Due to demand from our followers, we’ll be answering your investing questions on a regular basis with our new series of “Ask Money King NZ” articles. For our Winter 2022 Q&A we got plenty of quality questions, including about the importance of fees, whether the sharemarket will continue to go up over the long-term, and whether education might reduce the severity of market crashes. Here’s our answers.

The answers in this article have been provided without any knowledge or consideration of the personal circumstances of the person who asked the question. This content should not be taken as financial advice.

In case you missed it – Our first Q&A article:

– Ask Money King NZ – Your investing questions answered

1. When it comes to KiwiSaver, is passive or active the best and are fees important?

Firstly on fees. People tend to make a big fuss about them as they’re an easy but impactful aspect of investing that you can control – If you don’t like the fees, then you can easily switch to another provider. Fees are hugely important as lower fees means more dollars working for you to generate a return. A 1% fee on $30,000 isn’t just $300 going to the fund managers pockets, but rather $300 less invested for you – which by the time you retire that $300 would have grown to be much more.

We particularly dislike fixed fees (e.g. providers who charge a $30 membership fee regardless of how much money you have invested with them). This hurts those who have the least invested in KiwiSaver – For example, a $30 annual fee equates to a fee of 3% for an investor with a $1,000 balance. 3% may not seem much, but that’s almost a third of your profits assuming you make a 10% return.

However, we think value for money is even more important than fees alone. It’s perfectly fine to go with a more expensive provider if you feel they offer better value – For example, if they have better funds, better service, or if their ethics are more aligned with your preferences.

As for passive or active, there’s no definitive best:

- Passive works well as not many active funds manage to beat the market over the long-term, and they have lower fees.

- A small number of active managers are really good and have managed to outperform the market. Though their future performance isn’t guaranteed, while their higher fees are.

We personally prefer passive for the low fees and comfort that comes with knowing we’ll always perform in line with how the market performs. We feel that the mere potential for higher returns isn’t enough value for the extra fees we’d pay on an active fund.

2. How/should I get an accountant for FIF taxes or is it easy enough? (nearly at 50k for foreign stocks)

Calculating your FIF taxable income is the tricky part, but its difficulty will largely depend on things like the platforms you use, the quantity and type of FIF investments you have, and the FIF calculation methods you need to use (e.g. do you need to apply a quick sale adjustment?).

For many investors it won’t be too difficult, especially if you’re simply investing in shares/funds through InvestNow (who only have 2 FIFs and provide good FIF tax reporting). Hatch and Sharesies have a couple of quirks relating to FIF (see below article) that you’ll need to watch out for, but in many cases it’s possible to handle the taxes yourself (with the help of their reports and IRD’s tools). With foreign brokers like Interactive Brokers, it’s slightly harder as you’re totally on your own when it comes to FIF tax.

So if in doubt it’s always a good idea to check with an accountant. Get in touch with one, and most should be happy to have a quick chat at no cost to see how they can help you. An alternative is to use a service like Sharesight to track your portfolio and calculate your FIF tax for you.

Further Reading:

– Tax on foreign investments – How do FIF and Estate Taxes work?

3. I notice an investment platform called ShareMeUp – are they any good?

For those who don’t know, ShareMeUp is an investment platform that allows you to invest as little as $50 into a selection of NZX listed companies. Their key benefit is that they register the shares you purchase through them under your own name/CSN (as opposed to a custodian). But they come with a number of downsides:

- They don’t offer all NZX companies – only those that use Link Market Services as their registry.

- You can’t sell your shares through the platform. Instead you have to sell them through an NZX broker.

- Their fees can be quite high – up to 4% in some cases.

- They haven’t updated their app in 2 years, which raises questions about how well the platform is supported!

Overall the platform is too limited. Sharesies is cheaper, and those who care about having their shares registered under their CSN are usually happy with using ASB Securities/Jarden Direct or paying the $5 transfer fee on Sharesies. The lack of app updates is likely a sign of how little ShareMeUp is used.

4. Why aren’t we seeing any improvements made to the InvestNow platform?

Assuming you’re primarily referring to InvestNow’s dated UI with this question, we think the InvestNow platform is ok as it is. Having a slick UI won’t make you a better investor – in fact it could hurt you by encouraging you to check or tweak your portfolio too often. It’s really a set and forget platform for long-term investors, so it’s understandable they haven’t prioritised the interface.

Either that or they don’t have the resources. It takes a huge amount of time, money, and expertise (e.g. designers, developers, testers) to develop and improve a platform. However, InvestNow’s parent company have recently said they’re looking for a strategic partner to inject some of these resources – perhaps that’ll finally result in some meaningful enhancements to the platform.

5. If you had a very large amount to invest and you wanted to buy S&P 500, is IBKR best?

Interactive Brokers (IBKR) is probably best in terms of overall fees (with brokerage + FX for US shares starting from just $3 USD), assuming you’re investing decent amounts of money. But there’s a few other factors to consider that might make a PIE option like Smartshares/Kernel more suitable:

- You’ll have to pay FIF tax on a US domiciled S&P 500 fund, which is either time consuming, or costly if you use an accountant. Whereas a PIE fund will take care of the tax for you.

- You’ll pay tax at your marginal tax rate on a US domiciled S&P 500 fund. Whereas the maximum tax rate on a PIE is 28% – great if you’re on the 39% marginal tax rate.

- Kernel’s S&P 500 Fund is currency hedged, whereas all other options aren’t.

Overall there’s not a significant difference between the various S&P 500 funds and platforms (perhaps 1-2% between them over 10 years). It’s better to just select one and invest rather than overanalyse the options.

Further Reading:

– Smartshares US 500 (USF) vs Vanguard S&P 500 (VOO) – Which ETF is better?

6. Thoughts on investing in small cap index/ETF? Worth it or better to just stick to a main one like S&P 500 etc?

Most main indexes have little to no exposure to small cap companies (or in other words, the smaller companies listed on the sharemarket). That may provide a case for adding a small cap fund as a satellite holding in your portfolio, for further diversification, and for the higher potential returns that small caps provide. But keep in mind:

- You’ll pay for those higher potential returns with higher volatility.

- Small cap funds usually have higher fees.

- Adding more funds to your portfolio won’t necessarily increase diversification. Funds covering the main indexes are already well-diversified, and there’s diminishing benefits in adding more and more companies to an already diversified portfolio.

- If a small cap company is good enough it’Il grow and eventually be captured in the main large cap indexes anyway.

- By skipping small cap funds you’re not missing out on much, as small caps make up such a tiny proportion of global sharemarkets.

Most will find investing in the main indexes to be enough – they provide a good reflection of the sharemarket as a whole and are seen to have some of the highest quality companies. As for whether you should invest in a small cap ETF, it’s almost like deciding whether or not to invest in a thematic fund – they can be interesting add-ons to a portfolio, but they’re far from necessary.

7. Is it correct that historically big market crashes have happened due to investor fear/panic and subsequently mass selling of shares? Or are there lots of other factors to it?

There’s many other factors that contribute to market crashes – something that gets the ball rolling in terms people of selling off stocks in the first place. These are usually genuine reasons that reduce (or could potentially reduce) the value of shares like rising interest rates, poor economic conditions, regulatory changes, geo-political events, and so on.

Part 2 of the question: With all the information and education available these days about holding long term, not panicking and selling off during market corrections etc, would we potentially see less dramatic market crashes as more people are aware that its worth holding out for the long run during a crash?

Education won’t prevent things like interest rate changes and geo-political events, so crashes will continue to happen. Education could definitely help with the behavioural aspect of investing, like not panic selling during tough times, but unfortunately there’s a few limitations to this:

- Education tells you what to do in theory, but in practice the emotions that come out during a crash could result in you panic selling anyway.

- People tend to favour educational content that aligns with what they want to hear, and brush off content that doesn’t align with the above. This confirmation bias leads to people jumping into investing having learnt about the benefits, but without educating themselves of the risks.

- They’Il always be speculators in the market, who aren’t interested in investing long-term but are only out to make a quick buck.

- Relatively few people know about and have an interest in investing. So there’s new people coming into the investment world all the time, but haven’t had the time to learn sound investing behaviours.

So we don’t think education will make a material difference to the severity of future market crashes. But at least it still has the benefit of improving the investment results of those who do choose to consume such educational content.

8. Is the fundamental assumption that the market will always go up over time reliable?

Question continued: The general idea with the kind of investing we do is to constantly put money over time into index funds or stocks we believe in, based on the fact that in the long term the market goes up regardless of dips and spikes along the way. Obviously it has done exactly that since it began, but with things on the horizon like extreme climate change, global fisheries collapse, water shortages and so on I sometimes wonder if it’s possible that it wouldn’t always be the case?

For individual companies, they’re definitely at greater risk of declining due to disruptive changes. Think of SkyTV who’s been losing Satellite TV subscribers to online streaming services, and NZ King Salmon who are closing salmon farms due to climate change. It’s far from guaranteed that a company will go up or even survive over the long-term – In fact the average lifespan of a company in the S&P 500 is expected to be just 16-18 years before it drops out of the index. So individual companies require more active management to stay on top of, keeping an eye on factors that could change a company’s fortunes.

For index funds, there’s no guarantee they’ll always go up either. But they’re self-cleansing, so any companies that go extinct (say to climate change) will drop out the index, and be replaced by new companies (e.g. companies that are benefiting from or helping solve climate change). The idea is that companies will always adapt and grow regardless of what happens, and if not, a competitor will replace it. They’ll never be a shortage of strong, growing companies unless the world really turns to custard – and in that case we’d probably have greater things to worry about than money and index funds.

9. Any thoughts on whether using 2 index fund platforms is useful to spread risk around or unnecessary?

Reputable platforms don’t even touch investors’ money – instead your funds are held by a custodian, which keeps your money segregated from the platform in case it goes bust. So we don’t think platform diversification is necessary. Instead diversification across geographies and industries is much more useful in spreading risk.

Further Reading:

– What happens to your money if InvestNow or Sharesies go bust?

10. What’s your thoughts on hedging to NZD with part/some of your investments?

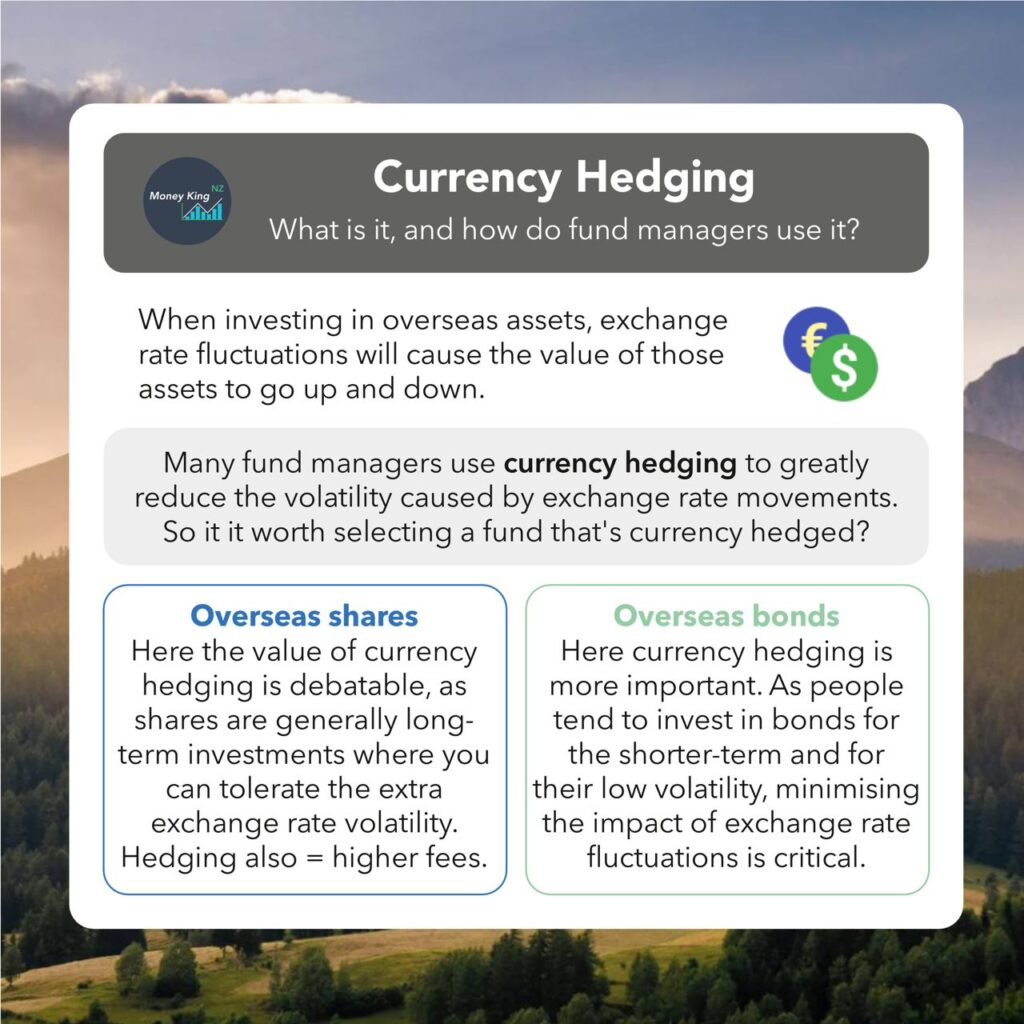

Currency hedging to NZ Dollars greatly reduces the impact of exchange rate volatility on your overseas investments. We think it’s necessary for bonds to be currency hedged – the idea of these investments is to provide stability to your portfolio, and currency movements could defeat the purpose of having bonds in the first place.

As for shares, it’s debatable but we don’t think hedging is important. Shares are long-term investments (which are already volatile) so removing exchange rate impacts is less important, as investors have the time to ride out the fluctuations. Plus exchange rate volatility isn’t always a bad thing – it can sometimes work in your favour, and the impacts tend to even out over time.

11. What are you invested in?

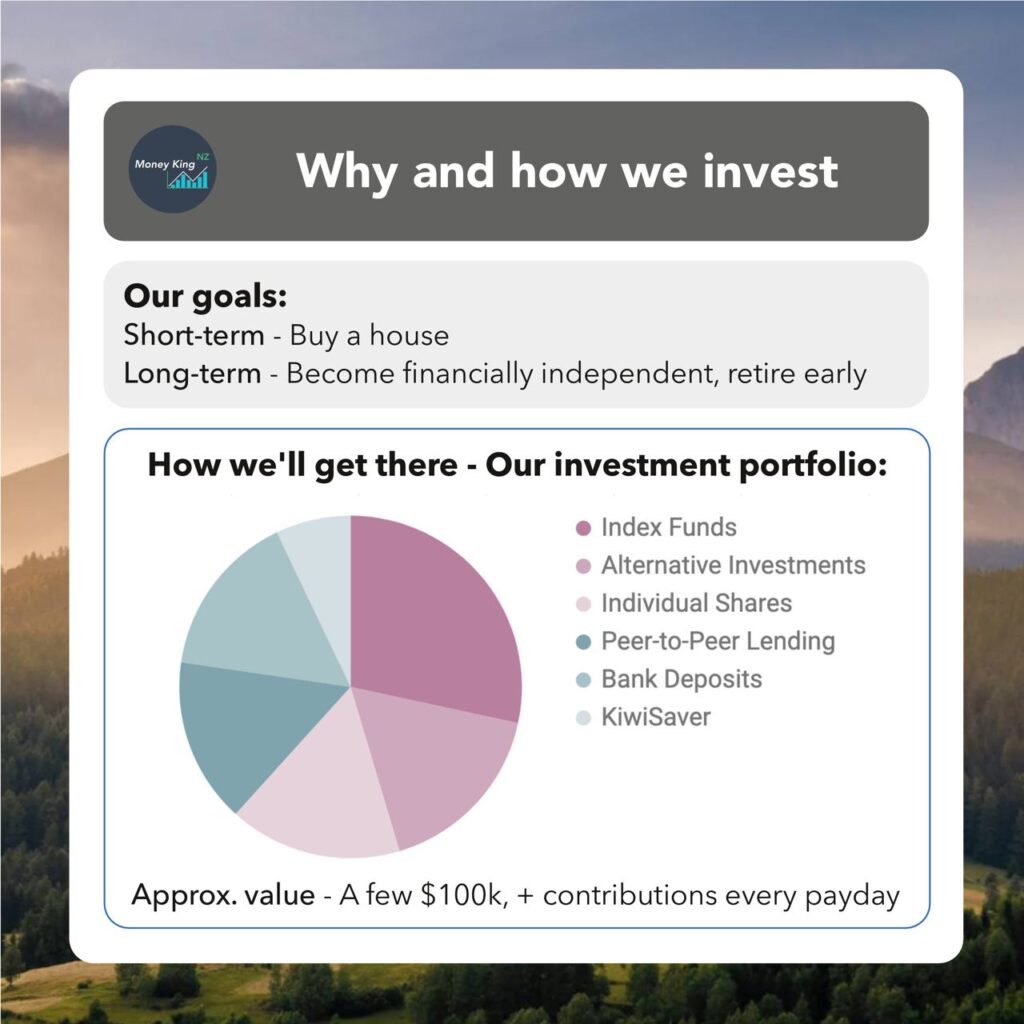

We’re investing in a mix of assets:

- Growth assets (index funds, NZX listed shares, private companies) which we hold long-term for retirement.

- Income assets (bank deposits, Conservative KiwiSaver, peer-to-peer lending) which we hold for a house deposit and other short-term needs.

Our current focus has been on building up our index fund investments – we’re very happy that the market downturn has allowed us to buy up units at cheaper prices!

Our portfolio is more complicated than we’d like, but it works for us and our multiple goals. What works for you may be totally different!

12. What ETFs are you invested in?

We have no substantial holdings in ETFs, but assuming you’re asking about index funds we have the following Kernel ones:

- Global 100 (60%)

- NZ 50 ESG Tilted (20%)

- Global Infrastructure (10%)

- Global Dividend Aristocrats (5%)

- Moonshots Innovation (5%)

Though what we’ve chosen aren’t necessarily the best funds. They’re simply what works well for us and our investing preferences.

13. Why no ETFs and just index funds?

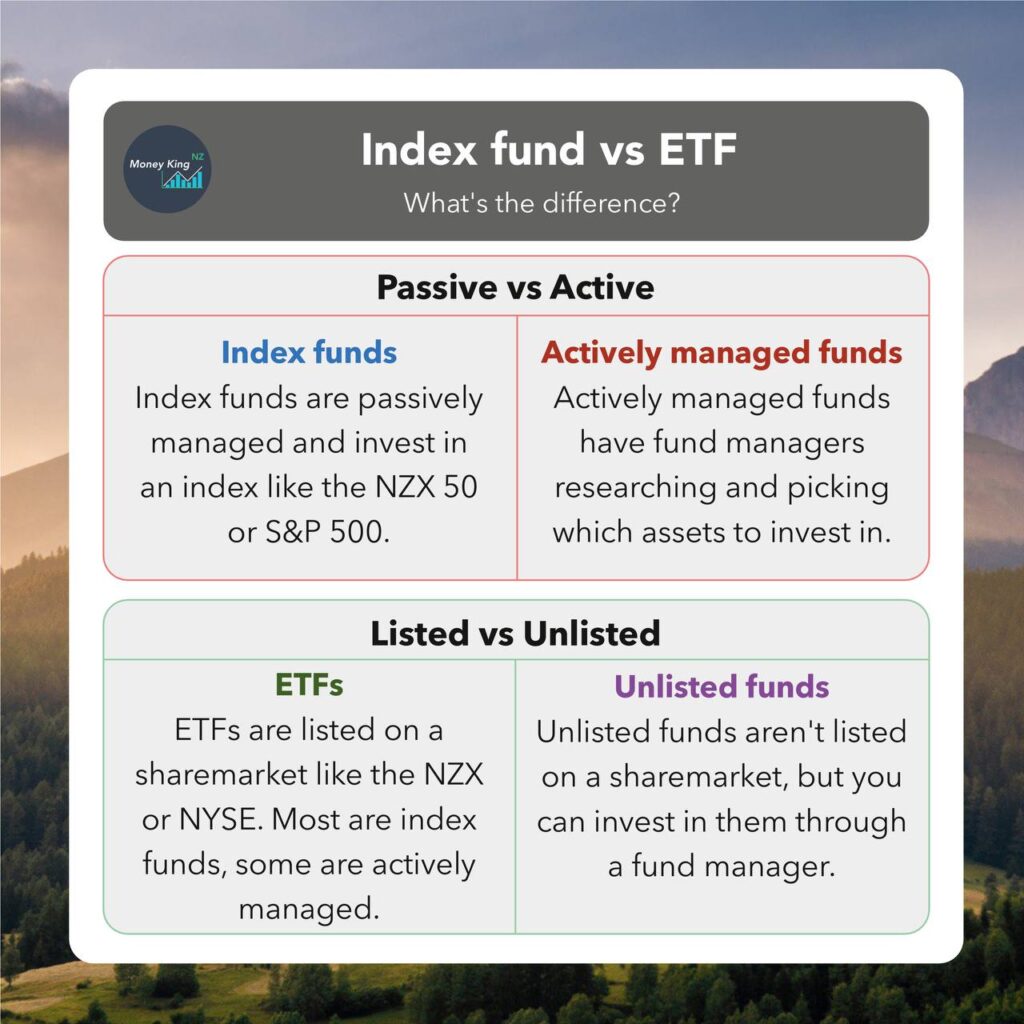

Firstly the difference between index funds and ETFs:

- Index funds passively invest in and track the performance of an index

- ETFs are funds that are listed and traded on an exchange e.g. the NZX. Most ETFs are index funds, but some are actively managed.

We don’t invest in ETFs because they’d be redundant in our portfolio:

- Our unlisted funds are enough in providing us with a diversified, long-term investment portfolio. Adding ETFs would have little diversification benefit.

- We don’t need the benefits of ETFs (i.e. the ability to trade them on an exchange). Most platforms (like InvestNow, Kernel, and Flint) allow you to easily buy and sell unlisted funds free of transaction costs.

Conclusion

Thanks to all who put a question through for this article. This is just our 2nd Q&A, and we’ll be looking to do them at that start of every season. Keep an eye on our Instagram for the next Q&A in about 3 month’s time!

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.