Gold and to some extent silver, are precious metals that are highly sought after assets, especially during challenging economic times. This article looks at the basics of investing in gold and silver including the reasons to invest (and the reasons to avoid them), how you can invest, how they compare to other investments, and how they might fit in your portfolio. Could they be genuine investments that can help diversify your portfolio? Or is investing in them really just gambling? We aim to provide a balanced view to help you decide for yourself.

This article covers:

1. Pros and cons of investing in gold and silver

2. How can you invest in gold and silver?

3. How does gold and silver compare with other investments?

4. How might gold/silver fit into your portfolio?

1. Pros and cons of investing in gold and silver

Reasons to invest in gold and silver

To hedge against the current financial system

Gold (and to some extent silver) is considered a safehaven in which many use to store some of their wealth to remove it from the banking system. They use it as a form of protection against an economic apocalypse, as it’s an asset that they believe will still be left standing and retain value if the worst were to happen (e.g. if the world’s fiat currencies like the NZ or US dollar were to become worthless). Gold has been ingrained in the minds of most people as being a prized and precious object, and that’s unlikely to change even if the world’s financial system were to fall over.

To hedge against inflation

While currencies used to be backed by gold, these days governments can ruthlessly increase the supply of money, causing inflation and reducing their value. However, Gold and silver are tangible and finite natural resources, and their value can’t be eroded by creating more of the metals out of thin air. It’s argued that they’ll retain their value or increase as fiat currencies like the US dollar weaken.

Asset class diversification

There doesn’t tend to be a correlation between gold/silver and other asset classes like shares, meaning they don’t closely follow the price movements of shares. So gold and silver could be used to further diversify your portfolio.

Industrial value

Gold and silver aren’t just valuable as a form of money. Gold is always in demand, being used in industrial applications such as for jewellery, electronic components, and dentistry. Silver has even more industrial uses, though that means its price tends to be more volatile and impacted by the state of the economy.

Reasons to avoid gold and silver

Not productive

One argument against investing in gold or silver is that they’re simply just lumps of metal. Unlike other assets like shares or bonds, they don’t produce anything and don’t generate any dividends or interest. The only way to make money from them is from capital gains – selling the lump of metal at a higher price than what you paid for it.

Not genuinely scarce

While gold and silver are ultimately finite natural resources, it’s hard to tell how much is left to be mined. More gold and silver is continuously mined from the earth every year, and new discoveries of gold/silver deposits or new technologies that improve mining threaten to further increase the world’s supply. Therefore it’s impossible to measure exactly how scarce these metals are.

Poor performance

Gold hasn’t reliably lived up to its reputation as a hedge against inflation. Take the following periods of high inflation in the US for example. While gold performed well in the 70s, it didn’t do a good job of hedging against inflation in later years:

| Period | Annualised inflation rate | Annualised gold performance |

| 1973-1979 | 8.8% | 35% |

| 1980-1984 | 6.5% | -10% |

| 1988-1991 | 4.6% | -7.6% |

More recently in 2022 we saw gold and silver go up in value as the war between Russia and Ukraine broke out, perhaps proving themselves as safehaven assets. But since then they’ve declined in value with gold sitting at around -7.50% and silver sitting at around -14.50% year-to-date. And that’s with inflation currently at multi-decade highs. However, they’re still outperforming the S&P 500 this year, which is down almost 25%.

Overall the performance of these metals are poor. While they’ve beaten leaving your wealth in dollars over the very long-term, they’ve done relatively poorly when compared to investing in shares. More on this later.

2. How can you invest in gold and silver?

Exchange Traded Funds (ETFs)

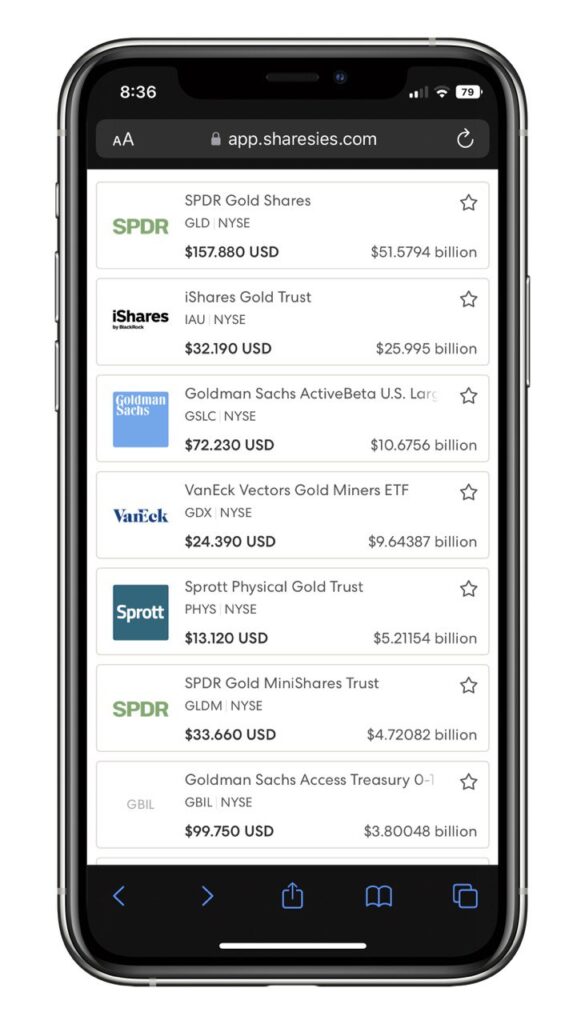

The first way you can invest is to buy an ETF which invest in physical gold or silver. Each unit of these ETFs is backed by physical gold/silver stored securely by a custodian. There aren’t any listed on the NZ sharemarket, however there’s plenty listed on the US market which you can access through a platform like Sharesies, Hatch, Stake, or Interactive Brokers. Here’s a couple of major gold ETFs:

- SPDR Gold Shares (GLD)

- iShares Gold Trust (IAU)

And a couple of silver ETFs:

- iShares Silver Trust (SLV)

- abrdn Physical Silver Shares ETF (SIVR)

Tip – Currency risk

Gold and silver are priced in US Dollars. Therefore, in addition to the price movements of the metals themselves, the value of your investment will also be impacted by exchange rate fluctuations between the NZ dollar and US dollar.

Pros of ETFs

- Convenient – Being available through online investment platforms, these funds allow you to get exposure to the price movement of gold/silver as easily as buying any other shares or ETFs. You can complete an investment transaction from the comfort of your own home and without interacting with anyone else.

- Accessible – The minimum investment for most investment platforms is incredibly low, so you could invest with as little as 1 cent. Plus you don’t have to buy an entire unit of an ETF at once – most platforms support fractional units which means you can buy a parts of a unit.

- Liquid – There’s usually plenty of trading volume on these ETFs, which means you should have no problem with buying or selling these ETFs when you need to. Plus they don’t tend to stray too far away from spot price (the global prices of gold/silver) of the underlying metal.

- Reasonable fees – The brokerage and foreign exchange fees required to buy into these ETFs are reasonable (depending on the platform you use), and ongoing management fees are also relatively cheap (e.g. 0.40% for GLD or 0.25% for IAU).

Further Reading:

– Buying shares in the USA – Sharesies vs Hatch vs Stake

Cons of ETFs

- Counterparty risk – Investing through an ETF may defeat the purpose of owning gold/silver as a hedge against the financial system. An ETF is a financial instrument that represents gold/silver, rather than gold/silver itself. It introduces counterparty risk to your investment, as it relies on several parties (like the fund manager, custodian, regulator) to handle and keep safe – and it can be argued that these parties won’t survive or won’t act honestly if an economic apocalypse were to hit.

- Tax treatment – Being overseas domiciled ETFs, they fall under the FIF tax regime. As a result they’ll be taxed the same as any other FIF shares or ETFs you hold, which may mean getting taxed with an assumption you made a 5% return for the year (under the FDR method), or on your actual unreleased capital gains (under the CV method). Whereas physical gold/silver is likely only taxed on any realised gains when you sell it.

Further Reading:

– Tax on foreign investments – How do FIF and Estate Taxes work?

Physical gold and silver

The second way you can invest is to buy gold or silver coins or bars, also known as gold and silver bullion. There’s a number of New Zealand based dealers selling physical gold/silver such as:

On each dealer’s website you’ll see that there’s lots of options to pick from when buying bars or coins. Usually the differences between the options aren’t too significant – after all they’re just lumps of metal. But things to consider are:

- The mint that produced the coin/bar. Bullion from certain mints may be more recognised than others.

- The level of purity. Most are ~0.9999% pure gold/silver, but others can be blended with other metals. The non-pure items may be subject to GST when purchasing.

- The denomination/weights. The standard denomination is 1 troy ounce (1ozt) which is about 31.1 grams, however you can buy bars/coins in other denominations like 0.5ozt or 1kg.

Tip – Cheaper isn’t better

Silver is significantly cheaper than gold, currently sitting at ~$35 NZD per troy ounce, compared to gold at ~$3,000 NZD per troy ounce. This may give some the perception that silver is a better investment, however price is irrelevant to how an asset might perform. It’s the percentage gain on your investment that ultimately matters.

Pros of physical gold and silver

- Direct access – By holding physical gold/silver yourself you remove counterparty risk or the reliance on others to make good on your investment. If an economic disaster were to hit, you could easily take it out of storage and spend it. Therefore it can be used as a true hedge against the current financial system. On the other hand, ETFs can’t be redeemed for actual gold/silver – instead you’d have to sell it for cash if you wanted to spend that money.

- Tangible – Like a house, gold/silver coins or bars are investments you can physically touch and see. That may give you a feeling of safety, or simply the enjoyment of owning an asset that looks cool. Meanwhile ETFs are just financial instruments that live in your investment account.

Cons of physical gold and silver

- Storage – Keeping your investment safe and secure is a key consideration for holding physical gold/silver. A quality safe could set you back a few thousand dollars, and covering large amounts of gold/silver with contents insurance will increase your premiums (if they can be covered by your policy in the first place). Safe deposit boxes or holding it in the custody of your gold dealer is another option, but that adds an expense of at least 1-2% p.a. Another thing to consider is that silver takes up a lot more space than gold. For example, at the time of writing $10,000 NZD worth of gold weighs just 100 grams, while the same value in silver is close to 9kg!

- Margins – You’ll always pay a premium to the spot price when buying gold/silver. This is to account for the cost of mining and producing the coin/bar, and the dealer’s profit margins. And when selling gold/silver, you’ll usually do so at a discount to the spot price. Essentially they have higher fees to buy/sell compared with ETFs, and due to these margins your investment would have to increase by several percent just to break even.

| $ NZD | % margin | |

| Gold spot price | $3,019.53 | |

| Buy price | $3,140.32 | +4% |

| Sell price | $2,902.17 | -3.89% |

| Increase needed to break even | $238.15 | 8.2% |

- Liquidity – Physical gold/silver is harder to buy/sell than an ETF. While dealers will readily allow you to buy/sell gold or silver with them, you’ll need to consider things like whether a particular coin/bar you want is in stock and the transportation of the metal to/from your home. You’re also limited by the denominations your coins/bars are in. For example, if you had a 1ozt gold coin, you’d have to sell the whole thing at once – It would be very difficult to sell half of it.

Personal Finance blogger The Happy Saver has a couple of posts sharing her first hand experiences in buying physical gold if you’re interested in learning more about it:

Further Reading:

– Let’s Buy Gold! (The Happy Saver)

– GOLD – A wild ride! (The Happy Saver)

Other methods

Lastly, here’s a brief look at some other methods you can use to get exposure to precious metals:

- Gold/Silver backed cryptocurrencies – Similar to gold/silver ETFs, these are crypto tokens which are backed by physical gold or silver. One example is Pax Gold (PAXG) where 1 PAXG token is backed by 1ozt of physical gold, and is available for purchase through crypto platforms like Easy Crypto.

- Gold/silver eco-system – This involves investing in companies influenced by the price of gold/silver, like those in the business of gold mining (who become more profitable or viable when the gold price increases). This can be more rewarding, but more risky than investing in the actual metal, and you’ll also lose some properties of gold/silver like the ability to use it as a hedge against the financial system.

- Jewellery – Jewellery may give you exposure to the price of gold/silver but isn’t an investment in our view. Jewellery is sold at high markups to the gold/silver spot price (given the effort required to design and make a piece), and can generally only be sold at large discounts to the spot price (given it would have to be melted down before it can be used for another purpose).

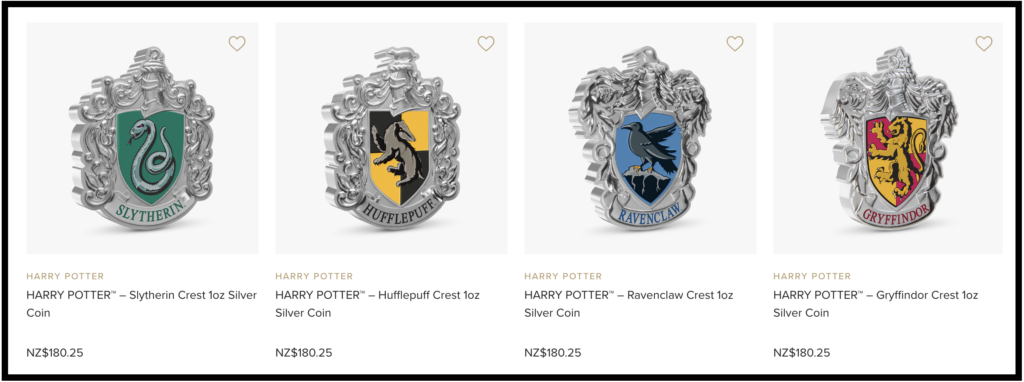

- Collectibles – Similar to jewellery, collectibles attract a huge premium to the actual gold/silver content it contains. For example, this 1ozt Matariki gold coin is almost 50% more expensive than its actual gold content, or the below silver Harry Potter themed coins are 5 times more expensive than their actual silver content. Therefore we wouldn’t consider them a genuine investment into gold/silver, but rather something more akin to Pokémon cards.

3. How does gold and silver compare with other investments?

Bitcoin & Litecoin

Similarities

- Inflation hedging – Both assets have a finite supply so are considered by many to be a hedge against inflation. Bitcoin is often referred to as digital gold, while Litecoin is sometimes considered digital silver.

- Alternatives to the current financial system – Both assets act as a store of value and can be transacted independently of governments or banks. They exist as monetary systems that are alternatives to the fiat currencies which we use today.

Advantages of Bitcoin & Litecoin

- Easy to transact – Bitcoin and Litecoin can be bought, sold, transferred, or sent across borders within minutes for a small fee. Each coin can also be divided into fractions, something which is much more difficult to do with physical gold/silver. In addition, storage options for crypto are much cheaper than buying a safe to keep precious metals.

- Genuinely scarce – Bitcoin and Litecoin have a hard cap on how many of each coin can exist. For Bitcoin, only 21 million can ever exist, and for Litecoin, the maximum supply is 84 million. As for gold and silver, their exact scarcity is unknown.

- Other use cases – The use cases of Bitcoin and Litecoin (and crypto in general) can go beyond using them as a store of value or hedge against the financial system. For example, they can be lent out to generate an income, or used to build decentralised apps or smart contracts.

Disadvantages of Bitcoin & Litecoin

- Not tangible – Bitcoin and Litecoin exist on a digital ledger which lives on the internet. You can’t see or feel them and in many cases they’re not user friendly. They’re more susceptible to being hacked or becoming lost due to a mishandling of wallet passphrases.

- It’s unproven – Despite their fixed supplies, we’re yet to see compelling evidence of Bitcoin and Litecoin working as an inflation hedge, with both coins declining over 60% year-to-date. They are much more volatile than precious metals. Going further than that, we have no idea whether crypto will be widely accepted as a currency if a crisis were to hit the financial system. It’s an unproven asset class which has only existed for just over a decade, and chances are it could go to zero. Compare that to gold/silver which has been used as a means of exchange and store of value for hundreds/thousands of years.

Further Reading:

– Digital Gold? 5 things to know about Bitcoin

Shares

Similarities

- Long-term investments – Both shares and gold/silver aren’t designed for those looking to invest for the short-term. They’re both volatile assets so are best suited to those with a long-term investment timeframe who have the ability to ride out all the ups and downs.

Advantages of shares

- Productivity – Shares represent a slice of ownership in a business. Businesses can be productive – Take Air New Zealand for example who transport passengers and cargo on their planes to make a profit. They can be innovative – Take Apple for example who are constantly developing new hardware and software to sell to their customers. That gives shares a much greater potential to produce an income and increase in value over time. Compare that with gold and silver which just sits in a safe and does nothing. The only way to make money from precious metals is to have someone buy it from you at a higher price than what you paid for it.

- Performance – While past performance doesn’t guarantee future results, shares have significantly outperformed gold and silver over the long-term, especially when you take dividends into account:

| Asset | 10 year performance | 30 year performance | 50 year performance |

| Gold | -3.68% | +395.87% | +2,499.50% |

| Silver | -39.90% | +441.00% | +1,020.64% |

| US shares | +159.24% | +798.96% | +3,283.40% |

| US shares with dividends reinvested | +218.27% | +1,509.17% | +13,879.72% |

Disadvantages of shares

- Can go bust – Companies and the environment they operate in can change over time. Even after doing adequate due diligence on a company before investing, it can still go bust or decline in significance over the decades. On the other hand, gold and silver are incredibly durable and will likely always be seen as valuable metals as they have been for thousands of years.

Bank deposits/Bonds

Similarities

- Alternative to shares – Bank deposits and bonds have different characteristics to shares, so tend to have a low correlation to them. Therefore they can be used as alternative building blocks for your portfolio, or a way to diversify away from shares.

Advantages of bank deposits/bonds

- Stability – Bank deposits and bonds usually don’t fluctuate in value too much. Therefore they’re useful asset classes for someone who’s risk adverse or is investing for the short-term and needing to protect their capital. On the other hand, those holding gold and silver are more likely to face ups and downs.

- Income producing – Bank deposits and bonds pay a regular stream of interest. You get no income when holding a lump of gold or silver.

Disadvantages of bank deposits/bonds

- Can go to zero – Bank deposits and bonds are IOUs or a promise that a bank/company will pay you back at some point in the future. That means a depositor or bondholder will probably lose some or all of their money if that bank or company goes bust. While gold and silver can also go down in value, it’s unlikely the value of these metals will ever go to zero.

4. How might gold/silver fit into your portfolio?

Is it investing or gambling?

Like Bitcoin, opinions surrounding gold and silver can be polarising. Some are huge fans of it (often referred to as “gold bugs”), others are against it. As for us, here’s how we see these precious metals:

- It’s not exactly gambling – These metals are tangible items which have both real and perceived value, and are generally bought with the expectation their price will increase over the long-term, rather than as a bet on a random outcome.

- But it’s not exactly an investment either – They’re just lumps of metal that don’t produce any income, and don’t have the ability to innovate. There’s better asset classes out there – Those investing for the long-term will probably be better off in shares, and those investing for the short-term will probably find bank deposits/bonds more suitable.

Instead we see gold and silver as a hedge or an insurance against the current financial system. If fiat currencies become worthless or the sharemarket completely collapses, there’s a good chance that these metals may very well be the last man standing.

How might that fit into your portfolio?

Personally we don’t believe that gold or silver is a necessary part of an investment portfolio. Every dollar you invest into gold/silver is one less dollar you have to invest into productive assets like shares. We don’t buy into the conspiracy theories or headlines that suggest the end of the world economy as we know it is imminent. And it’s often suggested that if the world ever got to the state where we had to turn to spending gold bars to put food on the table, we’d have bigger things to worry about than trying to preserve our wealth.

However, it can also be argued that we don’t buy insurance with the expectation that something bad will happen. For example, you don’t expect that your house is going to burn down, but you’d probably still buy house insurance – just in case that small possibility eventuates. This example perhaps provides some justification for having gold or silver as a small part of your portfolio in case world turns to custard.

Overall there’s no right or wrong answer to this question, and we can’t give financial advice on what you should do. Be sure to take into account your own personal views, and how gold/silver aligns with your financial goals before investing.

Conclusion

Precious metals are a fascinating topic which we haven’t covered until now on this site, so hope you found the article useful as a beginner’s guide to investing in gold and silver.

If you want to learn more on the topic, there’s plenty of other resources out there. Though many can have a vested interest, either for or against gold/silver, so make sure you take in lots of different perspectives. For example:

- Gold Survival Guide Blog (Gold Survival Guide). A blog with lots of handy articles about gold, though keep in mind it’s very favourable towards the metal, being written by a gold dealer.

- Investing In Gold (Ben Felix). A YouTube video with a much less favourable view on gold.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Do you have gold/silver or any precious metals in your portfolio?

No, we personally don’t think it’s necessary, but if we did we’d want to hold physical gold. However, the fees and storage costs for that are not worth it for the size of our portfolio and the proportion of our assets we’d allocate to precious metals. Maybe we’ll reconsider when we’re wealthier 😅

Hi. Great post!

Just letting you know that I do still own physical gold. And I still bring it out at dinner parties. The most frequent comment is still, “it’s so heavy”! Of all of my investments, this is the most tangible and interesting. But the reality is that it’s an unproductive asset unless I sell it. At one point, we owned more ounces but have since sold it and now only have two. The experience of both buying and selling was really interesting; it’s not often that you get to be that hands-on with investments, and I enjoyed it.

I continue to track their current value each month in my net worth:

Sept 2022 – $6,120 (NZD for two ounces)

Sept 2021 – $5192

Sept 2020 – $5,921

Sept 2019 – $4,934

Sept 2018 – $3,822

So, it has increased in value, but given it pays no dividends, given that to realise these gains, I have to sell the lot, it remains a small part of our portfolio. I consider selling from time to time, but then figure that it’s kind of like the collectable car people have sitting in their driveway. It has value and could be swapped for money, but it’s not in the way and is enjoyable to look at, so it’s worth keeping around.

Thanks for all of your thorough research.

Ruth (The Happy Saver)

Kia ora Ruth, thanks for the update on your gold investment – I enjoyed reading your posts on the. It’s pretty cool that you’re getting value out of it in ways other than monetary returns. For me personally, that reason alone would be enough to justify keeping that investment around – i.e. investing in what makes you happy or interested, rather than investing in what you’ll think will make the most money. Cheers 🙂

The ASX has a gold ETF – GOLD.ASX. Would buying this ETF trigger FIF tax? Thanks

Yes, that fund would be considered a FIF