Hello! Mrs Money King NZ here! Mr Money King NZ has been investing in the sharemarket for 7 years now, so in this article I’ll be asking him some questions about his investing journey so far – including his first investment, best performing one, investment mistakes, and more. Hope you enjoy and can learn a few things from his experiences!

1. What was your motivation for starting to invest?

Before I started investing I was earning a reasonable income and was always good at saving money. I’d accumulated a decent amount of money in savings accounts and the occasional term deposit, and I was pretty happy earning around $200 per month in interest for no effort, thinking that saving was the way to get ahead financially.

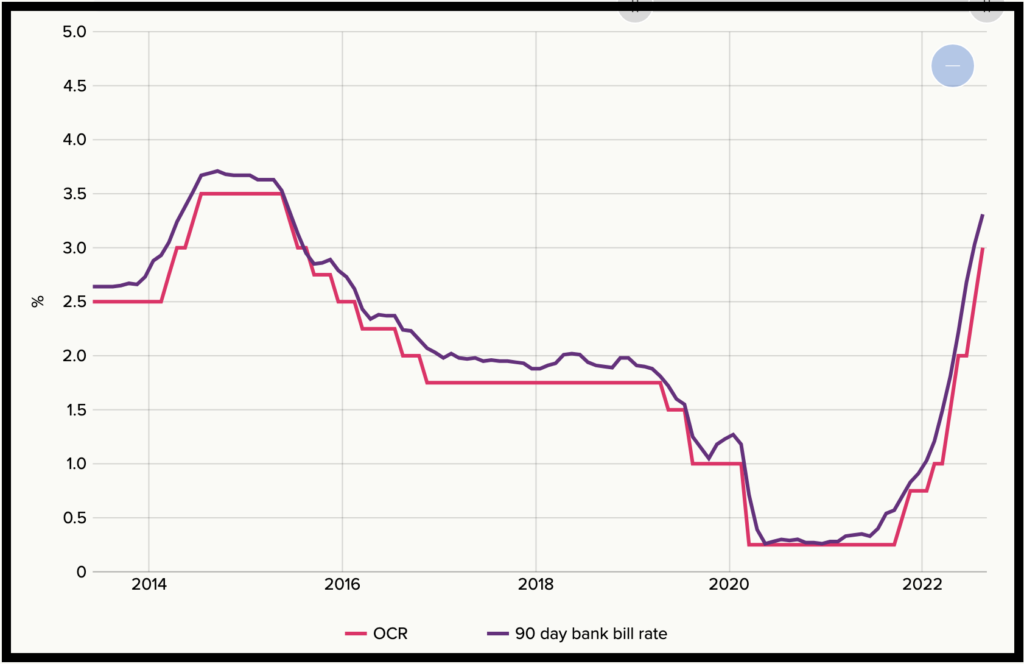

But falling interest rates in 2015 gave me a push to look at other options for growing my savings balances. I was making less and less interest on my savings each month even though my balances were growing. I thought there had to be a better way.

I didn’t have any specific financial goals at that time apart from wanting my money to work harder for me. It wasn’t until slightly later when I came across the concept of FIRE (Financial Independence, Retire Early), and that provided me with extra motivation to invest. The idea of building an investment portfolio that would eventually replace the income from my full-time job and allow me to retire early or do more meaningful work was really attractive.

2. Did you have any investing knowledge prior to starting?

Not really. My parents taught me about a number of things like saving money and putting it in term deposits, which was great because I learnt about interest and compounding quite early. They also taught me the importance of not borrowing money, except for things that appreciate in value like a house.

But investing wasn’t something they passed on to me. They owned a microscopic amount of shares, but never talked to me about it, apart from saying they were risky. I’m pretty that’s because sure they got burnt badly in the 1987 sharemarket crash and barely touched the market after that.

I did learn a bit of accounting and economics in high school/university. But education and work experience can only get you so far – they’re helpful when it comes to learning the concepts, but they’re ultimately useless when it comes to the practical side of things like deciding what platforms to use and knowing which funds to invest in. So while I was lucky to have a few things that helped set me up well, I still had to rely heavily on Google and YouTube videos to build up the right knowledge.

3. What was it like to invest back then?

It was very different to today. There was no Sharesies, Hatch, InvestNow, Kernel, or Simplicity. The main platforms you could use were:

- ASB Securities and ANZ Securities (now known as Jarden Direct) for investing in shares.

- RaboDirect for investing into managed funds from lots of different fund managers, similar to InvestNow. Got taken over by InvestNow in late 2017.

- Smartshares for their selection of ETFs.

- Managed funds from banks and other managers like Milford and Fisher Funds.

- Harmoney for peer-to-peer lending. Shut down the platform in 2020.

- Bonus Bonds which was arguably gambling rather than a genuine investment. Shut down in 2021.

Information on investing was hard to find too, even though there was the help of Google and YouTube. The content out there tended to be US-centric, or didn’t go in depth enough to explain the specific platforms New Zealanders could use to invest.

Overall investing back then was much more challenging than it is today. For comparison you can check out the article below, which shows there’s significantly more platforms to choose from these days:

Further Reading:

– The ultimate guide to investment platforms in New Zealand

4. What was your first investment?

First shares

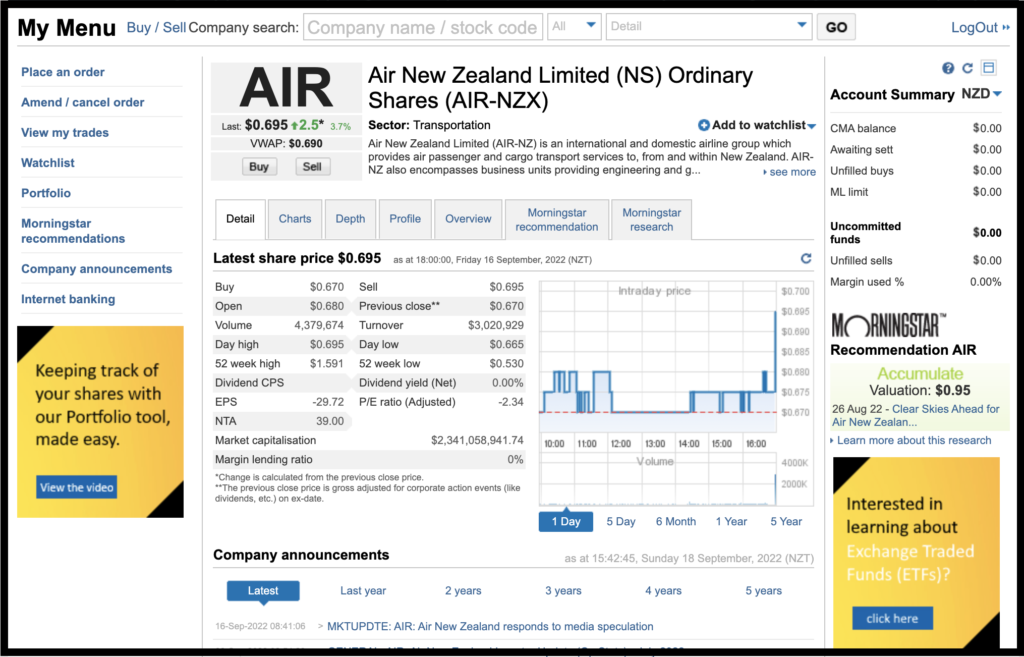

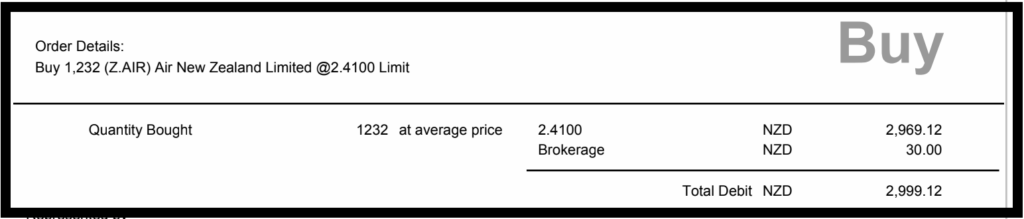

The first shares I bought were in Air New Zealand on 2 September 2015. I was a bit of an aviation/travel fan and liked the airline, and thought I knew enough about the business. Plus the price had dipped a little bit even though they had released some decent financial results, so I thought it was a good time to pull the trigger. I signed up to ASB Securities and invested $3,000 into the company as I thought that was a sweet spot between not committing too much money and not getting hit too badly on fees.

I don’t have these shares anymore as I fortunately sold them well before covid hit, taking profits at a price of over $3.

First fund

My first foray into funds was through the now defunct RaboDirect platform which I signed up to a few months after buying my first shares. I took a spray and pray approach, investing into lots of different funds – a few NZ funds, a few international funds, a few bond funds and so on. RaboDirect had an awful user experience, requiring a Digipass to do anything on the platform, which was a clunky physical device that generated 2-factor authentication codes.

In 2017 the InvestNow platform launched, which had lower fees, a relatively good UI, and blew everyone away with their Vanguard fund with a 0.20% fee, so I switched over. The move made me think more carefully about the funds I was investing into, as well as the benefit of index funds (which now make up the core of my portfolio). So over the years I gradually reduced the number of funds I held, and that was the inspiration for the below article:

Further Reading:

– More funds = less diversification? Are you investing in too many funds?

Other investments

Other investments I held at around that time were:

- KiwiSaver, which I put it in a Growth fund at Westpac which was my bank at the time. They were far from the best provider, but I didn’t know of any other option.

- Peer-to-peer lending with Harmoney, a platform which doesn’t operate anymore. I probably wouldn’t invest again as much of the lending on the platform was somewhat predatory, with the highest interest rates being around 30%.

5. What has been your best and worst performing investments?

Best investment

This would have to be the second company I invested in, Infratil. I bought $3,000 worth of shares just 2 days after making my first investment into Air New Zealand, and have been holding onto them since. They were $3.02 at the time and now they’re over $9, so I’ve tripled my initial capital, plus received a good amount of dividends along the way.

I invested in Infratil because they were another company I was familiar with, being one of the owners of Wellington Airport and NZ Bus – a couple of companies I was a regular customer of. I invested so soon after my Air NZ investment because after playing around on ASB Securities, I got super excited about all the companies I could choose from on the sharemarket.

Infratil have changed a lot since then, now having more of a focus on digital infrastructure and renewable energy, so I’ll be holding onto these shares as I quite like the fact that the company gives me exposure to these two attractive themes. In fact, I’ve added significantly more shares to my portfolio since my initial purchase in 2015 (although at much higher prices).

Worst investment

My worst investment was in NZ Refining (now known as Channel Infrastructure), which I bought in March 2016. I didn’t understand the company at all, but bought in at $3.56 purely for the chunky dividend yield which was around 10%. While I did get a huge dividend payout shortly after my purchase, the share price soon started to dip, followed by the company reducing its dividend, then eventually cutting dividends altogether. I held on to the company, refusing to realise my losses, hoping it would recover in the long-term.

I eventually sold the shares in 2020 for 68 cents, cutting my losses after deciding the money would be better off in other investments with stronger prospects. That was a capital loss of 82% or a total loss of 69% when factoring in the profit from dividends. Overall my investment lost over $2,000 – an expensive lesson in how not to pick companies.

6. What are the things that didn’t go well during your investing journey?

Not starting KiwiSaver earlier

I started KiwiSaver when I got my first permanent full-time job, but wish I’d started earlier than that. I had various part-time jobs and could’ve benefited from employer and government contributions. And my bank kept on pestering to sign up and get the $1,000 government kickstart payment (which isn’t available anymore), but I still didn’t sign up.

The problem was that I thought KiwiSaver was complicated and expensive, and I didn’t know if the small amount of money I’d be contributing would be enough to offset the fees. I also didn’t know where to go for detailed but uncomplicated information on the scheme. I tried to ask my local bank staff, but was brushed off and told to make an appointment with one of their financial advisers to get the information I wanted.

Now I know that KiwiSaver is worth it for most people, given how beneficial the employer and government contributions can be. Fees have come down a fair bit as well since 2014, so in most cases you don’t have to worry about them eating into your balances.

Investing for the short-term

I went in to the sharemarket with the mindset that trading for quick gains, or getting dividends was the way to make money from investing. That led to silly mistakes like selling off Restaurant Brands for a small 10% return when I could’ve held long-term and doubled my money, or like my above mentioned purchase of NZ Refining purely for the dividend cheque.

I’ve since realised that shares aren’t just a financial instrument that you buy into, with the hope they’ll go up in price. But rather when you buy shares, you’re buying a business that you think will grow and be successful over the long-term. And I’ve also realised that investing is more than just a way to make a few bucks on the side, but rather a way to gradually take over your main income and achieve financial freedom. It works best when you buy and hold for the long-term and let your returns compound.

Trying to time the market

I wasn’t consistent at all when it came to investing on a regular basis. Instead I fell into a couple traps:

- The market was constantly hitting new highs year after year, so I thought a downturn was due and that it was a bad time to invest.

- I paid too much attention to the news headlines and YouTube videos, most of which suggested a market crash was imminent, or that some geo-political event was coming that was going to be bad for the market.

That led to me being too conservative, keeping lots of cash (and other relatively safe investments) on the sidelines waiting for a crash before deploying it into shares. The crash never came (until covid), and I had missed out on loads of gains.

Now I no longer let the headlines dictate my investing behaviours. The reason why we see an overwhelming amount of negative content is because they get more clicks – a headline reading “Sharemarket set to crash 80%” is going to get a lot more attention that one that says “The sharemarket is going great!”. I now average in to my investments regularly instead of trying to outsmart and time the market.

Overdiversifying

As my portfolio and investing knowledge grew throughout 2016 and 2017, I gradually became too diversified across asset classes, investing my money across shares, bonds, funds, P2P lending, crowdfunding offers, cryptocurrency, Bonus Bonds, and term deposits. It was one of the symptoms of trying to time the market as I loaded up on lots of different (and often conservative) asset classes as I was afraid that shares would crash.

But the overdiversification didn’t end there. In terms of shares, I had up to 25 companies at one point. For my funds, I must have had around 30. And for P2P Lending, I was invested across 3 different platforms. I guess it was a symptom of not being confident enough with investing, so I just tried to get a slice of everything, to see how each one went.

My overdiversification may not seem like a big deal, but it meant that my time was focussed on admin and tracking everything, rather than learning how to put a good portfolio in place. You really don’t need a lot of assets to be diversified, so it’s better to focus on having a relatively small number of really good investments, rather than a large number of average investments. So while my experience was great for learning and understanding lots of different platforms and asset classes, I’ve since slimmed down the portfolio. My investments are now much better aligned with my goals and take barely any work to manage.

Trying to pick stocks

Picking individual companies to invest in was my first taste of investing, but it is hard. I’ve made a decent profit with it (with a simple return of over 50%), but have underperformed the market. That’s because I tended to pick NZ shares I was somewhat familiar with, but familiarity doesn’t make something a good investment.

Familiarity meant that I missed out on the likes of Fisher and Paykel Healthcare, a2 Milk, Mainfreight, and Xero which were incredibly cheap back in 2015. I also had minimal international exposure. I did try to broaden into overseas companies by investing through Stake (which was available in Australia before Hatch and Sharesies even existed), but wasn’t confident and familiar enough with the US market to deploy large amounts of money.

So if I had to start my investing journey again I would’ve relied more heavily on funds over picking individual companies, building something similar to what we’ve described in the article below. That way I can outsource the effort of stock picking to an index, or an active fund manager whose full-time job is to analyse and choose companies. Individual companies would still be part of my portfolio, but to a much smaller extent.

Further Reading:

– 4 steps to create an incredibly simple long-term investment portfolio

7. What are the things that went well during your investing journey?

Just starting

I started invested when I was 24 years old, and although I wish I had started earlier, I’m still glad I overcame my laziness and lack of knowledge and started in the first place. It’s made a meaningful difference to my finances and now I’m well on my way to achieving financial independence.

So I think anyone interested in investing should just jump in with a small amount of money, without worrying too much about the fine details and gaps in your knowledge. You don’t need to know everything to start, and learning by doing is a great way to go about it. And you don’t have to commit $3,000 like I did. Nowadays plenty of platforms (e.g. Sharesies, Kernel, InvestNow, and Flint) allow you to invest with much lower amounts like $50. The potential returns from putting in such a small amount won’t make you rich, but the things you’ll learn from doing so could change your life.

Not panic selling

The third company I invested into was Genesis Energy. Just a day into making that purchase, the shares dropped in value by $200! It made me feel awful and full of regret over investing in the first place, and made me wish I’d just stuck with term deposits. But I decided not to panic sell, hoping that the shares would eventually recover.

Looking back, this was a key point in my investing journey. I could’ve quit investing entirely after losing $200 so quickly, but didn’t panic. By continuing to invest, I’ve made a much greater return over leaving my money in the bank. And it was probably a good thing that I got a taste of volatility so early, as it helped desensitised me from further volatility. I’m still holding those Genesis shares today, and they’re up around 50% and have paid plenty of dividends over the years.

Prioritising saving and investing

Investing doesn’t work if you don’t have money to put towards it. I was fortunate enough to have a reasonable income with low expenses, so the very first thing I’d do each payday was to put away money for savings and investing (an idea commonly known as paying yourself first). I considered every payday primarily as an opportunity to improve my financial situation, rather than an opportunity to buy stuff, and that habit was key in building up my portfolio.

You don’t have to have a high income to make investing a priority either. All you need to do is spend less than you earn. That isn’t easy for everyone, but even investing a few dollars each week is still a few dollars towards improving your financial situation.

Reinvesting profits

Plenty of people see their investment earnings as bonus money that they can take out and boost their lifestyle. But I understood the power of compounding, therefore I reinvested every dividend payment and any capital gains I got, so that I could make even more investment returns of those.

7 years isn’t a long time when it comes to investing, but it’s enough to see the impact that compounding starts to have. In my first year of investing I made around $1,000 in dividends and interest, and now that’s up to around $18,000 per year – and that’s before taking into account capital gains. It’s a figure that’ll continue to grow as I reinvest that income and make ongoing contributions to the portfolio.

Continually learning

Investing quickly became a bit of a hobby of mine when I first started, so I spent plenty of time doing research on it. So while I did plenty of dumb things in my earlier years of investing, I was able to gradually absorb all the different concepts and learn from my mistakes.

I was a regular reader of sites like the Sharetrader forum, and probably spent way too much time watching finance videos on YouTube. And these days there’s plenty more resources that you can use to improve your investing knowledge (which you can find in the links below). I soon became the expert among my friends, and later started to share my knowledge more publicly through Money King NZ. But I’ll probably continue to make mistakes in the future, as no one can be 100% perfect when it comes to investing!

Further Reading:

– Useful Websites

– Blogs, Podcasts, YouTube

8. What’s next for your investing journey?

I now have a somewhat mature investment portfolio, so I’ll be taking a much more hands-off approach than before. I’ll mostly be leaving it alone, letting time do its work in growing the portfolio and compounding the returns. The portfolio has delivered an average of 5-6% in after tax returns per year so far, but hopefully that’ll improve as it’s since become more aggressively invested and better aligned with my goals.

I’ll continue to contribute to the portfolio every month, because investing will always be a high priority for me. However, I have the rising cost of living and many short-term goals competing for money (like international travel and ageing electronics that need replacement), so the portfolio might be a little slower to grow from here. But with retirement still 20-30 years away, I’m just taking a relaxed approach to balancing my current lifestyle and saving for my future self.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Great journey. Congrats!!

Thank you!

Good stuff! Great to see a Kiwi perspective on investing rather than the dime a dozen American ones. I’m a 4 year newbie with a lot to learn (better to start late than never eh?)

If you ever want to do an interview then let me know! 🙂

Thank you! Any time is a good time to start learning 🙂

Thank you for another interesting article, I have learnt so much from Money King.

Thanks so much! Very happy to hear that!

Enjoyable read!

Thanks!

Thank you! Love all your articles! I wonder when are you doing another article about – what you’ve been investing in?

Thank you. We recently did a social media post about our investments, but wasn’t sure there was much interest for an article? Our investments don’t change very often anyway, so such an article would probably be quite boring, though maybe there could be value in doing one annually?