Ethical investing is an increasingly relevant consideration when it comes to choosing what to invest in. It’s about aligning your investments with your values – Many people don’t want their money in things they consider to be bad, or they want their investments to reflect how they want the world to look like. But not all investments are built the same when it comes to meeting one’s ethical requirements. In this article we’ll be looking at six different types of ethical investments to help you decide which works best for you when it comes to your portfolio.

Background

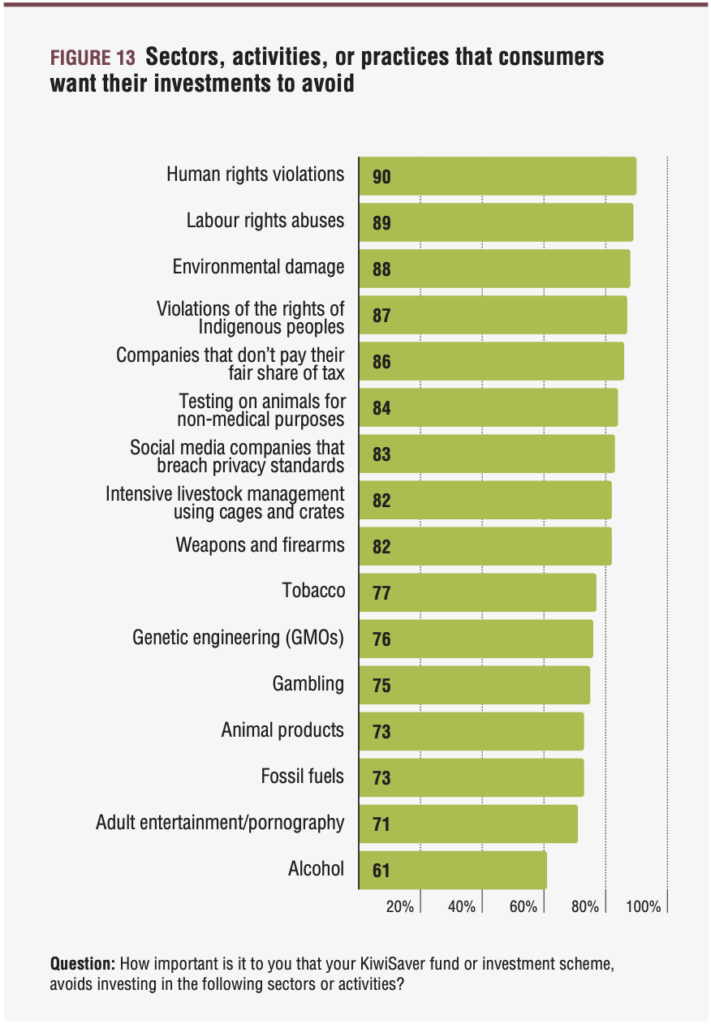

Ethical investing (which we’re using as an umbrella term for responsible investing, sustainable investing etc.) is a growing trend, with most New Zealanders wanting their funds to be invested ethically:

73% of New Zealanders want their funds to be invested ethically

Mindful Money

But the demand for ethical investing isn’t as clear-cut as saying 73% of people want ethical investments, and 27% don’t want ethical investments. Instead different people have varying attitudes towards the issue, and fit on a spectrum which might look like:

- I actively want unethical investments

- I don’t care about ethical investing

- I consider ethical investments as a nice to have

- I consider ethical investing somewhat important

- I actively want ethical investments

In other words, some people care about ethical investing more than others.

What might an ethical investment look like?

Unfortunately there is no black and white definition of what an “ethical” or “unethical” investment looks like. Firstly, someone’s expectations for an ethical investment will likely differ depending on where they fit on the above spectrum.

But perhaps more importantly, everyone’s ethical views are different. For example, some people may consider investing in alcoholic beverage companies to be unethical, while others are perfectly fine with it. There’s no universally right or wrong answer here, just a variation of values between one individual and another. So let’s look at some different types of investments with varying degrees of ethical-ness between them.

1. Sin stock funds

Sin stock funds invest in industries that most people would consider unethical. So why on earth would an article about ethical investments be talking about such funds? Well, we’re not condoning investing in companies that do bad, but rather highlighting the fact that everyone’s views are different. For example, while the vast majority of people want to avoid investing in companies involved with manufacturing weapons, a small amount of people still find these investments to be acceptable.

And some people are happy to consider profit over potential ethical issues, and actively seek to get exposure to such industries. For example, following Russia’s invasion of Ukraine a number of people sought to invest in weapons and oil companies to cash in on the unfortunate situation.

There’s no specific sin stock funds in NZ, but there’s plenty listed in the US which you can access through the likes of Sharesies, Hatch, or Interactive Brokers. For example:

- iShares U.S. Aerospace & Defense ETF (ITA) – Invests in US companies that manufacture aircrafts and other defence equipment, including nuclear and controversial weapons.

- iShares Global Energy ETF (IXC) – Invests in companies from around the world that produce and distribute oil and gas. Lots of fossil fuel exposure in this one

- AdvisorShares Vice ETF (VICE) – Invests in “vice” industries including alcohol, tobacco, fast food, and gambling.

2. Traditional funds

Traditional funds invest broadly into the sharemarket without any ethical considerations. Examples of these funds are:

- Smartshares S&P/NZX 50 ETF (NZG) – Invests in the 50 largest companies listed in New Zealand.

- Kernel S&P 500 Fund – Invests in the 500 largest companies listed in the United States.

- Smartshares Total World ETF (TWF) – Invests in over 9,000 companies from around the whole world.

- InvestNow Foundation Series Growth Fund – Invests in a diversified mix of NZ shares, international shares, NZ bonds, and international bonds.

Take the Kernel S&P 500 Fund for example, which will invest into all companies in the S&P 500 index, regardless of how unethical some of the companies may be perceived to be.

Further Reading:

– What do NZX 50, S&P 500, and Total World index funds actually invest in?

Yet these funds are some of the most popular. Traditional funds are easy to understand, accessible, reliable, often have low fees, and allow you drop your money in to the markets without having to do much research. They’d probably be suitable for those who aren’t concerned about ethical investing, or those who consider it as a a nice to have and are willing to put ease of use over ethical concerns.

In addition, traditional funds may still be acceptable to many from an ethical point of view. For example, while some people wouldn’t actively choose to invest in the likes of Amazon, Meta, or Nestle, they’d be willing to accept a passive exposure to these companies via an index fund. And lastly, some traditional funds are quite small in terms of the number of companies they have (like the NZX 50 ETF), so may not contain many controversial companies in the first place.

Tip

To find out how you can see all the companies a fund is invested in, check out our article Beyond the top 10 – How to see everything your fund is invested in.

3. Funds with exclusions

These funds exclude investments into companies involved with certain industries and activities, otherwise known as negative screening. This is a simple way to make the fund more “ethical” by removing its exposure to the nastiest sectors, perhaps making these funds best suited to those who consider ethical investing somewhat important or as a nice to have.

Some of these funds have relatively small exclusions lists, but aren’t explicitly marketed as ethical. For example:

- Macquarie All Country Global Shares Index Fund – Invests in around 3,000 companies from around the whole world, excluding those involved with tobacco.

- Kernel Global 100 Fund – Invests in 100 of the world’s largest global companies, tracking a custom index which excludes controversial weapons.

- Vanguard International Shares Select Exclusions Fund – Invests in around 1,500 companies from around the world, excluding those involved with tobacco, controversial weapons, and nuclear weapons.

While others have more extensive exclusions and are marketed as ethical. For example:

- Smartshares’ ESG funds – A range of 5 funds investing in global, US, Europe, Japan, and emerging markets shares. Their main difference from Smartshares’ traditional funds is that they exclude companies involved with controversial weapons, civilian firearms, nuclear weapons, thermal coal, nuclear power, tobacco, oil sands, and companies that have failed UN Global Compact rulings.

- Simplicity’s funds – Their range of funds excludes fossil fuels, alcohol, tobacco, gambling, civilian firearms, adult entertainment, military weapons, nuclear weapons, and companies breaching the principles of the UN Global Compact.

Many active fund managers also employ negative screening, even though they don’t go as far as calling their funds ethical. In fact most KiwiSaver funds have ethical exclusions to at least some extent, due to the greater media attention they tend to get. Some examples are:

- ANZ – Excludes weapons, civilian firearms, tobacco, whaling, unconventional oil and gas, thermal coal, and adult entertainment from their funds.

- BNZ – Excludes cluster munitions, landmines, nuclear weapons, tobacco, assault weapons, whaling, gambling, adult entertainment, oil & gas, and coal.

- Fisher Funds – Excludes coal, oil & gas, tobacco, weapons, and gambling.

- Milford – Excludes anti-personnel land mines, nuclear weapons, cluster munitions, whaling, tobacco, recreational cannabis, and civilian automatic/semi-automatic firearms.

- Westpac – Excludes controversial weapons, fossil fuels, coal, whaling, tobacco, and predatory lending.

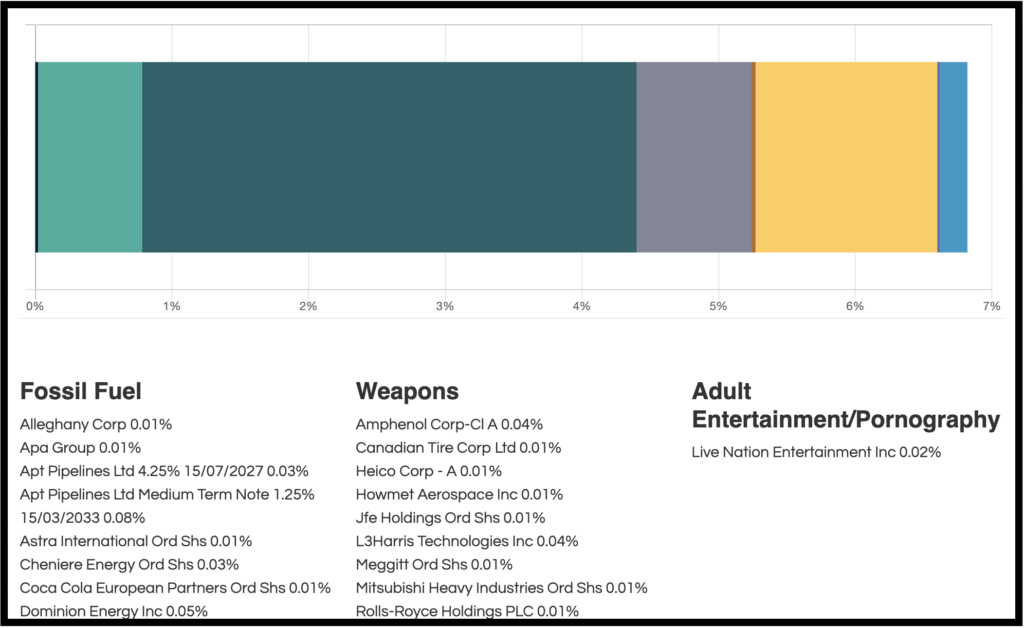

But while funds with exclusions take a big step towards divesting from the most undesirable companies, they may still not go far enough in meeting your personal definition of what’s ethical. One example, is ANZ’s KiwiSaver Growth Fund where one investor was shocked to find out they invested in Nestle, which is known for human rights abuses. Another example is BNZ, who claim to exclude a bunch of nasty industries from their funds. However, Mindful Money’s research suggests that their Growth Fund still has an almost 7% exposure to contentious industries like fossil fuels and weapons.

Tip

The Mindful Money website is a great resource for doing research on whether a particular fund is invested in any areas of concern.

4. ESG integrated funds

Some funds go further than simply screening “bad” companies out. These funds have an increased exposure to “good” companies, perhaps making these types of funds best suited to those who consider ethical investing a little more important. These funds use a couple of different strategies to increase their ethical company exposure:

ESG tilting

ESG tilted index funds not only exclude companies operating in contentious industries, but they also tilt companies according to their ESG rating. How this works is that each company inside an index is given a sustainability score, and have their weightings adjusted up or down according to that score.

What is ESG?

ESG stands for Environmental, Social, Governance, which are three broad factors commonly used to measure a company’s sustainability:

– Environmental – Considers a company’s impact on the environment, such as emissions and use of green technologies.

– Social – Considers a company’s impact on society, such as treatment of employees, suppliers, and consumers.

– Governance – Considers a company’s corporate governance issues, such as diversity of their board/management and the relationship with shareholders.

As a result sustainable companies make up a larger proportion of the fund, and less sustainable companies make up a smaller proportion of the fund. This tilt towards such companies often results in reduced carbon footprint exposure compared with their traditional counterparts. Some funds that use ESG tilting are:

- Kernel NZ 50 ESG Tilted Fund – Invests in the 50 largest companies listed on the NZX. Excludes Sky City Entertainment (for gambling) in addition to their ESG tilting. The below table shows the difference the adjusted weightings make to the fund’s 10 largest companies, compared to the traditional Smartshares NZ Top 50 ETF:

| Company | Smartshares NZ Top 50 | Kernel NZ 50 ESG Tilted | Difference |

| Auckland Airport | 5.48% | 10.79% | +5.31 |

| EBOS Group | 5.35% | 4.94% | -0.41 |

| Mainfreight | 5.26% | 3.43% | -1.83 |

| Fletcher Building | 4.93% | 5.37% | +0.44 |

| Infratil | 4.90% | 0.96% | -3.94 |

| Contact Energy | 4.87% | 8.67% | +3.80 |

| Meridian Energy | 4.76% | 9.55% | +4.79 |

| Spark | 4.71% | 2.60% | -2.11 |

| Fisher & Paykel Healthcare | 4.42% | 7.09% | +2.67 |

| a2 Milk | 4.21% | 3.41% | -0.80 |

- Harbour Sustainable NZ Shares Fund – Invests in the 50 largest companies listed on the NZX. Excludes Sky City Entertainment, Genesis Energy, Air New Zealand, and Fonterra in addition to some ESG tilting.

- Russell Sustainable Global Shares Fund – Invests in companies from around the whole world, excluding companies involved with coal, nuclear weapons, controversial weapons, civilian firearms, tobacco, and uranium. The fund has higher weightings towards companies with higher ESG scores and companies participating in the transition to renewable energy.

- Kernel Global Green Property Fund – Invests in over 200 REITs (Real Estate Investment Trusts) from around the world, weighted according to their ESG scores.

Despite the extent these funds go into making themselves more ethical/sustainable, they still aren’t guaranteed to be free of companies you don’t like. For example, some might not like a2 Milk for its involvement in dairy, or maybe others won’t like Auckland Airport for its relationship with aviation 🤷.

Positive screening

Positive screening involves actively picking companies that demonstrate good ESG practices, or have better ESG scores relative to others in their industry. While some fund managers mentioned above (like ANZ and Milford) also use positive screening to a minor extent, the below funds go further, being much more rigorous in integrating ethical and sustainability concerns into their company selection. The funds are also marketed as ethical/sustainable. Here’s just a few examples:

- Pathfinder – An ethical fund manager offering KiwiSaver and non-KiwiSaver funds.

- Booster Socially Responsible Investment funds – Their SRI funds include Moderate, Balanced, Growth, High Growth, and Geared Growth options and go further than their traditional funds in applying ethical screening.

- Macquarie Ethical Leaders funds – Their Ethical Leaders range of funds include Conservative, Balanced, Growth, NZ shares, and Global shares options.

The following funds take a slightly different approach to positive screening, actively picking companies that align to religious values (rather than a more generic ESG approach):

- Always-Ethical – A Shari’ah compliant fund (conforms to Islamic values), which avoids companies with high debt, and those involved with things considered ‘Haram’ (sinful) like alcohol, money lending, pork, and adult entertainment.

- Christian KiwiSaver – Offers Growth, Balanced, and Income KiwiSaver funds which invest based on Christian values.

And some funds pick companies based on their alignment with indigenous values:

- TAHITO Te Tai o Rehua Fund – Invests in NZ and Australian companies, which have been selected according to ESG factors and Māori indigenous values.

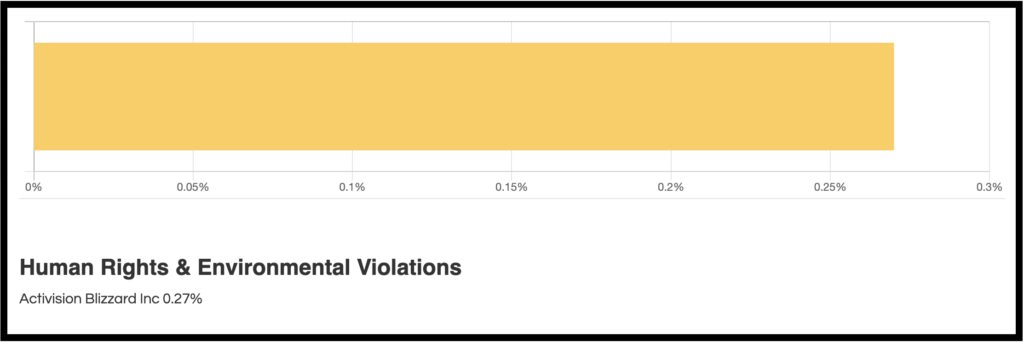

With their heavy emphasis on ethical investing, these funds should contain relatively few controversial investments. However, they’re still not guaranteed to fully align with your personal ethics. For example according to Mindful Money, Pathfinder’s Growth Fund still has a tiny bit invested into a company with human rights & environmental violations. In addition, they invest in crypto platform Easy Crypto which won’t be considered ethical to some due to the heavy energy consumption of some cryptocurrencies.

Tip

Check out a fund manager’s ethical/responsible investing policy to find out more details on how they invest ethically.

5. Thematic funds

Some people want to take ethical investing even further than just being particular about the types of companies they invest in. They see investing as not just a way to make money, but also a way to make a positive impact on the world.

62% of New Zealanders say it is important to them that their investment makes a positive difference in the world

Mindful Money

Thematic funds may help in this regard, by allowing you to tilt your portfolio towards ideas that you associate with making a positive difference. For example, these funds invest in companies involved with global trends that do good to the environment:

- Kernel Clean Energy Fund – Invests in companies involved in producing clean energy or providing clean energy technology and equipment.

- Kernel Electric Vehicle Innovation Fund – Invests in companies involved in the electric vehicle ecosystem including manufacturers and charging infrastructure.

- Pathfinder Global Water Fund – Invests in companies involved in the water industry like water utilities, filtration, and the manufacture of pumps, pipes, and irrigation equipment.

And these funds (which are listed in the US) invest more broadly across industries, but do so with a focus on a specific social theme:

- SPDR SSGA Gender Diversity Index ETF (SHE) – Invests in US companies that demonstrate gender diversity within their senior leadership.

- The NAACP Minority Empowerment ETF (NACP) – Invests in US companies that have strong racial and ethnic diversity policies in place.

And these funds don’t exactly meet the definition of a thematic fund, but still deserve a special mention as they take a unique approach to ethical investing:

- Kōura Carbon Neutral Cryptocurrency Fund – A KiwiSaver fund which invests in Bitcoin, and offsets the estimated carbon emissions relating to their cryptocurrency holdings through a carbon offset programme or by planting trees.

- Engine No 1 Transform 500 ETF (VOTE) – Invests in 500 of the largest companies listed in the US (similar to the S&P 500), but actively casts votes and works with companies with the aim of influencing them to make positive change.

Investing with the objective of making a specific environmental or social impact can be considered “impact investing”. However, the money you invest in these funds arguably doesn’t have an actual impact on the companies the fund contains. That’s because when you invest somewhere, your money usually goes to whoever’s selling that company’s shares, rather than to the company itself. At most your impact on a company will be a tiny indirect one, maybe by putting slight upwards pressure on a company’s share price, making it easier for them to raise capital in the future.

In addition, while these funds are less risky than investing in individual companies, they can still be relatively risky given their concentration towards a specific theme. Therefore they’re usually only suitable as a small part of portfolio, rather than to make up a core part of your investments. Thematic funds also tend to have higher fees than broad market funds.

6. Individual assets

Funds save you from researching and picking individual companies to invest in. But as we’ve seen above, even funds with an emphasis on ethical investing aren’t guaranteed to meet your expectations. Actively managed funds may still pick companies you don’t like, and index funds may have no choice but to include an undesirable company due to the index they track. It can be really tricky to find a fund that fully aligns with your ethical views and preferences!

Investing in individual assets can solve this issue, giving you the most control over how your portfolio is constructed. These assets can include:

- Shares – Gives you a share of ownership in a company. Shares usually also give you voting rights, so you can have your say on company issues.

- Bonds – Involves lending money to an organisation. A growing number of organisations are issuing green bonds, which are specifically issued to raise money for initiatives that have environmental benefits.

- Crowdfunding – Similar to shares, but usually involves investing into high growth companies looking to raise capital. Allows you to make a direct impact on companies you care about, as the money invested in crowdfunding deals typically go towards the company you’ve invested in (as opposed to other shares, where the money you invest usually goes to the seller of those shares).

Further Reading:

– Shares 101 – How to buy shares, which companies to pick, and more

– Bonds 101 – 5 things to know about investing in bonds

– 4 things to know about investing in Equity Crowdfunding

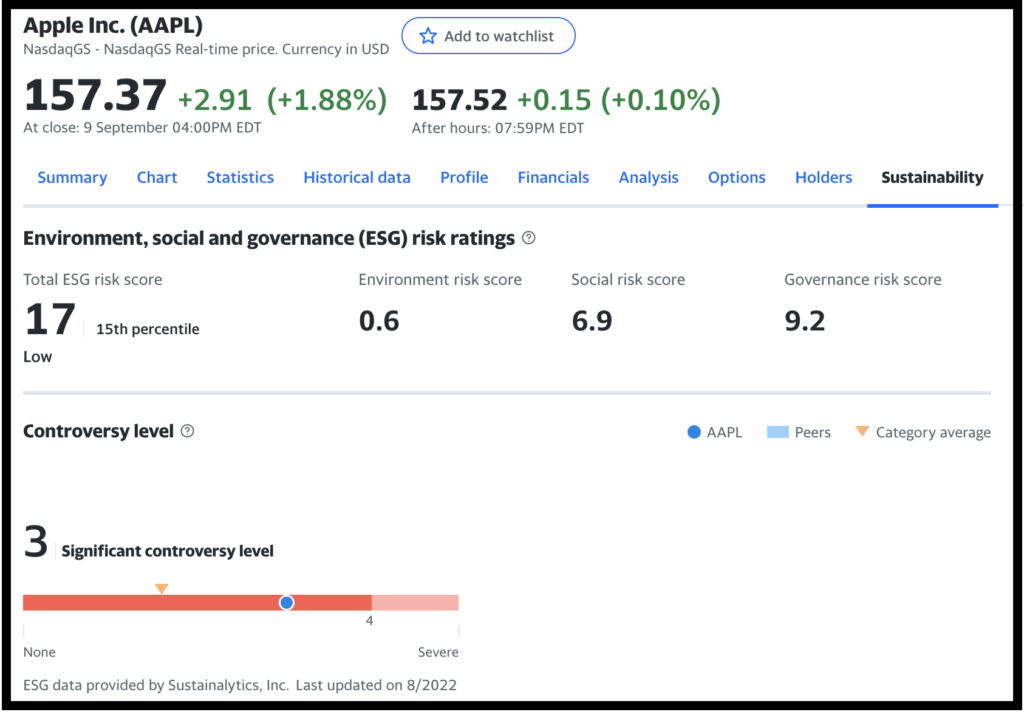

However, a potential issue with individual assets is that it can be hard to measure a company’s ESG metrics and its alignment with your ethics, especially if you don’t have an in depth knowledge of that business. Retail investors usually have to rely on annual reports and news articles to get their information, but those aren’t guaranteed to provide a detailed reflection of a company’s activities and controversies.

Yahoo Finance provides sustainability scores for a limited number of companies, but they’re not in depth enough to get a good understanding of how a company got a particular score. But hopefully more resources become available as ethical considerations become increasingly important when picking companies to invest in.

Otherwise plenty of other organisations like fund managers and brokers do sustainability research on companies. However, this research is usually proprietary and for internal or client use only. In this case, getting professional advice (e.g. from the likes of Craigs Investment Partners) may be a good approach if you’re looking to build a DIY ethical investment portfolio.

Conclusion

Traditional factors like investment timeframe and risk tolerance are key considerations when it comes to choosing what to invest in, but ethics and sustainability is an increasingly important topic. However, ethical investing is tricky as it means so many different things to different people. There’s no one size fits all solution when it comes to investing ethically:

- Sin stock funds – Provide exposure to sectors that most people consider to be unethical.

- Traditional funds – Provide broad exposure to the market without any ethical considerations. They remain some of the most popular products given their low fees, accessibility, and ease of use.

- Funds with exclusions – Provide broad exposure to the market, but screen out companies involved in certain contentious industries.

- ESG Integrated funds – Go further than negative screening by increasing their exposure to companies considered to be sustainable or companies aligned with certain values.

- Thematic funds – Invests in a particular theme, some of which can be perceived to have a positive impact on the world.

- Individual assets – Even the most ethical funds may not align with your values. Investing in individual assets gives you the most control over what companies go into your portfolio.

Overall there’s nothing wrong with any of these different approaches to ethical investing, and none is better than another. Every individual’s ethical views and attitude towards ethical investing is different and perfectly valid. So the type of investment you should pick comes down what ethical investing means to you, and what aligns with your personal values.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.