In March 2023’s What’s been happening in the markets article we look at whether NZ banks are safe in light of the failure of several overseas banks, and some interesting developments from fund managers and platforms including Simplicity, Kernel, Foundation Series, and Sharesies.

This article covers:

1. Market movements

2. Are the banks going bust?

3. Product updates

4. What we’ve been up to

1. Market movements

Here’s how the markets performed to 30 March 2023, in both their local currencies and in NZ dollar terms:

| Mar 2023 returns Local currency | Mar 2023 returns NZD | |

| NZ shares (S&P/NZX 50) | +0.32% | +0.32% |

| Australian shares (S&P/ASX 200) | -1.88% | -3.38% |

| US shares (S&P 500) | +2.03% | +0.60% |

| Bitcoin | +20.89% | +19.14% |

So markets are largely flat after a volatile month which saw the failure of multiple banks overseas (more on that in the next section). On a year-to-date basis, markets have begun the first quarter of 2023 on a positive note:

| 2023 YTD returns Local currency | 2023 YTD returns NZD | |

| NZ shares (S&P/NZX 50) | +4.01% | +4.01% |

| Australian shares (S&P/ASX 200) | +1.19% | +0.99% |

| US shares (S&P 500) | +5.50% | +6.79% |

| Bitcoin | +69.21% | +71.27% |

2. Are the banks going bust?

This month saw the failure of a number of overseas banks including Silicon Valley Bank (SVB) and Signature Bank. This has raised some questions around whether NZ banks are safe and what the implications are for the financial markets.

Are NZ banks safe?

As with all investments there is risk involved, even when you deposit money with a bank. And in New Zealand, bank deposits aren’t insured or guaranteed by the government. Plans to introduce a deposit insurance scheme aren’t expected to come into effect until 2024.

However, the major NZ banks are still some of the safest places to park your money:

- A major contributor to SVB’s demise was that they had invested a significant amount of customer deposits into long-term government bonds, which have performed poorly in recent times due to rising interest rates. SVB had to sell these bonds for a loss in order to get money to fulfil customer withdrawals. NZ banks have much less exposure to these types of investments.

- A large portion of SVB’s customer base were tech companies and startups, who are more susceptible to rising interest rates and market downturns. Poor market conditions had increased their customer base’s need to pull out cash, further accelerating SVB’s need to liquidate their loss-making investments. NZ banks have much more diversified customer bases.

- NZ banks are subject to stricter regulations, including requirements around how much liquid assets they need to hold in order to fulfil customer withdrawals.

So we’re unlikely to see the same scenes in New Zealand, but if you’re still worried about the safety of your deposits there’s nothing stopping you from:

- Spreading your money across different banks.

- Investing in a Cash fund, which invests in a diversified portfolio of bank deposits and cash equivalents.

How could it affect my investments?

There are fears that these bank failures could spread, resulting in other banks falling like dominoes and triggering the next GFC. Therefore we’ve seen a little bit of market volatility this month with share and bond prices bouncing up and down, and the shares of the wider Financials sector hit particularly hard (down around 11% for the month compared to a 2% increase for the S&P 500). However, there doesn’t appear to be any other major banks at risk of imminent collapse at this stage.

Interestingly, this whole situation could actually have a silver lining for the financial markets. It increases the chances that central banks will slow down or pause rate cuts, given they’ll be more cautious about the impact that rate rises have on the stability of the financial system. And if you’re the owner of assets like gold or crypto, you would’ve seen these assets appreciate over the last month as investors and speculators fled towards alternatives to the current financial system.

The medium to long-term implications of the situation are still uncertain. But we see the news of these banks going bust simply as noise for long-term investors. Markets have always recovered from adversity, whether it be a global pandemic or a major financial crisis. So long-term investors should probably ignore this news, and not let it distract you from your long-term goals. It’s not enough reason to sell off your shares, nor should it change the way you invest. And chances are you will have forgotten about this news in a few months’ time.

3. Product updates

Foundation Series expands their KiwiSaver offering

In November 2022 InvestNow Foundation Series introduced a couple of ultra low-cost index funds:

- Foundation Series US 500 Fund (0.03% fee) – Tracks the S&P 500 index, investing in the 500 largest companies listed in the United States.

- Foundation Series Total World Fund (0.07% fee) – Invests in over 9,000 companies from over 40 different countries including the US, UK, Japan, China, Canada, and Australia.

Now in March 2023, Foundation Series have made these funds available through InvestNow’s KiwiSaver scheme to go alongside their Growth and Balanced funds. The usual 0.5% transaction fee applies when buying or selling units in these two funds.

The big question many have on their minds is whether these funds are worth switching to. And they certainly could work out cheaper compared with competing funds such as the All Country Global Shares Index Fund (which has a management fee of 0.42%). However, you need to commit to holding onto these Foundation Series funds for at least 3-4 years to give time for their lower management fees to offset their transaction fees.

Further Reading:

– InvestNow Foundation Series review – What’s the catch with their 0.03% fee?

Sharesies introduces Dividend Reinvestment Plans

Dividend Reinvestment Plans (DRPs) are a scheme offered by certain companies, giving you the option of having your dividends automatically reinvested into more shares of that company. A long standing limitation of Sharesies is that you couldn’t participate in DRPs with any shares you owned through the platform.

Sharesies have now quietly launched the ability to participate in DRPs, albeit for selected companies only. At this stage it appears that Contact Energy is the only company with DRPs enabled on the platform.

Here’s some benefits of participating in a DRP:

- Allows you to get more shares in a company without paying brokerage fees.

- Shares issued via a DRP are often done so at a ~1-2% discount to market price.

- Provides a way to automatically reinvest your dividends (and compound your returns).

And here’s the limitations:

- Less control over what happens to your dividends. Could lead to your portfolio being concentrated towards a particular company.

- There’s no tax benefits for opting in to a DRP. You get taxed as if you’d taken the dividends as cash.

Further Reading:

– Dealing with Dividends – 5 things to know about them

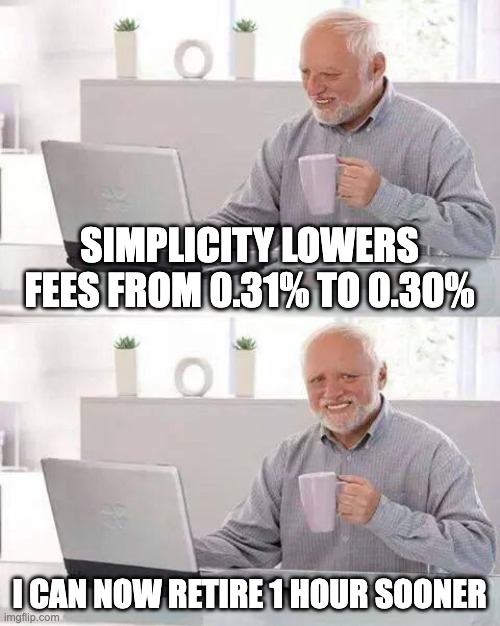

Simplicity reduces their fees

Simplicity are reducing the fees for their Growth, Balanced, and Conservative funds from 0.31% to 0.30% from 1 April. This is a small reduction and doesn’t really change much in terms of Simplicity’s competitiveness against other fund managers – Someone with $10,000 invested will only save $1 per year thanks to the change. But it’s still good to see a reduction in fees, especially when a few other investment providers have increased them recently.

Further Reading:

– Simplicity review – Could there be better fund options out there?

Kernel announces new climate friendly global funds

Kernel have announced that they’ll be adding new funds to their suite of products in the coming weeks. These are the:

- Kernel Global ESG Fund

- Kernel Global ESG (NZD Hedged) Fund

The index these funds track is quite the mouthful, being the S&P Developed Ex-Korea LargeMidCap Net Zero 2050 Paris-Aligned ESG Ex-Non-Pharma Animal Testing Index 😵. Simply put these funds invest broadly into global shares with investments from 24 developed countries, and incorporates some special ESG features:

- Excludes companies that are involved with certain activities including non-pharma animal testing, fossil fuels, controversial weapons, and tobacco.

- Adjusts the weightings of companies based on their exposure to the physical risks of climate change.

So how does this fund compare to the Global 100 Fund, which is currently Kernel’s main global fund offering? Both funds have a 0.25% management fee, come in currency hedged and unhedged versions, and are available as KiwiSaver and non-KiwiSaver options.

A major difference is how much broader the Global ESG Fund is, containing 641 companies versus just 100 with the Global 100 Fund (though the likes of Apple, Amazon, Microsoft, and Alphabet still feature among the largest constituents in each fund). In addition the Global ESG Fund invests across developed 24 markets versus 10 with the Global 100. However, US companies still dominate each fund, making up 67.3% of the Global ESG Fund and 70.3% of the Global 100 Fund.

Lastly, both funds are highly diversified, with exposure to 11 different industry sectors. However, an interesting aspect of the Global ESG Fund is it’s exposure to the energy sector which is just 0.4% (compared with the Global 100’s 7.8%). A clear example of the fund’s ESG features, which almost eliminates exposure to the less climate friendly energy sector.

Mercer takes over Macquarie

On the 3rd of March Mercer took over Macquarie’s fund management business, affecting popular products like the All Country Global Shares Index Fund. This change comes just under a year after Macquarie took over the management of these funds from AMP, leading to some investors feeling like these funds are unstable or untrustworthy. But this isn’t necessarily a bad change – At this stage there’s no changes to their funds, including fees, investment strategy, and asset allocations. The main difference investors will see is a change in the name of the fund manager from Macquarie to Mercer.

But those looking to switch away from Mercer/Macquarie funds may find the addition of Foundation Series’ two new funds to InvestNow KiwiSaver very timely.

4. What we’ve been up to

In case you missed them

In case you missed them, here’s the articles we published over the month:

- Ask Money King NZ (Autumn 2023) – Should I move from Sharesies?

- How many funds or shares do you need in your portfolio?

Our investing activity

Apart from our usual investments into index funds, this month we decided to switch to a new bank account for our short-term savings. Basically we’ve been long time customers of Heartland Bank’s Direct Call account, but the problem is that this account is taxed at 33% (our marginal tax rate), so we wanted to look at more tax efficient or higher interest rate options (for reference the interest rate of the Direct Call account was 3.60% at the time we decided to switch).

The options we considered were:

- Heartland Cash PIE – Also had an interest rate of 3.60%, but taxed as a PIE, giving us an effective interest rate of 3.92%.

- Squirrel On-Call Savings – Had an interest rate of 4.00%, but not a PIE.

- Kiwibank PIE Online Call – Had an interest rate of 3.85% and taxed as a PIE, giving us an effective interest rate of 4.20%.

We ultimately went with the Kiwibank account, as even though it has a lower headline interest rate than Squirrel’s option, the better tax treatment makes its effective returns slightly higher.

But unfortunately on the 29th of March, Heartland raised their Cash PIE interest rate to 4.10%, making its rate more attractive than the Kiwibank option. So are we going to switch back to Heartland? Probably not at this stage. Firstly, withdrawals from Kiwibank to our ANZ transaction account are a lot faster, taking just a few hours on business days, compared to overnight with Heartland. Secondly, Kiwibank has a higher credit rating than Heartland (A1 vs BBB). Lastly, even though Kiwibank doesn’t offer the absolute best interest rate, we’re happy to settle for it as we’re too lazy to constantly switch from account to account to chase the highest rate.

Outside of investing

Apart from investing this month we went to a couple of weddings, checked out SPARK Auckland as part of the Auckland Arts Festival, and got a Korean toastie from an interestingly named outlet Cyber_toast 2086.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Hey Moneykingnz, thanks for another great article.

Could you please go into more detail around the calculations for effective interest rate based on whether an account is taxed as a PIE or not?

Hi Ben, sure. For a PIE bank deposit you are taxed at a maximum rate of 28%, so a 30%, 33%, or 39% taxpayer effectively earns a higher rate of return than the headline interest rate.

A simple way to calculate the effective rate would be:

([Interest rate] x 1-28%) / 1-[your tax rate]

So let’s say we’re looking at a PIE term deposit which has an interest rate of 5%:

Note that some sources like interest.co.nz (where we got our effective rates for this article from) use a more complex calculation (which seems to take into account the fact that interest is paid and compounded monthly which results in an even higher effective rate).

Thanks!

I reckon you should add in a food highlight at the end of each post! 😛

Another enjoyable & educational monthly review thanks.

P.s. cyber toast is yum!

Ok we will. We cook at home a lot though so may have to share some recipes instead hahaha!