Should I be worried about using a bank with a BBB credit rating? What can be done to better incentivise KiwiSaver? I want to start investing and struggling to take the leap, any advice? These were some of the questions we answered in our 6th Ask Money King NZ Q&A held with our Instagram followers.

The answers in this article have been provided without any knowledge or consideration of the personal circumstances of the person who asked the question. This content should not be taken as financial advice.

In case you missed it – Our previous Q&A article:

– Ask Money King NZ (Autumn 2023) – Should I move from Sharesies?

1. Is now a good time to buy a rental property?

Interesting times in the real estate sector, which has gone from complete FOMO 1.5 years ago to a slow and depressing market. It seems that no one wants to buy rental property right now due to the fear of more interest rate hikes and more house price declines – And that’s if you can even afford a house in the first place with mortgage servicing costs so high.

But similar to other asset classes like shares, we think it’s a bad idea to try and time the market. As long as rental property is the right investment for your personal needs and financial goals, almost any time is a good time to buy regardless of what’s happening in the market. However, unlike shares the tricky part with property is that you can’t easily drip feed or dollar cost average your money into it, nor is it an easy asset class to diversify. So while you can pick up properties right now with substantial discounts, you really need to do your due diligence, think of it as a long-term investment, and be prepared to take on short-term pain around high interest rates and potentially further house price declines.

2. What are your views on the current NZD-USD exchange rate?

Unfortunately NZ Post lost our crystal ball in the mail, so we have no idea whether the exchange rate is high/low/going up/going down. But as long-term investors we choose not to focus on currency rates, as in a few decades time, chances are their impact on your investments will be minor in the grand scheme of things. In other words, the long-term increase in the value of your shares should well outweigh any adverse exchange rate movements.

We prefer to focus on regularly investing into the market, regardless of where the exchange rate is at. But if you are worried about the exchange rate, you can invest into a currency hedged fund which removes the impact of exchange rates on your investment.

Further Reading:

– Hedged vs Unhedged funds – What’s better?

3. What’s the best platform to start investing small amounts in the US market?

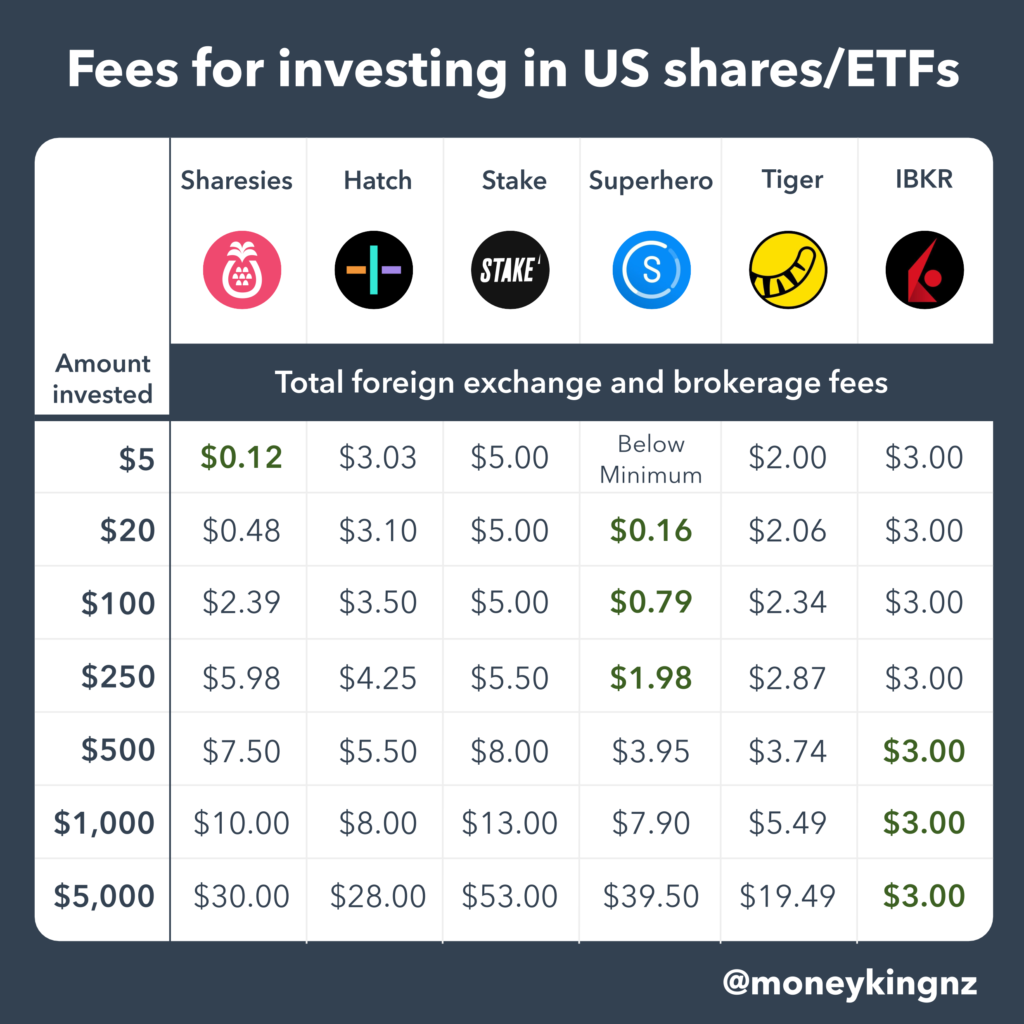

As with everything else in investing, there’s no definitive best. Fee structures for investing in US shares and ETFs vary hugely between providers, so you’ll want to start by looking at which platform’s fee structure aligns well with the amounts you’re investing. Sharesies and Superhero tend to work well for small amounts, while Interactive Brokers is cheaper if you’re investing large amounts.

You may also want to consider what additional features each platform has e.g. whether they have the ability to transfer shares in/out of the platform, if you want to access other markets like the NZX or ASX through the same platform.

But if you simply want to invest in an index fund like the S&P 500 (representing the 500 largest companies listed in the US market), you have a lot more options like Kernel and Foundation Series who offer NZ domiciled S&P 500 funds. You can find our comprehensive comparison between these funds below:

Further Reading:

– What’s the best S&P 500 index fund in 2022?

4. Who is Octagon Investment? They just got listed on Flint

They’re an active fund manager who launched in 2021, and are owned by Forsyth Barr, an investment advisory and broking company (whose clients probably make up the bulk of investment into Octagon’s funds). We’re guessing they’re named after the famous Dunedin landmark, given Forsyth Barr’s close ties to the city.

Octagon recently made eight funds available on the Flint fund platform:

- Octagon Australian Equities Fund

- Octagon Balanced Fund

- Octagon Global Equities Fund

- Octagon Growth Fund

- Octagon Income Fund

- Octagon Listed Property Fund

- Octagon New Zealand Equities Fund

- Octagon New Zealand Fixed Interest Fund

Further Reading:

– Flint Wealth review – A superior InvestNow clone?

5. If my RWT rate is 30% or higher, am I always better off in a PIE term deposit over a regular term deposit?

Some banks offer term deposits in two flavours – regular term deposits (taxed at your RWT rate) and PIE term deposits (taxed at your PIR). Assuming all other factors (like interest rate, interest payment frequency) are equal, those on a 30%+ income tax rate are generally better off with a PIE term deposit given PIR rates are capped at 28%.

However, there might be some quirks to watch out for with PIEs. Some banks don’t allow you to open PIEs through online banking, so you have to do it manually or in branch. And some banks might make it harder to break your term deposit or make an early withdrawal if it’s a PIE, so best to check the bank’s terms and conditions.

Further Reading:

– The ultimate guide to bank and savings accounts in New Zealand

6. How worried should I be about using a bank with a BBB credit rating?

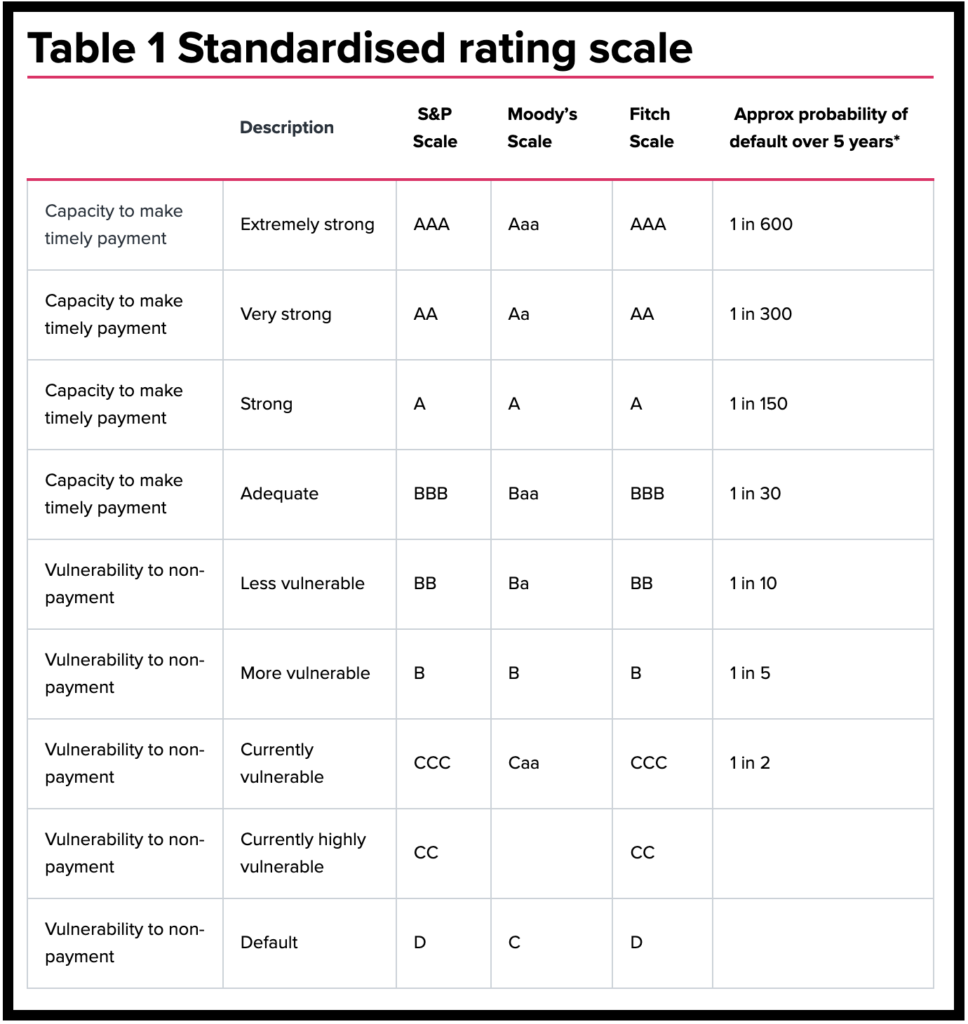

The below screenshot from the RBNZ website shows what the bank credit ratings mean:

A BBB rated bank is described as having “adequate” financial strength, though it is the lowest tier out of the investment-grade credit ratings. It’s considered to have a higher risk of getting into financial trouble if a bad economic downturn or some kind of crisis occurred, compared to say an AA rated bank. How much more risky? The ratings suggest a BBB rated bank has a 1 in 30 chance of defaulting over 5 years vs 1 in 300 for a AA rating.

This doesn’t necessarily mean a BBB rating is dangerous or a bad thing. The world doesn’t work according to probabilities – there is no financial god rolling a 30-sided die every 5 years, and making the bank go bust if they roll the number 30. With good management and no major economic shocks, the bank should have no issues remaining in good financial shape.

Overall it comes down to your risk tolerance. The bank’s interest rates, products, and service might be good enough for you to justify using them over a higher rated bank. But if you are one to worry about the state of the economy (as many people will be when choosing to invest in bank deposits in the first place), or the safety of our banks, then perhaps taking on more risk is not for you. Choosing a higher rated bank, or diversifying your money across multiple banks or via a cash fund may help you sleep better at night.

7. In your opinion what can be done to better incentivise KiwiSaver?

Apart from indexing the maximum government contribution to inflation and disallowing total remuneration contracts, we don’t think extra financial incentives are the way to go to encourage more people to contribute to KiwiSaver.

Financially savvy people are generally already doing well when it comes to participating in KiwiSaver (even if it’s just contributing the minimum to harvest the employer and government contributions). The problem is with people who are less knowledgable about KiwiSaver. They’ll always be conspiracy theorists who claim the government will take your money or those who insist rental property is the only way to build a retirement nest egg, regardless of how much free money you give away through the scheme. 10+ years ago we were in a similar boat, as we dragged our heels on signing up for KiwiSaver as we had no idea how it worked.

So we need better financial education in general. How about starting in schools, teaching kids about the basics of investing and KiwiSaver so they can make a better informed decision on where to put their money?

8. What about taxation changes to KiwiSaver (e.g. untaxed contributions or gains)?

The great thing about NZ’s tax system is that it’s relatively simple. For example, the Kernel High Growth Fund gets taxed the same regardless of whether you invest in that fund inside or outside of KiwiSaver. We think that’s a good thing – Why should people get taxed more just because they choose to invest for retirement outside of the KiwiSaver scheme?

So we don’t think changing the tax rules and making them more complex is the best way to make KiwiSaver more attractive. It’d probably be simpler to tweak the government contribution (which is effectively a tax change anyway).

However, if a future government were to overhaul the current tax system (e.g. by introducing a comprehensive capital gains tax or wealth tax), then that might be a good time to have another look at how KiwiSaver is taxed.

Further Reading:

– What taxes do you need to pay on your investments in New Zealand?

9. What are your views on crypto platforms?

Despite being around for over a decade, cryptocurrency is still an immature, largely unregulated asset class, and the same goes for the platforms that offer crypto services. Care and awareness is needed around the safety of your money, particularly around the custody of your coins.

A lot of major platforms like Binance and Crypto.com store your coins on platform, so if they go bust, pull an exit scam, or inappropriately use customer funds, you’ll lose some or all of your money. We saw that happen with FTX in late 2022 where the platform’s collapse saw investors lose billions of dollars worth of assets. There are little to no regulations or custodial arrangements to protect you if things go wrong, so it’s good to keep those risks in mind.

Otherwise you may want to consider holding your crypto in your own wallet, or using a non-custodial platform like Easy Crypto (who sends any crypto purchases direct to your wallet). However, there’s downsides to this approach, especially as you need to know how to secure your own wallet. Plenty of people have lost money this way, e.g. by misplacing their wallet’s keys.

Another option is to simply invest in crypto through a fund, like the Vault Bitcoin Fund on InvestNow which saves you from having to hold your coins yourself.

Further Reading:

– Easy Crypto review – The best on-ramp to the world of cryptocurrency?

– Vault International Bitcoin Fund review – The best way to own Bitcoin?

10. I want to start investing and struggling to take the leap. Any advice for first time investors?

Taking the leap is probably the hardest part of investing. There’s a lot to learn and a lot of platforms and investments to choose from, and analysis paralysis is a big issue. But our approach would be to just ignore the noise. Remember you don’t need to know everything about investing before getting started, and you don’t need to get everything perfect when first starting out.

So we’d just start very small and invest $10 or $100 into any reasonable looking investment. You’ll learn heaps from that initial investment – more than by reading investment websites and watching YouTube videos. And if you screw it up, $10 or $100 is a small price to pay for investing education. We’d also go for funds over individual shares. They’re well diversified and save you from having to research and pick stocks. We wrote about our beginner friendly, incredibly simple investment approach below:

Further Reading:

– 4 steps to create an incredibly simple long-term investment portfolio

11. Have you heard of Aera? Are they a new broker or savings platform?

They’re a newly launched platform that aims to help first home buyers purchase a home. Their first scheme is their Deposit Accelerator which aims to help people build a deposit by offering two high interest savings products:

- Overnight notice – Currently targets a 5.95% return by investing your money in Kernel’s Cash Plus Fund. Requires a day’s notice to get your money out.

- Thirty day notice – Currently targets a 4.95% return by investing your money in a mix of cash, Mercury Energy bonds, and Heartland Bank bonds. Requires 30 days’ notice to get your money out.

Their second (yet to be launched) scheme will be their Ownership Accelerator, a rent-to-own scheme which aims to allow people to get into a home with a deposit of as little as 2.5%. Basically every month you pay Aera a certain amount of money, some of which goes towards renting that house from Aera, with the rest going towards building up enough of a deposit to buy that house outright.

We don’t tend to be fans of these schemes as they seem to prey on people’s FOMO around home ownership.

- Firstly, there’s always a catch to using these schemes either through more interest, high fees, or having to share your capital gains with another party. Though Aera has not yet published their fees.

- Secondly, people need to realise that renting and investing elsewhere (like in shares) is an acceptable way to get ahead and build wealth. It totally sucks that home ownership is seen as such a big symbol of success and wealth, when in reality it sometimes just causes more financial stress.

- Thirdly, Aera’s savings products don’t really offer anything new for first home buyers. You can already invest directly into Kernel’s Cash Plus Fund, and their 30 day notice account is essentially a defensive fund (albeit heavily concentrated towards Mercury Energy bonds).

Further Reading:

– Can’t afford a house? 5 ways to help you get on the ladder

12. What are the top 3 financial advisors for middle class earners?

That’s a bit like asking for the top 3 flavours of ice cream 🍦

Firstly, different financial advisors will specialise in different areas such as mortgages, insurance, and investments. Knowing what type of advice you’re after (e.g. investment advice) should narrow your choices down.

Secondly, different investment advisers get paid in different ways, each with pros and cons, so make sure you understand your an adviser’s business model before signing up with them. Some get paid commission from the financial products they recommend to you, meaning you might not have to pay any fees upfront, however, that means the advisor will usually only recommend commission paying products to you (which usually have high fees). Other advisors only charge an upfront fee for preparing a financial/investment plan for you, but this means they’re able to recommend a wider range of products, not just those that pay commission. A good place to start might be Money Hub who has a list of fee-only advisers.

Lastly, different advisors will suit different people. Find one who you can communicate with easily, and someone you feel can help you meet your goals. Set up some initial consultations with advisers (which should usually be free), check their reviews/testimonials, and don’t be afraid to say no if you don’t like them.

13. What are the best KiwiSaver options for the long-term? I’ve been wondering about Kernel but it’s so new

Before even considering which KiwiSaver provider to go with, the more important thing is to understand which type of fund (e.g. aggressive/growth/balanced etc) is right for you. Long-term investing generally points to investing in growth/aggressive funds (as they provide the highest potential returns, and you have the time to ride out any market volatility), though some may want to go for a lower risk one depending on their individual risk tolerance. Sorted’s KiwiSaver Fund Finder could be a good place to start for figuring out the type of funds to invest in.

Next you can look at providers. Make sure they offer the type of fund you’re after, and look at how their funds align with your ethical investing preferences (if any), and other features a provider might offer (like the ability to pick individual funds/shares, if that’s important to you). Fees are also key, but we’d argue that value for money is more important than going for the absolute cheapest provider – There’s nothing wrong with paying more if you believe a certain provider offers something better over a cheaper one.

Kernel is a passive fund manager focusing on offering quality index funds with low fees – In fact they’re one of the lowest fee KiwiSaver providers with a fee of 0.25% for most funds. We don’t think Kernel being new is a bad thing – all other KiwiSaver providers were new at some point! Otherwise other low fee options include Simplicity and InvestNow Foundation Series.

Further Reading:

– What’s the best low cost Growth/Aggressive KiwiSaver fund?

14. Does it make sense to own AAPL and VOO at the same time?

Apple is the largest holding of VOO (Vanguard S&P 500 ETF), and the largest holding in many other US and global index funds. If you held Apple shares in addition to VOO, this would increase your portfolio’s exposure to that company. For example, if you invested 95% of your portfolio into VOO and 5% into AAPL, your portfolio’s weighting towards AAPL would be ~11.84%, compared with just ~7.2% if you had invested in only VOO.

This increased weighting towards Apple might make sense if you deliberately wanted that increased exposure (e.g. if you think Apple is the best and will outperform the rest of the market), but perhaps it’s not so good if you didn’t want that concentration towards AAPL in the first place.

15. What are the best AI companies to invest in?

We’re not the right people to ask when it comes to individual stock tips sorry. You could say we have a bias towards funds and index investing 😅

But if you’re really keen to get into AI companies a starting place could be to look at AI related thematic index funds (like the Smartshares Automation and Robotics ETF or the many that are listed on the US market). You could use the companies inside each fund as a starting point for your research. Or just invest in the ETF itself to get exposure to a diversified range of AI related companies.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Thanks! Always interesting to see what others are thinking and pondering about 🙂