Smartshares Total World (TWF), Foundation Series Total World Fund, Macquarie All Country, Russell Sustainable Global Shares, Kernel Global 100, Simplicity Global Share, and Vanguard International Shares Select Exclusions. These are all global shares index funds which are easily accessible to Kiwi investors, and allow you to effortlessly invest in sharemarkets across the world. So which one is the best? In this article we’ll take a detailed look at each fund including what they invest in, their fees, and tax efficiency to help you make a decision on which fund to invest in.

This article covers:

1. What’s on offer?

2. Fees

3. Fund composition

4. Tax

5. Fees and tax comparison

6. Other considerations

Update (10 Nov 2022) – Added the Foundation Series Total World Fund, and Kernel Hedged Global 100 Fund to the comparison.

Update (1 May 2023) – Added Simplicity’s Global Share funds to the comparison.

1. What’s on offer?

Global shares index funds allow you to invest in global sharemarkets in one go, by containing companies from sharemarkets in the US, Europe, Asia, and beyond. They make it easy to spread your investment portfolio outside of New Zealand, saving you from having to pick specific overseas countries or regions to invest in.

In addition to geographical diversification, each of these funds is spread broadly across many companies and industries. You’ll find the usual big name companies in these funds including Apple, Microsoft, Coca-Cola, and Toyota. This saves you from having to research and pick individual companies to invest in.

And being index funds, all of these benefits come with low management fees. Overall, global shares index funds are popular among Kiwi investors, and are commonly used as a core building block in a long-term investment portfolio. So let’s take a look at our fund options below:

Smartshares Total World

Smartshares’ core global funds are the Total World ETFs which track the FTSE Global All Cap Index. These funds contain over 9,000 large-cap, mid-cap, and small-cap companies from over 40 developed and emerging markets. The Total World ETF is available in two varieties – an unhedged version, and a NZ Dollar hedged version:

- Unhedged – Smartshares Total World ETF (TWF)

- Hedged – Smartshares Total World ETF (NZD Hedged) (TWH)

More on currency hedging later. You can invest in these funds direct from Smartshares (minimum investment $500), through InvestNow (TWF only, minimum investment $50), or via an NZX broker like Sharesies (minimum investment $0.01).

The Total World funds are also offered by Smartshares’ sibling fund manager SuperLife. The SuperLife versions of these funds have the same underlying investments, but have slight differences around fees and tax which we’ll cover later the in article. SuperLife’s funds are:

- Unhedged – SuperLife Total World Fund

- Hedged – SuperLife Total World (NZD Hedged) Fund

Both SuperLife funds are available direct from SuperLife (minimum investment $1), or through Flint (minimum investment $50).

Further reading:

– Smartshares & SuperLife review – The smart way to invest in shares?

Foundation Series Total World

Foundation Series offers the Total World Fund. It has the same underlying investments as Smartshares’ Total World ETFs, tracking the FTSE Global All Cap Index. It’s available through InvestNow (minimum investment $50)

Macquarie All Country Global Shares

Macquarie offers one global shares index fund, the All Country Global Shares Index Fund. The fund tracks the MSCI All Country World ex Tobacco Index and invests in over 2,900 companies globally from over 40 developed and emerging markets. The fund is 69% hedged to the NZ Dollar.

It’s available through both InvestNow (minimum investment $50) and Sharesies (minimum investment $0.01).

Russell Investments Sustainable Global Shares

Russell’s Sustainable Global Shares Funds aren’t strictly index funds. Instead the funds are based on the MSCI ACWI Index but are modified to give them a sustainability tilt. They exclude investment into coal, nuclear and controversial weapons, civilian firearms, and tobacco, and the funds also have higher weightings to companies participating in the transition to renewable energy. Overall the funds invest in over 1,300 companies from both developed and emerging markets. The fund is available in two varieties:

- Unhedged – Sustainable Global Shares Fund

- Hedged – Hedged Sustainable Global Shares Fund

Both funds are available through the InvestNow platform where the minimum investment is $50.

Russell also offers the Global Shares Fund and Hedged Global Shares Fund, but these are completely different actively managed funds.

Kernel Global 100

Kernel offers the S&P Global 100 Fund which tracks the S&P Global 100 Ex-Controversial Weapons Index. The fund invests in 100 large-cap companies from 10 developed countries around the world, and is designed to give broad global diversification with each company in the fund required to have operations in all three major continents, and have their assets and have revenue streams spread around the world. The fund is available in two varieties:

- Unhedged – Global 100

- Hedged – Hedged Global 100

You can invest in these funds directly via Kernel.

Further reading:

– Kernel review – High quality index funds

Simplicity Global Share

Simplicity offers the Global Share Fund which tracks the Bloomberg DM ex NZ ESG Screened Index, which includes over 1,000 companies across 25+ developed markets. The fund is available in two varieties.

- Unhedged – Unhedged Global Share

- Hedged – Hedged Global Share

You can invest in these funds directly via Simplicity, where the minimum investment is $1,000.

Further reading:

– Simplicity review – Could there be better fund options out there?

Vanguard International Shares Select Exclusions

Vanguard offers the International Shares Select Exclusions Index Funds which track the MSCI World ex Australia, ex Tobacco, ex Controversial Weapons, ex Nuclear Weapons Index. The funds invest in over 1,400 companies from 23 developed countries, but excludes Australian companies. Vanguard’s funds come in two varieties:

- Unhedged – International Shares Select Exclusions Index

- Hedged – International Shares Select Exclusions Index (NZD Hedged)

Both funds are available through the InvestNow platform where the minimum investment is $50.

Summary

Here’s an overview of the different global share index funds on offer:

| Fund | Constituents | Emerging markets? | Currency hedged? |

| Smartshares Total World | 9,472 | Yes | No |

| Smartshares Total World (Hedged) | 9,472 | Yes | Yes (100%) |

| Foundation Series Total World | 9,472 | Yes | No |

| Macquarie All Country Global Shares | 2,918 | Yes | Partially (69%) |

| Russell Sustainable Global Shares | 1,359 | Yes | No |

| Russell Hedged Sustainable Global Shares | 1,359 | Yes | Yes (100%) |

| Kernel S&P Global 100 | 100 | No | No |

| Kernel Hedged Global 100 | 100 | No | Yes (100%) |

| Simplicity Unhedged Global Share | 1,400+ | No | No |

| Simplicity Hedged Global Share | 1,400+ | No | Yes (100%) |

| Vanguard Intl. Shares Select | 1,455 | No | No |

| Vanguard Intl. Shares Select (Hedged) | 1,455 | No | Yes (100%) |

2. Fees

Management fees

All funds charge a management fee which is an ongoing fee charged as a percentage of the amount you have invested in a fund, and reflected as a tiny deduction in your fund’s unit price:

| Fund | Fee |

| Smartshares Total World | 0.40% p.a. |

| Smartshares Total World (Hedged) | 0.46% p.a. |

| Foundation Series Total World | 0.07% p.a. |

| SuperLife Total World | 0.48% p.a. |

| SuperLife Total World (Hedged) | 0.48% p.a. |

| Macquarie All Country Global Shares | 0.42% p.a. |

| Russell Sustainable Global Shares | 0.34% p.a. |

| Russell Hedged Sustainable Global Shares | 0.36% p.a. |

| Kernel S&P Global 100 | 0.25% p.a. |

| Kernel Hedged Global 100 | 0.25% p.a. |

| Simplicity Unhedged Global Share | 0.15% p.a. |

| Simplicity Hedged Global Share | 0.15% p.a. |

| Vanguard International Shares Select Exclusions | 0.20% p.a. |

| Vanguard International Shares Select Exclusions (Hedged) | 0.26% p.a. |

Other fees

Transaction fees

If you buy/sell Smartshares‘ ETFs through Sharesies or another NZX broker, then a brokerage/transaction fee will apply. For example, Sharesies charges a 0.5% transaction fee on orders up to $3,000, then 0.1% on any amounts above $3,000. There’s no transaction fees for investing in Smartshares’ ETFs direct via Smartshares, via InvestNow, or through SuperLife or Flint.

The Foundation Series Total World Fund has a 0.50% transaction fee to buy/sell.

No other funds covered in this article have transaction fees.

Spreads

Spreads apply whenever you buy or sell units in some funds. This is a small fee to cover the transaction costs of the fund, and work by applying a premium or discount to the fund’s unit price. For example, if a fund’s buy spread is 0.07% you’ll buy units in the fund at a 0.07% premium to the current unit price, and if a fund’s sell spread is 0.07% you’ll sell units in the fund at a 0.07% discount to the current unit price.

| Fund | Buy spread | Sell spread |

| Smartshares Total World | ~$0.005 | ~$0.005 |

| Smartshares Total World (Hedged) | ~$0.005 | ~$0.005 |

| SuperLife Total World | n/a | n/a |

| SuperLife Total World (Hedged) | n/a | n/a |

| Foundation Series Total World | n/a | n/a |

| Macquarie All Country Global Shares | 0.07% | 0.07% |

| Russell Sustainable Global Shares | 0.18% | 0.13% |

| Russell Hedged Sustainable Global Shares | 0.20% | 0.15% |

| Kernel S&P Global 100 | n/a | n/a |

| Kernel Hedged Global 100 | n/a | n/a |

| Simplicity Unhedged Global Share | n/a | n/a |

| Simplicity Hedged Global Share | n/a | n/a |

| Vanguard International Shares Select Exclusions | 0.07% | 0.07% |

| Vanguard International Shares Select Exclusions (Hedged) | 0.09% | 0.09% |

Spreads are arguably not a bad thing, as funds who don’t have spreads still incur transaction costs which are then passed onto investors in the form of a small drag on performance.

Account fees

Some investment platforms charge account fees on top of the other fees:

- Smartshares – A one-off $30 set-up fee applies if you’re investing directly via Smartshares.

- SuperLife – An ongoing account fee of $12 per year applies if you’re investing directly through SuperLife.

- Kernel – An ongoing account fee of $5 per month applies if you’re investing over $25,000 through Kernel. This can increase their effective fees by quite a bit, from a headline management fee of 0.25% to 0.49% if you’re investing $25,000, or 0.35% if you’re investing $100,000.

3. Fund composition

All five funds are built differently, tracking slightly different indices. But they’re still similar enough that you don’t need to invest in more than one. With the exception of Kernel, the investments inside each fund are quite similar with roughly the same exposure to different companies, countries, and industries. But there’s a few key aspects that set these funds apart, so here’s a more detailed look at some of them:

Emerging markets

Smartshares, Foundation Series, Macquarie, and Russell’s global funds each have a roughly 10% investment in emerging markets like like China, India, Brazil, and South Africa. Is it better to have exposure to these countries (as opposed to developed markets only)?

Emerging markets tend to offer higher growth potential, and they add a little bit of extra diversification to each fund. However, they tend to be more volatile and less stable. Take Russia for example which used to be included as an emerging market, but had its sharemarket obliterated as they went into war with Ukraine earlier this year. They definitely aren’t an essential part of an investment portfolio, and you could always invest in a standalone emerging markets fund if you still wanted exposure to this region.

Small caps

Most indices invest only in large and mid-cap companies (i.e. larger size companies). However with its 9,000+ constituents, Smartshares’ and Foundation Series’ Total World Funds also invests in small-cap companies. Like emerging markets, small-caps offer higher potential returns, but are more volatile. Again they’re not an essential part of a portfolio.

Ethical considerations

The Russell Sustainable Global Shares Fund and Simplicity Global Share Fund are the only funds here to promote themselves as ethical or sustainable.

Russell’s fund has a number of exclusions and ethical tilts, which aim to reduce the fund’s carbon footprint and fossil fuel exposure by at least 50% compared to the MSCI All Country World Index which the fund is based on:

- Excluding companies involved with Coal, Nuclear Weapons, Controversial Weapons, Civilian Firearms, Tobacco, and Uranium.

- Having higher weightings to companies with higher ESG scores and companies participating in the transition to renewable energy.

Simplicity’s fund tracks a custom index which excludes companies from a number of industries such as alcohol, fossil fuels, tobacco, gambling, and weapons.

Macquarie, Kernel, and Vanguard’s funds aren’t marketed as ethical or sustainable, but exclude companies involved in selected contentious industries:

- Macquarie All Country Global Shares Index – Tobacco

- Kernel Global 100 – Controversial Weapons

- Vanguard International Shares Select Exclusions – Tobacco, Controversial Weapons, Nuclear Weapons

Is the Global 100 Fund diversified enough?

Kernel’s Global 100 Fund is quite unique, investing in significantly fewer companies compared to other global funds, leaving many investors wondering whether the fund is diversified enough.

Kernel argues that having just 100 companies allows them to decrease transaction costs, and is still a strong representation of global sharemarkets. Given most indices are market cap weighted (with larger companies taking up a larger proportion of an index), smaller companies have much less influence on the performance of an index. For example:

- Russell’s funds – The 100 largest constituents make up 44% of the fund, with the remaining 92% of constituents making up only 56% of the fund.

- Macquarie’s funds – The 100 largest constituents make up 43% of the fund, with the remaining 96% of constituents making up only 57% of the fund.

- Smartshares’ & Foundation Series’ funds – The 100 largest constituents make up 37% of the fund, with the remaining 99% of constituents making up only 63% of the fund.

As a result of the dominance of the largest 100 constituents of each fund, there should be a reasonable level of correlation between Kernel’s Global 100 fund and other global funds, despite the huge difference in the number of constituents.

In terms of geographical diversification, Kernel’s fund invests in 10 countries. This isn’t a lot compared to Vanguard’s fund with 23 countries, or the 40+ countries represented in the funds that contain emerging markets. Plus the Global 100 is also more US-heavy with a 70%+ exposure to US shares compared with ~60% on other global funds. But 10 countries still gives a greater global spread than the US only S&P 500 index.

| Country | Global 100 Weighting | Total World Weighting |

| United States | 71.7% | 59.2% |

| United Kingdom | 7.9% | 4.2% |

| Switzerland | 5.7% | 2.4% |

| France | 4.4% | 2.5% |

| Japan | 3.2% | 6.1% |

| Germany | 3.2% | 2.0% |

| South Korea | 1.6% | 1.5% |

| Australia | 1.0% | 2.2% |

| Spain | 0.8% | 0.6% |

| Netherlands | 0.4% | 1.0% |

In terms of sector diversification, all 11 industries are represented within the Global 100. However, it’s IT heavy (almost a 30% weighting versus 20% on the Total World Fund), leaving it with less exposure to most other industries. However this tilt towards the IT sector isn’t too different from the S&P 500 which has a similarly heavy 27.1% weighting towards the sector.

| Industry | Global 100 Weighting | Total World Weighting |

| Information Technology | 29.8% | 20.7% |

| Healthcare | 13.7% | 11.6% |

| Consumer Discretionary | 12.2% | 13.5% |

| Consumer Staples | 11.5% | 6.3% |

| Financials | 9.5% | 14.6% |

| Communication Services | 8.6% | 3.1% |

| Energy | 7.2% | 5.4% |

| Industrials | 3.7% | 13.3% |

| Materials | 2.4% | 4.7% |

| Utilities | 0.8% | 3.3% |

| Real Estate | 0.7% | 3.7% |

Overall Kernel’s fund is less diversified than the other funds, but still diversified enough. We believe that good diversification isn’t about the quantity of assets you have, but rather how adequately you spread your money around different types of assets. We personally think that 100 companies is enough to achieve sufficient diversification, and you can always combine the Global 100 fund with other funds (like Kernel’s Global Dividend Aristocrats, Global Green Property, or Global Infrastructure funds) to increase it.

Further reading:

– S&P 500 vs S&P Global 100: Which Should I Invest In? (Kernel blog)

4. Tax

How are the funds taxed?

Different funds are structured differently, and this means they can be taxed in slightly different ways.

| Fund | Fund structure |

| Smartshares Total World | Listed PIE |

| SuperLife Total World | Multi-Rate PIE |

| Foundation Series Total World | Multi-Rate PIE |

| Macquarie All Country Global Shares | Multi-Rate PIE |

| Russell Sustainable Global Shares | Multi-Rate PIE |

| Kernel Global 100 | Multi-Rate PIE |

| Simplicity Global Share | Multi-Rate PIE |

| Vanguard International Shares Select Exclusions | Australian Unit Trust (FIF) |

Let’s start with the Vanguard funds which are Australian Unit Trusts. They’re considered Foreign Investment Funds (FIFs) in which special tax rules apply. Essentially you’ll need to calculate your taxable income using one of the following methods and include that income in your end of year tax return. InvestNow’s tax guide and tax reports should help you with this process.

- If you’ve invested under $50,000 into FIFs – You’re considered a de minimis investor and your distributions (dividends) are taxed at your marginal tax rate.

- If you’ve invested $50,000 or more into FIFs – Your taxable income must be calculated using either the FDR method or CV method, then taxed at your marginal tax rate.

All other funds are NZ domiciled PIEs. They automatically take care of your tax liabilities for you, which is good if you find FIF tax a hassle. However, there’s a misconception that these funds enable you to get around FIF tax altogether. But because all of these funds invest in overseas shares (which are also FIFs), the fund manager must pay FIF tax on those shares (calculated using the FDR method), which is then passed on to the fund’s investors – so you still end up paying FIF tax indirectly.

- SuperLife, Foundation Series, Macquarie, Russell, Kernel, and Simplicity funds are Multi-Rate PIEs (MRPs), so are taxed at your Prescribed Investor Rate (PIR), which should either be 10.5%, 17.5%, or 28%.

- The Smartshares ETFs (excluding SuperLife) are Listed PIEs so are taxed at a fixed rate of 28% (though if you’re on a lower rate you can claim back any excess tax paid on your tax return, to offset the tax payable on your other income).

One advantage of PIEs is that their maximum tax rate of 28% can be lower than your marginal tax rate. However, PIE funds can only apply the FDR method in calculating their taxable income, and not the CV method (which is useful during years of low or negative returns). A more comprehensive look at the FIF tax rules and quirks can be found in the article below:

Further reading:

– Tax on foreign investments – How do FIF and Estate Taxes work?

Tax leakage

Not all funds are created equal in terms of tax efficiency. Some funds have a tax leakage issue which comes about due to the following:

- When the underlying companies in each fund pays dividends, the fund has to pay tax on those dividends. This includes a 15% withholding tax that goes to the foreign government of where the dividend paying company is domiciled.

- Usually this 15% withholding tax can be claimed as a tax credit to reduce the amount of tax the fund has to pay (otherwise it’d be double taxed on the dividend).

- The above isn’t an issue for NZ domiciled PIE funds that hold their shares directly, as the fund can appropriately claim the above tax credits.

- But funds that aren’t NZ domiciled (like Vanguard’s funds), or funds that invest in their underlying shares through an overseas domiciled fund can be problematic. In these cases the fund forfeits some or all of their tax credits.

Tax leakage means the fund’s effective tax bill is higher, which is then passed onto the fund’s investors. Here’s the estimated tax leakage impact for each fund:

- Smartshares – Invests in its underlying shares entirely through the US domiciled Vanguard Total World Stock ETF. It’s US shares aren’t affected by the tax leakage issue, but the ~40% of the fund invested in the rest of the world is. Estimated tax leakage of 0.12% p.a. (2% dividends x 15% tax credits lost x 40% invested in rest of world = 0.12%)

- Foundation Series – Has the same underlying investments as Smartshares, so has the same tax leakage of 0.12%.

- Macquarie – Holds most shares directly, except for its emerging markets shares (~10% of the portfolio) which is held through an Australian Unit Trust. Estimated tax leakage of 0.03% p.a. (2% dividends x 15% tax credits lost x 10% invested in an AUT = 0.03%)

- Vanguard – Is an Australian Unit Trust, so all tax credits are lost. Estimated tax leakage of 0.30% p.a. (2% dividends x 15% tax credits lost = 0.30%)

- Russell, Kernel, Simplicity – All shares held directly, no tax leakage issue.

In addition, the Vanguard funds have two other sources of tax inefficiencies:

- Capital gains – As AUTs, the funds have to pay out any realised capital gains as dividends, resulting in a de minimis investor effectively paying tax on these gains. Being a passively managed fund means this shouldn’t be too substantial, but capital gains can still be realised when the fund is rebalanced or when it sells off shares as investors enter and exit the fund. Assuming these realised gains are paid out at a rate of 2%, this will have a 0.66% p.a. tax impact for a de minimis investor on a 33% tax rate.

- Management fee deductibility – On PIEs, the fund management fee is deductible as an expense, resulting in the fund having to pay slightly less tax on your behalf. As an AUT, 95% of the management fee on Vanguard’s fund isn’t tax deductible, leaving it with a ~0.06%-0.08% tax impact for a 33% taxpayer.

What’s the most tax efficient?

Let’s assume you’re on the 33% marginal tax rate. With a tax efficient PIE, we can expect the annual tax impact on your fund to be 1.40% (5% deemed dividend on the FDR method x 28% tax rate). However tax inefficiencies can increase a fund’s overall tax impact:

- Smartshares/SuperLife – Minor tax leakage issue relating to non-US shares. Annual tax impact of ~1.52%.

- Foundation Series – Minor tax leakage issue relating to non-US shares. Annual tax impact of ~1.52%.

- Macquarie – Minor tax leakage relating to emerging markets shares. Annual tax impact of ~1.43%

- Russell – No tax leakage issue, annual tax impact of 1.40%

- Kernel – No tax leakage issue, annual tax impact of 1.40%

- Simplicity – No tax leakage issue, annual tax impact of 1.40%

For the Vanguard AUTs, your tax impact depends on whether you apply the FIF tax rules or the de minimis exemption:

- FIF – Tax impact of 2.01% using the FDR method, and 0.36% using the CV method. Estimated weighted average tax impact of 1.52% p.a. assuming the CV method is applied 30% of the time.

- De minimis exemption – Estimated annual tax impact of 1.68% (0.66% from dividends + 0.66% from realised capital gains + 0.36% from tax leakage).

The below table summarises the estimated annual tax impact for each fund:

| Fund | Estimated annual tax impact |

| Smartshares Total World | 1.52% (Listed PIE) |

| SuperLife Total World | 1.52% (Multi-Rate PIE) |

| Foundation Series Total World | 1.52% (Multi-Rate PIE) |

| Macquarie All Country Global Shares Index Fund | 1.43% (Multi-Rate PIE) |

| Russell Sustainable Global Shares | 1.40% (Multi-Rate PIE) |

| Kernel S&P Global 100 | 1.40% (Multi-Rate PIE) |

| Simplicity Global Share | 1.40% (Multi-Rate PIE) |

| Vanguard International Shares Select Exclusions | 1.52% (FIF rules) |

| Vanguard International Shares Select Exclusions | 1.68% (De minimis exemption) |

Overall tax is very complicated, but we believe that the tax impact of each fund is close enough that they’re not worth stressing out over!

5. Fees and tax comparison

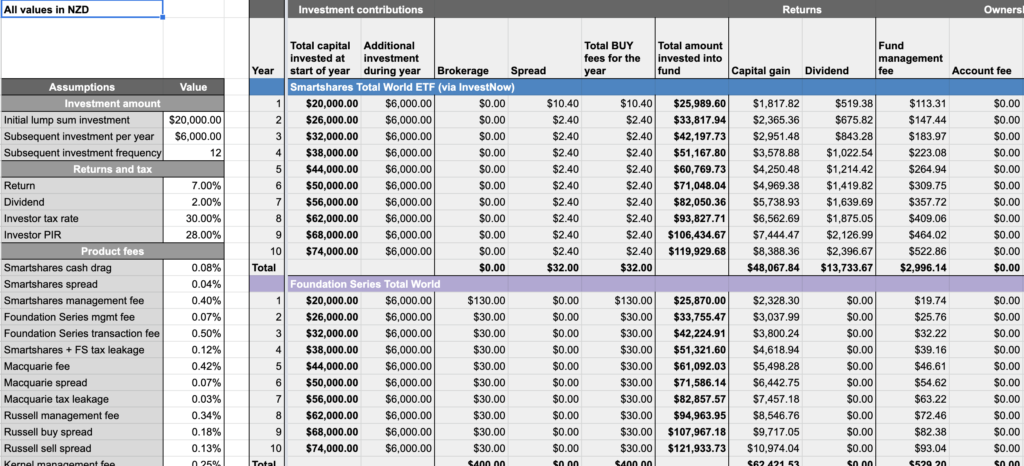

There’s quite a lot of fee and tax differences between the funds, making it quite hard to make a fair comparison between them. So we plugged the numbers into a spreadsheet to see which fund would work out best for a few different scenarios. It’s not a sophisticated calculation and has many limitations – for example, it assumes all funds will deliver the same returns (even though all funds track different indexes). But this comparison should still give us a good idea of the results between each fund:

A – Andrew from Arrowtown

Andrew has $100,000 NZD to invest in a global shares index fund. His tax rate is 33%. After 10 years Andrew’s investment would be worth:

| Fund | Result after 10 years |

| Smartshares Total World | $197,370 |

| Foundation Series Total World | $202,270 |

| Macquarie All Country Global Shares | $198,630 |

| Russell Sustainable Global Shares | $200,448 |

| Kernel Global 100 | $202,050 |

| Simplicity Global Share | $204,933 |

| Vanguard International Shares | $201,397 |

B – Barry from Bluff

Barry has $20,000 NZD to invest in a global shares index fund. He will follow this lump sum investment with an additional $500 investment every month. His tax rate is 30%. After 10 years Barry’s investment would be worth:

| Fund | Result after 10 years |

| Smartshares Total World | $128,326 |

| Foundation Series Total World | $130,310 |

| Macquarie All Country Global Shares | $128,900 |

| Russell Sustainable Global Shares | $129,698 |

| Kernel Global 100 | $130,117 |

| Simplicity Global Share | $131,919 |

| Vanguard International Shares | $130,622 |

C – Courtney from Castlepoint

Courtney will invest $250 per month into a global shares index fund. Her tax rate is 17.5%. After 10 years Courtney’s investment would be worth:

| Fund | Result after 10 years |

| Smartshares Total World | $45,760 |

| Foundation Series Total World | $46,284 |

| Macquarie All Country Global Shares | $45,927 |

| Russell Sustainable Global Shares | $46,152 |

| Kernel Global 100 | $46,282 |

| Simplicity Global Share | $46,837 |

| Vanguard International Shares | $46,137 |

So investing in the Simplicity Global Share Fund seems to deliver the better result over the long-term for most scenarios, followed closely by Kernel’s Global 100 and Foundation Series’ Total World Funds. However, there’s not a massive gulf between the different options, and this comparison doesn’t take into account non-financial factors like ease of use, and being set-and-forget when it comes to taxes. In addition, the comparison doesn’t take into account that in reality all funds will deliver slightly different returns because of the different indexes they track (and without a crystal ball it’s impossible to say exactly which index will perform best into the future).

You can copy the spreadsheet we used to do the calculations here (using Google Sheets) and play around with the numbers if you wish to do your own comparison.

6. Other considerations

Currency Hedging

Investing in international shares adds another layer of volatility to your investments due to fluctuations in exchange rates. For example, even if the price of your shares stay the same, the value of your investment would still rise and fall as the NZ Dollar goes up and down. Smartshares, Russell, Kernel, Simplicity, and Vanguard funds have currency hedged versions to greatly reduce these fluctuations, while the Macquarie fund is 69% hedged to the NZ Dollar.

So should you go for the Hedged or Unhedged version of a fund? There’s no definitive answer, and it depends on personal preferences. But it’s our personal view that unhedged is perfectly fine:

- Hedging is usually more expensive – Smartshares and Vanguard’s hedged funds charge an extra 0.06% in management fees, while Russell’s hedged fund charges an additional 0.02%. Kernel and Simplicity’s hedged funds however, have the same fee as their unhedged funds.

- Exchange rate volatility can sometimes be beneficial – Volatility goes both ways. For example, so far in 2022 global sharemarkets have gone down significantly, but so has the NZD-USD exchange rate. This exchange rate drop has dampened the impact of the sharemarket downturn on Kiwi investors.

- Currency fluctuations should even out over the long-term – Given shares are a long-term investment, there’s less need to hedge them as the volatility evens out over time.

Fractional units

It isn’t possible to buy fractional units in Smartshares’ ETFs (unless you invest via Sharesies). This can result in some quirks where you’re left with uninvested cash after putting in an investment order to buy these ETFs, especially when using the InvestNow platform (this quirk is described in more detail in this article). All other funds support fractional units, so don’t have the same issue.

Distributions

All funds intend (although do not guarantee) to pay distributions at the following frequencies:

- Smartshares – 6 monthly, except for SuperLife – No distributions

- Foundation Series – No distributions

- Vanguard – Quarterly

- Macquarie – 6 monthly

- Kernel – Quarterly

- Simplicity – No distributions

- Russell – 6 monthly

All distributions can be automatically reinvested into the fund (except when using Sharesies or Flint), or taken as a cash payment.

SuperLife, Foundation Series, and Simplicity do not pay distributions, instead any income/dividends the funds earn are automatically reinvested and reflected as an increase in their unit prices.

KiwiSaver

Some of these funds are available to be selected as part of a KiwiSaver scheme:

- SuperLife Total World – SuperLife KiwiSaver

- Macquarie All Country – InvestNow KiwiSaver

- Kernel Global 100 – Kernel KiwiSaver

- Foundation Series Total World – InvestNow KiwiSaver

Russell, Simplicity, and Vanguard’s global funds aren’t available as part of a KiwiSaver scheme.

Further reading:

– The ultimate guide to KiwiSaver funds and schemes

Conclusion

Of our five global shares index funds, none are built equally. Here’s our overall thoughts about each option:

- Smartshares Total World – Provides the ultimate level of diversification, containing 9,000 companies across over 40 countries. However, it’s a relatively expensive fund once you factor in the tax inefficiencies.

- Foundation Series Total World – Same as Smartshares Total World, but with way cheaper management fees. Though you’d need to hold this fund for at least 3-4 years to break even on the 0.50% transaction fee, so it’s best if you’re willing to commit to this fund long-term.

- Macquarie All Country – An old investor favourite available on both InvestNow and Sharesies, but we think that the competing funds are slightly more compelling with their lower management fees.

- Russell Sustainable Global Shares – It’s tax efficient and many will be fans of the sustainability tilt. Though the fund doesn’t seem to be too popular among investors, perhaps due to their slightly higher fees and spreads.

- Kernel Global 100 – Another tax efficient fund with reasonable fees. Less diversified but still adequate. Watch out for the account fee that kicks in on balances over $25,000 as it can make the fund a little bit more expensive.

- Simplicity Global Share – The newest option, which comes with incredibly low fees, good diversification, and ethical exclusions.

- Vanguard International Shares – Has probably fallen out of favour due to new, cheaper, and more tax efficient funds becoming available.

There’s certainly no definitive best, and your personal preferences will also have a big influence which one you should invest in. Just keep in mind the funds are similar enough that it’s probably not worth investing in more than one as they’ll overlap/duplicate each other. So if you’re struggling to deicide, all are solid options – so we think it’s better to just pick one and start investing rather than let analysis paralysis hold you back.

Follow Money King NZ

Join over 7,300 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Thoroughly enjoyed reading this, I learned quite a few things. Thank you for providing such an awesome resource!

Thanks Ben!

Hi, congratulations for the article!!

any reasons for not including Smartshares Global Equities ESG ETF (ticker ESG)?

Thanks. The article was already massive without ESG, so we had to stop somewhere! So we stuck with the most popular option across the 5 fund managers – The higher fee of ESG probably doesn’t help in that regard.

Great article! I am personally been invested in the smartshares total world via invest now for the past 2 years and very happy with my investment as this fund is including emerging markets. I think going forward these emerging markets will produce great returns especially China.

Keep up the good work

Thank you Dean

Wish your post were out before I started my investing journey (a year back). Just realised I bought global shares from 3 different sources. Reading your post, I feel like I have paid a lot on fees (3 sources instead of just 1). Do you have any advise to offer for my situation please? Market is down so selling any of them feel like I am realising my losses.

Hi Chris, a couple of things to consider. Firstly, the situation on fees isn’t so bad. Given fees are largely percentage based, you usually wouldn’t pay substantially more by spreading your money across 3 funds vs having it in 1 fund. Secondly, you aren’t really realising your losses by selling down your funds (assuming you’re reinvesting the money into another global fund). The global fund you’re reinvesting into will be down by a similar amount so you’ll also be buying into your new fund at a lower cost.

Kia ora!

Many thanks for this, it’s so helpful!

Thank you!

I know all funds are held in trusts, but is any one fund better managed or safer than another e.g. from fraud or mismanagement? I am essentially planning to invest my life’s savings, so am looking for a bit more assurance!

Not really, they’re all reputable fund managers, and (for the NZ domiciled funds anyway) fall under the same regulations and are monitored by independent supervisors. You could perhaps argue that some fund managers are more well established, versus Kernel who’s essentially a start-up, but their trust/custody arrangements and supervisor means your money won’t be lost if they were to shut down. So whatever fund you choose, your life savings should be in good hands!

Hi there,

Regarding Russells funds, is there any advantages of investing in the Global Shares Fund instead of the Sustainable Global Shares Fund?

Hi, they’re quite different products. The Global Shares Fund is actively managed, with Russell’s investment managers handpicking the companies the fund invests in. The advantage is that the fund could potentially outperform the return of the market (which the Sustainable Global Shares Fund tries to achieve with its passive investment strategy). The disadvantage is that it charges higher fees (0.89% vs 0.34%), and actively managed funds tend to perform worse than its passively managed counterparts over the long-term (in the Global Shares Fund’s case it’s returned 10.17% over the last 5 years, underperforming its market benchmark which has returned 11.79%).

Thank you so much. These are exactly the issues I have been trying to get my head around. So if in effect you would be paying about 1.4 – 1.68 % in “fees”, for these funds, taking into account tax slippage etc, then this makes the actively managed funds look less expensive ….or do the actively managed funds have tax slippage or other issues that need to be taken into consideration too, making what you pay greater than their stated fees also?

Hi Shelly, actively managed funds need to pay tax on their holdings as well. So if we assume it’s a tax efficient PIE fund 100% invested in global shares, it’ll also have an annual tax impact of about 1.4%.

Let me echo the thanks of many(above) for tackling these tricky options. We’re Kiwis in the +70s; in a PIE managed fund — needing more value/ dividend index funds to supplement that growth.

Would Russell funds be best? Which uncomplicated offering do you recommend?

And which local vendors do we access them through, please?

Cheers Kevin. We’re not allowed to give specific recommendation on what you should invest in, but we can give an overview of the value/dividend index funds out there. All are PIE funds which keep things relatively uncomplicated:

Dividend focussed index funds – Smartshares NZ Dividend ETF, Smartshares Aus Dividend ETF (accessible through InvestNow/Sharesies/direct from Smartshares), or the Kernel Dividend Aristocrats Fund (accessible through Kernel)

Value focussed index fund – Smartshares US Large Value ETF

In addition, some other sector specific funds may have a slight dividend focus like Kernel’s Global Infrastructure and Global Green Property Funds.

Out of this list, I can only find the Smartshares Total World fund on Sharesies. Are there other funds available on sharesies which are equivalent to the Russell, Macquarie or Vanguard listed?

Hi David, the Macquarie All Country Global Shares Index Fund is also available on Sharesies. Otherwise there’s some fairly similar US listed alternatives like the iShares Global 100 ETF which is similar to Kernel’s fund.

It’s impressive Kernel can offer a global 100 fund at 0.25% fee compared to iShares Global which comes in at 0.40%. Blackrock being a much bigger company I would have thought the fees for iShares Global are cheaper. I am however still hesitant to pull the trigger on Kernel global 100 despite reading their article on diversification, it feels like 100 companies is still too little, wondering if you had some thoughts on this.

The iShares Global 100 is likely a niche fund for Blackrock hence the higher fee compared to their other funds. On the other hand it’s a core fund for Kernel, plus Kernel also make money from their membership fees. There’s probably two things to think about when it comes to diversification with the Global 100:

That probably doesn’t give you any more info over what you’ve already read, but hope it helps!

Hi

All this tax stuff confuses me!

If an Investor is on 39% marginal tax rate what’s the difference between an PIE vs AUT with tax leakage and capital gains?

How do I calculate this?

Hi there, For PIEs, the tax rate remains at 28% meaning a tax impact of ~1.40% to ~1.52% for the PIEs mentioned in this article. For the AUTs, you get taxed at 39% so the tax impact is:

Great Read, love your summary!

I really enjoyed the way you’ve broken down these confusing sections.

I have a couple of questions:

I have most of my investments in the Invest now Vanguard Int Shares exclusion fund, do you see value/downsides in moving all of this over to the new Foundation series total world? I’m quite interested in the significantly lower fees it offers.

I plan on using this as a large portion of my retirement fund 30+ years

Just curious if this was a typo or am if i missing something in the conclusion:

“Vanguard International Shares – Has the cheapest overall management fees” which is 0.20%pa,

But the “Foundation Series Total World” is 0.07%pa?

Thanks!

That last part is a typo, thanks. It is now the 2nd cheapest, after the addition of the Foundation Series Fund.

As for value/downsides of the new fund, it will save you a lot in management fees over the long-term, plus in many cases will likely be more tax efficient than that Vanguard fund. On the other hand, you’d need to hold the Foundation Series fund for at least 3-4 years to break even on the transaction fees. That’s easier said than done – imagine you switched funds every time a new, cheaper fund came out – it’d cost you more to constantly switch funds than to stick with your original fund!

Hi Moneyking

Thanks for this super informative piece.

One question I have when trying to choose a fund is the gap between annual fund return (after charges and tax) and index return. This is the bar graphs in the Fund Updates.

For example, for the year ending 31.3.2022, Superlife Total World (unhedged), this gap is 8.12 – 6.19 = 1.93%. For Kernel Global 100 it’s 19 – 16.54 = 2.46%.

Is this a relevant metric when comparing funds? Should I only care about fund return figures (for which past performance can not be projected forward) or take this gap into account (which I assume can persist over time to a similar degree)?

Many thanks

Elton

Yes, that’s definitely a relevant metric given the objective of an index fund is to replicate the performance of an index as closely as possible (though you’ll always get a gap due to fees, tax, tax inefficiencies, cash drag and so on). The hard part is identifying which funds are good or bad at replicating an index – 1 year’s data is not enough to tell what kind of gap it may have into the future, though a persistent gap over the long-term may be a sign of a poor performing fund.

Thanks for your reply.

One would expect funds with lower fees and favourable tax regime to track closer to the index. But that doesn’t always seem to be the case even in multi-year comparison (eg Kernel SP100 vs Superlife TWF).

In this case, is Kernels lower fee still meaningful?

Fees are still important, given they’re a guaranteed expense every year, while a fund’s tracking error could improve (or get worse) year after year.

But perhaps going for a higher fee fund is justified if a lower fee fund persistently tracks far from the index.

Hi, have been buying vti and Vxus through IBKR. Just thinking about tax leakage and switching to VT. As I can tell tax leakage would be the same as my split is currently at market weight? I am waiting for a good nz pie that has VT at a low expense ratio and ideally 100% hedged. One day??

Yes, the tax leakage should be similar in both cases. Perhaps one day Foundation Series will release a hedged version of their funds, though Kernel’s and Russell’s funds probably come closest to what you’re looking for.

Hi. Any advice for parents choosing a fund for a child’s (1 year old) investment account? Amounts are minor at this stage ~$200 per month. PIR is 10.5%. Thanks.

Wow, I wish my parents had invested $200 per month for me when I was 1!

Probably the key difference to consider when investing for kids is tax efficiency. NZ listed ETFs are considered listed PIEs so are taxed at a fixed rate of 28%. You can claim back the overpaid tax as a credit to offset any other income tax. However, for a child this credit wouldn’t be very helpful given they usually won’t have any other income to offset the credits against. So it may be beneficial to stick with unlisted funds when investing for kids.

Hi MoneyKing, seeking your opinion please. I have invested in 4 different funds for each of my kids (between 6-9 years old) since 2 years ago. The 4 funds are Smartshares TW ETF, Smartshares US 500 ETF and 2 from Vanguards. I am thinking of selling off these 4 funds and re-invest them to Foundation Series for 2 reasons – save me headaches so I don’t have to think about FIF/tax returns for them (planning to continue investing for them till they turn 18 or longer – basically when I think they are mature to handle their own investments) and the fees are really low. I am not investing in very large amount (about $50-$100 per month for each kid). Love to hear your thoughts. Thanks.

Hi Chris, we can’t give you advice on what exactly to invest in but can perhaps provide some facts to validate your thinking. Firstly, the tax situation should improve by moving to Foundation Series. You’ll avoid FIF and as a bonus your kids will probably pay less tax as the Smartshares ETFs are taxed at a flat rate of 28%, while Foundation Series can be taxed at a lower rate (e.g. 10.5%). Secondly, the overall fees should be lower as long as you invest for at least a few years to offset the upfront transaction fees associated with Foundation Series. Thirdly, your asset allocation won’t change dramatically by switching to Foundation Series as they invest in similar assets as your 4 existing funds. Hope that helps 🙂

Really appreciate the content in this article, and love your blog overall.

Question on the Foundation Series Total World. Do the calculation of the value at the end include the 0.5% transaction fee when selling it at the end of the 10 year period for example?

Thank you. Yes, the calculations include the transaction fee for selling

When you say “Russell, Kernel, Simplicity – All shares held directly, no tax leakage issue.” could you please tell me where you can see the actual holdings for these funds beyond say the top 10? For most European or US funds or ETFs it is easy enough to find this information on the fund’s own webpage, or am I missing something?

Just as an example, when Russell says it has a weighting of 11% of its “Portfolio Structure (manager weight)” with Oaktree Capital in Emerging Markets, does this imply that it is investing in Oaktree’s funds, not directly as you say? When Simplicity made the move to DWS, it still doesn’t seem as if we can see what DTA’s DWS is applying on Simplicity’s behalf (again the reporting is not comprehensive). Perhaps there are total holdings disclosures available somewhere that you know about though?

Hope you can help! Thanks, Lisa

Hi Lisa, some fund managers are really good and display a full list of holdings on their websites – take Kernel for example. Others we have to look into the Disclose Register where fund managers have the regulatory obligation to upload their funds’ full holdings twice a year. We cover the Disclose Register in this article: https://moneykingnz.com/beyond-the-top-10-how-to-see-everything-your-fund-is-invested-in/

In the case of Simplicity, their global share fund is too new so they haven’t been required to disclose their full holdings yet. In this case we just have to ask the fund manager and/or rely on what they claim about their fund as the truth (and in Simplicity’s case they do explicitly claim they buy the shares directly).

As for Russell Investments, such a statement would imply they invest via Oaktree’s funds. Though this isn’t necessarily disadvantageous depending on the structure of that fund (e.g. if it were also a PIE holding its assets directly). But as far as we know, they don’t hold any external funds – you might be looking at the “Russell Investments Global Shares Fund” which is different from the “Russell Investments Sustainable Global Shares Fund” we covered in this article.

I have a suspicion that the holdings of the new Simplicity Global Shares Fund will resemble this one:

https://etf.dws.com/en/IE00BCHWNQ94-msci-world-esg-screened-ucits-etf-1d/#FundHoldings

Hi, I’m finding your website super helpful and user friendly for newbies to investing. Have a question though…should you invest in a simplicity growth diversified fund and a single sector unhedged global share fund or are you supposed to just pick one? Do they crossover with their investments? Still in analysis paralysis!

Thx Mel

Hi Mel. Generally it’s not necessary to invest in both of those funds as they crossover significantly. The Growth Fund already invests 59% into global shares, so by also investing into the Unhedged Global Share Fund, you’d be doubling up on global shares. That’s not necessarily a bad thing though, if you intentionally wanted to increase your portfolio’s exposure to global shares (and away from bonds and NZ shares).

Thanks so much for all your articles, so much really useful information.

I have an NZ50 and US500 via InvestNow, and Kiwisaver is Simplicity Growth. I’m thinking that adding a global share fund for more international exposure could be a good idea?

The Russell Sustainable Global Shares fund is an option as I’m interested in more sustainable investing – there seems to be less focus on this fund though as a good option (Smartshares TWF and Foundation Series get more coverage) – is there a reason for this?

Many thanks,

Michelle

Hi Michelle, adding a global fund would increase the geographical diversification of your portfolio. They invest in 20+ countries compared to the US 500 which just invests in one. However, global funds have a large allocation to US shares, so will overlap greatly with your US 500 fund (in other words you don’t really need to invest in both the US 500 and a global fund). You may find the following article helpful in deciding which one to invest in: https://moneykingnz.com/sp-500-vs-global-index-funds-whats-better/

Russell isn’t a well known name among retail investors, but that isn’t necessarily a bad thing! As long as the fund is right for you, then there’s nothing wrong with choosing it even though competing options get more coverage. Another fund you may want to consider is Kernel’s recently released Global ESG fund, which also has a sustainability aspect to it: https://kernelwealth.co.nz/funds/global-esg

Also since you’re already with Simplicity you might consider their new GSF, which is even more diversified and has lower fees than the Kernel fund.

Thank you, that’s really helpful. I’ll look into the Simplicity GSF.

Hi, thanks for all your analysis, very helpful, simplicity seems to have the edge, has anything changed since the articles to change your outcomes. Have money with super life but they have not changed with the times, fees are high and duplication of funds. Simplicity and Kernel do not have an Australian fund. Is this an issue?

People who want to invest long term, 10 years plus, in global shares mainly with a set and forget approach I narrow it down to Kernel and Simplicity. Unfortunately each platform has advantages and disadvantages. Any comments appreciated

Hi MoneyKing

I love this article, thank you so much. I have tried to modify your spreadsheet to suit me but am a bit confused.

I am currently on 33% PAYE tax rate putting in $150 a fortnight into InvestNow Vanguard Unhedged International Shares Select Exclusions Index. I have < $50,000 invested so am a de minimis investor. I don't plan to touch these investments for 30 years. My calculations (from modifying your spreadsheet) is that Simplicity Global Share Fund is the best fund for me to be in.

Calculated values after 30 years (at 7% return and 0 initial lump sum):

Smartshares Total World ETF (via InvestNow) $397,175.46

Foundation Series Total World $421,761.09

Macquarie All Country Global Shares $402,596.86

Russell Sustainable Global Shares $410,844.80

Kernel Global 100 Fund $415,796.12

Simplicity Global Share Fund $428,465.41

Vanguard International Shares $410,653.70

Is this right? If so, should I modify my fortnightly payment from InvestNow into Simplicity (without selling out of InvestNow)?

Any advice appreciated (happy to email modified spreadsheet)