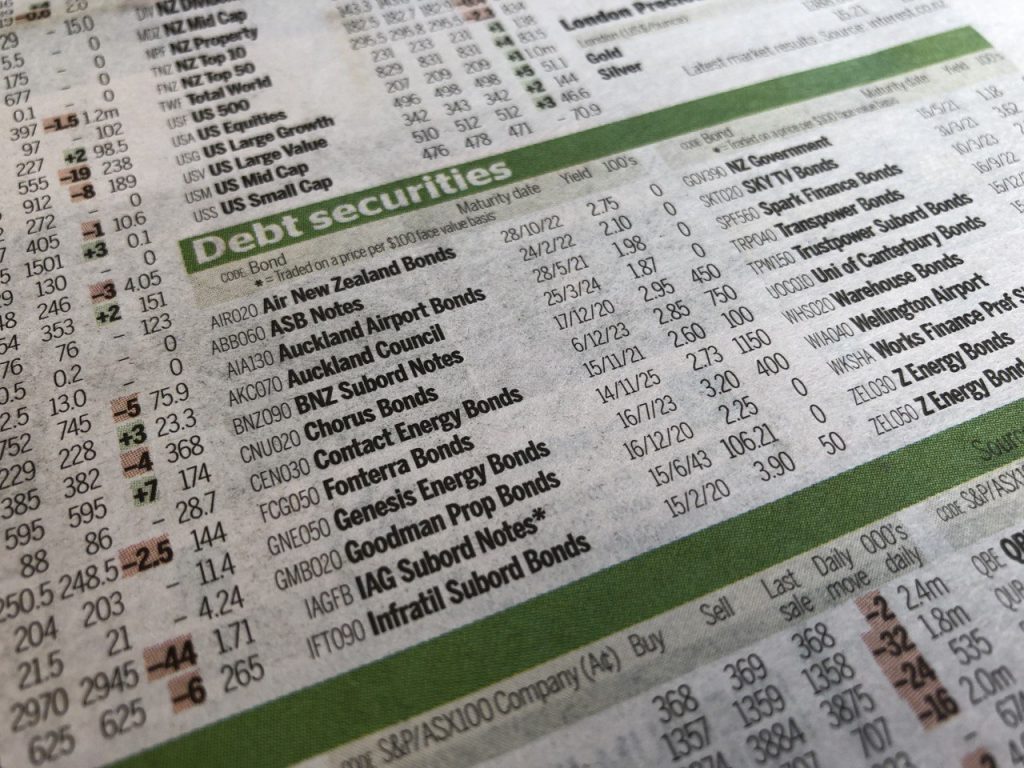

Bonds (also known as fixed interest) are essentially an “IOU” to a government or corporation. These organisations issue bonds to borrow money from investors, and in return they pay a set amount of interest to investors for the duration of the bond.

Further Reading:

– Bond Basics – 5 things to know about investing in bonds

Bond funds package up multiple bond issues into one fund, similar to the way share funds package up the shares of multiple companies into a single fund. With these funds you can get exposure to a diversified range of bond issues without having to spend tens of thousand of dollars in building your own bond portfolio.

There are a small number of bond index funds in New Zealand, so let’s take a look at the options as well as some competitive non-index fund options:

A. Smartshares

Smartshares, an ETF Issuer owned by NZX, offers two bond index funds:

- S&P/NZX NZ Government Bond ETF (NGB) – Tracks the S&P/NZX NZ Government Bond Index, investing in NZ Government issued bonds.

- Global Aggregate Bond ETF (AGG) – Tracks the Bloomberg Barclays Global Aggregate Index, investing in government and corporate bonds from around the world in both developed and emerging markets.

Smartshares also issues the actively managed (non-index) bond funds. These funds aim to outperform the above passively managed funds:

- NZ Bond ETF (NZB) – Invests in New Zealand government and corporate bonds.

- Global Bond ETF (GBF) – Invests in government and corporate bonds from around the world in both developed and emerging markets.

B. SuperLife

SuperLife offers a few bond funds, most of them quite similar to Smartshares’ offering (given they are sibling companies):

- S&P/NZX NZ Government Bond Fund – Invests entirely into the Smartshares S&P/NZX NZ Government Bond ETF.

- Overseas Non-government Bonds Fund – Invests entirely into the Vanguard International Credit Securities Index Fund, investing in government and corporate bonds from around the world in both developed and emerging markets.

- Global Aggregate Bond Fund – Invests entirely into the Smartshares Global Aggregate Bond ETF.

SuperLife also offers the following non-index bond funds, given their investment into actively managed assets:

- NZ Bonds Fund – Invests mostly into the Smartshares NZ Bond ETF with a small allocation towards the Smartshares S&P/NZX NZ Government Bond ETF.

- Overseas Bonds Fund – Invests entirely into the Smartshares Global Bond ETF.

C. Macquarie

Macquarie offers just one bond index fund:

- Ethical Leaders Hedged Global Fixed Interest Index Fund – Tracks the Bloomberg Barclays MSCI Global Aggregate SRI Select ex Fossil Fuels Index.

D. Simplicity

Simplicity’s sole bond fund is not an index fund (it does not track an index), but is worthy of inclusion here given the few choices we have for bond index funds:

- NZ Bond Fund – Invests primarily in NZ government bonds, with a small allocation towards NZ corporate bonds.

2. How can you invest in these funds, and what are the fees?

There are two main types of fees you’ll pay when investing in these bond funds:

- Fund Management Fee – A fee charged as a percentage of the amount you have invested in the fund. Low management fees are more important for bond funds, given their lower return compared to shares.

- Channel Fee – There are multiple ways you can invest in these bond index funds. Most charge a fee such as an account fee, or brokerage fee.

A. Smartshares

Fund Management Fees

The management fees for Smartshares’ bond index funds are relatively low given they are passively managed:

| Fund | Management Fee |

| S&P/NZX NZ Government Bond ETF | 0.20% |

| Global Aggregate Bond ETF | 0.30% |

The management fees for Smartshares’ non-index bond funds are higher, given their active management strategy:

| Fund | Management Fee |

| NZ Bond ETF | 0.54% |

| Global Bond ETF | 0.54% |

Through which channels can you invest in these funds, and what are their fees?

- Direct through Smartshares – You can buy Smartshares’ funds directly from Smartshares. They require a minimum initial investment of $500, and subsequent investments require $250 for one-off investments, or $50 for regular monthly investments. You cannot sell any investments through Smartshares – instead any sell transactions must be done through a broker.

- InvestNow – The InvestNow platform gives investors access to all Smartshares’ bond funds except for the S&P/NZX NZ Government Bond ETF. The minimum investment is $50 if you invest through a Regular Investment Plan, or $250 for one-off investments. Unlike investing directly through Smartshares, InvestNow allows you to sell your investment through their platform.

- Sharesies – Sharesies offers buying and selling of all Smartshares’ bond funds with a low minimum investment of just 1 cent.

- Brokers – Smartshares’ funds are Exchange Traded Funds (ETFs). This means the funds are listed and traded on the sharemarket, just like the shares of an ordinary company. You can use a broker like ASB Securities or Jarden Direct to buy and sell these ETFs through the NZ sharemarket. This requires you to buy a minimum of 100 units for an initial investment into a fund – currently about $130 for the Global Aggregate Bond ETF, or $240 for the S&P/NZX NZ Government Bond ETF.

The fees for each channel are:

| Channel | Fee |

| Smartshares (direct) | A $30 Establishment fee applies if you’re investing directly through Smartshares for the first time. |

| InvestNow | No other fees apply, apart from the above Fund Management Fees. |

| Sharesies | A brokerage fee of 0.5% on orders up to $3,000, then 0.1% on any amounts above $3,000, applies to buying or selling any Smartshares ETFs. |

| Brokers | Brokers charge brokerage fees every time you buy and sell shares. This fee can be quite expensive, starting at $15, so investing in Smartshares ETFs through brokers is probably not an ideal strategy for investing at a small scale. |

Other fees

Spreads are charged whenever you buy or sell units in Smartshares’ funds. When buying units you pay a small premium over the unit price, and when selling the units you sell them at a slight discount to the unit price.

Smartshares’ funds are Listed-PIEs, which means they are taxed at a flat 28% tax rate. This may not desirable for those on lower tax rates. All other funds in this article are Multi-Rate PIEs which allows investors at lower tax rates to be taxed at their appropriate rate (e.g. 10.5% or 17.5%).

B. SuperLife

Fund Management Fees

The management fees for SuperLife’s passively managed bond funds are more expensive than their Smartshares equivalents:

| Fund | Management Fee |

| S&P/NZX NZ Government Bond Fund | 0.44% |

| Overseas Non-government Bonds Fund | 0.44% |

| Global Aggregate Bond Fund | 0.49% |

The management fees for SuperLife’s actively managed bond funds are cheaper than their Smartshares equivalents:

| Fund | Management Fee |

| NZ Bonds Fund | 0.44% |

| Overseas Bonds Fund | 0.49% |

Through which channels can you invest in these funds, and what are their fees?

These funds are only available direct through SuperLife. They charge a $12 per year account fee. There is no minimum investment required.

C. Macquarie

Fund Management Fees

| Fund | Management Fee |

| Ethical Leaders Hedged Global Fixed Interest Index Fund | 0.43% |

Through which channels can you invest in these funds, and what are their fees?

Macquarie’s fund is available through InvestNow. No other fees apply, apart from the above fund management fee. The minimum investment is $50 if you invest through a Regular Investment Plan, or $250 for one-off investments.

D. Simplicity

Fund Management Fees

Despite Simplicity’s bond fund not being an index fund, their management fee is a low 0.10%:

| Fund | Management Fee |

| NZ Bond Fund | 0.10% |

Through which channels can you invest in these funds, and what are their fees?

The NZ Bond Fund is only available direct through Simplicity. They require a minimum investment of $1,000.

3. The role of bond funds in your portfolio

Bonds are an important asset class falling somewhere between shares and cash. They typically give you a higher return than cash, but can still fluctuate in value. They give lower return than shares but are much less volatile in terms of value and the income they provide – with shares dividends can be reduced or cancelled, while bond interest payments are guaranteed as long as the bond issuer stays in good financial shape.

Let’s see how bonds can act as a “shock absorber” for your investment portfolio when the markets are volatile. Here’s a performance comparison between some bond and share ETFs between 24 February 2020 to 23 March 2020 to show how each behaved during a major market crash (unfortunately most NZ domiciled bond index funds are quite new so there is limited performance data available):

| Bonds Global Aggregate Bond | Bonds NZ Bond | Shares Total World | Shares NZ Top 50 |

| -3.36% | -2.15% | -24.71% | -35.86% |

So who needs the stability of bonds? Here’s some examples of how they might fit in to a portfolio:

- Longer-term investors – While shares might make up the bulk of a long-term portfolio, bonds can complement the portfolio to dampen the volatility of shares. You’ll have at least one asset in your portfolio that’s not plummeting down in a market crash.

- Medium-term investors – Bonds could make up a moderate part of a medium-term portfolio to greatly reduce the portfolio’s volatility.

- Shorter-term investors – Bonds could make up a large part of a short-term portfolio to provide a relatively stable portfolio, while potentially giving a higher return than cash (although cash is still best for the very short-term).

Some recent arguments against having bonds in your portfolio at all have been:

- Interest rates are incredibly low – This means the interest income you get from bonds are also low, making it questionable as to whether bonds are even worth it. The argument against this is that other asset classes (like term deposits and shares) are currently also expensive and low yielding – bonds still pay a decent income relative to these other asset classes.

- Inflation is coming – Inflation causes interest rates to rise, leading to the value of existing bonds to fall (because with higher interest rates, new bond issues are more attractive as they pay higher interest). The argument against this is that over time existing bond issues in your bond fund will mature, and the money will be gradually reinvested into new bonds with higher interest rates.

So despite these arguments, bonds are still an important asset class. However, there are a couple of key reasons where a bond fund is not required in your portfolio:

- You want an aggressive portfolio – You want to forgo investing in bonds in order to have your portfolio fully invested in shares. This will increase the volatility of your portfolio, but potentially increase your returns over the long-term.

- You are invested in a “Diversified” fund – Like Simplicity’s Growth fund, in which case a sufficient amount of bonds is already included as part of these funds.

- You already have investments in individual bond issues – In which case you may already have a sufficient amount of bonds in your portfolio.

4. International Bond Funds

Those of you using the likes of Sharesies, Hatch, or Stake might be tempted by the large selection of international bond funds listed on US or Australian exchanges. However, investing in these might not be a good idea.

The problem with international domiciled bond funds is that they aren’t currency hedged to the New Zealand Dollar. This means the value of your fund will go up and down along with the exchange rate fluctuations between the NZ and AU/US Dollars (even if the underlying bond investments stayed the same in value).

These exchange rate fluctuations are problematic because bonds are defensive investments, and any exchange rate volatility could easily cancel out the stability you’re wanting to achieve with your bond investment. Therefore, it’s probably better to invest in the NZ domiciled bond funds covered in this article, given they’re hedged to the NZ Dollar.

Unhedged share funds

These are ok given shares are long-term growth investments, where investors are usually prepared to put up with volatility related to exchange rate movements.

Conclusion

Bonds can play a key part of your investments, providing stability to a portfolio, particularly for short to medium term investors where investing mostly in shares would be too volatile. While the bond options for NZ investors are relatively new and limited (particularly for low cost index fund options), there are a few solid offerings.

Smartshares is always a strong contender in the index fund space, providing low cost and easily accessible options. SuperLife and Macquarie also provide good choices but can be relatively expensive, and their funds are quite similar to Smartshares’ offering.

Simplicity’s NZ Bond Fund is somewhat pointless – for most people it’s not worth signing up to them just for their bond fund because of the $20 annual membership fee (you’d have to invest at least $20,000 into this fund for it to be cheaper than investing in the Smartshares NZ Government Bond ETF). And if you’re already invested in Simplicity’s Conservative/Balanced/Growth funds, the bond components in these funds make it unnecessary to invest in the standalone bond fund.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Hi MK,

I understand the theory of why I should have bonds in my portfolio. However when I look at the 1,3 and 5 year returns it becomes very unattractive especially when compared to some share index funds over the same periods and their dividends. How can this be when bonds are supposed to help protect the portfolio or are we in a transitional period where they need to catch up to interest rates? Also, are the quoted returns a combination of market value and distributions combined?

Thanks,

Craig

Hi Craig, returns are just one side of the story when it comes to bonds. You’d need to consider their volatility which are lower compared with shares, making bonds good for reducing risk or for shorter-term investing. However, you pay for that lower volatility with lower returns. We’re hoping to dive deeper into the numbers around that in a future article. The quoted returns will usually factor in distributions. Cheers.

Smartshare Global Aggregate Bond ETF (AGG) holds a foreign domicile share for nearly entirety of its portfolio (iShares Core Global Aggregate Bond UCITS ETF) which will trigger FIF tax for the fund.

Superlife, Macquarie and Smartshare Global Bonds Fund appear to hold foreign bonds directly for most of their portfolio. As I understand foreign bonds are not liable for FIF.

It would seem the FIF tax on AGG may not sufficiently offset by its lower (difference of around 0.2%) with other bond funds

Good point Elton. It does seem like a potential tax disadvantage. We haven’t done an article on bonds for a while so we’ll definitely look into it further next year 🙂

Even Macquarie Ethical Leaders Hedged Global Fixed Interested Index Fund and some of the Superlife bond funds contained foreign domiciled ETFs which can cause tax leakage.