Last week was World Investor Week, and the Wellington branch of the New Zealand Shareholders’ Association put on a free investing seminar. The theme was use it or lose it – use your money wisely or you’ll end up frittering it away! The speaker was Baubre Murray, a Chartered Accountant, and experienced investor, who presented to a packed out room in the NZX offices on Wellington’s waterfront.

I wasn’t planning to go to this event, but after I saw this advertised on my Facebook News Feed, I felt hungry for more free food and thirsty for more investing knowledge. And as a result you get a bonus Money King NZ article this week, in which I’ll be covering the key points of the seminar, so hopefully you learn something new!

This article is not endorsed or sponsored by the NZSA or Baubre Murray, is my personal interpretation of the seminar’s content, and is not to be considered as investment advice.

1. Key takeaways from the seminar

Attitudes towards money

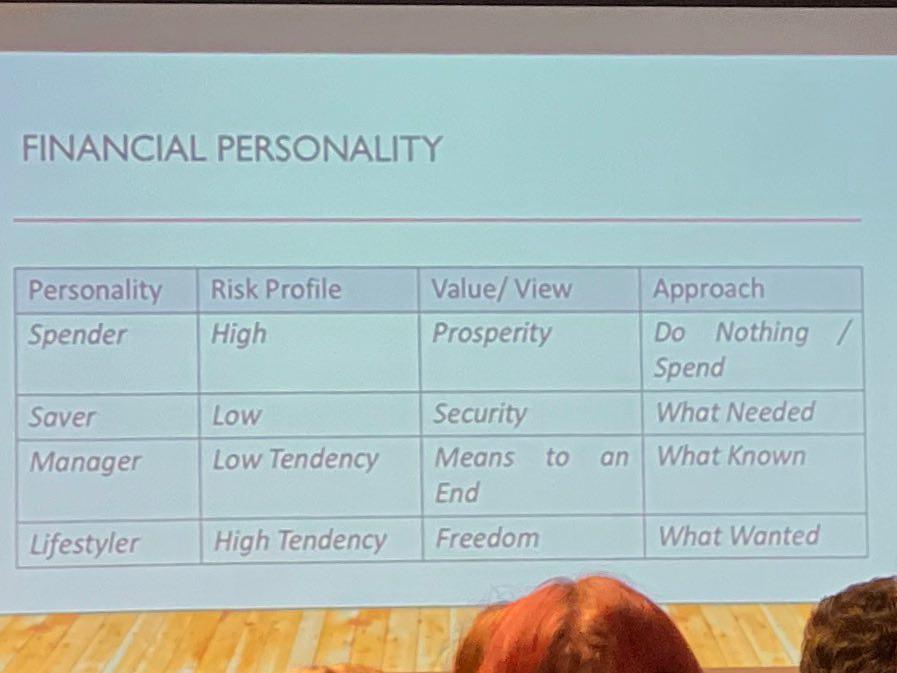

The first topic was to understand your own money personality, as this can influence what approach to money and investing will work for you. For example, if you’re a saver, then owning your own business might not work out the best for you. (I will admit that I found this section of the seminar a little confusing, and would have liked to hear more practical examples of how different personalities affected one’s investing decisions).

Personality – What you do with your money

- Spender – Always buying stuff

- Saver – Always putting money aside

- Manager – These people are balanced, both spending and saving

- Lifestyler – These people don’t worry about money

Risk profile – Your approach to risk

- Low – Some people are cautious and don’t like taking risk

- High – Some people are very happy to take on risk, and are gamblers in extreme cases

- Balanced – Most people would fall somewhere in between the two risk profiles

Value/view – What money means to you

- Prosperity – They see money as a tool to live a luxury life and to look wealthy

- Security – Money provides safety

- Means to an end – Money is used to keep you going in life

- Freedom – Money can be used to buy freedom and do whatever you want

Approach to investing

- Do nothing – These people just spend and don’t even think about retirement, or even the next month

- What needed – Just invest what’s needed to survive

- What known – Just stick to what they know about (e.g. property)

- What wanted – Just get on with it and invest what they feel like investing in

Find strategies that work with your personality. It’s important to also consider your partner – for example if you are a spender, and your partner is a saver, you may need strategies to deal with this e.g. having a budgeted amount of money that you can spend on whatever you like.

Overall there is no right or wrong when it comes to your financial personality. The most important thing is to have a positive attitude towards money! It’s ok to want to improve your financial situation!

KiwiSaver

The most important takeaway of seminar is to be in the right type of KiwiSaver fund. Should you be in a Defensive, Conservative, Balanced, Growth, or Aggressive fund? Selecting the right fund could make hundreds of thousands of dollars of difference over a lifetime of being in KiwiSaver.

Unfortunately many people leave their investment in a ‘default fund’, which are Defensive funds investing mostly in cash, resulting in low returns. Under 40s should be in a Growth or Aggressive fund which contain more shares. The speaker is over 40, but still in an Aggressive fund!

Buying your first home

There are many ways to put together a deposit. The speaker suggested setting your KiwiSaver contributions to 10% when you start working as this will help you get a deposit relatively quickly. A single person with a $60,000 income could realistically put together a deposit in 5 to 7 years, particularly as employer contributions, government contributions, and investment returns also help.

It will be easier with two people though. If you don’t have a partner, then there are solutions like Miuwi, which is like Tinder for house buying (you match with someone to co-own a house with). You could also get flatmates or boarders (plus you don’t have to pay tax on boarder income of up to $270 a week)

There are a couple of initiatives that can also help you (eligibility criteria apply):

- KiwiSaver HomeStart Grant (now called the First Home Grant) – a $3000 to $10,000 grant towards your home

- Welcome Home Loan (now called the First Home Loan) – reduces your deposit requirement to 10% from the traditional 20% (now further reduced to 5%)

Be positive – anyone can do it!

Absolutely everyone can get on the property ladder very quickly!

Mortgages

Some tips for managing your mortgage:

- Make more frequent payments (fortnightly rather than monthly)

- Split up your mortgage to mitigate interest rate risks e.g. if you split it into 2 and 5 year terms, and if interest rates go up, then you get the benefit of locking in lower rates for longer with the 5 year term

- Put only a small amount in a variable mortgage e.g the rate for a variable account might be 5.5%, compared with 3.5% for a fixed term loan. On $100,000, this results in you having to pay $2,000 extra interest in one year – enough money to buy flights to Amsterdam!

A common question is should you use any extra money to repay your mortgage or invest it? There is no right or wrong answer, but it’s more of a matter of maths. The answer depends on investment returns compared with mortgage interest rates. For example, if you can achieve 12% in investment returns, then investing makes more sense than paying off a mortgage charging 4% interest (though you should also factor in risk).

If you choose to invest it, be cautious about dumping the money into KiwiSaver, as this money is locked up until 65. You couldn’t use that money to retire early!

Retirement

You don’t need $1 million for retirement! A more accurate figure is that a single person will need $598 per week for a basic no frills retirement. You might get $411 of that from the government (superannuation), leaving you needing to cover a $200 shortfall. That’s $10,000 a year, which equates to needing around $200,000 to $250,000 of savings to live to 85-90 (although you would need more if you wanted to live a fancy lifestyle).

Contributing 3% to KiwiSaver will get you there if you’re starting under 30 (or you can use the handy tools on Sorted.org to perform your own retirement savings calculations). Owning your own home is also important for retirement, otherwise housing costs will make retirement a lot more expensive.

The Investing Triangle

So what are you going to do with your money? If you’re an employee or contractor, you get paid for your time. Unfortunately your hours in the day are limited so it’s hard to earn more money. The solution is to invest:

Business – Businesses operate through leverage – getting other people work for you, machines to work for you, or borrowing the bank’s money to make income for you. Owning a business is not for everyone – make sure to stick to something you know and understand, and only do it if you’re comfortable with it. On the other hand it could be a great way to make money for those who don’t want to work for others.

Property – This could be:

- Commercial property (retail, offices, industrial, and rural). You need a lot of capital to get into this, but there are solutions like investing in a syndicate.

- Residential property.

Shares – interestingly the speaker used shares as an umbrella term for term deposits, bonds, and shares:

- Term deposits – Putting your money in the bank. You’ll only earn interest with no opportunity for capital gains, although it’s a safe investment.

- Bonds – Lending money to company or government. You get a fixed rate of interest but its value can go up and down depending on demand for the bond. You can also sell bonds before their maturity.

- Shares – Owning part of a company. You can benefit from dividends and capital gains.

Don’t want to get your hands dirty in business or property? You can buy shares and this can give you exposure to businesses and/or property!

Buying shares

How would you get into shares?

- ETFs and index funds are a low cost way to get exposure to shares. Sharesies is a great platform to get access to these funds as you can invest cents at a time

- Use DIY brokers like ASB Securities and Direct Broking

- The Craigs Investment Partners KiwiSaver scheme allows you to select your own shares to invest in

- You could approach a financial adviser at a firm like Craigs or Forsyth Barr

Things to consider/keep in mind:

- Be diversified across companies, industries, and countries

- Dollar Cost Average – drip feed your money in over time take advantage of changing prices e.g. so you don’t have to put all your money in when the market is high

Teaching Children

Some tips to teach your children about money:

- Use positive language. For example, ask “How can we afford this?” instead of “We can’t afford this”

- Pay them for chores – in real life you don’t get paid for nothing

- Give them allowances for things like transport and clothes. Let them spend the money on other things if they don’t use up all the allowance

- Banqer is a financial education programme run in primary schools that teaches them about money

Fundamentals of money

To conclude, there were some generic tips about money:

- Spend less than you earn

- Get a job

- Contribute to KiwiSaver

- Get better qualified

- Reduce debt

- Reduce expenses

- Increase income

- Look after your assets, especially yourself

- Hold appropriate insurance

- Learn to manage with a partner

- Beware of reverse mortgages

- Learn to manage on minimal income

- Use reputable advisers

- Have a buffer (an emergency fund)

- Create a savings plan

2. Did they try to sell anything?

The event was run by New Zealand Shareholders’ Association, so there was definitely a mention of what they do – essentially NZSA advocates for smaller retail investors so they have more of a voice, and offer a few events and educational initiatives (e.g. courses and a sharemarket game where you get $10k to invest in a virtual sharemarket).

There were a few Sharesies representatives at the event, and the speaker frequently mentioned how great Sharesies was throughout her talk (not surprising, given she’s a shareholder of the Sharesies platform). In fact Sharesies set up a little stall at the seminar where their representatives were on hand to answer questions, or even sign you up on the spot.

Keen to start building your investment portfolio with Sharesies? Sign up with this link, and you’ll get a bonus $5 in your account to invest!

3. Was there any free food?

Sadly there was no free food at this event, apart from some Pineapple Lumps that Sharesies had at their stall 🙁 . While at the stall to collect my Pineapple Lump, I also took a couple of Sharesies postcards and a pen – which did nothing to satisfy my empty stomach, but I can’t be too greedy at these free events!

4. My thoughts on the seminar

The seminar was definitely more suitable for beginners, or those wanting to refresh or reinforce their investing knowledge. For me, I am still learning all the time, but unfortunately there wasn’t really anything in this seminar to challenge my thinking about investing. I would have loved to hear more about money personalities and what implications these personalities had for someone’s investing strategy.

However, there was one important thing I did take away from the workshop. I really admired how the speaker was super warm and encouraging. She believes that anyone can get ahead financially if they have a positive attitude, and a positive mindset is something I will definitely keep in mind when managing my own finances and investments.

Happy investing!

My overall rating of the event: 3.5/5 stars

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.