The Reserve Bank of New Zealand is officially forecasting an economic storm on the horizon, predicting a recession will hit the country in 2023. So in November 2022’s What’s been happening in the markets article we explore whether you should get out of the market before the recession hits, as well as covering the recent market movements, and other investment product updates.

This article covers:

1. Market movements

2. OCR increase and the upcoming recession

3. Product updates

4. What we’ve been up to

1. Market movements

Here’s how the markets performed across the month (as at 30 November 2022) in both their local currencies and in NZ dollar terms:

| MTD | MTD (NZD) | YTD | YTD (NZD) | |

| NZ shares (S&P/NZX 50) | 1.88% | 1.88% | -11.37% | -11.37% |

| Australian shares (S&P/ASX 200) | 6.14% | 3.82% | -2.15% | -0.86% |

| US shares (S&P 500) | 2.21% | -3.86% | -16.96% | -8.25% |

| Bitcoin | -19.79% | -24.56% | -64.42% | -60.68% |

So sharemarkets were overall positive this month helped by the fact that inflation figures in the US came in lower than expected. However, when you translate the performance of US shares back to NZ dollars, you would have ended up with a slight loss this month. That’s because the USD has weakened against the NZD, offsetting the gains of the sharemarket.

The end of crypto?

The cryptocurrency world had another turbulent month with FTX, one of the world’s largest exchanges, going bust. As an unfortunate result, anyone who had funds stored on the platform will likely lose most or perhaps all of their money. If you’re interested in the background of the exchange’s collapse, you can check out this YouYube video.

A few people have been suggesting that the demise of FTX will see the end of crypto. Though we don’t think that’ll be the case, as FTX going bust is an issue with a particular platform, rather than a particular coin. For example, if Sharesies or Hatch were to shut down, that doesn’t necessarily mean the sharemarket is dead. However, this event will have damaged a lot of people’s confidence in the asset class, and raises a lot of questions around whether other crypto platforms are shady as well – both of which are reflected in Bitcoin’s ~20% drop this month.

Fortunately there’s no immediate concern surrounding any NZ based platforms. For example, one of our largest players Easy Crypto isn’t a custodial platform and doesn’t even hold onto their customers’ funds. But it’s still a good time to take onboard some of the lessons learned from this fiasco:

- Keep any substantial amounts of crypto you own held in your own wallet, rather than on an exchange.

- The size of a crypto exchange, or the fact that it has celebrity/influencer endorsements doesn’t necessarily make it a more legitimate platform.

- There’s no such thing as a safe, high yielding investment. If it’s too good to be true, it probably is.

2. OCR increase and the upcoming recession

On the 23rd of November the Reserve Bank raised NZ’s Official Cash Rate (OCR) by 75 basis points from 3.50% to 4.25% in the ongoing fight against inflation. They’ve also forecast that their rate hikes are likely to tip the country into a recession from mid-2023. This has raised a couple of common questions which we address here:

How does the OCR work in fighting against inflation?

Simply put, inflation is when the prices of goods and services go up. This is due to:

- High demand – Things like pent up demand from COVID restrictions, and having too much money pumped into the economy in response to the pandemic has resulted in high demand for goods and services.

- Supply constraints – The war in Ukraine, supply chain issues relating to COVID, and low unemployment has meant that the supply of goods and services has been constrained in many areas.

- Inflation expectations – As people and businesses expect high inflation, they demand higher wages or put their prices up in anticipation of future inflation. This feeds into increasing inflation even further.

So how does the OCR work in fighting inflation? While it doesn’t have a direct impact on inflation itself, it does have an impact on interest rates – if the OCR rises, interest rates tend to follow:

| Nov 2021 | Nov 2022 | |

| OCR | 0.75% | 4.25% |

| Average 1 year mortgage rate | 2.43% | 5.88% |

| Average 1 year term deposit rate | 1.92% | 4.66% |

The most obvious consequence of higher interest rates is that people and businesses need to spend more money on servicing debt like mortgages and loans. For example, homeowners need to use more money to pay their mortgage, and that means less money to spend in the economy. Therefore demand for goods and services should reduce. However, the downside of these interest rate hikes is that they may lead to a recession and higher unemployment. But we won’t know the exact impact of these rate hikes for some time, as they take a while to actually start having an impact. For example, homeowners on fixed term mortgages won’t face an increase in mortgage payments until they need to renew their loans onto new rates.

There’s a number of other side effects to what the Reserve Bank is doing with the OCR. For example, people and businesses may also become less confident about the economy and their financial situation in general, so tighten their belts. It’s fear and all the negative commentary around the economy that also helps dampen down inflation.

As for the impact of the OCR on investors, higher interest rates means more incentive to save money in term deposits. That’s one of the key reasons why we’ve seen relatively risky assets like bonds and shares go down this year, as they’ve become less attractive relative to cash.

Further Reading:

– The Reserve Bank want a recession….Or do they? (Your Money Blueprint)

Should I stop investing because a recession is coming?

It’s widely anticipated that we’ll be facing a recession within the next year or so, and a lot of people have been wondering whether you should be selling out of your shares in advance. We think that’s not such as good idea:

- It’s already too late to get out of the market – The sharemarkets won’t suddenly drop when the recession arrives. Sharemarkets have already gone down this year, as they’ve already priced in the possibility of a recession. In other words, it’s too late to use the fact that a recession is coming to your advantage, because the market has already factored this information in to its current value.

- You won’t know when to get back into market – Let’s say you sold out of the market and have a bunch of cash on the sidelines, waiting to be reinvested at some point. How will you know when’s the right time to invest that money? Unfortunately, the market recovery won’t be announced in advance. Nor will it suddenly increase when the recession is over. In fact, the sharemarket usually recovers well before the economy actually does, because it prices in or anticipates the economic recovery. Take COVID for example, where sharemarkets started to recover even when we were still in lockdowns, because it was factoring in the eventual recovery.

- Consistently timing the market is impossible – Recessions are normal, and you’re bound to face several of them throughout your investing career. Could you consistently time and outsmart the market every time a recession came?

So what should you do instead?

- Invest regularly/dollar cost average into your investments instead of trying to time the market.

- Ensure your investment portfolio is aligned with your investment timeframe and risk tolerance.

- Have an emergency fund so that you don’t have to disturb your long-term investments to pay for unexpected expenses.

Further Reading:

– 2020 Recession? How to prepare your investment portfolio

3. Product updates

Foundation Series offers ultra low fee S&P 500 and Total World funds

InvestNow launched two new index funds with market leading management fees under their Foundation Series brand:

- US 500 Fund (0.03% fee) – Invests in the 500 largest companies listed in the US via the Vanguard S&P 500 ETF (VOO)

- Total World Fund (0.07% fee) – Invests in over 9,000 companies from around the world via the Vanguard Total World ETF (VT)

On top of this there’s a 0.50% transaction fee whenever you buy or sell units in the fund.

These funds invest in a familiar set of indexes, making many wonder whether these are good alternatives to competing funds from the likes of Smartshares, Vanguard, and Macquarie. Unfortunately there’s no definitive answer – While the ultra low management fee is attractive, you’d need to hold them for a least a few years for the management fees to offset the upfront transaction fees, and be worth it over the other funds. More in our Foundation Series review below:

Further Reading:

– InvestNow Foundation Series review – What’s the catch with their 0.03% fee?

Sugar Wallet adds gold

Sugar Wallet is a platform which has been reselling Simplicity’s funds, while clipping the ticket by charging an extra account fee on top. This month they expanded their platform into offering physical gold as an investment option. The minimum investment is $1 (as you can buy a fractional share of the metal) and your investment is purchased and stored on your behalf through gold broker BullionStar. It comes with the following fees:

- 1% transaction fee to buy/sell gold

- 1% p.a. ongoing storage fee

Here’s a weird catch with the platform – Sugar Wallet doesn’t allow you to invest in more than one asset at once. For example, you can’t hold an investment in the Simplicity Growth Fund and gold at the same time. That’s certainly lacking compared to other platforms!

Further Reading:

– Sugar Wallet review – Clipping the ticket?

– Gold and Silver – Is it investing or gambling?

Another round of Sharesies updates

Auto-invest for NZX and ASX shares

Following their addition of auto-invest for US shares in September, Sharesies has now expanded the feature to NZX and ASX shares. This means auto-invest is now available across all markets that Sharesies offers.

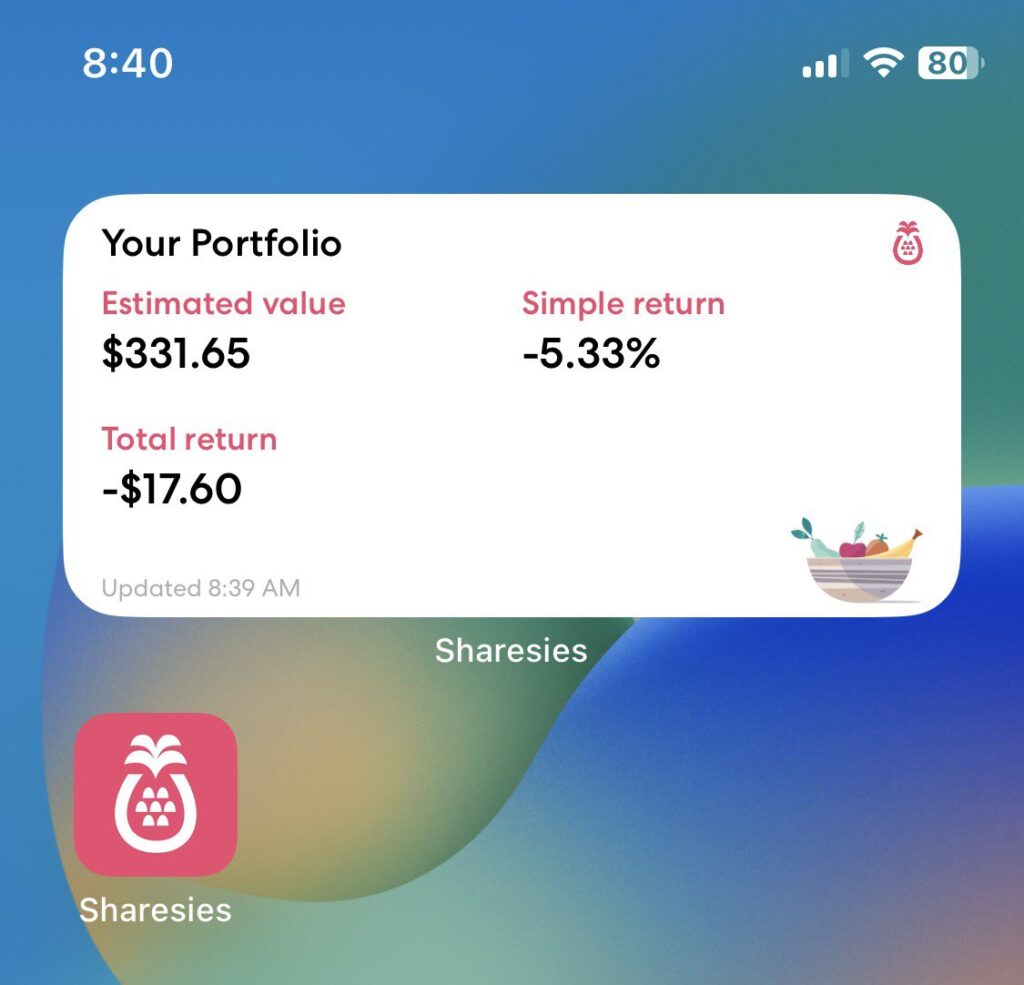

Mobile widgets

Sharesies also added a new feature to their iOS and Android apps in the form of widgets which allow you to easily track the value of your portfolio on your home or lock screen.

Looks nice and slick, but we can’t help but have a negative view towards this new feature. Having your portfolio balance so highly visible isn’t going to make you a better investor, and it’s likely to do more harm than good. Seeing your portfolio always fluctuating up and down could lead to making emotional decisions (e.g. panic selling or FOMO) and anxiety, especially during times of high volatility. There’s really no need to have a constant eye on your investments, especially when you’re investing for the long-term.

Did Sharesies liquidate customer accounts?

Sharesies have recently liquidated and closed the accounts of some customers. This may raise some concerns among investors, but there’s nothing shady going on here. Those who had their accounts closed failed to answer questions around how often, how much, and why they invested though the Sharesies platform – This information isn’t captured for marketing purposes, but rather it’s information that investment platforms need about their customers in order to comply with Anti-Money Laundering and Countering Financing of Terrorism law.

Therefore it’s normal for investment platforms to reach out to you from time to time to ask for your details. In fact InvestNow have also been emailing clients and closing accounts where necessary in order to keep up with their compliance requirements. So check with your platform if you’re ever in doubt about them requesting your personal information – Better to be safe than sorry when it comes to the risk of having your assets sold off and investment accounts closed!

Keen to start building your investment portfolio with Sharesies? Sign up with this link, and you’ll get a bonus $5 in your account to invest!

Smartshares diversifies its fund offerings

Smartshares has purchased QuayStreet, a fund manager who offer 10 funds and are currently owned by Craigs Investment Partners. With QuayStreet being an active fund manager, the acquisition is somewhat unusual given Smartshares primarily offers passively managed funds. It’ll be interesting to see how this affects their overall fund lineup, and while no immediate changes are flagged, they’ve indicated that the funds could be listed on the NZX (making them ETFs instead of unlisted funds).

4. What we’ve been up to

Money King NZ happenings

We’re now heading into that time of the year when things quieten down in the investment world, as people start getting into Summer holiday mode. As a result you may see slightly less content from us over the next couple of months as we also take a break.

On the investing front, we’re having to reduce our investment contributions – Not because we’re trying to time the market, but rather due to a change in circumstances. We expect to face a large number of expenses over the next year, so while we’re optimistic about our investments over the long-term, investing money we need in the next 6 months to 1 year in shares is way too risky – That might not be enough time for them to recover if the markets continue to perform poorly.

Apart from investing this month we climbed up the Mount William Walkway, got the popular mango sticky rice from KIIN Thai Underground Kitchen, and went to a crazy amount of furniture stores looking for the perfect couch and dining table – And we eventually did picking up some furniture and homeware during the Black Friday sales. A lot of other content creators like to bash Black Friday sales given they encourage more spending, but we personally think it’s a good time to buy stuff that you need.

In case you missed them

Thanks for dropping by and reading our November 2022 news article. In case you missed them, here’s the articles we published over the month:

- A beginner’s guide to US-listed ETFs – A guide to the 100 largest US listed ETFs

- InvestNow Foundation Series review – What’s the catch with their 0.03% fee? – We review Foundation Series’ funds including their new ultra low fee US 500 and Total World funds.

- Hedged vs Unhedged funds – What’s better? – An in depth look at how exchange rates can affect your overseas investments and the pros and cons of currency hedged vs unhedged funds.

Follow Money King NZ

Join over 7,300 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.