Another month, another portfolio clobbering? In September 2022’s What’s been happening in the markets article we cover the recent market movements, whether it’s a good time to invest overseas with the weak NZ Dollar, as well as heaps of updates to Sharesies and other investment platforms and products.

This article covers:

1. Market movements

2. Avoid US shares with the weak NZD?

3. Product updates

4. What we’ve been up to

1. Market movements

Here’s how the markets performed across the month (as at 28 September 2022) in both their local currencies and in NZ dollar terms:

| MTD | MTD (NZD) | YTD | YTD (NZD) | |

| NZ shares (S&P/NZX 50) | -4.15% | -4.15% | -14.69% | -14.69% |

| Australian shares (S&P/ASX 200) | -6.96% | -5.60% | -13.20% | -6.62% |

| US shares (S&P 500) | -5.97% | +0.43% | -21.97% | -6.68% |

| Bitcoin | -16.14% | -8.00% | -57.69% | -49.41% |

It’s been another gloomy month, but when you take into account exchange rates, US shares are actually up for the month! The weakening NZ Dollar has acted as a shock absorber for the market volatility, and is something we’ll cover in more depth later in the article.

Many investors will be feeling deflated, going through a drawn out period of market weakness with no sign of things getting better. But on the bright side, this market downturn will eventually pass, and September has brought us a month closer to the end it, whenever it might be. The continued downturn also gives us a lower entry point into the market, so our dollars go further in buying up investments. It’s a bit of short-term pain for long-term gain.

So how should you be investing during this time? We strongly believe that focussing on things you can control (like your investment contributions and investing mindset) is a much better approach than getting caught up on things you can’t control (like the price movements of your investments). We thought that Sarah from the OneUp Project had a nicely laid out market downturn plan, which closely aligns with our thinking:

Economic news

Economic events have had a big impact on sharemarket performance in recent times, and here’s a couple of highlights from the past month:

- US inflation figures for the month of August came in at +0.10%, when the market was expecting it to drop 0.10%. Subsequently the US Federal Reserve continued to raise interest rates at pace to combat this stubborn inflation, increasing the federal funds rate by another 0.75%. Both events caused the market to freak out over the increasing likelihood that interest rates will go higher and stay there for longer than previously anticipated.

- NZ avoided a recession with GDP increasing by 1.7% over the quarter of June 2022. This follows the March 2022 quarter’s GDP figures of -0.2%. This didn’t appear to have an impact on the local sharemarket, but the NZX still suffered following the path of US shares.

2. Avoid US shares with the weak NZD?

The NZ Dollar has taken a beating over 2022, particularly this month as it dipped below the 60 cent mark. While that’s helped dampen the volatility of the sharemarket, it’s made it more expensive for us Kiwis to buy the currency needed to invest in overseas shares. So given the weak currency, should you avoid investing in overseas shares?

| At the start of 2022: | 1 NZD bought 0.68 USD |

| At the start of September: | 1 NZD bought 0.61 USD |

| Now: | 1 NZD buys 0.57 USD |

Well, trying to wait for the perfect exchange rate to invest is exactly the same as trying to time the market. And we all know that trying to find the perfect time to enter the market is near impossible, and that market timing rarely goes well for those who attempt it. Plus remember that even after factoring in the currency movements, US shares (as represented by the S&P 500 index) are down by 6.7% this year, so they’re still cheaper than they were at the start of 2022.

What’s the solution?

Instead of worrying about whether or not it’s a good time to invest, we think that dollar cost averaging (DCA) is a superior approach. DCA involves investing consistently on a regular basis, regardless of market conditions. Many of us already use DCA as a strategy to help smooth out the impact of share price fluctuations on our investments, so why not apply the same concept to currency fluctuations? Basically short-term exchange rate movements aren’t something you should be bothered about if you’re a long-term investor.

But if you’re still concerned about exchange rates, you could consider investing in a currency hedged fund, which eliminate most of the impacts that currency movements can have on a fund. For example these funds are fully hedged to the NZD:

- Kernel S&P 500 Fund

- Smartshares Total World (NZD Hedged) ETF

- Russell Hedged Sustainable Global Shares Fund

- Vanguard International Shares Select Exclusions Index (NZD Hedged) Fund

And these funds are partially hedged to the NZD:

- Macquarie All Country Global Shares Index Fund – 69% hedged to the NZD.

- Simplicity Growth Fund – Their international shares are 65% hedged to the NZD, and their international bonds are fully hedged to the NZD.

However, they’re not a silver bullet for avoiding the issue. Hedged funds aren’t guaranteed to perform better over an unhedged fund, as hedging can hurt your returns as much as it can help you. It’s impossible to tell exactly how exchange rates will move, and therefore impossible to know whether a hedged or unhedged fund will leave you better off.

Further Reading:

– What’s the best global shares index fund in 2022?

– What’s the best S&P 500 index fund in 2022?

3. Product updates

Upgrades galore at Sharesies

Sharesies came out with a number of new improvements across September. While none of these upgrades are particularly exciting or game changing, they’re still great news for Sharesies’ customers as they start to close the functionality gap with other platforms like Hatch and Stake.

Milford funds

Firstly, Sharesies made four new funds available on their platform, all from Milford who are one of New Zealand’s most popular active fund managers. These are:

- Milford Aggressive Fund

- Milford Active Growth Fund

- Milford Australian Absolute Growth Fund

- Milford Trans-Tasman Equity Fund

Investing in Milford’s funds through Sharesies is essentially identical to investing directly through Milford, however comes with a lower minimum investment of just 1 cent (versus $1,000 via the direct route). This also makes Milford’s funds even more accessible than investing through InvestNow and Flint, who require a minimum investment of $50.

In addition, being unlisted managed funds, Milford’s offerings don’t have any transaction fees applied to them when buying or selling the funds (though you’ll still have to pay Milford’s fund management fees).

Voting for NZX shares

Secondly, Sharesies enhanced their shareholder voting functionality for NZX listed companies. Sharesies had offered voting rights to investors in the past, but only for issues they considered significant enough (like voting on Ampol’s takeover of Z Energy). This enhancement will now allow you to vote on all company matters at a company’s annual general meetings (AGMs). These matters tend to be quite boring, like electing people to the company’s board or appointing auditors, but occasionally voting occurs for more substantial issues like acquisitions or mergers.

While this enhancement makes the ability to vote more widely available, it’s still limited to votes that occur during AGMs. Votes that occur outside of AGMs will still only be passed on to investors when they’re deemed to be substantial enough.

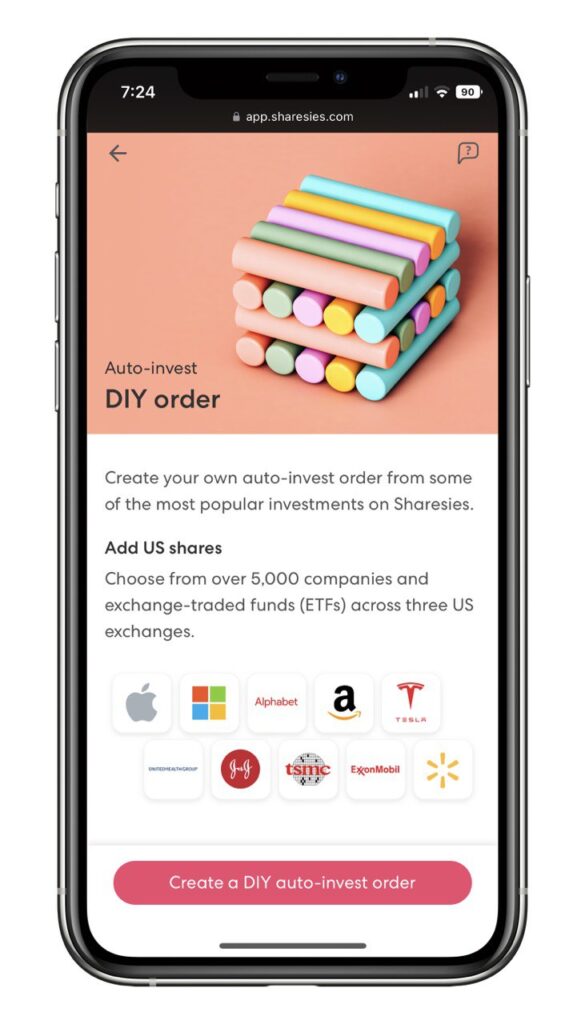

Auto-invest for US shares

Thirdly, Sharesies added the ability to auto-invest into US shares and ETFs. This allows you to set up a DIY order to automatically make investments into those shares either weekly, fortnightly, every four weeks, or monthly. A handy feature if you’re looking to make regular investment contributions into US assets.

More upgrades to come

Apart from the above Sharesies have stated that they’re working on the following features:

- Auto-invest for NZX and ASX shares.

- Dividend Reinvestment Plans for selected companies, which would allow you to automatically reinvest your dividends into buying more shares of that company.

- They may also be exploring stop-loss orders, which are orders that automatically trigger automatically to sell your shares if they drop to or below a specified price.

Further Reading:

– Sharesies review – Still a good investment platform in late 2021?

– Milford review – Better than index funds?

Keen to start building your investment portfolio with Sharesies? Sign up with this link, and you’ll get a bonus $5 in your account to invest!

Simplicity tax leakage fixes

Tax leakage has been an ongoing issue for Simplicity, resulting in suboptimal tax treatment for the international shares held in their funds. This leakage has been estimated to cost Growth Fund investors around 0.15% per year in extra tax, making their funds more expensive than what their headline management fee of 0.31% suggests.

The good news is that Simplicity have stated that they’re actively working on fixing this issue. We’re not sure exactly how they’ll implement the fix, how it might alter their funds, and when it will happen. But given Simplicity is one of the more popular fund managers out there, this is sure to have a positive impact on a lot of investors.

Further Reading:

– InvestNow Foundation Series vs Simplicity funds – Tax leakage an issue?

Management/ownership changes

There have been a couple of changes to the management/ownership of some products:

- InvestNow’s parent company IIS has been sold to offshore firm Apex Group. There’s no immediate changes, but hopefully this will enable some investment into much needed improvements for the InvestNow platform.

- Macquarie (who offer the popular All Country Global Shares Index Fund) will be handing over the management of those funds to Mercer, just months after they took over the funds from AMP Capital in April 2022. Mercer are a a longstanding fund manager in NZ, and are also a KiwiSaver provider.

All these changes may concern investors, but apart from new management, nothing has changed about these products at this stage. So there’s no need to worry about the safety of your money or make any knee-jerk reactions to these announcements, until we know more about what the changes might bring.

Further Reading:

– What happens to your money if InvestNow or Sharesies go bust?

Other updates

Here’s a couple more small updates for the month:

- Trove may be another new investment platform preparing to launch in the near future. They’re a subsidiary of full service broker Forsyth Barr, and with all the technical development staff we see they’ve been hiring in recent months, it looks like the platform could be quite substantial.

- SuperLife will be increasing their management fees by 0.10% per fund, but only for their Workplace Savings and UK Pension Transfer products. The fees for their ordinary Invest and KiwiSaver products will be remaining the same.

4. What we’ve been up to

It’s been another reasonably busy month for the Money King NZ, with steady visitor numbers despite the continued market weakness – so that’s great to see. Money King NZ was also featured on Brent Coleman’s YouTube video 10 Best Websites For New Zealand Investors In 2022. Thanks for mentioning our site Brent! Feel free to check out his video to see which other sites made the list.

As for our own investing activity, we’re continuing to average in to the market as usual. However, we have a lot of stuff competing for our money right now like holidays, new electronics, food, and so on. Should we keep our foot on the gas and keep investing the same amounts as we’ve always been, or should we relax a little and spend more on our wants? We’re not market timers, but can’t help feeling a little guilty about the prospect of pulling back our investment contributions while the markets are down. It’s not easy finding the right balance between living life now and investing for the future!

Apart from investing this month we ate waffles with a panda at Cafe Rhythm, ran, walked, and swam to work off the food, and continued to play with cats 😻

In case you missed them

Thanks for dropping by and reading our September 2022 news article. In case you missed them, here’s the articles we published over the month:

- Ask Money King NZ (Spring 2022) – What changes would we make to KiwiSaver? – Our usual quarterly Q&A article. This time we had a bit of a KiwiSaver theme with the questions.

- 6 types of ethical investments in New Zealand – A lot of people consider ethical investing to be somewhat important to them, but not all investments are built the same when it comes to meeting one’s ethical requirements. We look at six different types of ethical investments to help you decide which works best for you.

- 7 years of being an investor – Money King NZ’s investing journey – Mr Money King NZ describes his investing journey so far, including his first investment, best performing one, and his worst mistakes.

Follow Money King NZ

Join over 7,300 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.