An increasing number of investment platforms are starting to provide savings accounts alongside their traditional products like shares and index funds. Examples of such platforms are Sharesies, Kernel, Squirrel, and InvestNow (who do term deposits). With higher than average interest rates, are these services good places to keep your money? Or are they risker than saving directly through a bank?

This article covers:

1. What’s on offer?

2. Are these products safe?

3. Comparison with other savings options

1. What’s on offer?

Those needing to use their money for short-term goals may want to consider sticking their money in a savings product. They’re low risk and protect your money from the volatility of the sharemarket. And in the case of on-call accounts, they provide easy access to your money, making them great options to store your emergency fund. So let’s look at the savings and term deposit options offered by investment platforms Sharesies, Squirrel, Kernel, and InvestNow.

The interest rates mentioned in this article are correct as at the time of writing (15 May 2023), but are subject to change.

Sharesies Save

Sharesies launched in 2017 and have since grown to be New Zealand’s most widely used investment platform with over 500,000 clients. They primarily provide investors with the ability to invest in shares and ETFs across the NZ, Australian, and US markets.

Sharesies added the Save product to their platform in May 2023. Save is an on-call savings product, allowing you to freely deposit and withdraw money without any penalties. Any money you deposit into Save currently earns interest at 4.35% p.a.

Squirrel On-Call

While Squirrel‘s primary business is mortgage broking, they’ve been operating a peer-to-peer lending platform since 2015. In January 2023 they added an on-call savings account to their platform. Similar to Sharesies Save, it provides almost instant deposits and withdrawals without any strings attached. Squirrel’s account currently pays an interest rate of 5.00%.

A minor difference with Squirrel’s On-Call account is that it isn’t actually a standalone product. It’s actually tightly integrated with their P2P lending platform – Any funds deposited into the platform that isn’t invested into P2P loans will automatically earn interest (unlike Sharesies Save where you have to manually transfer money from your Sharesies Wallet to the Save account before you earn interest).

Kernel Save

Kernel launched in 2019 as an index fund manager and has since grown to provide 19 funds with both KiwiSaver and non-KiwiSaver options.

In April 2022, they launched Kernel Save. This is a notice saver product which works differently to Sharesies and Squirrel’s on-call products – Instead of being able to withdraw your money immediately, Kernel requires you to give them 34 days’ notice before you can access it (though you can deposit money at anytime without restrictions). In return for the lower accessibility of your money, you get a slightly higher interest rate which is currently 5.25%.

InvestNow term deposits

InvestNow is a fund platform that launched in 2017. Today they offer a massive selection of 150+ funds from around 30 different fund managers. InvestNow are less well known for their term deposit offering, which launched in 2018, and allows you to invest in term deposits across six different banks:

- ANZ

- Bank of China

- BNZ

- China Construction Bank

- Heartland Bank

- SBS

Term deposits work differently to on-call and notice saver accounts. They involve locking up your money for a fixed period of time, in which you’ll get paid a fixed rate of interest (as opposed to on-call savings and notice saver accounts where the interest rate is subject to change at anytime). You also can’t make further deposits into a term deposit, nor can you (in normal circumstances) withdraw money from one until the term ends.

Term deposits are the least flexible and accessible savings product, but usually have the highest interest rates. Here’s a selection of InvestNow’s current terms and rates:

| Bank | 6m | 9m | 1y | 18m | 2y |

| ANZ | 5.50% | 5.40% | 5.70% | 5.35% | 5.25% |

| Bank of China | 5.20% | 5.50% | 5.70% | 5.30% | n/a |

| BNZ | 5.65% | 5.60% | 5.85% | 5.55% | 5.23% |

| China Construction Bank | 5.55% | 5.80% | 5.90% | 5.80% | n/a |

| Heartland Bank | 5.40% | 5.70% | 5.90% | 5.25% | 5.20% |

| SBS | 4.90% | 5.30% | 5.45% | 5.25% | n/a |

Further Reading:

– Bonus Saver vs Notice Saver vs Term Deposit – Which savings product is right for you?

2. Are these products safe?

Neither Sharesies, Squirrel, Kernel, or InvestNow are registered banks or deposit takers. They don’t even hold the money you deposit into their savings products. Instead any money you put into these products is held with the following banks:

- Sharesies Save – Sharesies does not publicly disclose the bank they use, apart from saying they have an AA- credit rating. However, it is speculated that they use ASB, given that’s who they currently have a banking relationship with.

- Squirrel On-call – Held with BNZ, which has a AA- credit rating.

- Kernel Save – Held with Heartland Bank, which has a BBB credit rating.

- InvestNow term deposits – Depends on which bank’s term deposit you choose.

- ANZ (AA-)

- Bank of China (A)

- BNZ (AA-)

- China Construction Bank (A)

- Heartland Bank (BBB)

- SBS (BBB)

In each case the bank pays the platform interest, which is then passed on to their own clients. The platforms don’t invest your money into the sharemarket, loans, or anywhere else. So is it riskier to save your money through these platforms, as opposed to going directly through a bank?

Credit risk

The first risk to consider is the possibility of the bank where your money is stored going bust or getting into financial trouble. In this case you could lose some or all of the money you deposited. This credit risk is the same regardless of whether you invest via a platform, or directly through a bank. For example, putting your money in Squirrel’s On-Call account has same credit risk as putting it into a savings account held directly with BNZ. In addition, contrary to popular belief there is no government guarantee or depositors insurance regardless of whether you invest via a platform, or directly through a bank.

However, deposits in New Zealand banks are generally considered to be low risk, and are heavily regulated and monitored. For reference, here’s what the credit ratings imply about the creditworthiness of each bank:

- AA- (Very strong) – 1 in 300 chance of defaulting and failing to repay investors over a 5 year period.

- A (Strong) – 1 in 150 chance of defaulting.

- BBB (Adequate) – 1 in 30 chance of defaulting.

A BBB rating (like what Heartland Bank has) doesn’t necessarily mean it’s a dangerous bank or a bad option. But their lower credit rating should still be taken into consideration by investors when deciding which account to use.

Platform risk

The platforms offering these savings products are essentially middlemen between you and a bank. So the second risk to consider is what would happen if the platform goes bust?

The good news is that any money you put into these products never actually touches the platform itself. When you deposit money, it goes straight to the bank each platform uses, into accounts in the name of a custodian. This custodian operates as a seperate entity from the platform and exists to hold assets on your behalf. Your funds never get held on the platform’s balance sheet or intermingled with the platform’s assets. While these custodial arrangements help protect you from platform risk, note that they don’t protect you from credit risk – They won’t save you if the bank at which your money is held goes bust.

Example

Any money you deposit into Sharesies Save goes into an account at an AA- rated bank (ASB?) under the name of Sharesies’ custodian Sharesies Nominee Limited. The money never touches the books of the Sharesies platform itself (Sharesies Limited). You remain the beneficial owner of that money, so if the Sharesies platform were to get into financial trouble, they couldn’t use that money to repay their debts or their staff salaries.

So what would actually happen if your platform goes bust? Let’s say you wake up one day and your investment platform has completely vanished. There is a risk is that you might not be able to withdraw your money for a short period of time, given the administrative work involved to appoint a liquidator who would then work out how to connect investors back up with their funds. This is the same risk as you already take on if you already invest in shares/funds/P2P loans through these platforms.

However, this is a worst case scenario. All are relatively established platforms and are unlikely to disappear overnight. If one of those platforms were to get into trouble, a more likely scenario would see the platform sold off to another operator, who (under new ownership) would continue to operate as usual, allowing investors to continue accessing their money.

Further Reading:

– What happens to your money if InvestNow or Sharesies go bust?

3. Comparison with other savings options

Here’s how these platforms’ savings products compare with saving your money directly with a bank.

Rate comparison

Sharesies Save & Squirrel On-Call vs other On-call Savings accounts

Here’s how Sharesies Save and Squirrel On-Call compare with the on-call savings accounts offered by various other New Zealand banks:

- Westpac Simple Saver – 2.50%

- ANZ Online Savings – 2.55%

- ASB Savings On Call – 2.65%

- Rabobank RaboSaver – 4.00%

- BNZ Rapid Save – 4.30%

- Kiwibank On-line Call – 4.35%

- Sharesies Save – 4.35%

- Heartland Direct Call – 4.60%

- Squirrel On-Call – 5.00%

These on-call accounts could also be compared to bonus saver accounts. However, these accounts penalise you with a lower interest rate if you withdraw your money or fail to increase your balance by a certain amount each month. Therefore they tend to be inferior to on-call accounts.

- Westpac Bonus Saver – 0.90%. Increases to 4.25% if your balance is $20 greater than on the last business day of the prior month.

- ANZ Serious Saver – 1.10%. Increases to 4.25% if you make no withdrawals and deposit at least $20 a month.

- Co-operative Bank Step Saver – 1.80%. Increases to 4.50% if you make no more than one withdrawal and increase your balance each month.

- ASB Savings Plus – 2.55%. Increases to 4.65% if you make no withdrawals, apart from 1 withdrawal during the first 5 days of a calendar quarter.

- Rabobank Premium Saver – 2.25%. Increases to 5.00% if you increase your account balance by at least $50 per month.

Overall Sharesies and Squirrel offer rates that are higher than the average bank. There’s no catch to this – These platforms have access to institutional banking products and rates that ordinary retail banking clients can’t access, and choose to pass on these higher rates to their own customers.

Kernel Save vs other Notice Saver accounts

The interest rate Kernel Save offers is better than Kiwibank and Westpac’s 32 day notice saver. But it is identical to Heartland Bank’s own 32 day Notice Saver (though Kernel locks your money in for an extra 2 days), so there’s little benefit to choosing them over going direct via Heartland, apart from the convenience factor.:

- Westpac 32 day Notice Saver – 4.50%

- Kiwibank 32 day Notice Saver – 4.55%

- Kernel Save (34 days’ notice) – 5.25%

- Heartland 32 day Notice Saver – 5.25%

Some notice saver accounts require a longer notice period. Though only Heartland’s 90 day notice saver has a better rate than Kernel Save:

- Kiwibank 90 day Notice Saver – 5.10%

- Rabobank 60 day NoticeSaver – 5.10%

- Heartland 90 day Notice Saver – 5.50%

InvestNow term deposits vs TDs direct with bank

InvestNow’s term deposits are a mixed bag, sometimes paying a higher interest rate than going directly through the bank, and sometimes paying a lower interest rate. It probably pays to shop around when choosing a term deposit (you can use a comparison site like interest.co.nz).

| Bank | 6m | 9m | 1y | 18m | 2y |

| ANZ (via InvestNow) | 5.50% | 5.40% | 5.70% | 5.35% | 5.25% |

| ANZ (direct) | 5.35% | 5.40% | 5.70% | 5.35% | 5.30% |

| BNZ (via InvestNow) | 5.65% | 5.60% | 5.85% | 5.55% | 5.23% |

| BNZ (direct) | 5.50% | 5.45% | 5.70% | 5.40% | 5.30% |

| Heartland (via InvestNow) | 5.40% | 5.70% | 5.90% | 5.25% | 5.20% |

| Heartland (direct) | 5.50% | 5.80% | 6.00% | 5.35% | 5.30% |

| SBS (via InvestNow) | 4.90% | 5.30% | 5.45% | 5.25% | n/a |

| SBS (direct) | 5.00% | 5.40% | 5.55% | 5.35% | 5.35% |

Further Reading:

– The ultimate guide to bank and savings accounts in New Zealand

Tax

You pay tax on any interest earned through these savings products (which for the majority of investors, should be automatically deducted and paid to the IRD for you). With all platforms’ products you get taxed at your RWT rate (which will either be 10.5%, 17.5%, 30%, 33%, or 39%). This is a potential weak point of Sharesies, Squirrel, Kernel, and InvestNow’s savings products – None are structured as PIEs.

Examples of PIE on-call savings products are Kiwibank’s PIE Online Call account and Heartland’s Cash PIE account. The below table shows the effective interest rates for Kiwibank and Heartland’s accounts for those in the 30%, 33%, and 39% tax brackets. It shows that if your tax rate is 39%, your effective tax rate from these PIE products is over 5%, beating out Squirrel’s on-call account thanks to their tax efficiency, being taxed at a maximum rate of 28%.

| Interest rate | 30% | 33% | 39% | |

| Kiwibank On-line Call | 4.35% | 4.47% | 4.67% | 5.13% |

| Heartland Cash PIE | 4.60% | 4.73% | 4.94% | 5.43% |

As for notice saver accounts, Westpac and Kiwibank’s offerings are both structured as PIEs. Despite having lower interest rates than Heartland’s 32 day Notice Saver (paying 5.25%), if your tax rate is 39%, Westpac and Kiwibank’s Notice Savers could work out better for you because of their PIE status.

| Interest rate | 30% | 33% | 39% | |

| Westpac 32 day Notice Saver | 4.50% | 4.63% | 4.84% | 5.31% |

| Kiwibank 32 day Notice Saver | 4.55% | 4.68% | 4.89% | 5.37% |

Many banks (including ANZ, BNZ, and Heartland) also do term deposits in PIE form, but these aren’t available through InvestNow. Let’s take BNZ’s term deposits for example, where in most cases investing through InvestNow will give you an interest rate 15 basis points higher than going directly through BNZ. But even though BNZ’s rates are lower, the availability of PIE options can increase the effective interest rate to the extent that they equal or beat InvestNow for those in the 30-39% tax brackets.

| 6m | 9m | 1y | 18m | |

| InvestNow interest rate | 5.65% | 5.60% | 5.85% | 5.55% |

| BNZ direct interest rate | 5.50% | 5.45% | 5.70% | 5.40% |

| PIE effective rate @ 30% | 5.65% | 5.61% | 5.86% | 5.55% |

| PIE effective rate @ 33% | 5.91% | 5.86% | 6.13% | 5.80% |

| PIE effective rate @ 39% | 6.49% | 6.43% | 6.73% | 6.37% |

You can use the below to do your own effective interest rate calculations for PIE savings products:

Minimum investment

There are no minimum investment amounts required for Sharesies Save, Squirrel On-Call, and Kernel Save. This aligns with most other bank savings products who in most cases also don’t have any minimums.

For InvestNow’s term deposits, the minimum investment amount for each bank is:

- ANZ, China Construction Bank – $10,000

- Bank of China – $100,000

- BNZ, Heartland, SBS – $2,000

Notable differences are Heartland and SBS, whose minimums are just $1,000 if investing directly.

Payment of interest

Sharesies Save, Squirrel On-Call, and Kernel Save pay out any interest you earn on a monthly basis. This is the same as almost every other bank savings product. For InvestNow’s term deposits, the interest you earn is paid out at maturity (when your term deposit ends), unless the term is 2 years or longer, where interest will be paid either annually or semi-annually, depending on the bank.

InvestNow’s offering is generally inferior to term deposits held directly with a bank, which in many cases give you the option of having interest paid out or reinvested on a monthly, quarterly, semi-annually, or annual basis. Generally more frequent interest payments are better, as they allow you to get your interest sooner so you can reinvest and compound your returns or use it to provide you with a regular income.

Deposit/Withdrawal processing times

Sharesies’ and Squirrel’s accounts provide almost immediate access to your money without any penalties. That could make them good for emergency funds or whatever other scenario that requires you to have quick access to your savings. So just how fast can you actually get your money out?

- Sharesies Save – To get money into Sharesies Save you first need to deposit money into your Sharesies Wallet, which takes up to a few hours on business days. You then need to manually transfer that money into Sharesies Save (though this transfer occurs instantly). To withdraw money from Sharesies Save, you need to move it back to your Sharesies Wallet. This happens immediately, at which point you can use the money to invest in shares, or withdraw it to your bank account which takes up to 1 business day, or 2 business days if you request the withdrawal after 4pm.

- Squirrel – Squirrel is a lot more streamlined. On business days it takes around 1-2 for any deposits to appear in the platform. Once your money arrives it automatically starts earning interest – There is no need to transfer it into a separate account. For withdrawals, on business days it also takes around 1-2 hours to receive in your bank account.

As for the major banks, deposits and withdrawals also take around 1-2 hours (on business days) to get from one bank to another, or are usually instant if transferring between two accounts within the same bank. A notable exception is Heartland whose deposits and withdrawals take at least 1 business day to process.

So Squirrel and the major banks are the fastest services, and will get even better as the big banks begin to process payments on weekends starting from late May 2023. Heartland and Sharesies are a little slower, with the latter having a slightly clunky user experience – It would be better if Sharesies simply paid interest on your Wallet balance instead of making you manually transfer money in and out of a separate Save account.

Investnow and Kernel are also a little slower, requiring at least 1 business day to get your money in and out of their platforms. But that might not matter as much, given their savings products have a lock-up period and aren’t designed for you to have instant access to your money in the first place.

Fees

There are no direct fees to invest in Sharesies Save, Squirrel On-Call, Kernel Save, or InvestNow’s term deposits. Most bank savings products don’t charge fees either, but it’s worth checking the fine print to make sure – For example, BNZ’s Rapid Save account charges $3 per withdrawal if you make more than one withdrawal per month.

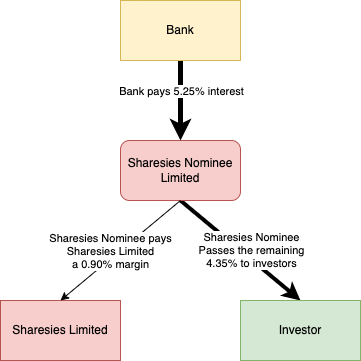

However, in some cases the platform you invest through makes money by clipping the ticket on the interest they receive from the bank they store your savings with:

- Sharesies – Earns a commission of up to 0.90%.

- Squirrel – Earns a small margin to cover their costs, but the amount is not disclosed.

- Kernel – Kernel does not earn fees or commissions from Heartland.

- InvestNow – Earns a 0.10% distribution fee from the bank you open a term deposit with.

These commissions/fees aren’t directly charged to the investor, but rather deducted from the amount of interest the platform receives from the bank. For example:

- Let’s say you deposit money into Sharesies Save. Assuming Sharesies earns the Official Cash Rate (OCR) of 5.25% from the bank, and takes a commission of 0.90%, you’d be left with the remaining 4.35%. This commission can fluctuate from time to time, though is capped at 0.90%.

- Let’s say you open a term deposit paying 5.90% interest with InvestNow. In this case the bank would pay InvestNow 6.00% in interest. 0.10% of interest goes to InvestNow, while you’d earn the 5.90% in interest as advertised.

While these fees don’t result in you losing any of the advertised amount of interest you receive, they could still be considered an indirect fee, given they effectively reduce the amount of interest that could’ve otherwise been passed on to you.

Account types

Banks typically offer different types of accounts including individual, joint, company, and trust accounts. Kernel and InvestNow also offer all of these account types. However, Sharesies and Squirrel are more limited in the account types they offer:

- Sharesies – No joint, company, or trust accounts

- Squirrel – No joint accounts

So that’s bad news if you’re looking to open a new joint Sharesies or Squirrel account (e.g. an account in the name of both yourself and your partner).

Convenience

If you’re already using Sharesies/Squirrel/Kernel/InvestNow to invest, you can access their savings products without having to sign up for a new account elsewhere. InvestNow’s offering is particularly useful, allowing you to compare and access term deposits from six different banks without having to sign up to each bank individually. This convenience may be another factor to consider when choosing to use one of these platforms over going direct via a bank.

Another potential reason to use these platforms is to keep your savings separate from the bank you usually use. This might help you keep your savings out of sight, and make it less likely to dip into your funds and spend it.

Conclusion

Platforms like Sharesies, Squirrel, Kernel, and InvestNow are going beyond their traditional funds/shares/P2P lending offering, and offering more tools (like savings accounts and term deposits) for people to manage their wealth. They’re handy additions to each platform, giving their existing investors the convenience of adding a short-term savings option to their portfolios without having to sign up with another service. And while savings accounts aren’t the most exciting products, in some cases these platforms are attempting to disrupt the big banks, offering better than average interest rates without adding substantially more risk.

However, there’s a couple of key negatives to watch out for. Firstly, none of these platforms offer PIE accounts, making them less efficient from a tax perspective. Therefore they may have lower effective interest rates when compared with a PIE product. Secondly, with InvestNow, your term deposit interest is paid out at maturity in most cases – there’s no option to receive monthly or quarterly interest payments to compound your returns more regularly. Despite these downsides, their competitive interest rates and highly convenient offerings make saving money through these platforms worthy of your consideration.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

I opened a Sharesies Savings account purely out of interest, but I will not be using it. The fact that it a custodial product is disappointing, and is a deal breaker for me.

There may not be a government guarantee or depositors insurance at present, but I believe there is legislation being considered by parliament to introduce a depositor guarantee up to $100k (which is bugger all) in the not to distant future. From memory there was one introduced temporarily during the GFC. Most first world western countries have had this in place for decades.

Oops, we forgot to mention in the article that there is indeed a deposit guarantee scheme going through the process at parliament. Might be in place in 2024, maybe later…