June 2022 has been a bleak month for investors! In this article we’ll take a look at how shares, bonds, and crypto have been holding up, discuss the prospects of a recession (plus reasons to be optimistic), and as usual provide updates on some investment products. Lastly we’ll take a look at what we’ve personally been up to in recent weeks.

This article covers:

1. Market movements

2. Is a recession coming?

3. Product updates

4. What we’ve been up to

1. Market movements

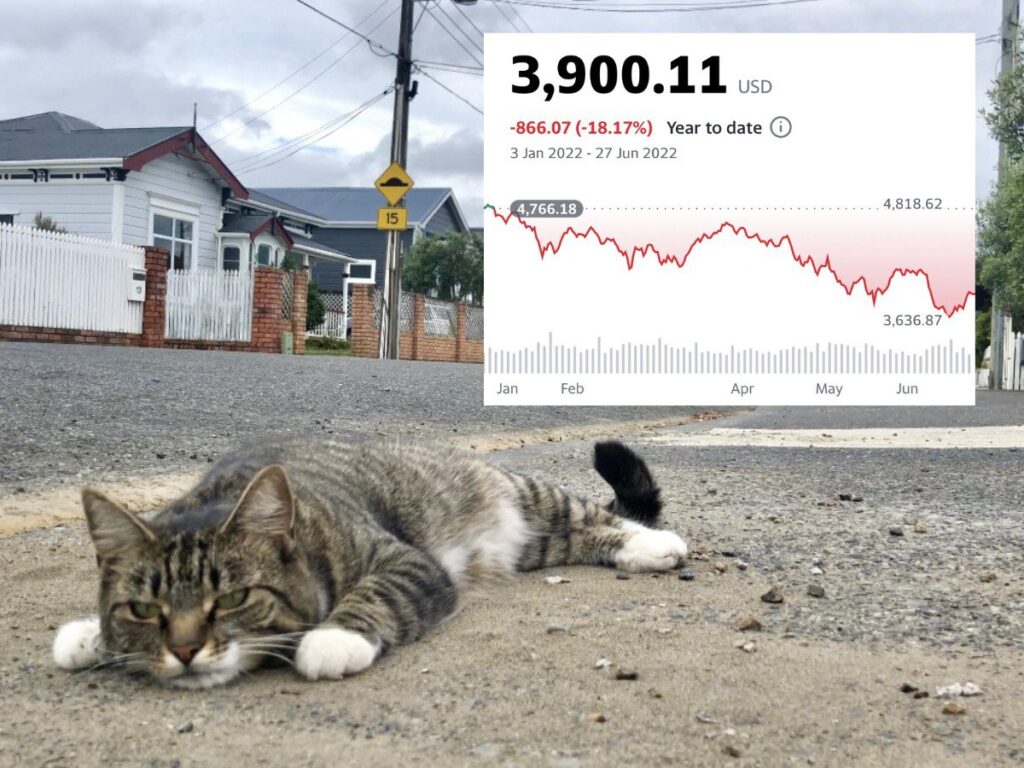

Already battered investment portfolios had salt poured into their wounds this month, with markets continuing to slide downwards. Let’s see how certain markets have been doing (as at 29 June 2022), by looking at the performance of selected Smartshares ETFs:

| 1 month return (NZD) | Year-to-date return (NZD) | |

| NZ shares (NZG) | -2.83% | -17.35% |

| Australian shares (AUS) | -7.63% | -8.07% |

| US shares (USF) | -3.08% | -14.24% |

| NZ Government bonds (NGB) | -2.25% | -6.86% |

| Global bonds (AGG) | -2.58% | -10.70% |

The downward slide this month comes as inflation numbers in the US were higher than expected at 8.6%, when many were hoping it would’ve started to eased. The fear that comes with higher than expected inflation is that central banks will raise interest rates more aggressively to tackle it – essentially putting brakes on the economy.

Bonds haven’t been immune from the market carnage either. They’re inversely correlated to interest rates – in general, when interest rates are expected to rise, bond prices tend to fall. Given bonds make up a large proportion of Conservative KiwiSaver funds, some have done worse their Growth counterparts in recent times. Here’s the recent performance of Simplicity’s KiwiSaver funds as at 31 May 2022:

| 1 month return | 3 month return | 1 year return | |

| Simplicity Growth | -1.78% | -4.41% | -3.38% |

| Simplicity Balanced | -1.27% | -4.43% | -4.93% |

| Simplicity Conservative | -0.59% | -4.54% | -6.58% |

It’s taught many investors that Conservative funds aren’t as “safe” as they may have expected – A good example of how every asset class has bad years, even bonds.

Cryptocurrency

Cryptocurrencies have also had a horror year so far, with most major coins falling 60%+:

| 1 month return (USD) | 6 month return (USD) | |

| Bitcoin | -30.19% | -57.35% |

| Ethereum | -35.27% | -69.41% |

| Solana | -18.21% | -79.50% |

| Dogecoin | -17.60% | -61.28% |

| Terra Luna Classic | +10.20% | -100.00% |

We’ve certainly seen people’s attitude to crypto turn as a result, especially when the asset class (which was often seen as a lucrative get rich quick scheme) doesn’t deliver the desired results.

In addition, they’ve been a few notable recent events in the crypto world such as:

- Luna – A major cryptocurrency which had its entire value wiped out, as the mechanisms that keep the Luna ecosystem running collapsed.

- Celsius – A crypto lending platform which suspended the ability for investors to make withdrawals after extreme market volatility led to the platform having liquidity issues.

- BitPrime – A NZ-based crypto broker which suspended trading, also coming into financial stress due to market volatility.

This doesn’t do good for the reputation of crypto which often already struggles to cement itself as a legitimate asset class. Though it’s probably not a bad thing to weed out some of the poorer quality coins and platforms. A good reminder to not take on more risk than you can handle.

It’s the long-term result that matters

It’s easy to criticise certain investments or markets in general when they’re not performing well. It’s an example of recency bias where people put more emphasis on recent results, rather than looking at the big picture. Take Mainfreight for example, whose shares have dropped over 20%. This seems really bad, especially as it’s underperformed the main NZX 50 index.

But investing isn’t a get rich quick scheme. Over the short-term, whether an investment will do well or not is essentially a coin flip. It’s inappropriate to judge such an asset on their short-term performance. Back to the Mainfreight example, if you look at their longer term results you’ll see that the company is still up an incredible 200% over the last 5 years.

That’s why we and many others are proponents of having a long-term mindset when it comes to investing. Good investors know that any market downturns are just noise, that they’ll usually be short lived, and that they’re an opportunity to buy up quality assets at lower prices. And over time, those quality assets tend to trend upwards – those long-term results are what really matters.

2. Is a recession coming?

Central banks around the world are facing a tough balancing act in getting inflation under control. Basically high inflation isn’t a good thing – it means our cost of living is rising quickly, which subsequently presents the risk of people demanding higher wages, resulting in prices spiralling even higher as business have higher costs to cover.

Central banks can raise interest rates as a tool to tackle inflation, but could end up stalling the economy in the process. And with rates currently rising fast, it’s almost guaranteed that they’ll be at least some short-term economic pain in the fight against inflation. Everyone seems to think a recession is imminent (if we aren’t already in one). So what’s actually happening out there?

What is a recession?

A recession is a sustained period of declining economic activity, and is often measured by having two consecutive quarters of negative GDP growth. We’re not there yet in New Zealand – While the most recent March 2022 quarter showed negative GDP, we still need to see next quarter’s numbers (which come out in September) to confirm we’re in a recession.

| Quarter | GDP |

| June 2021 | +2.8% |

| September 2021 | -3.7% |

| December 2021 | +3.0% |

| March 2022 | -0.2% |

| June 2022 | ? |

So given the technical definition of a recession relies on a trailing indicator, it’s possible New Zealand could already be in a recession. But given the time it takes for a recession to show up in the numbers, we may not know for sure until months after the fact.

Is a recession inevitable? Yes, a recession will eventually come – if not now, it could be next year, the year after, or several years later. Like sharemarket dips, recessions are very normal, and something we’ll likely face several times throughout our lifetimes. It’s a matter of when, not if.

How will it affect the sharemarket?

A recession means there’s less economic activity going on. People spend less money, businesses produce less goods and services, more people become unemployed, and everyone’s more pessimistic about the economy. This isn’t a good thing for most companies.

But keep in mind the sharemarket and economy are different things – the sharemarket is essentially just a collection of (mostly large) companies, while the economy is a much broader concept. The sharemarket won’t reflect the economic performance of your local dairy or favourite cafe for example. So we don’t know for sure what the impact on your investment portfolio will be. Nor do we know what the severity or length of the next recession will be. Not all recessions will be like the Global Financial Crisis, or the COVID-19 pandemic where large parts of the economy shut down for long periods of time.

Also keep in mind that sharemarkets are forward looking. The markets have fallen substantially this year, likely already pricing in the prospect of economic damage into current share prices. Because the chance of a recession is already factored into prices, we won’t necessarily see markets suddenly fall off a cliff when a recession is confirmed. Similarly, markets tend to recover when the economy is still in a recession – Given its forward looking nature, the market anticipates and prices in the economic recovery in advance of it actually happening.

So it’s extremely hard to predict the movement of the sharemarket in relation to a recession. We don’t know how much the markets have further to fall. The eventual recovery of the market won’t be announced in advance. So instead of trying to outsmart the market, it’s better to drip feed into your investments regularly and consistently.

A few reasons to be optimistic

We’re far from being experts in economics, but hopefully this helped you make sense of the current situation. There’s certainly a lot of doomsday predictions, and bad news headlines out there, but we like to be a bit more optimistic. So let’s finish with a few reasons why:

- The market has always recovered from a downturn – Sharemarkets have had a 100% track record of recovering from any crashes and corrections. While that record isn’t guaranteed to continue into the future, the companies listed on the sharemarket didn’t get there by standing still. They’ll continue to innovate, grow, and overcome any challenges the world throws at them, so there’s a good chance the markets will fare perfectly fine over the long-term.

- A recession may already be priced in to share prices – Share prices have already gone down substantially in anticipation of higher interest rates and economic pain. Things can always get worse if more bad news comes out, but it’s likely that the worst of the pain is behind us.

- Interest rates won’t go up forever – The Reserve Bank of New Zealand forecasts the OCR will peak at 4% in 2023. Many are sceptical that rates will actually reach that level, as the economy will cool down faster than expected (especially as business confidence is already falling). So chances are we may see the OCR settling down to a more neutral level (around 2%) sooner than we think. Squirrel has a good article that explores this from a housing market lens.

- The more pessimistic people are, the more likely we are at the bottom – Investor sentiment can be considered a contrarian indicator. Past data has suggested that the strongest sharemarket returns tend to follow periods when sentiment is very pessimistic, and the weakest returns follow periods when sentiment is very optimistic. Currently AAII sentiment data is showing extreme bearishness (pessimism over how the sharemarket will perform over the next 6 months), something that has pointed to the bottom of previous market crashes.

- You’re well educated – Given you’re reading this, you’re probably either already knowledgable or keen to learn more about investing. You know that the best way to deal with market downturns is to stay the course and keep contributing to your portfolio. The improvement in investor education seems to be evident in the fact that significantly fewer people are switching from Growth to Conservative KiwiSaver funds this time round compared with the COVID crash. So we think you’ll come out on the other side of this crash just fine.

3. Product updates

New global funds on InvestNow

A couple of new low cost global share funds became available on InvestNow this month. These are the:

- Russell Investments Sustainable Global Shares Fund (0.34% fee)

- Russell Investments Hedged Sustainable Global Shares Fund (0.36% fee)

They’re not strictly index funds, but are based on the MSCI ACWI Index, and are modified to exclude coal, nuclear and controversial weapons, civilian firearms, and tobacco. The funds also have a higher weighting to companies with higher ESG scores and companies participating in the transition to renewable energy, reducing their overall carbon footprint and fossil fuel exposures.

The funds’ competitive fees, tax efficiency, and sustainability tilt should make them a compelling alternative to the popular Macquarie All Country, Smartshares Total World, and Vanguard funds also available on InvestNow. Check out our article below for a comprehensive comparison between the funds:

Further Reading:

– What’s the best global shares index fund in 2022?

Stake offers stock lending

Stake announced that they’ll be offering a new stock lending feature, where you can lend out your shares to borrowers such as institutional investors and investment banks. If you opt-in to the feature, and your shares happen to get lent out, you may earn some passive income in return. You’ll also still get any dividends and capital gains/losses, however you lose any voting rights relating to shares that’ve been lent out. In addition, the borrower has to deposit collateral worth 102% of the shares being borrowed in order to secure the loan.

You make money from the fees a borrower has to pay for borrowing your stock. These borrowing fees depends on the specific shares you’ve lent, with larger companies tending to have lower fees, and smaller companies usually being more lucrative. The problem is that it’s not transparent how much of these borrowing fees will actually end up in your pockets. We understand that Stake shares some of those fees with DriveWealth (who facilitates the lending process), with investors getting just a 20% cut of what’s left.

Apart from the lack of transparency, we have a few other concerns about this feature:

- It’s low risk, but not no risk – Borrowers have to place assets like cash as collateral to secure their loan. This greatly reduces the risks, but you could still lose money if the borrower can’t pay you back and the collateral isn’t enough to cover the full value of your shares, or if DriveWealth itself goes bust.

- Stake takes the lions share of the profits – You only get 20% of the borrowing fee, while you take on all the risk.

- Investors are being opted-in automatically – We understand that investors are being opted in to the new feature automatically, which starts on 13 July. You’ll need to opt-out manually if you don’t wish to take part.

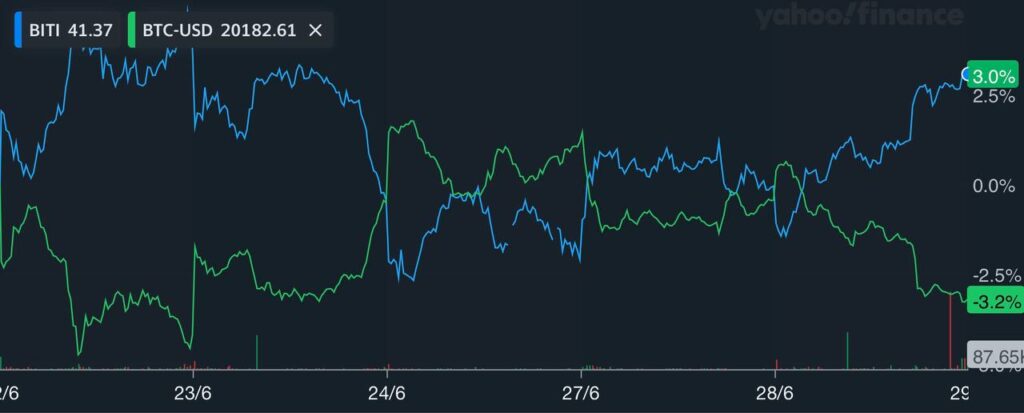

New Crypto ETFs

Those who think Bitcoin is going down can now invest in a new ETF (BITI – ProShares Short Bitcoin Strategy ETF) which shorts the cryptocurrency. That means that the ETF goes up when the price of Bitcoin goes down. Buying into the ETF is pretty much gambling, as the price of Bitcoin is way too unpredictable, but it may be of interest to people who are adamant that Bitcoin is going to zero. The ETF is listed in the US and is available on Hatch or Stake.

In other crypto ETF news, Canadian fund manager 3iQ has expressed interest in launching a couple of crypto ETFs here in New Zealand, following the company’s launch of Bitcoin and Ethereum ETFs in Australia. Would you in BITI or any of 3iQ’s ETFs? Let us know in the comments.

Flint lowers their minimum investment

Fund platform Flint has lowered their minimum investment from $250 to just $50 per purchase. This brings them in line with InvestNow’s minimum, and makes buying into their range of ~100 funds (from managers like SuperLife, Milford, and Harbour) much more accessible. And unlike InvestNow you don’t have to set up a regular investment plan to access the lower minimum. Thanks to Murray for letting us know about this.

Further Reading:

– Flint Wealth review – A superior InvestNow clone?

4. What we’ve been up to

Investments

You’re not alone in seeing your portfolios plummet this year, with our very own investments falling 10%+. But we’re not worried about that, as we’re investing long-term so the occasional downturn isn’t unexpected. So we’ve just been contributing to our investments as usual. And we’re not interested in timing the market, so we’re not trying to invest more, nor less during this time. But the nice part of investing during a downturn is that our Dollars go further in buying up more shares.

The only change we’ve really made during this time is around how often we check our investments. There’s no need to check our asset prices everyday when we’re investing for 10-20 years, especially when the number are so depressing right now.

Cost of living

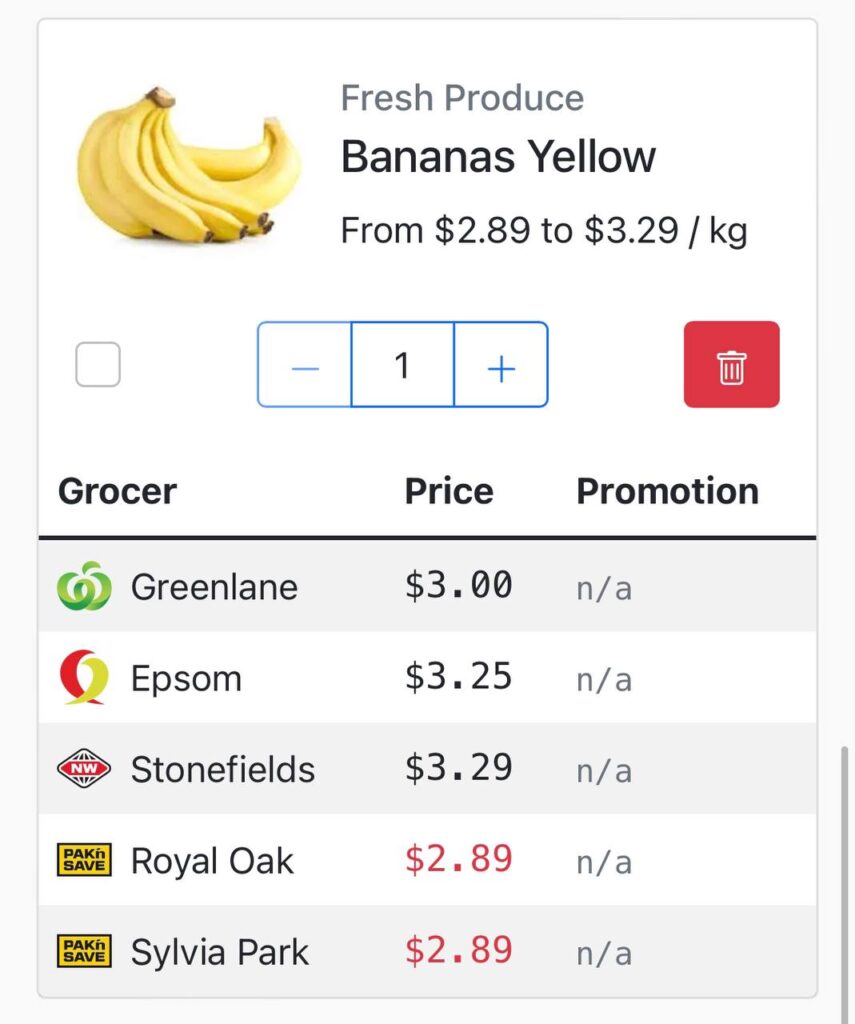

The rising cost of living has been challenging for so many people, with many basic needs like fuel, utilities, and housing becoming increasingly expensive. But one area where we fortunately haven’t been hit too hard is groceries. Here’s what we’ve been doing to keep our grocery bills relatively stable:

- Supermarket alternatives – We’ve been getting a lot of our fruit and vegetables from markets, Asian supermarkets, and fruit stores, which are often significantly cheaper than buying from the main supermarkets.

- Meal planning – We plan what we’re going to cook before going shopping. That way we know exactly what we need to buy for the week, and have minimal food wastage.

- Freezing meat – Meat probably makes up the biggest chunk of our grocery bills, so if one of our staples (e.g. rump steak, chicken breast, beef mince) is on special, we’ll buy extra and keep it in the freezer for future weeks.

- Buying home brands – Brands like Pams or Budget tend to be cheaper than the big brand equivalents. Plus there’s little to no difference in quality, with most home brand products coming out of the same factory as the mainstream brands.

- Comparing supermarkets – We often check the Grocer website to compare prices between nearby supermarkets. As a result we’ve been going to Pak’nSave Royal Oak instead of Pak’nSave Sylvia Park in recent weeks, which tends to have slightly lower prices.

Matariki holiday

Life for us isn’t all about saving and investing. We made use of the first Matariki public holiday to visit friends and family in Wellington, and eat more than we probably should’ve. A good few days break from work.

Money King NZ site

The Money King NZ site has been pretty quiet, with visitor numbers dropping off over the year, despite an improvement in the quantity and hopefully quality of our content. We’re probably getting half the views as we’d usually do. It’s simply a reflection of current investor sentiment – people are simply too scared to invest right now. Regardless of readership, we still intend to pump out new content every week, so hopefully you’ll find our articles useful, and consider sharing them with friends or family.

Conclusion

Thanks for dropping by on our site and reading our June 2022 news article. Things we’ll be keeping an eye on over the next few weeks include whether the Superhero brokerage platform will finally launch in NZ, whether Sharesies will launch a KiwiSaver scheme, and how the All Blacks will perform against Ireland. Lastly, be sure to check out our June 2022 articles if you haven’t already:

In case you missed them – June 2022’s articles:

– Ask Money King NZ (Winter 2022) – More investing questions answered

– When’s a good time to sell or switch your investments?

– 12 more investing myths and misconceptions busted

– What’s the best global shares index fund in 2022?

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Thanks a good read

Thank you!

Awesome work and love your insights. Thank you.

Thanks VJ

Thank you! This was a really helpful overview. I appreciated the link to the Squirrel article too. I hadn’t come across the Grocer NZ app before – very cool! I’m so glad you’re going to keep building our knowledge and enabling informed decisions.

Kia pai tō rā

Kia ora Alayne, that’s very nice to hear you found our content helpful!

Thanks so much! I’ve really enjoyed your articles and learnt quite a bit over the past few months. Was helpful in helping me choose an investment platform and index funds. I really like thess monthly round ups too. Thought I’d take a second to let you know! Keep up the good mahi 🙂

Thanks Jase, appreciate the feedback and glad the articles were helpful! We’ll be sure to continue the monthly round ups.