S&P 500 index funds are one of the most popular investment options for Kiwis. But they’ve been a few changes since we released our popular Smartshares US 500 (USF) vs Vanguard S&P 500 (VOO) – Which ETF is better? article in August 2021. Most notably fund managers Kernel and Foundation Series released their own S&P 500 funds to contend with Smartshares’ and Vanguard’s offerings. So which of these four options is the best for investing in the S&P 500? In this article we’ll take a detailed look at each fund including the differences between them, their fees and taxes, and other considerations to help you make a decision on which one to invest in.

This article covers:

1. What’s on offer?

2. Performance and currency hedging

3. Fees & taxes

4. Other considerations

Update (10 Nov 2022) – Added the Foundation Series US 500 Fund to the comparison.

Update (9 May 2023) – Updated to reflect new fees and options for investing in VOO

Update (25 Jul 2023) – Added coverage of the Smartshares US 500 NZD Hedged ETF to the article

1. What’s on offer?

S&P 500 index funds allow you to invest into the famous S&P 500 index, which represents the 500 largest companies listed in the United States. There’s some pretty big, well known companies in the S&P 500 and the 10 largest companies in this index are:

- Apple

- Microsoft

- Amazon

- Alphabet (Class A)

- Alphabet (Class C)

- Tesla

- Berkshire Hathaway (Class B)

- Unitedhealth

- Johnson & Johnson

- Nvidia

Fun fact:

The index has a quirk where it contains 503 constituents. This is because some companies in the index have two classes of stock. For example, Alphabet has Class A and Class C stock listed on the market. These are counted as two constituents, but only take up one slot in the 500 companies allowed in the index.

Further reading:

– What do NZX 50, S&P 500, and Total World index funds actually invest in?

The Smartshares US 500 ETF (USF), Foundation Series US 500 Fund, Kernel S&P 500 Fund, and Vanguard S&P 500 ETF (VOO), are three of the major S&P 500 index fund options for New Zealand investors. Below we’ll take a closer look at the options from each issuer.

Smartshares US 500 (USF)

Smartshares offers the US 500 ETF (USF). It’s a NZ domiciled ETF tracking the S&P 500 index. You can invest in this fund direct from Smartshares (minimum investment $500), through InvestNow (minimum investment $50), or via an NZX broker like Sharesies (minimum investment $0.01).

The US 500 ETF is also offered by Smartshares’ sibling fund manager SuperLife. The SuperLife version of this fund has the same underlying investments, but has slight differences around fees and tax which we’ll cover later the in article. The SuperLife US 500 Fund is available direct from SuperLife (minimum investment $1), or through Flint (minimum investment $50).

Smartshares also offers the US 500 NZD Hedged ETF (USH). This is the same as USF but is currency hedged to the NZ dollar (more on currency hedging later). Being a relatively new fund, USH isn’t yet available on some platforms like InvestNow and SuperLife, but is available direct from Smartshares or via Sharesies.

Foundation Series US 500

Foundation Series offers the US 500 Fund. Like Smartshares USF, it’s a NZ domiciled fund tracking the S&P 500 index. You can invest in this fund through InvestNow (minimum investment $50).

Kernel S&P 500

Kernel offers the S&P 500 Fund which tracks the S&P 500 Dynamic Hedged Index. It’s a NZ domiciled fund investing in the same underlying companies of the S&P 500, but is currency hedged to the NZ Dollar. You can invest in this fund directly via Kernel (minimum investment $1).

Vanguard S&P 500 (VOO)

Vanguard offers the S&P 500 ETF (VOO), which is a US listed ETF. You can invest in this fund through a broker that offers access to the US market like Sharesies, Hatch, Stake, Superhero or Interactive Brokers.

Other S&P 500 index funds:

There are many more S&P 500 funds listed in the US sharemarkets like the iShares Core S&P 500 ETF (IVV) and SPDR S&P 500 ETF Trust (SPY). This article will focus on Vanguard’s VOO offering, but the concepts discussed in this article can generally be applied across all US listed S&P 500 ETFs.

Fun fact:

Smartshares, Foundation Series, and Kernel funds all track the S&P 500 by investing into the Vanguard S&P 500 ETF (VOO) as their sole holding, instead of investing directly into the underlying companies of the index.

2. Performance and currency hedging

All three funds track the same index and hold exactly the same companies. There’s no opportunity for one fund to perform better than another in terms of the underlying investments they hold. But those looking at sites like Yahoo Finance to compare the returns of USF with VOO will find that their returns are different. For example, USF has increased in price by 82.73% over the last 5 years, while VOO has increased by just 55.21%.

That’s because Vanguard’s VOO is priced in USD, while Smartshares’ USF is priced in NZD. So to make an apples to apples comparison between the two funds, you’ll need to convert the price movements of VOO to NZ Dollars. And in the last 5 years, the NZD has fallen 16.73% against the USD.

So once you factor in these exchange rate movements, you’ll see that VOO and USF have performed very similarly:

| 1 year return | 5 year return (p.a.) | |

| Smartshares US 500 (USF) | 10.88% | 15.24% |

| Kernel S&P 500 | -1.33% | 12.29% |

| Vanguard S&P 500 (VOO) NZD return | 10.87% | 15.27% |

So how come Kernel’s fund is so different? Kernel’s fund (as well as Smartshares’ USH fund) is currency hedged to the NZ Dollar, essentially removing exchange rate volatility between the NZD and USD from the equation. That means Kernel and Smartshares’ hedged funds should deliver a similar return to VOO’s USD return.

This hasn’t worked in Kernel’s favour in recent years. The NZD has weakened against the USD, leading to unhedged investments like USF and VOO going up in NZD terms, but Kernel’s fund hedges away and misses out on this favourable exchange rate movement. But remember, exchange rate volatility goes both ways – If the NZD were to go up against the USD, that would work in Kernel’s favour. It’s all a little confusing, but in summary:

- Smartshares US 500 (USF) – Priced in NZD (but not hedged to the NZD), so will deliver a similar return to the S&P 500 index, plus will be impacted by exchange rate fluctuations between the NZD and USD.

- Foundation Series US 500 – Same as above. Priced in NZD (but not hedged to the NZD).

- Kernel S&P 500 – Priced in NZD and currency hedged to the NZD, so will deliver a similar return to the S&P 500 index in USD terms. It won’t be impacted by exchange rate fluctuations between the NZD and USD.

- Smartshares US 500 NZD Hedged (USH) – Same as above. Priced in NZD and currency hedged to the NZD.

- Vanguard S&P 500 (VOO) – Priced in USD. Will deliver a similar return to the S&P 500 index, plus will be impacted by exchange rate fluctuations between the NZD and USD (given you have to change between NZD and USD when buying and selling the fund).

Is it better to currency hedge?

Unfortunately no one can predict future currency movements with 100% certainty so we don’t know which fund will deliver the best performance going forward. But it’s our opinion that hedging isn’t necessary – given S&P 500 index funds are long-term investments, investors have time to ride out any exchange rate volatility. In the past Kernel has even made strong arguments in favour of being unhedged.

But because Kernel and Smartshares’ hedged fund essentially strips away the exchange rate layer, the hedged option might be less confusing for investors to understand. The USD return you see for VOO on Yahoo Finance is roughly what you’ll get with the currency hedged funds. Overall there’s no right or wrong or definitive best option, and the one you should choose will come down to your personal preferences.

Further reading:

– Hedged vs Unhedged funds – What’s better?

3. Fees & taxes

There’s a few significant differences in the fees and taxes you’ll pay under each fund:

Management fees

All funds charge a management fee which is an ongoing fee charged as a percentage of the amount you have invested in a fund, and reflected as a tiny deduction in your fund’s unit price:

| Fund | Management Fee |

| Smartshares US 500 (USF) | 0.34% |

| Smartshares US 500 NZD Hedged (USH) | 0.38% |

| SuperLife US 500 | 0.44% |

| Foundation Series US 500 | 0.03% |

| Kernel S&P 500 | 0.25% |

| Vanguard S&P 500 (VOO) | 0.03% |

Foundation Series and VOO’s management fees are by far the cheapest, but that doesn’t tell the full story…

Foreign exchange fees

Given VOO is listed in the US, you must convert your NZ Dollars to US Dollars in order to buy it. This conversion comes with foreign exchange fees, which varies depending on which platform you use:

- Sharesies – 0.5%

- Hatch – 0.5%

- Stake – 1% with a minimum charge of $2 USD

- Superhero – ~0.79%

- Interactive Brokers – 0.002% with a minimum charge of $2 USD

These fees will also apply when you eventually sell, and need to move the money back to NZ Dollars.

Foreign exchange fees don’t apply when buying and selling Smartshares, Foundation Series, and Kernel funds, given they’re bought and sold in NZ Dollars. Each fund manager still has to change your NZD to USD to buy the underlying assets of each fund, but the costs associated with that are covered by the management fees.

Brokerage fees

For Foundation Series you may need to pay a transaction fee of 0.50% every time you buy or sell units in the fund.

For VOO you may need to pay brokerage/transaction fees every time you buy or sell units in the fund. This varies by platform:

- Sharesies – 1.9%, with a maximum charge of $5 USD

- Hatch – $0.01 per share with a minimum charge of $3 USD

- Stake – 0.01%, with a minimum charge of $3 USD

- Interactive Brokers – $0.005 per share with a minimum charge of $1 USD

For Smartshares, you’ll also have to pay brokerage if you buy or sell USF through Sharesies or another NZX broker. However, these fees are avoidable if you use InvestNow, SuperLife, or Flint to access USF.

Kernel doesn’t charge any brokerage fees.

Spreads

Spreads typically apply when buying and selling Smartshares’ and Vanguard’s ETFs. For USF you can expect to pay a spread of around 0.04%, and for VOO you can expect a spread of around 0.01%. Spreads mean you’ll buy units in each ETF at a small premium, and sell them at a small discount. But because these funds are ETFs (listed and traded on the sharemarket) spreads can fluctuate depending on market conditions.

Other fees

Some investment platforms charge other types of fees, most notably:

- Smartshares – A one-off $30 set-up fee applies if you’re investing directly via Smartshares.

- SuperLife – An account fee of $12 per year applies if you invest directly through SuperLife.

- Kernel – An account fee of $5 per month applies if you’re investing over $25,000 through Kernel. This can increase their effective fees by quite a bit, from a headline management fee of 0.25% to 0.49% if you’re investing $25,000, or 0.35% if you’re investing $100,000 – That’s higher than USF’s fee.

- Hatch – A one-off set-up fee of $1.50 USD, plus $0.50 USD annually for tax filing fees.

- Stake – A one-off set-up fee of $5 USD, and $2 USD withdrawal fee.

- Interactive Brokers – Withdrawal fees of $15 NZD if you make more than 1 withdrawal per month.

Tax

Our different S&P 500 index funds are structured differently, and this means they can be taxed in slightly different ways.

| Fund | Fund structure |

| Smartshares US 500 (USF) | Listed PIE |

| Smartshares US 500 NZD Hedged (USH) | Listed PIE |

| SuperLife US 500 | Multi-Rate PIE |

| Foundation Series US 500 | Multi-Rate PIE |

| Kernel S&P 500 | Multi-Rate PIE |

| Vanguard S&P 500 (VOO) | Foreign Investment Fund (FIF) |

Let’s start with the Vanguard fund which is a US domiciled investment and therefore considered to be a Foreign Investment Fund (FIF) in which special tax rules apply. Essentially you’ll need to calculate your taxable income using one of the following methods and include that income in your end of year tax return:

- If you’ve invested under $50,000 into FIFs – You’re considered a de minimis investor and your distributions (dividends) are taxed at your marginal tax rate.

- If you’ve invested $50,000 or more into FIFs – Your taxable income must be calculated using either the FDR method or CV method, then taxed at your marginal tax rate.

All other funds are NZ domiciled PIEs. They automatically take care of your tax liabilities for you, which is good if you find FIF tax a hassle. However, there’s a misconception that these funds enable you to get around FIF tax altogether – Because all of these funds invest in overseas shares (which are also FIFs), the fund manager must pay FIF tax on those shares (calculated using the FDR method), which is then passed on to the fund’s investors (so you still end up paying FIF tax indirectly).

- SuperLife, Foundation Series, and Kernel funds are Multi-Rate PIEs (MRPs), so are taxed at your Prescribed Investor Rate (PIR), which should either be 10.5%, 17.5%, or 28%.

- The Smartshares ETFs are Listed PIEs so are taxed at a fixed rate of 28% (though if you’re on a lower rate you can claim back any excess tax paid on your tax return, to offset the tax payable on your other income).

One advantage of PIEs is that their maximum tax rate of 28% can be lower than your marginal tax rate. However, PIE funds can only apply the FDR method in calculating their taxable income, and not the CV method (which is useful during years of low or negative returns). A more comprehensive look at the FIF tax rules and quirks can be found in the article below.

Further reading:

– Tax on foreign investments – How do FIF and Estate Taxes work?

What’s the most tax efficient?

Let’s assume you’re on the 33% tax rate and 28% Prescribed Investor Rate. With the PIEs, we can expect the annual tax impact on your fund to be 1.40% p.a. (5% deemed dividend with the FDR method x 28% PIR).

For the Vanguard ETF, your tax impact depends on whether you apply the FIF tax rules or the de minimis exemption:

- FIF – Estimated weighted average tax impact of 1.22% p.a. This assumes the FDR method has a tax impact of 1.65% and is applied 70% of the time, the CV method during a low 2% return year has a tax impact of 0.66% and is applied 10% of the time, and the CV method during a negative return year has a tax impact of 0% and is applied 20% of the time.

- De minimis exemption – Estimated annual tax impact of 0.66% p.a. (2% dividend x 33% tax rate).

Fortunately there’s no tax leakage issues to be worried about on any of these funds.

So despite being a FIF the Vanguard ETF has a smaller tax impact compared with our PIEs (for a 33% taxpayer anyway), thanks to its ability to apply the de minimis exemption and CV method. However, this tax advantage has to be balanced against the time, effort, and potential accounting costs associated with FIFs.

Fees & Tax comparison

There’s quite a lot of variables here, making it quite hard to make a fair comparison between the funds. On one hand we have Smartshares and Kernel whose funds have a higher management fee, but don’t attract any FX or brokerage fees and are simpler when it comes to tax. On the other hand we have Foundation Series and Vanguard who have a lower ongoing management fee, but attracts extra one-off transaction fees.

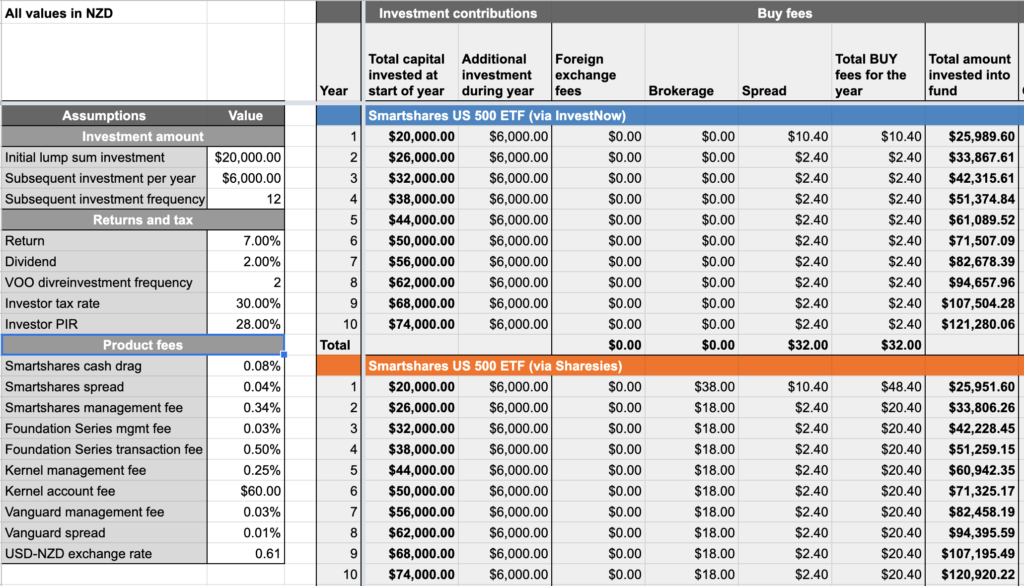

So we plugged the numbers into a spreadsheet to see which fund would work out best for a few different scenarios. It’s not a sophisticated calculation and has many limitations, but should still give us a good idea of the results between each fund:

A – Andrew from Arrowtown

Andrew has $100,000 NZD to invest in a S&P 500 ETF. His tax rate is 33%. After 10 years Andrew’s investment would be worth:

| Fund/Platform | Result after 10 years |

| Smartshares USF (via InvestNow) | $200,922 |

| Foundation Series US 500 | $205,348 |

| Kernel S&P 500 | $202,143 |

| Vanguard VOO (via IBKR) | $202,537 |

| Vanguard VOO (via Sharesies) | $199,816 |

| Vanguard VOO (via Hatch) | $200,413 |

| Vanguard VOO (via Superhero) | $199,397 |

B – Barry from Bluff

Barry has $20,000 NZD to invest in a S&P 500 ETF. He will follow this lump sum investment with an additional $500 investment every month. His tax rate is 30%. After 10 years Barry’s investment would be worth:

| Fund/Platform | Result after 10 years |

| Smartshares USF (via InvestNow) | $130,003 |

| Foundation Series US 500 | $131,759 |

| Kernel S&P 500 | $130,161 |

| Vanguard VOO (via IBKR) | $134,360 |

| Vanguard VOO (via Sharesies) | $131,768 |

| Vanguard VOO (via Hatch) | $132,910 |

| Vanguard VOO (via Superhero) | $133,191 |

C – Courtney from Castlepoint

Courtney will invest $250 per month into a S&P 500 ETF. Her tax rate is 17.5%. After 10 years Courtney’s investment would be worth:

| Fund/Platform | Result after 10 years |

| Smartshares USF (via InvestNow) | $46,259 |

| Foundation Series US 500 | $46,714 |

| Kernel S&P 500 | $46,295 |

| Vanguard VOO (via IBKR) | $47,582 |

| Vanguard VOO (via Sharesies) | $47,073 |

| Vanguard VOO (via Hatch) | $46,993 |

| Vanguard VOO (via Superhero) | $47,826 |

So investing in VOO through Interactive Brokers seems to deliver the better result over the long-term for most scenarios. It even beats out Foundation Series, the cheapest NZ domiciled option, as FIFs are often more tax efficient than PIEs for those investing less than $50,000. The catch is that you do have to commit to holding these funds for at least 3-4 years for the lower management fees to start offsetting the higher transaction and FX costs.

However, there’s not a massive gulf between the different options, and this comparison doesn’t take into account non-financial factors like ease of use (like user friendliness of the UI and auto-invest functionality), and being set-and-forget when it comes to taxes.

You can copy the spreadsheet we used to do the calculations here (using Google Sheets) and play around with the numbers if you wish to do your own comparison.

4. Other considerations

There’s some other important considerations when deciding on which S&P 500 index fund to invest in.

S&P 500 vs Global index funds

The S&P 500 is one of the most popular and attractive investment vehicles for a number of reasons such as:

- It’s well known and easy to understand

- It’s well diversified

- It’s had a track record of strong returns

But how does it compare with global shares index funds which invest more broadly across the world?

Popularity and ease of use

The S&P 500 is the world’s most famous sharemarket index, and investment content creators are constantly talking about it. It easy to understand, containing the 500 largest companies listed in the United States, many of which are highly recognisable like Apple, Tesla, and Walmart. Global funds on the other hand are less commonly talked about – there’s not really a global shares index with the same level of recognition as the S&P 500.

But either way both the S&P 500 and global indices provide an easy way to get exposure to international sharemarkets, saving you from having to research and pick individual companies. And just because the S&P 500 is more popular, doesn’t necessarily mean it’s better.

Diversification

The 500 companies contained within a S&P 500 index fund provides plenty of diversification, and is certainly safer than going all in on 1-2 companies. Several industry sectors are represented in the index including IT, healthcare, and consumer goods. Its industry breakdown isn’t too dissimilar to the FTSE Global All Cap Index:

| Industry | S&P 500 Weighting | FTSE Global Weighting |

| Information Technology | 26.8% | 20.4% |

| Healthcare | 15.1% | 12.3% |

| Financials | 10.8% | 14.4% |

| Consumer Discretionary | 10.5% | 13.6% |

| Communication Services | 8.9% | 3.1% |

| Industrials | 7.8% | 13.1% |

| Consumer Staples | 7.0% | 6.6% |

| Energy | 4.4% | 5.1% |

| Utilities | 3.1% | 3.4% |

| Real Estate | 2.9% | 3.7% |

| Materials | 2.6% | 4.3% |

In addition, the S&P 500 is said to have good geographical diversification as ~30% of its companies’ revenues are derived from outside the US. However we’d argue against this, as the S&P 500 only has companies listed in one country, whereas global funds will typically give you exposure to companies listed in 20-40 countries:

| Country | S&P 500 Weighting | FTSE Global Weighting |

| United States | 100.0% | 59.2% |

| Japan | 0.0% | 6.2% |

| United Kingdom | 0.0% | 4.1% |

| China | 0.0% | 4.0% |

| Canada | 0.0% | 3.2% |

| France | 0.0% | 2.5% |

| Switzerland | 0.0% | 2.4% |

| Australia | 0.0% | 2.1% |

| Germany | 0.0% | 1.9% |

| Taiwan | 0.0% | 1.9% |

So our strong preference is to invest in a global shares index fund instead of the S&P 500 due to the significantly greater geographical diversification you’ll get. You don’t need to invest in both, as being the largest market in the world, US shares already make up a large proportion (typically 55% – 60%) of global funds.

Performance

The average return of the S&P 500 (back to the index’s inception in 1957) is 10.67% per year, despite going through events like the Global Financial Crisis and COVID-19. It’s been a great way to grow wealth over the long-term, and has done better than global shares in recent times:

| 3 months | 1 year | 5 years | |

| Smartshares US 500 (USF) | -2.12% | 10.88% | 15.24% |

| Smartshares Total World (VOO) | -3.38% | 2.96% | 10.80% |

However, it’s far from guaranteed that US shares will continue to outperform global shares into the future. No one knows with 100% certainty which country’s sharemarket will perform the best over the long run, and it’s common for yesterday’s winners to become tomorrow’s losers.

But there’s no right or wrong answer here – it’s ok to pick the S&P 500 if that’s your personal preference. US listed companies are some of the best in the world, and you’re unlikely to go too far wrong with them over the long-term

Further reading:

– What’s the best global shares index fund in 2022?

– S&P 500 vs Global index funds – What’s better?

Unit prices

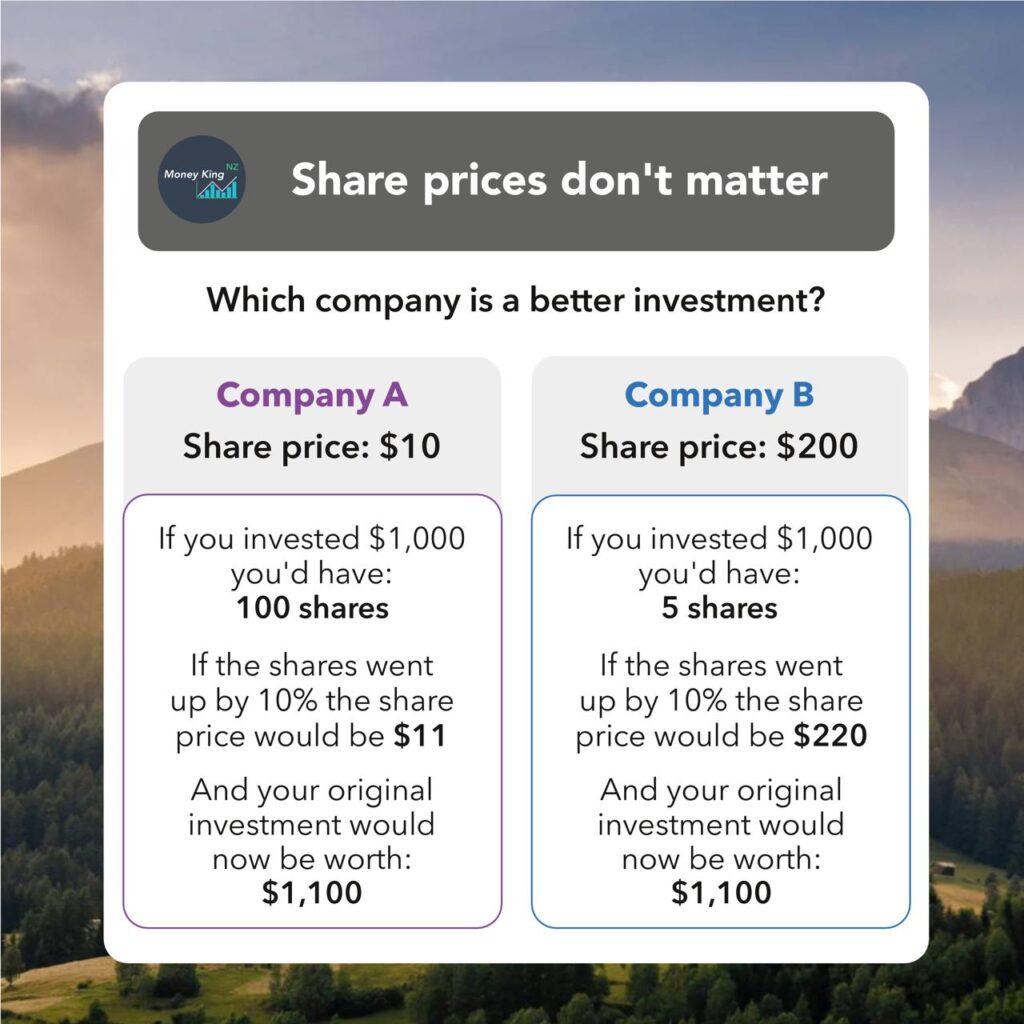

Unit prices are a common source of confusion for investors as Smartshares’ and Kernel’s funds essentially represent units in Vanguard’s fund, yet have significantly different prices:

| Fund | Unit price |

| Smartshares US 500 (USF) | $11.22 NZD |

| Foundation Series US 500 | TBC |

| Kernel S&P 500 | $3.82 NZD |

| Vanguard S&P 500 (VOO) | $348.36 USD |

But that fact that 1 unit of VOO is more “expensive” is irrelevant. Fund managers can choose whatever unit price they want when starting up a fund. In this case both Smartshares and Kernel have split each unit of VOO into smaller, lower priced units, as Kiwi investors are typically used to lower unit prices. A low or high unit price is neither better or worse – you get the same performance & dividends either way.

Fractional units

It isn’t possible to buy fractional units in Smartshares’ ETF (unless you invest via Sharesies). This can result in some quirks where you’re left with uninvested cash after putting in an investment order to buy these ETFs, especially when using the InvestNow platform (this quirk is described in more detail in this article). All other funds support fractional units, so don’t have the same issue.

Distributions

All funds intend to pay distributions at the following frequencies:

- Smartshares – 6 monthly, except for SuperLife – No distributions

- Foundation Series – No distributions

- Kernel – Quarterly

- Vanguard – Quarterly

For Smartshares and Kernel distributions can be automatically reinvested into the fund (except when using Sharesies), or taken as a cash payment.

For Vanguard, your dividends will be paid out as USD cash to your brokerage account. Watch out for the brokerage fees you’ll incur to reinvest these distributions, especially with Hatch as its flat $3 USD fee could be quite chunky relative to the dividend payment you wish to reinvest.

SuperLife and Foundation Series do not pay distributions, instead any income/dividends the funds earn are automatically reinvested and reflected as an increase in their unit prices.

Distribution yield

In regards to the distribution yield, you’ll find some differences between each fund:

- Smartshares USF – 0.99%

- Kernel – 1.73%

- Vanguard – 1.62%

However, these differences are largely irrelevant. Remember all funds invest in the same 500 companies, so there isn’t any opportunity for one fund to generate more dividend income over another. While Smartshares’ yield is lower, it reflects the fact that tax is passed through to investors in the form of reduced dividends, whereas Kernel’s and Vanguard’s dividend doesn’t reflect any tax.

Overall this isn’t a big difference to worry about, although Kernel’s and Vanguard’s arrangement may be slightly advantageous. That’s because for these funds tax is paid at the end of each year (rather than built into your dividend payments), so that means more of your money stays invested and earning a return throughout the year.

Best platform to buy VOO

There’s a number of brokers you can use to buy VOO such as Sharesies, Hatch, Stake, Superhero, Interactive Brokers, as well as a few others. There’s no single best option, but rather the best one for you will depend on your personal preferences and how much you’re investing. But in general:

- Superhero is the most cost effective for those investing under ~$380 USD at a time, thanks to their percentage based fees.

- Interactive Brokers is the most cost effective for those investing larger amounts, thanks to their flat fees.

Sharesies, Hatch, and Stake usually work out to be more expensive, though other factors could still make it a good option. For example, Sharesies offers a large range of products such as NZ/Aussie/US shares, managed funds, savings, and KiwiSaver (coming soon) all under one roof. This convenience factor could make them an attractive option despite their higher fees.

KiwiSaver

A couple funds are available to be selected as part of a KiwiSaver scheme:

- SuperLife US 500 – SuperLife KiwiSaver

- Kernel S&P 500 – Kernel KiwiSaver

- Foundation Series US 500 – InvestNow KiwiSaver

Conclusion

Would we invest in a S&P 500 index fund? Probably not. The US is just one part of global sharemarkets, and we don’t see any reason to concentrate our investments solely into the US, over diversifying them across multiple countries through a global shares index fund.

But with the S&P 500 being a classic go-to choice for investors, there’s still plenty of interest in Smartshares, Foundation Series, Kernel, and Vanguard’s index fund options. So what are our overall thoughts on each fund?

- Smartshares US 500 – Has reasonable fees, is easily accessible through lots of platforms, and takes care of your taxes for you. However, the flat tax rate and lack of fractional units on some platforms can be annoyances for some investors.

- Foundation Series US 500 – Probably the all round best option here. Comes with the lowest headline management fee at just 0.03% (matching Vanguard) and is a PIE so avoids FIF tax. Should work out cheaper than Smartshares and Kernel over the long-term as the low management fee needs time to offset the higher 0.50% transaction fee.

- Kernel S&P 500 – Kernel likes to offer unique funds that are slightly different to their competitors, and heir S&P 500 Fund is no different, adding currency hedging. But Kernel’s added account fee for higher balances could make them a relatively expensive option, and the hedging is arguably unnecessary.

- Vanguard S&P 500 – Also comes with the lowest headline management fee at just 0.03%, and is potentially more tax efficient. But this comes with added costs such as brokerage and foreign exchange fees, and tends to be the least investor friendly option thanks to possibly having more effort in dealing with taxes.

Let us know in the comments what you think – Would you invest in an S&P 500 fund over a global fund? And if so, which one would you pick?

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Would be interested to know what global fund you would invest in.

Some global funds are too diversified for my liking.

In saying that some are predicting the US500 to only average 4% over the next 10 years. Will be interesting to see if that plays out.

Thanks for dissecting this all out for us!

We personally have the Kernel Global 100 Fund – not many would call that too diversified! Otherwise we’d go for Russell’s Sustainable Global Shares Fund if we were on InvestNow. One of our recent articles compared the global fund options: https://moneykingnz.com/whats-the-best-global-shares-index-fund-in-2022/

Kernel’s Global Infrastructure performnce is quite impressive especially 1 year when majority were falling

Yes, infrastructure related companies have been relatively resilient in recent times, thanks to being stable businesses with inflation hedging properties. Up 15.28% over the last year vs 3.54% for the Global 100.

Thanks MK.

Vanguard exclusions funds on Investnow. Have you done an article on this?

I am considering

S&P 500 (which platform is better if investing +50K?

Macquarie’s All Country Global Shares Index Fund

Do you know of any good dividend paying Funds?

https://www2.asx.com.au/markets/company/QUS ?

Thanks

Hi, we covered global funds here which includes the Vanguard Exclusions Fund and the Macquarie All Country Fund: https://moneykingnz.com/whats-the-best-global-shares-index-fund-in-2022/

As for dividends, most broad market funds like global, S&P 500, or NZX 50 funds will pay them. But if you are specifically looking for dividends you might want to look into Smartshares’ NZ Dividend or Aussie Dividend funds, or Kernel’s Dividend Aristocrats fund.

Sharesies does now allow transfers in and out.

That’s been the case for a while for NZX shares. Are they now offering transfers for ASX and US shares?

I plan to invest $100K NZD & I settled on one of these 2 funds:

Foundation Series US 500 Fund (from Investnow) = expense ratio 1.03 (Management fee 0.03% + 0.50% Buy fee + 0.50% Sell fee)

vs.

S&P 500 (from Kernel) = expense ration 0.25% + $60 Annual Platform fee = 0.25% + (60/100000)*100 = 0.25% + 0.06% = 0.31%

Due to the lower expense ratio, it appears that it’s best to invest in S&P 500 (from Kernel) and NOT Foundation Series US 500 Fund (from Investnow)

Your thoughts, please.

Regards

The fee calculation is a little more complicated than that. The management fee is an ongoing fee, while the transaction fees are one off charges you only pay when you buy or sell units in the fund.

So in year 1:

In year 2:

In year x (the year you sell your fund):

So Foundation Series has high upfront costs and high exit costs, but lower ongoing costs. So depending on how long you plan to hold the funds, Foundation Series might work out cheaper as the lower ongoing costs offset the high buy/sell fees. On the other hand, if you sell out of Foundation Series too soon, Kernel would be cheaper as you wouldn’t have had enough time for the lower ongoing costs of Foundation Series to offset the buy/sell fees.

Thank you for your response and I understand it…

However, I forgot to mention this:

Initial Lumpsum Investment is NZD100K and then recurring monthly investment of NZD 10000/month.

So in this scenario, for the Foundation Series, the expense ratio is .03% +.5% (buy cost)=0.53%

Now at some time in the future (e.g. 20 years’ time) we would sell and then we would be impacted by .5% (sell cost).

So in this above scenario, I believe the total expense ratio is .03% + .5% (buy cost) + .5% (sell cost) = 1.03%

Your thoughts, please.

Kind regards

Hannah

The buy and sell fee only applies to the amount you’re buying/selling, not to your entire investment. So for your ongoing investments of $10,000 per month, the buy fee only applies to that $10,000 not to the $100,000 you already put in.

The sell fee of 0.5% won’t come into effect until year 20 until you sell.

Hello,

I appreciate a lot of your clear explanation. And it is now well understood.

Thank you for your explanations once again.

Regards

In addition, I also found that you already explained my queries in this earlier post of yours. I should search more.

https://moneykingnz.com/investnow-foundation-series-review-whats-the-catch-with-their-0-03-fee/

Hi there, I am looking to invest $100 per week into the SP500. My plan is to largely not touch this money, but to take out some withdrawals over my lifetime (for kids, travel etc).

Part of me is hesitant to invest in the Foundation series, as it has minimal return data yet and has a transaction fee (so if I changed my mind, or found a better fund there would potentially be a high exit fee).

So would choosing Smartshares via invest now, potentially be a better option to choose for the first 10 years and then I can move to foundation series once I see the long term return data. Or are we pretty sure that both funds will perform similarly?

Keen to hear your thoughts,

Lucy

Both funds’ performance will be almost identical. Both funds track the same index, so invest in the same underlying companies, so will perform the same. The difference you’ll face is fees. Foundation Series has the lower management fees, but as you say if you change your mind, it could work out more expensive as you might not have invested long enough for the lower management fee to make up for the transaction fees.

Great post.

I am currently investing in VOO using hatch platform and liked the idea of being able to alternate fif methods based on market return.

However I wonder if this is worth it given that my personal tax bracket is 39 per cent. Maybe a PIE fund taxed at 28 per cent would work out better even if FDR was applied all the time.

Thanks for your thoughts.

Under a PIE fund, the tax impact each year would be 1.40% (5% FDR x 28% tax rate).

Under VOO, tax impact each year varies depending on which FIF method you use.

If we assume that we use CV 30% of the time the average tax impact per year for VOO would be 1.60%. So a little higher than using a PIE. Obviously those calculations can vary depending on which assumptions you use.

I would like to start investing $50 a week into an s&p 500 fund. But wonder if the fees/exchange rates charges of doing this are more favourable if I were to save each week and deposit $200 every 4 weeks?

That depends on any transaction or FX fees your fund/platform may charge.

If the fees are purely percentage based e.g. 0.5%, then your fees are going to be the same regardless of whether you do 4 purchases of $50 or 1 purchase of $200, because 0.5% x ($50 x 4) is the same as 0.5% x $200.

If the fees are fixed e.g. $2 per transaction, then your fees will be cheaper to invest $200 at once (instead of across 4 transactions), because $2 x 1 is less than $2 x 4.

Hi, when I was starting out I bought Smart S&P500 but later added Foundation series SP500 because of their low fees. Performance was expcetional in 2024. I gradually added Foundation series world, somewhat lower return but still great. The funds perform better than my portfolio held with one of NZ highly regarded investment partners. It makes me wonder if I should continue with them… the investment partner that is 😉

IMO, long term is the key here. Short term high return wont necessarily lead to the same level of performance in the long run. I think SP500 is a good benchmark that you can use to measure the fund manager’s performance. Although you may not invest in SP500 for long, its performance can be checked easily. Use that to measure your fund manager on different timeframe and you will have the answer.

Me personally would trust SP500 over human beings managed fund.

Been doing some research for the best way to invest S&P500 from NZ and came across this article. While some of the info may need to be updated, the underlying philosophy and logic shared by you remain unchanged. Thanks for sharing.

Also, I got in touch with Kernel yesterday and confirmed they have removed their membership fee permanently:

“… I can confirm that we previously had a monthly fee for accounts with $25,000+. As at 31st December 2024, the fee no longer exists and will not come back in future. However, we may introduce other fees in future for added features and benefits, but the core product currently available will not see a fee come back.”

I believe by waiving the fees (including account fee) bundled with 0.25% management fee, access to hedged and unhedged SP500 as well as some other good funds makes Kernel a strong candidate for your investment journey.

Maybe time for another update to this article, lol?

Hi

we have recently sold an asset and have significant capital to invest over the next ten years or so without withdrawing

and we are looking for a secure dividend , to be paid out , leaving the original investment untouched

NZ residence, Taxed as a company at present , semi retired

Is sharesies a good platform or should we try – InvestNow ?

We are looking at ETF ‘s and index funds although we are very green investors

AJ

I would use sharesight’s share tracker and look into the returns of some of the funds you may be interested in. I’ve found hatch ok to use. However if you need to do an fif tax return you need to have the Sharesight pro plan. I think the Sharesight annual fee is tax deductible.

The thinking these days is that you don’t need dividends to live off. You can also withdraw capital instead of getting dividends and still keep your capital intact long term. Martin Hawes new book Retirement Ready has discussion on this in his investment chapter.