Most people think of insurance as an everyday expense like rent, electricity, or petrol. But could it actually be a powerful financial tool, or perhaps it’s just gambling? In this article we provide an introduction to the various types of insurance, explore the role insurance might play in your financial life, and look at things you might think about when deciding on what insurance to buy.

This article covers:

1. An introduction to general insurance

2. An introduction to life and health insurance

3. Other types of insurance

4. Is insurance gambling?

5. What insurance do you need?

1. An introduction to general insurance

In this article we’ll be focusing on 2 broad categories of insurance. Firstly, let’s look at general insurance which covers things you own like your house, car, and contents. Examples of general insurance providers are State, AMI, Tower, and AA.

Note that this is just a high level guide to each type of insurance. Check the documents specific to an insurance policy, or refer to an insurance adviser to understand what is and isn’t covered in detail.

House insurance

House insurance covers you if your house is damaged or destroyed. For example, if your house gets wiped out by an earthquake or if your break a window, house insurance will pay the cost of repairing or rebuilding your house. The exact scenarios house insurance covers differs depending on the exact policy and the insurance company. For example:

- Basic – These policies are cheaper and covers sudden or accidental damage to your house due to events like fire, a vehicle crashing into the building, or vandalism.

- Comprehensive – These policies are more expensive but may include extras like covering hidden gradual damage to your home (e.g. from a slow leaking water pipe), offering temporary accommodation if you’re unable to live in your home, lower excess for broken glass, and replacement of keys and locks.

- Landlord cover – This is a special type of house insurance designed specifically for landlords, and may cover a few extra scenarios such as loss of rent or if your house gets contaminated with meth.

Contents insurance

Contents insurance covers your personal belongings if they are damaged or destroyed. For example, if your house is destroyed by a fire, house insurance will only cover the house itself and not the contents inside. You’d need contents insurance to be covered for replacing things like your home appliances, clothes, computers, and so on. Similar to house insurance, providers sometimes offer different levels of contents insurance:

- Basic – May only cover you if your contents are damaged or lost due to burglary, fire, storm, flood, or natural disaster. Some items may only be covered for their market value. For example, if an old fridge gets destroyed, insurance will only pay out the current value of that fridge, which likely won’t be enough for you to buy a replacement fridge.

- Comprehensive – Provides additional coverage, such as for accidental damage to your possessions. May also provide repair or replacement cover for some items. For example, if an old fridge gets destroyed, insurance will pay to replace that fridge.

If you’re renting, note that any insurance policies your landlord has won’t cover your personal contents, so you may want to consider getting your own contents insurance policy. In fact, many contents insurance policies come with legal liability cover which covers you in case you accidentally damage someone else’s property (e.g. if you accidentally damage the house you’re renting).

Car insurance

The exact coverage car insurance provides depends on the type of policy you purchase. The common policy types are:

- Third party – Only covers you for the damage your vehicle does to another person’s car or property. For example, if you crashed your vehicle into someone else’s car and they needed repairs, this insurance would cover the cost of that person’s repairs.

- Third party, fire, and theft – Same as above, but also covers you if your vehicle is stolen or damaged by fire. For example, if your car is stolen, this insurance would cover the cost of repairing or replacing your car (up to the value your car is insured for).

- Comprehensive – Same as above, but also covers accidental damage to your own vehicle. For example, if you crashed your vehicle into someone else’s car, this insurance would cover the repair costs of their car and your own car.

Note that car insurance won’t cover mechanical problems, but you can usually add roadside assistance to your policy to help you out if your car breaks down. In addition car insurance can sometimes work differently for young drivers (under 25s) as they’re considered higher risk. Some insurance providers don’t offer car insurance to young people, and if they do, often apply higher premiums and higher excesses when making a claim.

2. An introduction to life and health insurance

Secondly, let’s look at insurances which covers your life, income, and health. Examples of life and health insurance providers are NIB, Partners Life, AIA, and Southern Cross.

Note that this is just a high level guide to each type of insurance. Check the documents specific to an insurance policy, or refer to an insurance adviser to understand what is and isn’t covered in detail.

Life insurance

Life insurance covers you in case you die, by paying out a lump sum of money to your family. For example, if you unexpectedly pass away, those that are financially dependent on you may struggle to pay the mortgage or everyday bills. The insurance company will pay out a sum of money to your family to ease this financial burden.

Premiums for life insurance (the money you pay for the insurance policy) tend to be structured in one of two ways, which you can choose between:

- Stepped – The premiums are initially lower, but increase every year as you get older (eventually becoming more expensive than level premiums).

- Level – The premiums are initially higher than stepped premiums, but they stay the same for a certain amount of time (e.g. up to age 65), so may work out cheaper if you keep your policy over the long-term.

A couple of other things to note in relation to life insurance. Firstly, you don’t necessarily have to die for life insurance to be paid out – you may also be covered if you’re diagnosed with a terminal illness and have 12 months or less left to live. Secondly, most life insurance policies will have a number of exclusions – For example, they won’t cover you if you commit suicide within 13 months of taking out a policy.

Trauma insurance

Trauma insurance covers you if you are affected by certain critical illnesses, by paying out a lump sum of money. For example, if you got cancer you will likely face a number of life changes (like taking time off work to recover and paying for medical expenses). The money you’d receive upon getting diagnosed with these illnesses can help ease the financial burden on you. Examples of conditions covered by trauma insurance policies include (though each condition needs to meet certain severity thresholds for trauma insurance to pay out):

- Cancer

- Heart attack

- Stroke

- Blindness

Trauma insurance complements life insurance and you can usually choose between stepped and level premiums. In addition you have a couple of options for how your trauma insurance policy works in conjunction with your life insurance policy:

- Accelerated cover – Any trauma insurance payouts will affect your life insurance cover. For example, let’s say you had a $500,000 life insurance policy and a $200,000 trauma insurance policy. If your trauma insurance paid out that $200,000, your life insurance cover would reduce to $300,000.

- Standalone cover – Your trauma insurance will operate separately from your life insurance. For example, if you had a $500,000 life insurance policy and a $200,000 trauma insurance policy, your life insurance payout would be unaffected by any claims made on your trauma insurance. Standalone cover is more expensive than accelerated cover.

Income insurance

Income insurance covers you in case you can’t work due to an illness or injury by paying you a portion of your income for a certain period of time. For example, if you get badly injured and are out of work for several months you might not have enough money to pay your bills. Income insurance would pay out up to 75% of your income every month until you return to work so you can continue to pay for your everyday expenses.

When purchasing income insurance, there are a few settings for you to consider:

- Percentage of income covered – How much of your income do you want your income insurance to pay out? This can usually be up to 75% of your normal income, with higher percentages resulting in higher premiums.

- Wait period – How long after you submit a claim do you want to wait before income insurance starts paying out? Typical wait periods you can choose from are 4, 8, or 13 weeks. Longer wait periods having lower premiums, though you’d have greater reliance on sick leave or emergency savings to cover yourself during this time.

- Payment period – What’s the maximum period of time you want income insurance to pay you? You can usually choose for payments to last up to 2 or 5 years, or up until age 65 or 70.

Note that income insurance won’t cover you if you lose your income due to redundancy. However, some income insurance providers may offer redundancy insurance as an optional add-on to your policy.

Trauma insurance vs Income insurance

There is some overlap between these two types of insurance as they both provide you with financial support if you get seriously sick. However, there are two key differences:

– Trauma insurance only covers specific conditions and illnesses. Income insurance covers any illnesses or injuries, as long as they prevent you from working.

– Trauma insurance pays out a one off lump sum of money. Income insurance gives you regular monthly payments for as long as you’re unable to work and as long as you’re within your payment period.

Health insurance

Health insurance covers your health treatment at private healthcare facilities. For example, if you needed surgery to remove cataracts, you can go through the public healthcare system which would cost you very little or nothing at all. However, as a non-urgent operation, you may need to wait a long time before you can have this surgery. Going through private healthcare could get you treated faster, potentially resulting in a better health outcome.

Generally health insurance only covers private hospital treatment and surgery, but you can buy add-ons to increase the coverage of your policy:

- Diagnostic imaging and tests – Covers procedures and specialist visits for diagnosing medical conditions such as CT scans and colonoscopies.

- Everyday healthcare – Helps cover everyday healthcare costs like GP appointments, annual health checks, and flu vaccinations.

- Dentist and optometrist cover – Helps cover the costs of dental work and prescription glasses/contact lenses. There is usually a limit as to how much you can claim per year (e.g. $750), and co-payment is usually required (e.g. insurance pays 75% towards your dental work, while you pay the remaining 25%).

In most cases health insurance won’t cover any pre-existing conditions, which are health conditions or symptoms you already have or know about. For example, if you had an issue with your knee, it’s unlikely a new health insurance policy would pay for treatment of that knee.

3. Other types of insurance

There are lots of other types of insurance you can get. Here’s a brief mention of some of them:

- Pet insurance – Can help cover vet bills if your cat or dog gets sick or has an accident.

- Funeral insurance – Works similar to life insurance by paying out a small lump sum of money to your family if you pass away, so they can pay for funeral costs and other associated expenses.

- Travel insurance – Covers things like medical expenses, lost luggage, flight disruptions, and rental car excesses while you’re travelling.

- Mortgage insurance – Similar to income insurance in that it pays out a regular amount in case you can’t work due to an injury or illness. However, mortgage insurance is designed to cover your mortgage repayments only.

- Total and Permanent Disability insurance – Works similar to trauma insurance by paying out a lump sum if you’re unable to work ever again due to a permanent disability.

- ACC – Most of you would’ve heard of ACC, but many people wouldn’t have realised that they provide a form of insurance covering everyone in New Zealand. Pays for treatment and rehab and loss of income for injuries resulting from accidents. ACC is paid for by levies deducted from your pay (for PAYE employees), employers, self-employed, car registrations, petrol, and funding from the government.

- EQC – Another crown entity like ACC. Covers damage to houses caused by natural disasters like earthquakes and landslides, as long as you have your own house insurance with fire cover.

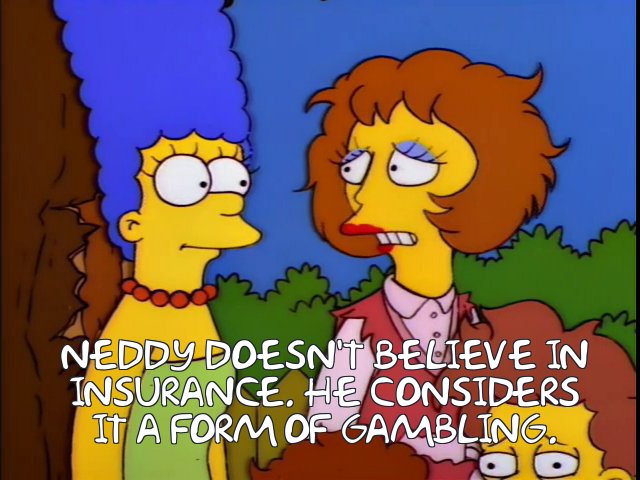

4. Is insurance gambling?

The role of insurance in one’s financial life is interesting to think about. Is it a necessary financial tool or is it just gambling?

The first thing to note is that insurance isn’t going to make you rich. For every dollar you pay in insurance premiums, on average you’ll get less than a dollar back in claims. Think about how an insurance company needs to collect more in premiums (and other revenue) than it pays out in claims to pay for its operating expenses and to make a profit. It’s like a casino where the house always wins. When you think about insurance this way, you’re better off not having insurance and just investing the money you would’ve otherwise spent on it!

So why do people still buy insurance? Look at the types of risks you face in everyday life – You could crash your car, develop a serious illness, get hit by a train, or a natural disaster could destroy your home. There is no way to eliminate the above risks, perhaps unless you drastically sacrificed the quality of your life. And all of these risks could result in devastating financial consequences if they were to eventuate.

With insurance you get benefits such as:

- Helps you manage the financial impact of those risks, by paying a little bit each month (in insurance premiums) to avoid losing lots of money in the future (if the above risks were to eventuate). You are essentially spreading the cost of a risk over time and across many people (i.e. other policyholders at your insurance company, who are also paying premiums that will help cover the cost of your claims if you need it).

- You don’t have to save hundreds of thousands of dollars in an emergency fund (e.g. to cover you just in case your house got destroyed). Insurance cover can greatly reduce the need for emergency savings (though an emergency fund is still necessary as insurance won’t cover every unexpected expense in life).

- Protection for your assets such as your home, investment portfolio, or KiwiSaver fund. With the right insurance cover you’ll be less reliant on selling these off to cover your costs if something bad were to happen.

- Provides peace of mind that you and your family have protection in case something bad happened. You can live life without having to wrap yourself in bubble wrap every time you leave home.

5. What insurance do you need?

Unfortunately we don’t know the answer to this question, as it heavily depends on your personal circumstances (perhaps even more so than investing). Factors like your age, assets, debts, income, dependents, and risk appetite could all influence the right level of insurance cover for you. Examples of what you might want to think about for each type of insurance are:

General insurance

- House insurance – This obviously isn’t required if you don’t own a house. But if you are a homeowner, you probably have to insure your home in order to get a mortgage on the property. And even if you’re mortgage free, a house is an incredibly expensive and valuable asset – It would be uncommon to leave it uninsured.

- Contents insurance – What stuff do you own? Someone renting a fully furnished place will probably have less need for contents insurance than someone who owns lots of electronics and appliances.

- Car insurance – How valuable is your car? If you have an old, cheap car, 3rd party cover might be sufficient. A more expensive car might justify getting more comprehensive cover.

Life & health insurance

- Life insurance – Do you have any financial obligations (e.g. a mortgage, kids), and what would happen to those if you die? If your partner would struggle to pay the mortgage or feed your kids after an unexpected death, perhaps it would be worth considering life insurance. If you don’t have such financial obligations, or if you already have a large amount of assets to your name, life insurance might be less important.

- Trauma insurance – Similar to life insurance – Could you cover your financial obligations and have enough money to take care of yourself if you got seriously ill?

- Income insurance – Could you cover everyday expenses if you got sick or injured and were unable to work? You may want to consider your job type (e.g. a carpenter might struggle to work with a broken arm, while someone working a desk job might not), and whether you have other sources of income (e.g. sick leave or emergency savings) when deciding on income insurance.

- Health insurance – We see this as a luxury purchase because the public healthcare system is already comprehensive. Though health is arguably your most important asset, and health insurance could help you get faster treatment if something goes wrong.

Overall you’ll need to think about the risks each type of insurance covers and what the financial impact on you might be if the risk eventuates – Could a particular event ruin your finances, or would you be ok?

The answer changes over time

The amount of insurance cover you need will likely change throughout your lifetime. For example:

- A young person is likely to have few financial obligations. Therefore you might not need much insurance as there is not much to protect.

- Throughout your working life you might buy a house, have kids, and at the same time you might not have built up much assets. Therefore you might need more insurance coverage to protect yourself and your family.

- As you get older, your kids get older and less financially dependent on you, and hopefully your wealth will have also grown. Therefore you might be able to strip back your insurance coverage, and perhaps be in a position to self-insure for many circumstances.

One person who illustrates their changing insurance needs over time really well is The Happy Saver, who has a couple of great blog posts on her family’s insurance cover:

The Happy Saver posts on insurance:

– Insurance (YAWN)

– We have cancelled another insurance policy

The excess is important

Your excess is the amount of money you have to pay towards an insurance claim. For example, let’s say you have a car accident and your car is going to cost $1,000 to repair. If your car insurance policy has an excess of $400, then you’ll need to pay $400 towards the repairs, with the insurance company paying the remaining $600. Not all types of insurance require an excess (e.g. life insurance).

In most cases the excess for your insurance policy is customisable. Setting a higher excess means your premiums will be cheaper. However, this will mean that insurance won’t cover you for smaller claims given the excess may be higher than the amount you’re claiming, and you’ll have to self insure for these cases. For example, if you have a contents insurance policy with a $500 excess, and you lose your phone worth $400, it wouldn’t be worth making a claim since it’d be cheaper to replace the phone yourself than paying the excess. So you don’t want to set the excess too high, and find yourself struggling when you need to make a claim.

Ultimately the excess you choose will depend on personal circumstances and what you want to get out of your insurance policy. Take a contents insurance policy for example:

- Do you want to cover relatively small losses (like a stolen laptop) as well as big items? If so, you might set your excess lower.

- Do you only want to cover big items and significant losses (e.g. if your house burnt down along with all your possessions), and have the ability to self-insure for small losses? If so, you may set your excess higher, which would result in lower premiums.

It’s a balancing act

Overall, deciding how to set up your insurances is a tricky balancing act. You don’t want to not be under-insured, exposing yourself to too much financial damage if something bad happened. Nor do you want to over-insured. Remember that insurance isn’t going to make you rich, so you don’t want to unnecessarily pay hundreds or thousands of dollars in premiums that can be better used to invest into your own assets, and to build up your ability to self-insure.

Here’s a couple of personal examples of how we achieve a balance. We have house, contents, car, health, life, and trauma insurance policies, but balance them out with the following:

- Setting our excesses high – Having higher excesses makes our premiums cheaper. While small claims won’t be covered, insurance still gives us peace of mind that it’s there to protect us from big claims, and we still have our emergency fund to self-insure for small things.

- Keeping our level of cover low – Take life insurance for example. If one of us dies, the sum we’re insured for won’t be enough to pay off the entire mortgage, but can still reduce it to a more manageable amount for the surviving partner. For us insurance isn’t about covering every cent of a bad event, but it will still greatly mitigate the financial impact of one.

Your circumstances will differ greatly from ours. It will require reflection on your own finances and personal circumstances to find your insurance sweet spot that makes you feel like your policies are providing value for money – To feel like you’re adequately protected, while not feeling you’re overspending on coverage.

This may sound daunting, but you’re not alone when it comes to choosing your insurances. You can always talk to an insurance adviser whose services are typically free (given they’re paid through commissions from the insurance company). There are also a number of insurance comparison sites you can use to compare policies and premiums across different providers. We found Life Direct particularly helpful in comparing quotes between life and health insurance providers. In addition MoneyHub has a number of guides that take a more in depth look at the different types of insurance.

Conclusion

Insurance definitely isn’t a tool for you to make money. However, it is similar to an emergency fund, a potentially important tool to protect you from losing money if something bad were to happen to you, whether it be your car getting stolen, suffering from a severe injury, or your cat requiring expensive surgery. Insurance works by having you sacrifice a relatively small amount of money each month to spread the cost of a risk out over time and across many people. If everything in life goes well you won’t see a return on that money. But in case something does go wrong, you’ll know that you have a policy in place to at least dampen the financial impact.

Insurance is a powerful tool, but it’s a complex one so we can’t cover everything to do with it in this article. In addition the insurance cover you need will differ greatly from one person to another – there’s no one-size-fits-all answer. But we hope this has been a useful beginner’s overview to the topic, and we hope it puts you in a better position to do your own research, whether it be looking at policy documents from various providers, or setting up a meeting with an insurance adviser.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.