On Thursday 29 September 2022, kōura, Easy Crypto, and NZ Everyday Investor hosted an educational session titled “Crypto Curious?” with the aim of demystifying the world of cryptocurrency for those curious about the asset class. In this article we’ll be covering what we learnt at the event, and sharing our thoughts on the topic.

This article is not endorsed or sponsored by kōura, Easy Crypto, or NZ Everyday Investor, is our personal interpretation of the event’s content, and is not to be considered as investment advice.

1. Key takeaways from the event

The Crypto Curious? event was presented by three well known representatives in the investment/crypto industry:

- Rupert Carlyon (kōura’s founder)

- Paul Quickenden (Easy Crypto’s head of NZ)

- Darcy Ungaro (host of the NZ Everyday Investor podcast)

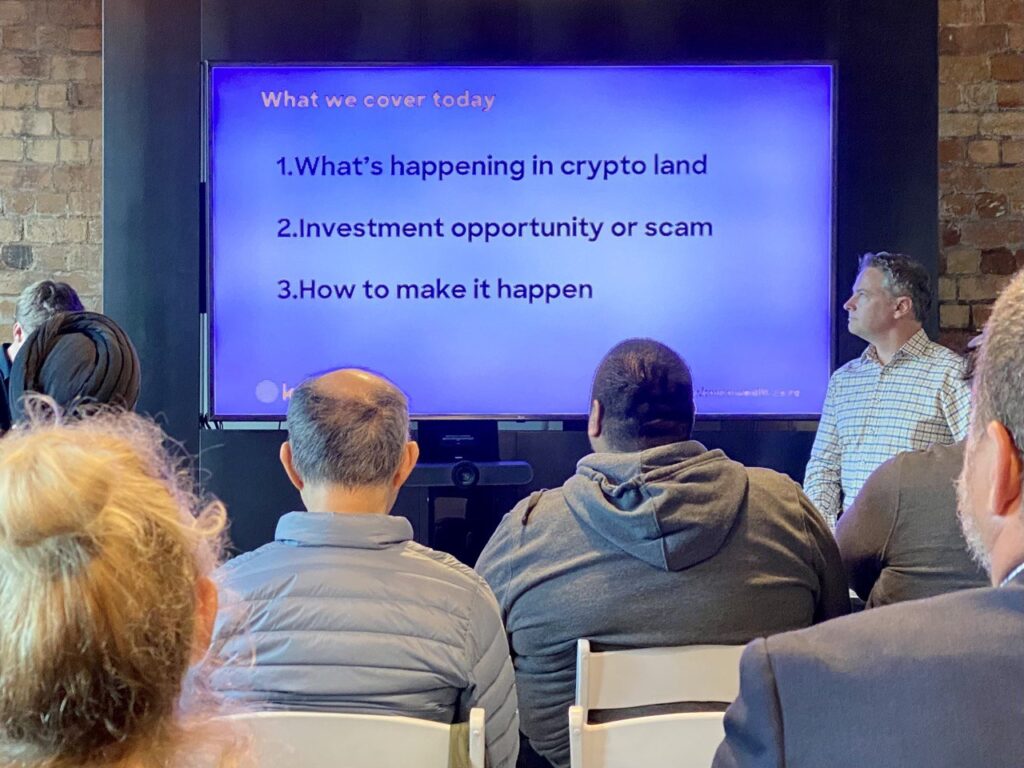

They covered three areas during the session including:

- What’s currently happening the crypto space

- Reasons for/against investing in crypto

- How to invest in crypto

Here were the key takeaways from the event.

What’s happening in the crypto land?

Last year we had low interest rates and lots of cheap money come into the financial system. The resulting low returns from conservative assets like bank deposits saw people hunting out higher risk assets like cryptocurrency. This year we’ve seen a reversal of that with interest rates rising, and money flowing out of those asset classes.

However, cryptocurrencies have been surprisingly stable since June. In fact it’s been the 2nd best asset class of the quarter, coming in behind the US Dollar. That provides some optimism that we’ve flushed out the bad stuff in the market.

While there have been a few victims of this market downturn (like crypto broker Bitprime essentially frozen and Luna imploding in value), innovation in the space is continuing. For example, Ethereum has completely transformed how it operates, going from using mining to staking, and reducing its energy consumption by over 99% in the process.

Investment opportunity or scam?

Traditional commentary suggests that cryptocurrency is a scam. They don’t produce anything and they could be seen as a ponzi scheme, existing as digital coins on the internet:

An unproductive asset with no unique value

Warren Buffet

A decentralised ponzi scheme

Jamie Dimon

However, there’s a growing number of real use cases and reasons for adopting cryptocurrency. Such as:

- International money transfers

- Decentralised finance apps

- Smart contracts

- Being an alternative to gold

- Something institutions are starting to hold on their balance sheets

Perhaps crypto could be analogous to the internet, where it initially had limited uses cases and adoption? And maybe the boom in shitcoins in recent years could be similar to the dot-com bubble, where everyone got carried away with investing in internet companies with no real value? Despite the internet’s early challenges, it’s become ingrained into our lives, and over the last 25 years the percentage of internet and software companies making up the S&P 500 has increased from 5% to 25%-30%.

So how might crypto fit in your investment portfolio? There’s probably two main reasons to invest in it:

- To get exposure to its use cases (e.g. money transfers, smart contracts), especially if you believe crypto will follow the same path as the internet.

- To hedge against the current financial system (e.g. thinking of it as digital gold).

But it’s probably a good idea to limit your exposure to the asset class. Cryptocurrencies are still largely unproven, and it’s possible the prices could go to zero. Also keep these important lessons from the dot-com bubble in mind when looking into crypto:

- Scams – Beware of scams. If it’s too good to be true, it probably is.

- Diversify – Spread your money across different assets. We don’t know which ones are going to win.

- Patience – There’ll be lots of ups and downs along the way. Long-term investing is best.

- FOMO – Those who rush in to invest are often the ones left holding the bag. Make sure you have a clear reason for why you want to invest in a particular cryptocurrency.

- Influencers – Be cautious of influencers trying to promote a particular coin. A popular person (like Kim Kardashian) touting a coin doesn’t make it a good investment.

How to make it happen?

There’s three main ways you can invest in crypto in New Zealand:

- Direct – Purchasing crypto from a broker/exchange like Easy Crypto and holding it in your own wallet/custody.

- Funds – A fund that holds cryptocurrency, like the Vault International Bitcoin Fund which is available on InvestNow.

- KiwiSaver – It’s possible to have crypto in your KiwiSaver portfolio, with kōura allowing an up to 10% allocation into their Carbon Neutral Cryptocurrency Fund.

Further Reading:

– How to buy Bitcoin in New Zealand (step-by-step guide)

Plus there’s a few other ways to get exposure to the asset class:

- Futures contracts – Financial instruments that allow you to speculate on the future price of a cryptocurrency.

- Futures based funds – Funds that hold crypto futures contracts e.g. the ProShares Bitcoin Strategy ETF (BITO).

- Crypto infrastructure – Companies that are heavily influenced by the price of cryptocurrencies e.g. Microstretegy (MSTR) who hold a significant amount of Bitcoin on their balance sheet or Coinbase (COIN) who are a major crypto exchange.

An interesting aspect of having so many methods to invest through is that diversification in the crypto world isn’t necessarily about buying lots of different coins. But rather diversification can also involve investing in a single coin through many different methods, each unlocking unique characteristics and pros/cons of a cryptocurrency. For example:

- Holding Bitcoin directly allows you to use it as a currency or easily convert it to other cryptos. However, you’ll need to consider how to store the coins securely.

- Holding Bitcoin via a fund allows you to profit from the price movements of cryptocurrency, may have tax advantages, and takes care of the storage issue for you. However, you lose the ability to spend your coins without having to first sell units in the fund.

We discuss these pros and cons in more detail in the article below, where we compare investing directly in Bitcoin with investing through the Vault International Bitcoin Fund:

Further Reading:

– Vault International Bitcoin Fund review – The best way to own Bitcoin?

If you choose to hold cryptocurrency directly, security is an important consideration. There’s different types of wallets you can use, and among them there tends to be a trade-off between convenience and security:

- Exchange wallets – Most convenient as it doesn’t require you to self-custody your coins, and allows you to instantly swap from one crypto to another. However, least secure as you could lose all your coins if the exchange/service gets hacked or goes bust (like how Celsius did earlier this year).

- Software wallets – Slightly less convenient, as you’ll usually have to move it to an exchange to sell or swap the cryptocurrency. But slightly more secure, given it’s held in your custody.

- Hardware wallets – Most secure as access to your coins is offline. But least convenient as it requires you to have access to your physical hardware wallet to spend your coins.

The type of wallet you should choose comes down to factors like how much crypto you own, how much you can afford to lose, and how you intend to use your coins. You may also choose to diversify across different types of wallets/custody. But above all, password security is critical as social engineering is a common way that hackers manage to steal cryptocurrency, regardless of which wallet type is used.

2. Did they try to sell anything?

It was an educational focussed session, with the hosts covering various aspects of crypto without trying to plug their own products. Though Rupert from kōura encouraged everyone to consider signing a petition they’re running, which is campaigning for the ability for partners to share their KiwiSaver contributions, to help reduce retirement savings inequality arising from things like one partner taking time off work to have children.

It’s actually quite a shame they didn’t spend a few minutes talking about their products which are actually quite unique. We’ve reviewed both kōura and Easy Crypto in the past in case you’re interested in looking further into them:

Further Reading:

– Kōura review – Crypto meets KiwiSaver

– Easy Crypto review – The best on-ramp to the world of cryptocurrency?

3. Was there any free food?

Our favourite part of any investing event is the free food. This event didn’t disappoint with free beer and wine on offer, as well as Pizza from Toto Pizza. A well catered event, though with Miann right downstairs from the event venue we couldn’t resist stopping by for dessert afterwards.

4. Overall thoughts on the event

We think newbies to the cryptocurrency space would’ve found the event useful, as it was packed with practical information on the topic. Though for us coming in as somewhat knowledgeable, the event didn’t have as much of an eye-opening impact on us as the very first crypto event we went to back in 2017. Perhaps a fun idea for future events would be to hold a debate between those on both sides of the crypto fence, so that we could see some stronger arguments for or against crypto presented.

But we still enjoyed hearing the hosts’ perspectives and mindset on cryptocurrency, with our favourite takeaways of the event being:

- Crypto could make up a small part of your portfolio to give you exposure to its potentially high growth – coming from either its growing use cases or from being a hedge against the current financial system. Though it shouldn’t be such a big part of your portfolio that it would cause you financial stress if it went to zero.

- Diversification in the crypto space isn’t necessarily about holding lots of different coins, but can also involve holding the same coin across different methods.

So should you invest in crypto? Well, it’s always going to be a hard sell to get people to try an asset class that’s gone down 60%+ over the past year, and that was probably reflected in the modest number of people who turned up to the event. But as you probably know, it’s better to invest in something when the prices are low, rather than when the prices are high. Crypto definitely isn’t a must have, but something you could allocate a tiny proportion of your portfolio to if you’re willing to take on the risk, in exchange for high potential rewards. Just be cautious and keep the lessons of the dot-com bubble in mind.

Overall, together with the free food and drink, it was a great event. So don’t be shy in heading along to any future events that investment providers like kōura/Easy Crypto may organise!

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.