Harmoney is New Zealand’s first and largest Peer to Peer (P2P) Lending platform launching back in September 2014. They’ve since facilitated the lending of over $1.2 billion across over 60,000 loans, significantly more than any other P2P Lending platform in NZ. Harmoney was my very first investment (outside of bank deposits), connecting me and over 8,000 other investors directly to people borrowing money, giving us the opportunity to earn “the lion’s share” of interest.

Following on from my article 5 things to know about investing in Peer to Peer Lending, I’ll be reviewing the Harmoney platform. What are their returns, risks, fees, and features like? Is it worth investing on this platform?

Harmoney is no longer open for new investment

This is the first article in my Peer to Peer Lending review series:

Article 1 – Harmoney review (this article)

Article 2 – Lending Crowd review

Article 3 – Squirrel review

Disclosure: I actively invested in Harmoney between February 2015 and June 2016. Since then I’ve only been on the platform to withdraw funds as my loans get repaid and check how things are going. While all factual information I’ve reported should be accurate, my subjective thoughts and experiences on the platform may differ from someone who has more recently been active on the platform.

1. Getting Started

Harmoney allows borrowers to borrow between $3,000 and $70,000. Each loan is split up into $25 lots called “notes”, and then listed on the marketplace for lenders to invest in. As a lender, all you need to get started with Harmoney is to invest in one note, making the minimum investment amount a very accessible $25.

Your money can be invested in either 3 or 5 year loan terms, across 30 different risk grades between A1 and F5 (more on that below). There’s no way to withdraw your money early, apart from the monthly loan repayments you’ll get from borrowers over the term, so make sure the terms suit you before investing.

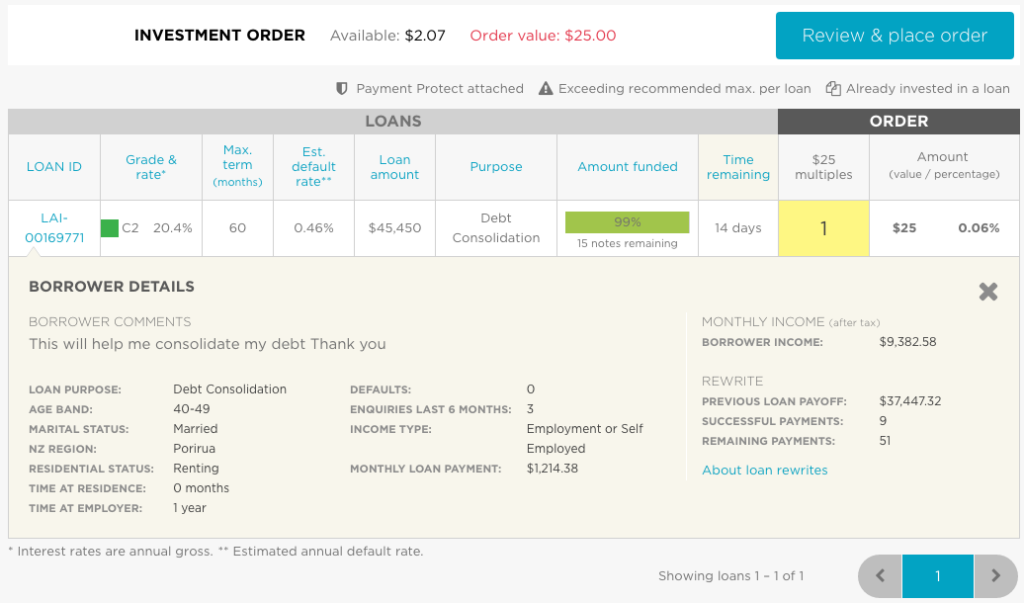

Once you’ve signed up for an account, and deposited money, the process for investing in loans is pretty simple. You start by going into the Marketplace where you’ll be presented with a list of loans available to invest in, along with each loan’s term, interest rate, and risk grade.

If you expand each loan, Harmoney allows you to see basic borrower details like their income, age range, employment, and the infamous borrower comments. I quite liked reading the borrower comments and looking at borrower details, as it allows you to know exactly what you’re investing in, and filter out borrower types that you don’t like.

My experience – What did I invest in?

My strategy was to invest in risk grades between A4 – E5. I thought grades A1-A3 offered an interest rate that was too low, while F grades were too risky. I also stuck exclusively with 3 year loans as I was just trying out P2P Lending and didn’t want my money locked in for the longer 5 year period. Overall I started with an initial $500 investment in the platform, and built that up to just over $4,000.

2. Potential Returns

Interest

Harmoney gives you the potential to earn Interest of between 6.99% and 29.99% on each loan. This compares favourably with other P2P Lending platforms, Lending Crowd (6.89% – 18.96%) and Squirrel (6% – 8.5%). Investors receive interest every month as part of a borrower’s loan repayments (each repayment also consists of principal repayments), which you can then withdraw or reinvest into more loans.

You’re the one lending the money, and taking the risk, so you’re the one who should get the returns

Harmoney

Investing in higher risk grades gives you a higher potential return. Having such as wide spread of risk grades gives investors a lot of control over what returns they want to chase, and the risk they want to be exposed to.

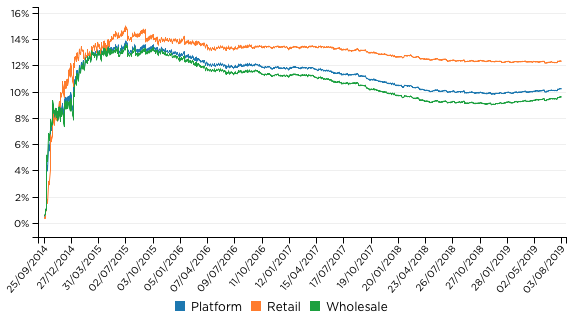

Harmoney uses a statistic called Realised Annual Return (RAR) to measure your returns (before tax). RAR takes interest earned and subtracts fees and any loan defaults. At time of writing, the average RAR on the platform for retail investors is 12.32%, and has reduced slightly over time as Harmoney’s fees have increased, and interest rates charged to investors have dropped (in the past they were up to 40%!).

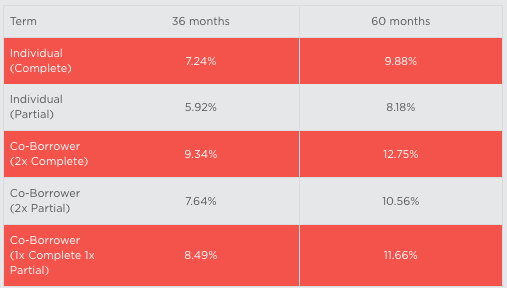

Payment Protect

There is a second source of returns you can make through Harmoney and that is Payment Protect. This is essentially a type of insurance that borrowers pay for, that allows them to skip repayments in the case of death or terminal illness (for “Partial cover”), as well as disability and redundancy (if they take on “Complete cover”). Harmoney says about 30% of loans have Payment Protect attached to them.

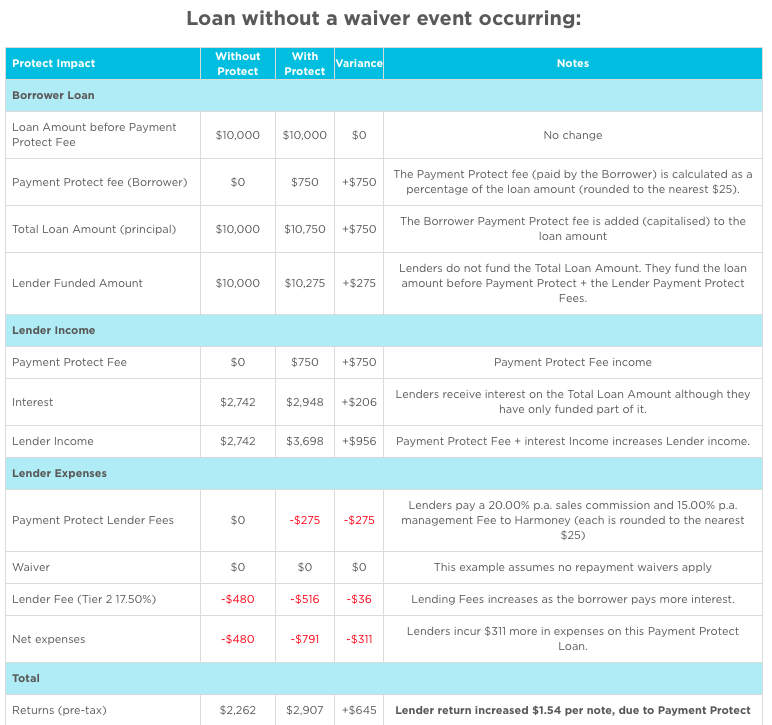

The below table shows how much a borrower has to pay on top of their loan to get Payment Protect. Lenders will only earn part of the Payment Protect income though, thanks to a complicated waiver and fee system (more on that later). However, Harmoney suggests loans with Payment Protect attached can return an additional 1% on average, compared to loans without Payment Protect.

My experience – What returns did I get?

I achieved a RAR of 13.47% – Much better than putting money in the bank, and I enjoyed getting interest payments every month as I could reinvest that into more loans to compound my investment.

I did not invest in loans with Payment Protect as I found it was too complicated for something that would only get you an extra 1% return. As many people say, never invest in something you don’t fully understand.

3. Risk

Charge-offs

The key risk when lending money through Harmoney is that the borrower doesn’t pay you back (“defaulting” on the loan). When this happens, your loan is “charged-off”, and you lose any money invested in that loan which hasn’t already been repaid.

You’re the one lending the money, and taking the risk, so you’re the one who pays when s#!t hits the fan

Money King NZ

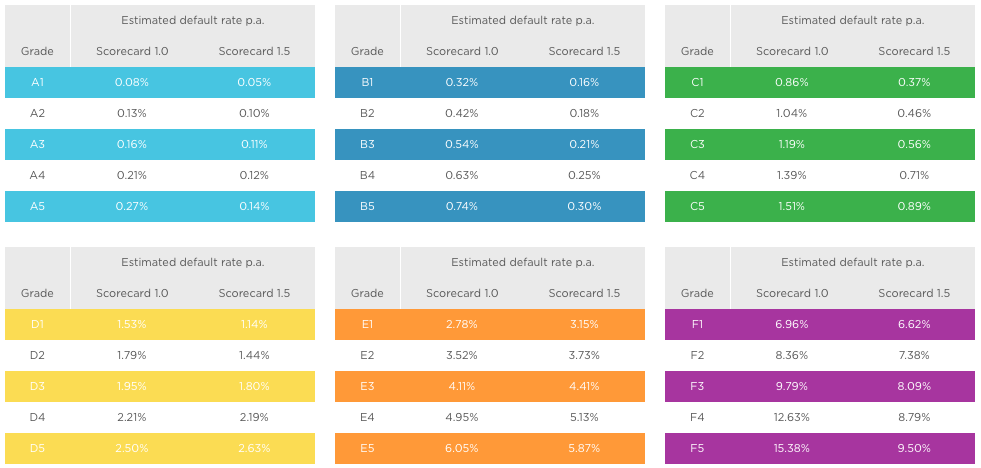

Harmoney estimates their loans will default at a rate starting at 0.05% per annum for A1 grade loans, increasing to 9.50% for the riskiest F5 grade loans. All loans on Harmoney are unsecured. Harmoney is yet to go through an economic recession, so it is not yet known how the platform will perform when times get tough and unemployment increases.

Harmoney uses fractionalisation to mitigate the impact of loan charge-offs, as each loan is split into $25 notes. This means that investors only need to expose $25 of their money to each loan, and can spread their money across a diverse range of loans. If one loan is charged-off, the investor will only lose the notes they’ve invested into that loan, rather than all of their money.

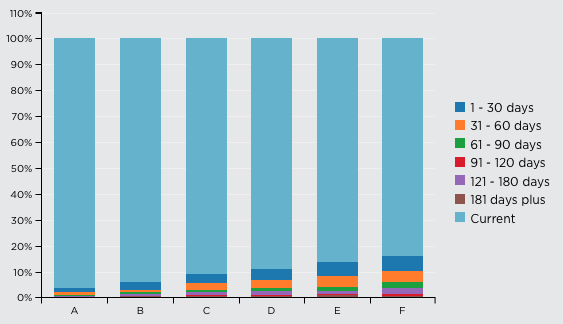

Arrears

Arrears are when a borrower misses or does not make their loan repayments on time, but are have not yet defaulted. The impact on investors is that they receive their money later than expected, and arrears often turn into defaults/charge-offs. Loans in higher risk grades are more likely to be in arrears than lower risk grades (as shown in the graph below). You can read more about Harmoney’s process for handling arrears on this page.

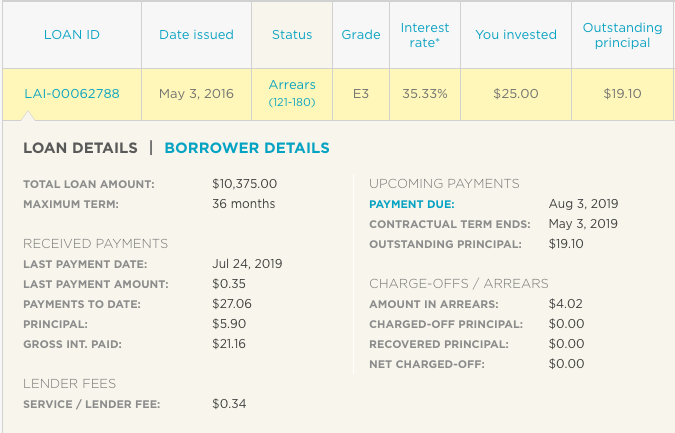

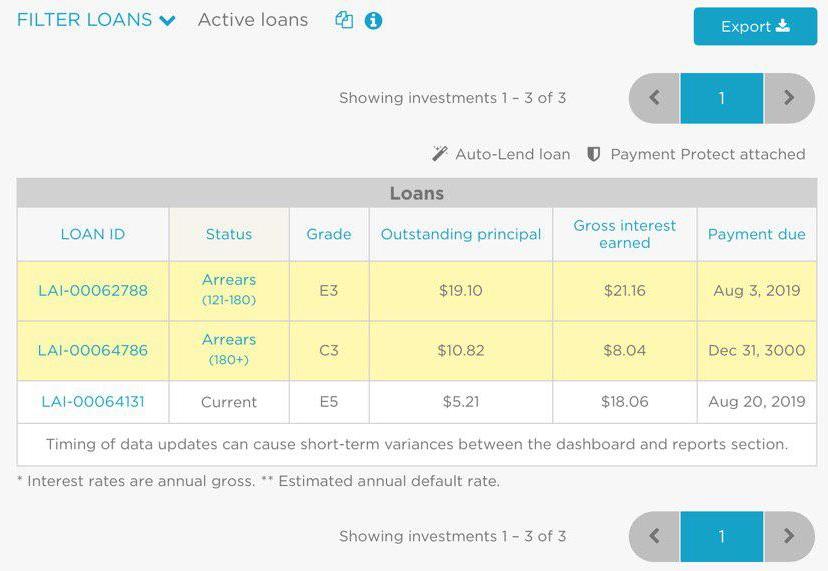

Harmoney sometimes offers borrowers who are in arrears to enter an “Unforeseen Hardship” payment plan, where they can pay off the loan with smaller repayments over a longer period of time. Below you can see one of my loans which was supposed to be repaid on 3 May 2019 – instead it still has $19.10 outstanding, with the borrower making very small repayments (their last repayment was $0.35 on 24 July 2019).

This arrangement is better than having a loan charged-off completely, but it would be better for this to be more transparent to the lender – there is nothing on the UI to state that the borrower is on a payment plan.

Payment Protect Waivers

if a loan you’ve invested in has Payment Protect, and the borrower suffers a “Waiver event” (see table below), they can skip their repayments to you for the duration of the waiver (meaning you completely lose any principal and interest you would have received during that time). Personally I don’t like the idea of investing in Payment Protect loans as it adds another layer of risk for little return – you essentially act as an insurer and take the loss if something goes wrong.

My experience – Did the risk occur for me?

I haven’t had the best experience with charge-offs, even having a loan in the very lowest risk grade (A1) charged-off 🙁 . Overall I have had $345.48 charged-off. Out of $1155.41 in interest earned, that equates to 30% of my income lost to charge-offs. Although this high percentage can be partially explained by the fact that I stopped investing in June 2016, resulting in my interest earned gradually decreasing, while my charge-offs increased as time went on.

As for arrears, I still have three loans outstanding (on payment plans), even though they should have all been paid off by June 2019. Fortunately it’s only a small amount of money outstanding, but it does prevent me from closing my account for good.

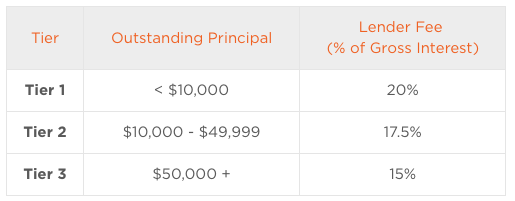

4. Platform Fees

Harmoney has a tiered fee structure charging between 15 and 20% of the interest you earn, depending on how much money you have invested with them. This fee structure started in June 2016.

Prior to June 2016, Harmoney had a different fee structure where lenders paid a service fee of 1.25% on all principal and interest repaid to them. This fee structure was much cheaper and equated to between 5-6% of interest earned. However, it attracted complaints as the fee was charged even in cases where borrowers repaid their principal early (which meant lenders paid a fee just to have their principal repaid).

Another fee you’ll pay if you invest in Payment Protect loans are Payment protect fees. This is a 20% commission of the Payment Protect income, plus another 15% annual management fee. The table below (and this link) shows the calculation of a lender’s potential income and fees for a loan with Payment Protect. It is way too complicated for me, and would benefit from some simplification.

My experience – Fees

I decided to stop investing with Harmoney in June 2016 when they raised their fees to the current level of 20%. Even though the returns I was getting were great, I felt that giving Harmoney a 20% share of my returns was way too much, given that I was undertaking all the risk. Perhaps at a higher tier the fee (which drops to 15-17.5%) would feel more fair. But it is a lot of money you need to invest ($10,000+) to get to those tiers.

5. Platform Features

Harmoney’s platform is one of the most feature-rich:

- Auto-Lend – allows you to automatically invest in loans based on criteria set by you (such as risk grade, age band, residential status). Means you don’t have to be hands-on in picking and placing orders in loans

- Direct debit – automatically takes funds from your bank account, so good for making regular investments

- Auto-withdraw – allows you to automatically withdraw any excess cash you have on the platform to your bank account every week

- Reports – see a filterable list of every loan you’ve invested in, its status, how much interest you’ve earned, and how much is left to be repaid

- Platform Statistics – a page that gives you heaps of statistics about the platform such as borrower demographics, amount lent, and average returns. Well worth a look, and adds a lot of transparency to the platform

A major feature missing from Harmoney is a secondary market, where you can sell your loan investments to get your money out early. You will have to wait for borrowers to gradually pay your loans back before you’re able to withdraw your money from the platform.

My experience – Platform features

While they are handy, I didn’t use any of the special features of the site like Auto-Lend. You had to hold a large amount of cash in your account for Auto-Lend to work – this is because the Auto-Lend function gives priority to lenders holding a high proportion of cash.

I preferred to manually invest to keep my idle cash balances to a minimum, and I didn’t mind doing so by logging into the platform a couple of times a day. This also gave me the benefit of knowing exactly what kinds of loans I was investing in.

6. Other Talking Points

Loan availability

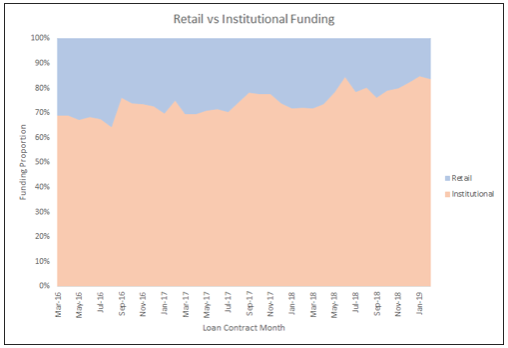

At times there can be very few loans for lenders to invest in. Loan availability is made worse by the fact that Institutional investors (like Heartland and TSB Banks) are taking up around 80% of all loans, leaving only crumbs for retail investors (individuals). This also means that Harmoney isn’t a genuine P2P Lending platform, as most of the lending is coming from institutions, rather than “peers” or individuals.

Unsuprisingly, Harmoney has decided to cease offering P2P Lending for retail investors from 1 April 2020.

Rewrites

Another thing that makes loan availability even worse is rewrites. Rewrites occur when a borrower wants to increase the amount they’re borrowing. To facilitate this, the original loan is repaid in full to its original lenders, and the new “rewritten loan” is placed onto the Marketplace for new lenders to invest in. I think this causes totally unnecessary churn and that only the additional amount being borrowed should be placed onto the Marketplace for new lenders. It’s made worse by the fact that Harmoney actively encourages borrowers to rewrite their loans.

Fraud

Sometimes I see loans listed on the marketplace that seem unrealistic, or maybe even fraudulent. Some examples are:

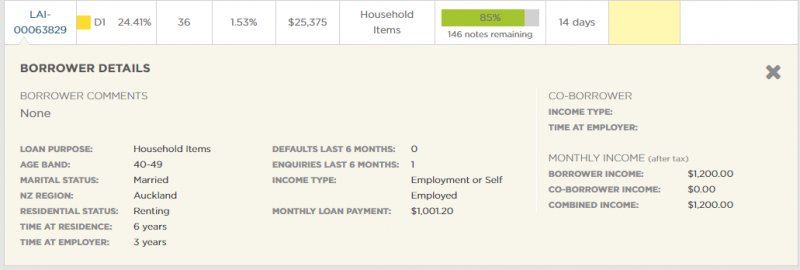

- A borrower with a whopping $20k monthly income, borrowing $25k to see the dentist.

- A borrower with a $1,600 monthly income, with monthly loan repayments of $900 (56% of their income).

- Pictured below, a couple with a $1,200 monthly income, with monthly loan repayments of $1,000! How can they afford rent and food after repaying their loan!?

This gives me the impression that Harmoney is letting non-genuine loans onto the platform, or that they aren’t doing the best job of verifying borrower details, such as their income.

In fact, Harmoney did face an issue with fraud where people used stolen IDs to apply for loans. Because lenders take on all the risk in P2P Lending, it was ultimately them (rather than Harmoney) who were the victims of the fraud, losing all of their investment in these dodgy loans. But it must be noted that fraud is a risk that could be encountered on any P2P Lending platform, not just Harmoney.

Glitches

I’ve occasionally encountered bugs on the platform. For example, eagle-eyed readers of this article may have spotted that the next payment on one of my loans is due on 31 December 3000!! Another time my withdrawal went to the wrong bank account (although they quickly addressed that).

Conclusion

I liked Harmoney during my time investing on the platform. It’s easy to understand and use, and I achieved satisfactory returns. While I tolerated the glitches and high defaults, the fee increase to 20% was the final straw leading me to quit – I wasn’t prepared to give away a fifth of my income to a platform with so many issues, and when I was the one taking on all the risk. Although, I probably would have stayed with Harmoney a lot longer if the fee was more reasonable.

I’m glad that I started with Harmoney, and had a decent experience with it overall, because it led to to continue with P2P Lending via Lending Crowd and Squirrel. I’d be confident that I could still achieve better returns than bank deposits if I restarted investing in Harmoney today. But it’s just not for me given the high 20% fee I’d face, and the many cons of the platform.

I still think Harmoney could be suitable two groups of people – those new to P2P Lending wanting to give it a go (with it’s low minimum investment and user-friendly platform), and those investing over $50k, qualifying for the lower 15% fee.

Pros

- Potential to achieve much higher returns than bank deposits or even other P2P Lending platforms

- Useful features like Auto-Lend allows you to be a hands-off investor

- Low minimum investment amount of $25

- Easy to use and understand

Cons

- High fees

- Not true P2P Lending – mostly funded by institutional lenders resulting in low loan availability for retail investors

- Sometimes feels unsafe – high rate of charge-offs, platform glitches, fraudulent looking loans

- No secondary market to get your money out early

- Payment Protect is too complicated and risky for such small returns

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.