In February 2024’s What’s been happening in the markets article we cover Foundation Series’ new currency hedged funds, look at what Kernel has been up to with their savings products, and check out how the markets have been performing.

This article covers:

1. Product updates

2. Market Movements

3. What we’ve been up to

1. Product updates

Foundation Series Hedged funds

Foundation Series has launched two new funds, which are identical to their existing international share funds, apart from the fact that they’re currency hedged:

- Hedged Total World Fund – Invests in over 9,000 companies from over 40 different countries including the US, UK, Japan, China, Canada, and Australia, fully hedged to the NZ dollar.

- Hedged US 500 Fund – Tracks the S&P 500 index, investing in the 500 largest companies listed in the United States, fully hedged to the NZ dollar.

These funds have the same fees as their unhedged equivalents – That’s management fees of 0.07% for Total World and 0.03% for US 500, plus a transaction fee of 0.50% when you buy or sell units in the funds. These new funds are available through the InvestNow platform, as both KiwiSaver and non-KiwiSaver funds.

What is currency hedging?

When you invest in international shares, the value of those shares are influenced not just by the price of those shares, but also by exchange rates. Currency hedged funds aim to remove the impact of exchange rates on the value of your fund, so that they’re only affected by share prices.

Currency hedged funds don’t necessarily reduce risk or enhance returns. They can remove the negative impacts of exchange rate movements on your fund, but at the same time they’ll also remove the positive impacts (the impact of currency on your investments can be both good or bad). Therefore there’s no definitively best option between hedged and unhedged funds, but these new funds will allow Foundation Series’ investors to have more options in customising their portfolios (e.g. by investing in 50% hedged and 50% unhedged).

Further Reading:

– Hedged vs Unhedged funds – What’s better?

Kernel is joining the on-call savings party

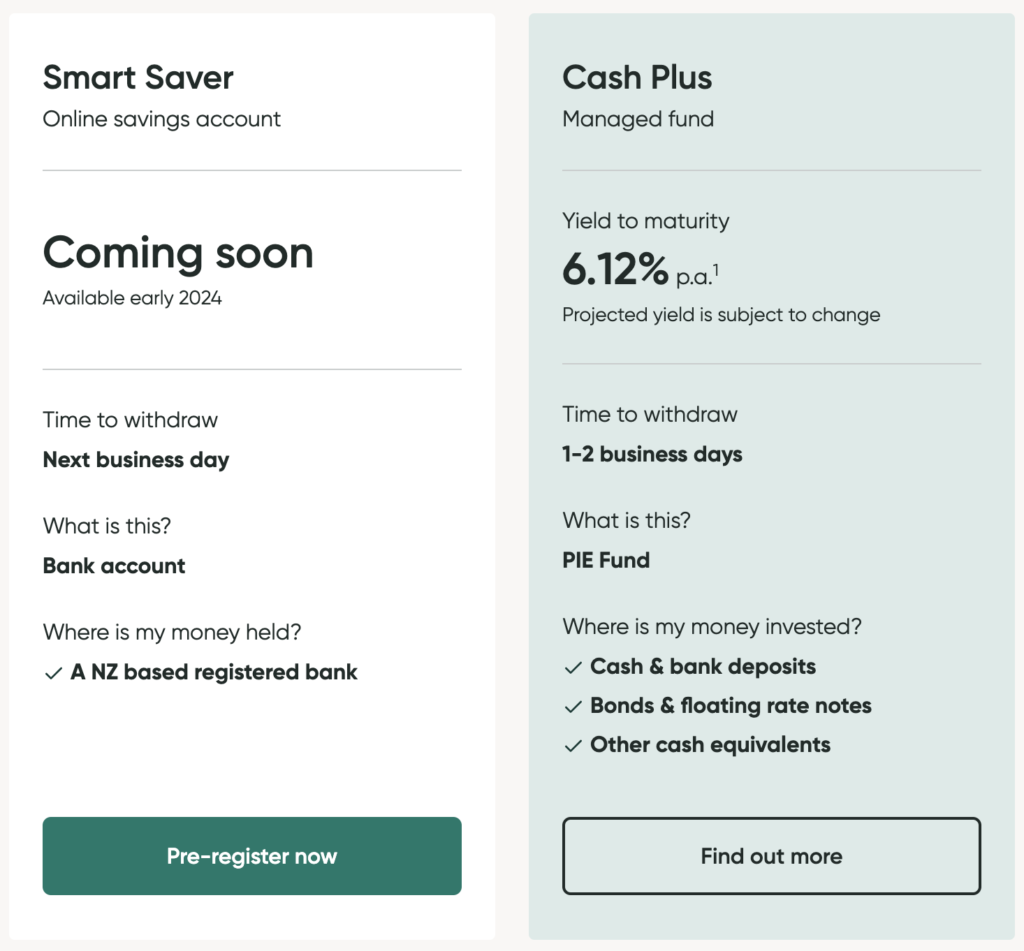

Kernel has quietly offered a savings account for a few years now, through their “Save” product. This was a notice saver account offering a variable interest rate (most recently sitting at 5.25%), but requiring 34 days’ notice to get your money out. This made the account inferior to products like Squirrel’s On-call account, which offered the same interest rate but provided almost instant access to your money.

Now Kernel is set to replace its notice saver account with a new “Smart Saver” product, which will be an on-call savings account allowing you to get your money back within a business day. Kernel will be joining other investment platforms and fund managers like Sharesies, Squirrel, and Booster who have all recently launched their own on-call savings products.

It’s not yet known what interest rate Smart Saver will have and which bank the money will be stored with, but we’ll be sure to update you as soon as the details are publicly released.

Further Reading:

– Sharesies Save, Kernel Save, Squirrel On-Call – Good places to keep your money?

2. Market Movements

Here’s how the markets have performed in February 2024 (as at 28 February), in both their local currencies and in NZ dollar terms:

| Local currency | NZD | |

| NZ shares (S&P/NZX 50) | -0.96% | -0.96% |

| Australia shares (S&P/ASX 200) | -0.26% | -1.03% |

| US shares (S&P 500) | 4.62% | 4.90% |

| Japan shares (Nikkei 225) | 8.05% | 5.62% |

| UK shares (FTSE 100) | -0.07% | 0.05% |

| Bitcoin | 41.84% | 42.22% |

NZ shares had a challenging February as a bunch of Kiwi companies reported their earnings and gave business updates. Highlights (or should we say lowlights) included Fletcher Building whose shares fell around 10% over the last month after reporting a $120 million loss, and The Warehouse Group whose shares fell ~15% in a month where they announced they’d be selling off their Torpedo7 store for $1 to focus on their core brands.

We’re also continuing to face interest rate uncertainty. The NZX is an interest rate sensitive market as it contains lots of high yielding companies – For example, as interest rates rise, many NZX listed companies become less attractive relative to higher bank deposit rates. There’s been a lot of fear recently that the OCR will increase (such as ANZ’s forecast for the OCR to rise and peak at 6%), helping weigh down the market. However, the Reserve Bank held the OCR at 5.50% which will be a relief to many.

Overseas, the US markets have continued their strong run, however, this has been largely thanks to a few star performers. For example, Nvidia and Meta are both up over 20% for the month after reporting strong earnings. The news wasn’t as positive for Apple which has fallen approximately 5% over the month. But perhaps what might be surprising is the performance of Japanese shares and Bitcoin, both of which have outperformed US shares! Check out their year-to-date performance below:

| Local currency | NZD | |

| NZ shares (S&P/NZX 50) | -0.11% | -0.11% |

| Australia shares (S&P/ASX 200) | 0.92% | -0.28% |

| US shares (S&P 500) | 6.29% | 10.17% |

| Japan shares (Nikkei 225) | 17.16% | 13.83% |

| UK shares (FTSE 100) | -1.40% | 1.63% |

| Bitcoin | 42.72% | 47.93% |

3. What we’ve been up to

It’s been a quiet month for our investments, with no changes to our portfolio and no interesting events. But one thing we have been looking at with our finances is our electricity provider. We’re currently with Flick, who have emailed us to say that our bills are going to go up around $20 per month from April. Fortunately we can bear this extra cost, but it represents a ~20% increase which seems really steep!

After looking at alternative retailers, there’s no obviously cheaper option (although Frank Energy is a contender), but we still have the next month to do some maths and consider whether it’s worth switching. We don’t really want to switch, only for our new retailer to raise their prices as well.

Outside of investing and money, we’ve been enjoying the nice weather, exploring the beaches of Whangaparāoa, hiking on the recently reopened Cascade Kauri area, and enjoyed the Auckland Lantern Festival (after years of cancellations from covid and flooding).

We went to several solid food joints this month including Burnt Butter Diner in Avondale (for interesting but tasty and well presented dishes), Domo Bakery in Takapuna (for our croissant fix), Toastie in Newmarket (for awesome toasties and coffees), and Jax Burger Shack in East Tamaki.

Thanks for reading and your ongoing support!

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.