Should I keep my investments in NZ or move them to Australia? What are your thoughts on InvestNow’s new 0.30% fee on their Vanguard funds? Is the NZX 50 worth investing in? These were some of the questions we answered in our 9th Ask Money King NZ Q&A held with our Instagram followers.

The answers in this article have been provided without any knowledge or consideration of the personal circumstances of the person who asked the question. This content should not be taken as financial advice.

In case you missed it – Our previous Q&A article:

– Ask Money King NZ (Summer 2023) – Is buying a house a bad investment!?

1. Do you like Booster Savvy?

Booster Savvy is a fund which works a lot like a bank account. Basically the money you invest into this fund gets deposited with BNZ and earns a set interest rate, which is currently 5%. That beats competing products like Sharesies Save (4.60% interest rate), and may even beat Squirrel’s 5.25% when you take into account Savvy’s PIE status.

Savvy comes with a few bonus features as well like a debit card so you can easily spend your money, and the ability to split your money into different “stacks”. It goes well beyond being just a savings product.

Overall we do like the product as it provides a compelling option for your savings (and possibly as a transaction account too), especially as traditional bank savings products become increasingly uncompetitive with their inferior interest rates and penalties for withdrawing your money (like bonus saver accounts which cut your interest rate whenever you make a withdrawal).

2. Any low cost Australasian funds you’d recommend having a look at?

Some actively managed funds invest across both New Zealand and Australian shares like the Devon Trans-Tasman Fund, Fisher Funds Trans Tasman Equity Trust, Milford Trans-Tasman Equity Fund, and Pie Australasian Dividend Growth Fund. However, there’s no low cost fund that we know of that invests broadly across both NZ and Australia shares, so you’d have to invest in two separate funds to get exposure to these markets.

For NZ shares, there is plenty of choice. Smartshares, Harbour, and Kernel all offer variations of a NZX 50 fund with fees starting from 0.20%:

- Smartshares S&P/NZX 50 (0.20% fee)

- Smartshares NZ Top 50 (0.50%)

- Harbour NZ Index Shares (0.20%)

- Kernel NZ 50 ESG Tilted (0.25%)

There are other non-NZX 50 NZ index funds worth considering too:

- Kernel NZ 20 (0.25%)

- Simplicity NZ Share (0.10%)

The selection for Aussie shares is quite limited, and many people are happy with getting exposure to Australia through a global shares fund (of which Australia makes up around 2%). Otherwise Smartshares has an option to consider:

- Smartshares S&P/ASX 200 (0.30%)

Alternatively you could buy a Vanguard or BetaShares Australian shares index fund off the ASX for much lower management fees (although you’d need to take into account brokerage and FX fees for this option).

Further Reading:

– What’s the best NZ shares index fund in 2022?

– How to invest in Australian shares from New Zealand

3. What happened to Sugar Wallet? They started with a bang.

Sugar Wallet was originally an investment platform that offered investment into Simplicity’s Growth, Balanced, and Conservative funds with as little as $1. They did get a lot media attention at the start, but they probably didn’t get the traction they wanted from actual investors.

We weren’t surprised. They offered nothing substantially better compared to investing with Simplicity directly, but charged $36 per year in fees on top of Simplicity’s management fees. So there was little reason to invest with them in the first place.

They tried to pivot their business by offering investment into gold and removing the Simplicity fund offering, but that’s probably not a big enough market in NZ to sustain an investment platform with. We don’t know what they’re up to these days, but it seems like they’re now trying to provide a gold investment platform in Turkey and India

Further Reading:

– Sugar Wallet review – Clipping the ticket?

4. I moved to Australia 3 years ago and have a Sharesies NZ account I DCA into each week. Should I sell out and open a Sharesies Australia account or just keep investing in one spot with Sharesies NZ?

We don’t think there’s a right or wrong answer here. Assuming you’d be holding the same or similar assets through either platform, whether you invest through Sharesies AU or Sharesies NZ won’t make a significant difference to how well your portfolio will perform. Nor does the platform you use make a difference to your tax liabilities (it is primarily the asset and tax rules of your country that matters).

But a few things you might want to consider are:

- Sharesies NZ fees are generally slightly cheaper than Sharesies AU fees. But that needs to be balanced out with any foreign exchange fees you may be incurring by changing AUD (e.g. from your salary) to NZD to deposit into Sharesies NZ.

- Do you plan to move back to NZ? If so, that may provide a strong case for sticking to Sharesies NZ. However, if you plan to stay in Australia forever, an Aussie platform might work better (especially as it saves you from switching between AUD and NZD).

- Is it worth the transaction and FX fees to sell out of Sharesies NZ and rebuy the same investments in Australia? You could always keep your existing investments in Sharesies NZ and start a new account with an Australian platform.

5. What are the biggest/most popular long-term funds in NZ? Similar to US target date funds.

Most long-term investors will probably want to invest in aggressive or growth type funds which invest mostly into shares. According to Morningstar the biggest Growth KiwiSaver funds (by assets under management at 31 December 2023) are:

- ASB Growth – $5.5b

- ANZ Growth – $4.8b

- Milford Active Growth – $4.7b

- Fisher Funds Growth – $3.6b

- ANZ Balanced Growth – $3.4b

The biggest Aggressive KiwiSaver funds are:

- Kiwi Wealth Growth – $2.6b

- Generate Focussed Growth – $2.5b

- Milford Aggressive – $1.3b

- AMP Aggressive – $722m

- Booster High Growth – $717m

But a big disclaimer that a fund’s size or popularity isn’t a good indicator of how well it suits you, nor does it mean it’s the “best”. We personally invest in one of the tiniest KiwiSaver funds with one of the very smallest KiwiSaver providers.

As for target date funds, these aren’t really a thing in NZ. However, some KiwiSaver providers like Fisher Funds and SuperLife have schemes where they automatically move you to more conservative asset allocations as you get older and closer to retirement.

6. What do you think of Tempo?

Tempo is a fund manager who offers 15 funds and has an app that gives you digital advice on what funds to pick to build your investment portfolio.

The problem with Tempo is that their fund management fees are horrendously high. Their NZ/Australia funds are actively managed and charge 1.10-1.20%, while their international funds are passively managed yet still charge 0.95% and above! You could find the same funds elsewhere for 2-4x cheaper.

Our personal preference is to invest in lower fee platforms, as it means less of our money eaten by fees and more money staying invested for us and earning a return. However, Tempo’s high costs may be worth it for some people. For example, if you needed help with building a portfolio appropriate for your financial goals (something a lot of people struggle to get right), using Tempo and getting its digital advice could be “cheaper” than trying to build a DIY portfolio and getting it wrong, or cheaper than seeing a traditional financial adviser.

We covered Tempo in a little more detail back in August 2023:

Further Reading:

– What’s been happening in the markets (August 2023)

7. Any thoughts on Milford or Generate KiwiSaver funds? They seem to be consistent high performers.

Many of Milford’s and Generate’s funds have outperformed the market over the years, which can make them attractive options for investors. The problem is that past performance isn’t a guarantee of future performance. Just because Milford or Generate outperformed the market by x% in the past, doesn’t mean they’ll outperform the market by x% into the future. And the longer the timeframe, the less likely an active fund manager is to continue outperforming the market.

But what is guaranteed is that these active fund managers will continue to charge high fees of 4-5x what a passive fund manager charges. And you’ll pay these high fees regardless of whether the fund manager outperforms or underperforms the market.

We don’t think there’s anything wrong with active fund managers, if you think their fees provide value for money and you believe they’ll continue to perform well. But you’re taking on more risk in a way as you’re relying on the skill of the fund manager to make good investing decisions with your money. It’s very possible that Milford and Generate could be the few highly skilled fund managers that do outperform index funds over the long-term, but we don’t have a crystal ball to tell whether that’ll be the case.

Further Reading:

– Milford review – Better than index funds?

8. InvestNow will now charge a 0.30% transaction fee on Australian based Vanguard funds. Thoughts?

From 25 March InvestNow will be charging a 0.30% transaction fee whenever you buy units in the two Vanguard International Shares Select Exclusions Index funds listed on the platform, so that they can recover some of the costs associated with listing these funds. No other funds are affected by this change.

This makes the Vanguard funds a lot less attractive as currently there are no transaction fees on these funds. But fortunately over the years there have been a growing number of alternative global shares index funds to invest in such as:

- Foundation Series Total World (has a higher 0.50% transaction fee, but lower 0.07% management fee)

- Kernel Global ESG

- Simplicity Global Share

- Vanguard Total World ETF (VT) or a similar ETF listed on the US market.

These alternatives are more tax efficient and just as cheap as Vanguard’s funds. So we don’t think the Vanguard funds on InvestNow were that compelling anyway, even before this transaction fee was announced. Maybe this new fee will be the catalyst for investors to reassess and potentially switch to a more attractive alternative.

Further Reading:

– What’s the best global shares index fund in 2022?

9. For tax efficiency, what are your thoughts on investing up to say $49k in a non-PIE, then investing in a PIE?

When you invest directly in overseas shares (like US listed shares or ETFs), you get taxed under the FIF tax rules if the cost of those investments is $50,000 NZD or over. By investing only $49,000 in such assets, you remain under the $50k threshold and continue to be exempt from FIF. As a result you only have to pay tax on the dividends earned from those assets. Even if the value of those assets rise above $50k, you’ll still remain under the threshold given it’s calculated based on cost, rather than market value.

The second part of the strategy is to invest any excess money above $49k into a PIE fund. For example, instead of investing into the Vanguard S&P 500 ETF (which counts towards FIF), you could invest into the Smartshares US 500 ETF (which is a PIE). This allows you to keep avoiding FIF tax as PIEs don’t count towards the $50k threshold (although you’d still be paying FIF tax indirectly through the PIE).

So the above is a valid strategy. However, there may be a few drawbacks to the strategy and things to watch out for. For example,

- Splitting your investments across the two types of funds and potentially two investment platforms increases the complexity of your portfolio.

- Even if you’re under the $50k FIF threshold, you may still need to pay tax on your dividends. This may require you to submit an IR3 tax return.

- With your foreign assets, any dividends you earn from them have to be converted back to NZD to be reinvested into PIEs. Otherwise reinvesting them in their native currency could push you over the $50k threshold.

- This strategy might not work in the first place if the dividends you’re earning are above a certain amount. For example, if your investment is yielding over ~4.65% and you’re a 33% taxpayer, you might be better off with a PIE.

- Sharesies and Hatch have a couple of tax quirks which we cover in this article.

Personally we feel the tax saved isn’t worth the downsides and prefer the simplicity of going all in on PIEs, but everyone is different and may find this to be a worthwhile strategy.

Further Reading:

– Tax on foreign investments – How do FIF and Estate Taxes work?

10. Is the NZX 50 a fund worth investing in?

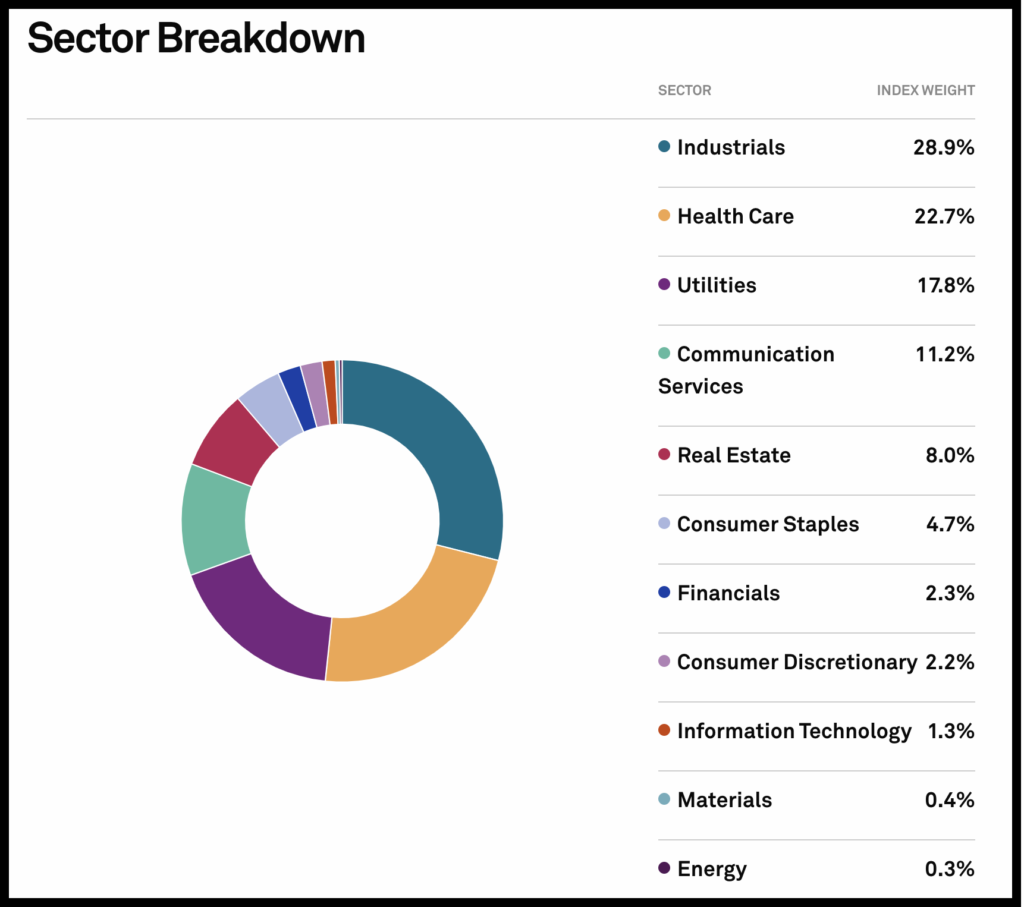

A NZX 50 index fund invests into the 50 largest companies listed on the NZ sharemarket.

From a performance perspective, it’s impossible to tell whether a NZX 50 index fund will be “worth it” as no one has a crystal ball to say how well that fund or index is going to perform into the future. While the NZX 50 has performed poorly over the last few years, that says nothing about its future performance – It could continue to perform poorly, massively outperform overseas markets, or perform somewhere in between – It’s really impossible to tell.

Outside of performance, we like the NZX 50 for a few reasons:

- It provides broad exposure to the domestic sharemarket in one go, including healthcare, utility, infrastructure, and property businesses.

- NZ shares have tax advantages over international shares, which give them a ~1% per year head start over foreign stocks

- The NZX 50 has a unique sector mix (e.g. heavily weighted towards utilities and healthcare), providing diversification away from the tech heavy (and arguably expensive) global or US index funds.

Those are some of the reasons why most fund managers will allocate at least a small percentage (e.g. 10-30%) of their diversified funds towards NZ shares. While NZ shares aren’t mandatory to invest in (your portfolio isn’t going to break if you exclude them), we personally think there’s compelling factors to consider them.

11. You haven’t mentioned the Russell Sustainable Global Shares Fund in your articles recently, any issues with them?

The Russell Sustainable Global Shares Fund is a low cost global shares fund available on InvestNow. It has a management fee of 0.32% (or 0.34% for the currency hedged version), making the fund is a little bit more expensive than competing global shares funds like Foundation Series Total World, Kernel Global ESG, or Simplicity Global Share. But has a couple of key points of difference:

- The fund invests in emerging markets (like China, India, and Brazil) while many global funds (like Simplicity’s and Kernel’s) don’t.

- They have ethical exclusions and ethical tilting, while Foundation Series’ funds don’t.

Therefore they could be a good option to consider if you want exposure to emerging markets shares AND want the sustainable aspect of the fund (given there’s no other low cost fund that come with both of these attributes).

So overall there’s nothing particularly wrong with the funds, but they haven’t really gotten much traction or popularity from retail investors (maybe the relatively unknown Russell brand doesn’t help).

Further Reading:

– What’s the best global shares index fund in 2022?

12. What are the tax complications of a New Zealander who lives outside of NZ, and invests in NZ shares?

Regardless of whether you’re a NZ tax resident or not, you would need to pay tax on the income/dividends you receive from any NZ shares. But assuming you’re no longer a NZ tax resident, there are two sides to the tax equation.

- Firstly, the tax you need to pay to the NZ government/IRD.

- Secondly, the tax you need to pay to the government where you’re a tax resident.

On the NZ side, you would pay non-resident withholding tax (NRWT) to the IRD on any dividends. Generally this is up to 30%, but can be reduced to 15% if you’re a tax resident of a country where NZ has a double tax agreement with. You won’t be able to use any imputation credits on the dividends, but companies might pay non-resident shareholders a supplementary dividend to help offset the tax impact.

On the foreign side, you may have tax implications in the country you’re a tax resident of. Under your country’s tax rules you might be liable for income tax for the dividends you received from your NZ shares, and may also have some form of capital gains tax. You would need to get tax advice specific to that country to understand your tax obligations there.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Nice article, very informative! Thank you.

Thank you!

Thanks. Love these Q&As 🙂 Good to see what’s on top of everyone’s minds!

Thanks Jase!

Question regarding 9. Tax Efficiency… does Bitcoin count towards your overseas holdings?

Great article. Thanks.

No it doesn’t if you’re holding it directly. But it will count if you’re holding it via an overseas domiciled fund (like a US listed Bitcoin ETF).

Hey MoneyKing, thanks for the article once again, so informative. Very little people go into finances like y’all do.

What do you think of Savvy? Are you planning to move from your current savings to it?

See Q1 for our thoughts on Savvy. We are personally interested in moving (from Squirrel) due to the PIE status and extra features the product offers, but probably not until we fully exit our P2P Loans we have with Squirrel (as it would be a pain to manage having our money spread across too many platforms).

Hello,

Regarding Booster Savvy,

they hold the funds with BNZ. Why is BNZ not offering a similar option directly to their clients?

What is the incentive for BNZ on this deal?

Regards,

Dan

Offering their own clients lower interest rates = higher margins for the bank. And there is always going to be plenty of clients using those accounts (no matter how inferior the rate may be) due to people being too lazy to switch or not aware of other options. So there’s little incentive for the bank to improve their rates.

As for the rates they offer Booster etc., we aren’t familiar with these wholesale banking products, but it’s likely they can still profit from them as the money can be lent out as home loans or personal loans. The margins would be lower, but the volume of money is much higher than a retail client’s account.

Great article MoneyKingNZ

quick question regarding item 9 (FIF):

why 49000 rather than, let’s say, 49900, which is still below the 50K line? Is there something else (than contributions) that could make the cost higher than the actual sum of contributions? maybe the dividends being reinvested?

Please clarify

$49k is just what the person asking the question suggested. $49,900 would still be below the threshold.

NZX for most people is fine, not great, not terrible. But for me after 6 years of underperformance and no signs of any improvement any time soon I pulled the pin this month and went 100% in Kernel Global EGS. Like you say NZX is mostly defensive stock which is ok for wealth preservation but not great for wealth accumulation. Plus NZ government policies incentivise investing in NZ property and again, I don’t see that changing anytime soon.

Agreed. The FIF Limit specifically makes people invest into property instead of equities. It’s a dangerous game that the vast majority of money people save is in property. Feels like a bubble.