S&P 500 and global index funds are two common methods of diversifying an investment portfolio beyond our tiny NZ sharemarket. But there’s plenty of debate and confusion out there around which one is the better choice. Some swear by the S&P 500, while others love the worldwide diversification a global index fund provides. In this article we explore the pros and cons of each fund type to help you decide which one you should be investing in.

This article covers:

1. What are S&P 500 and global index funds?

2. Pros of S&P 500 index funds

3. Pros of global index funds

4. Performance comparison

1. What are S&P 500 and global index funds?

S&P 500 index funds

The S&P 500 is a sharemarket index measuring the performance of the 500 largest companies listed in the United States (and represents about 80% of the US sharemarket). S&P 500 index funds seek to track (or in other words match) the performance of the S&P 500 index. So if you were to invest in such a fund, you’d benefit from the collective performance of the 500 largest companies listed in the US. Examples of such funds are:

- Smartshares US 500 ETF (USF)

- Foundation Series US 500 Fund

- Kernel S&P 500 Fund

- Vanguard S&P 500 ETF (VOO)

Further Reading:

– What’s the best S&P 500 index fund in 2022?

Global index funds

There’s a variety of different global funds out there, each tracking different indexes. However the thing they all have in common is that they don’t only invest in US listed companies, but also invest in companies listed in countries all around the world such as the UK, Canada, Japan, France, and Australia. Therefore the performance of those non-US listed companies will also influence the performance of a global index fund. Examples are:

- Kernel Global 100 Fund – Tracks the S&P Global 100 Ex-Controversial Weapons Index

- Vanguard International Shares Select Exclusions Index Fund – Tracks the MSCI World ex Australia, ex Tobacco, ex Controversial Weapons, ex Nuclear Weapons Index

- Smartshares Global Equities ESG ETF (ESG) – Tracks the MSCI World Ex Australia Custom ESG Leaders Index

Some global index funds also invest in emerging markets like China, India, Brazil – these are less mature markets, but have higher potential for growth. Examples are:

- Smartshares Total World ETF (TWF) – Tracks the FTSE Global All Cap Index

- Foundation Series Total World Fund – Tracks the FTSE Global All Cap Index

- Macquarie All Country Global Shares Index Fund – Tracks the MSCI All Country World ex Tobacco Index

Further Reading:

– What’s the best global shares index fund in 2022?

2. Pros of S&P 500 index funds

The S&P 500 is a well known index

The S&P 500 is perhaps the most famous sharemarket index in the world. Finance content creators are constantly talking about it, while famous and successful investors like Warren Buffet are huge proponents of investing in it. Our S&P 500 related articles are consistently among our most viewed.

We wouldn’t consider high recognition enough of a reason to invest in one fund over another – Just because fin-fluencers recommend it, and other people are investing in it, doesn’t necessarily mean you should as well. But this factor probably goes some way in explaining its popularity among Kiwi investors.

Excellent diversification

Firstly, by investing in a S&P 500 fund you’re spreading your investment across 500 different companies. These include famous names such as Apple, Microsoft, Disney, Costco, and Coca-cola. It’s highly unlikely you’d lose all your money by investing in the S&P 500, as that would require all 500 companies to go bust all at the same time.

Secondly, the index gives you diversification across many sectors. Not only des an investment into the S&P 500 get you exposure to IT companies, it also gives you access to companies operating in consumer staples, financials, real estate, and other sectors.

Thirdly, many consider the S&P 500 to have adequate geographical exposure. Roughly 30-40% of revenues of S&P 500 companies come from overseas. Take Tesla for example who sell their cars all around the world, or Meta whose Facebook and Instagram user bases are global. Therefore despite only containing US listed companies, the S&P 500 index is still exposed to the economies of Asia, Europe, South America and so on.

So the S&P 500 is considered to be a very well diversified index. Perhaps enough so that there’s limited advantage to going for a global fund due to the diminishing diversification benefits you achieve from adding more and more companies into a fund. For example, a market cap weighted index funds of 9,000 companies isn’t much more diversified than an index fund of 500 companies (and is perhaps over diversified) – that’s because the smallest 8,500 companies make up a relatively small proportion of such a fund, and the more additional companies you add into the fund, the less impact that company has in making the fund more diversified.

Solid track record

The S&P 500 is one of the oldest sharemarket indexes, surviving wars, recessions, market crashes, and countless other crises. Despite a volatile history, it’s delivered an average return of roughly 10% per year over the several decades it’s existed. Therefore it’s often perceived to be a relatively safe but fruitful place to invest your money.

Can you really earn 10% p.a. with the S&P 500?

Keep in mind that the S&P doesn’t really go up 10% every year. In some years the S&P 500 will deliver low or even negative returns, and in other years it’ll exceed a 10% return. The 10% figure is simply just a long-term average, though it’s not guaranteed that the index will continue to deliver the same average return into the future. The 10% figure also doesn’t take into account any fees and taxes you’ll have to pay on your investment. These aren’t downsides specific to the S&P 500 (global and other index funds have the same issue), but we’re just mentioning this so you have the right expectations around the returns you’ll get.

Lower fees

On average S&P 500 index funds have lower management fees than their global counterparts (with the exception of Kernel):

| Fund manager | S&P 500 fee | Global fund fee |

| Smartshares | 0.34% | 0.40% |

| Foundation Series | 0.03% | 0.07% |

| Kernel | 0.25% | 0.25% |

Tax efficiency

Some global funds have a small tax leakage issue which increases each fund’s tax bill. This can add an annual tax impact of around 0.12% in the case of Smartshares and Foundation Series’ Total World funds, due to their inability to claim foreign tax credits on dividends paid by non-US shares. We won’t get into the detail of this issue, but you can read more about it in our article here.

This tax leakage issue doesn’t affect any of the S&P 500 funds mentioned in this article (nor does it affect Kernel’s Global 100 Fund).

3. Pros of global index funds

True global diversification

The S&P 500 is limited to investing in US listed companies, which some could view as a slightly arbitrary way to choose what to invest in (i.e. investing in the S&P 500 is essentially selecting investments purely based on the fact that they’re listed on the Nasdaq or NYSE).

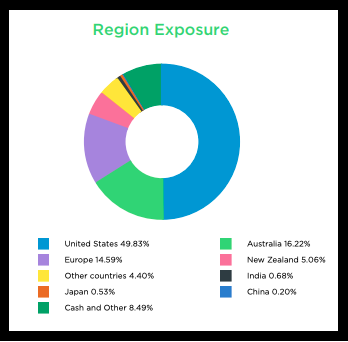

Global index funds aren’t constrained to companies listed in the US, providing true international diversification by investing into companies from all around the world. This gives you exposure to companies such as Taiwan Semiconductor Manufacturing Co, Samsung, and Unilever. Here’s a look at the geographical spread of companies in USF (Smartshares S&P 500 ETF) compared with TWF (Smartshares Total World ETF):

| Country | USF (S&P 500) Weighting | TWF (FTSE Global) Weighting |

| United States | 100.0% | 58.8% |

| Japan | 0.0% | 6.2% |

| United Kingdom | 0.0% | 4.1% |

| China | 0.0% | 3.7% |

| Canada | 0.0% | 3.1% |

| France | 0.0% | 2.8% |

| Switzerland | 0.0% | 2.4% |

| Australia | 0.0% | 2.3% |

| Germany | 0.0% | 2.1% |

| Taiwan | 0.0% | 1.8% |

What is the benefit of such diversification? Just like there’s risks of investing in one company, there’s risks of concentrating on one country. Choosing the S&P 500 is like betting that US companies will perform better than companies listed in other sharemarkets across the world – but what if they don’t? What if other markets perform better? Investing in a global fund is like spreading your eggs across many baskets so you’ll benefit when they do well.

You could argue that the globally diversified revenues of S&P 500 companies mitigates the need to invest outside of the US. But we consider this to be a poor argument. For example, the FTSE 100 (an index representing the 100 largest companies listed on the London Stock Exchange) earns 75-80% of its revenues from outside the United Kingdom. Yet few people would consider the FTSE an adequately geographically diversified index even though it has a much higher proportion of overseas revenue compared with the S&P 500.

Alternatively you could point to the fact that global sharemarkets are loosely correlated in how they perform – For example, when US shares go down, chances are other countries’ markets will also fall, and there’s no way to diversify away from this. But there’s always a small chance that an issue could arise that only affects US listed companies – for example, some kind of US-specific political or regulatory change.

Going beyond geographical diversification

Geographical diversification may not be the only type of diversification you get with investing in a global index fund. The Smartshares and Foundation Series Total World funds also contain mid and small-cap companies, whereas the S&P 500 only contains large-cap companies. While mid and small size companies aren’t essential to have in a diversified portfolio, this could be an additional consideration when deciding between funds.

Better sector diversification

It could be argued that the US sharemarket is tech heavy, with the Information Technology sector representing a quarter of the S&P 500 index. This might not be a problem if you don’t mind or intentionally want higher IT exposure, but could leave the S&P 500 more susceptible to poor performance if tech companies had a bad time (for example, if regulation affected the major players in the industry like Apple and Microsoft). A global fund like TWF still has a substantial weighting towards tech, but less so than the S&P 500:

| Industry | USF (S&P 500) Weighting | TWF (FTSE Global) Weighting |

| Information Technology | 26.5% | 19.6% |

| Healthcare | 14.7% | 11.7% |

| Financials | 11.7% | 15.1% |

| Consumer Discretionary | 10.6% | 14.0% |

| Industrials | 8.4% | 13.9% |

| Communication Services | 7.8% | 2.75% |

| Consumer Staples | 6.7% | 6.3% |

| Energy | 5.1% | 5.5% |

| Utilities | 2.9% | 3.2% |

| Materials | 2.8% | 4.6% |

| Real Estate | 2.8% | 3.4% |

You still get exposure to US shares

Global index funds tend to have a roughly 60% allocation to US shares. So you don’t miss out on US shares by investing in them over the S&P 500 – You just get less exposure. For example, if you invested $100 in a S&P 500 index fund, $100 will go towards US shares. However if you invested $100 in a global index fund, you’d still get ~$60 worth of US shares (with the remaining $40 spread across companies listed in other countries).

Should you be investing in both?

In most cases probably not. If you’re already investing into a global fund, adding on the S&P 500 wouldn’t add any diversification, but rather it would achieve the opposite by concentrating your portfolio towards US shares. For example, a portfolio split 50/50 between a global fund and the S&P 500 would have a ~80% allocation towards the US. This might be a good thing if you intentionally want higher US exposure, but it’s a bad thing if you’re seeking more geographical diversification.

The professionals tend to go global

To get another perspective on the S&P 500 vs global debate, we could look at how fund managers construct their diversified funds. These funds are designed to be a one-stop-shop for an investment portfolio (or in other words, a fund that’s diversified enough to be your sole holding, whether it be in KiwiSaver or outside of KiwiSaver), by investing in a broad mixture of domestic and international shares (+ bonds in some cases). Examples are:

- Simplicity Growth Fund

- Foundation Series Growth Fund

- Kernel High Growth Fund

- SuperLife High Growth Fund

In all of these examples, each fund invests globally for the international shares portion of the fund. None of them opt to give their diversified fund customers a pure US/S&P 500 exposure.

Active fund managers tend to also go global when picking companies to invest in. They don’t limit their investable universe to just the United States. For example:

- Milford Aggressive Fund – Has a 20.4% exposure to companies listed outside of NZ/Australia/US

- Fisher Funds International Growth Fund – Includes companies based in the UK, China, and Brazil

- Pathfinder Ethical Growth Fund – Includes companies based in Europe, Asia, and Canada.

Just because the professionals all invest globally, doesn’t necessarily mean a global strategy is right for you. But it demonstrates that the fund managers see benefits and opportunities in investing in non-US companies.

4. Performance comparison

The last question we’ll look at in this article is what performs better out of the S&P 500 and a global index fund?

S&P 500 vs Global fund performance

Let’s start by comparing the performance of USF (Smartshares US 500 ETF) vs TWF (Smartshares Total World ETF).

| USF | TWF | |

| 1 year (31/12/21 to 31/12/22) | -13.52% | -12.76% |

| 3 years (31/12/19 to 31/12/22) | 8.58% | 4.63% |

| 5 years (31/12/17 to 31/12/22) | 10.25% | 5.93% |

| 7 years (31/12/15 to 31/12/22) | 10.67% | 7.58% |

If we look at 1 year performance figures, you could say that a global fund is the better option. In 2022, TWF held up slightly better than USF in what was a tough year for sharemarkets. Though 1 year is far from enough to make a judgement on performance – If we look at the 3-7 year annualised performance, the data makes the S&P 500 look much more favourable.

However the S&P 500 hasn’t performed all global funds. If we compare the underlying index returns of Kernel’s S&P 500 vs the Hedged Global 100, the global fund comes out on top.

| S&P 500 | Global 100 | |

| 1 year (31/01/22 to 31/01/23) | -10.77% | -8.91% |

| 5 years (31/01/18 to 31/01/23) | 7.99% | 9.53% |

Though note that Kernel’s Global 100 has a very different composition compared with other global index funds, notably only having ~100 constituents and having a higher ~70% weighting towards US companies.

Longer-term comparison

Longer-term performance is trickier to measure, as none of the above funds (nor many global sharemarket indexes) have existed for long enough. But we can do a slightly longer-term comparison between the:

- S&P 500

- MSCI EAFE (an index representing global shares from 21 non-US and Canada countries)

- MSCI ACWI (a global index combining US and non-US shares)

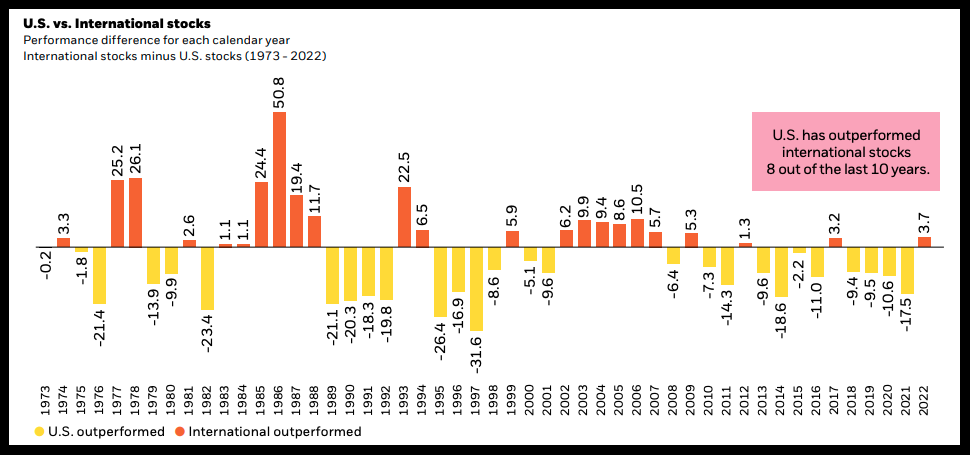

If we take a decade-by-decade look at the three indices, the past decade or so has been outstanding for the S&P 500. A big part of this can be attributed to the IT sector which returned 18.33% p.a. in the last 10 years.

| S&P 500 | MSCI EAFE | MSCI ACWI | |

| 2020s* | 7.66% | 1.34% | 4.49% |

| 2010s | 13.56% | 5.87% | 9.37% |

| 2000s | -0.87% | 1.58% | 0.89% |

However, the S&P 500 hasn’t always seen this fantastic performance. If you go back further to the 2000s, the S&P 500 had a “lost decade” delivering negative returns over the 10 year period. While non-US shares didn’t do much better, they at least stayed positive. And if you look back even further, you’ll see that the best performing market has swung back and forth like a pendulum between US and non-US shares:

But overall the S&P 500 has been the clear winner over the last 10-20 years. Non-US shares have been a big drag on the overall performance of sharemarkets globally:

| S&P 500 | MSCI EAFE | MSCI ACWI | |

| 10 year performance | 12.56% | 5.16% | 8.54% |

| 20 year performance | 9.80% | 6.92% | 8.60% |

Does past performance even matter?

While our performance analysis suggests that the S&P 500 has historically been the better tool for building wealth, we would argue that these figures don’t matter. These results are good at showing how much money you could’ve made in the past, but provide no guarantee of future performance.

What really matters are future results and how the indices will perform throughout the 2020s and beyond – and no one knows with 100% certainty whether US shares will keep outperforming, or whether the pendulum will swing back in favour of non-US shares (which is probably a matter of when, not if). What we do know is that sometimes the S&P 500 will perform better, and sometimes global shares will perform better. So regardless of how each perform it’s probably better to pick one option and stick to it, rather than constantly switching between them and trying to chase the best performing one.

You don’t want to be that guy who keeps changing lanes in traffic in the freeway only to see your old lane start zooming ahead.

Jeremy Schneider

Conclusion

Both S&P 500 and global index funds are great ways to diversify an investment portfolio into international shares. So what’s the better choice out of the two?

Our personal choice comes down to the following question – Do we have a good reason to invest solely in US shares, or a reason to believe that US listed shares are substantially better than non-US listed shares? Our answer to this question is no. We don’t know what the future holds, so choose not to try and pick the winning country. We take the geographically diversified route, investing in lots of countries through a global index fund, so that we can benefit regardless of what country performs best in the future.

But we can’t speak for all investors. Some are happy with the US only exposure with the S&P 500, and others intentionally seek to be invested only in US shares. And that’s fine too – it all comes down to your personal preference. Both types of funds are well diversified, usually have low fees, and offer great potential for growth over the long-term. And as we often say on our articles, sometimes it’s better to just pick one than spend too time and effort worrying about which one to invest in.

Perhaps a more important consideration is around whether you should invest in a hedged or unhedged fund? Fund out more about these two fund types in our article below:

Further Reading:

– Hedged vs Unhedged funds – What’s better?

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Great article as always and good arguments for why S&P 500 isn’t technically diversified overseas just because it has overseas revenues.

Been sticking with VT and relaxing.

For reference the Kernel High Growth fund invests in their Global fund (unhedged and hedged) around 60%, and does not invest in the S&P fund.

Any downsides to investing in both? What if you just had a 50:50 split as investing strategy?

Most global funds already contain the S&P 500, so you wouldn’t get any additional diversification by having both. You’d just end up concentrating your portfolio towards the US – a 50:50 split would have a ~80% allocation towards the US.

An absolutely fantastic article explaining pros and cons of investing in S&P 500 (US) versus global markets. it also highlights the fact that the diversified S&P 500 index isn’t that diversified when it comes to geographic distribution. It would help for you to explain difference between S&P Global 100 and FTSE Global funds/ETFs, if any. Expense ratio for S&P Global is high (0.4). It would be nice to have a similar albeit less known passive fund or ETF with similar global large cap diversification, but with a lower expense ratio.

Thanks, we covered the composition of the S&P Global 100 in more detail here: https://moneykingnz.com/whats-the-best-global-shares-index-fund-in-2022/#3

Kernel does offer a Global 100 Fund with management fees of 0.25% in case that’s what you’re after.

Both S&P 500 and Global index funds have their pros and cons, so it ultimately depends on your investment goals and risk tolerance.