In April 2023’s What’s been happening in the markets article we look at the massive changes Simplicity are making to their funds (including new funds, fees, and asset allocation tweaks), Sharesies’ new savings product, as well as this month’s market movements.

This article covers:

1. Market movements

2. Simplicity makes massive changes to their fund offering

3. Sharesies Save

4. What we’ve been up to

1. Market movements

Here’s how the markets performed to 28 April 2023, in both their local currencies and in NZ dollar terms:

| Apr 2023 returns Local currency | Apr 2023 returns NZD | |

| NZ shares (S&P/NZX 50) | 1.14% | 1.14% |

| Australian shares (S&P/ASX 200) | 1.83% | 1.96% |

| US shares (S&P 500) | 1.46% | 2.73% |

| Bitcoin | 3.15% | 4.44% |

The markets posted gains in a month where inflation and interest rates dominated the news headlines yet again. This April we saw the OCR go up 50 basis points to 5.25% – Great news for savers, but not so good for borrowers. However, we also saw inflation figures fall to 6.7% in the March 2023 quarter (down from 7.2% in the quarter ending December 2022). Combined with a softening economy and recession fears, it appears that interest rates may be finally reaching the peak and perhaps set to come down sooner rather than later.

Even though this month’s sharemarket gains have been small, if you look at the year so far, shares have actually performed reasonably well. All of this despite the gloominess around the economy.

| 2023 YTD returns Local currency | 2023 YTD returns NZD | |

| NZ shares (S&P/NZX 50) | 4.76% | 4.76% |

| Australian shares (S&P/ASX 200) | 3.84% | 3.51% |

| US shares (S&P 500) | 8.59% | 11.53% |

| Bitcoin | 77.71% | 82.51% |

While we don’t know how the market will perform for the remainder of 2023, we think this performance demonstrates that investors should be cautious about trying to time the market or staying on the sidelines until the economy gets better. By doing so, you might miss out on much of the sharemarket rebound and end up buying back into the market at higher prices.

2. Simplicity makes massive changes to their fund offering

Popular fund manager and KiwiSaver provider Simplicity have rolled out a number of significant changes to their fund offering:

A) A fix for the tax leakage issue

Firstly, Simplicity have shifted the management of their international shares and bonds to DWS, a not very well known but large global funds manager. Previously the international share and bond portions of their Growth, Balanced, and Conservative funds was managed by Vanguard. That led to one of our biggest gripes with Simplicity’s funds – Vanguard’s funds were in an Australian domiciled structure and suffered from tax inefficiencies which we first wrote about in November 2021.

With the move to DWS, the inefficiencies have been patched thanks to their international assets now being held in a tax efficient PIE structure. That’s a win for Simplicity’s customers who were potentially losing around 0.30% per year to the tax issues.

B) New funds

Secondly, Simplicity have launched five new funds.

New standalone global funds

There are three new standalone global share and bond funds:

- Hedged Global Share Fund – Invests fully into global shares, hedged to the NZ dollar. Tracks the Bloomberg DM ex NZ ESG Screened Index, which includes over 1,400 companies across 20+ developed markets.

- Unhedged Global Share Fund – Same as above, without the currency hedging.

- Hedged Global Bond Fund – Tracks the Bloomberg MSCI Global Aggregate SRI Exclusions Float Adjusted Index, which includes bonds from over 2,500 issuers across 20+ countries.

All have a management fee of 0.15%, and have Simplicity’s usual ethical screens, excluding investment into companies involved with the likes of weapons, tobacco, and gambling. They’re only available as non-KiwiSaver funds.

Their new global funds are perhaps the most interesting, as they bring a new, very compelling option to the somewhat crowded global index fund space (competing with the likes of Smartshares and Foundation Series’ Total World funds, as well as Kernel’s global funds). Perhaps we could see some of these providers cut their fees in response?

Further Reading:

– What’s the best global shares index fund in 2022?

New Aggressive and Defensive funds

Simplicity are also launching two new diversified funds, available in both KiwiSaver and non-KiwiSaver versions:

- High Growth Fund – Invests almost entirely into NZ and global shares.

- Defensive Fund – Invests mainly into NZ and international bonds, with smaller allocations to cash and mortgage lending.

The target asset allocations for these funds are:

| Fund | High Growth | Defensive |

| Cash | 2% | 15% |

| NZ fixed interest | 0% | 44% |

| International fixed interest | 0% | 36% |

| NZ shares | 15% | 0% |

| International shares | 73% | 0% |

| Unlisted NZ property | 10% | 5% |

This will be great news for many investors, as the lack of an Aggressive fund was another big gripe we had with Simplicity’s offering. Previously their Growth Fund was their “riskiest” option, but their new High Growth Fund gives more choice for investors willing to take on more volatility for higher potential returns.

However, the lack of a Cash fund remains a big gap in Simplicity’s offering. While the new Defensive Fund should be less volatile than their existing Conservative Fund, it invests primarily in bonds, so will still face downturns in its value from time to time. Simplicity provides no genuine Cash option for those who can’t afford to see the value of their fund go down (for example, those intending to withdraw their money in the very short-term to buy a house).

C) Asset allocation tweaks

Thirdly, there’s a few changes to the asset allocations of Simplicity’s diversified funds.

Non-index investments increased

Simplicity is well known for their non-index investments into build-to-rent housing, mortgage lending, and private equity. These special investments currently make up around 7.5% of Simplicity’s diversified funds. The current allocations are:

| Build-to-rent | Mortgages | Private equity | |

| Defensive | n/a | n/a | n/a |

| Conservative | 0% | 7.5% | 0% |

| Balanced | 2% | 5.5% | 0% |

| Growth | 3% | 2% | 2.5% |

| High Growth | n/a | n/a | n/a |

Now allocations towards these non-index investments have increased (at the expense of reduced exposure to NZ shares and bonds), and now make up to 20% of their diversified funds. Most notably, the Defensive Fund has a large 15% allocation towards mortgage lending, while the High Growth Fund has sizeable exposures to both build-to-rent housing and private equity. The new indicative allocations are:

| Build-to-rent | Mortgages | Private equity | |

| Defensive | 5% | 15% | 0% |

| Conservative | 2.5% | 7.5% | 0% |

| Balanced | 3.5% | 6.5% | 0% |

| Growth | 4.5% | 3% | 2.5% |

| High Growth | 10% | 0% | 7.5% |

An overview of Simplicity’s non-index investments

– Build-to-rent: Involves building new apartments and townhouses, then renting them out to long-term tenants through the “Simplicity Living” entity. Makes money from the development gains on a new property, and capital gains and rental income on their completed properties. Currently has one development available for rent, with three more under construction (all in Auckland).

– Mortgages: Involves lending money (as a floating rate home loan) to first home buyers to purchase a property. Makes money from the interest paid by the borrowers.

– Private equity: Involves investing in early stage, unlisted companies. Makes money from the capital gains in these companies.

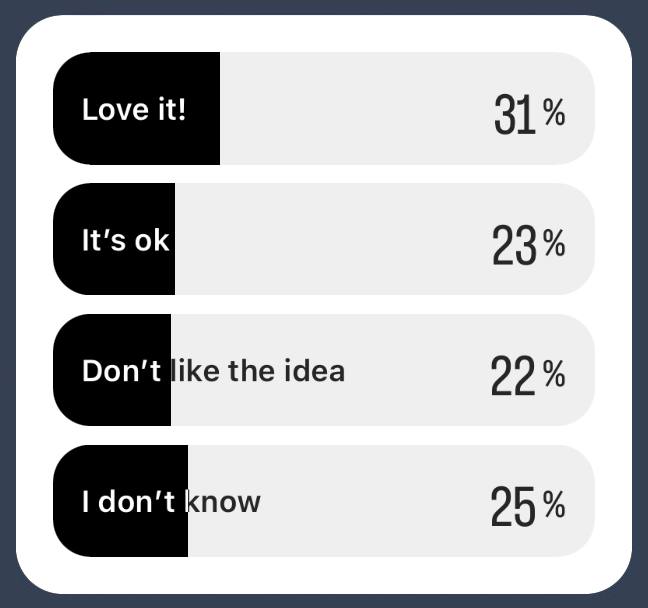

This is perhaps the most controversial of the changes. Our recent Instagram poll demonstrated that there are mixed feelings towards having KiwiSaver money allocated away from shares and into build-to-rent housing:

Some enjoy the fact that their money is going towards initiatives that are seen to benefit society (like providing warm, long-term housing), and the increased allocation to these investments should enable Simplicity to expand these projects. Others see these investments as distracting initiatives, and won’t be pleased that Simplicity’s funds are straying even further away from being simple, passively managed index funds.

We also have a number of concerns with their increased exposure to BTR:

- This is a good thing if you intentionally want more exposure to residential property development and rentals. Otherwise, could this be providing too much exposure to the NZ residential property market (especially if you already own your own home, and when you combine it with their mortgage lending allocation)?

- Is Simplicity Living too concentrated? All of their developments are in the Auckland isthmus, and all of the properties are apartments and townhouses. That could leave them vulnerable if something goes wrong with the Auckland residential property market.

- Should Simplicity Living be split into two entities – a property development entity, and a property rentals entity? With these two business activities currently mixed together in a single entity, it can be hard to determine the potential risks and returns of BTR. The property development aspect of Simplicity Living is a relatively risky business (targeting a 10% return on development to compensate investors for the risk), while the rentals aspect of Simplicity Living is relatively safe (targeting a return of inflation + 3%, so we’ll assume this to be ~5% p.a.). By splitting BTR into two separate entities, it would be easier for investors to determine the level of exposure they have to the riskier development business versus the safer rentals business. It would also enable Simplicity to better align each BTR business to each fund – For example, the Defensive Fund might only have an allocation to the rentals business, while the High Growth Fund might only have an allocation to the development business.

Overall we would question whether there is a compelling reason to have such an oversized allocation towards BTR in their funds, especially when the potential returns don’t appear to stack up against the extra risk and concentration.

Australian shares cut

Simplicity’s diversified funds previously had a standalone allocation (of up to 6%) towards Australian shares. This is no longer the case, with their funds’ only exposure to Aussie stocks now being through their international shares allocation.

D) Another fee reduction

Lastly, Simplicity have reduced the management fees of their Diversified funds from 0.30% to 0.29%. That’s not a massive reduction, but it comes very shortly after they reduced their fees just a month ago from 0.31% to 0.30%. Altogether their fee structure is as follows:

- Diversified funds – 0.29%

- International share/bond funds – 0.15%

- Domestic share/bond funds – 0.10%

Further Reading:

– Simplicity review – Could there be better fund options out there?

3. Sharesies Save

Sharesies have announced a new “Save” product which is an on-call savings account, allowing you to earn interest on your money at a rate of 4.35% (which is subject to change). You can withdraw the money at any time without penalty and there are no fees or minimum investment amounts. Sharesies is expected to open the Save product sometime in May.

Sharesies won’t be holding any money kept in the Save product themselves. Instead the money will be held at a major NZ registered bank. While Sharesies haven’t disclosed the exact bank this is, they’ve stated that it has a credit rating of AA-, so it’s likely to be either ASB, ANZ, BNZ, or Westpac (though we reckon they’re using ASB, as it’s the bank Sharesies currently has a banking relationship with). Therefore any money kept in Save is safe if Sharesies go bust because it’s held independently from the platform, rather than on the platform’s own balance sheet.

Sharesies Save vs other on-call savings accounts

Here’s how Sharesies Save stacks up against other on-call savings accounts (as at 20 April 2023):

- ANZ Online Savings – 2.25%

- ASB Savings On Call – 2.25%

- Westpac Simple Saver – 2.50%

- Kiwibank On-line Call – 3.85%

- Rabobank RaboSaver – 3.90%

- BNZ Rapid Save – 3.95%

- Sharesies Save – 4.35%

- Heartland Direct Call – 4.60%

- Squirrel On Call (funds stored with BNZ) – 5.00%

Sharesies’ offering is certainly competitive, but it’s not the best. Heartland and Squirrel both offer higher rates (and Heartland’s account is also available in PIE form, giving it an even better effective interest rate of 5.04% for 33% taxpayers). However, if you’re already a Sharesies customer, their Save account could still be a convenient place to park your money when it isn’t invested in the markets. Just keep in mind you won’t automatically earn interest on your uninvested funds – you have to manually transfer money in your Sharesies wallet over to the Save product to start earning interest on it.

Sharesies Save vs Kernel Save

A few investors have asked us about how Sharesies Save compares to other products like Kernel Save (5.25% interest) and Rabobank’s PremiumSaver account (up to 4.65% interest). But isn’t an apples-to-apples comparison between these products:

- Sharesies Save is an on-call savings account, providing instant access to your money without any penalties.

- Rabobank PremiumSaver is a bonus saver account, also providing instant access to your money, but penalises you by paying you a lower interest rate of 2.25% if you don’t increase your account balance by at least $50 each month.

- Kernel Save is a notice saver account. It requires you to give 34 days’ notice to withdraw your money, so it’s a lot less accessible than the above two products.

Overall an on-call product like Sharesies Save would better suit someone who needs the flexibility to get their money out at anytime, while Kernel’s or Rabobank’s products would suit those who are willing to give up this flexibility in return for higher interest rates.

Further Reading:

– The ultimate guide to bank and savings accounts in New Zealand

4. What we’ve been up to

In case you missed them

In case you missed them, here’s the articles we published over the month:

It’s been a quiet month for producing new content, but we’ve been taking advantage of the slowdown in investing interest to spend less time on writing articles, and catch up on other projects at home. We also made a couple of trips out towards the Bay of Plenty (stopping by Te Puna Quarry Park and Karangahake Gorge), and picked persimmons at Shiziyuan Persimmon Garden.

Our investing activity

Nothing to see here. Just another boring month of drip feeding money into our index funds, while not keeping too close of an eye on them – like how good long-term investing should be 😏

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Thank you for this! Much awaited fix and offers from Simplicity. With the move to DWS, is all of the tax leakage issues with Simplicity fixed?

Yes, theoretically the tax leakage issues have been fixed with the move to a tax efficient PIE fund. In the coming weeks we’ll take a deeper look into the funds, and update if we find any info that suggests there are still remaining tax inefficiencies.

Thanks for a great sumary MoneyKing.

Had a play around on the Simplicity site and can’t see any option to keep my current investments as it is and simply direct new regular investments into a mix of their international share and bond offering (kinda like their growth fund without the property thingy).

Any downside to holding an “old” portfolio and starting a new one like this?

I would love to set and forget but the competition is stiff and new offerings come out that make one want to reassess, lol!

That seems like a feasible way to construct your own DIY portfolio without the non-index investments. It would just add more complexity having two portfolios, and perhaps add some extra work in rebalancing your holdings.

All these new products certainly are a distraction to those trying to set and forget! But we’d be forever moving from fund to fund if we jumped ship a new fund came out! So we like to consider very carefully before moving funds.

Very interesting.

I agree that Global Shares fund looks interesting (particularly the unhedged version) but need to see how much the ESG factors skew it away from a more straightforward market-cap weighted portfolio (e.g. Investnow Total World or Kernel Global 100).

That’s something I hadn’t thought of, didn’t realise it was ESG…

Still confused by hedged/unhedged.

Hopefully this article can shed some light on hedged vs unhedged funds: https://moneykingnz.com/hedged-vs-unhedged-funds-whats-better/

We’re keen to look into the fund in more detail in the coming weeks, especially comparing it against Kernel’s new Global ESG fund. But here’s some key observations in case anyone is interested:

So without looking into it in too much detail, we’d say Simplicity’s new fund is somewhat comparable to Vanguard’s International Shares Select Exclusions Index Fund.

Hi there,

I can’t find that new Kernel fund on the website? Only a couple of sector-specific funds…

It’s not officially released for retail clients yet, but will be coming soon.

I see you’ve mentioned a couple of times that you will be looking at the new Simplicity options in a future article. I was very excited to see their more aggressive growth option for kiwisaver, but not particularly excited to see a significant element of the allocation (10%) is to unlisted property. As you say, I already own property in NZ and would prefer to diversify away from that particular basket [case].

I know it is not your style to have an opinion on the right or wrong of this, but if you could delve into the consequence of this a little bit, or even get Simplicity to comment on the relative risk/reward of this element, that would be great. For example, I wonder how it would compare to some of the REIT’s on offer. To be honest, at this stage I am likely to not invest in their aggressive growth option because of that allocation towards property.

cheers,

Mike

Hi Mike. As we touched on in the article, we see Simplicity Living as having two sides to the business – development and rentals. In our experience property development is a relatively risky venture, especially in the current environment with rising construction costs. Simplicity Living are targeting a 10% development margin so should deliver a similar or perhaps slightly better return than shares. On the other hand, the rentals business is less risky – it should deliver a lower return than shares with lower volatility, but perhaps perform better than bonds. Overall we view Simplicity Living essentially like a REIT, albeit one that deals with residential property (unlike our listed REITs which are primarily involved in commercial property). It is a genuine investment opportunity and one that can deliver genuine returns, in addition to any social good that it could bring.

Now for the consequences of this allocation:

So our personal opinion is that we like the idea, but there doesn’t seem to be a compelling reason to have Simplicity Living as an oversized allocation in their funds – especially when it’s so tightly concentrated in Auckland, increases our exposure to residential property (which we consider unattractive as we already have an expensive house, located just minutes from Simplicity’s developments), lacks transparency versus listed equities and REITs, and overall should not have a significant enough increase in returns to compensate for the added risk and concentration.

Great, thanks. I really appreciate the speedy and thorough reply. Yeah that all makes sense and doesn’t allay any fears! Hmmm. I may have to mull over this one a bit further. I have been considering a move to investnow for some of their Kiwisaver offerings, but really empathise with an earlier comment regarding this being a difficult environment to have a set and forget mentality!

cheers,

Mike

While the simplicity living could/is making fund overweight to NZ property for homeowning kiwis (also given ‘property owning’ shares in NZ share fund) dependant on your preferences the mortgage lending seems hardly much different to having a term deposit with a bank. With just 20% in business lending (https://www.interest.co.nz/banking/112371/nz-banks-housing-lending-continues-rising-percentage-their-overall-lending-business) the rest is really in property lending (farm lending still mostly property). So simplicity’s lending appears just a less risky (higher deposit requirements, first home buyers only) version of what the banks are doing with your term deposit (at least until deposit insurance implemented).

I am a private investor with no conflict of interest.

I am currently going through a restructure of investments and read this and other articles with great interest – many thanks.

I have visited the Simplicity website to view their recent offerings and in particular the Global Share Fund. A fee of 0.15% is very appealing.

I could find very little to inform a potential investor as to what they might be investing in. There a reference to an unknown share index “Bloomberg DM ex NZ ESG Screened Index”. I searched the internet for anything that looked vaguely like it – did wonder if it was the MSCI index. I decided to send an email to Simplicity for asking for more information.

REPLY:

Thanks for your email.

The new indices are bespoke to Simplicity and the data is not publicly available. Simplicity pays a licence fee to Bloomberg in order to use the index to benchmark our funds. It is very common for fund managers not to disclose certain benchmark information and if you want specific security or allocation data you may be able to purchase this directly from Bloomberg.

We can make the following country allocations available for you and I understand more information is going to be disclosed as part of our regulatory reporting.

As a potential investor, I found the response unsatisfactory.

What’s the Best Global Share Fund in 2022:

I read the update May 1, 2023 in which Simplicity’s Fund was put ahead of all the other funds when assessing performance using various investing scenarios over 10 years. I accept that the assessment was done on the basis that performance was considered to be equal across the funds and this was more an assessment of the impact of costs and fees.

However, the assessment of Simplicities’ Global Fund is potentially misleading given we have no clear understanding of the investment or the index being used. The other funds in the comparison all use transparent well known indexes with historic performance to consider.

Simplicity might well have a winner with this new fund but they need to do much more to convince this investor.

I concur wholeheartedly with Richard. I emailed Simplicity and recieved a similar response. It seems odd to me that they are publicizing these funds so actively when basic information like that is not available.

Hi Richard, sorry to hear about your experience with trying to get detailed holdings info from Simplicity. We could argue that the Simplicity Global Share funds are quite similar to any other global developed market index fund, with over 1,400 companies, primarily weighted towards the US, with smaller allocations towards UK, Japan, France, Canada etc. It’s well diversified and you can’t really go wrong with investing in it, with the main point of difference with this fund being the fact that it has a bunch of ESG exclusions. Arguably, Simplicity’s target customers don’t care about the weightings and constituents of the underlying index.

But ultimately we agree with your perspective. We think it’s fair that as an investor, the list of assets your money is being invested in should be easily accessible, and that they should follow the likes of Kernel in disclosing their funds’ full holdings on their public website. And it is reasonable that investors would want to dig deep into the underlying asset data of the funds in order to help make an investment decision, instead of just relying on how the fund manager labels the fund.

We’re keen to dig into this transparency issue further. Will update you with how it goes.

For those interested I recommend watching Ben Felix Sustainable Investing on You Tube. He provides an assessment of sustainable investing. His view is that while ESG investing may suit the investment strategy of a group of investors, the resulting outcome will more likely be inferior investment returns.