Exchange Traded Funds (ETFs) that invest in the S&P 500 index are a convenient and popular way for Kiwis to get exposure to international shares. The S&P 500 index comprises 500 of the largest companies listed in the United States, including some of the world’s most influential and recognisable organisations such as Apple, Microsoft, Tesla, Visa, and Johnson & Johnson.

There are two pathways that New Zealanders typically take to invest in S&P 500 ETFs. One route is through the locally domiciled Smartshares US 500 ETF (USF), which you can buy through Smartshares directly, InvestNow, Sharesies, or via a NZX broker. The other path is to go offshore and buy the NYSE listed Vanguard S&P 500 ETF (VOO) through platforms like Sharesies or Hatch. Both Smartshares and Vanguard ETFs aim to track the same index, so which one is better?

1. Background

There are many options to invest in the S&P 500, but the two in question for this article are:

- Smartshares US 500 ETF (USF), listed on the NZX

- Vanguard S&P 500 ETF (VOO), listed on the NYSE (New York Stock Exchange)

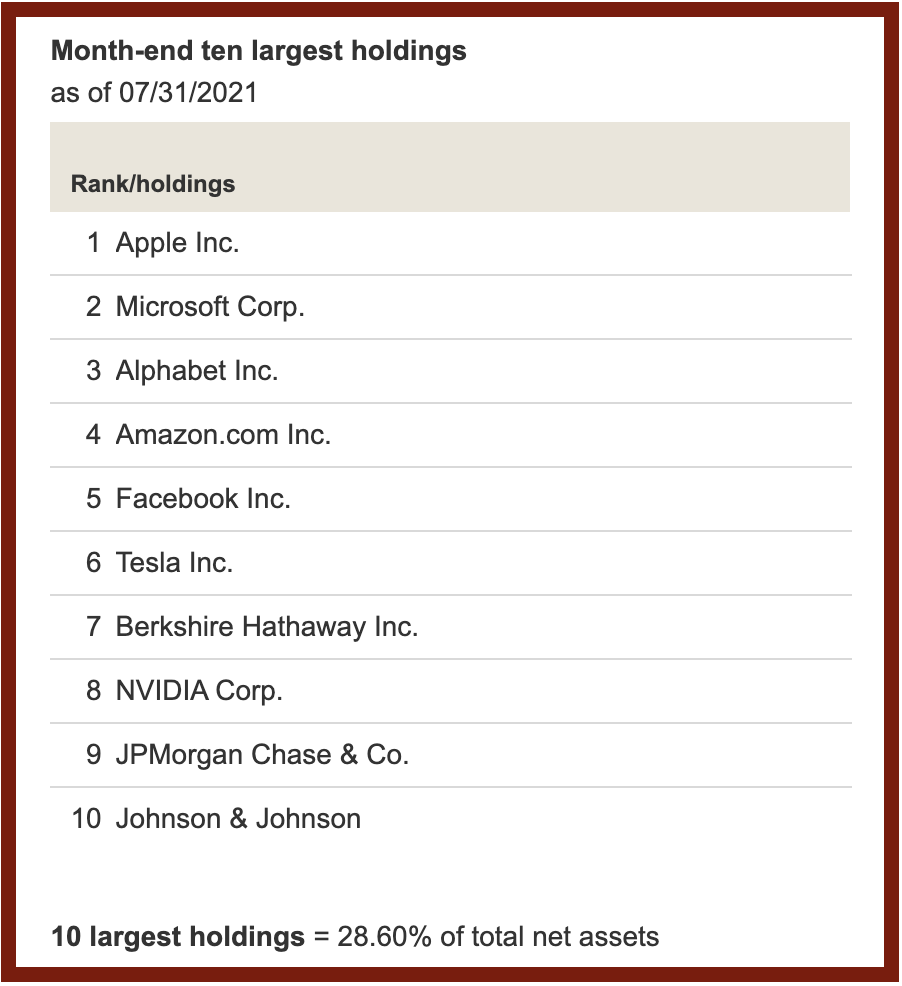

The Vanguard ETF tracks the S&P 500 index by investing directly into the underlying companies of the index. In other words, they buy the shares of all 500 companies that make up the S&P 500 such as Apple, Tesla, and Visa.

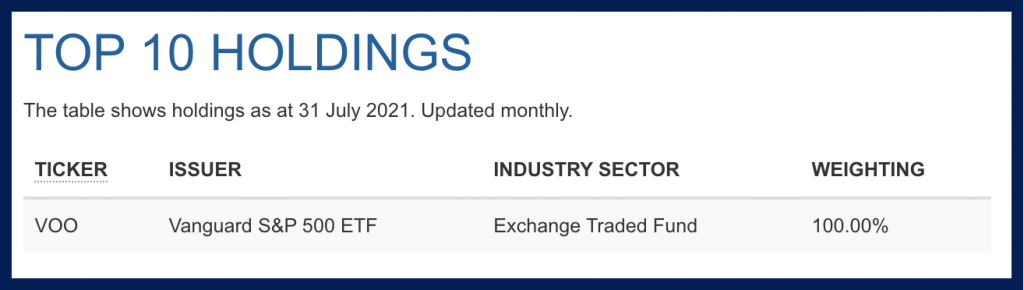

The Smartshares ETF tracks the S&P 500 index by investing into the Vanguard S&P 500 ETF as their sole holding, instead of directly investing in the underlying companies! Smartshares simply take the Vanguard product and repackage it to create a NZ domiciled product – a product that’s listed on the NZ market, priced in NZ Dollars, and follows the local regulations and tax treatments.

It is Smartshares’ standard practice to do this for their global ETFs. For example, those investing in the Smartshares Total World ETF (TWF), will find that this ETF’s sole holding is the Vanguard Total World Stock ETF (VT). So which option is better? – investing in the Smartshares ETF repackaged for NZ investors, or taking the more direct route with the Vanguard ETF?

2. Differences to consider

First off, here’s a few points to consider (and not to consider) when comparing the two Smartshares and Vanguard ETFs.

There’s more to compare than just the management fee

Looking at the management fee of each ETF, we can see there’s quite a difference:

- Smartshares US 500 ETF – 0.34%

- Vanguard S&P 500 ETF – 0.03%

The same is true for the Total World ETFs:

- Smartshares Total World ETF – 0.40%

- Vanguard Total World Stock ETF – 0.08%

On the surface the Vanguard products look superior because of their vastly lower fees right? Unfortunately management fees aren’t the only fee that investors pay – you need to consider the full cost of ownership that comes with investing in these funds.

For Smartshares ETFs there are the following additional fees:

- Brokerage – While fund platform InvestNow doesn’t charge any brokerage fees, other services you can use to invest in Smartshares ETFs do. For example, Sharesies charges a brokerage fee of 0.5% (for orders up to $3,000) on Smartshares ETFs.

- Buy/sell spread – Spreads typically apply when buying and selling Smartshares ETFs. For USF you can expect to pay a small $0.005 per unit premium when buying units in the ETF, and sell your units at a small $0.005 per unit discount. Spreads also apply to Vanguard ETFs, but these are negligible in comparison.

- Cash drag – Not a fee, but will affect the performance of Smartshares’ ETFs. The Smartshares US 500 ETF is not 100% invested into the Vanguard S&P 500 ETF – instead it has a small holding (less than 0.20%) in cash. This will be a small drag on the ETF’s performance.

For Vanguard ETFs there are also a few additional fees, and assuming you use Sharesies or Hatch to invest, will likely be higher than Smartshares’ additional fees:

- Foreign exchange – To buy Vanguard ETFs you need to exchange your NZD to USD. This comes with a 0.40%-0.50% fee. The same fee applies when you sell your ETFs and need to convert your USD back to NZD.

- Brokerage – Sharesies charges a brokerage fee of 0.5% (for orders up to $3,000). Hatch charges a flat brokerage fee of $3 USD (for orders for up to 300 shares).

- Dividend reinvestment – Neither Sharesies or Hatch offer automatic dividend reinvestment plans. Any dividends are deposited into your USD account, and you have to manually invest them into more units of your ETF. This will incur brokerage fees.

Further Reading:

– Buying shares in the USA – Sharesies vs Hatch vs Stake

Tax differences

I won’t get into too much detail on tax differences, but here’s a very quick overview of the rules.

Vanguard

The Vanguard S&P 500 ETF is considered a Foreign Investment Fund (FIF), so FIF tax rules apply. Investors must calculate their taxable income on FIFs by using one of the following methods:

- Fair Dividend Rate (FDR) – Take 5% of the market value of your FIF investments at the beginning of the income year

- Cumulative Value (CV) – Calculate the closing value of your FIF investments plus gains, and subtract the opening value of your FIF investments at the start of the income year plus costs

- De minimis exemption – If the cost of your FIF investments is less than $50,000 you can apply the de minimis exemption, in which case the value of dividends received from your FIF investments = your taxable income

Your taxable income is then multiplied by your marginal tax rate to determine your tax liability. For example, if your FIF investments cost $100,000 and your marginal tax rate was 33%, under the FDR method your taxable income would be $5,000 (5% of $100k), and your tax liability would be $1,650 (33% of $5,000). You would need to declare this income on your IR3 tax return and pay your tax liability to the IRD every year.

Smartshares

The Smartshares US 500 ETF is a New Zealand domiciled Portfolio Investment Entity (PIE). Given this fund invests in a FIF, the fund manager calculates the fund’s taxable income using the FDR method, then passes the tax liability on to investors through a reduction of the fund’s unit price/dividend (which can explain why USF’s dividend yield of 0.34% is lower than VOO’s yield of 1.34%). Therefore your tax liability is taken care of for you automatically (at a tax rate of 28%), and there is no need to do anything in regards to tax returns. However, if you have a tax rate of less than 28% you can declare the excess tax paid on your IR3 tax return to offset your other tax liabilities.

Further Reading:

– What taxes do you need to pay on your investments in New Zealand?

– Kernel Foreign Tax Calculator (USF is row 1, VOO is row 6 of the spreadsheet)

Price doesn’t matter

On 2 August 2021, the prices of the two ETFs were:

- Smartshares US 500 ETF – $11.64 NZD

- Vanguard S&P 500 ETF – $402.33 USD

This huge difference in price is a result of Smartshares cutting up a single unit of VOO into multiple units of USF in their process of repackaging the ETF for NZ investors (given New Zealand investors are more used to smaller unit prices). This price difference is does not make one ETF better than another, nor does it impact performance.

Further Reading:

– Smartshares Exchange Traded Funds: Understanding The Unit Price (Passive Income NZ)

Let’s look at the performance of both funds over the last year as an example:

| Smartshares USF | Vanguard VOO | |

| Price as at 3 August 2020 | $9.06 NZD | $297.42 USD |

| Price as at 2 August 2021 | $11.64 NZD | $402.33 USD |

| Percentage change | 28.48% | 35.27% |

However, this isn’t an apples to apples comparison as it doesn’t take into account the change in the exchange rate between USD and NZD. Over the year the USD has gotten weaker over the NZD, so when you convert the price of VOO back to NZD you’ll see that the percentage change is 28.72%, which is almost the same as the return of USF.

| USD-NZD exchange rate | Vanguard VOO (in NZD) | |

| Price as at 3 August 2020 | 1.5067 | $448.12 NZD |

| Price as at 2 August 2021 | 1.4337 | $576.82 NZD |

| Percentage change | -4.85% | 28.72% |

So let’s say we invested $1,000 into both USF and VOO on 3 August 2020. Ignoring any FX or brokerage fees, one year later we would have the following:

| Smartshares USF | Vanguard VOO | |

| Units owned | 110.37 | 2.23 |

| Value of units at 2 August 2021 | $1284.71 NZD | $1286.31 NZD |

So the difference in unit price or number of units owned does not matter. In the next section of this article, we’ll look at a more detailed fee comparison between the two ETFs, taking into account all the fees and taxes involved.

3. Fee comparison

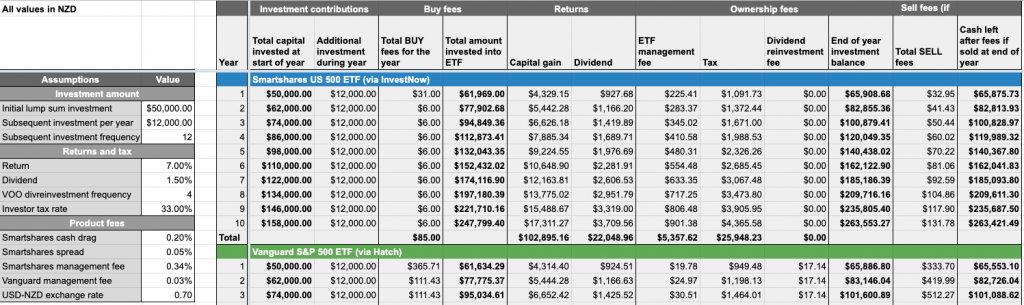

Now that we know what to consider (and what not to consider), we can move on to a full fee comparison between the two Smartshares and Vanguard ETFs. This is quite difficult to do as there are lots of variables to consider. But I plugged the numbers for three different investors into a spreadsheet to see which ETF works out better for them.

The assumptions I used for this comparison are:

- Platforms used – To invest in USF we’ll use InvestNow, and to invest in VOO we’ll either use Hatch or Sharesies – the cheapest NZ platforms for investing in the respective ETFs.

- Entry and exit fees – Standard Sharesies and Hatch brokerage and FX fees apply. Assume a buy/sell spread of 0.05% for the Smartshares ETF.

- Capital gains – Every year we make a capital gain of 7% on the amount invested in the ETF on a given year. The capital gain on USF will be multiplied by 99.8% to reflect its cash holdings of ~0.20%.

- Dividends – Every year both ETFs pay a 1.5% dividend. This is multiplied by 99.8% for USF to reflect its cash holdings. For USF, these are reinvested automatically. For VOO, these are manually reinvested 2 times per year (to match the dividend payment frequency of USF).

- Management fees – This is calculated on the amount invested in the ETF on a given year + the 7% capital return.

- Tax – For VOO the de minimis exemption will be used if the capital invested is less than $50,000 at the start of the year, otherwise use the FDR method. Tax paid by deducting the tax liability from the investment balance at the end of the year. Assume no fees for US tax filing through Hatch (you would usually pay $1.50 USD per year).

- Exchange rate – The NZD/USD exchange rate remains at 0.70.

- Portfolio – Our investors hold no other FIF investments on their portfolios.

Now that all the assumptions are out of the way, here’s the results for our three investors!

A. Andrew from Arrowtown

Andrew has $100,000 NZD to invest in a S&P 500 ETF. His tax rate is 33%. After 10 years Andrew’s investment would be worth:

- Smartshares US 500 ETF (via InvestNow) – $191,472.80

- Vanguard S&P 500 ETF (via Hatch) – $191,334.39

This is made up of $100,000 of his capital invested, plus:

| Smartshares | Vanguard | |

| Entry & exit fees (brokerage/spreads/FX) | – $145.78 | – $1,555.77 |

| Returns (capital gain + dividends) | + $115,619.60 | + $115,807.85 |

| Management fees | – $4,957.79 | – $437.34 |

| Tax | – $19,043.23 | – $22,480.35 |

The results across both ETFs are pretty much the same for Andrew, with Smartshares’ higher management fees offset by lower entry & exit fees and favourable tax treatment, given his tax for USF is calculated at a lower rate of 28% (vs 33% for VOO).

B. Barry from Bluff

Barry has $20,000 NZD to invest in a S&P 500 ETF. He will follow this lump sum investment with an additional $1,000 investment every month. His tax rate is 30%.After 10 years Barry’s investment would be worth:

- Smartshares US 500 ETF (via InvestNow) – $212,756.30

- Vanguard S&P 500 ETF (via Hatch) – $213,935.95

This is made up of $140,000 of his capital invested, plus:

| Smartshares | Vanguard | |

| Entry & exit fees (brokerage/spreads/FX) | – $176.43 | – $2,297.91 |

| Returns (capital gain + dividends) | + $92,038.67 | + $93,136.74 |

| Management fees | – $3,946.63 | – $351.73 |

| Tax | – $15,159.31 | – $16,465.44 |

Vanguard is slightly more favourable for Barry, particularly as he’s starting off with an investment balance below $50,000 – given the tax advantage he gets from applying the de minimis exemption for his first three years of investing (after which the cost of his investment exceeds $50,000, and he must use the FDR method).

C. Courtney from Castlepoint

Courtney will invest $250 per month into a S&P 500 ETF. Her tax rate is 17.5%.After 10 years Courtney’s investment would be worth:

- Smartshares US 500 ETF (via InvestNow) – $44,927.67

- Vanguard S&P 500 ETF (via Sharesies) – $46,788.35

This is made up of $30,000 of her capital invested, plus:

| Smartshares | Vanguard | |

| Entry & exit fees (brokerage/spreads/FX) | – $37.48 | – $521.49 |

| Returns (capital gain + dividends) | + $17,519.93 | + $17,947.72 |

| Management fees | – $751.26 | – $67.78 |

| Tax | – $1,803.52 | – $554.27 |

The result from Vanguard is clearly better for Courtney. The low management fee and tax advantage she gets from applying the de minimis exemption is more than enough to offset Sharesies’ brokerage and foreign exchange fees.

So in general:

- The two ETFs deliver quite similar results for larger investment portfolios, particularly if you’re starting out with over $50,000 NZD invested in Foreign Investment Funds.

- The Vanguard S&P 500 ETF delivers better results if you have a smaller investment portfolio and can apply the de minimis exemption in regards to tax. This means you only have to pay tax on the dividends, and for the S&P 500 the dividends should be relatively low.

- However, in the very short-term (for 2-3 years) Smartshares is better as it takes a couple of years for Vanguard’s lower management fees (and sometimes favourable tax treatment) to offset the initial foreign exchange and brokerage costs. This should be no problem, as these S&P 500 ETFs are intended for long-term investment.

But while the assumptions I’ve made so far keep the above comparisons relatively simple, they are not perfect. The main limitations of the comparison are:

- CV method – I assumed we made a constant 7% return every year. In reality you will get a higher return in some years, and a low or negative return on your investments in other years – in which case it could be beneficial to apply the CV method to calculate your tax liability for your FIFs. The CV method is not available for USF, making VOO more favourable in this instance.

- Payment of tax and dividends – I assumed that the tax liability for both ETFs were paid out of the returns of the ETF (i.e. the capital gain/dividend). While this is true for USF, for VOO the taxes are paid as an out of pocket expense to the IRD every year. This means you’ll either have to put some cash aside, or sell some units of the ETF to pay for your tax liability.

- Tax advice – I assumed that no accountant was used to help calculate and file the taxes. In reality an accountant may be required (which will cost you), particularly when dealing with the FIF tax rules associated with VOO.

- InvestNow cash drag – I assumed that there is no additional cash drag from using the InvestNow platform. In reality InvestNow doesn’t offer fractional investment into ETFs (like Sharesies or Hatch), so any investment in USF will always result in some cash left over from your order (rather than getting invested into units of the ETF). The effect will be more drastic for smaller order sizes and this cash drag may impact returns, but can be mitigated by regularly investing the excess cash.

- Changing assumptions and parameters – I assumed that all the assumptions and parameters I used remain the same throughout 10 years. Things like fees, tax rules, exchange rates can and do change over time, and would alter the results.

You can copy the spreadsheet I used to do the calculations here and play around with the numbers if you wish to do your own comparison.

Conclusion

Despite investors facing additional foreign exchange and brokerage costs to buy the Vanguard S&P 500 ETF, if you invest for a long enough period of time (2-3 years) these extra fees are often offset by Vanguard’s lower management fees compared with the Smartshares US 500 ETF. However, there is not a massive difference in results between the Smartshares and Vanguard products – perhaps small enough that it’s probably better to just pick the ETF you feel is better for you, rather than spending too much time on overanalysing the options (and perhaps not starting to invest at all). A lot can change in 10 years (such as fees or tax rules) that could totally flip which option is more favourable.

For me Smartshares is the more convenient product. Things like foreign exchange, dividend reinvestment, and most importantly tax are all taken care of me – the streamlined investment process, and having all my index fund investing on one platform (InvestNow) is worth more to me than any potential gains (probably a few hundred dollars over ten years) I could make by switching to the Vanguard equivalent. However, those who have already set up an account with Sharesies or Hatch to invest in other US shares and ETFs may find it less difficult to add Vanguard’s S&P 500 ETF to their portfolio.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Hello, thanks for this article and the spreadsheet! I’ve found it super useful.

I was wondering if you could shed some light on whether you’d be in worse off tax position if you started with VOO (using FIF tax) then part way through the year end up selling and switching to Smartshares 500 (PIE) instead? I’m considering doing this exact switch as I think it’s less stress doing calculations etc and PIE would make it simpler and I don’t need to keep cash around for the any impending tax. Any thoughts or advice is appreciated!

Hi. Let’s say you had over $50k NZD invested in VOO today (April 2022), and switched that to USF. You’d need to consider the fact that you’ll still be subject to FIF tax at end of tax year (March 2023) given you’ve held over $50k in FIFs for at least part of the year – that won’t necessarily put you in a worse tax position, but it’ll take some time before you’re totally free of your FIF tax obligations. You’d also need to consider whether the brokerage and FX costs you’ll pay are worth the switch – for some it’ll be an unnecessary expense, for others it’ll be worth it for the reduced stress and accounting costs.

Hi. Thanks for the great article!

I was following through the first half of the article to find out if it’d be better for me to invest directly through the Vanguard website rather than buying the ETF (i.e. VOO) through other platforms like InvestNow, Smartshares etc. Do you think there is any benefit in doing that?

your advice is appreciated.

Hi, we don’t believe it’s possible to for New Zealanders to invest directly through Vanguard

Hi Team,

Thank you for a valuable comparison between these investment options. Im pretty new to Stock & ETF investment and am a little confused. If you are able to explain or point me in the direction of some helpful information I’d really appreciate it.

So… I have been looking into VOO and USF lately to decide on where to start investing, and have noticed that they perform differently. VOO has clearly decreased (roughly 29%)more in value YTD than USF (roughly 12%), which in my understanding means that the investors in each fund have different perceptions of the market or different ideas of investment, or these are totally independent markets based on a common Vanguard Fund investment. It appears that VOO tracks the S&P 500 index very closely interms of performance but USF not so much. I am wondering whether the performance of the two ETF’s is vastly different, with the majority of Smartshares Investors being likely NZ based and Vanguard VOO Investors being US based? If the performance of the funds are not the same or linked, then are each of the funds more affected by the local economies of investors i.e. USF has not fallen as much as VOO due to NZ investors being more optimistic than US investors. Would a recession in the US see a big effect on USF or can it be quite isolated? Is VOO historically more volatile than USF?

I am not looking to try to day trade but even for long term investment combined with dollar cost averaging, entry price can make a huge difference as can exit price. I am wondering if there is more opportunity in a more volatile fund to capitalize on market declines, by introducing capital at these times, or is this just additional risk or the folly of an inexperienced investor?

I like the Smartshare investment as it takes the currency exchange rate out of the potential variable when cashing up for retirement, but I like the fact that VOO is the actual market rather than a market of a market with another layer of potential variables affecting the unit price.

Any words of wisdom would be much appreciated. Interestingly most of the Youtube investors I have followed are investing through Hatch into VOO, but it seems the writer of this article preferred Smartshares through maybe InvestNow. An expansion of any pro’s and con’s from a NZ based investment perspective would be great.

In summary, what the h*ll am I doing? Please advise! ☺

Many thanks for your great information.

Regards Mike

Hi Mike, the performance of these funds are largely the same. VOO is priced in US Dollars, while USF is priced in NZ Dollars so you need to translate VOO’s performance to NZD terms for a fair comparison. You’ll find that both funds have similar performance as the NZD has declined against the USD over the year. These points are covered in section 2 of this article.

If you’re looking for an investment that matches the performance of VOO without the currency impact, then Kernel’s S&P 500 Fund could be an option. It’s hedged to the NZD so you won’t get those currency variations.

This is so useful! Will you add in the Kernel fund? Not sure if I should looks at that with lower fee?

Thanks, we’re currently working on an updated article which will include Kernel’s fund. Should be out in 2-3 days.

Hi, I’ve been looking for the most cost effective way to invest in the Vangaurd S&P500 and your info has been very helpful thanks. I’ve just found this article on the InvestNow website from April 2019 which shows a brokerage charge and mentions a one-off fee of $30, possibly brokerage of 0.6% according to the example. Maybe it’s out of date and they have scrapped this fee now, are you sure there is no brokerage?

https://investnow.co.nz/smartshares-access-to-etfs-for-new-zealand-investors-when-is-0-34-cheaper-than-0-04/

Hi Craig, that article is a bit different to ours as it was written by Smartshares and compared investing in an S&P500 ETF directly via Smartshares vs a traditional online broker (e.g. ASB Securities), while we compared investing via InvestNow vs a low cost broker. It’s a little confusing given it was posted on the InvestNow website!

So that one-off $30 fee applies when investing direct via Smartshares, but does not apply when investing via InvestNow.

In terms of brokerage, the $60 in that article comes from the fact that by investing direct via Smartshares you need to sell your units through an NZX broker like ASB Securities which does charge brokerage fees. But by investing through InvestNow, you can buy and sell through the platform without needing an NZX broker, and there’s no brokerage in either instance.

谢谢分享。有个问题请教:昨天2022年9月25日(美东时间),理论上 购买新西兰的 USF.NZ ETF,它跟踪标普500 VOO.US ,两者的市盈率应该是一样的。可是USF.NZ 的市盈率只有8.26,比VOO.US 18.66少许多,不知问题在哪里?谢谢

That’s right, the P/E ratios of the underlying companies of both funds should be identical, given both funds contain the same companies. However, the P/E ratio for USF factors in exchange rate fluctuations between NZD and USD hence the difference with VOO.

Hi, i have a question

With the NZD to USD at 55 cents, i am trying to think how this affects a non-hedged Smartshares fund such as their SP500 (USF).

If i am purchasing with NZD, then presumably i am buying less units per $1000 than when the exchange rate was at 65 cents.

In saying that, given the fund isnt hedged then does the NTA which is quoted in NZ already have the upside built in from the forex trend. e.g if the price of the underlying Vanguard fund VOO stayed static for a month in USD, but the NZD got weaker against the USD, then the NTA which is quoted in NZD should increase right?

Trying to confirm the theory above is correct, and also work out whether the exchange rate is so poor at the moment that i should hold off buying any more Smartshares units. Normally i dont get to fussed about the Forex rates and dollar cost average in, but with such an extreme exchange rate it has me thinking!

Hi Mark, yes being an unhedged fund USF will be affected by exchange rate movements. So even if VOO stayed at the same price, and the NZD declined, USF would go up in price. The opposite would apply if the NZD went up. Note that VOO would also face the same exchange rate fluctuations, as even through it’s priced in USD, you still need to exchange between NZD and USD to buy/sell units in VOO. To avoid exchange rate volatility you’d need to use a hedged fund like Kernel’s S&P 500 Fund.

Just one more thing to keep in mind is that the purpose of dollar cost averaging is to remove market timing from the equation and smooth out the impact of market movements, by consistently investing regardless of market conditions. Tweaking your DCA plan in response to forex rates would go against the purpose of it. But that’s just our thinking, and not financial advice for what you should do 🙂

When investing through the likes of Hatch, their funds being US domiciled, I have some concern that it is potentially exposing one’s investments to US estate taxes. Do you have any thoughts on that?

That’s an added concern when choosing US domiciled investments which we covered in our article here. However, it can be argued that in reality the tax will never apply – We haven’t seen any cases where the US government has chased down a Kiwi investor for estate tax. So we’re afraid there’s no definitive answer, so investors will just have to factor in that risk when deciding which fund to invest in.

Thank you very much for this highly informative and useful article. I am new to smartshares and am muse opting for the S&P500 index fund.

I have a question for you in regards to compound interest..

You stated as an example:

Andrew has $100,000 which he leaves in his smartshares S&P 500 account for 10 years and earns a total of $191,472 after 33% annual tax.

While , Barry from Bluff invests just $20,000 .. but contributes $1000 a month for 10 years and pays 30% tax and earns $212,756.

Please explain why the $100,000 example isn’t substantially higher after 10 years.

Thank you

Barnaby

That’s because Andrew didn’t invest any further money during those 10 years. That $191,472 comes purely from the capital gains and dividends of his initial $100,000 invested.

Meanwhile Barry invested a total of $140,000 over those 10 years. Yet he’s only $21,000 ahead of Andrew (instead of $40,000 ahead), as the money invested has been drip fed into his fund over time and has had less time to make a return and compound.

Hope that helps.

Thanks for all the comparisons.

I think i am confused. Where is the tax coming from on the smartshares calculations? All 3 examples have significant tax. I thought if NZ listed ETF tax would only be on dividends (income to the PIE)? This would be minimal with such a low dividend rate.

Hi Pete, it isn’t the dividends that get taxed. The fund invests into overseas assets so must pay FIF tax on those holdings. That FIF tax then gets passed onto investors in the fund (though it is less obvious to them given the fund is structured as a PIE). We cover FIF tax in further detail in this article: https://moneykingnz.com/tax-on-foreign-investments-how-do-fif-and-estate-taxes-work/

Great article, I have a question regarding Foreign Tax Credits.

I read an article that basically says if you invest in a NZ domiciled fund that invests in a foreign fund of which holds the underlying stocks then all Foreign Tax Credits are lost and are unable to be claimed to offset NZ based tax requiements. Seeing as USF is directly invested in VOO and doesnt actually hold the underlying stocks directly then I am picking this is the case.

As opposed to buying VOO directly through Sharesies/Hatch I am picking you would be able to claim the Foreign Tax Credits to reduce your NZ tax bill.

Is this another reason it could be better to invest directly in the VOO fund yourself as opposed to through USF, or is it something thats so negligible that it isnt going to affect the end result too much?

I have given a link to the article in case you want to check it out. Cheers.

https://www.castlepointfunds.com/are-you-being-double-taxed

Hi Brent, there’s actually no difference in Foreign Tax Credits (FTC) between investing through a NZ domiciled fund vs directly owning VOO. In either scenario you are still owning the underlying stock via VOO, so you cannot claim the FTCs associated with the underlying stock yourself. However, you can claim the FTC associated with the dividends VOO pays. In the case of direct ownership you can claim the FTCs associated with VOO yourself. In the case of going via a fund, the fund manager can also claim the FTCs associated with VOO to reduce the taxable income on the fund.

That’s how US ETFs holding US shares work anyway. The FTC issue that the Castle Point article raises would be more applicable to a global ETF like Vanguard Total World (VT). In that case, the FTCs relating to non-US companies the fund holds would not be usable by a NZ fund that holds VT, like the Smartshares Total World ETF. In that case, it would be beneficial from a tax efficiency perspective to go for a fund that holds those non-US companies directly.

Oh my days!! Just when I think I’m getting my head around it 🙂 I’m NZ based and thought I would give investing a crack. Was sick of procrastinating. Wanting a fund/funds I could contribute to regularly – hassle free. I bought Vanguard International Shares Select Exclusions Index Fund and Smartshares – Australian Resources ETF (ASR) via InvestNow. The FIF associated with the Vanguard Fund has made me think twice now. I haven’t even been in for a year. If I pull out now, will this cause issues at tax time? It is a very small investment $$ wise. Am I right in thinking it would be simpler investing in Smartshares EFTs via Investnow so it’s all done for me? If my PIR is 17.5% will I still be taxed at the max 28%. If yes, will the IRD sort this out at tax time or will I need to claim it back. Hoping I haven’t got the wrong end of the wrong stick. Thanks in advance.

Is there anything to be said in terms of liquidity of the asset?

Is it easier to buy/sell VOO compared to USF?

VOO definitely has more liquidity and should be able to buy/sell with much lower spreads. USF does have market makers so you should have no problems with buying and selling, but the spreads may be higher.

Hi,

I am just starting out investing and have been investing $2000 each month into VOO through Sharesies. I currently have $11000 invested in VOO. My plan is to invest $2000 each month for the next 20-30 years. Are you able to explain the tax/cost implications of staying with VOO as opposed to switching to USF please. I am just trying to understand which ETF is better for my investment plan.

Thanks,

Chris

Thanks for the helpful article. Just got round to trying to compare best setup for me. I have both Hatch and smartshares etfs.

Just wondering, does your spreadsheet take into account the fx fee charged by Hatch to buy the USD and then convert them back to NZD when you sell the holding? It’s .5% per the Hatch site. I believe if you transfer USD in from Wise to Hatch there is no fx fee.

As you say though, time in the market is probably more important than trying to dissect the fee structures although the tax rate may affect the outcome markedly if you are on a higher tax rate than 28%.

Things have changed a bit since you set up that spreadsheet! NZD:USD is now .60 and the US500 long term average is 12.32%.