In July 2023’s What’s been happening in the markets article we look at whether using KiwiSaver for rental bonds is a good idea, give our usual investment product and market updates, as well as check in on how the fight against inflation is going.

This article covers:

1. Product updates

2. How are investors feeling about the market?

3. Market Movements

4. What we’ve been up to

1. Product updates

Index fund updates

There have been a couple of index funds updates this month which many of you will be interested in:

Kernel High Growth Fund

Firstly, some of you will already be familiar with Kernel’s High Growth Fund, a diversified fund which invests in a variety of Kernel’s NZ and global index funds. Almost 60% of the fund is invested in global shares (~30% in Kernel’s unhedged Global 100 Fund, and ~30% in Kernel’s hedged Global 100 Fund):

| Fund | Weighting |

| Cash Plus Fund | 2.00% |

| NZ 20 Fund | 23.50% |

| NZ Small & Mid Cap Fund | 5.90% |

| Global 100 Fund | 29.30% |

| Global 100 (NZD Hedged) Fund | 29.30% |

| Global Infrastructure (NZD Hedged) Fund | 5.00% |

| Global Green Property Fund | 5.00% |

With Kernel recently launching their new Global ESG Fund, they have quietly tweaked the composition of their High Growth Fund, swapping the unhedged Global 100 Fund out for the unhedged Global ESG Fund. This should slightly increase the overall diversification of the High Growth Fund especially given the Global ESG Fund invests in significantly more companies (~800 vs 100). The new fund composition is as follows:

| Fund | Weighting |

| Cash Plus Fund | 2.00% |

| NZ 20 Fund | 23.50% |

| NZ Small & Mid Cap Fund | 5.90% |

| Global ESG Fund | 29.30% |

| Global 100 (NZD Hedged) Fund | 29.30% |

| Global Infrastructure (NZD Hedged) Fund | 5.00% |

| Global Green Property Fund | 5.00% |

This change also affects Kernel’s Balanced Fund, whose unhedged global share exposure has also been switched over to the Global ESG Fund.

Simplicity Global Share Fund

Secondly, a number of our followers have expressed interest in the Simplicity Global Share Fund, a global share index fund which invests in 1,400+ companies across 20+ countries. Many have found it difficult to find information on what this fund actually invests in, but the good news is that Simplicity have updated their “Where in the world is my money” calculator which can be used to show the underlying holdings of the fund (note that this calculator doesn’t work on mobile phones).

This is a good step for the transparency of the Global Share Fund, but we still find key information on the fund to be lacking. For most other index funds in New Zealand, you can find charts and factsheets showing statistics and the country and sector breakdown of the fund or underlying index, making it easy to tell which countries and industries your fund invests in. Such information isn’t easily accessible for Simplicity’s funds.

Further Reading:

– Beyond the top 10 – How to see everything your fund is invested in

Is using KiwiSaver for rental bonds a good idea?

The New Zealand general election is just around the corner on October 14 2023, and in the lead up we’re starting to see political parties release details on their policies. This month the National Party proposed that under 30s should be allowed to withdraw from their KiwiSaver fund to pay for a rental or tenancy bond. But is this a good idea?

We do like the idea of exploring ways to make KiwiSaver more useful and attractive, and National’s proposal arguably isn’t the worst one. The money required for a bond is small in the grand scheme of things, and the money would be transferred directly to Tenancy Services and returned to your KiwiSaver when it’s no longer needed. The money can only be used for a bond for up to 5 years.

But using KiwiSaver money for rental bonds can lead to loads of issues. What if a difficult landlord makes it hard to get the bond back? What about the returns you miss out on while the bond is sitting with Tenancy Services? Could this rule tweak cause confusion and distrust in KiwiSaver, and perhaps open the door for the scheme to be used for every little financial need? These issues can result in National’s proposal having a greater impact on one’s retirement savings than initially expected.

KiwiSaver should be a tool that helps people get ahead financially, especially when it comes to preparing for retirement. But unfortunately National’s policy doesn’t help with this cause, and is really just a band-aid solution. There are plenty of better mechanisms to support young people with their rental bonds like Bond Grants from Work and Income or setting up a sidecar savings account as part of the KiwiSaver scheme (essentially a ring-fenced part of your KiwiSaver that can be withdrawn for emergencies or rental bonds).

First Home Partner scheme changes

Kāinga Ora First Home Partner is a shared ownership scheme designed to help you into home ownership with a deposit of as little as 5%. It involves Kāinga Ora funding and taking up a 10-25% share in the ownership of your home, and is currently only available on new build homes, and if your household income is $130,000 or less. From 14 August the scheme is being expanded and will become available on existing homes as well, so first home buyers looking to take advantage of the scheme will have more choice in the houses they can buy. The income cap is also being increased to $150,000 or less which should increase the number of people eligible for the scheme.

Further Reading:

– Can’t afford a house? 5 ways to help you get on the ladder

A sneaky way Sharesies makes more money?

Many of you know that when you buy and sell shares through Sharesies, they charge a 1.9% transaction fee capped at the following amounts:

- $25 NZD for NZ shares

- $15 AUD for Australian shares

- $5 USD for US shares

This cap is beneficial for large transactions – Take NZ shares for example, where you theoretically won’t pay any more than $25 for transactions of $1,316 and over. However, one of our readers Anthony has identified an interesting scenario where you could be charged more than the $25 cap for a large transaction. This scenario comes about as follows:

- Say you placed an order to buy $10,000 worth of Infratil shares with a limit price of $9.80. This limit price of $9.80 means your shares will only be purchased at a price of $9.80 or lower (and if the share price of Infratil was above $9.80, your order won’t be filled).

- Your order gets partially filled, and you end up buying $1,000 worth of Infratil shares at a price of $9.80. You now have $9,000 worth of Infratil shares left to buy.

- Unfortunately the price of Infratil goes up to $9.90. The remaining $9,000 of your order won’t fill because it’s above your limit price of $9.80.

- Sharesies doesn’t allow you to edit the limit price of your order. You can only cancel your original order and place a new order for the remaining $9,000 with a new limit price of $9.90.

- In the end the $10,000 of shares you wanted to buy has been executed across two orders, so you pay two lots of transaction fees. You pay $19 for the first transaction of $1,000 ($1,000 x 1.9%), plus $25 for the second transaction of $9,000. Altogether you’ve paid $44 for a transaction which should’ve theoretically cost just $25.

While this scenario should only happen on rare occasions (e.g. if you’re placing a large limit order for an illiquid company), it is a poor investor experience resulting in an almost doubling of fees. This issue could easily be solved if Sharesies were to allow editing of an order’s limit price (like almost every other broking platform), or if you are someone who might be affected by this issue, it might be worth using a competing platform in the first place.

Scams

We are hearing about a number of people getting hit by investment scams, so here’s a friendly reminder about how to protect yourself from them.

Firstly, here’s some red flags that suggest an investment opportunity might actually be a scam:

- ☎️ Cold calls – It’s generally illegal to offer investment opportunities through cold calling or via an unsolicited email or message. A lot of scammers will try to impersonate reputable companies/influencers when messaging their victims.

- 💸 High returns with low/no risk – Scammers will often offer trading platforms, exclusive IPOs, or some other opportunity with easy, low-risk gains. Legit investments always have some degree of risk, and will never guarantee quick profits. If it sounds too good to be true, then it probably is.

- 💶 Unusual payment methods – While there’s plenty of legitimate reasons to transfer money offshore or to use cryptocurrencies, requiring these to pay for an investment opportunity can be a massive red flag.

Here’s what you can do if you’re uncertain about an investment opportunity:

- 💻 Check online resources – Look at reviews (e.g. on Money King NZ, or MoneyHub), check the FMA’s shockingly huge list of scams, and make sure the provider is listed on the Financial Service Providers Register (FSPR).

- 👥 Have a chat – Check with friends and family to see what they think about the investment opportunity. A second opinion may help you spot red flags that you’ve missed.

- 🇳🇿 If in doubt – Use a trusted, local investment platform. There are plenty of great New Zealand based options to help you grow your wealth like Sharesies, InvestNow, Kernel, Simplicity, Hatch, Flint, Smartshares, SuperLife, Milford + many more! Some lesser known investment opportunities may be more tempting than familiar ones, but ask yourself whether they’re worth risking your money over.

2. How are investors feeling about the market?

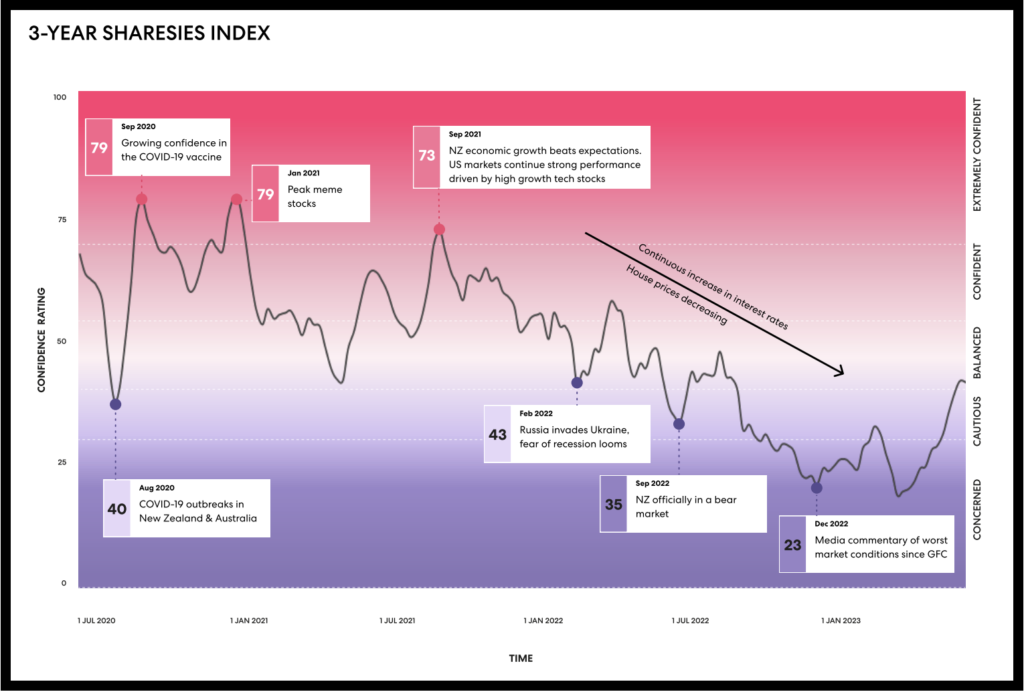

Sharesies has done some interesting analysis on how confident Kiwi investors are feeling, giving insight into whether people are feeling optimistic or pessimistic about their investments. The platform has crunched the numbers on the ratio between buy and sell orders, the ratio between cash deposits and withdrawals on the platform, investor risk appetite, and volatility of the most popular assets held through the platform. When put together, these data points result in the “Sharesies Index” which is currently at a level of 43 (out of 100), suggesting investors are currently feeling neutral about the market.

This is up from an all-time low in March 2023 when the index was at 21, an increase that can be attributed to the fact that markets have generally performed well in recent months. Our very own poll (which asked our Instagram followers how they were feeling about their investments) similarly showed an improvement in investor sentiment over the past several month.

However, the ongoing fear around inflation, interest rates, and the economic recession have meant that many investors are still being cautious about investing.

Some other interesting stats from Sharesies’ analysis:

– The percentage of money Sharesies’ customers have invested in individual companies versus ETFs and managed funds is currently sitting above 80%. That’s a much higher proportion than we expected!

– The most popular companies held by Sharesies investors are Air New Zealand, Tesla, Apple, Auckland Airport, and Mainfreight.

– The most popular funds held by Sharesies investors are Smartshares US 500, Smartshares NZ Top 50, Vanguard S&P 500, Pathfinder Global Responsibility, and Pathfinder Global Water.

What does this data mean for me?

Nothing really. This data is certainly interesting to look at, and shows that it’s normal to feel up and down about your investments as the markets fluctuate. But how everyone else is feeling shouldn’t influence when or how you personally invest. The best investors ignore their emotions around investing – They don’t time the market, and they don’t invest only when they’re feeling good about the world. Instead they keep investing consistently even during times of fear – which in fact is often the best time to invest as asset prices tend to be lower when everyone’s scared of the market.

As Warren Buffett says, “Be fearful when others are greedy, and greedy when others are fearful.”

3. Market Movements

Here’s how the markets performed to 31 July 2023, in both their local currencies and in NZ dollar terms:

| July 2023 returns Local currency | July 2023 returns NZD | |

| NZ shares (S&P/NZX 50) | 1.17% | 1.17% |

| Australian shares (S&P/ASX 200) | 2.88% | 0.54% |

| US shares (S&P 500) | 3.11% | 1.45% |

| Bitcoin | -4.04% | -5.59% |

The markets have generally had a positive month, despite all the continued doom and gloom around the interest rates and the economy. That’s why we always tell people to not time the market – it’s just so incredibly difficult to pick which direction the market is heading in. Those who’ve been sitting on the sidelines and waiting for the economy to improve before investing would’ve missed on the decent returns we’ve seen so far this year. Check out the year-to-date returns of the US market!

| 2023 YTD returns Local currency | 2023 YTD returns NZD | |

| NZ shares (S&P/NZX 50) | 5.08% | 5.08% |

| Australian shares (S&P/ASX 200) | 5.28% | 5.98% |

| US shares (S&P 500) | 19.52% | 22.18% |

| Bitcoin | 76.91% | 80.85% |

Inflation update

This month we had New Zealand’s latest Inflation figures come in at 6% – Still very high, but a welcome drop from 6.7% reported in the previous quarter, and a sign that all the interest rate increases we’ve had in recent times are doing their job:

| Quarter | Inflation |

| June 2023 | 6.0% |

| March 2023 | 6.7% |

| December 2022 | 7.2% |

So with inflation easing, why are the prices of goods and services still rising, and why is everything still so expensive? Unfortunately falling inflation doesn’t mean falling prices – It just means that prices are rising at a lower rate than before. We would need to have a negative inflation rate (or deflation) to see a fall in prices. In addition, the inflation rate of 6% is just the average inflation rate across lots of different goods and services. While things like transport are going down in price, this is offset by things like food going up faster than the average rate:

In the June 2023 quarter:

Food rose 2.2 percent, influenced by:

– grocery food (up 2.7 percent)

– restaurant meals and ready-to-eat food (up 3.0 percent)

– meat, poultry, and fish (up 1.8 percent)

Housing and household utilities rose 1.2 percent, influenced by:

– actual rentals for housing (up 1.1 percent)

– home ownership (up 1.1 percent)

– household energy (up 2.7 percent)

Transport fell 1.9 percent, influenced by:

– passenger transport services (down 7.8 percent)

– private transport supplies and services (down 1.2 percent)

So as long as the inflation rate is above 0%, the cost of living is going to keep rising, and this will likely be the case throughout our entire lifetimes. This demonstrates the importance of investing any money required for your long-term goals (such as retirement) into growth assets like shares or property, in order to keep up with rising prices.

4. What we’ve been up to

In case you missed them, here’s the articles we published over the month:

Personally we have quite a few things going on with our investments/finances:

- Completed a revamp and rebalancing of our index fund investments, switching from Kernel’s Global 100 Fund to their Global ESG Fund.

- Got our KiwiSaver government contribution, a welcome $521.43 boost to our accounts after recently withdrawing our funds for our house purchase.

- Reviewed our personal insurance cover (e.g. life, trauma, and health insurance). It’s something we’ve been putting off for a very long time, but getting some basic cover gives us peace of mind that the financial impact will be softened if the worst happens to our health. Let us know if you’re keen to see more content on insurance.

Outside of investing, we’ve had to do a bit of travel this month. Destinations included Whanganui and the hot pools of Rotorua!

Thanks for reading and your ongoing support!

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Yes please some content on Insurances.

There are so many products Health, Life, Trauma, permanent disability, Income Protection. Do you need them all or is this being over insured? And what level of insurance is best i.e. Balancing risk with smaller premiums to use to say reduce ones mortgage for example. This may be better use of money on a tight budget.

It’s a tricky balancing act isn’t it. We will cover insurance in a future article.

Thanks for update.

I similarly have been looking at Kernel’s new global fund which likely provides greater diversity but I am unwilling to put funds there until they provide detail on where the money is going.

I am surprised at Kernel’s slow response to this given the launch fanfare.

Yeah, it’s pretty frustrating when you can’t see the underlying holdings – it probably has something to do with index licensing and restrictions on what Kernel can share. However, the details of the holdings are supposed to be made available this month (August). In the meantime the index provider has some useful country and sector breakdowns: https://www.spglobal.com/spdji/en/indices/esg/sp-developed-ex-korea-largemidcap-net-zero-2050-paris-aligned-esg-ex-non-pharma-animal-testing-index/#data

Thanks for the blog! Am curious on your switch from Global 100 -> Global ESG, as I’m looking to do the same thing. Basically I don’t want the top 2 holdings in the global 100 to take up 25% of the portfolio, and though the ESG holdings are not yet published, I think it would be much better.

One concern though is the ESG aspect, as that brings a human element into it of assessing the ESG score, curious to hear what your thoughts are here.

Also curious on what your thoughts are on going 100% Global ESG as the one fund portfolio. Does it offer enough diversification in the long run?

You are probably right that as indices become more sophisticated (adding ESG weighting etc.), there becomes more chance of human influence. You could argue that index funds were originally designed so you can match the return of the market, and that these new funds have added so much complexity that they look totally different from the market and no longer truly meet the definition of passive investing.

But to be honest we aren’t really concerned about the human element. Firstly, the fund still behaves broadly like a passively managed fund – There is still a clear index methodology, and the fund manager still tries to replicate the performance of the index, rather than tries to make active decisions on where to invest. Secondly, the ESG scores are only reviewed annually and the fund rebalanced quarterly, unlike active managers who are constantly researching, picking, and reviewing stocks. Thirdly, despite the ESG aspects, the index is still highly correlated with traditional global market indexes – So while it won’t perfectly match the performance of a traditional index fund, it’ll still be close enough for us. Lastly, the fund still meets our requirements to be a globally diversified index fund that has low fees.

As for your diversification question, the fund does offer plenty of diversification, being invested across ~800 companies, 11 sectors, and ~20 countries. Is that enough to be the only fund in your portfolio? The answer is pretty subjective and different people will have different opinions. Personally we prefer to add more NZ exposure for the tax benefits this provides, but others are ok with a heavy international exposure.

Thanks for all the information you provide. It is much appreciated. The offer of global funds from NZ now on different platforms have become cheaper and there is probably no need to source these from the US or Australia. However, I find it difficult to compare because there is little long term data (5+ years) and they seem to all use similar but different indexes.

Also, have you ever reviewed the advantages and disadvantages of using full brokers?

Yeah, it’s so hard to compare past performance of funds due to the lack of data. Though we’d argue that past performance is just one of many factors to consider when comparing funds, and arguably not a very important one.

That’s because past performance is simply just past performance. But it’s future performance that matters when it comes to how your investments will do. There will be some variation in future performance between the global funds, but unfortunately we don’t have a crystal ball to tell which will perform best. Fortunately, given the heavy overlap in underlying investments in all the global funds, the performance difference shouldn’t be massive between them. You could pick any random global fund and still expect to do pretty well over the long-term.

So other more important factors to consider are things like fees, tax efficiency, alignment to your personal preferences, and things like transparency, platform ease of use etc.

We haven’t comprehensively looked at full service brokers, but that could be a topic for the future. Thanks for the suggestion.

I would love some insurance primers! I’ve recently updated our house and contents policies and found it really hard to know how to set the premiums. I.e. should you always just go for the highest premiums your savings allow and self-insure everything under that? Should you be optimising for the rare lose-everything-at-once scenario and worry less about a dropped computer if you’ve got the cashflow? I presume the insurance companies are smarter than me, so what’s the best way to think about it?

I’ve used a broker to arrange income and life insurance, so I somewhat trust their advice, but just guidelines about how to think logically about insurance would be great!

That’s a tough one. Don’t know if we’ll go that far in depth in our article, as what you go for is quite personal. But you are probably already on the right track in terms of your thinking – Do you want your insurance to cover everything from a broken computer to a loss of everything? Or do you have the financial capacity to cover the small stuff, and only want insurance to cover the devastating loss of everything scenario? It does require a lot of reflection on your finances and circumstances to figure out what you want out of the insurance policy.

I was wondering if you had any insight on how Kernel gets the underlying holdings of the ESG global fund. I’ve been looking around on the S&P Developed Ex-Korea LargeMidCap Net Zero 2050 Paris-Aligned ESG Ex-Non-Pharma Animal Testing Index website and it only shows the top 10 holdings, even then not by weighting. Where would one get such information?

Kernel pays S&P a license fee to get the underlying holdings and weightings data of the index. Kernel probably isn’t allowed to share this data publicly. However, Kernel can share details of the underlying holdings of their Global ESG fund (which should theoretically be almost identical to the index anyway). They appear to update this data monthly, with the latest data being as at 30 June. The new Global ESG funds launched on 3 July so there Kernel has not published holdings data for them yet, but we expect this to be available very soon when data for 31 July is released.

Thanks! I didn’t know that you had to pay a license fee to S&P to get the underlying holdings, that’s great information!

Also – I couldn’t find any index providers that sell this fund, does this mean Kernel is one of the only companies provide this index?

Yes, perhaps Kernel is the only fund manager in the world to track this index. That’s the case for a few of their funds given they use a few custom built indices from S&P.

Hey MoneyKing, great article.

Are you also going to switch your Global 100 allocation to Global ESG?

Thanks

David

We already have 😀

Would Simplicity’s global fund be better than Kernels Global ESG? It is cheaper

Yes, it is certainly cheaper but the fees are close enough that several other factors are worth considering. For example:

So when picking funds, we like the approach of picking one that delivers most value for money, rather than simply going for the cheapest. In this case the value Kernel provides outweighs the fee savings Simplicity would give us. But for lots of other people, the lower fees of Simplicity will outweigh the value Kernel offers, and that’s fine too.

I have significant funds with both Simplicity and Kernel.

There are things I like about both providers.

However there is one aspect of Kernel which really annoys me and that there is their inability to update dashboard investment valuations regularly and in line with their stated policy in FAQ.

In a recent video update with questions and answers I submitted a question on this issue which was not featured but did hear the CEO provide patronising nonsense that they felt investors are advantaged by not knowing the day to day value of their various investments.

I have transferred and invested money with Kernel and a week out still do not have an accurate valuation on my dash board.

Simplicity seems to delay valuation update by 3 working days and are consistent.

It is my view Kernel needs to do better in this area.

Kernel’s twice weekly trading and valuation frequency might have contributed to your issue? Say an investor placed an order on 1pm Wednesday, they would have had to wait until Monday for the order to start processing, and until Tuesday afternoon for their dashboard to update (and even longer if there was some delay or if there was a public holiday).

We do agree that investors are better off not checking their investments daily – less chance of making emotional investment decisions when they’re not seeing the day to day fluctuations of their asset values. However, having the platform update inconsistently is the wrong way to discourage investors to check their portfolios. We agree with you that portfolio valuations should update reliably and consistently, and other mechanisms (like education) should be used to discourage frequent portfolio checking. The potentially good news is that Kernel have just moved to daily trading from this week onwards, which should theoretically mean your portfolio updates more frequently. Hopefully that improves your experience with them.

Full marks to Kernel – they have rectified my concern – pricing appears consistently displayed after 1 day.

This appears to have occurred with daily trading.