August 2022 was an eventful month, so in this article we have heaps to cover including recent market movements, the return of meme stocks, proposed KiwiSaver tax changes, investment scams, demystifying some corporate actions, and much more!

This article covers:

1. Market movements

2. Product updates

3. Investment scams

4. What we’ve been up to

1. Market movements

Following on from a positive month in July, the markets were generally strong in the first half of August, as investors became optimistic about inflation peaking and the possibility of interest rates being hiked less aggressively. Here’s how certain markets performed up until the 15th of the month:

| Aug 1-15 (NZD) | |

| NZ shares (S&P/NZX 50) | +2.58% |

| Australian shares (S&P/ASX 200) | -0.35% |

| US shares (S&P 500) | +1.33% |

| Bitcoin | +2.03% |

However, the second half of August wasn’t so positive, as the US Federal Reserve signalled that they’re still committed to continue hiking interest rates to get inflation under control:

| Aug 16-30 (NZD) | |

| NZ shares (S&P/NZX 50) | -1.19% |

| Australian shares (S&P/ASX 200) | +0.91% |

| US shares (S&P 500) | -3.73% |

| Bitcoin | -14.14% |

Overall, here’s how the markets performed across the month (as at 30 August 2022) in both their local currencies and in NZ dollar terms:

| MTD | MTD (NZD) | YTD | YTD (NZD) | |

| NZ shares (S&P/NZX 50) | +1.36% | +1.36% | -10.63% | -10.63% |

| Australian shares (S&P/ASX 200) | +0.76% | +0.55% | -5.99% | -0.54% |

| US shares (S&P 500) | -3.49% | -2.44% | -16.37% | -6.65% |

| Bitcoin | -14.42% | -12.34% | -56.82% | -51.80% |

While the volatility we’re seeing might be one of the least desirable parts of investing, such short-term fluctuations in your investments shouldn’t be a major concern if you’re investing for the long-term over 10, 20, or 30+ years – it’s the end result that really matters! And for those continuing to contribute to your portfolios, the current downturn has a silver lining as it allows you to accumulate your investments at cheaper prices.

Meme stocks make a comeback

Outside of the major market indices we saw meme stocks come back to life this month, and this time it was Bed Bath & Beyond (BBBY) shares (which has no relation to the NZ retailer with the same name) getting the Reddit WallStreetBets treatment. The company pumped from around $5 at the start of the month to $23 by mid-August.

Many Kiwi investors were keen to get a slice of the action, with the company even ending up on Hatch’s most popular list. However, the rally didn’t last long with the price now having dropped to about $13. That’s still higher than start of month, but BBBY is still down over 30% for the year.

The rise of BBBY follows AMTD (HKD) shares which started at ~$20 in mid-July, surged to $1,679 by early August, but has since crashed to just $140. While meme stocks can be a fun gamble, they’re definitely not sustainable investments for building meaningful wealth over the long-term. Sooner or later they’ll come tumbling back down to earth, and you don’t want to be the one left holding the bag.

Sell in September?

We recently saw an interesting Instagram post by a prominent investing podcaster about the “September Effect”, which refers to the fact that sharemarkets have tended to fall during that month:

The stock market tends to drop off in September as people return from summer vacation & head back to school. It’s believed that investors liquidate their stocks to contribute to schooling costs for children and to lock in gains/tax losses before the end of the year.

Some may be wondering whether you should sell your investments for the month, or hold off investing more money, given this phenomenon? Well, firstly if you dig deeper you’ll find that the average decline of the S&P 500 during September is just 0.5%, making the September Effect less scary than it may first appear.

Since 1950, the S&P 500 has averaged a 0.5% decline during the month of September.

Investopedia

Secondly, the September Effect has become even weaker in recent years, perhaps as people have already started to sell off their shares in August in anticipation of the effect.

In recent years, the effect has dissipated. Over the past 25 years, for the S&P 500, the average monthly return for September is approximately -0.4%, while the median monthly return is now positive

Investopedia

Lastly, sharemarket movements never strictly adhere to averages or trends. If they did, they would be easy to predict, and everyone would be rich! In reality, no one knows exactly which direction the markets will go next month. So it’s not worth it to try and time the market over such trends, and risking getting the timing wrong.

2. Product updates

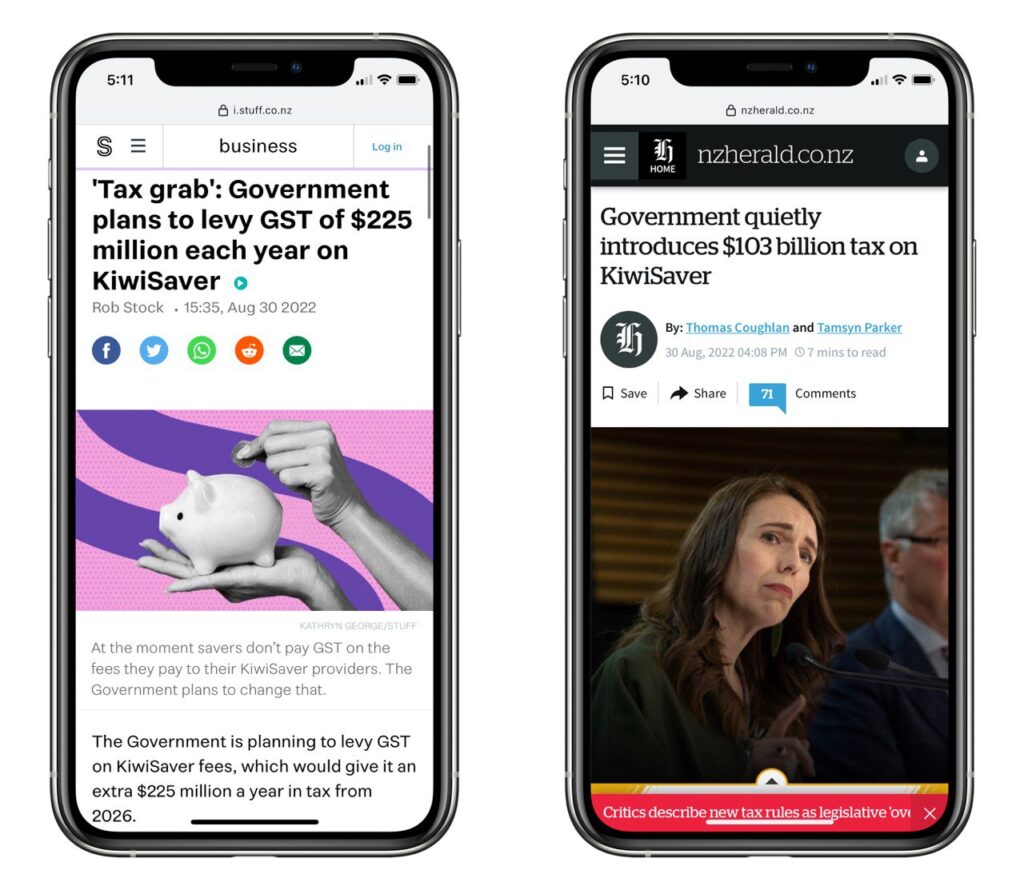

KiwiSaver tax grab?

On 30 August you may have seen some alarming headlines about the government planning to introduce millions/billions in additional taxes on KiwiSaver. So let’s take a look at what was being proposed…

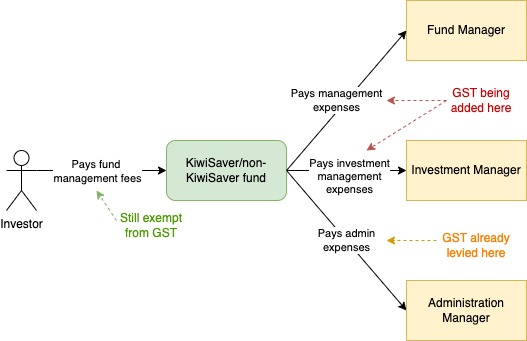

KiwiSaver funds incur a number of expenses in their operations, and currently some of these expenses are exempt from GST, while others aren’t:

- Fund management expenses (exempt from GST, but still applied by some providers) – Expenses relating to offering and issuing units in a fund, communicating and reporting to investors, and overall operations of a fund.

- Investment management expenses (exempt from GST, but still applied by some providers) – Expenses relating to determining which assets a fund should invest into.

- Administrative expenses (not exempt from GST) – Various legal, accounting, and IT costs.

For non-KiwiSaver funds, the Fund Management and Investment Management expenses are also mostly exempt from GST, usually having GST applied at an effective rate of 1.5%. The proposed change would’ve removed these exemptions with the intention of making GST treatment consistent across different fund types and providers, meaning both KiwiSaver and non-KiwiSaver funds would have GST applied to their management costs at the normal 15% rate.

Given this added GST would’ve make it more expensive for funds to operate, it was anticipated that the costs would be passed onto investors through an increase in fees. Although the likely impact would’ve been small in the grand scheme of things, it’s still not great for investors, as it would mean less money invested, earning a return, and compounding over time. FMA modelling suggested the change would collectively reduce the country’s investment balances by $186 billion by 2070.

But perhaps more concerning is that proposal serves as fuel for the rampant KiwiSaver myths and misconceptions out there, many of which claim that KiwiSaver is a scam or exists purely as a government tax grab. It’s not what we want to see when it comes to having New Zealanders feeling confident towards in saving and investing for their retirement.

The government quickly dropped the proposal on 31 August after significant backlash. But we think there was no need to panic about the proposed GST changes in the first place. There were no changes to how your contributions, balance, or fund’s underlying investments would be taxed. And it wouldn’t have taken effect until 2026, so it’s likely some fund managers would’ve chosen not to pass on all of the increased costs to investors, as the KiwiSaver landscape scales up and becomes more competitive over the years.

Further Reading:

– 12 KiwiSaver myths and misconceptions busted

Hatch partners with Jarden Direct…

Hatch, a platform which currently only offers US shares, is merging with Jarden Direct, which is a more traditional brokerage platform mainly offering NZX and ASX shares:

FNZ, the global team that purchased Hatch late last year, is continuing to back you, our Hatch investors, and today has acquired Jarden Direct’s platform assets. This includes, Jarden Direct, Direct Broking (formerly ANZ securities), Broker Direct, and Fonterra stock trading platform, TAF (Trading Among Farmers).

FNZ will be 75% owners of Hatch, and Jarden 25% owners, with our freshly minted venture keeping the much-loved name, Hatch. #triplethreat

What does this mean for you, our customers? Right now, nothing. Bringing Jarden Direct into Hatch will give us access to more retail broking licences and services. Meanwhile, all platforms will continue to run as usual while we plan how FNZ + Hatch + Jarden Direct can create the best investing experience NZ has to offer.

Hatch

The news comes almost a year after FNZ acquired Hatch from Kiwi Wealth, with the intention of adding access to more products and markets to the platform. We think both Hatch and Jarden Direct are quite complementary partners, with Hatch bringing a friendly digital platform, and Jarden Direct bringing access to the likes of the NZ and Aussie markets to the table. As for the exact features, fees, and what the next generation of the Hatch/Jarden Direct platform will look like, we’ll just have to wait and see.

…As two of their co-founders leave the company

The above partnership comes as two Co-founders of Hatch quietly left the company. Investors responded with mixed feelings including some feeling surprised, and others appreciating the work Kristen and Nat had done for the investor community. Some are even worried about the change:

But we don’t believe there’s any cause for concern, as there’s nothing yet that’s changed about the platform itself, and there’s plenty of valid reasons for staff to leave a company that isn’t necessarily indicative of something bad going on. Perhaps their vision for Hatch differed from that of their new parent company and partner?

Further Reading:

– Hatch review – Hard to recommend

Fisher Funds buys Kiwi Wealth

Another big piece of news was that Kiwi Group Holdings (who also owns Kiwibank) announced their sale of Kiwi Wealth to Fisher Funds. Post-acquisition, Fisher Funds will become the 2nd largest KiwiSaver provider (after ANZ) with $13 billion under management. The deal follows Fisher Fund’s recent acquisition of Aon’s KiwiSaver scheme, whose members got absorbed into their existing Fisher Funds TWO scheme.

This may be a little concerning for Kiwi Wealth’s customers, but apart from the new ownership, there won’t be any drastic changes to the Kiwi Wealth funds for now. It appears that Kiwi Wealth will remain a separate brand to Fisher Funds for the foreseeable future (after earlier speculation that the Kiwi Wealth brand would disappear entirely).

The big question that remains is whether Kiwi Wealth will remain as a default KiwiSaver provider under Fisher Funds’ ownership. They’ll need to negotiate with the government to keep their default status, but if that doesn’t go through, anyone in the Kiwi Wealth Default Fund will be transferred over to a default fund with another provider.

In related news, not long after the Kiwi Wealth disposal was revealed, the government announced that it was acquiring 100% of Kiwi Group Holdings (KGH), giving them direct control of Kiwibank. While the government already had indirect control of the bank, with KGH being owned by NZ Post, the NZ Superannuation Fund, and ACC, the deal ensures that Kiwibank won’t be sold off to private investors. However, a model with mixed public and private ownership could’ve been beneficial for the bank, as argued by these Craigs and RNZ articles.

Further Reading:

– KiwiSaver fund check in – How do the new default funds affect you?

Corporate actions

A few interesting corporate actions took place over the month, so here we’ll be explaining and demystifying them.

Heartland capital raise

During their full year results on 23 August, Heartland Group (HGH) announced they were raising $200 million in capital in order to pay off debt and have capacity for further growth. $130 million would be raised through a Placement, with the remaining $70 million being raised through a Share Purchase Plan. On the day of the announcement, shares in the Placement were offered to Sharesies’ investors with a same day deadline of 4pm.

This attracted some complaints towards the platform, given the short notice which provided only a few hours for investors to make a decision and deposit enough money to invest. However, it’s common for Placements to have such a short turnaround as they’re are designed for companies to quickly raise capital from institutional investors like fund managers and brokers. There’s not much Sharesies can do here, apart from perhaps providing more education as these deals can be confusing for investors.

For those that missed out on the Placement, no worries. The Share Purchase Plan runs until the 5th of September and allows existing Heartland Group shareholders to buy up to $50,000 in HGH shares at the same or better price as the Placement. And if you’re not a shareholder of Heartland you can still buy their shares on market at the current market price.

Tesla share split

Tesla executed a 3-for-1 share split, which meant that shareholders in the company got an extra 2 Tesla shares for each share they already held. To compensate for the extra shares, the share price of Tesla reduced by a third following the split, going from approximately $900 to $300. So someone holding 1 Tesla share worth ~$900 would now have 3 Tesla shares also worth ~$900. Investors aren’t any better or worse off following the split, nor does the split change the company’s fundamentals.

Arguably it does make the shares more accessible, as it now costs less to buy one full share of Tesla. But we think this benefit is overstated, given many brokers offer fractional shares, making it unnecessary to buy whole shares. So we like to think of it as more of like a marketing trick to make the shares appear more attractively priced.

AMC goes APE

In other meme stock news, holders of AMC Entertainment received a special dividend this month. This wasn’t a cash dividend, but came in the form of “preferred equity units” trading under the ticker “APE”. These APE shares are effectively the same as their normal AMC shares, giving holders the same voting rights, and being convertible to ordinary AMC shares if the company board and shareholders approve.

This dividend from AMC was effectively a 2-for-1 share split in disguise, with AMC’s pre-dividend share price of $18.02, falling to $10.46 to reflect the new APE shares, which was priced at $6 after its first day of trading. So the special dividend wasn’t about giving free or bonus money out to investors, but effectively a marketing gimmick to build hype around the company, and a sneaky way for the company to issue more shares.

Further Reading:

– Rights issues, share buybacks, and acquisitions – 5 things to know about Corporate Actions

Equity crowdfunding offers

We’ve seen a few equity crowdfunding offers recently like Supie and Rubber Monkey, which have gotten a few people curious about investing in these kind of deals. While equity crowdfunding offers allow you to buy shares in interesting companies that investors don’t usually have access to, these investments don’t work like the mainstream investment platforms, and there’s a few key differences you should know about before jumping in.

Firstly, there’s typically very limited opportunities, if any, to sell your investment as they’re not listed on any sharemarket. Also because these companies aren’t listed, you have limited visibility of the company’s current share price. They’re long-term investments, and you should be willing to hold onto these companies until they either list onto a sharemarket, get acquired by another company, or provide another way to sell off your shares.

In addition, the companies offered through these platforms are usually less mature compared with listed ones, meaning they have higher potential returns, but come with higher risk – So it’s probably a good idea to do thorough due diligence before investing. If in doubt, stick to the mainstream platforms which are perfectly adequate for building your investment portfolio.

Further Reading:

– 4 things to know about investing in Equity Crowdfunding

Other updates

Here’s a few more small updates for the month:

- Sharesies – Sharesies is planning for a “large batch of new fund managers to join the platform in the next couple of months“, adding to their currently limited managed funds offering, while their KiwiSaver offering is still a long way off.

- Binance – The crypto platform is shutting down a number of advanced/specialist features for NZ customers including futures and options trading, likely due to local regulations. Their core exchange features remain available to Kiwi users.

- Stake – Stake added the ability to deposit money into your account using a debit or credit card. While this may be convenient, investors should be wary of the chunky fees, sitting at 2% for debit cards and 3% for credit cards.

- Simplicity – Simplicity co-founder Sam Stubbs released a book “Money Made Simple“, a guide aiming to help Kiwis become better with money. The book was given away for free to Simplicity members throughout August, but interestingly here in Auckland, the places you could get the book were highly concentrated towards wealthier suburbs 🤔.

3. Investment scams

Social media scam alert

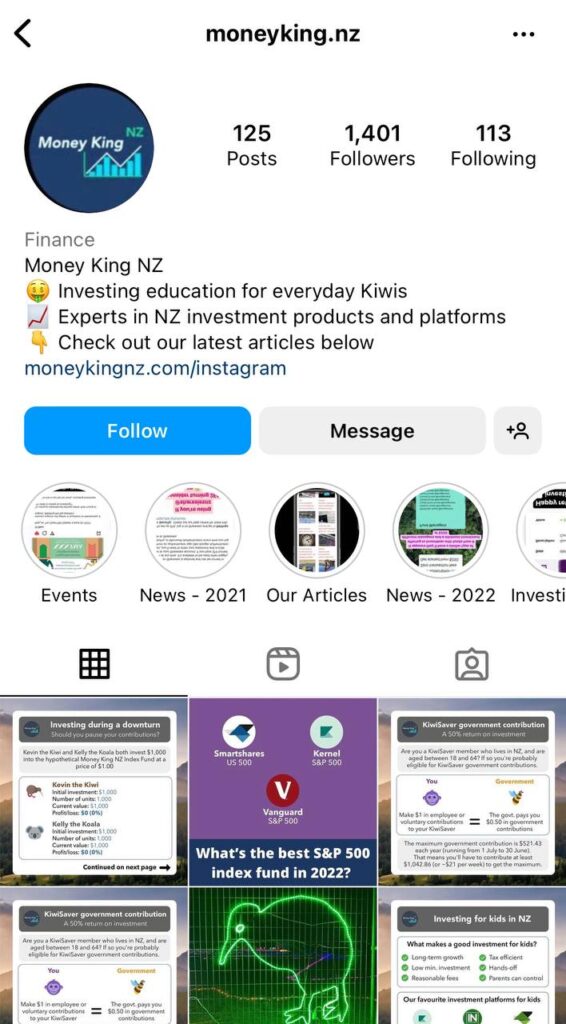

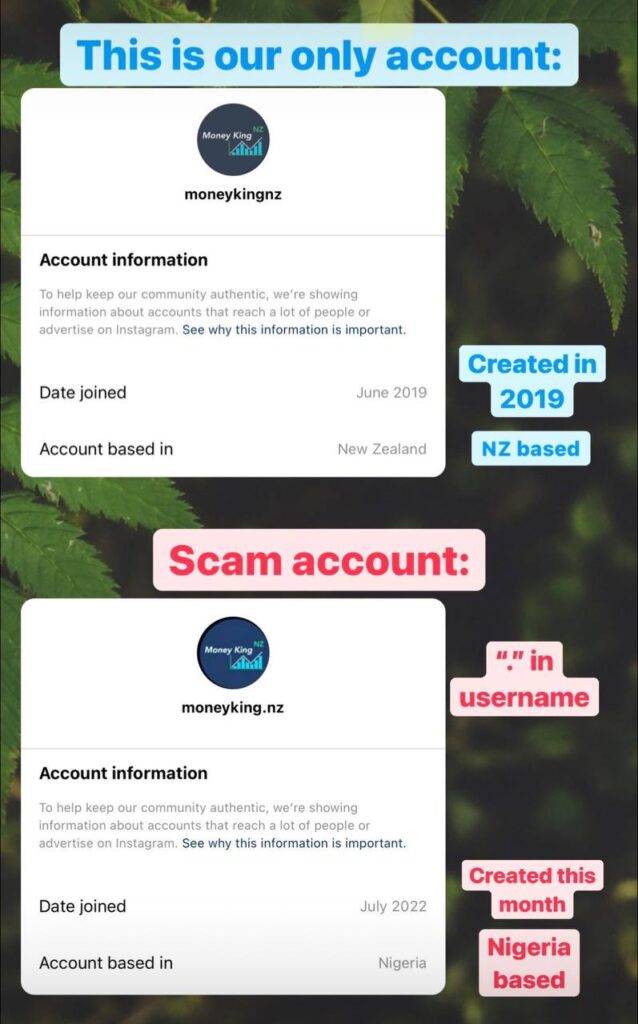

Earlier this month some of our followers came across an Instagram account that tried to impersonate us, copying everything from our bio, profile photo, and posts, to having a similar follower count. This fake Money King NZ account would message our followers, starting up a conversation and ultimately trying to get them to sign up for a scam trading/investment platform.

This was frustrating as it took Instagram at least 2 weeks to remove the account despite many of our followers reporting it. Other personal finance accounts like Kernel and Frances Cook were also impersonated by the scammers. To make matters worse, we had a similar issue on Facebook where an account pretending to be us encouraged people to message them to receive “airdrop rewards”.

So how can you tell whether one of our social media accounts is the real deal?

- We only have one account – To clear up any possible doubt, we only have one account on each social media platform we’re on (Facebook, Instagram, Twitter, LinkedIn). Any other Money King NZ accounts are fake.

- Account info – Dig into an account’s information/about page, and you’ll likely find that the fake account will be based offshore (e.g. in Nigeria), while the real Money King NZ is New Zealand based.

- Be wary of DMs and rewards – We’d never message you out of the blue about investment/trading opportunities. And unfortunately we also do not offer airdrop rewards to our good followers.

While the fake accounts eventually got removed, the issue is bound to crop up again sooner or later. Please ignore and/or report them as we’d hate for you to lose your money to them, and thanks in advance for your support on this!

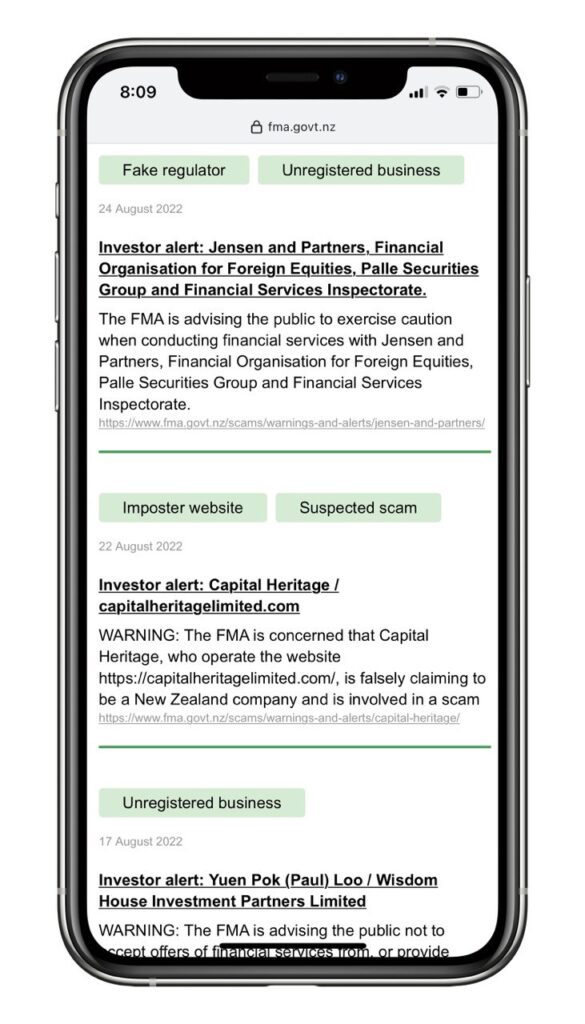

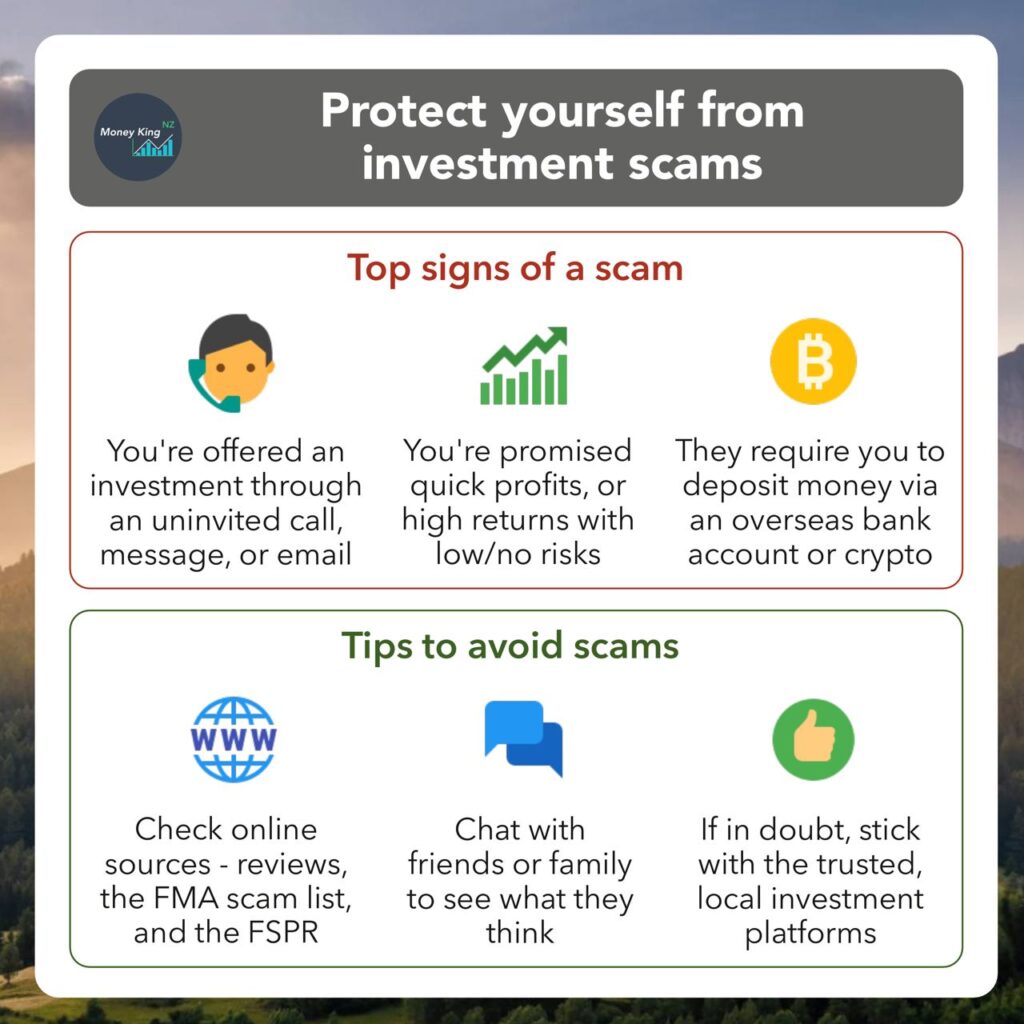

Staying safe from scams

Investment scams don’t just exist on social media. So here’s how can you stay safe from them in general. Firstly, here’s some red flags that suggest an investment opportunity might actually be a scam:

- ☎️ Cold calls – It’s generally illegal to offer investment opportunities through cold calling or via an unsolicited email or message. A lot of scammers will try to impersonate reputable companies/influencers when messaging their victims.

- 💸 High returns with low/no risk – Scammers will often offer trading platforms, exclusive IPOs, or some other opportunity with easy, low-risk gains. Legit investments always have some degree of risk, and will never guarantee quick profits. If it sounds too good to be true, then it probably is.

- 💶 Unusual payment methods – While there’s plenty of legitimate reasons to transfer money offshore or to use cryptocurrencies, requiring these to pay for an investment opportunity can be a massive red flag.

Here’s what you can do if you’re uncertain about an investment opportunity:

- 💻 Check online resources – Look at reviews (e.g. on Money King NZ, or MoneyHub), check the FMA’s shockingly huge list of scams, and make sure the provider is listed on the Financial Service Providers Register (FSPR).

- 👥 Have a chat – Check with friends and family to see what they think about the investment opportunity. A second opinion may help you spot red flags that you’ve missed.

- 🇳🇿 If in doubt – Use a trusted, local investment platform. There are plenty of great New Zealand based options to help you grow your wealth like Sharesies, InvestNow, Kernel, Simplicity, Hatch, Flint, Smartshares, SuperLife, Milford + many more! Some lesser known investment opportunities may be more tempting than familiar ones, but ask yourself whether they’re worth risking your money over.

Further Reading:

– The ultimate guide to investment platforms in New Zealand

4. What we’ve been up to

Interesting reads

Here’s some interesting investing related content we came across this month:

- The pitfalls DIY investors need to avoid (Cooking the Books podcast) – Frances Cook chats with Anthony Edmonds of InvestNow about the pitfalls investors may face when using DIY investment platforms.

- How long should I fix my mortgage for? (Your Money Blueprint) – Your Money Blueprint tackles the mortgage question that’s so commonly asked.

- 65% of Americans are doing ‘the exact opposite of what they’re supposed to,’ says investing expert—here’s what to do instead (CNBC) – We’ve been constantly banging on about why the current market downturn is a great time to continue investing, and this article reinforces our message.

- Who’s The King Of The NZ Retail Sector? (MoneyBren Blog) – Another cracker of an article by MoneyBren, this time analysing the retail companies listed on the NZX.

- You Suck at Investing. (How Money Works YouTube channel) – A look at why most investors (even professional ones) fail to make a return below the market average.

Money King NZ happenings

The Money King NZ site had its busiest month of the year so far, with visitor numbers well up on previous months. This probably had to do with people being more optimistic about investing, and our recent articles being quite relevant to investors. So if you’re new to the site, welcome, and if not, thank you for your ongoing support!

Outside of the website we attended the Kernel & Money Men Roadshow, which was an event held around the country, encouraging people to have more open conversations about money as we can learn so much from each other’s money experiences. A good initiative, and we’ll be sharing some of our own money journeys in an upcoming article.

Apart from investing, this month we ate the best noodles we’ve ever had (though were way too spicy), bought a new toaster, and continued to play with cats 😂

In case you missed them

Thanks for dropping by and reading our August 2022 news article. In case you missed them, here’s the articles we published over the month:

- What’s the best low cost Growth/Aggressive KiwiSaver fund? – A comparison between the low cost KiwiSaver options offered by Simplicity, InvestNow, Kernel, and BNZ.

- 4 steps to create an incredibly simple long-term investment portfolio – A beginner’s guide to investing, which shows that creating a long-term portfolio can be much simpler than you think! Our most popular article of the month.

- 12 tax myths and misconceptions busted – Busting all sorts of tax myths from tax brackets and secondary tax to FIFs and more.

- Should you quit KiwiSaver? Our response to YouTube KiwiSaver advice – We respond to some questionable claims about KiwiSaver made by a NZ personal finance YouTuber.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Great article, but the lack of details on the noodle-source is concerning… transparency is key! 😀

Haha, that was from 1982 Xinjiang Rice Noodle on Dominion Road, a restaurant we randomly picked while looking for lunch. Anything spicier than mild is dangerous 😵

Another great article – thank you.

Thanks for reading!