Investment firms regularly run free investing workshops and seminars to share their knowledge to the public (and they usually have free food!). This month I’ve been seeing ads for complimentary investing workshops run by Craigs Investment Partners plastered all over my Facebook News Feed.

I almost never click on Facebook ads, but this time I made a rare exception. Craigs are one of the big players in the NZ investment scene, so the chance to hear what they had to say was one I couldn’t miss. Fortunately there was a workshop coming up in Wellington, so I promptly registered.

In this article I’ll be covering what I learnt, and sharing my thoughts on the workshop. Today’s article is a little different to what I usually write, so make sure you let me know your thoughts!

This article is not endorsed or sponsored by Craigs Investment Partners, is my personal interpretation of the workshop’s content, and is not to be considered as investment advice.

1. Key takeaways from the workshop

A. Building an Investment Portfolio

The ‘entrée’ of the workshop was a brief talk on putting together an investment portfolio:

Portfolio assets

There are two major asset classes you can have in an investment portfolio:

- Shares (growth assets) – units of ownership in a company

- Bonds (income assets) – a loan from an investor to a company

The mix of shares and bonds you should have in your portfolio varies – an example of a conservative portfolio would contain 70% bonds, and 30% shares. The mix you should have depends on your financial position, age, goals, income requirements, and risk tolerance.

Diversification

Diversification is the only free lunch in investing

Harry Markowitz

Diversification is highly important in an investment portfolio. It’s incredibly hard to predict how an asset will perform in a given year – if you knew the secret to predicting this, then you wouldn’t have to work another day in your life! So it’s best to invest a little bit in many different assets. There are three aspects of an investment portfolio that you can diversify:

- Asset class – having both shares and bonds. This lowers risk and volatility.

- Sector – investing in different industries. A couple of sectors they favour are aged care and IT.

- Geography – being invested in diffrent regions. Craigs invest 1/3 of clients’ money offshore. I thought this was pretty low, but their clients are often nervous about investing in less familiar markets. I also read that Craigs favours investing locally as they can better research the more familiar Australasian market, and take advantage of NZ imputation credits.

B. Market Insights

The ‘main course’ of the workshop was Craigs sharing their market insights – what themes do they currently see in the financial markets?

US & China

You have probably heard of the issues between the two in the news. These are the main players in global economy, and a worsening of trade tensions between these countries could really dent global growth. This would cause a flight to safe haven assets like the USD (being the world’s reserve currency), and result in a fall in the NZ and Australian dollars.

New Zealand’s economy would definitely be affected by trade tensions as China is our largest export market (21.7% of our exports in mainly dairy, meat, logs, tourism), and USA is our 3rd largest export market (10.7% of exports in mainly meat, dairy, wine, tourism).

Australian market

This has been a tough market! The Australian sharemarket is still 6.2% below its 2007 peak (excluding dividends). This is really poor when you compare with New Zealand (up 84.6%) and United States (up 49.7%) during the same period.

The reason for this is that the Australian market is heavily weighted towards banking and resources sectors, and this is evident by looking at the top 10 companies in the Australian sharemarket (which I’ve put below). These sectors have performed poorly over the last decade (and you couldn’t say other big Aussie companies like Woolworths and Wesfarmers have done well either!)

However, it’s not completely bad for investors – when you factor in dividends, the Australian market is up 58% since 2007. That’s still poor compared to New Zealand which is up 160% since 2007 when you include dividends.

New Zealand market

New Zealand’s economy has been chugging along well, supported by these factors:

- NZ’s main export markets are doing well economically

- Unemployment is at a 10 year low

- Regional confidence is positive – the housing market has been strong which leads to positive sentiment. Auckland is less positive, as their house prices are down

However, there are some headwinds to look out for:

- House price growth is slowing

- Net migration is slowing

- Household debt is high

- Business confidence has been low with the Labour government in power

Low Interest Rates

Interest rates locally and around the world are expected to remain low. This is awesome for borrowers, but bad for savers.

As an example, from 2007 to 2019, the 2 year mortgage rate has fallen from 9% to 4.25%. Meanwhile the term deposit rate has fallen from 8.42% to 2.90%, resulting in 66% less income. Back in 2007 you needed $475,000 to generate a $40,000 annual income from term deposits. Now you need $1,379,000 in term deposits to generate the same income!

This has seen people seek higher yielding, but higher risk investments. Here are the yields from other asset classes:

- Auckland rental yield (before costs) – 3%

- NZ Fixed Interest – 3%

- NZX 50 – 4%

- NZ Listed Property – 5.5%

- NZ Utilities sector – 6%

Bonds

Bonds are still an important part in portfolio even when yields are low. Bonds act as a safety net in your portfolio and could help you sleep better at night in times of volatility (NZ corporate bonds went up 14.4% in 2008 during the Global Financial Crisis). They’re relatively low risk, with very few bond defaults in New Zealand over last two decades.

Fixed income is important for diversification, capital preservation, and as a shock absorber during periods of volatility

Examples of recent bond issues are Kiwibank 5-year bonds paying 2.155%, and Metlifecare 7-year bonds paying 3%. Demand for these bonds have been very high despite their low rates, especially as money from maturing term deposits look for a new home. Given inflation is currently low, the real returns of bonds are still acceptable.

Share Prices

Share prices are currently in line with long-term averages, although some countries are more expensive than others:

- NZ, Australia, and emerging markets are more expensive

- US, UK, Europe, and Japan are less expensive

There are a few things to be cautious about, that could have a negative impact on the markets:

- US corporate earnings growth has softened. The effect of Trump’s corporate tax cuts on earnings have been one-off.

- Trade tensions between US and China, as mentioned above

- The yield curve inversion, where the US 10-year Treasury yield is now lower than the 3-month yield. This indicator has preceded past recessions.

However, we are now in different operating environment. Reserve banks are now more proactive in trying to stimulate economies and stave off recession, for example, by lowering interest rates.

C. In summary

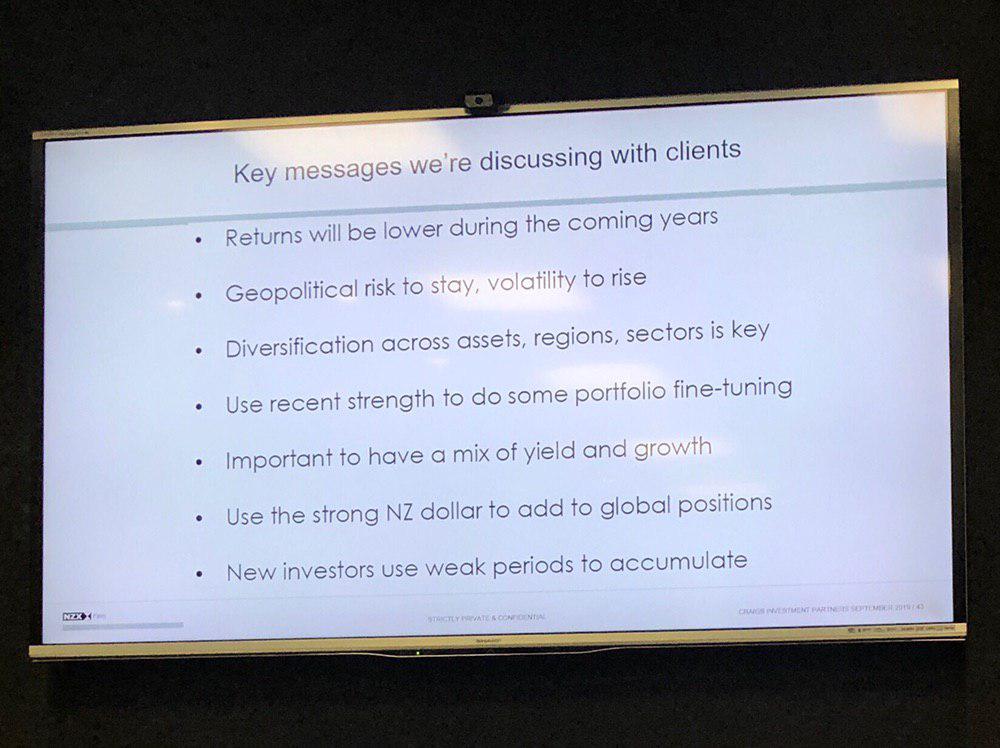

I thought this slide summed up the key topics discussed in the workshop nicely:

I should have taken more photos of slides, but there was a lot of information to absorb, and I was furiously scribbling down notes!

2. Did they try to sell anything?

There is usually a catch with attending free workshops – otherwise why would they make it free? Usually the workshop’s organiser uses the workshop to sell their product or build awareness of their service.

This workshop started with introduction about Craigs, and a couple of their key products. But overall the workshop was genuinely informative, and they did not push these products onto us. For those curious:

About Craigs

Craigs Investment Partners are one of NZ’s largest investment advisory firms, with over 500 people in offices from Kerikeri to Invercargill. They have $19 billion of clients’ funds under management and also own QuayStreet Asset Management. Their services include sharebroking, portfolio management, and investment banking.

KiwiSaver

Craigs offer two types of KiwiSaver schemes:

- QuayStreet – a traditionally managed KiwiSaver scheme, with a selection of ten funds for investors to choose from

- Craigs – a scheme for more sophisticated investors. Investors get to choose exactly what shares and funds to invest in from over 160 options

mySTART

mySTART is a savings scheme which compliments their KiwiSaver scheme – it provides more flexibility as your money is not locked in. It requires $100 per month in regular contributions. Fees are a $30 annual fee + up to 1.25% brokerage + a 1.00% management fee.

3. Was there any free food?

Now for the real reason I attended the workshop 😛 ! There was some cheese and cracker platters, nibbles, along with wine and beer on offer following the workshop.

4. My thoughts on the workshop

I spent an hour at the event and thought it was well worth attending. I got the most value out of their market insights – it’s always good to get a professional perspective on what’s going on in the economy and financial markets, and see how it aligns with my own thinking.

They did not share a lot of information on how to invest and build an investment portfolio, but I guess they don’t want to give too much of this away – if we knew too much about investing, Craigs’ financial advisers would be out of a job!

Want to attend their Investing Workshops yourself? Keep an eye on their Investor Education page for upcoming workshops in your area.

Lastly, I picked up their August 2019 News & Views magazine which discussed a couple of their themes in more detail, and made for some great reading 🙂

My overall rating of the event: 5/5 stars

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.